Key Insights

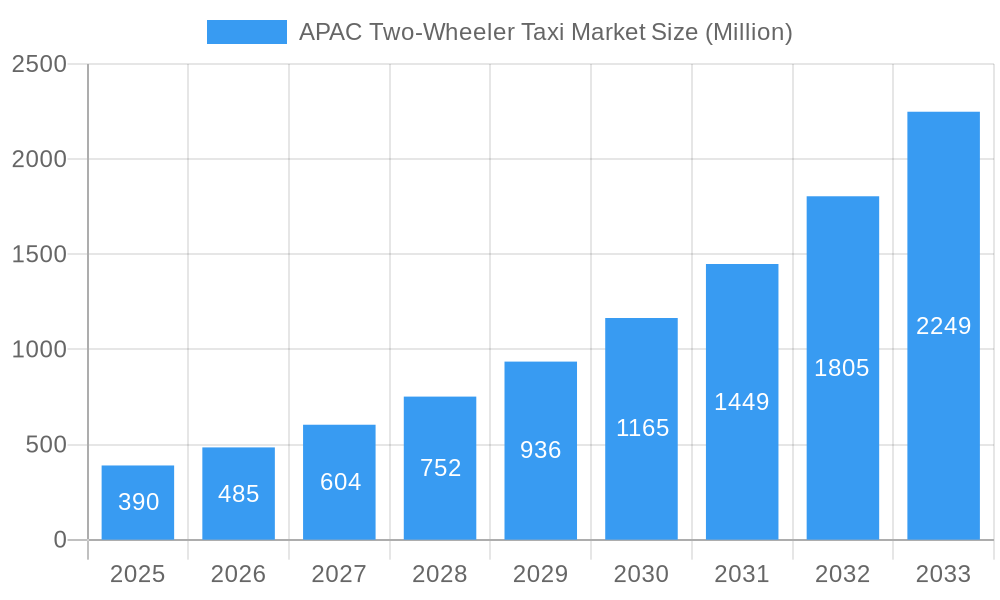

The APAC Two-Wheeler Taxi Market is poised for extraordinary expansion, projected to reach an estimated value of USD 0.39 billion by 2025 and surge to significantly higher figures throughout the forecast period. This robust growth is underpinned by a remarkable Compound Annual Growth Rate (CAGR) of 24.50%, indicating a dynamic and rapidly evolving landscape. The primary drivers fueling this surge include increasing urbanization across key Asian nations, leading to greater demand for efficient and affordable last-mile connectivity. The proliferation of smartphones and widespread internet penetration have significantly boosted the adoption of ride-hailing applications, making two-wheeler taxis an increasingly convenient option for daily commutes and short-distance travel. Furthermore, the cost-effectiveness and agility of two-wheelers in navigating congested urban environments make them a preferred choice over traditional four-wheeler taxis, especially in densely populated cities within China, India, Japan, Thailand, and Vietnam.

APAC Two-Wheeler Taxi Market Market Size (In Million)

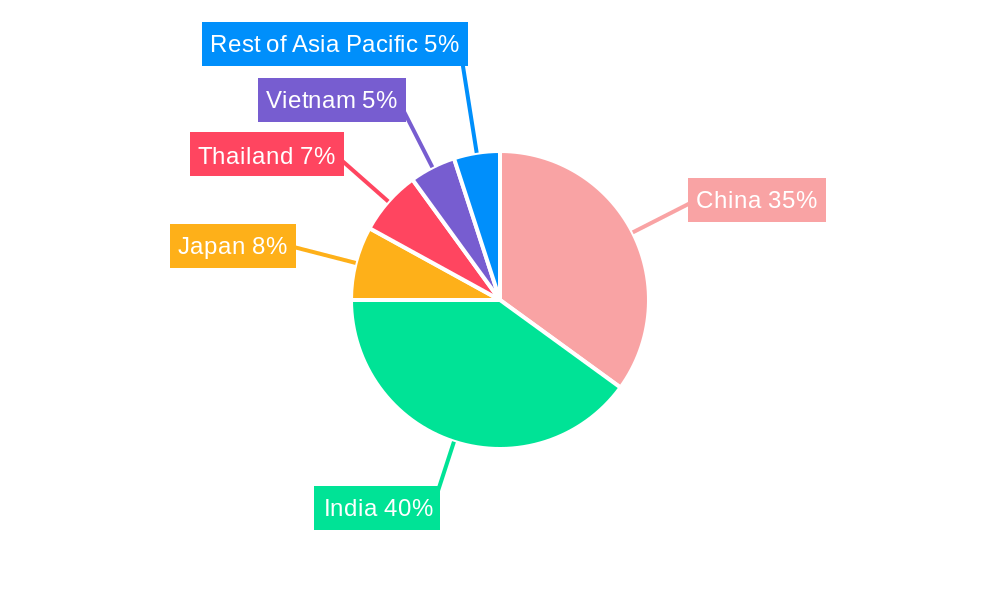

The market segmentation reveals a strong preference for "Pay as You Go" service models, reflecting the immediate and on-demand nature of two-wheeler taxi services. However, the Subscription-Based model is expected to gain traction as users seek regular, discounted travel options. Geographically, China and India are expected to dominate the market due to their massive populations and high adoption rates of mobility solutions. Japan, Thailand, and Vietnam are also significant contributors, with growing urban populations and increasing disposable incomes. Emerging trends include the integration of electric two-wheelers to promote sustainability, the development of advanced rider safety features, and the expansion of these services into Tier 2 and Tier 3 cities. While rapid expansion is evident, potential restraints could include evolving regulatory frameworks in different countries, infrastructure challenges in certain regions, and intense competition among key players like Rapido, Uber, GOJEK, Grab, and Ola, which will necessitate continuous innovation and service differentiation to maintain market share.

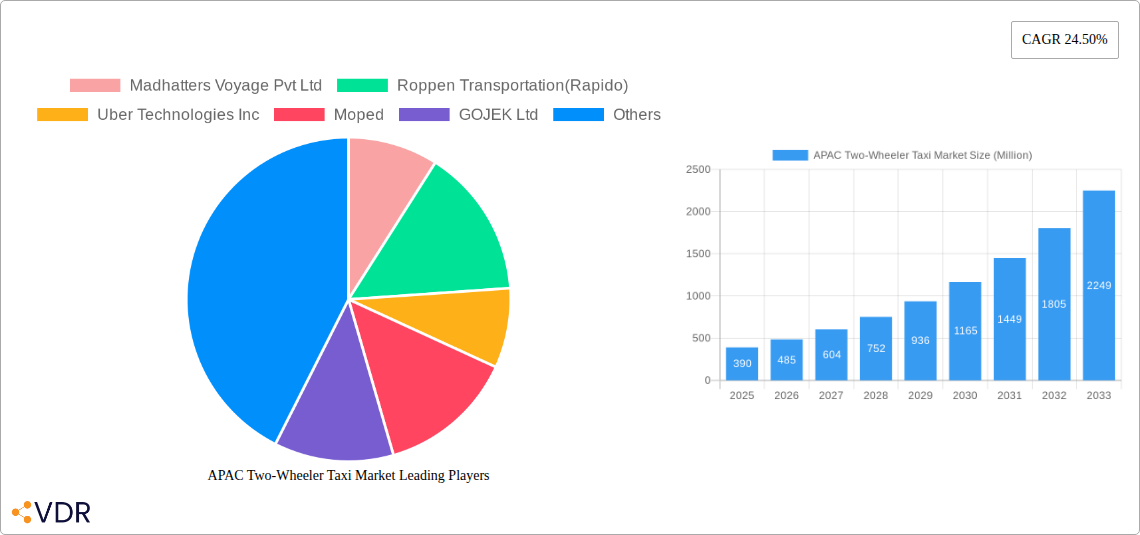

APAC Two-Wheeler Taxi Market Company Market Share

APAC Two-Wheeler Taxi Market Report: Revolutionizing Urban Mobility in Asia-Pacific

Unlock critical insights into the burgeoning APAC Two-Wheeler Taxi Market, a dynamic sector poised for exponential growth. This comprehensive report offers an in-depth analysis of market dynamics, growth trajectories, regional dominance, and key player strategies. With a focus on Motorcycle and Scooter segments, Pay as You Go and Subscription-Based services, and the key geographies of China, India, Japan, Thailand, and Vietnam, this report is essential for stakeholders seeking to capitalize on the future of two-wheeler ride-hailing. Covering the historical period of 2019-2024 and a robust forecast from 2025-2033, driven by a Base Year of 2025, this report presents data in Million Units, ensuring actionable intelligence for your business.

APAC Two-Wheeler Taxi Market Market Dynamics & Structure

The APAC Two-Wheeler Taxi Market is characterized by a moderately fragmented structure, with a blend of established global players and agile local innovators. Market concentration is increasing as leading companies like GOJEK Ltd, GrabTaxi Holdings Pte Ltd, and ANI Technologies Pvt Ltd (OLA) consolidate their presence through strategic acquisitions and service expansions. Technological innovation drivers are primarily focused on app development, GPS tracking accuracy, real-time traffic management, and the integration of electric vehicles (EVs) to meet sustainability demands. Regulatory frameworks across APAC nations are evolving, with governments increasingly focusing on passenger safety, driver welfare, and emissions reduction, impacting operational models and market entry strategies.

- Competitive Product Substitutes: While direct competition comes from other two-wheeler taxi operators, indirect substitutes include ride-sharing services using four-wheelers (e.g., Uber Technologies Inc.), public transportation networks, and personal vehicle ownership. The convenience and cost-effectiveness of two-wheeler taxis often provide a competitive edge, particularly in congested urban environments.

- End-User Demographics: The primary end-users are urban dwellers, often young professionals, students, and daily commuters seeking affordable and time-efficient transportation. A growing segment includes tourists looking for a localized and accessible way to navigate cities.

- M&A Trends: The market has witnessed strategic mergers and acquisitions aimed at expanding geographical reach, acquiring technological capabilities, and diversifying service offerings. For instance, the consolidation of ride-hailing platforms often includes two-wheeler taxi services as a key component. The estimated volume of M&A deals in the broader ride-hailing sector in APAC over the historical period has been in the range of 5-10 significant transactions annually, with a projected increase in specialized two-wheeler acquisitions moving forward.

- Innovation Barriers: Key barriers include the significant capital required for platform development and driver onboarding, stringent and often inconsistent regulatory compliance across different countries, and the challenge of building trust and brand loyalty in a competitive landscape.

APAC Two-Wheeler Taxi Market Growth Trends & Insights

The APAC Two-Wheeler Taxi Market is experiencing a transformative growth phase, fueled by rapid urbanization, increasing disposable incomes, and a growing demand for convenient and affordable mobility solutions. The market size is projected to expand significantly from an estimated XX Million units in 2024 to reach an impressive XX Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This growth is underpinned by evolving adoption rates of ride-hailing services, which have become an integral part of daily commutes for millions across the region.

The market is being reshaped by profound technological disruptions. The proliferation of smartphones and widespread internet connectivity have been instrumental in the widespread adoption of mobile-based ride-hailing platforms. Advanced GPS technology, real-time data analytics, and sophisticated dispatch algorithms are enhancing operational efficiency and user experience. Furthermore, the increasing focus on environmental sustainability is driving the adoption of electric motorcycles and scooters, presenting a significant opportunity for eco-friendly transportation solutions. This shift towards green mobility is not only driven by consumer preference but also by government incentives and stricter emission regulations.

Consumer behavior shifts are also playing a crucial role. Consumers are increasingly prioritizing convenience, cost-effectiveness, and speed, especially in heavily congested urban centers where two-wheeler taxis offer a distinct advantage over traditional modes of transport. The "on-demand" economy has normalized instant service gratification, making ride-hailing an expected part of the transportation ecosystem. The rise of the gig economy has also provided a flexible income source for a large pool of drivers, further contributing to the supply side of the market. The market penetration of two-wheeler taxi services, which stood at approximately XX% in key urban centers in 2024, is expected to climb to over XX% by 2033, indicating substantial room for growth. The estimated market size in the base year 2025 is projected to be XX Million units.

Dominant Regions, Countries, or Segments in APAC Two-Wheeler Taxi Market

India stands out as the dominant region and country driving significant growth within the APAC Two-Wheeler Taxi Market. This dominance is propelled by a confluence of factors including a massive population base, highly dense urban environments prone to traffic congestion, a burgeoning middle class with increasing disposable incomes, and a well-established culture of motorcycle and scooter usage. The Motorcycle segment is overwhelmingly dominant in India due to its affordability, maneuverability, and widespread availability of these vehicles.

- Economic Policies & Infrastructure: Government initiatives aimed at promoting digital India and easing business regulations have fostered a conducive environment for ride-hailing platforms. The extensive road networks, albeit often congested, and the widespread availability of mobile internet infrastructure are critical enablers.

- Market Share & Growth Potential: India’s two-wheeler taxi market accounted for an estimated XX% of the total APAC market in 2024 and is projected to maintain a strong CAGR of over XX% during the forecast period. The sheer volume of potential users and the affordability of the service translate into immense growth potential.

- Consumer Behavior: Indians are highly receptive to cost-effective and time-saving solutions, making two-wheeler taxis a preferred choice for daily commutes, especially for short to medium distances. The convenience of booking through mobile apps has further accelerated adoption.

China also represents a significant market, driven by its large urban populations and rapid adoption of technology. While the two-wheeler taxi market exists, regulatory landscapes and a strong presence of other mobility options like e-hailing cars and public transport influence its specific growth trajectory. Japan, with its advanced technological infrastructure and focus on efficiency, presents opportunities, particularly for premium or specialized two-wheeler taxi services, though regulatory frameworks are more stringent.

The Thailand and Vietnam markets are emerging as high-potential growth areas. In Thailand, initiatives like the electric motorcycle taxi pilot project (May 2022) involving TAILG and UNEP, and the public-private partnership with EGAT, Stallions, and TAILG demonstrate a clear push towards sustainable mobility and an expansion of the two-wheeler taxi ecosystem. Vietnam's rapidly growing economy and young population are driving demand for affordable transportation, making it a fertile ground for two-wheeler taxi services.

The Pay as You Go service type remains the primary revenue model, catering to the transactional needs of the majority of users. However, the Subscription-Based service type is showing nascent growth, particularly among corporate clients or frequent commuters seeking cost predictability and premium benefits.

APAC Two-Wheeler Taxi Market Product Landscape

The product landscape in the APAC Two-Wheeler Taxi Market is characterized by a rapid evolution of the digital platforms and the increasing integration of electric vehicles. Mobile applications developed by companies like Rapido, GOJEK, and OLA are the core products, offering intuitive interfaces for booking, real-time tracking, driver-rider communication, and secure payment gateways. Unique selling propositions often revolve around speed of service, affordability, and specialized features like women-only ride options. Technological advancements are focused on enhancing app functionality, improving algorithmic efficiency for dispatch, and integrating AI for personalized user experiences. The emergence of electric motorcycles and scooters as a viable alternative for taxi services represents a significant technological advancement, promising reduced operational costs and environmental benefits.

Key Drivers, Barriers & Challenges in APAC Two-Wheeler Taxi Market

Key Drivers:

- Rapid Urbanization: Growing city populations create a persistent demand for efficient and affordable transportation.

- Affordability and Convenience: Two-wheeler taxis offer a cost-effective and faster alternative to cars and congested public transport.

- Smartphone Penetration & Digitalization: Widespread access to smartphones and mobile internet fuels the adoption of app-based services.

- Gig Economy Growth: Availability of a flexible workforce willing to become drivers.

- Environmental Consciousness: Growing demand for sustainable mobility solutions, leading to increased adoption of EVs.

Barriers & Challenges:

- Regulatory Hurdles: Inconsistent and evolving regulations across different countries regarding licensing, safety standards, and driver status.

- Safety Concerns: Perceptions of safety, particularly for female passengers, and the inherent risks associated with two-wheeler travel.

- Intense Competition: High market saturation in certain regions leading to price wars and pressure on margins.

- Driver Retention: Challenges in retaining drivers due to low earnings, long working hours, and lack of benefits.

- Infrastructure Limitations: Poor road conditions and inadequate parking facilities in some urban areas.

- Supply Chain Disruptions (EVs): Potential challenges in the supply chain for electric motorcycle components and charging infrastructure.

Emerging Opportunities in APAC Two-Wheeler Taxi Market

Emerging opportunities lie in the expansion of electric two-wheeler taxi fleets, driven by sustainability mandates and favorable government incentives. The development of integrated mobility platforms that offer a seamless blend of two-wheeler taxis, ride-sharing, and public transport options presents a significant avenue for growth. Furthermore, targeting underserved rural and semi-urban areas with tailored two-wheeler taxi services, and expanding into niche segments such as food delivery and last-mile logistics using two-wheelers, are promising avenues. The increasing adoption of subscription models for regular commuters also offers a stable revenue stream.

Growth Accelerators in the APAC Two-Wheeler Taxi Market Industry

Growth accelerators in the APAC Two-Wheeler Taxi Market are primarily driven by strategic technological advancements and robust market expansion initiatives. The increasing integration of artificial intelligence (AI) and machine learning (ML) into ride-hailing platforms for optimized route planning, dynamic pricing, and predictive maintenance is enhancing operational efficiency. Strategic partnerships between ride-hailing companies and electric vehicle manufacturers are crucial for scaling up EV adoption. Furthermore, aggressive marketing campaigns targeting new user segments and geographical expansions into emerging economies within APAC will fuel sustained growth. Government support through subsidies for EV adoption and infrastructure development also acts as a significant catalyst.

Key Players Shaping the APAC Two-Wheeler Taxi Market Market

- Madhatters Voyage Pvt Ltd

- Roppen Transportation (Rapido)

- Uber Technologies Inc

- Moped

- GOJEK Ltd

- GrabTaxi Holdings Pte Ltd

- ANI Technologies Pvt Ltd (OLA)

Notable Milestones in APAC Two-Wheeler Taxi Market Sector

- May 2022: Thai government and UNEP initiated a pilot project for electric motorcycle taxis in Thailand, utilizing fifty donated electric motorcycles from TAILG for research and sustainable mobility demonstration.

- May 2022: A public-private initiative in Thailand saw EGAT, The Stallions Company Limited, and Dongguan Tailing Electric Vehicle Company Limited (TAILG) of China collaborate to introduce electric mobility in the form of motorcycle taxis, promoting eco-friendly transport.

In-Depth APAC Two-Wheeler Taxi Market Market Outlook

The APAC Two-Wheeler Taxi Market is on a robust upward trajectory, driven by an interplay of technological innovation, evolving consumer preferences, and supportive government policies. The future outlook is characterized by the accelerated adoption of electric two-wheelers, driven by environmental consciousness and operational cost savings. Strategic expansions into Tier-2 and Tier-3 cities, alongside a deeper penetration into existing urban markets, will be key growth strategies. The report forecasts significant market expansion driven by a CAGR of XX% from 2025–2033, with key players like GOJEK, Grab, and OLA continuing to consolidate their positions through service diversification and technological integration. Opportunities in developing integrated mobility ecosystems and niche logistics services present substantial long-term potential for market leaders.

APAC Two-Wheeler Taxi Market Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter

-

2. Service Type

- 2.1. Pay as You Go

- 2.2. Subscription-Based

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Thailand

- 3.5. Vietnam

- 3.6. Rest of Asia-Pacific

APAC Two-Wheeler Taxi Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Thailand

- 5. Vietnam

- 6. Rest of Asia Pacific

APAC Two-Wheeler Taxi Market Regional Market Share

Geographic Coverage of APAC Two-Wheeler Taxi Market

APAC Two-Wheeler Taxi Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Smartphone User and Internet Penetration Across the Region

- 3.3. Market Restrains

- 3.3.1. Increase in Traffic Problems

- 3.4. Market Trends

- 3.4.1. Increase in Smartphone and Internet Penetration Across the Region will Stimulate Pay as You Go Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Pay as You Go

- 5.2.2. Subscription-Based

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Thailand

- 5.3.5. Vietnam

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Thailand

- 5.4.5. Vietnam

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Motorcycle

- 6.1.2. Scooter

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Pay as You Go

- 6.2.2. Subscription-Based

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Thailand

- 6.3.5. Vietnam

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. India APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Motorcycle

- 7.1.2. Scooter

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Pay as You Go

- 7.2.2. Subscription-Based

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Thailand

- 7.3.5. Vietnam

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Japan APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Motorcycle

- 8.1.2. Scooter

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Pay as You Go

- 8.2.2. Subscription-Based

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Thailand

- 8.3.5. Vietnam

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Thailand APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Motorcycle

- 9.1.2. Scooter

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Pay as You Go

- 9.2.2. Subscription-Based

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Thailand

- 9.3.5. Vietnam

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Vietnam APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Motorcycle

- 10.1.2. Scooter

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Pay as You Go

- 10.2.2. Subscription-Based

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Thailand

- 10.3.5. Vietnam

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Rest of Asia Pacific APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Motorcycle

- 11.1.2. Scooter

- 11.2. Market Analysis, Insights and Forecast - by Service Type

- 11.2.1. Pay as You Go

- 11.2.2. Subscription-Based

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Thailand

- 11.3.5. Vietnam

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Madhatters Voyage Pvt Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Roppen Transportation(Rapido)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Uber Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Moped

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 GOJEK Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 GrabTaxi Holdings Pte Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ANI Technologies Pvt Ltd (OLA)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Madhatters Voyage Pvt Ltd

List of Figures

- Figure 1: Global APAC Two-Wheeler Taxi Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: China APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: China APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2025 & 2033

- Figure 5: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: China APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2025 & 2033

- Figure 9: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: India APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2025 & 2033

- Figure 13: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: India APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2025 & 2033

- Figure 17: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2025 & 2033

- Figure 23: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2025 & 2033

- Figure 29: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2025 & 2033

- Figure 31: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2025 & 2033

- Figure 37: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 15: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 19: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 23: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 27: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Two-Wheeler Taxi Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the APAC Two-Wheeler Taxi Market?

Key companies in the market include Madhatters Voyage Pvt Ltd, Roppen Transportation(Rapido), Uber Technologies Inc, Moped, GOJEK Ltd, GrabTaxi Holdings Pte Ltd, ANI Technologies Pvt Ltd (OLA).

3. What are the main segments of the APAC Two-Wheeler Taxi Market?

The market segments include Vehicle Type, Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Smartphone User and Internet Penetration Across the Region.

6. What are the notable trends driving market growth?

Increase in Smartphone and Internet Penetration Across the Region will Stimulate Pay as You Go Segment.

7. Are there any restraints impacting market growth?

Increase in Traffic Problems.

8. Can you provide examples of recent developments in the market?

May 2022: A significant milestone was achieved as the Thai government and the United Nations Environment Program (UNEP) jointly initiated a pilot project for electric motorcycle taxis in Thailand. In a remarkable collaboration, approximately fifty electric motorcycles generously donated by the Chinese company TAILG will be utilized as green motorcycle taxis, serving as both a research project and a demonstration of sustainable mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Two-Wheeler Taxi Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Two-Wheeler Taxi Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Two-Wheeler Taxi Market?

To stay informed about further developments, trends, and reports in the APAC Two-Wheeler Taxi Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence