Key Insights

The Middle East and Africa (MEA) Solar Panel Recycling Market is set for substantial growth, driven by increasing volumes of end-of-life solar panels and a regional focus on circular economy principles. With a projected market size of 344.7 million in 2025, the sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 14.4% from 2025 to 2033. This expansion is propelled by rising solar energy installations in key nations like the UAE, Egypt, and South Africa, as these systems reach their operational limits. Maturing regulatory frameworks are promoting responsible disposal and recycling, aiming to minimize environmental impact and recover valuable materials such as silicon, aluminum, and copper. The "Thermal" process segment is forecast to lead due to its efficient metal recovery capabilities. "Crystalline Silicon" panels, currently the most common, will remain the primary feedstock for recyclers.

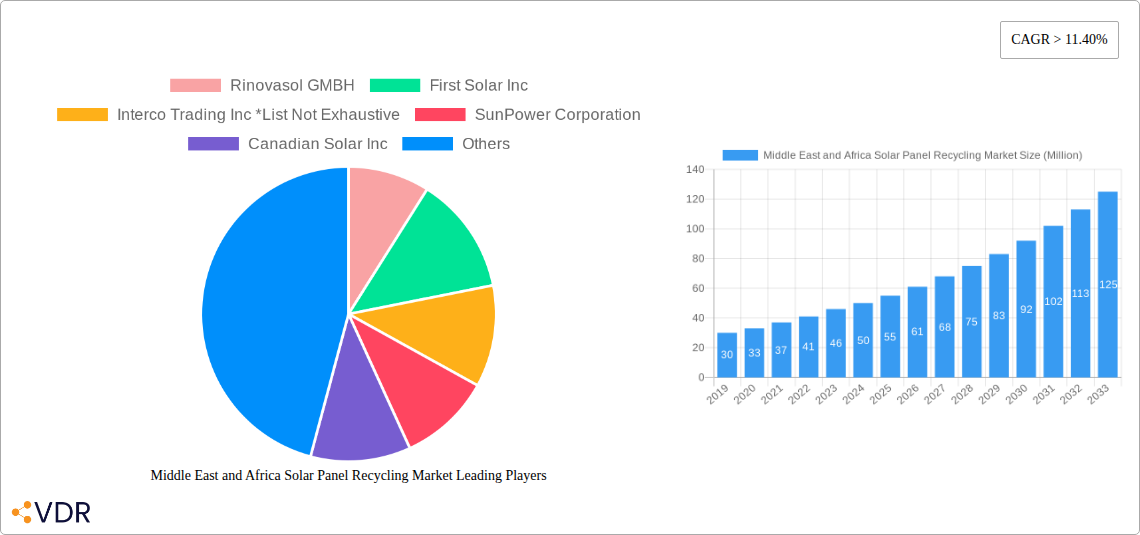

Middle East and Africa Solar Panel Recycling Market Market Size (In Million)

The MEA solar panel recycling market features developing but rapidly advancing infrastructure. Prominent companies such as First Solar Inc. and Trina Solar Ltd. are expected to significantly influence market development through innovation and strategic alliances. The UAE, with its ambitious renewable energy goals, and Egypt, with its growing solar projects, are projected to spearhead demand for recycling services. South Africa's established solar sector also offers significant opportunities. The "Rest of Middle East and Africa" segment, encompassing emerging markets, is likely to witness accelerated growth as solar adoption rises and waste management concerns intensify. Initial investment costs and limited awareness are challenges being addressed by supportive government initiatives and the economic advantages of material recovery, paving the way for a dynamic and sustainable MEA solar panel recycling market.

Middle East and Africa Solar Panel Recycling Market Company Market Share

Middle East and Africa Solar Panel Recycling Market Report: Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Middle East and Africa (MEA) Solar Panel Recycling Market, exploring its dynamics, growth trajectories, and future potential. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report provides actionable insights for stakeholders seeking to navigate this rapidly evolving sector. The MEA solar panel recycling market is projected to witness significant expansion, driven by increasing solar energy adoption, growing environmental consciousness, and evolving regulatory landscapes across the region.

Key Market Participants: Rinovasol GMBH, First Solar Inc, Interco Trading Inc, SunPower Corporation, Canadian Solar Inc, Trina Solar Ltd, Sharp Corporation.

Key Segments Covered:

- Processes: Thermal, Mechanical, Chemical, Other Processes

- Types: Crystalline Silicon, Thin Film

- Geographies: South Africa, Egypt, United Arab Emirates, Rest of Middle East and Africa

Middle East and Africa Solar Panel Recycling Market Dynamics & Structure

The Middle East and Africa solar panel recycling market is characterized by an evolving structure influenced by increasing solar energy deployment and the subsequent need for end-of-life management. Market concentration is gradually shifting as new players enter, spurred by the growing volume of solar panels reaching their operational lifespan. Technological innovation is a significant driver, with ongoing research into more efficient and cost-effective recycling processes. Regulatory frameworks are nascent but expanding, with governments in key markets like the UAE and South Africa beginning to implement policies encouraging responsible disposal and recycling. Competitive product substitutes, primarily new solar panel manufacturing, are indirectly influencing the recycling market by determining the volume of panels entering the waste stream. End-user demographics are diversifying, with a growing base of commercial and utility-scale solar projects contributing to the recycling demand. Mergers and acquisitions (M&A) are anticipated to play a crucial role in consolidating the market and fostering economies of scale. Barriers to innovation include the high initial investment required for advanced recycling technologies and the lack of standardized collection and processing infrastructure across many African nations.

- Market Concentration: Fragmented with emerging consolidation trends.

- Technological Innovation Drivers: Development of advanced material recovery techniques, automation in dismantling processes.

- Regulatory Frameworks: Increasing focus on Extended Producer Responsibility (EPR) schemes and waste management directives.

- Competitive Product Substitutes: While new panel sales are not direct substitutes, the rate of solar adoption impacts the future recycling volume.

- End-User Demographics: Shift towards utility-scale projects and commercial installations requiring robust end-of-life solutions.

- M&A Trends: Expected to increase as companies seek to gain market share and technological expertise.

Middle East and Africa Solar Panel Recycling Market Growth Trends & Insights

The Middle East and Africa solar panel recycling market is poised for substantial growth, driven by the exponential rise in solar energy installations across the region. As solar farms mature and individual solar panels reach their end-of-life, typically after 25-30 years, the volume of waste solar panels will increase dramatically. This trend, coupled with a growing emphasis on circular economy principles and environmental sustainability, is creating a robust demand for specialized recycling services. The market size evolution is directly correlated with the installed solar capacity, which has seen remarkable growth in countries like the UAE, Egypt, and South Africa, fueled by government initiatives, declining solar technology costs, and a desire for energy independence. Adoption rates for dedicated solar panel recycling facilities are still in their nascent stages, but are expected to accelerate as regulatory mandates and corporate sustainability goals become more stringent.

Technological disruptions in recycling are focusing on enhancing the recovery rates of valuable materials such as silicon, silver, copper, and aluminum, thereby improving the economic viability of recycling. Advanced mechanical separation techniques, alongside chemical and thermal processes, are being refined to handle the complex composition of solar panels efficiently. Consumer behavior shifts, particularly among large-scale solar project developers and utilities, are moving towards integrating end-of-life management plans from the project inception phase, recognizing the long-term environmental and economic implications. Market penetration of formal recycling services is currently low in many parts of the MEA region, presenting a significant opportunity for growth. The projected CAGR for the MEA solar panel recycling market is estimated to be in the XX% range from 2025 to 2033, reflecting the dynamic interplay of increasing solar waste generation and developing recycling infrastructure. The increasing global focus on reducing electronic waste and the recovery of critical raw materials will further propel the adoption of solar panel recycling solutions across the Middle East and Africa.

Dominant Regions, Countries, or Segments in Middle East and Africa Solar Panel Recycling Market

The Middle East and Africa solar panel recycling market's dominance is currently being shaped by a confluence of factors, with the United Arab Emirates emerging as a key leader. This leadership is attributed to its proactive stance on renewable energy adoption, significant investments in solar power infrastructure, and a growing commitment to environmental sustainability and circular economy principles. The UAE's robust economic policies and its strategic position as a regional hub facilitate the development of advanced recycling infrastructure.

- Dominant Geography: United Arab Emirates

- Drivers: Strong government support for renewable energy, substantial solar project pipeline, advanced waste management infrastructure, and a clear focus on sustainability initiatives.

- Market Share: Expected to hold a significant portion of the regional recycling market due to early adoption and investment in recycling technologies.

- Growth Potential: High, driven by the decommissioning of older solar installations and the establishment of specialized recycling facilities.

Among the Processes, the Mechanical recycling segment is anticipated to hold significant sway in the near to medium term. This is due to its relatively lower initial investment costs and its effectiveness in separating core components like glass, aluminum, and silicon wafers. Mechanical processes offer a foundational approach to material recovery, making them accessible for early-stage market development.

- Dominant Process: Mechanical Recycling

- Key Drivers: Cost-effectiveness, scalability for initial waste volumes, and ability to recover bulk materials like glass and aluminum frames.

- Market Share: Expected to be a significant contributor as the volume of solar panel waste increases.

- Growth Potential: Strong, as it often serves as a preliminary step for more advanced material recovery.

Regarding Type, Crystalline Silicon panels represent the vast majority of current and historical solar installations. Therefore, the recycling infrastructure will primarily be geared towards processing this type. As Crystalline Silicon panels reach their end-of-life in large numbers, the demand for recycling this specific type will be paramount.

- Dominant Type: Crystalline Silicon

- Key Drivers: Dominance in global and regional solar panel installations, leading to a larger volume of waste panels.

- Market Share: Expected to command the largest share of the recycling market for the foreseeable future.

- Growth Potential: Directly proportional to the lifespan of installed Crystalline Silicon panels.

While South Africa and Egypt are also significant markets with considerable solar energy deployment, the UAE's comprehensive approach to waste management and its forward-thinking policies provide it with a leading edge in establishing a mature solar panel recycling ecosystem. The "Rest of Middle East and Africa" category encompasses a broad range of countries with varying levels of solar development and recycling infrastructure, presenting both challenges and opportunities for market expansion.

Middle East and Africa Solar Panel Recycling Market Product Landscape

The product landscape in the MEA solar panel recycling market is defined by the evolving technologies designed to efficiently dismantle and recover valuable materials from photovoltaic (PV) modules. Innovations are primarily focused on maximizing the yield of silicon, silver, copper, and aluminum, thereby enhancing the economic viability of recycling. Advanced mechanical shredding and separation techniques are crucial for isolating different material streams. Chemical processes, including hydrometallurgy and pyrometallurgy, are being developed to achieve higher purity recovery of specific elements. Performance metrics are increasingly measured by the percentage of material recovered and the purity of recovered raw materials, directly impacting the market's profitability and sustainability. Unique selling propositions for recycling providers often revolve around their ability to offer comprehensive end-to-end solutions, from collection logistics to material processing, ensuring compliance with environmental regulations.

Key Drivers, Barriers & Challenges in Middle East and Africa Solar Panel Recycling Market

Key Drivers:

- Surge in Solar Energy Deployment: Rapid growth in solar installations across the MEA region generates a substantial future stream of end-of-life panels.

- Environmental Regulations & Sustainability Goals: Increasing government mandates and corporate sustainability commitments are pushing for responsible waste management.

- Circular Economy Initiatives: The global push towards a circular economy encourages resource recovery and waste reduction.

- Economic Value of Recovered Materials: The presence of valuable materials like silicon, silver, and copper makes recycling economically attractive.

Key Barriers & Challenges:

- Nascent Infrastructure: Lack of established collection networks, processing facilities, and specialized recycling technologies in many parts of the region.

- High Initial Investment: Setting up advanced recycling plants requires significant capital expenditure.

- Logistical Complexities: Transporting bulky and sometimes fragile solar panels from diverse locations can be costly and challenging.

- Regulatory Uncertainty: Inconsistent or underdeveloped regulatory frameworks across different countries can hinder investment and standardization.

- Cost Competitiveness: Competing with the cost of virgin materials and the potential for cheaper, less environmentally sound disposal methods.

- Lack of Skilled Workforce: The need for trained personnel to operate and maintain advanced recycling equipment.

Emerging Opportunities in Middle East and Africa Solar Panel Recycling Market

Emerging opportunities in the MEA solar panel recycling market lie in the development of decentralized recycling solutions tailored to specific regional needs and the creation of advanced material recovery technologies. The growing number of small-scale solar PV systems in rural African communities presents a unique opportunity for specialized collection and recycling initiatives, as highlighted by the UNEP DTU Partnership project. Furthermore, the increasing demand for recycled raw materials in the manufacturing of new solar panels and other electronic components creates a closed-loop value chain. There is also an opportunity to leverage digitalization for better tracking and management of solar panel waste streams, enhancing transparency and efficiency.

Growth Accelerators in the Middle East and Africa Solar Panel Recycling Market Industry

Several catalysts are poised to accelerate the growth of the MEA solar panel recycling industry. Technological breakthroughs in enhancing the efficiency and economic viability of recovering critical raw materials from solar panels will be paramount. Strategic partnerships between solar panel manufacturers, project developers, recycling companies, and waste management authorities are crucial for establishing robust collection and processing networks. Market expansion strategies that focus on building regional processing hubs and offering end-to-end recycling solutions will drive adoption. Increased investment in research and development for novel recycling processes and material valorization techniques will also play a significant role in boosting the industry's trajectory.

Key Players Shaping the Middle East and Africa Solar Panel Recycling Market Market

- Rinovasol GMBH

- First Solar Inc

- Interco Trading Inc

- SunPower Corporation

- Canadian Solar Inc

- Trina Solar Ltd

- Sharp Corporation

Notable Milestones in Middle East and Africa Solar Panel Recycling Market Sector

- April 2021: A new research project at the UNEP DTU Partnership is expected to create better opportunities for collecting and recycling electronic waste from small solar PV systems in Kenya and other African countries.

In-Depth Middle East and Africa Solar Panel Recycling Market Market Outlook

The future outlook for the Middle East and Africa solar panel recycling market is exceptionally promising, driven by the impending wave of solar panel decommissioning and the region's growing commitment to environmental stewardship. Strategic opportunities abound for companies that can develop and implement scalable, cost-effective, and technologically advanced recycling solutions. The integration of circular economy principles into national energy policies will further solidify the market's growth trajectory. Early movers who invest in building robust infrastructure, foster collaboration across the value chain, and leverage innovative recycling technologies will be well-positioned to capitalize on this rapidly expanding market. The increasing recognition of solar panel waste as a valuable resource rather than a liability will be a key driver for sustained growth and market development.

Middle East and Africa Solar Panel Recycling Market Segmentation

-

1. Process

- 1.1. Thermal

- 1.2. Mechanical

- 1.3. Chemical

- 1.4. Other Processes

-

2. Type

- 2.1. Crystalline Silicon

- 2.2. Thin Film

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East and Africa

Middle East and Africa Solar Panel Recycling Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle East and Africa Solar Panel Recycling Market Regional Market Share

Geographic Coverage of Middle East and Africa Solar Panel Recycling Market

Middle East and Africa Solar Panel Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Strong Dependence on Prevailing Weather Condition

- 3.4. Market Trends

- 3.4.1. Crystalline Silicon (c-Si) Type to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Thermal

- 5.1.2. Mechanical

- 5.1.3. Chemical

- 5.1.4. Other Processes

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Crystalline Silicon

- 5.2.2. Thin Film

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. South Africa Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Thermal

- 6.1.2. Mechanical

- 6.1.3. Chemical

- 6.1.4. Other Processes

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Crystalline Silicon

- 6.2.2. Thin Film

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Egypt Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Thermal

- 7.1.2. Mechanical

- 7.1.3. Chemical

- 7.1.4. Other Processes

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Crystalline Silicon

- 7.2.2. Thin Film

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. United Arab Emirates Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Thermal

- 8.1.2. Mechanical

- 8.1.3. Chemical

- 8.1.4. Other Processes

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Crystalline Silicon

- 8.2.2. Thin Film

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Rest of Middle East and Africa Middle East and Africa Solar Panel Recycling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Thermal

- 9.1.2. Mechanical

- 9.1.3. Chemical

- 9.1.4. Other Processes

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Crystalline Silicon

- 9.2.2. Thin Film

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Egypt

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Rinovasol GMBH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 First Solar Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Interco Trading Inc *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SunPower Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Canadian Solar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Trina Solar Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sharp Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Rinovasol GMBH

List of Figures

- Figure 1: Middle East and Africa Solar Panel Recycling Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Solar Panel Recycling Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 2: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 6: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 7: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 10: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 14: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 15: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Process 2020 & 2033

- Table 18: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Type 2020 & 2033

- Table 19: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Solar Panel Recycling Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Solar Panel Recycling Market?

The projected CAGR is approximately 14.4%.

2. Which companies are prominent players in the Middle East and Africa Solar Panel Recycling Market?

Key companies in the market include Rinovasol GMBH, First Solar Inc, Interco Trading Inc *List Not Exhaustive, SunPower Corporation, Canadian Solar Inc, Trina Solar Ltd, Sharp Corporation.

3. What are the main segments of the Middle East and Africa Solar Panel Recycling Market?

The market segments include Process, Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 344.7 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems.

6. What are the notable trends driving market growth?

Crystalline Silicon (c-Si) Type to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Strong Dependence on Prevailing Weather Condition.

8. Can you provide examples of recent developments in the market?

April 2021: A new research project at the UNEP DTU Partnership is expected to create better opportunities for collecting and recycling electronic waste from small solar PV systems in Kenya and other African countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Solar Panel Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Solar Panel Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Solar Panel Recycling Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Solar Panel Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence