Key Insights

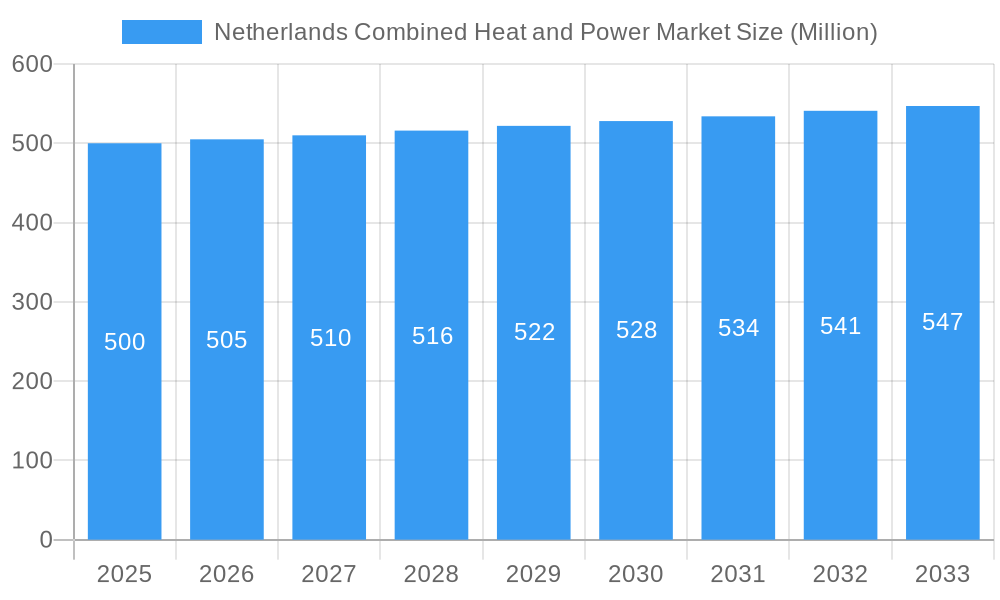

The Netherlands Combined Heat and Power (CHP) market is poised for steady growth, driven by a strategic focus on energy efficiency and decarbonization. With a current market size estimated at approximately $500 million and projected to expand at a Compound Annual Growth Rate (CAGR) of 1.34% over the forecast period (2025-2033), the market's value is expected to reach around $550 million by 2033. This growth is primarily fueled by the urgent need to reduce energy consumption and greenhouse gas emissions across various sectors. The Dutch government's ambitious climate goals, coupled with incentives for adopting cleaner energy technologies, are significant drivers propelling the adoption of CHP systems. The increasing demand for reliable and cost-effective energy solutions in both residential and industrial settings further underpins this positive market trajectory. Innovations in renewable energy integration within CHP systems are also emerging as a key trend, allowing for more sustainable and environmentally friendly operations, which is crucial for meeting the Netherlands' commitment to a greener future.

Netherlands Combined Heat and Power Market Market Size (In Million)

The market is segmented across diverse applications, including residential, commercial, industrial, and utility sectors, each presenting unique growth opportunities. The industrial sector, in particular, is a major contributor due to its high energy demands and the significant potential for energy savings through CHP implementation. Natural gas remains a dominant fuel type, offering a balance of efficiency and availability, though there is a discernible shift towards integrating renewable energy sources like biomass and biogas into CHP systems. This transition is critical for aligning with stringent environmental regulations and advancing the circular economy principles. However, the market faces certain restraints, including the high initial capital investment required for CHP system installation and the ongoing operational and maintenance costs. Additionally, the complexity of integrating CHP systems with existing energy grids and the availability of favorable policy frameworks for renewable-based CHP can present challenges. Despite these hurdles, the inherent benefits of energy efficiency, reduced emissions, and enhanced energy security ensure a promising outlook for the Netherlands CHP market.

Netherlands Combined Heat and Power Market Company Market Share

This comprehensive report offers an in-depth analysis of the Netherlands Combined Heat and Power (CHP) market, providing critical insights into its dynamics, growth trajectory, and competitive landscape. Covering the historical period of 2019–2024, base year 2025, and forecast period 2025–2033, this study is an essential resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities in this vital sector. We delve into key market segments, including applications such as Residential, Commercial, Industrial, and Utility, and analyze the impact of various Fuel Types including Natural Gas, Renewable Energy Sources, and Other Fuel Types.

Netherlands Combined Heat and Power Market Market Dynamics & Structure

The Netherlands Combined Heat and Power (CHP) market is characterized by a dynamic and evolving structure. Market concentration is influenced by a mix of large, established players and a growing number of specialized providers, particularly in niche applications. Technological innovation serves as a primary driver, with advancements in micro-CHP systems, integration of renewable fuels, and digital control technologies significantly enhancing efficiency and reducing environmental impact. Regulatory frameworks, including government incentives for energy efficiency and CO2 reduction, play a crucial role in shaping market adoption. Competitive product substitutes, such as standalone heating systems and grid-supplied electricity, are increasingly challenged by the economic and environmental advantages of CHP. End-user demographics are diverse, ranging from individual households seeking cost savings and energy independence to large industrial facilities aiming to optimize operational costs and meet sustainability targets. Mergers and acquisitions (M&A) trends indicate consolidation among larger players and strategic partnerships to leverage complementary technologies and expand market reach.

- Market Concentration: A moderate level of concentration with key players holding significant market shares, but with increasing fragmentation in smaller-scale applications.

- Technological Innovation Drivers: Efficiency improvements in combustion engines, fuel flexibility (including hydrogen blends and biogas), smart grid integration, and advanced control systems are key innovation areas.

- Regulatory Frameworks: Subsidies for renewable energy integration, carbon pricing mechanisms, and energy efficiency mandates are supportive of CHP market growth.

- Competitive Product Substitutes: Standalone boilers, electric heaters, and grid electricity pose competition, but CHP's cost-effectiveness and environmental benefits are increasingly competitive.

- End-User Demographics: Growing demand from residential sector for lower energy bills and from industrial sector for reliable and cost-effective energy solutions.

- M&A Trends: Strategic acquisitions of smaller technology providers and partnerships to develop integrated energy solutions are observed.

Netherlands Combined Heat and Power Market Growth Trends & Insights

The Netherlands Combined Heat and Power (CHP) market is poised for significant growth, driven by a confluence of economic, environmental, and technological factors. The market size has witnessed a steady expansion over the historical period, a trend projected to accelerate through the forecast period. This growth is underpinned by increasing adoption rates of CHP systems across various sectors, propelled by a strong policy push towards energy efficiency and decarbonization. Technological disruptions, such as the integration of advanced materials for higher temperature resistance and more efficient energy conversion, are enhancing the performance and applicability of CHP units. Furthermore, evolving consumer behavior, with a heightened awareness of energy costs and environmental impact, is creating a stronger demand for sustainable and cost-effective energy solutions like CHP. The Netherlands' commitment to climate goals, coupled with the inherent advantages of CHP in reducing primary energy consumption and greenhouse gas emissions, positions it as a cornerstone of the nation's energy transition. The parent market for CHP is the broader energy generation and heating sector, while the child market segments explore specific applications and fuel types.

- Market Size Evolution: Experiencing robust growth driven by energy efficiency mandates and cost savings.

- Adoption Rates: Increasing adoption across residential, commercial, and industrial segments due to economic and environmental benefits.

- Technological Disruptions: Advancements in fuel flexibility, efficiency, and integration with renewable energy sources are key disruptors.

- Consumer Behavior Shifts: Growing consumer preference for sustainable and cost-effective energy solutions is a significant driver.

- Market Penetration: Expected to increase significantly as awareness and incentives grow, particularly in urban and industrial areas.

- CAGR: Projected to show a healthy compound annual growth rate, reflecting the strong demand and supportive policies.

Dominant Regions, Countries, or Segments in Netherlands Combined Heat and Power Market

Within the Netherlands Combined Heat and Power (CHP) market, the Industrial segment consistently emerges as a dominant force, driven by its substantial energy requirements and the significant operational cost savings achievable through CHP integration. Large-scale industrial facilities, including chemical plants, food processing units, and manufacturing operations, benefit immensely from the simultaneous production of heat and electricity, leading to reduced energy bills and a smaller carbon footprint. Natural Gas remains the dominant Fuel Type in this segment due to its widespread availability, relatively stable pricing, and mature infrastructure for its utilization in CHP systems. However, there is a notable and accelerating shift towards Renewable Energy Sources for CHP generation, significantly influenced by the industry development in the first half of 2024, where renewable energy sources generated more electricity than fossil fuels in the Netherlands for the first time. Renewables produced 32.3 billion kilowatt-hours, accounting for 53% of the total electricity output, with wind power significantly contributing to this increase. This historical milestone signifies a strong policy and market momentum towards greener energy solutions, directly impacting the future fuel mix for CHP. The Commercial segment is also a significant growth area, driven by hotels, hospitals, and large office buildings seeking to improve energy efficiency and reduce operational costs. While the Residential sector is growing, its adoption is more sensitive to upfront investment costs and system complexity, making the Industrial and Commercial sectors the primary growth engines for the broader CHP market in the Netherlands.

- Dominant Segment (Application): Industrial, due to high energy demands and significant cost-saving potential.

- Dominant Segment (Fuel Type): Natural Gas currently leads, but Renewable Energy Sources are experiencing rapid growth and increasing market share.

- Key Drivers for Industrial Dominance:

- High thermal and electrical energy needs.

- Significant operational cost reductions through energy integration.

- Compliance with environmental regulations and sustainability targets.

- Reliability of energy supply for continuous operations.

- Growth Potential of Renewable Energy Sources:

- Government incentives and policy support for decarbonization.

- Increasing availability and decreasing costs of renewable fuels like biogas and green hydrogen.

- Technological advancements in integrating renewables with CHP systems.

- Positive public perception and corporate social responsibility initiatives.

- Commercial Segment Growth Factors:

- Energy cost optimization for businesses.

- Enhanced energy independence and resilience.

- Meeting corporate sustainability goals and attracting environmentally conscious customers.

Netherlands Combined Heat and Power Market Product Landscape

The product landscape within the Netherlands Combined Heat and Power (CHP) market is characterized by continuous innovation aimed at enhancing efficiency, fuel flexibility, and environmental performance. Advanced micro-CHP units are becoming more accessible for residential and small commercial applications, offering significant energy savings and reduced emissions. For larger industrial and utility applications, modular CHP systems and large-scale gas turbines are being optimized for higher output and lower emissions, with increasing integration of digital monitoring and predictive maintenance capabilities. Innovations in materials science are leading to components that can withstand higher operating temperatures, thereby improving thermodynamic efficiency. Furthermore, a significant trend is the development of CHP systems capable of utilizing a wider range of fuels, including biogas, hydrogen, and syngas derived from waste, aligning with the Netherlands' ambitious renewable energy targets. These advancements are crucial for meeting diverse end-user demands and contributing to the nation's decarbonization efforts.

Key Drivers, Barriers & Challenges in Netherlands Combined Heat and Power Market

The Netherlands Combined Heat and Power (CHP) market is propelled by several key drivers. The strong government commitment to reducing greenhouse gas emissions and enhancing energy efficiency, through various subsidies and regulatory frameworks, is a primary catalyst. Economic incentives that lower the upfront investment cost and improve the return on investment for CHP systems are crucial. Furthermore, rising energy prices make CHP's inherent cost savings more attractive for end-users. Technological advancements in CHP systems, leading to improved efficiency and wider fuel options, are also significant growth accelerators.

However, the market faces notable barriers and challenges. The initial capital investment for CHP systems can be substantial, posing a challenge for widespread adoption, particularly in the residential sector. Complex regulatory processes and permitting procedures can sometimes delay project implementation. Competition from established, cheaper energy sources and the ongoing development of renewable energy technologies like solar and wind power present competitive pressures. Supply chain disruptions for critical components and skilled labor shortages can also impede market growth.

- Key Drivers:

- Supportive government policies and incentives for energy efficiency and CO2 reduction.

- Economic benefits of reduced energy costs and improved operational efficiency.

- Technological advancements leading to higher efficiency and fuel flexibility.

- Growing environmental consciousness among consumers and businesses.

- Barriers & Challenges:

- High initial capital expenditure for CHP system installation.

- Complex regulatory and permitting landscape.

- Competition from traditional energy sources and other renewable technologies.

- Potential supply chain constraints and skilled labor shortages.

Emerging Opportunities in Netherlands Combined Heat and Power Market

Emerging opportunities in the Netherlands Combined Heat and Power (CHP) market are largely driven by the nation's aggressive energy transition goals and the increasing focus on circular economy principles. The growing availability of biomethane and green hydrogen presents a significant opportunity for decarbonizing existing and new CHP installations, moving beyond natural gas. The integration of CHP systems with smart grids and energy storage solutions offers new possibilities for optimizing energy distribution and grid stability. Furthermore, the development of localized energy communities and district heating networks powered by CHP presents untapped potential, particularly in urban and suburban areas. The increasing demand for industrial heat in specific sectors, combined with the need for reliable and sustainable energy, also creates niche opportunities for specialized CHP solutions.

Growth Accelerators in the Netherlands Combined Heat and Power Market Industry

Several factors are acting as growth accelerators for the Netherlands Combined Heat and Power (CHP) market. The continuous advancements in turbine and engine technology are leading to more efficient, reliable, and cost-effective CHP units, making them increasingly attractive across all applications. Strategic partnerships between technology providers, energy companies, and industrial end-users are facilitating larger-scale deployments and the development of integrated energy solutions. Government initiatives, such as the Energy Efficiency Directive and specific support schemes for renewable energy integration, are significantly de-risking investments and encouraging market expansion. The Dutch government's commitment to achieving net-zero emissions by 2050 provides a long-term, stable policy environment that fosters sustained investment and innovation in CHP technologies.

Key Players Shaping the Netherlands Combined Heat and Power Market Market

- ABB Ltd

- Viessmann Werke GmbH & Co KG

- Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec)

- Microgen Engine Corporation Holding B V

- Siemens AG

- Caterpillar Inc

- Centrica PLC

- General Electric Company

- BDR Thermea Group BV

- Capstone Turbine Corporation

Notable Milestones in Netherlands Combined Heat and Power Market Sector

- First Half of 2024: Renewable energy sources generated more electricity than fossil fuels in the Netherlands for the first time. Renewables produced 32.3 billion kilowatt-hours, accounting for 53% of the total electricity output, with wind power significantly contributing to this increase.

- 2023: Increased government focus on hydrogen integration into existing gas infrastructure, paving the way for hydrogen-ready CHP systems.

- 2022: Several industrial companies announced investments in upgrading or installing new CHP units to meet sustainability targets and reduce energy costs amidst volatile energy prices.

- 2021: Launch of new, more efficient micro-CHP units for residential use, supported by revised subsidy schemes.

- 2020: Expansion of district heating networks in urban areas, with a growing integration of CHP as a primary heat source.

In-Depth Netherlands Combined Heat and Power Market Market Outlook

The future outlook for the Netherlands Combined Heat and Power (CHP) market is exceptionally promising, driven by a robust commitment to energy transition and decarbonization. Growth accelerators, including sustained technological innovation in fuel flexibility (particularly with hydrogen and biogas), enhanced system efficiencies, and strategic market partnerships, will continue to propel market expansion. The ongoing support from stringent environmental regulations and financial incentives by the Dutch government provides a stable and predictable environment for investment. Emerging opportunities in the circular economy, the development of smart energy communities, and the industrial sector's continuous demand for reliable and cost-effective energy solutions will further fuel growth. The Netherlands Combined Heat and Power Market is thus well-positioned to play a pivotal role in achieving the nation's climate objectives while delivering significant economic benefits to its diverse end-users.

Netherlands Combined Heat and Power Market Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Renewable Energy Sources

- 2.3. Other Fuel Types

Netherlands Combined Heat and Power Market Segmentation By Geography

- 1. Netherlands

Netherlands Combined Heat and Power Market Regional Market Share

Geographic Coverage of Netherlands Combined Heat and Power Market

Netherlands Combined Heat and Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industries such as chemicals

- 3.2.2 paper

- 3.2.3 and pulp require reliable and efficient power solutions

- 3.2.4 making CHP systems an attractive option. The chemical sector

- 3.2.5 in particular

- 3.2.6 is expected to continue driving demand for natural gas-based CHP due to its established infrastructure and logistics.

- 3.3. Market Restrains

- 3.3.1 The increasing share of renewable energy sources

- 3.3.2 such as wind and solar

- 3.3.3 presents challenges for integrating CHP systems into the grid. The variability of renewable energy can affect the efficiency and operation of CHP plants

- 3.4. Market Trends

- 3.4.1 Natural gas has traditionally been the primary fuel for CHP systems in the Netherlands

- 3.4.2 accounting for over 70% of fuel usage. This trend is expected to continue

- 3.4.3 driven by the chemical sector's substantial demand for CHP

- 3.4.4 which benefits from natural gas's efficiency and environmental compatibility.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Combined Heat and Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Renewable Energy Sources

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Viessmann Werke GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microgen Engine Corporation Holding B V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Centrica PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BDR Thermea Group BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Capstone Turbine Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Netherlands Combined Heat and Power Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Netherlands Combined Heat and Power Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 3: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 6: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Combined Heat and Power Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Netherlands Combined Heat and Power Market?

Key companies in the market include ABB Ltd, Viessmann Werke GmbH & Co KG, Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec), Microgen Engine Corporation Holding B V, Siemens AG, Caterpillar Inc, Centrica PLC, General Electric Company, BDR Thermea Group BV, Capstone Turbine Corporation.

3. What are the main segments of the Netherlands Combined Heat and Power Market?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Industries such as chemicals. paper. and pulp require reliable and efficient power solutions. making CHP systems an attractive option. The chemical sector. in particular. is expected to continue driving demand for natural gas-based CHP due to its established infrastructure and logistics..

6. What are the notable trends driving market growth?

Natural gas has traditionally been the primary fuel for CHP systems in the Netherlands. accounting for over 70% of fuel usage. This trend is expected to continue. driven by the chemical sector's substantial demand for CHP. which benefits from natural gas's efficiency and environmental compatibility..

7. Are there any restraints impacting market growth?

The increasing share of renewable energy sources. such as wind and solar. presents challenges for integrating CHP systems into the grid. The variability of renewable energy can affect the efficiency and operation of CHP plants.

8. Can you provide examples of recent developments in the market?

In the first half of 2024, renewable energy sources generated more electricity than fossil fuels in the Netherlands for the first time. Renewables produced 32.3 billion kilowatt-hours, accounting for 53% of the total electricity output, with wind power significantly contributing to this increase.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Combined Heat and Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Combined Heat and Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Combined Heat and Power Market?

To stay informed about further developments, trends, and reports in the Netherlands Combined Heat and Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence