Key Insights

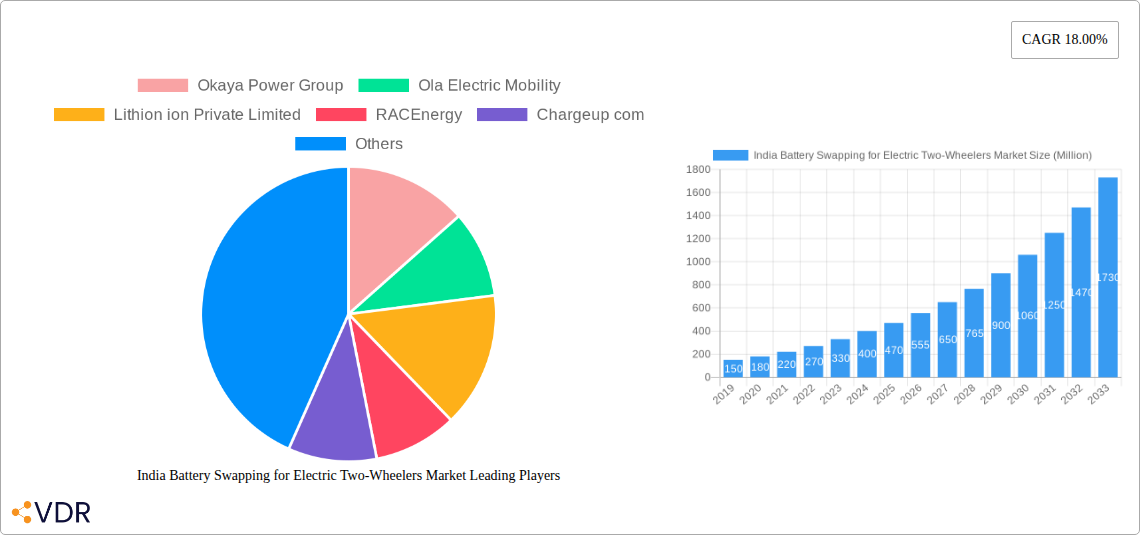

The Indian battery swapping market for electric two-wheelers is poised for substantial growth, projected to reach an estimated XX million by 2025 and expand at a remarkable CAGR of 18.00% through 2033. This robust expansion is primarily fueled by the government's strong push for electric mobility through favorable policies, subsidies, and the establishment of charging infrastructure. The burgeoning demand for affordable and convenient electric two-wheelers, especially in urban and semi-urban areas, further amplifies this growth. The Pay-Per-Use model is expected to dominate the service type segment, offering flexibility and cost-effectiveness for consumers, while the Subscription Model will cater to users seeking predictable expenses and enhanced convenience. Lithium-ion batteries are rapidly gaining traction due to their superior energy density, faster charging capabilities, and longer lifespan compared to traditional Lead-acid batteries, driving innovation and adoption in the sector.

India Battery Swapping for Electric Two-Wheelers Market Market Size (In Million)

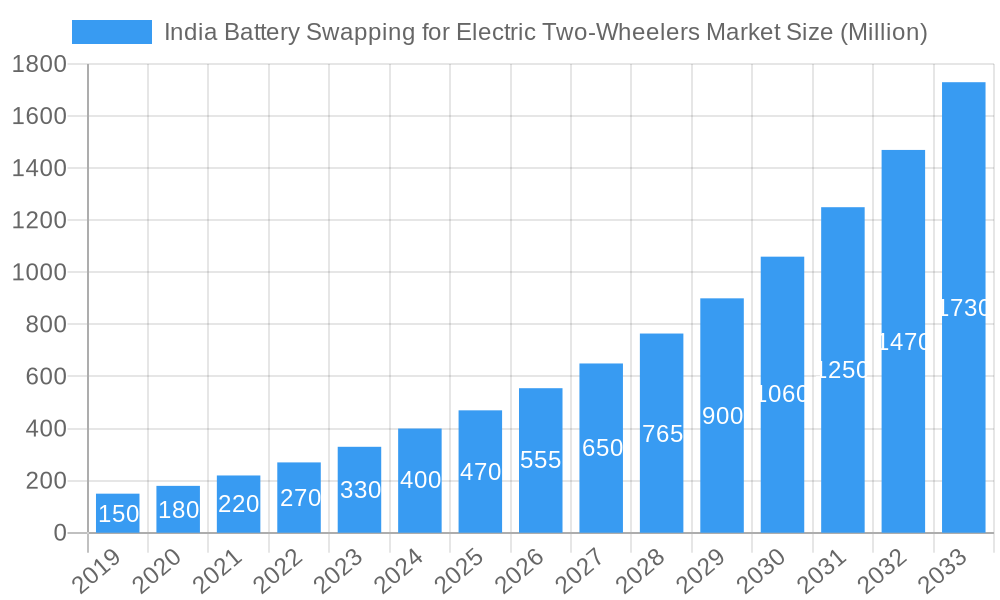

The competitive landscape features key players like Okaya Power Group, Ola Electric Mobility, and Sun Mobility, who are actively investing in expanding their battery swapping networks and developing advanced battery technologies. These companies are instrumental in overcoming existing challenges such as range anxiety and long charging times, making electric two-wheelers a more viable and attractive option for a wider consumer base. The market's growth trajectory is further supported by continuous technological advancements in battery management systems, faster swapping mechanisms, and the integration of smart technologies for efficient network management. The increasing adoption of electric two-wheelers for last-mile delivery services and the growing environmental consciousness among consumers are also significant growth drivers, solidifying India's position as a leading market for battery swapping solutions in the electric two-wheeler segment.

India Battery Swapping for Electric Two-Wheelers Market Company Market Share

This in-depth report provides a definitive analysis of the India battery swapping for electric two-wheelers market, a rapidly evolving sector crucial for India's electric mobility transition. Focusing on critical market dynamics, growth trends, regional dominance, product landscape, and key players, this report offers actionable insights for stakeholders seeking to capitalize on the burgeoning opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report leverages comprehensive data and expert analysis to deliver a future-forward perspective. Understand the impact of evolving service models, battery technologies, and strategic industry developments that are shaping the electric vehicle (EV) battery swapping ecosystem in India.

India Battery Swapping for Electric Two-Wheelers Market Market Dynamics & Structure

The India battery swapping for electric two-wheelers market exhibits a dynamic and increasingly concentrated structure, driven by significant technological innovation and evolving regulatory frameworks. Key players are actively investing in R&D for advanced battery technologies and efficient swapping infrastructure, contributing to a competitive landscape. End-user demographics are shifting, with a growing adoption among delivery fleets and a rising segment of individual riders seeking convenience and reduced upfront costs. Mergers and acquisitions (M&A) are becoming more prominent as established players seek to consolidate market share and enhance their operational capabilities, aiming to achieve economies of scale.

- Market Concentration: Moderate to high, with leading players like Okaya Power Group and Ola Electric Mobility strategically expanding their network reach.

- Technological Innovation: Focus on faster swapping times, higher energy density batteries (Lithium-ion dominance), and intelligent battery management systems.

- Regulatory Frameworks: Government incentives and evolving safety standards are critical drivers, influencing adoption rates and operational compliance.

- Competitive Product Substitutes: Traditional ICE two-wheelers and standalone EV charging solutions present ongoing competition, but battery swapping offers a distinct advantage in turnaround time.

- End-User Demographics: Rapid growth in the commercial segment (last-mile delivery) and increasing interest from urban commuters.

- M&A Trends: Strategic partnerships and acquisitions are anticipated to increase as companies aim to secure market share and expand their footprint. For example, a predicted 5-10 M&A deals in the electric two-wheeler and battery swapping space are expected between 2025-2027.

India Battery Swapping for Electric Two-Wheelers Market Growth Trends & Insights

The India battery swapping for electric two-wheelers market is poised for exponential growth, driven by a confluence of factors including government support, declining battery costs, and an increasing consumer preference for sustainable transportation. The market size is projected to witness a substantial surge, from an estimated 15 million units in 2025 to over 45 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 15-20%. This expansion is fueled by the inherent advantages of battery swapping, such as drastically reduced downtime for commercial users and a more affordable entry point for individual consumers by decoupling battery costs from vehicle purchase.

Technological disruptions, particularly the advancements in Lithium-ion battery technology, are enhancing range, safety, and lifespan, further accelerating adoption rates. Consumer behavior is shifting from range anxiety to a focus on convenience and affordability, making the pay-per-use and subscription models increasingly attractive. The operational efficiency offered by battery swapping stations for fleets significantly boosts their earning potential, driving a positive feedback loop for market penetration. This trend is further supported by the continuous development of smart battery management systems and the rollout of extensive swapping networks across urban and semi-urban areas. The estimated market penetration of battery-swapping enabled electric two-wheelers is expected to rise from 5% in 2025 to over 25% by 2033, underscoring its transformative impact.

Dominant Regions, Countries, or Segments in India Battery Swapping for Electric Two-Wheelers Market

The India battery swapping for electric two-wheelers market is witnessing significant traction across various segments, with Lithium-ion battery type emerging as the dominant technology due to its superior energy density, faster charging capabilities, and longer lifespan compared to Lead Acid batteries. Within service types, the Pay-Per-Use Model is gaining substantial momentum, particularly among commercial fleet operators like last-mile delivery services. This model offers unparalleled flexibility and cost-efficiency, allowing businesses to manage their operational expenses effectively by paying only for the energy consumed or battery swaps utilized.

Dominant Battery Type: Lithium-ion

- Market share projected to exceed 85% of the total battery swapping units by 2028.

- Key drivers include higher energy density enabling longer range, faster swap times, and extended battery life, reducing the total cost of ownership.

- Companies like Okaya Power Group and Lithion ion Private Limited are heavily investing in Lithium-ion battery manufacturing and swapping solutions.

Dominant Service Type: Pay-Per-Use Model

- Preferred by commercial segments due to its operational flexibility and cost-effectiveness.

- Enables businesses to scale operations without significant upfront capital expenditure on batteries.

- Last-mile delivery companies are early adopters, leveraging it to maximize vehicle uptime and profitability.

Regional Dominance:

- Metropolitan and Tier-1 Cities: Initially leading due to higher EV adoption, robust infrastructure development, and a dense concentration of commercial fleets. Cities like Delhi, Mumbai, Bengaluru, and Chennai are at the forefront.

- Emerging Markets: Tier-2 and Tier-3 cities are expected to witness rapid growth as infrastructure expands and government incentives permeate these regions.

- Key Drivers for Dominance: Favorable government policies, increasing disposable incomes, growing environmental consciousness, and the presence of key battery swapping operators and EV manufacturers.

India Battery Swapping for Electric Two-Wheelers Market Product Landscape

The product landscape in the India battery swapping for electric two-wheelers market is characterized by a focus on interoperability, safety, and enhanced performance. Innovations are centered around developing standardized battery packs that can be swapped across different vehicle models and brands, simplifying operations for consumers and fleet managers. Advanced battery management systems (BMS) are integrated to monitor battery health, optimize charging, and ensure user safety. Many solutions feature swappable Lithium-ion battery packs with capacities ranging from 1.5 kWh to 3 kWh, providing adequate range for urban commuting and last-mile deliveries. The unique selling proposition often lies in the speed of the swap, typically under 60 seconds, and the integration of IoT capabilities for remote monitoring and analytics.

Key Drivers, Barriers & Challenges in India Battery Swapping for Electric Two-Wheelers Market

Key Drivers:

- Government Initiatives: Favorable policies such as FAME II subsidies and production-linked incentives for EVs and battery manufacturing are significant catalysts. The push towards electrification of last-mile delivery fleets also acts as a strong driver.

- Reduced Total Cost of Ownership (TCO): Battery swapping lowers the upfront cost of EVs by separating battery purchase and allows for efficient management of battery degradation, leading to a lower TCO for commercial users.

- Convenience and Time Efficiency: Eliminates long charging times, providing a seamless experience for riders, especially for commercial operations where vehicle uptime is critical.

- Technological Advancements: Improvements in Lithium-ion battery technology, including higher energy density and faster charging capabilities, enhance the attractiveness of swapping solutions.

Barriers & Challenges:

- High Initial Infrastructure Investment: Setting up a widespread network of battery swapping stations requires substantial capital investment.

- Battery Standardization and Interoperability: Lack of universal standards for battery packs across different manufacturers can hinder widespread adoption and create vendor lock-in.

- Battery Safety and Management: Ensuring the safety of swappable batteries and managing their lifecycle, including recycling and disposal, are critical concerns.

- Grid Capacity and Stability: The increased demand from numerous swapping stations could strain local power grids, especially in densely populated areas.

- Consumer Awareness and Trust: Educating consumers about the benefits of battery swapping and building trust in the technology are essential for wider acceptance.

- Supply Chain Volatility: Dependence on imported raw materials for batteries can lead to price fluctuations and supply chain disruptions. For instance, a 10-15% increase in lithium prices could impact battery manufacturing costs.

Emerging Opportunities in India Battery Swapping for Electric Two-Wheelers Market

Emerging opportunities in the India battery swapping for electric two-wheelers market are manifold. The expansion of swapping networks into Tier-2 and Tier-3 cities presents a vast untapped market. Innovative business models, such as battery-as-a-service (BaaS) integrated with fleet management software, offer enhanced value propositions. The development of smart city initiatives and the integration of battery swapping stations with existing urban infrastructure like petrol pumps and retail outlets create synergistic growth avenues. Furthermore, exploring interoperable battery standards to allow for seamless swapping across a wider range of vehicle brands is a significant opportunity to accelerate market penetration. The rise of electric two-wheeler ride-sharing services also presents a substantial demand driver.

Growth Accelerators in the India Battery Swapping for Electric Two-Wheelers Market Industry

Growth in the India battery swapping for electric two-wheelers market is being significantly accelerated by strategic partnerships between battery swapping providers, EV manufacturers, and fleet aggregators. The continuous refinement of battery technology, leading to improved performance and reduced costs, is a key accelerator. Government policy support, including fiscal incentives and mandates for EV adoption in specific sectors like e-commerce and logistics, provides a strong impetus. The rapid urbanization and the increasing need for efficient, cost-effective last-mile delivery solutions are also powerful growth catalysts. Furthermore, the development of smart battery management systems and cloud-based platforms enhances operational efficiency and scalability.

Key Players Shaping the India Battery Swapping for Electric Two-Wheelers Market Market

- Okaya Power Group

- Ola Electric Mobility

- Lithion ion Private Limited

- RACEnergy

- Chargeup com

- Voltup in

- Sun Mobility Private Limited

- Numocity Technologies

- Upgrid solutions Private Limited (Battery Smart)

- Twenty Two Motors Private Limited (Bounce Infinity)

- Esmito Solutions Pvt Ltd

Notable Milestones in India Battery Swapping for Electric Two-Wheelers Market Sector

- November 2022: Taiwan-based battery-swapping ecosystem leader, Gogoro, announced a B2B partnership with India's EV-as-a-Service platform Zypp Electric to begin its battery-swapping pilot service in the country. Both companies plan to accelerate the shift of last-mile deliveries to electric using battery swapping.

- September 2022: Battery-swapping startup VoltUp announced a partnership on Wednesday with Adani Electricity, Hero Electric, and Zomato to open 500 electric mobility stations across Mumbai by 2024, catering to over 30,000 riders daily. This is the first smart mobility partnership in India between a battery-swapping startup and infrastructure, original equipment manufacturers, and last-mile partners.

- June 2022: New Delhi-based EV solutions provider SUN Mobility announced the expansion of its battery-swapping network to Maharashtra as part of its partnership with Amazon India. The first set of battery-swapping stations in the state was set up at Amazon facilities in Mumbai and Pune, respectively. The company aims to locate over 2,000 battery-swapping units across Maharashtra by 2025.

In-Depth India Battery Swapping for Electric Two-Wheelers Market Market Outlook

The outlook for the India battery swapping for electric two-wheelers market is exceptionally robust, driven by strong government backing, rapid technological advancements, and increasing consumer demand for sustainable mobility solutions. The market is expected to witness sustained high growth as more stakeholders invest in expanding swapping infrastructure and developing interoperable battery solutions. The continuous innovation in battery technology, coupled with declining battery costs, will further fuel adoption rates. Strategic alliances and collaborations among key players will play a pivotal role in consolidating the market and achieving economies of scale. The growing focus on electrifying last-mile delivery services and the increasing preference for cost-effective EV ownership models will continue to be primary growth accelerators, positioning battery swapping as a cornerstone of India's electric vehicle ecosystem.

India Battery Swapping for Electric Two-Wheelers Market Segmentation

-

1. Service Type

- 1.1. Pay-Per-Use Model

- 1.2. Subscription Model

-

2. Battery Type

- 2.1. Lead Acid

- 2.2. Lithium-ion

India Battery Swapping for Electric Two-Wheelers Market Segmentation By Geography

- 1. India

India Battery Swapping for Electric Two-Wheelers Market Regional Market Share

Geographic Coverage of India Battery Swapping for Electric Two-Wheelers Market

India Battery Swapping for Electric Two-Wheelers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Focus of Manufacturers on Improving Lithium Ion Batteries Expect to Enhance Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Swapping for Electric Two-Wheelers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pay-Per-Use Model

- 5.1.2. Subscription Model

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Lead Acid

- 5.2.2. Lithium-ion

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Okaya Power Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ola Electric Mobility

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lithion ion Private Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RACEnergy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chargeup com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Voltup in

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sun Mobility Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Numocity Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Upgrid solutions Private Limited (Battery Smart)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Twenty Two Motors Private Limited (Bounce Infinity

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Esmito Solutions Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Okaya Power Group

List of Figures

- Figure 1: India Battery Swapping for Electric Two-Wheelers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Battery Swapping for Electric Two-Wheelers Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 2: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 3: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 5: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 6: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Swapping for Electric Two-Wheelers Market?

The projected CAGR is approximately 22.7%.

2. Which companies are prominent players in the India Battery Swapping for Electric Two-Wheelers Market?

Key companies in the market include Okaya Power Group, Ola Electric Mobility, Lithion ion Private Limited, RACEnergy, Chargeup com, Voltup in, Sun Mobility Private Limited, Numocity Technologies, Upgrid solutions Private Limited (Battery Smart), Twenty Two Motors Private Limited (Bounce Infinity, Esmito Solutions Pvt Ltd.

3. What are the main segments of the India Battery Swapping for Electric Two-Wheelers Market?

The market segments include Service Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Focus of Manufacturers on Improving Lithium Ion Batteries Expect to Enhance Demand.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: Taiwan-based battery-swapping ecosystem leader, Gogoro, announced a B2B partnership with India's EV-as-a-Service platform Zypp Electric to begin its battery-swapping pilot service in the country. Both companies plan to accelerate the shift of last-mile deliveries to electric using battery swapping.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Swapping for Electric Two-Wheelers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Swapping for Electric Two-Wheelers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Swapping for Electric Two-Wheelers Market?

To stay informed about further developments, trends, and reports in the India Battery Swapping for Electric Two-Wheelers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence