Key Insights

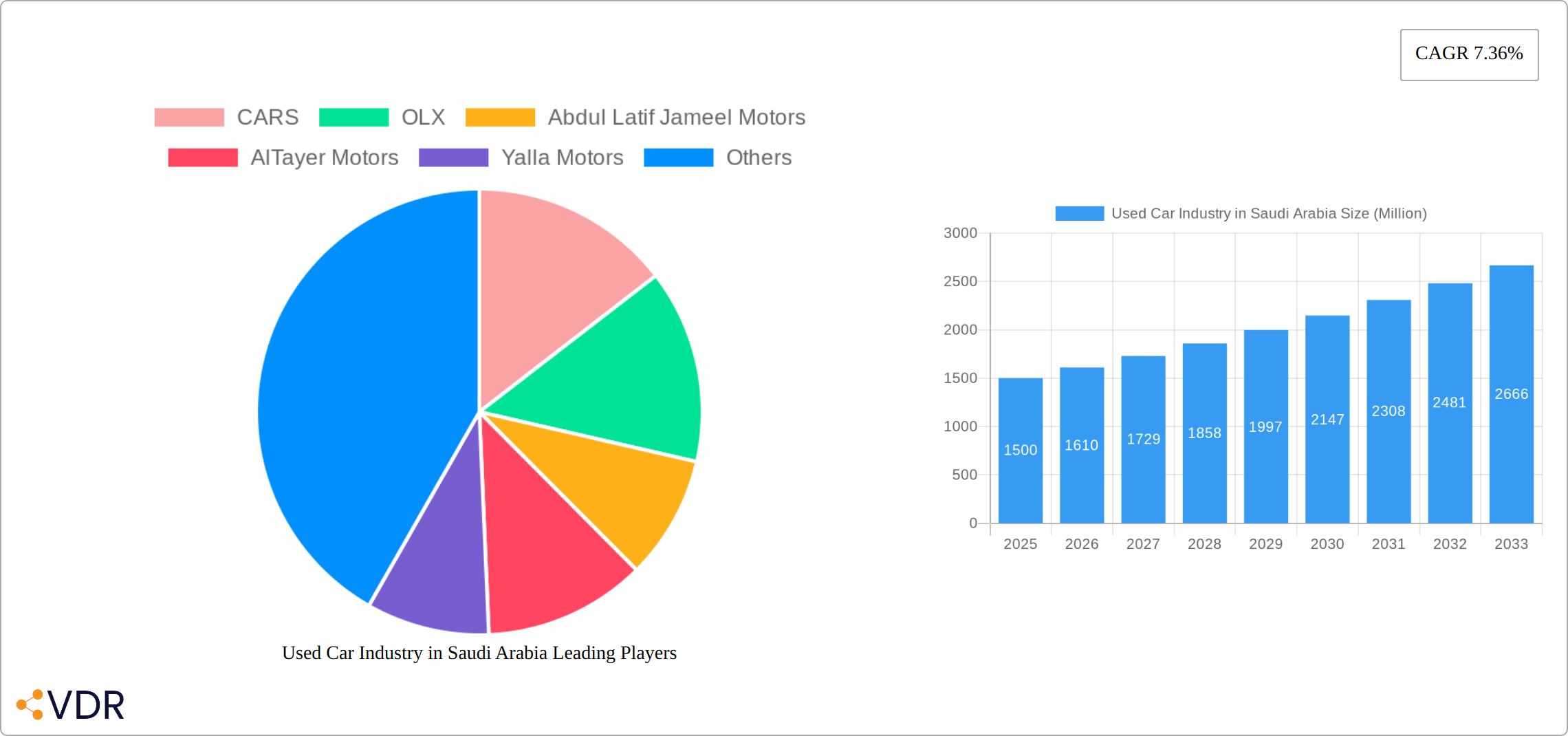

The Saudi Arabian used car market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.36% from 2025 to 2033. This expansion is driven by several factors. Rising disposable incomes among Saudi citizens, coupled with a preference for more frequent vehicle upgrades, fuels demand for affordable used car options. Furthermore, the government's initiatives to improve infrastructure and expand transportation networks contribute to increased vehicle ownership and subsequent trade in the used car market. The popularity of online sales channels, offering wider reach and convenience, further accelerates market growth. Segmentation reveals a diverse landscape: Hatchbacks and Sedans remain popular choices, alongside a growing demand for SUVs and MUVs catering to larger families. Organized vendors, including established dealerships and online platforms like Yalla Motors and Dubizzle Motors LLC, are experiencing significant growth, alongside a persistent unorganized sector. Geographic variations exist, with regions like the Central and Eastern regions potentially exhibiting higher growth rates due to population density and economic activity. However, challenges remain, including concerns about vehicle reliability and the availability of financing options for used car purchases.

The competitive landscape is intensely dynamic, with both international and domestic players vying for market share. Companies like Abdul Latif Jameel Motors and Al-Futtaim Group, known for their established presence and brand reputation, are competing against online marketplaces like CARS and OLX, which benefit from their wider reach and technological advantage. The balance between organized and unorganized sales channels will likely shift towards greater formalization as consumer preference shifts towards transparency and assurance. Future growth will hinge on addressing consumer concerns about used car quality and establishing robust quality control mechanisms, along with the continuous development of financing options that ease access to affordable credit. The used car market in Saudi Arabia represents a significant and growing sector with substantial potential for further expansion in the coming decade. The interplay of economic factors, consumer preferences, and technological advancements will define its trajectory.

Used Car Industry in Saudi Arabia: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic used car market in Saudi Arabia, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth trends, key players, and future opportunities for industry professionals, investors, and policymakers. The report segments the market by vehicle type (Hatchback, Sedan, MUV, SUV), sales channel (online, offline), and vendor type (organized, unorganized), providing a granular understanding of this thriving sector.

Keywords: Saudi Arabia used car market, used car sales Saudi Arabia, online used car market Saudi Arabia, used car industry Saudi Arabia, Saudi Arabia automotive market, used car dealerships Saudi Arabia, OLX Saudi Arabia, Yalla Motors, Abdul Latif Jameel Motors, Al-Futtaim Group, used car market analysis Saudi Arabia, Saudi Arabia car market forecast.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Used Car Industry in Saudi Arabia Market Dynamics & Structure

The Saudi Arabian used car market is a dynamic and evolving sector, characterized by a sophisticated blend of established players and rapidly emerging digital platforms. Understanding its competitive landscape, technological integrations, regulatory environment, and prevailing market trends is crucial for stakeholders. The market is a mosaic of organized dealerships and a vast network of unorganized sellers, each contributing to the overall market concentration and dynamics.

- Market Concentration: The market exhibits a moderate level of concentration. While major automotive groups such as Abdul Latif Jameel Motors and Al-Futtaim Group command substantial market shares, they operate alongside a multitude of independent dealers and increasingly influential online marketplaces. Projections indicate that the organized sector will hold approximately 60% of the market share by 2025, with the unorganized sector accounting for the remaining 40%. This balance highlights the continued relevance of traditional sales channels while acknowledging the ascendancy of organized retail.

- Technological Innovation: The advent and widespread adoption of online platforms like CARS, OLX, and Yalla Motors are revolutionizing the used car sector by enhancing transparency and consumer accessibility. These digital solutions are streamlining the buying and selling processes. However, a key area for future development lies in the seamless integration of advanced digital technologies across the entire automotive value chain, from vehicle sourcing and inspection to sales and after-sales services.

- Regulatory Framework: The market's trajectory is significantly influenced by government regulations pertaining to vehicle inspections, emissions standards, and import/export protocols. Any future policy adjustments, particularly concerning import duties, environmental mandates, or consumer protection laws, have the potential to substantially reshape market growth and competitive dynamics.

- Competitive Product Substitutes: The used car market faces indirect competition from attractive leasing options and flexible new car financing schemes. Furthermore, direct competition arises from the pricing and availability of new vehicles. Fluctuations in the new car market, whether in terms of price or supply, directly impact the demand and pricing strategies within the used car segment.

- End-User Demographics: Saudi Arabia boasts a youthful demographic profile coupled with a steadily increasing average disposable income. This combination significantly fuels the demand for used cars, positioning them as an attractive and economical alternative to new vehicle purchases, particularly for first-time car buyers and budget-conscious consumers.

- M&A Trends: Over the past five years, the used car industry has observed a moderate but strategic level of mergers and acquisitions. These activities, involving approximately XX deals with a combined value of XX Million USD, have predominantly focused on consolidating the digital landscape through the acquisition of online platforms and the strategic expansion of physical dealership networks to enhance market reach and operational efficiency.

Used Car Industry in Saudi Arabia Growth Trends & Insights

The Saudi Arabian used car market has demonstrated robust growth throughout the historical period from 2019 to 2024, propelled by sustained economic expansion and a rising propensity for vehicle ownership. The market expanded significantly, with the total volume of used cars sold increasing from XX Million units in 2019 to an impressive XX Million units in 2024, reflecting a Compound Annual Growth Rate (CAGR) of XX%. Looking ahead, the forecast period spanning 2025 to 2033 anticipates continued strong growth, with the market projected to reach an estimated XX Million units by 2033, exhibiting a sustained CAGR of XX%. This upward trajectory is underpinned by several key factors:

- A continuously rising disposable income and an expanding middle-class demographic.

- A pronounced and growing preference for Sports Utility Vehicles (SUVs) and Multi-Utility Vehicles (MUVs) within the used car segment, driven by lifestyle and utility needs.

- The increasing integration and acceptance of online platforms for both the purchasing and selling of used vehicles, enhancing convenience and market access.

- Supportive government initiatives aimed at enhancing national infrastructure and improving transportation networks, making vehicle ownership and usage more practical.

- A discernible shift in consumer behavior, with a growing number of individuals opting for used vehicles as a more prudent and economical choice compared to new car acquisitions.

Dominant Regions, Countries, or Segments in Used Car Industry in Saudi Arabia

The primary economic hubs and densely populated metropolitan areas of Saudi Arabia, including the capital city of Riyadh, the coastal metropolis of Jeddah, and the eastern industrial center of Dammam, serve as the epicenters of the used car market. These regions drive significant demand due to their high population densities and robust economic activity. Among the different vehicle types, the SUV segment commands the largest market share, followed by sedans and hatchbacks. While offline sales channels, such as traditional dealerships, currently hold a dominant position, online platforms are experiencing rapid expansion and are steadily gaining traction in market influence.

- Leading Segment (Vehicle Type): SUVs constitute the most dominant segment, largely owing to their appeal to family-oriented consumers and their inherent suitability for Saudi Arabia's diverse terrains and climate. The market share for SUVs in 2025 is estimated to be around 45%.

- Leading Segment (Sales Channel): Offline sales, primarily through franchised and independent dealerships, maintain their market leadership with an estimated 70% market share in 2025. However, the rapid evolution and increasing consumer adoption of online sales channels indicate significant future growth potential and a shifting market landscape.

- Leading Segment (Vendor Type): The organized sector, encompassing large dealership networks and certified pre-owned programs, holds a dominant position in the market. Nevertheless, the unorganized sector, comprising independent dealers and private sellers, continues to retain a significant and influential presence, catering to specific market segments.

Key growth catalysts for the industry include ongoing improvements in road infrastructure, sustained economic prosperity, and supportive government policies designed to foster automotive sector development and consumer mobility.

Used Car Industry in Saudi Arabia Product Landscape

The used car market showcases a diverse range of vehicles, varying in age, condition, make, and model. Online platforms are enhancing product transparency by providing detailed vehicle history reports and images. Innovations include the introduction of certified pre-owned vehicles with warranties, bolstering consumer trust. Furthermore, the development of digital tools to facilitate vehicle inspections and valuations streamlines the buying process.

Key Drivers, Barriers & Challenges in Used Car Industry in Saudi Arabia

Key Drivers:

- Robust economic growth and a consistent rise in disposable incomes across the population.

- Accelerating urbanization trends coupled with substantial investments in improving national road infrastructure.

- A pervasive and increasing demand for personal transportation and private vehicles.

- Rapid technological advancements, particularly the widespread adoption and innovation of online sales and service platforms.

Key Challenges:

- Ensuring consistent vehicle quality and maintaining a high degree of transparency throughout the used car transaction process.

- The absence of a universally standardized and accessible system for vehicle history reporting, which can impact consumer trust and due diligence.

- Navigating stringent import regulations and managing the volatility of currency exchange rates, which can significantly influence pricing and availability.

- Intensifying competition from attractive leasing arrangements and appealing financing offers for new vehicles, which present alternative ownership models.

Emerging Opportunities in Used Car Industry in Saudi Arabia

- Strategic expansion of digital marketplaces, coupled with the seamless integration of innovative fintech solutions to streamline financing processes for used car buyers.

- Growth and wider adoption of certified pre-owned (CPO) programs designed to enhance consumer confidence through rigorous inspections and extended warranties.

- Leveraging advanced data analytics to refine pricing algorithms, optimize inventory management, and improve risk assessment for financial services.

- Development and implementation of targeted marketing strategies that precisely address the preferences and needs of specific demographic segments and vehicle type preferences.

Growth Accelerators in the Used Car Industry in Saudi Arabia Industry

The long-term growth of the Saudi Arabian used car market hinges on several factors. Technological innovation, particularly in online platforms and digital financing, is crucial. Strategic partnerships between established dealerships and online platforms can enhance market reach and efficiency. Expanding into underserved markets and offering tailored financing options can broaden market access and customer base.

Key Players Shaping the Used Car Industry in Saudi Arabia Market

- CARS

- OLX

- Abdul Latif Jameel Motors

- AlTayer Motors

- Yalla Motors

- Dubizzle Motors LLC

- Al-Futtaim Group

- Arabian Auto Agency

- Al Nabooda Automobiles LLC

Notable Milestones in Used Car Industry in Saudi Arabia Sector

- 2020: Launch of several online used car platforms, significantly increasing market reach.

- 2022: Introduction of stricter vehicle inspection standards aimed at improving quality and safety.

- 2023: Several major dealerships invest in digital tools to enhance customer experiences.

- 2024: Increased regulatory scrutiny over online used car sales, prompting improvements in transparency.

In-Depth Used Car Industry in Saudi Arabia Market Outlook

The Saudi Arabian used car market exhibits strong growth potential driven by increasing vehicle ownership, favorable demographics, and accelerating technological adoption. Strategic investments in digital infrastructure, expansion of certified pre-owned programs, and the development of efficient financing solutions will be key to unlocking future opportunities. The market is poised for further consolidation, with larger players likely to acquire smaller independent dealers to increase market share.

Used Car Industry in Saudi Arabia Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. SUVs and MUVs

-

2. Sales Channel

- 2.1. Online

- 2.2. Offline

-

3. Vendor Type

- 3.1. Organized

- 3.2. Unorganized

Used Car Industry in Saudi Arabia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Industry in Saudi Arabia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Luxury Cars is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Comparatively Limited Market Transparency May Hinder the Market

- 3.4. Market Trends

- 3.4.1. Hatchback Segmented to Gain Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. SUVs and MUVs

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Vendor Type

- 5.3.1. Organized

- 5.3.2. Unorganized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. SUVs and MUVs

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Vendor Type

- 6.3.1. Organized

- 6.3.2. Unorganized

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. SUVs and MUVs

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Vendor Type

- 7.3.1. Organized

- 7.3.2. Unorganized

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. SUVs and MUVs

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Vendor Type

- 8.3.1. Organized

- 8.3.2. Unorganized

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. SUVs and MUVs

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Vendor Type

- 9.3.1. Organized

- 9.3.2. Unorganized

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. SUVs and MUVs

- 10.2. Market Analysis, Insights and Forecast - by Sales Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Vendor Type

- 10.3.1. Organized

- 10.3.2. Unorganized

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Central Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 12. Eastern Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 13. Western Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 14. Southern Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 CARS

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 OLX

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Abdul Latif Jameel Motors

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 AlTayer Motors

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Yalla Motors

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Dubizzle Motors LLC

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Al-Futtaim Group

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Arabian Auto Agency*List Not Exhaustive

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Al Nabooda Automobiles LLC

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.1 CARS

List of Figures

- Figure 1: Global Used Car Industry in Saudi Arabia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Saudi Arabia Used Car Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 3: Saudi Arabia Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 5: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 6: North America Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2024 & 2032

- Figure 7: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 8: North America Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2024 & 2032

- Figure 9: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 10: North America Used Car Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 13: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 14: South America Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2024 & 2032

- Figure 15: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 16: South America Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2024 & 2032

- Figure 17: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 18: South America Used Car Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 21: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 22: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2024 & 2032

- Figure 23: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 24: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2024 & 2032

- Figure 25: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 26: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 29: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 30: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2024 & 2032

- Figure 31: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 32: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2024 & 2032

- Figure 33: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 34: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 37: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 38: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2024 & 2032

- Figure 39: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 40: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2024 & 2032

- Figure 41: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 42: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 4: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 5: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 13: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 14: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 19: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 20: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 21: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 26: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 27: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 28: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 40: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 41: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Turkey Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Israel Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: GCC Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: North Africa Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 49: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 50: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 51: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 52: China Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: India Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: South Korea Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: ASEAN Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Oceania Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Industry in Saudi Arabia?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Used Car Industry in Saudi Arabia?

Key companies in the market include CARS, OLX, Abdul Latif Jameel Motors, AlTayer Motors, Yalla Motors, Dubizzle Motors LLC, Al-Futtaim Group, Arabian Auto Agency*List Not Exhaustive, Al Nabooda Automobiles LLC.

3. What are the main segments of the Used Car Industry in Saudi Arabia?

The market segments include Vehicle Type, Sales Channel, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Luxury Cars is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

Hatchback Segmented to Gain Momentum.

7. Are there any restraints impacting market growth?

Comparatively Limited Market Transparency May Hinder the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Industry in Saudi Arabia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Industry in Saudi Arabia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Industry in Saudi Arabia?

To stay informed about further developments, trends, and reports in the Used Car Industry in Saudi Arabia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence