Key Insights

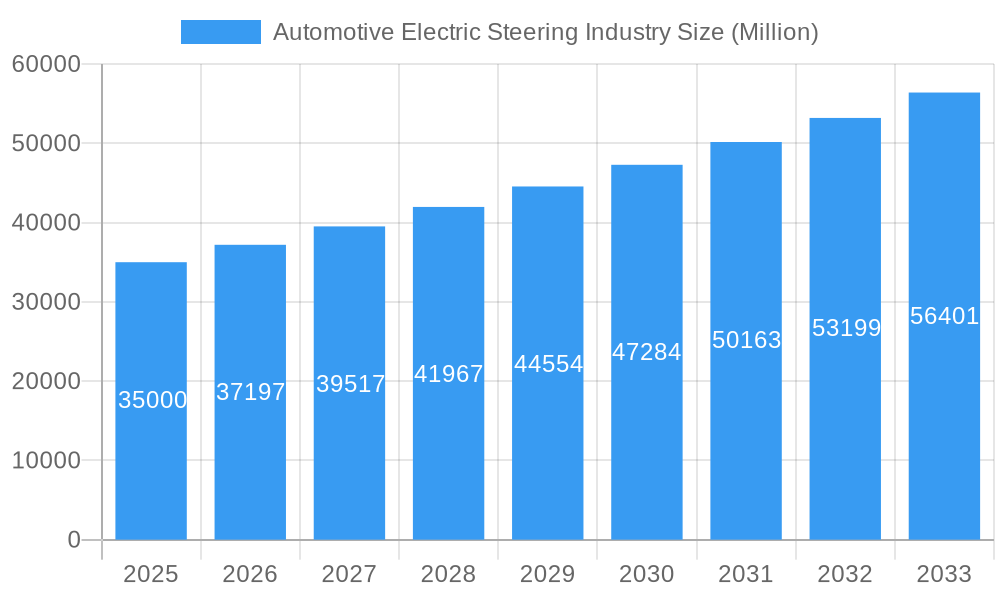

The global Automotive Electric Steering (AES) market is poised for substantial expansion, driven by an increasing emphasis on vehicle safety, fuel efficiency, and the rapid adoption of advanced driver-assistance systems (ADAS). With a projected market size of approximately USD 35,000 million in 2025, the industry is expected to witness a Compound Annual Growth Rate (CAGR) of 6.26% through 2033. This growth trajectory is fundamentally fueled by the inherent advantages of electric steering systems over traditional hydraulic counterparts, including reduced energy consumption, enhanced steering precision, and the ability to integrate sophisticated electronic controls. The rising demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), which are more amenable to electric steering integration due to their existing electrical architectures, further bolsters this market. Moreover, stringent government regulations worldwide mandating improved safety features and lower emissions are acting as significant catalysts, pushing automakers to invest heavily in AES technology. Key growth drivers include the escalating complexity of vehicle powertrains, the integration of steering with other ADAS functionalities like lane-keeping assist and autonomous parking, and the continuous innovation in sensor technology and motor efficiency.

Automotive Electric Steering Industry Market Size (In Billion)

The market segmentation offers a comprehensive view of the evolving landscape. The "Column Type" segment is anticipated to maintain a dominant position, owing to its widespread adoption in a majority of passenger vehicles. However, the "Pinion Type" and "Dual Pinion Type" segments are expected to witness robust growth, particularly in performance-oriented and luxury vehicles, offering superior steering feel and responsiveness. From a component perspective, steering racks and columns will continue to represent the largest share, but the growth of sensors and steering motors is projected to outpace, reflecting the increasing sophistication of the electronic control units that manage these systems. Passenger cars are the primary market, but the penetration of AES in commercial vehicles is steadily increasing, driven by the need for improved maneuverability and driver comfort in long-haul applications. Geographically, the Asia Pacific region, led by China and Japan, is expected to emerge as the largest and fastest-growing market, owing to its massive automotive manufacturing base and strong government support for new energy vehicles. North America and Europe will also remain significant markets, driven by established automotive industries and stringent safety standards.

Automotive Electric Steering Industry Company Market Share

Automotive Electric Steering Industry Report Description

Unlock the future of automotive mobility with our comprehensive analysis of the Automotive Electric Steering Industry. This in-depth report provides critical insights into market dynamics, growth trajectories, and the competitive landscape of electric power steering (EPS) systems, a cornerstone of modern vehicle technology. With a focus on precision and actionable intelligence, this study is indispensable for manufacturers, suppliers, investors, and automotive professionals navigating this rapidly evolving sector.

Report Scope:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Key Market Segments Covered:

- By Type: Column Type, Pinion Type, Dual Pinion Type

- By Component Type: Steering Rack/Column, Sensor, Steering Motor, Other Component Types

- By Vehicle Type: Passenger Cars, Commercial Vehicles

Presenting all quantitative values in Million Units.

Automotive Electric Steering Industry Market Dynamics & Structure

The automotive electric steering industry is characterized by a dynamic interplay of technological advancements, stringent regulatory frameworks, and evolving consumer demands. Market concentration is moderate, with key players like JTEKT Corporation, Hyundai Mobis Co Ltd, Denso Corporation, and ZF Friedrichshafen AG holding significant shares, driving innovation and influencing pricing strategies. Technological innovation is primarily fueled by the increasing demand for advanced driver-assistance systems (ADAS), autonomous driving capabilities, and enhanced fuel efficiency. The push for electrification and stricter emission standards further propels the adoption of electric power steering (EPS) over traditional hydraulic systems. Regulatory frameworks, particularly concerning vehicle safety and emissions, act as both a catalyst and a constraint, encouraging the integration of sophisticated EPS features. Competitive product substitutes are limited, with hydraulic power steering (HPS) systems gradually being phased out. End-user demographics, particularly the growing preference for SUVs and electric vehicles (EVs) among younger, tech-savvy consumers, are shaping product development towards more responsive and customizable steering experiences. Merger and acquisition (M&A) trends indicate a consolidation phase, with companies seeking to expand their technological portfolios and market reach.

- Market Concentration: Moderate, with a few dominant global players.

- Technological Innovation Drivers: ADAS integration, autonomous driving, electrification, fuel efficiency improvements.

- Regulatory Frameworks: Vehicle safety standards (e.g., UNECE), emission regulations.

- Competitive Product Substitutes: Diminishing presence of hydraulic power steering (HPS).

- End-User Demographics: Growing demand from EV and SUV segments, younger consumer base.

- M&A Trends: Strategic acquisitions for technology enhancement and market expansion.

Automotive Electric Steering Industry Growth Trends & Insights

The automotive electric steering industry is poised for robust growth, driven by a confluence of technological evolution and market imperatives. The global market size is projected to witness a significant expansion from an estimated value of $XX Billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This upward trajectory is underpinned by the accelerating adoption rates of EPS systems across various vehicle segments, particularly passenger cars and commercial vehicles. Technological disruptions, such as advancements in sensor technology, sophisticated control algorithms, and the integration of steer-by-wire systems, are redefining steering performance and safety. Consumer behavior shifts towards a greater appreciation for driving dynamics, comfort, and advanced safety features are directly contributing to the demand for EPS. The penetration of EPS in new vehicle production lines is steadily increasing, replacing conventional hydraulic systems due to their superior energy efficiency, reduced maintenance, and enhanced flexibility for integrating advanced driving functionalities. Market penetration for EPS in new passenger car production is expected to reach XX% by 2033, up from an estimated XX% in 2025. The integration of EPS is becoming a standard feature in electric vehicles (EVs), as it aligns with the overall electrification strategy and offers opportunities for regenerative braking synergy. Furthermore, the increasing prevalence of semi-autonomous and autonomous driving features necessitates precise and responsive EPS systems, acting as a significant growth catalyst. The industry's ability to innovate and adapt to these evolving demands will be crucial in capitalizing on the projected market expansion. The estimated market size in 2025 is expected to be $XX Billion, growing to $XX Billion by 2033.

Dominant Regions, Countries, or Segments in Automotive Electric Steering Industry

The Passenger Cars segment, particularly within the Asia-Pacific region, is a dominant force propelling the growth of the automotive electric steering industry. This dominance is attributed to several key drivers, including robust automotive production volumes, increasing disposable incomes, and a strong government push towards advanced automotive technologies, including electrification and improved safety standards. China, in particular, stands out as a pivotal market due to its massive automotive manufacturing base and significant investments in R&D for electric vehicles. The Asia-Pacific region's market share in the global EPS market is estimated to be around XX% in 2025, with a projected growth rate exceeding the global average.

Within the Component Type segment, the Steering Rack/Column holds a substantial market share, forming the core of EPS systems. However, the Steering Motor and Sensor segments are experiencing accelerated growth due to increasing complexity and the need for higher precision in modern steering applications. For instance, advanced sensor technologies are crucial for enabling ADAS features and autonomous driving capabilities.

The Pinion Type EPS systems are witnessing a surge in adoption, especially in smaller to mid-sized passenger cars, due to their compact design and cost-effectiveness. Nevertheless, Column Type EPS continues to maintain a significant presence, particularly in entry-level vehicles, while Dual Pinion Type EPS is gaining traction in applications requiring enhanced steering precision and a broader gear ratio range.

Economic policies in countries like China, South Korea, and Japan, which actively promote automotive innovation and manufacturing, coupled with substantial investments in electric vehicle infrastructure, further solidify the dominance of these regions. The sheer volume of vehicle production and the increasing demand for technologically advanced features in passenger vehicles make this segment the primary growth engine for the automotive electric steering industry. The market share of the Passenger Cars segment is projected to be XX% of the total market in 2025.

Automotive Electric Steering Industry Product Landscape

The automotive electric steering industry is characterized by continuous product innovation focused on enhancing safety, performance, and efficiency. Key product advancements include the development of more compact and lighter EPS units, reducing vehicle weight and improving fuel economy. Innovations in sensor technology are leading to higher precision and faster response times, enabling seamless integration with advanced driver-assistance systems (ADAS) and autonomous driving functionalities. The development of steer-by-wire systems, which eliminate the mechanical linkage between the steering wheel and the wheels, represents a significant leap forward, offering unparalleled design flexibility and enhanced safety through redundancy. Performance metrics are constantly being optimized for reduced latency, improved torque feedback, and greater customization options for drivers. Unique selling propositions often revolve around the integration of intelligent control algorithms that adapt to varying driving conditions and driver preferences.

Key Drivers, Barriers & Challenges in Automotive Electric Steering Industry

Key Drivers:

- Increasing Demand for Advanced Safety Features: The mandatory integration of ADAS, such as lane-keeping assist and automatic emergency braking, necessitates precise EPS systems.

- Growth of Electric and Autonomous Vehicles: EPS is a fundamental component for EVs, offering energy efficiency, and crucial for the sophisticated control required in autonomous driving.

- Fuel Efficiency and Emission Regulations: EPS systems are more energy-efficient than hydraulic systems, helping manufacturers meet stringent environmental standards.

- Technological Advancements: Continuous innovation in sensor technology, motor efficiency, and control software enhances EPS performance and functionality.

- Comfort and Driving Experience: EPS provides variable steering ratios and customizable assistance levels, improving driver comfort and maneuverability.

Barriers & Challenges:

- High Initial Investment Costs: The development and manufacturing of advanced EPS components require significant capital expenditure.

- Supply Chain Vulnerabilities: Reliance on specific raw materials and electronic components can lead to disruptions, impacting production volumes. The estimated impact of supply chain disruptions on market growth is a reduction of XX% in forecast year 2025.

- Regulatory Hurdles and Standardization: Evolving safety regulations and the need for industry-wide standardization can slow down the adoption of new technologies.

- Competition and Price Pressures: Intense competition among established and emerging players can lead to price erosion, impacting profit margins.

- Consumer Perception and Trust: Building consumer trust in the reliability and safety of EPS, especially for higher levels of automation, remains a challenge.

Emerging Opportunities in Automotive Electric Steering Industry

Emerging opportunities in the automotive electric steering industry are primarily centered around the burgeoning electric and autonomous vehicle markets. The development of advanced steer-by-wire systems presents a significant untapped market, offering OEMs greater design freedom and enabling new vehicle architectures. Furthermore, the growing demand for personalized driving experiences is creating opportunities for sophisticated EPS systems that can adapt to individual driver preferences through advanced software algorithms. The integration of EPS with V2X (Vehicle-to-Everything) communication technologies opens avenues for enhanced predictive safety and traffic management systems. The expansion into emerging economies with rapidly growing automotive sectors also presents substantial growth potential as these markets increasingly adopt advanced automotive technologies.

Growth Accelerators in the Automotive Electric Steering Industry Industry

Several key catalysts are accelerating the growth of the automotive electric steering industry. The relentless pursuit of higher levels of vehicle automation is a primary driver, as EPS systems are indispensable for the precise and responsive control required for autonomous driving. Strategic partnerships and collaborations between automotive OEMs, Tier-1 suppliers, and technology companies are fostering rapid innovation and accelerating the development of next-generation EPS solutions. Market expansion strategies, including entry into new geographical regions and targeting niche vehicle segments with specific steering requirements, are also contributing to sustained growth. The increasing focus on software-defined vehicles, where EPS functionality is increasingly managed by advanced software, is another significant growth accelerator, enabling continuous updates and feature enhancements throughout the vehicle's lifecycle.

Key Players Shaping the Automotive Electric Steering Industry Market

- JTEKT Corporation

- Hyundai Mobis Co Ltd

- Denso Corporation

- ZF Friedrichshafen A

- NSK Ltd

- GKN PLC

- Mitsubishi Electric Corporation

- Hitachi Automotive Systems Ltd

- Nexteer Automotive

- Robert Bosch GmbH

- Hubei Henglong Auto System Group

- Thyssenkrupp Presta AG

Notable Milestones in Automotive Electric Steering Industry Sector

- August 2022: NSK Ltd. announced plans to revamp its steering operations, receiving an order for electric power steering (EPS) from the Volkswagen (VW) Group and initiating volume production in spring 2023.

- June 2022: Robert Bosch announced plans to strengthen its mobility production and development capabilities in Japan, transferring its electric power steering (EPS) assembly line for Japanese automakers from an overseas plant to its Musashi Plant in Namegawa Town.

In-Depth Automotive Electric Steering Industry Market Outlook

The automotive electric steering industry is projected to experience sustained and significant growth in the coming years. This optimistic outlook is driven by the continued integration of EPS across all vehicle segments, from entry-level passenger cars to heavy-duty commercial vehicles, fueled by the global shift towards electrification and autonomous driving technologies. The industry's commitment to innovation, particularly in areas like steer-by-wire and advanced sensor integration, will further solidify its market position. Strategic investments by key players in enhancing production capacities and research and development capabilities will ensure a steady supply of advanced EPS solutions to meet evolving automotive demands. The focus on sustainability and energy efficiency will continue to drive the replacement of traditional hydraulic systems, creating ongoing opportunities for EPS manufacturers. The market's trajectory indicates a robust future, driven by technological progress and the increasing demand for safer, more efficient, and more connected vehicles.

Automotive Electric Steering Industry Segmentation

-

1. Type

- 1.1. Column Type

- 1.2. Pinion Type

- 1.3. Dual Pinion Type

-

2. Component Type

- 2.1. Steering Rack/Column

- 2.2. Sensor

- 2.3. Steering Motor

- 2.4. Other Component Types

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Electric Steering Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Egypt

- 5.3. United Arab Emirates

- 5.4. Rest of Middle East and Africa

Automotive Electric Steering Industry Regional Market Share

Geographic Coverage of Automotive Electric Steering Industry

Automotive Electric Steering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns

- 3.3. Market Restrains

- 3.3.1. Shift towards Disposable Filters

- 3.4. Market Trends

- 3.4.1. Government Initiatives and Growing Emphasis on Safer Automotive Systems are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Electric Steering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Column Type

- 5.1.2. Pinion Type

- 5.1.3. Dual Pinion Type

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Steering Rack/Column

- 5.2.2. Sensor

- 5.2.3. Steering Motor

- 5.2.4. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Electric Steering Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Column Type

- 6.1.2. Pinion Type

- 6.1.3. Dual Pinion Type

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Steering Rack/Column

- 6.2.2. Sensor

- 6.2.3. Steering Motor

- 6.2.4. Other Component Types

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Electric Steering Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Column Type

- 7.1.2. Pinion Type

- 7.1.3. Dual Pinion Type

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Steering Rack/Column

- 7.2.2. Sensor

- 7.2.3. Steering Motor

- 7.2.4. Other Component Types

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Electric Steering Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Column Type

- 8.1.2. Pinion Type

- 8.1.3. Dual Pinion Type

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Steering Rack/Column

- 8.2.2. Sensor

- 8.2.3. Steering Motor

- 8.2.4. Other Component Types

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Automotive Electric Steering Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Column Type

- 9.1.2. Pinion Type

- 9.1.3. Dual Pinion Type

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Steering Rack/Column

- 9.2.2. Sensor

- 9.2.3. Steering Motor

- 9.2.4. Other Component Types

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automotive Electric Steering Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Column Type

- 10.1.2. Pinion Type

- 10.1.3. Dual Pinion Type

- 10.2. Market Analysis, Insights and Forecast - by Component Type

- 10.2.1. Steering Rack/Column

- 10.2.2. Sensor

- 10.2.3. Steering Motor

- 10.2.4. Other Component Types

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JTEKT Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai Mobis Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ZF Friedrichshafen A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NSK Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GKN PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hitachi Automotive Systems Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nexteer Automotive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Robert Bosch GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hubei Henglong Auto System Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Thyssenkrupp Presta AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 JTEKT Corporation

List of Figures

- Figure 1: Global Automotive Electric Steering Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Electric Steering Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Automotive Electric Steering Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Electric Steering Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 5: North America Automotive Electric Steering Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 6: North America Automotive Electric Steering Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Electric Steering Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Electric Steering Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Electric Steering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Electric Steering Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Automotive Electric Steering Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Automotive Electric Steering Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 13: Europe Automotive Electric Steering Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 14: Europe Automotive Electric Steering Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Electric Steering Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Electric Steering Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Electric Steering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Electric Steering Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Electric Steering Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Electric Steering Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Electric Steering Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Electric Steering Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Electric Steering Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Electric Steering Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Electric Steering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Electric Steering Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Automotive Electric Steering Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Automotive Electric Steering Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 29: South America Automotive Electric Steering Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 30: South America Automotive Electric Steering Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: South America Automotive Electric Steering Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: South America Automotive Electric Steering Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Automotive Electric Steering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Electric Steering Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Automotive Electric Steering Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Automotive Electric Steering Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 37: Middle East and Africa Automotive Electric Steering Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 38: Middle East and Africa Automotive Electric Steering Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 39: Middle East and Africa Automotive Electric Steering Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Middle East and Africa Automotive Electric Steering Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Electric Steering Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Electric Steering Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Electric Steering Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 3: Global Automotive Electric Steering Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Electric Steering Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Electric Steering Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Electric Steering Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 7: Global Automotive Electric Steering Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Electric Steering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Electric Steering Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Automotive Electric Steering Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 14: Global Automotive Electric Steering Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Electric Steering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Electric Steering Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Automotive Electric Steering Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 24: Global Automotive Electric Steering Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global Automotive Electric Steering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Electric Steering Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Automotive Electric Steering Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 33: Global Automotive Electric Steering Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global Automotive Electric Steering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Automotive Electric Steering Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Automotive Electric Steering Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 40: Global Automotive Electric Steering Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 41: Global Automotive Electric Steering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: South Africa Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Egypt Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Arab Emirates Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Automotive Electric Steering Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Electric Steering Industry?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Automotive Electric Steering Industry?

Key companies in the market include JTEKT Corporation, Hyundai Mobis Co Ltd, Denso Corporation, ZF Friedrichshafen A, NSK Ltd, GKN PLC, Mitsubishi Electric Corporation, Hitachi Automotive Systems Ltd, Nexteer Automotive, Robert Bosch GmbH, Hubei Henglong Auto System Group, Thyssenkrupp Presta AG.

3. What are the main segments of the Automotive Electric Steering Industry?

The market segments include Type, Component Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns.

6. What are the notable trends driving market growth?

Government Initiatives and Growing Emphasis on Safer Automotive Systems are Driving the Market.

7. Are there any restraints impacting market growth?

Shift towards Disposable Filters.

8. Can you provide examples of recent developments in the market?

In August 2022, NSK Ltd. announced its plan to revamp the steering operations. The company received an order for electric power steering (EPS) from the Volkswagen (VW) Group and announced its plans to start volume production during the spring of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Electric Steering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Electric Steering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Electric Steering Industry?

To stay informed about further developments, trends, and reports in the Automotive Electric Steering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence