Key Insights

The Japan Automotive Electric Actuators Market is projected for substantial growth, driven by the increasing integration of advanced automotive technologies and stringent environmental regulations. With an estimated market size of ¥204 million in 2023 and a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033, the market is on an upward trajectory. This expansion is primarily fueled by the rising demand for Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), which require a greater number of electric actuators for critical functions like throttle control, battery thermal management, and powertrain electrification. The advancement of autonomous driving and Advanced Driver-Assistance Systems (ADAS) also necessitates sophisticated actuators for precise control of steering, braking, and acceleration, further amplifying market demand. The passenger car segment, particularly luxury and premium vehicles, is anticipated to lead revenue contribution due to their early adoption of these cutting-edge features.

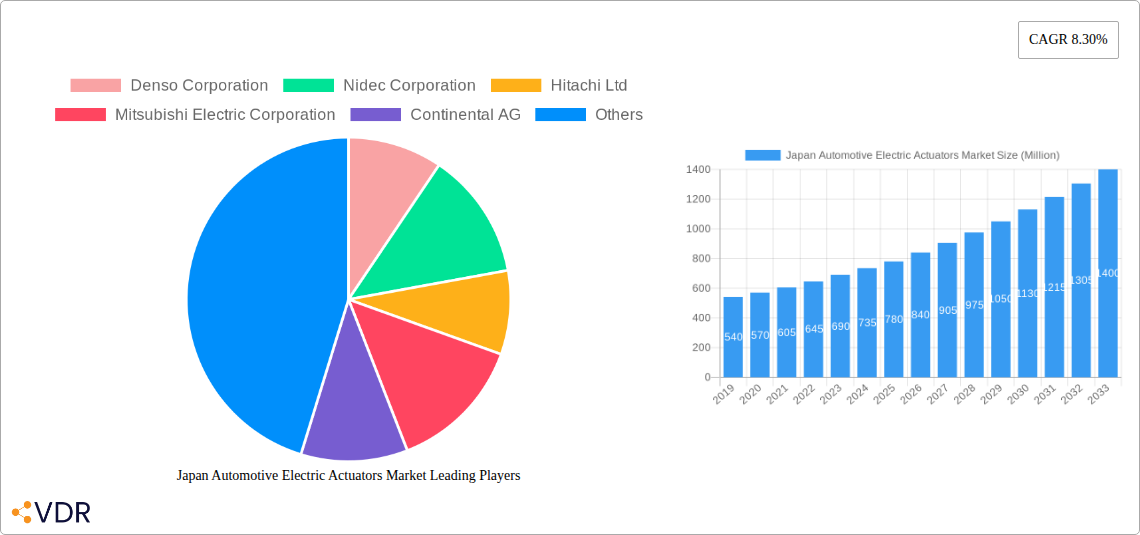

Japan Automotive Electric Actuators Market Market Size (In Million)

Despite significant growth prospects, certain factors may influence the market's expansion. The higher initial cost of electric actuators relative to mechanical alternatives, alongside substantial research and development investments required by manufacturers, could present challenges. Moreover, the complexity of integrating these systems into existing automotive architectures and the need for specialized manufacturing expertise may pose hurdles. However, continuous technological innovations, including actuator miniaturization and enhanced energy efficiency, coupled with supportive government incentives for EV adoption and increasingly rigorous safety standards, are expected to counterbalance these restraints. The market is also witnessing diversification in applications beyond conventional throttle and seat adjustments, with an emerging focus on advanced closure systems and sophisticated brake actuators to enhance vehicle safety and performance. Leading industry players such as Denso Corporation, Nidec Corporation, and Hitachi Ltd. are actively investing in R&D to secure a significant share of this burgeoning market.

Japan Automotive Electric Actuators Market Company Market Share

Japan Automotive Electric Actuators Market: A Comprehensive Industry Report (2019-2033)

This in-depth report analyzes the Japan Automotive Electric Actuators Market, a critical component of the nation's advanced automotive industry. With a study period spanning from 2019 to 2033, and a base year of 2025, this research provides crucial insights into the market dynamics, growth trends, and competitive landscape of electric actuators for automotive applications in Japan. We meticulously examine various segments, including Passenger Cars and Commercial Vehicles, and applications such as Throttle Actuators, Seat Adjustment Actuators, Brake Actuators, Closure Actuators, and Others. The report forecasts significant evolution driven by technological advancements and evolving consumer demands, with all values presented in Million Units.

Japan Automotive Electric Actuators Market Market Dynamics & Structure

The Japan Automotive Electric Actuators Market is characterized by a high degree of technological sophistication and a concentrated competitive landscape, driven by leading automotive component manufacturers. Key drivers of technological innovation include the relentless pursuit of fuel efficiency, enhanced vehicle safety, and the integration of advanced driver-assistance systems (ADAS). Regulatory frameworks, particularly those focused on emissions reduction and autonomous driving capabilities, are compelling automakers to adopt more sophisticated electric actuator solutions. The competitive product substitute landscape is gradually evolving, with advancements in smart materials and miniaturization posing potential challenges to traditional actuator designs. End-user demographics in Japan, with an aging population and a strong preference for advanced technology, are influencing demand for features like adaptive seating and simplified vehicle operation. Mergers and acquisitions (M&A) trends are likely to intensify as companies seek to consolidate market share, acquire critical technologies, and expand their product portfolios. For instance, recent M&A activity in the broader automotive electronics sector points towards strategic consolidations aimed at capturing a larger share of the future mobility market. Barriers to innovation include the high cost of research and development for novel actuator technologies and the stringent quality and reliability standards demanded by the Japanese automotive sector.

- Market Concentration: Dominated by a few key global players with established R&D capabilities and strong relationships with Japanese OEMs.

- Technological Innovation Drivers: Focus on electrification, autonomous driving, ADAS integration, and miniaturization of components.

- Regulatory Frameworks: Stringent emissions standards and evolving safety regulations are pushing for actuator innovation.

- Competitive Product Substitutes: Potential for advanced materials and non-traditional actuation mechanisms to emerge.

- End-User Demographics: Aging population driving demand for comfort and ease-of-use features.

- M&A Trends: Anticipated consolidation to gain technological edge and market access.

Japan Automotive Electric Actuators Market Growth Trends & Insights

The Japan Automotive Electric Actuators Market is poised for robust growth, driven by the accelerating pace of vehicle electrification and the increasing sophistication of automotive systems. The Forecast Period (2025–2033) is expected to witness a significant surge in the adoption of electric actuators across various vehicle types and applications, with an estimated Compound Annual Growth Rate (CAGR) of xx%. This expansion is underpinned by the global shift towards Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), which inherently rely on a greater number and variety of electric actuators for functions ranging from battery thermal management to regenerative braking systems. Furthermore, the integration of autonomous driving technologies and advanced driver-assistance systems (ADAS) necessitates precise and rapid control offered by electric actuators for steering, braking, and throttle control. Consumer behavior is also evolving, with a growing demand for enhanced comfort, convenience, and personalized driving experiences, leading to increased uptake of electric seat adjustment actuators, intelligent door closure systems, and other comfort-related actuator applications. The market penetration of electric actuators in new vehicle production is projected to reach xx% by 2033, up from an estimated xx% in the base year 2025. Technological disruptions, such as the development of more efficient and compact actuator designs, advancements in sensor integration, and the implementation of AI for predictive maintenance, will further fuel market expansion. The Estimated Year (2025) will see the market size reaching xx Million Units, reflecting the foundational adoption of these technologies. The Historical Period (2019–2024) laid the groundwork for this growth, with steady increases in demand driven by early adoption of ADAS and stricter emission norms.

Dominant Regions, Countries, or Segments in Japan Automotive Electric Actuators Market

Within the Japan Automotive Electric Actuators Market, the Passenger Car segment is expected to remain the dominant force, driven by its larger production volumes and the increasing integration of advanced features. Japanese automakers are renowned for their focus on innovation and premium features in passenger vehicles, leading to a higher penetration of electric actuators for applications such as advanced seating adjustments, sophisticated climate control systems, and active aerodynamic components. The Throttle Actuator application is also a significant contributor to market growth, as it is fundamental to modern engine management systems, particularly in the context of fuel efficiency and emissions control in both internal combustion engine (ICE) vehicles and hybrid powertrains. However, the Brake Actuator segment is anticipated to witness the most substantial growth, fueled by the widespread adoption of electronic stability control (ESC), anti-lock braking systems (ABS), and the burgeoning demand for advanced regenerative braking systems in EVs and HEVs. The development of electro-mechanical braking systems, offering faster response times and greater control, is a key driver.

- Dominant Vehicle Type: Passenger Car, accounting for a significant market share due to high production volumes and feature integration.

- Key Application Segments Driving Growth:

- Brake Actuator: Significant growth projected due to increasing adoption of advanced braking systems and EV/HEV powertrains.

- Throttle Actuator: Continued strong demand, essential for modern engine control and emission management.

- Seat Adjustment Actuator: Growing demand driven by comfort and luxury features in passenger vehicles.

- Closure Actuator: Increasing integration for enhanced convenience and safety features.

The growth in these segments is propelled by economic policies supporting automotive manufacturing and R&D, as well as continuous investments in infrastructure for electric vehicle charging and advanced automotive testing facilities. The market share of the Passenger Car segment is estimated to be around xx% in 2025, with Brake Actuators projected to grow at a CAGR of xx% during the forecast period.

Japan Automotive Electric Actuators Market Product Landscape

The product landscape of the Japan Automotive Electric Actuators Market is defined by continuous innovation aimed at improving performance, reducing size and weight, and enhancing energy efficiency. Leading manufacturers are developing compact, high-torque actuators with integrated sensors for precise feedback control. Key product innovations include brushless DC motor-based actuators for superior durability and efficiency, and the increasing integration of electronic control units (ECUs) directly within the actuator module for streamlined system architecture. Applications are expanding beyond traditional engine and seat functions to include active grille shutters for improved aerodynamics, electric exhaust gas recirculation (EGR) valves for emissions control, and sophisticated door and tailgate opening/closing systems. Performance metrics are being optimized for faster response times, higher precision, and extended operational lifespans, crucial for safety-critical applications like braking and steering. Unique selling propositions often lie in proprietary control algorithms, advanced sealing technologies for harsh automotive environments, and the ability to meet extremely low noise, vibration, and harshness (NVH) requirements.

Key Drivers, Barriers & Challenges in Japan Automotive Electric Actuators Market

The Japan Automotive Electric Actuators Market is propelled by several key drivers. The accelerating global transition towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) is a primary catalyst, as these powertrains necessitate a more extensive use of electric actuators for various functions. Stringent emission regulations and government mandates for improved fuel efficiency further drive the adoption of advanced actuation systems. The increasing sophistication of automotive features, including ADAS, autonomous driving technologies, and enhanced in-cabin comfort and convenience, directly fuels demand for electric actuators.

- Key Drivers:

- Electrification of vehicles (EVs & HEVs)

- Stricter emission and fuel efficiency regulations

- Advancements in ADAS and autonomous driving

- Growing consumer demand for comfort and convenience features

However, the market faces significant barriers and challenges. The high cost of research and development for novel actuator technologies, coupled with the substantial initial investment required for advanced manufacturing processes, presents a considerable hurdle. Supply chain disruptions, particularly for critical electronic components and rare earth magnets, can impact production volumes and lead times. Regulatory hurdles, including the complex and evolving homologation processes for automotive components, can also slow down market entry. Intense competition among established global players and emerging domestic manufacturers can lead to price pressures.

- Key Barriers & Challenges:

- High R&D and manufacturing investment costs

- Supply chain vulnerabilities and component shortages

- Complex and evolving regulatory compliance

- Intense competitive landscape and price pressures

- Need for robust cybersecurity in connected actuator systems

Emerging Opportunities in Japan Automotive Electric Actuators Market

Emerging opportunities within the Japan Automotive Electric Actuators Market are largely shaped by the evolving automotive ecosystem. The growing demand for sophisticated cabin customization and comfort features in premium and luxury vehicles presents a significant avenue for growth in advanced seat adjustment actuators and intelligent interior climate control systems. The rapid development and deployment of autonomous driving technologies, even at lower levels of autonomy, will spur demand for highly precise and responsive actuators in steering and braking systems. Furthermore, the increasing focus on vehicle lightweighting and energy efficiency creates opportunities for the development of smaller, more power-efficient actuators made from advanced composite materials. The aftermarket segment for actuator replacements and upgrades also holds untapped potential, particularly for older vehicles equipped with less sophisticated systems.

Growth Accelerators in the Japan Automotive Electric Actuators Market Industry

Several catalysts are accelerating long-term growth in the Japan Automotive Electric Actuators Market. Technological breakthroughs in actuator design, such as the development of more efficient and durable micro-actuators, are continuously expanding their applicability. Strategic partnerships between actuator manufacturers and automotive OEMs, focused on co-development of next-generation actuation systems, are crucial for driving innovation and ensuring market fit. The increasing adoption of electric vehicle platforms by a wider range of automakers, including traditional manufacturers and new entrants, significantly expands the addressable market for electric actuators. Furthermore, government initiatives and incentives promoting EV adoption and the development of intelligent transportation systems act as powerful market expansion strategies, creating a more favorable environment for actuator suppliers.

Key Players Shaping the Japan Automotive Electric Actuators Market Market

- Denso Corporation

- Nidec Corporation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Aptiv Plc

Notable Milestones in Japan Automotive Electric Actuators Market Sector

- 2019: Increased adoption of electric throttle control systems across a wider range of passenger car models due to stricter emission standards.

- 2020: Introduction of advanced electric seat adjustment actuators offering greater personalization and comfort features in luxury vehicles.

- 2021: Significant investment in R&D for electro-mechanical braking systems by major automotive suppliers in anticipation of autonomous driving.

- 2022: Enhanced integration of closure actuators in SUVs and minivans for improved convenience and hands-free operation.

- 2023: Development of more compact and energy-efficient actuators for EV thermal management systems to improve battery range.

- 2024: Growing focus on cybersecurity for connected actuators, ensuring the safety and integrity of automotive systems.

In-Depth Japan Automotive Electric Actuators Market Market Outlook

The future outlook for the Japan Automotive Electric Actuators Market is exceptionally bright, fueled by the sustained momentum of vehicle electrification and the relentless pursuit of advanced automotive functionalities. Growth accelerators, including breakthroughs in actuator miniaturization and efficiency, are opening new application frontiers. Strategic collaborations between key industry players are fostering rapid innovation and market penetration. The expanding adoption of EV platforms by major Japanese and global manufacturers presents a substantial and sustained demand for a diverse range of electric actuators. Government support for sustainable mobility solutions further solidifies the positive market trajectory. The market is poised for significant expansion, driven by an increasing demand for sophisticated, reliable, and efficient actuation systems that are integral to the future of automotive technology.

Japan Automotive Electric Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Others

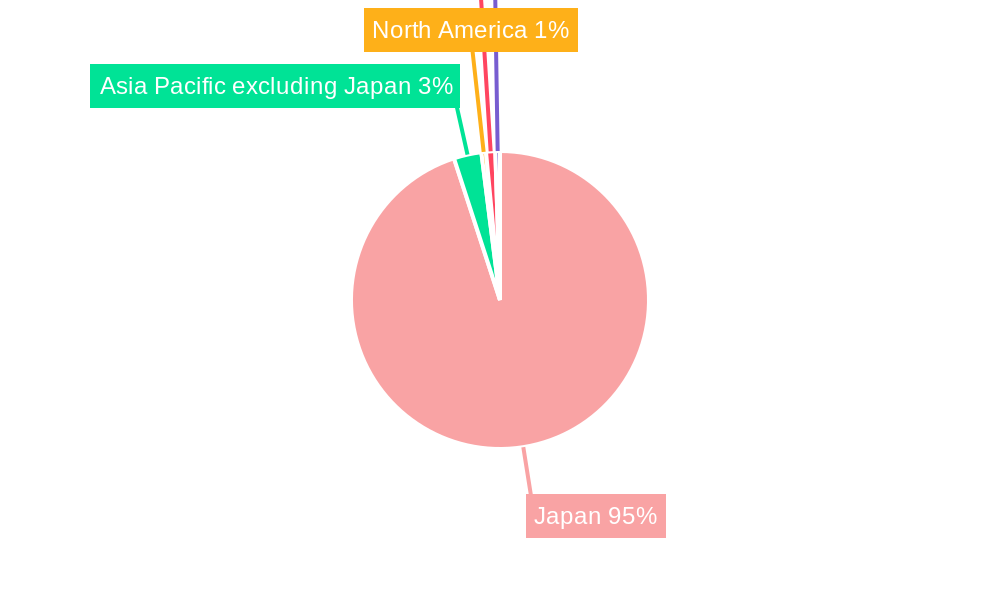

Japan Automotive Electric Actuators Market Segmentation By Geography

- 1. Japan

Japan Automotive Electric Actuators Market Regional Market Share

Geographic Coverage of Japan Automotive Electric Actuators Market

Japan Automotive Electric Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for ADAS Integration

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Electric Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Automotive Electric Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nidec Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aptiv Pl

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Japan Automotive Electric Actuators Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan Automotive Electric Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Automotive Electric Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Japan Automotive Electric Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Japan Automotive Electric Actuators Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Japan Automotive Electric Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Japan Automotive Electric Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: Japan Automotive Electric Actuators Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Automotive Electric Actuators Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Japan Automotive Electric Actuators Market?

Key companies in the market include Denso Corporation, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Aptiv Pl.

3. What are the main segments of the Japan Automotive Electric Actuators Market?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 204 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for ADAS Integration.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Electric Actuators Market to Grow.

7. Are there any restraints impacting market growth?

High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Automotive Electric Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Automotive Electric Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Automotive Electric Actuators Market?

To stay informed about further developments, trends, and reports in the Japan Automotive Electric Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence