Key Insights

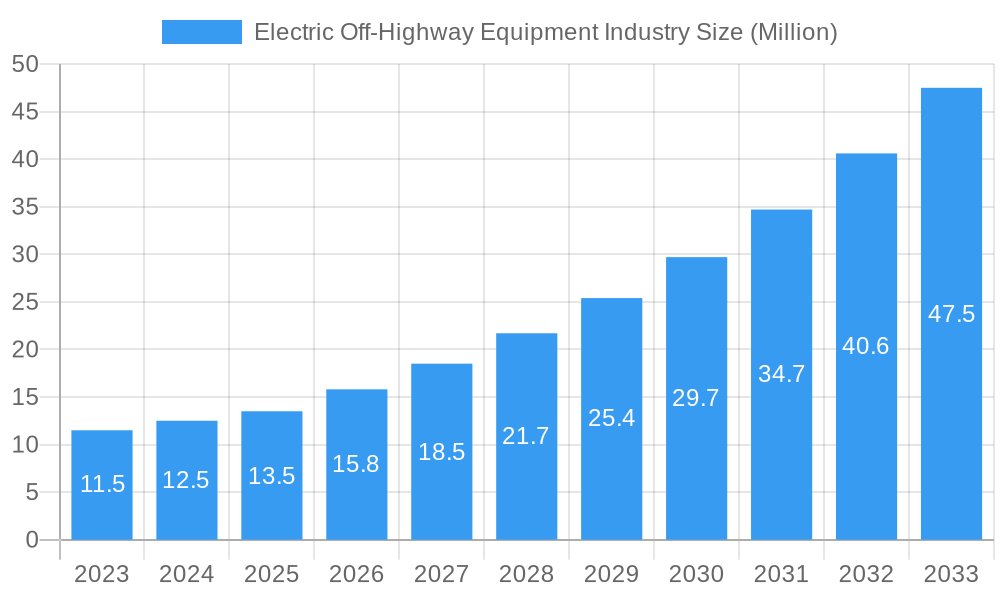

The global Electric Off-Highway Equipment market is poised for remarkable expansion, projected to reach USD 13.5 million in 2025 with an impressive Compound Annual Growth Rate (CAGR) of 16.72% through 2033. This robust growth is primarily fueled by a confluence of factors including escalating environmental regulations demanding reduced emissions, increasing adoption of advanced technologies for enhanced efficiency and productivity, and a growing awareness of the long-term cost savings associated with electric powertrains compared to their diesel counterparts. The inherent advantages of electric off-highway equipment, such as lower operational noise, reduced maintenance requirements, and superior torque characteristics, are further driving demand across key sectors. The market is witnessing significant innovation, with manufacturers investing heavily in research and development to expand the range and capabilities of their electric offerings.

Electric Off-Highway Equipment Industry Market Size (In Million)

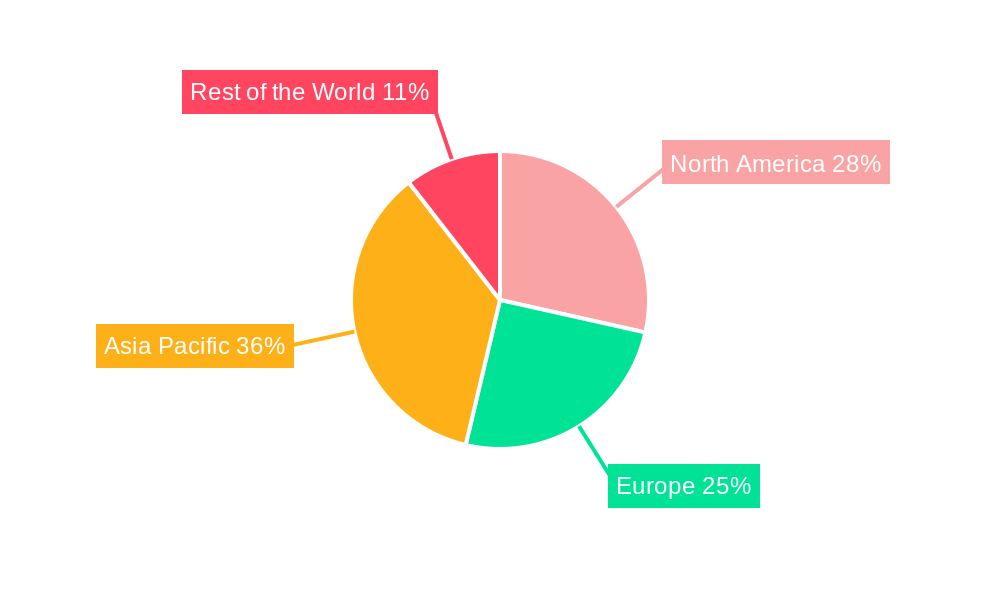

The market is strategically segmented by powertrain type, with Pure Electric dominating the landscape, followed by Hybrid options. Equipment types like Loaders, Excavators, and Dump Trucks are at the forefront of electrification, with Farm Tractors and other construction machinery also experiencing a rapid shift. The Construction and Mining industries are the primary application areas, with Agriculture rapidly emerging as a significant growth segment. Geographically, the Asia Pacific region, led by China and India, is expected to be a major growth engine due to substantial infrastructure development and supportive government initiatives. North America and Europe are also demonstrating strong adoption rates, driven by stringent emission standards and a focus on sustainable practices. While the upfront cost of electric equipment can be a restraint, the long-term total cost of ownership, coupled with government incentives and evolving battery technology, is mitigating this concern, paving the way for widespread electrification in the off-highway sector.

Electric Off-Highway Equipment Industry Company Market Share

Electric Off-Highway Equipment Industry Report: Market Analysis, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global electric off-highway equipment market, a rapidly evolving sector driven by sustainability mandates, technological advancements, and increasing demand for zero-emission solutions in construction, mining, and agriculture. We explore market dynamics, growth trajectories, dominant regions, product landscapes, key drivers, barriers, emerging opportunities, and strategic insights for industry stakeholders. Our analysis leverages a detailed study period from 2019 to 2033, with a base year of 2025, offering precise quantitative and qualitative assessments. The report examines parent and child market segments, including powertrain types (Pure Electric, Hybrid) and equipment categories (Loaders, Excavators, Dump Trucks, Farm Tractors, and other specialized equipment like bulldozers), as well as application areas (Construction and Mining, Agriculture). All values are presented in Million units.

Electric Off-Highway Equipment Industry Market Dynamics & Structure

The electric off-highway equipment industry is characterized by a dynamic and evolving market structure. Market concentration is gradually shifting as established OEMs and new entrants invest heavily in electrification. Technological innovation is a primary driver, fueled by advancements in battery technology, electric powertrains, and intelligent control systems, all aimed at enhancing efficiency, reducing operational costs, and minimizing environmental impact. Regulatory frameworks, including emissions standards and government incentives for green technologies, are playing a pivotal role in accelerating adoption. Competitive product substitutes, predominantly diesel-powered machinery, are facing increasing pressure from their electric counterparts, particularly in enclosed or noise-sensitive environments. End-user demographics are broadening, with a growing awareness and demand for sustainable solutions across the construction, mining, and agriculture sectors. Mergers and acquisitions (M&A) trends are on the rise as companies seek to gain market share, acquire new technologies, and expand their electric product portfolios.

- Market Concentration: Moderate to High, with key players dominating specific niches.

- Technological Innovation Drivers: Battery density improvements, charging infrastructure development, advanced motor efficiency, and telematics integration.

- Regulatory Frameworks: Stricter emission norms, government subsidies for electric vehicle purchases, and corporate sustainability goals.

- Competitive Product Substitutes: Traditional diesel-powered construction, mining, and agricultural machinery.

- End-User Demographics: Construction companies, mining operators, agricultural enterprises, rental companies, and government agencies focused on sustainable infrastructure development.

- M&A Trends: Strategic acquisitions of battery technology firms, electric powertrain specialists, and companies with strong regional distribution networks.

Electric Off-Highway Equipment Industry Growth Trends & Insights

The electric off-highway equipment industry is poised for significant growth, projected to expand at a robust Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by a confluence of factors including escalating environmental consciousness, stringent government regulations on emissions, and the economic advantages offered by electric machinery in the long run. Market penetration of electric off-highway equipment is steadily increasing, particularly in regions with strong sustainability initiatives and well-developed charging infrastructure. Technological disruptions are at the forefront, with continuous improvements in battery energy density, faster charging capabilities, and enhanced powertrain efficiency making electric solutions increasingly viable alternatives to their fossil fuel counterparts. Consumer behavior shifts are evident as end-users prioritize total cost of ownership, reduced noise pollution, and improved operator comfort, all key advantages of electric equipment. Furthermore, the growing demand for automation and connectivity in off-highway operations further synergizes with the inherent digital nature of electric powertrains. The parent market for off-highway equipment is undergoing a fundamental transformation, with the child market of electric variants experiencing accelerated growth due to these compelling trends. The market size is projected to reach significant figures by 2033, indicating a strong future for electric alternatives.

Dominant Regions, Countries, or Segments in Electric Off-Highway Equipment Industry

The electric off-highway equipment industry is experiencing dominant growth driven by specific regions, countries, and market segments. North America and Europe currently lead the adoption of electric off-highway machinery, owing to their stringent environmental regulations, robust economic policies supporting green technology, and well-established infrastructure for both charging and servicing. Within these regions, countries like the United States, Canada, Germany, and the United Kingdom are at the forefront, with significant investments in electric construction equipment and electric farm tractors.

The Construction and Mining application segment is a primary growth engine. The demand for excavators, loaders, and dump trucks with zero-emission capabilities is high in urban construction projects and in mining operations where air quality and noise reduction are critical. The Powertrain: Pure Electric segment is experiencing the most substantial growth within the Powertrain category, driven by advancements in battery technology and the desire for complete elimination of tailpipe emissions.

In terms of Equipment Type, electric loaders and excavators are seeing the highest adoption rates due to their suitability for a wide range of construction tasks and their potential for significant operational cost savings through reduced fuel and maintenance expenses. The Agriculture application is emerging as a significant growth area, with electric farm tractors gaining traction for tasks within confined spaces like greenhouses and livestock buildings, as well as for smaller farm operations where the benefits of low noise and zero emissions are highly valued.

- Dominant Regions: North America and Europe.

- Leading Countries: United States, Canada, Germany, United Kingdom.

- Key Application Segment: Construction and Mining.

- Dominant Powertrain Segment: Pure Electric.

- High-Growth Equipment Types: Loaders, Excavators, Farm Tractors.

- Emerging Application Segment: Agriculture.

- Market Share: Pure Electric powertrains are estimated to hold over 65% of the market share in 2025 within the electric off-highway segment, with a projected increase to over 75% by 2033.

Electric Off-Highway Equipment Industry Product Landscape

The electric off-highway equipment product landscape is rapidly diversifying with innovative offerings designed for efficiency and sustainability. Key product innovations include the development of compact electric excavators and wheeled loaders with enhanced battery capacities, enabling full-day operation on a single charge. Zero-emission performance is a paramount selling proposition, making these machines ideal for sensitive environments like urban areas, indoor facilities, and agricultural settings. Performance metrics such as extended operational runtimes (4-5 hours continuous use in mixed-duty cycles for some models), reduced noise levels, and comparable or superior productivity to their diesel counterparts are key technological advancements being highlighted. The integration of modular battery systems and advanced power management further optimizes energy utilization, setting new benchmarks in the industry.

Key Drivers, Barriers & Challenges in Electric Off-Highway Equipment Industry

The electric off-highway equipment industry is propelled by several key drivers. Technological advancements in battery technology, leading to increased energy density and faster charging times, are crucial. Stringent environmental regulations and government incentives promoting the adoption of zero-emission vehicles are significant catalysts. Furthermore, the growing demand for reduced operational costs, including lower fuel and maintenance expenses, is a compelling factor for end-users.

However, the industry faces notable barriers and challenges. The high upfront cost of electric off-highway equipment compared to traditional diesel models remains a significant restraint. The availability and standardization of charging infrastructure across diverse operational sites present a logistical hurdle. Limited battery range for certain heavy-duty applications and longer charging cycles compared to refueling diesel equipment can impact productivity. Supply chain issues for critical battery components and intense competitive pressures from established diesel equipment manufacturers also pose challenges. The need for specialized technician training to service electric machinery further adds to the complexity.

- Key Drivers:

- Advancements in battery technology (energy density, charging speed).

- Stringent environmental regulations and government subsidies.

- Reduced operational costs (fuel, maintenance).

- Growing corporate sustainability initiatives.

- Barriers & Challenges:

- High initial purchase price.

- Limited charging infrastructure availability.

- Battery range limitations for certain applications.

- Supply chain vulnerabilities for battery components.

- Need for specialized technician training.

- Competitive pressure from diesel equipment.

Emerging Opportunities in Electric Off-Highway Equipment Industry

Emerging opportunities in the electric off-highway equipment industry are vast, driven by unmet market needs and evolving operational demands. The expansion of electric machinery into new application areas, such as port operations, warehousing, and specialized industrial applications requiring silent and emission-free operation, presents significant growth potential. The development of battery-swapping solutions and ultra-fast charging technologies could address range anxiety and downtime concerns. Furthermore, the integration of advanced telematics and data analytics for optimizing electric equipment performance and fleet management offers lucrative opportunities. Untapped markets in developing economies are also poised for growth as sustainability awareness and infrastructure development progress. The increasing focus on circular economy principles for battery recycling and repurposing also opens up new business models.

Growth Accelerators in the Electric Off-Highway Equipment Industry Industry

Several growth accelerators are fueling the long-term expansion of the electric off-highway equipment industry. Breakthroughs in solid-state battery technology promise further improvements in energy density, safety, and charging times, making electric solutions even more competitive. Strategic partnerships between equipment manufacturers, battery suppliers, and charging infrastructure providers are crucial for creating comprehensive ecosystems that facilitate adoption. Market expansion strategies, including the development of smaller, more affordable electric models and tailored financing options for end-users, will broaden accessibility. The increasing focus on total cost of ownership (TCO) calculations by end-users, which often favor electric machinery over its lifespan, will also act as a significant accelerator.

Key Players Shaping the Electric Off-Highway Equipment Industry Market

- BEML Limited

- CNH Industrial N V

- Volvo CE

- Deere and Company

- SANY Heavy Industry Co Ltd

- Hitachi Construction Machinery Co Ltd

- XCMG Group Co Ltd

- Doosan Group

- Caterpillar Inc

- Liebherr International AG

- Komatsu Ltd

- Sennebogen Maschinenfabrik GmbH

- OJSC BelAZ

Notable Milestones in Electric Off-Highway Equipment Industry Sector

- November 2023: Volvo CE announced the availability of its flagship electric construction machines, ECR25 Electric compact excavator and L25 Compact wheeled loader, for sale in Indonesia, following their presentation at Indotruck Utama’s Inspire 2023 event. The company is also strategizing product launches in China, South Korea, Japan, and Singapore.

- October 2023: Komatsu Ltd. announced plans to introduce its 20-tonne class electric excavators (PC200LCE-11 and 210LCE-11) with lithium-ion batteries as rental machines in Japan and Europe. The company aims for gradual introduction across Asia, North America, and Australia, with a goal of becoming carbon neutral by 2050.

- July 2023: JCB introduced its first full electric wheeled loader, offering low noise and zero-emission operation suitable for livestock buildings, glasshouses, and horticultural applications. This machine features a 20kWh battery pack, matching the productivity of the 403 diesel model and capable of a full working day or 4-to-5 hours of continuous use in a mixed-duty cycle.

In-Depth Electric Off-Highway Equipment Industry Market Outlook

The future outlook for the electric off-highway equipment industry is exceptionally promising, driven by a confluence of technological advancements, supportive regulatory environments, and a growing global emphasis on sustainability. Growth accelerators such as the maturation of battery technology, leading to enhanced performance and reduced costs, will continue to make electric alternatives more attractive. Strategic partnerships and collaborations among key industry players will foster innovation and streamline the deployment of electric solutions. The expanding scope of applications, from urban construction to remote mining operations, coupled with the development of robust charging infrastructure, will significantly broaden market reach. End-users are increasingly recognizing the long-term economic and environmental benefits of electrification, signaling a robust demand trajectory for electric off-highway equipment in the coming years. The market is set to witness substantial growth, driven by innovation and a clear shift towards a greener, more sustainable operational future.

Electric Off-Highway Equipment Industry Segmentation

-

1. Powertain

- 1.1. Pure Electric

- 1.2. Hybrid

-

2. Equipment Type

- 2.1. Loaders

- 2.2. Excavators

- 2.3. Dump Trucks

- 2.4. Farm Tractors

- 2.5. Other Equipment Types (Bulldozers, etc.)

-

3. Application

- 3.1. Construction and Mining

- 3.2. Agriculture

Electric Off-Highway Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Off-Highway Equipment Industry Regional Market Share

Geographic Coverage of Electric Off-Highway Equipment Industry

Electric Off-Highway Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Preference towards Availing Eco-Friendly Equipment/Machinery to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Powered Off-Highway Equipment Hampers the Market Growth

- 3.4. Market Trends

- 3.4.1. Hybrid Segment of the Market to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Powertain

- 5.1.1. Pure Electric

- 5.1.2. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Loaders

- 5.2.2. Excavators

- 5.2.3. Dump Trucks

- 5.2.4. Farm Tractors

- 5.2.5. Other Equipment Types (Bulldozers, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Construction and Mining

- 5.3.2. Agriculture

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Powertain

- 6. North America Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Powertain

- 6.1.1. Pure Electric

- 6.1.2. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Loaders

- 6.2.2. Excavators

- 6.2.3. Dump Trucks

- 6.2.4. Farm Tractors

- 6.2.5. Other Equipment Types (Bulldozers, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Construction and Mining

- 6.3.2. Agriculture

- 6.1. Market Analysis, Insights and Forecast - by Powertain

- 7. Europe Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Powertain

- 7.1.1. Pure Electric

- 7.1.2. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Loaders

- 7.2.2. Excavators

- 7.2.3. Dump Trucks

- 7.2.4. Farm Tractors

- 7.2.5. Other Equipment Types (Bulldozers, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Construction and Mining

- 7.3.2. Agriculture

- 7.1. Market Analysis, Insights and Forecast - by Powertain

- 8. Asia Pacific Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Powertain

- 8.1.1. Pure Electric

- 8.1.2. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Loaders

- 8.2.2. Excavators

- 8.2.3. Dump Trucks

- 8.2.4. Farm Tractors

- 8.2.5. Other Equipment Types (Bulldozers, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Construction and Mining

- 8.3.2. Agriculture

- 8.1. Market Analysis, Insights and Forecast - by Powertain

- 9. Rest of the World Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Powertain

- 9.1.1. Pure Electric

- 9.1.2. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Loaders

- 9.2.2. Excavators

- 9.2.3. Dump Trucks

- 9.2.4. Farm Tractors

- 9.2.5. Other Equipment Types (Bulldozers, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Construction and Mining

- 9.3.2. Agriculture

- 9.1. Market Analysis, Insights and Forecast - by Powertain

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BEML Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CNH Industrial N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Volvo CE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Deere and Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SANY Heavy Industry Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Construction Machinery Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 XCMG Group Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Doosan Grou

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Caterpillar Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Liebherr International AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Komatsu Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Sennebogen Maschinenfabrik GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 OJSC BelAZ

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 BEML Limited

List of Figures

- Figure 1: Global Electric Off-Highway Equipment Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 3: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 4: North America Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 5: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 6: North America Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 11: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 12: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 13: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 14: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 19: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 20: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 21: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 27: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 28: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 29: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 30: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 2: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 3: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 6: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 7: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 13: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 14: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 22: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 23: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 31: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 32: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Off-Highway Equipment Industry?

The projected CAGR is approximately 16.72%.

2. Which companies are prominent players in the Electric Off-Highway Equipment Industry?

Key companies in the market include BEML Limited, CNH Industrial N V, Volvo CE, Deere and Company, SANY Heavy Industry Co Ltd, Hitachi Construction Machinery Co Ltd, XCMG Group Co Ltd, Doosan Grou, Caterpillar Inc, Liebherr International AG, Komatsu Ltd, Sennebogen Maschinenfabrik GmbH, OJSC BelAZ.

3. What are the main segments of the Electric Off-Highway Equipment Industry?

The market segments include Powertain, Equipment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Preference towards Availing Eco-Friendly Equipment/Machinery to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Hybrid Segment of the Market to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Electric Powered Off-Highway Equipment Hampers the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2023: Volvo CE announced that its two flagship electric construction machines, the ECR25 Electric compact excavator and the L25 Compact wheeled loader, are available for sale in Indonesia after being presented to customers at Indotruck Utama’s Inspire 2023 event in September. Apart from Indonesia, the company is also strategizing to launch new electric products in China, South Korea, Japan, and Singapore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Off-Highway Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Off-Highway Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Off-Highway Equipment Industry?

To stay informed about further developments, trends, and reports in the Electric Off-Highway Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence