Key Insights

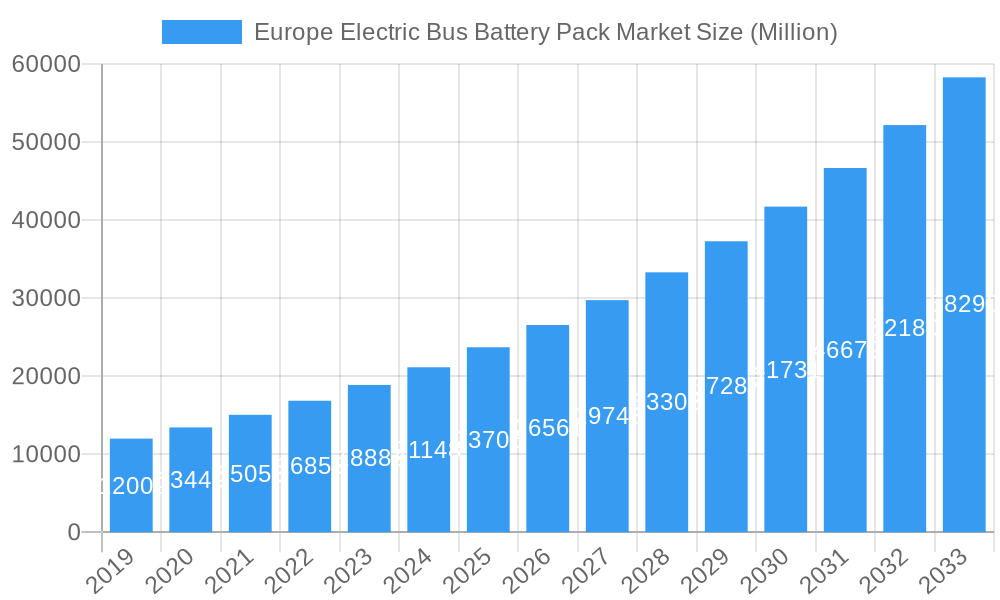

The European electric bus battery pack market is projected for substantial growth, with an estimated market size of 23.8 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 14% from the base year 2025. This expansion is driven by stringent environmental regulations across Europe, ambitious government fleet electrification mandates, and increasing demand for sustainable public transit. Key growth factors include a heightened focus on reducing urban carbon emissions and improving air quality, alongside advancements in battery technology enhancing range, reducing charging times, and lowering costs. Government incentives, subsidies, and charging infrastructure investments further support the economic viability and environmental benefits of electric buses for transit authorities. The market is dominated by Battery Electric Vehicles (BEVs), with Plug-in Hybrid Electric Vehicles (PHEVs) offering a transitional solution.

Europe Electric Bus Battery Pack Market Market Size (In Billion)

The market is segmented by battery components and materials, with Lithium Iron Phosphate (LFP) battery chemistry gaining traction for its safety and cost-effectiveness, alongside Nickel Cobalt Manganese (NCM) and Nickel Cobalt Aluminum (NCA) chemistries. Dominant battery capacities range from 40 kWh to 80 kWh, with a growing trend towards larger capacities (Above 80 kWh) to accommodate longer routes. Advanced manufacturing methods like laser welding are critical for battery pack assembly and performance. Leading players, including Contemporary Amperex Technology Co. Ltd (CATL), LG Energy Solution Ltd, and BYD Company Ltd, are investing in R&D for more efficient, durable, and cost-competitive battery solutions. Europe's proactive policies and strong automotive sector position it as a key growth market for electric bus battery packs.

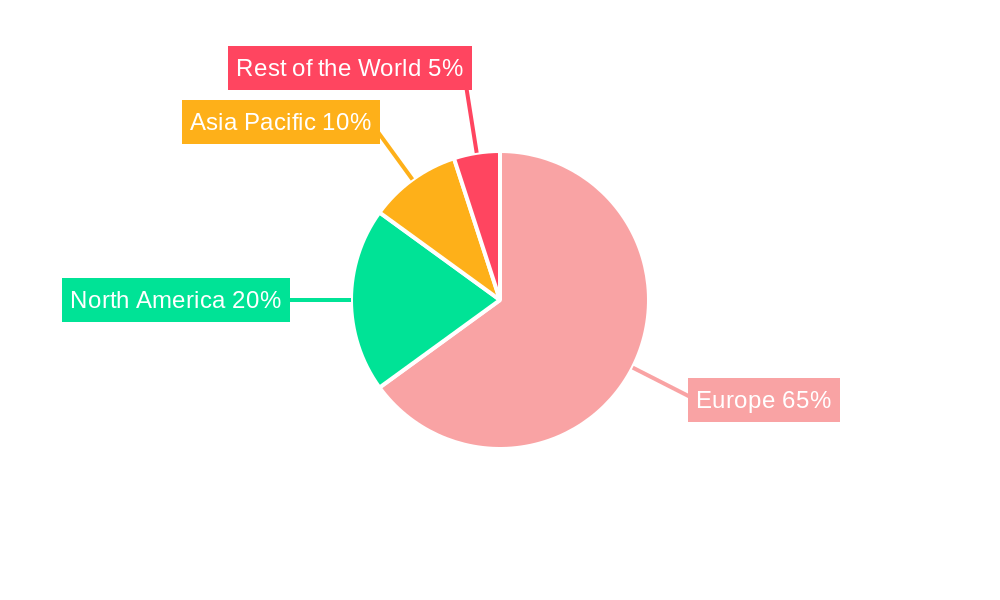

Europe Electric Bus Battery Pack Market Company Market Share

Europe Electric Bus Battery Pack Market: Comprehensive Analysis and Growth Projections (2019-2033)

Report Description:

Dive deep into the burgeoning Europe Electric Bus Battery Pack Market, a critical sector poised for exponential growth driven by stringent environmental regulations, increasing urbanization, and a strong commitment to sustainable transportation across the continent. This in-depth report offers a holistic view of the market dynamics, growth trends, and competitive landscape for electric bus battery packs, providing invaluable insights for stakeholders seeking to capitalize on this transformative industry. With a study period spanning from 2019 to 2033, and a base year of 2025, our analysis meticulously covers historical performance, current scenarios, and future projections, empowering strategic decision-making.

We explore the intricate market structure, dissecting the influence of parent market (Electric Vehicle Battery Market) and child market (Specific Electric Bus Battery Pack Segments) to offer a granular understanding of the forces at play. Discover the dominant Propulsion Types like BEV and PHEV, and the evolving Battery Chemistries such as LFP, NCA, NCM, and NMC. Examine the critical role of Battery Capacity ranges (15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh, Less than 15 kWh), various Battery Forms (Cylindrical, Pouch, Prismatic), and the advanced Manufacturing Methods (Laser, Wire). Our report delves into the essential Battery Components (Anode, Cathode, Electrolyte, Separator) and Material Types (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Other Materials) that define performance and sustainability. All values are presented in Million Units for clear quantitative analysis.

This report is your definitive guide to understanding the Europe electric bus battery market share, electric bus battery demand Europe, electric bus battery technology Europe, and the key players like SAIC Volkswagen Power Battery Co Ltd, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, LG Energy Solution Ltd, Microvast Holdings Inc, TOSHIBA Corp, Contemporary Amperex Technology Co Ltd (CATL), Accumulatorenwerke Hoppecke Carl Zoellner & Sohn GmbH, Akasol AG, BYD Company Ltd, SK Innovation Co Ltd, Panasonic Holdings Corporation, NorthVolt AB, SVOLT Energy Technology Co Ltd (SVOLT). Gain critical insights into the growth drivers, market challenges, and future opportunities within this dynamic and rapidly expanding sector.

Europe Electric Bus Battery Pack Market Market Dynamics & Structure

The Europe Electric Bus Battery Pack Market is characterized by a moderate to high concentration, with a few dominant players holding significant market share, yet exhibiting a dynamic competitive environment fueled by rapid technological advancements and increasing demand. Key drivers of technological innovation include the relentless pursuit of higher energy density, faster charging capabilities, enhanced safety features, and extended lifespan for battery packs, directly impacting the performance and cost-effectiveness of electric buses. Regulatory frameworks, particularly stringent emissions standards and government incentives for electric vehicle adoption, play a pivotal role in shaping market growth and investment. For instance, EU Green Deal initiatives and national targets for fleet electrification are directly stimulating demand for battery packs. Competitive product substitutes, such as advancements in fuel cell technology, are being closely monitored, though battery-electric solutions currently dominate the landscape due to established infrastructure and cost advantages. End-user demographics are shifting towards municipalities, public transport operators, and fleet managers prioritizing operational efficiency, reduced environmental impact, and long-term cost savings. Mergers and acquisitions (M&A) trends are prevalent as companies seek to consolidate supply chains, acquire cutting-edge technologies, and expand their geographical reach.

- Market Concentration: Dominated by a few key players but with room for emerging innovators.

- Technological Innovation Drivers: Higher energy density, faster charging, improved safety, extended lifespan.

- Regulatory Frameworks: EU Green Deal, national emission targets, subsidies for EV adoption.

- Competitive Product Substitutes: Emerging fuel cell technologies, though currently less prevalent for buses.

- End-User Demographics: Municipalities, public transport authorities, fleet operators focusing on sustainability and cost efficiency.

- M&A Trends: Strategic acquisitions for technology integration, market expansion, and supply chain security.

Europe Electric Bus Battery Pack Market Growth Trends & Insights

The Europe Electric Bus Battery Pack Market is experiencing a robust growth trajectory, marked by a significant evolution in market size and adoption rates. The forecast period of 2025–2033 is anticipated to witness an impressive Compound Annual Growth Rate (CAGR), propelled by a confluence of factors including aggressive decarbonization targets set by European nations and the European Union. This surge in adoption is fundamentally reshaping the transportation landscape, with electric buses steadily replacing their diesel counterparts in urban centers and intercity routes across the continent. Technological disruptions are at the forefront of this evolution, with continuous improvements in battery chemistry, such as the growing dominance of Lithium Iron Phosphate (LFP) for its cost-effectiveness and enhanced safety, and Nickel Manganese Cobalt (NMC) for its higher energy density, significantly enhancing the range and efficiency of electric buses. Furthermore, advancements in battery management systems (BMS) and thermal management technologies are crucial in optimizing performance under diverse climatic conditions prevalent in Europe.

Consumer behavior shifts are evident, with a growing preference among public transport authorities and private operators for sustainable and economically viable solutions. The total cost of ownership (TCO) for electric buses, once a deterrent, is now becoming increasingly competitive due to falling battery prices, reduced maintenance costs, and lower energy consumption compared to internal combustion engine buses. This trend is further amplified by the increasing availability of charging infrastructure, a critical enabler for widespread adoption. Market penetration of electric buses, while still varied across different European countries, is on a steep upward curve, indicating a strong market potential for battery pack manufacturers. The demand is particularly pronounced in regions with proactive government policies and significant investment in public transport modernization. The journey from legacy diesel fleets to advanced electric mobility is a defining characteristic of the current market, with battery pack innovations playing a central role in accelerating this transition.

Dominant Regions, Countries, or Segments in Europe Electric Bus Battery Pack Market

The BEV (Battery Electric Vehicle) propulsion type currently dominates the Europe Electric Bus Battery Pack Market, driven by its zero-emission credentials and increasingly competitive performance metrics. Within the battery chemistry segment, LFP (Lithium Iron Phosphate) is emerging as a dominant force, particularly for urban transit buses, due to its superior safety profile, longer cycle life, and cost advantages compared to other chemistries, aligning well with the stringent safety regulations and budget constraints of public transport operators. This preference for LFP is reflected in its growing market share, estimated to be over xx% in 2025.

In terms of capacity, 40 kWh to 80 kWh and Above 80 kWh segments are experiencing significant traction. These higher capacity ranges are essential to meet the demanding operational requirements of urban buses, including longer routes and higher passenger loads, ensuring a full day's operation without frequent recharges. The Prismatic battery form is also gaining prominence due to its excellent space utilization and thermal management properties, making it ideal for integration into bus chassis.

Geographically, Germany and France are leading the charge in the adoption of electric buses, supported by robust government subsidies, ambitious fleet electrification targets, and significant investments in charging infrastructure. These countries represent a substantial portion of the market share, estimated at over xx% and xx% respectively in 2025. Key drivers for their dominance include:

- Economic Policies: Strong financial incentives, tax breaks, and favorable loan schemes for public transport operators transitioning to electric fleets.

- Infrastructure Development: Significant public and private investment in charging depots and fast-charging stations, crucial for operational continuity.

- Regulatory Push: Ambitious national and regional targets for reducing transport emissions, mandating the phase-out of diesel buses.

- Technological Adoption: Early and widespread adoption of advanced battery technologies and bus models from leading manufacturers.

- Public Awareness & Demand: Growing public demand for cleaner public transportation, influencing policy decisions.

The NCM (Nickel Cobalt Manganese) chemistry, while still significant, is gradually ceding ground to LFP in certain applications where cost and safety are paramount. However, NCM remains competitive for longer-range applications. The market for NMC (Nickel Manganese Cobalt), NCA (Nickel Cobalt Aluminum), and Others remains relevant, catering to specific performance needs and niche applications.

Europe Electric Bus Battery Pack Market Product Landscape

The Europe Electric Bus Battery Pack Market is witnessing a wave of product innovation focused on enhancing energy density, accelerating charging speeds, and improving overall battery longevity. Manufacturers are actively developing advanced battery packs that offer optimized performance for diverse operational demands, from short urban routes to longer intercity journeys. Key product advancements include the integration of high-performance cathode materials like nickel-rich NMC and the adoption of LFP for its inherent safety and cost-effectiveness. Innovations in battery thermal management systems are crucial for ensuring optimal operating temperatures, thereby extending battery life and maintaining performance in varying European climates. Furthermore, manufacturers are investing in sophisticated Battery Management Systems (BMS) that provide real-time monitoring, diagnostics, and precise control over charging and discharging cycles, enhancing safety and efficiency. The unique selling propositions for leading products revolve around their superior energy density (providing longer range), faster charging capabilities (minimizing downtime), robust safety features (meeting stringent European safety standards), and extended cycle life (reducing the total cost of ownership).

Key Drivers, Barriers & Challenges in Europe Electric Bus Battery Pack Market

Key Drivers:

- Stringent Environmental Regulations: European Union directives and national government mandates for reducing greenhouse gas emissions are the primary catalysts, pushing for the electrification of public transport fleets.

- Declining Battery Costs: Continuous advancements in battery manufacturing and economies of scale are leading to a reduction in battery pack prices, making electric buses more economically viable.

- Government Incentives and Subsidies: Financial support, tax benefits, and procurement preferences offered by governments significantly lower the upfront cost of electric buses.

- Technological Advancements: Improvements in battery energy density, charging speed, and lifespan are enhancing the practical usability and attractiveness of electric buses.

- Growing Urbanization and Smart City Initiatives: The need for cleaner, quieter, and more efficient urban transportation solutions fuels the demand for electric buses.

Barriers & Challenges:

- High Upfront Cost: Despite declining prices, the initial capital expenditure for electric buses and charging infrastructure remains a significant hurdle for many transport operators.

- Charging Infrastructure Limitations: The availability, speed, and reliability of charging infrastructure, particularly in smaller towns and rural areas, can be a constraint.

- Battery Lifespan and Replacement Costs: While improving, concerns about battery degradation over time and the cost of eventual replacement can influence purchasing decisions.

- Supply Chain Volatility and Raw Material Dependency: Dependence on specific raw materials like lithium and cobalt, coupled with potential supply chain disruptions, poses a risk to consistent production and pricing.

- Grid Capacity and Management: The increased demand on electricity grids, especially during peak charging times, requires significant investment in grid upgrades and smart charging solutions.

Emerging Opportunities in Europe Electric Bus Battery Pack Market

Emerging opportunities within the Europe Electric Bus Battery Pack Market lie in the increasing demand for second-life battery applications for stationary energy storage, offering a sustainable avenue for retired bus batteries. The development and integration of solid-state battery technology promise further advancements in safety and energy density, opening new avenues for performance enhancement. Furthermore, there is a growing opportunity in providing integrated energy solutions, combining battery packs with charging infrastructure and grid management services, offering a holistic approach to fleet electrification. The expansion of electric bus routes into less developed regions within Europe presents a significant untapped market. Evolving consumer preferences for more sustainable and efficient public transport are also creating demand for innovative bus designs and battery solutions that can cater to specific route profiles and passenger needs.

Growth Accelerators in the Europe Electric Bus Battery Pack Market Industry

Several key catalysts are accelerating the growth of the Europe Electric Bus Battery Pack Market. Technological breakthroughs in battery chemistry, such as the development of cobalt-free batteries and advanced anode materials, are enhancing performance and reducing costs. Strategic partnerships between battery manufacturers, bus OEMs, and energy providers are crucial for developing standardized solutions and accelerating deployment. For instance, collaborations focused on building out charging infrastructure in key urban hubs are directly supporting fleet expansion. Market expansion strategies, including targeting new geographical regions within Europe and exploring different bus segments (e.g., school buses, intercity coaches), are broadening the market's reach. Furthermore, the increasing focus on circular economy principles within the battery industry, emphasizing recycling and reuse, is enhancing the long-term sustainability and attractiveness of electric bus technology.

Key Players Shaping the Europe Electric Bus Battery Pack Market Market

- SAIC Volkswagen Power Battery Co Ltd

- BMZ Batterien-Montage-Zentrum GmbH

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Microvast Holdings Inc

- TOSHIBA Corp

- Contemporary Amperex Technology Co Ltd (CATL)

- Accumulatorenwerke Hoppecke Carl Zoellner & Sohn GmbH

- Akasol AG

- BYD Company Ltd

- SK Innovation Co Ltd

- Panasonic Holdings Corporation

- NorthVolt AB

- SVOLT Energy Technology Co Ltd (SVOLT)

Notable Milestones in Europe Electric Bus Battery Pack Market Sector

- February 2023: Samsung SDI announced expansion of investment in its Hungary plant, significantly boosting production capacity to meet surging demand for mid- to large-size batteries.

- January 2023: Samsung SDI reported record-high profits for 2022, a testament to the robust demand for electric vehicle batteries and energy storage systems.

- November 2022: Samsung SDI partnered with Sungkyunkwan University to establish a specialized course for battery technologies, aiming to cultivate the next generation of battery experts.

In-Depth Europe Electric Bus Battery Pack Market Market Outlook

The future outlook for the Europe Electric Bus Battery Pack Market is exceptionally promising, underpinned by strong growth accelerators and a clear strategic direction towards sustainable transportation. Continued advancements in battery technology, particularly in energy density and charging speeds, will further enhance the operational efficiency and economic viability of electric buses. Strategic collaborations among industry players will streamline supply chains and accelerate the development and deployment of charging infrastructure, addressing a key bottleneck. The growing emphasis on circular economy principles, including battery recycling and second-life applications, will contribute to long-term sustainability and cost competitiveness. As governments remain committed to ambitious climate targets, investment in electric bus fleets and the underlying battery technology is set to escalate, creating significant market opportunities for innovative and reliable battery pack solutions. The transition to electric mobility is not just an environmental imperative but also a pathway to economic growth and technological leadership in the European automotive sector.

Europe Electric Bus Battery Pack Market Segmentation

-

1. Propulsion Type

- 1.1. BEV

- 1.2. PHEV

-

2. Battery Chemistry

- 2.1. LFP

- 2.2. NCA

- 2.3. NCM

- 2.4. NMC

- 2.5. Others

-

3. Capacity

- 3.1. 15 kWh to 40 kWh

- 3.2. 40 kWh to 80 kWh

- 3.3. Above 80 kWh

- 3.4. Less than 15 kWh

-

4. Battery Form

- 4.1. Cylindrical

- 4.2. Pouch

- 4.3. Prismatic

-

5. Method

- 5.1. Laser

- 5.2. Wire

-

6. Component

- 6.1. Anode

- 6.2. Cathode

- 6.3. Electrolyte

- 6.4. Separator

-

7. Material Type

- 7.1. Cobalt

- 7.2. Lithium

- 7.3. Manganese

- 7.4. Natural Graphite

- 7.5. Nickel

- 7.6. Other Materials

Europe Electric Bus Battery Pack Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Bus Battery Pack Market Regional Market Share

Geographic Coverage of Europe Electric Bus Battery Pack Market

Europe Electric Bus Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Electrification

- 3.3. Market Restrains

- 3.3.1. The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Bus Battery Pack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. BEV

- 5.1.2. PHEV

- 5.2. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.2.1. LFP

- 5.2.2. NCA

- 5.2.3. NCM

- 5.2.4. NMC

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. 15 kWh to 40 kWh

- 5.3.2. 40 kWh to 80 kWh

- 5.3.3. Above 80 kWh

- 5.3.4. Less than 15 kWh

- 5.4. Market Analysis, Insights and Forecast - by Battery Form

- 5.4.1. Cylindrical

- 5.4.2. Pouch

- 5.4.3. Prismatic

- 5.5. Market Analysis, Insights and Forecast - by Method

- 5.5.1. Laser

- 5.5.2. Wire

- 5.6. Market Analysis, Insights and Forecast - by Component

- 5.6.1. Anode

- 5.6.2. Cathode

- 5.6.3. Electrolyte

- 5.6.4. Separator

- 5.7. Market Analysis, Insights and Forecast - by Material Type

- 5.7.1. Cobalt

- 5.7.2. Lithium

- 5.7.3. Manganese

- 5.7.4. Natural Graphite

- 5.7.5. Nickel

- 5.7.6. Other Materials

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BMZ Batterien-Montage-Zentrum GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung SDI Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Energy Solution Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microvast Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TOSHIBA Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Contemporary Amperex Technology Co Ltd (CATL)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accumulatorenwerke Hoppecke Carl Zoellner & Sohn GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Akasol AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BYD Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SK Innovation Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Panasonic Holdings Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 NorthVolt AB

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SVOLT Energy Technology Co Ltd (SVOLT)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

List of Figures

- Figure 1: Europe Electric Bus Battery Pack Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Electric Bus Battery Pack Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 2: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 3: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 5: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Method 2020 & 2033

- Table 6: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 8: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 10: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 11: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 12: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 13: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Method 2020 & 2033

- Table 14: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 16: Europe Electric Bus Battery Pack Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Germany Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: France Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Netherlands Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Belgium Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Poland Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Denmark Europe Electric Bus Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Bus Battery Pack Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the Europe Electric Bus Battery Pack Market?

Key companies in the market include SAIC Volkswagen Power Battery Co Ltd, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, LG Energy Solution Ltd, Microvast Holdings Inc, TOSHIBA Corp, Contemporary Amperex Technology Co Ltd (CATL), Accumulatorenwerke Hoppecke Carl Zoellner & Sohn GmbH, Akasol AG, BYD Company Ltd, SK Innovation Co Ltd, Panasonic Holdings Corporation, NorthVolt AB, SVOLT Energy Technology Co Ltd (SVOLT).

3. What are the main segments of the Europe Electric Bus Battery Pack Market?

The market segments include Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Electrification.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

The Cost of Raw Materials Used in the Manufacturing of Switches is High.

8. Can you provide examples of recent developments in the market?

February 2023: Samsung SDI is expanding investment in its Hungary plant, which has the largest production capacity to respond to the fast-increasing demand for mid- to large-size batteries.January 2023: Korean battery maker Samsung SDI posted record-high profit in 2022, driven by solid demand for electric vehicle batteries and energy storage systems.November 2022: Samsung SDI has signed an agreement with Sungkyunkwan University to establish a course for battery technologies to raise battery experts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Bus Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Bus Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Bus Battery Pack Market?

To stay informed about further developments, trends, and reports in the Europe Electric Bus Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence