Key Insights

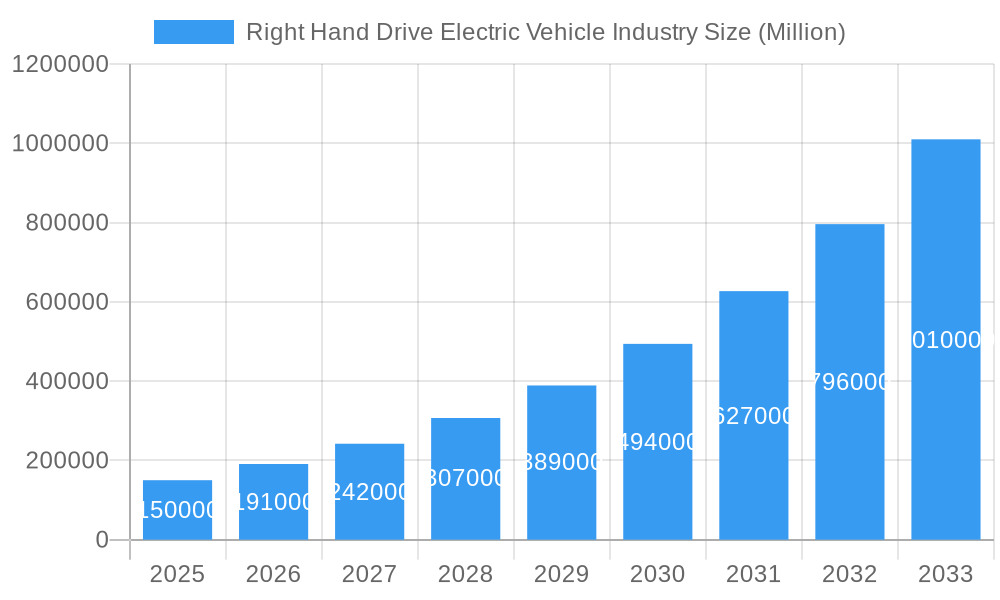

The global Right Hand Drive (RHD) Electric Vehicle (EV) market is set for significant expansion, projected to reach an estimated USD 5.61 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 22.28% through 2033. This growth is driven by stringent emission regulations, government incentives for EV adoption, and increasing consumer demand for sustainable transportation. The market is witnessing a strong shift towards electrification, particularly in RHD vehicle markets, due to environmental concerns and long-term cost savings. Advancements in battery technology, improving range and charging speed, are also contributing to market growth.

Right Hand Drive Electric Vehicle Industry Market Size (In Billion)

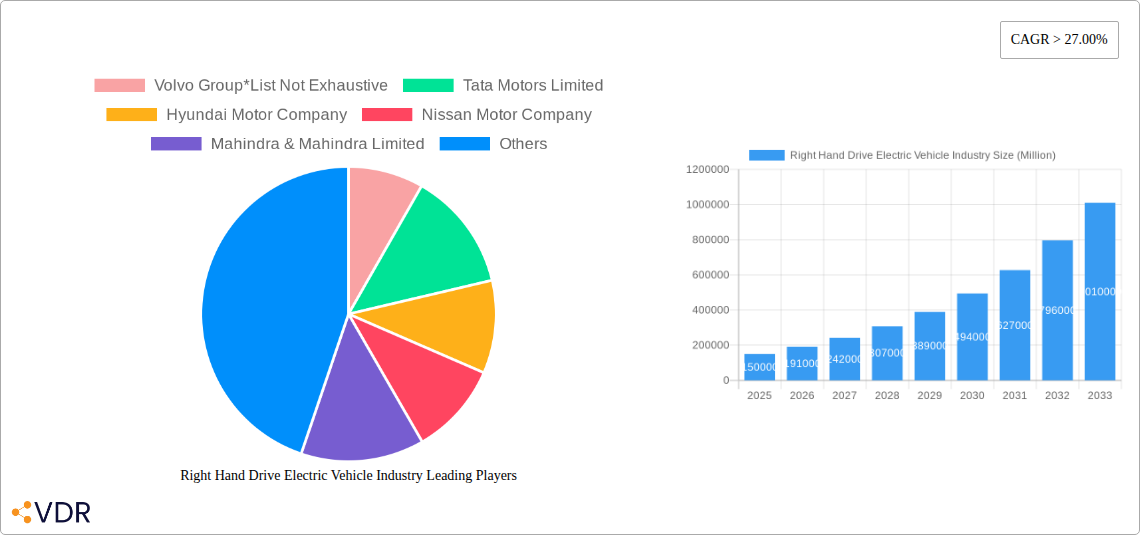

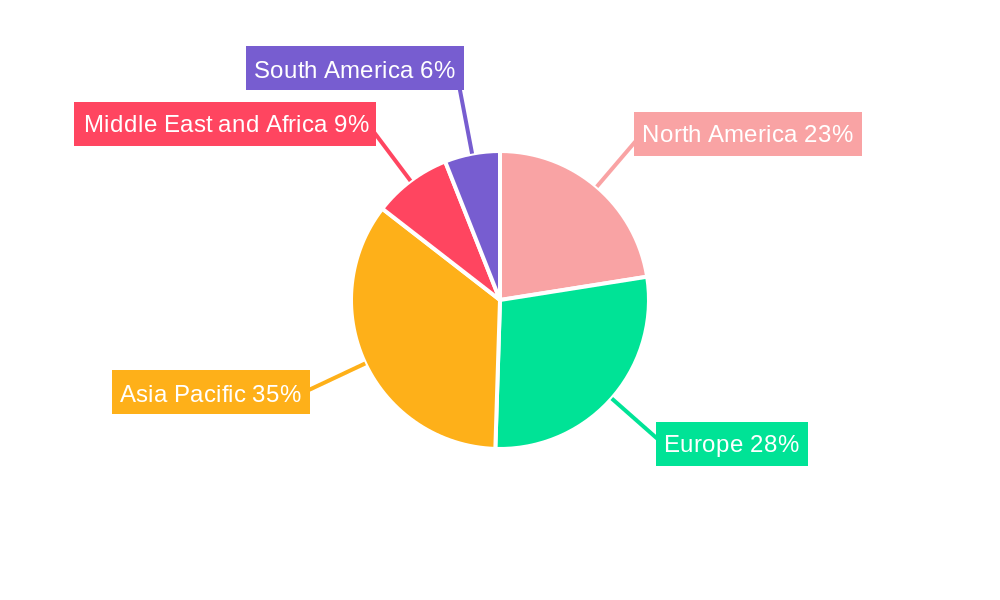

Key trends include the diversification of RHD EV models across passenger and commercial segments, and the integration of advanced driver-assistance systems (ADAS) and connectivity features. While market growth is strong, challenges such as high initial purchase costs, charging infrastructure availability, and limited RHD model availability in some emerging markets are being addressed through innovation and policy. Leading companies like Volvo Group, Tata Motors, Hyundai Motor Company, Nissan Motor Company, and BYD CO LTD are investing in R&D and expanding their RHD EV offerings. The Asia Pacific region, particularly Japan and Malaysia, is anticipated to lead market growth, followed by Europe and North America.

Right Hand Drive Electric Vehicle Industry Company Market Share

Comprehensive Report: Right Hand Drive Electric Vehicle Industry – Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This definitive report provides an in-depth analysis of the global Right Hand Drive (RHD) Electric Vehicle (EV) industry, covering a critical study period from 2019 to 2033, with a base and estimated year of 2025. Our research leverages cutting-edge methodologies to deliver precise market sizing, future projections, and strategic insights essential for industry stakeholders. This report is meticulously structured to offer unparalleled clarity and actionable intelligence on the evolving RHD EV landscape, integrating high-traffic keywords such as "electric vehicles," "RHD EVs," "BEV market," "commercial electric vehicles," and "passenger EVs" to maximize search engine visibility. We delve into parent and child market segments, presenting all quantitative values in Million units for standardized comprehension.

Right Hand Drive Electric Vehicle Industry Market Dynamics & Structure

The RHD electric vehicle market is characterized by a dynamic interplay of rapidly evolving technologies, stringent regulatory frameworks, and shifting consumer preferences. Market concentration varies significantly across key RHD regions, with established automotive giants and agile new entrants vying for market share. Technological innovation serves as a primary driver, fueled by advancements in battery technology, charging infrastructure, and vehicle performance, leading to competitive product substitutes that continuously redefine consumer expectations. Regulatory mandates, such as government incentives for EV adoption and stricter emission standards, are pivotal in shaping market growth trajectories. End-user demographics are broadening, encompassing both eco-conscious consumers and fleet operators seeking cost-effective and sustainable transportation solutions. Mergers and acquisitions (M&A) are increasingly prevalent as companies seek to consolidate market positions, acquire critical technologies, and expand their global footprint. For instance, several M&A deals in the historical period (2019-2024) have aimed at securing battery supply chains and expanding R&D capabilities in key RHD markets.

- Market Concentration: Fragmented in some regions, dominated by key players in others.

- Technological Innovation Drivers: Battery density improvements, faster charging solutions, autonomous driving integration.

- Regulatory Frameworks: Government subsidies, tax credits, zero-emission mandates, and charging infrastructure development policies.

- Competitive Product Substitutes: Increasing availability of long-range BEVs, PHEVs, and emerging FCEVs.

- End-User Demographics: Growing adoption among urban commuters, ride-sharing services, and logistics companies.

- M&A Trends: Strategic acquisitions of battery manufacturers and charging network providers.

Right Hand Drive Electric Vehicle Industry Growth Trends & Insights

The RHD electric vehicle market is poised for exponential growth, driven by a confluence of factors that are reshaping the automotive industry landscape. The market size evolution is marked by a sustained upward trajectory, with projections indicating a significant expansion in the coming years. Adoption rates for electric vehicles in RHD markets are accelerating, fueled by increasing consumer awareness of environmental benefits and declining total cost of ownership. Technological disruptions, including breakthroughs in solid-state batteries and bidirectional charging capabilities, are not only enhancing vehicle performance but also creating new use cases for EVs, such as grid stabilization services. Consumer behavior shifts are evident, with a growing preference for sustainable mobility solutions, smart vehicle features, and seamless charging experiences. The CAGR for the RHD EV market is expected to be robust throughout the forecast period (2025-2033), indicating a period of sustained expansion and market penetration. This growth is underpinned by substantial investments in R&D and manufacturing capacities by leading automotive manufacturers and new entrants.

Dominant Regions, Countries, or Segments in Right Hand Drive Electric Vehicle Industry

The Right Hand Drive (RHD) Electric Vehicle (EV) industry's growth is primarily propelled by Battery Electric Vehicles (BEVs) within the Passenger Vehicle segment, particularly in key Asian markets. Countries like India, Australia, the United Kingdom, and Southeast Asian nations are emerging as significant contributors to the RHD EV market. Economic policies, including substantial government incentives, tax exemptions, and subsidies for EV purchases and charging infrastructure development, play a crucial role in stimulating demand. For example, India's "FAME" (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme has been instrumental in boosting EV sales. Furthermore, the expanding charging infrastructure network, with a growing number of charging stations in urban and semi-urban areas, is directly addressing range anxiety and enhancing the convenience of EV ownership.

- Dominant Segment (Vehicle Type): Passenger Vehicles are leading the charge due to higher consumer accessibility and a wider range of model availability.

- Dominant Segment (Propulsion Type): Battery Electric Vehicles (BEVs) are the frontrunners, benefiting from advancements in battery technology and increasing charging network coverage.

- Key Regional Drivers:

- India: Strong government support, growing domestic manufacturing, and a large potential consumer base.

- Australia: Increasing environmental consciousness, government EV targets, and expansion of charging infrastructure.

- United Kingdom: Ambitious emissions reduction targets, ICE vehicle sales ban in the future, and widespread charging network development.

- Southeast Asia (e.g., Singapore, Thailand): Government initiatives promoting green mobility and the introduction of new EV models by global manufacturers.

- Growth Potential: The commercial vehicle segment for RHD EVs is also exhibiting strong growth potential, driven by fleet operators seeking to reduce operational costs and meet sustainability goals.

Right Hand Drive Electric Vehicle Industry Product Landscape

The RHD electric vehicle product landscape is rapidly diversifying, marked by continuous innovation in vehicle design, battery technology, and user experience. Manufacturers are introducing a wide array of electric SUVs, sedans, hatchbacks, and commercial vehicles tailored to the specific needs and preferences of RHD markets. Key product innovations include enhanced battery ranges exceeding 500 kilometers on a single charge, ultra-fast charging capabilities enabling an 80% charge in under 30 minutes, and advanced driver-assistance systems (ADAS) for improved safety and convenience. Unique selling propositions often revolve around sustainable materials used in vehicle interiors, sophisticated infotainment systems, and seamless integration with smart home and energy ecosystems. Technological advancements are focused on improving energy efficiency, reducing vehicle weight through advanced materials, and optimizing powertrain performance.

Key Drivers, Barriers & Challenges in Right Hand Drive Electric Vehicle Industry

The RHD electric vehicle market is propelled by a combination of transformative forces. Technological advancements in battery energy density and charging speed are significantly improving EV feasibility. Government incentives, such as tax credits and purchase subsidies, coupled with increasingly stringent emission regulations, are creating a favorable market environment. The growing awareness of environmental sustainability among consumers is also a key driver.

Conversely, several barriers and challenges impede the market's full potential. The higher upfront cost of EVs compared to their internal combustion engine (ICE) counterparts remains a significant hurdle for mass adoption. The availability and accessibility of charging infrastructure, particularly in rural areas and for apartment dwellers, present a challenge. Supply chain disruptions for critical battery components and manufacturing capacity constraints can also impact production volumes and pricing. Intense competition from established automakers and new EV startups adds further pressure.

Emerging Opportunities in Right Hand Drive Electric Vehicle Industry

Emerging opportunities in the RHD electric vehicle industry are vast and span across various dimensions. The untapped potential of developing economies in Asia and Africa presents a significant growth avenue, requiring localized product offerings and affordable EV solutions. Innovative business models, such as battery-as-a-service (BaaS) and battery swapping stations, are gaining traction, offering more flexible ownership and operational models. The integration of EVs with smart grids and renewable energy sources opens up opportunities for vehicle-to-grid (V2G) and vehicle-to-home (V2H) applications, transforming EVs into mobile energy storage units. Evolving consumer preferences towards connected car technologies and autonomous driving features are creating demand for advanced EV models with sophisticated digital ecosystems.

Growth Accelerators in the Right Hand Drive Electric Vehicle Industry Industry

Several catalysts are accelerating the long-term growth of the RHD electric vehicle industry. Breakthroughs in battery technology, leading to lower costs, higher energy density, and faster charging times, are critical growth accelerators. Strategic partnerships and collaborations between automakers, battery manufacturers, and charging infrastructure providers are essential for scaling up production and expanding network coverage. Government policies that promote domestic EV manufacturing and incentivize research and development are also significant growth drivers. Market expansion strategies, including the introduction of more affordable EV models and the development of robust after-sales service networks, will further propel adoption.

Key Players Shaping the Right Hand Drive Electric Vehicle Industry Market

- Volvo Group

- Tata Motors Limited

- Hyundai Motor Company

- Nissan Motor Company

- Mahindra & Mahindra Limited

- BMW Group

- MG Motor India Pvt Ltd

- Audi AG

- Toyota Motor Corporation

- Honda Motor Co Ltd

- BYD CO LTD

Notable Milestones in Right Hand Drive Electric Vehicle Industry Sector

- January 2022: Toyota announced the upcoming launch of its new electric SUV BZX4 in various ASEAN countries, including Thailand and Singapore, with an expected launch before the end of 2022.

- January 2022: Tata Motor Company unveiled plans to mainstream EVs, targeting 50,000 annual sales in FY 2023 and aiming to scale up production capacity to 125,000-150,000 units annually within the next two years.

- December 2021: BMW Group Asia launched the first-ever BMW iX and new BMW iX3 electric cars in Singapore.

- April 2021: Mahindra & Mahindra announced its ambitious plan to launch 16 electric vehicles (EVs) by 2027 across SUV and light commercial vehicle categories to solidify its leadership in India's electric mobility segment.

In-Depth Right Hand Drive Electric Vehicle Industry Market Outlook

The future market potential for the RHD electric vehicle industry is exceptionally bright, driven by ongoing innovation and supportive policy landscapes. The continuous advancements in battery technology, promising extended range and reduced charging times, will be a primary growth engine. Furthermore, the strategic expansion of charging infrastructure networks across key RHD markets will significantly alleviate range anxiety and boost consumer confidence. Emerging markets are expected to witness substantial growth as governments implement favorable policies and manufacturers introduce more accessible EV models. Strategic partnerships aimed at securing supply chains and fostering technological collaboration will be crucial for sustained development. The increasing demand for sustainable transportation solutions, coupled with the declining total cost of ownership for EVs, positions the RHD electric vehicle market for a transformative and robust growth trajectory in the coming decade.

Right Hand Drive Electric Vehicle Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Propulsion Type

- 2.1. Battery Electric Vehicle

- 2.2. Plug-in Hybrid Electric Vehicle

- 2.3. Fuel Cell Electric Vehicle

Right Hand Drive Electric Vehicle Industry Segmentation By Geography

-

1. North America

- 1.1. Bahamas

- 1.2. Jamaica

-

2. Europe

- 2.1. United Kingdom

- 2.2. Ireland

-

3. Asia Pacific

- 3.1. Japan

- 3.2. Malaysia

- 3.3. Indonesia

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. South Africa

- 4.2. Uganda

- 4.3. Kenya

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Guyana

- 5.2. Suriname

- 5.3. Falkland Islands

Right Hand Drive Electric Vehicle Industry Regional Market Share

Geographic Coverage of Right Hand Drive Electric Vehicle Industry

Right Hand Drive Electric Vehicle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Growing Demand for Passenger Cars

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Right Hand Drive Electric Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicle

- 5.2.2. Plug-in Hybrid Electric Vehicle

- 5.2.3. Fuel Cell Electric Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Right Hand Drive Electric Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Battery Electric Vehicle

- 6.2.2. Plug-in Hybrid Electric Vehicle

- 6.2.3. Fuel Cell Electric Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Right Hand Drive Electric Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Battery Electric Vehicle

- 7.2.2. Plug-in Hybrid Electric Vehicle

- 7.2.3. Fuel Cell Electric Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Right Hand Drive Electric Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Battery Electric Vehicle

- 8.2.2. Plug-in Hybrid Electric Vehicle

- 8.2.3. Fuel Cell Electric Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East and Africa Right Hand Drive Electric Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Battery Electric Vehicle

- 9.2.2. Plug-in Hybrid Electric Vehicle

- 9.2.3. Fuel Cell Electric Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. South America Right Hand Drive Electric Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.2.1. Battery Electric Vehicle

- 10.2.2. Plug-in Hybrid Electric Vehicle

- 10.2.3. Fuel Cell Electric Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Volvo Group*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tata Motors Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hyundai Motor Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nissan Motor Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mahindra & Mahindra Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BMW Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MG Motor India Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Audi AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Toyota Motor Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Honda Motor Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BYD CO LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Volvo Group*List Not Exhaustive

List of Figures

- Figure 1: Global Right Hand Drive Electric Vehicle Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Right Hand Drive Electric Vehicle Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Right Hand Drive Electric Vehicle Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 5: North America Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America Right Hand Drive Electric Vehicle Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Right Hand Drive Electric Vehicle Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 9: Europe Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Right Hand Drive Electric Vehicle Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 11: Europe Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: Europe Right Hand Drive Electric Vehicle Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Right Hand Drive Electric Vehicle Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Right Hand Drive Electric Vehicle Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 17: Asia Pacific Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 18: Asia Pacific Right Hand Drive Electric Vehicle Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Right Hand Drive Electric Vehicle Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 21: Middle East and Africa Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Middle East and Africa Right Hand Drive Electric Vehicle Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 23: Middle East and Africa Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: Middle East and Africa Right Hand Drive Electric Vehicle Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Right Hand Drive Electric Vehicle Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 27: South America Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: South America Right Hand Drive Electric Vehicle Industry Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 29: South America Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: South America Right Hand Drive Electric Vehicle Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Right Hand Drive Electric Vehicle Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Bahamas Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Jamaica Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Ireland Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 16: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Japan Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Australia Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 24: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: South Africa Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Uganda Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Kenya Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 30: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 31: Global Right Hand Drive Electric Vehicle Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Guyana Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Suriname Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Falkland Islands Right Hand Drive Electric Vehicle Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Right Hand Drive Electric Vehicle Industry?

The projected CAGR is approximately 22.28%.

2. Which companies are prominent players in the Right Hand Drive Electric Vehicle Industry?

Key companies in the market include Volvo Group*List Not Exhaustive, Tata Motors Limited, Hyundai Motor Company, Nissan Motor Company, Mahindra & Mahindra Limited, BMW Group, MG Motor India Pvt Ltd, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd, BYD CO LTD.

3. What are the main segments of the Right Hand Drive Electric Vehicle Industry?

The market segments include Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

Growing Demand for Passenger Cars.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

In January 2022, Toyota announced to launch of its new electric SUV BZX4 in various ASEAN countries such as Thailand and Singapore. The vehicle is expected to launch before the end of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Right Hand Drive Electric Vehicle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Right Hand Drive Electric Vehicle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Right Hand Drive Electric Vehicle Industry?

To stay informed about further developments, trends, and reports in the Right Hand Drive Electric Vehicle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence