Key Insights

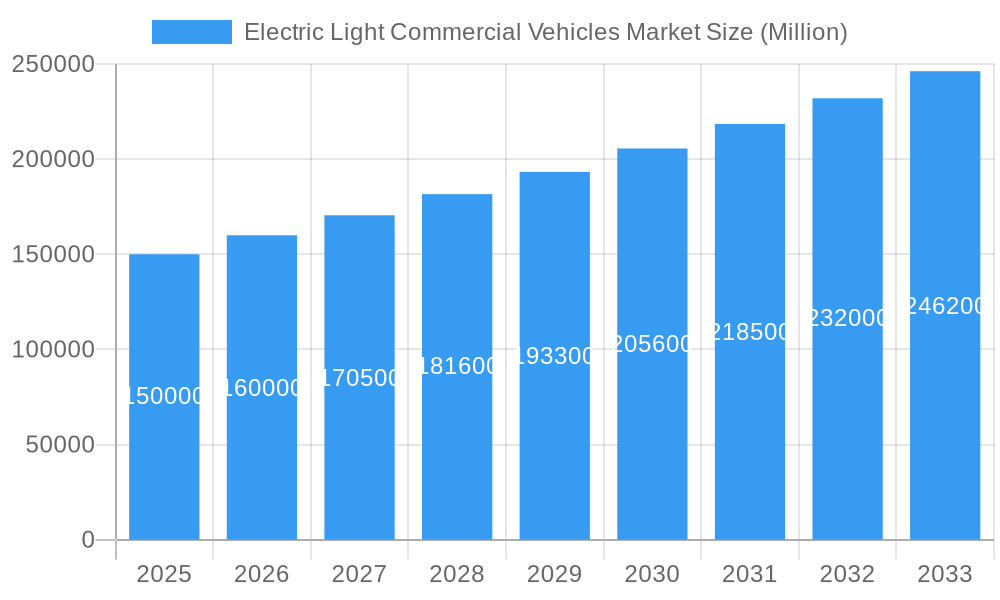

The Electric Light Commercial Vehicles (eLCV) market is projected for significant growth, with an anticipated market size of $38.35 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 37.9% through 2033. This expansion is driven by stringent environmental regulations, corporate sustainability initiatives, and the cost-efficiency of electric powertrains. Urban areas are increasingly implementing emission control zones and zero-emission vehicle incentives, making eLCVs essential for logistics and fleet operations. Advances in battery technology are enhancing range and charging speed, increasing eLCV practicality for diverse commercial uses.

Electric Light Commercial Vehicles Market Market Size (In Billion)

Market growth is further stimulated by evolving consumer preferences and technological advancements. The demand for eco-friendly transport, coupled with government incentives, accelerates electric mobility adoption. Key trends include integrated connectivity for fleet management, specialized eLCVs for sectors like cold chain logistics, and a focus on circular economy principles for batteries. Challenges include the initial purchase cost, charging infrastructure availability, and potential grid strain. However, the strong momentum towards commercial vehicle electrification, supported by manufacturers and startups, points to a transformative future for the eLCV market.

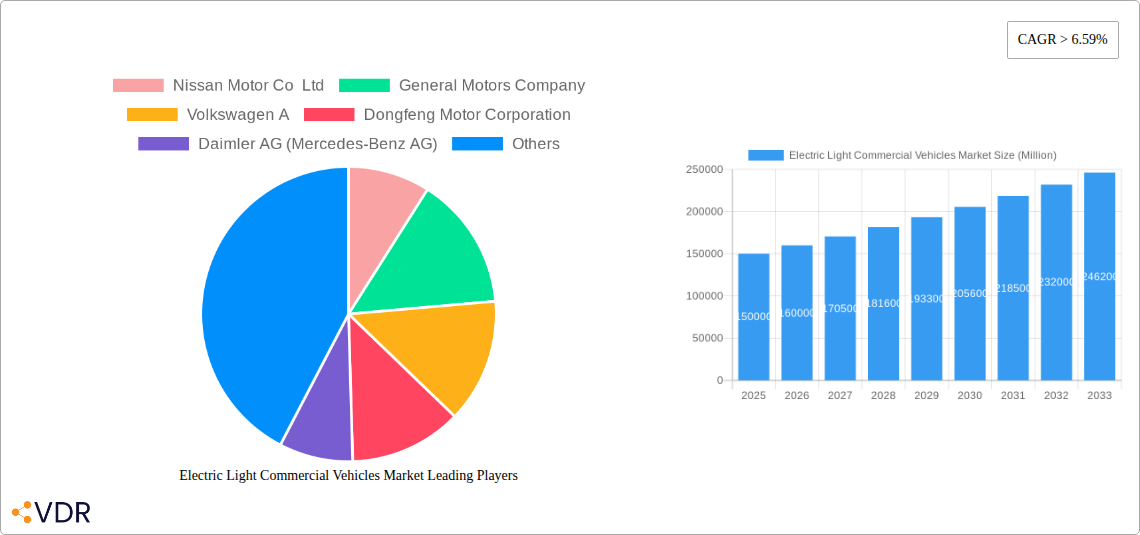

Electric Light Commercial Vehicles Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the Electric Light Commercial Vehicles Market, designed for maximum visibility and engagement.

Report Title: Electric Light Commercial Vehicles Market: Navigating the Future of Urban Logistics & Fleet Electrification (2019-2033)

Report Description: Explore the dynamic Electric Light Commercial Vehicles (eLCV) market, a sector rapidly transforming due to sustainability mandates and operational efficiencies. This in-depth report analyzes the global eLCV market, covering Vehicle Configurations like vans and pickups, and Fuel Categories including Battery Electric Vehicles (BEV), Fuel Cell Electric Vehicles (FCEV), Hybrid Electric Vehicles (HEV), and Plug-in Hybrid Electric Vehicles (PHEV). With a detailed study period from 2019 to 2033, a base year of 2025, and an estimated year of 2025, this report provides robust insights into historical trends and future projections.

Discover critical market dynamics, growth trajectories, dominant regions, product innovations, and the key players like Nissan Motor Co Ltd, General Motors Company, Volkswagen AG, Dongfeng Motor Corporation, Daimler AG (Mercedes-Benz AG), BAIC Motor Corporation Ltd, BYD Auto Co Ltd, Groupe Renault, Rivian Automotive Inc, and Ford Motor Company shaping this burgeoning industry. Understand the impact of recent developments, such as General Motors' electric Cadillac Escalade launch and Ford's flexible EV solutions pilot, on the market's trajectory. This report is essential for fleet managers, automotive manufacturers, policymakers, and investors seeking to capitalize on commercial fleet electrification. All values are presented in Million units.

Electric Light Commercial Vehicles Market Market Dynamics & Structure

The Electric Light Commercial Vehicles (eLCV) market is characterized by a moderately consolidated structure, with key players like BYD Auto Co Ltd, Dongfeng Motor Corporation, and General Motors Company holding significant market shares. Technological innovation serves as a primary driver, fueled by advancements in battery technology, charging infrastructure, and vehicle efficiency. Regulatory frameworks globally are increasingly pushing for zero-emission transportation, particularly in urban areas, creating a fertile ground for eLCV adoption. Competitive product substitutes, primarily conventional internal combustion engine (ICE) light commercial vehicles, are facing intense pressure from the environmental and operational benefits of electric alternatives. End-user demographics are shifting, with logistics companies, delivery services, and tradespeople increasingly recognizing the total cost of ownership advantages of eLCVs, including lower fuel and maintenance costs. Mergers & Acquisitions (M&A) are on the rise as established automakers seek to secure market positions and new entrants aim to disrupt the landscape.

- Market Concentration: Moderate, with leading players dominating specific regional markets.

- Technological Innovation Drivers:

- Increased battery energy density and faster charging capabilities.

- Development of advanced telematics and fleet management systems for eLCVs.

- Improvements in electric powertrain efficiency and range.

- Regulatory Frameworks:

- Stringent emission standards and zero-emission vehicle mandates.

- Government incentives for eLCV purchases and charging infrastructure deployment.

- Urban access restrictions for polluting vehicles.

- Competitive Product Substitutes: Conventional ICE LCVs, with ongoing efforts to improve their efficiency and reduce emissions.

- End-User Demographics: Growing demand from e-commerce logistics, last-mile delivery services, and businesses with sustainability targets.

- M&A Trends: Strategic acquisitions and partnerships to accelerate product development and market penetration.

Electric Light Commercial Vehicles Market Growth Trends & Insights

The Electric Light Commercial Vehicles (eLCV) market is poised for exponential growth, driven by a confluence of technological advancements, supportive government policies, and evolving business imperatives. The market size is projected to expand significantly from its historical period of 2019-2024 through the forecast period of 2025-2033. This expansion is underpinned by a substantial increase in eLCV adoption rates across various sectors, from last-mile delivery to trades and services. Technological disruptions, particularly in battery cost reduction and charging speed, are making eLCVs increasingly competitive with their internal combustion engine (ICE) counterparts. Consumer behavior shifts, influenced by corporate sustainability goals and the tangible operational cost savings offered by electric fleets, are further accelerating demand.

The CAGR for the eLCV market is expected to be robust, reflecting the rapid transition away from traditional powertrains. Market penetration of eLCVs is forecast to climb steadily as charging infrastructure becomes more widespread and the variety of available eLCV models diversifies. By 2025, the market is anticipated to reach xx million units, with further substantial growth projected through 2033. This growth is not merely incremental; it represents a fundamental shift in how commercial transportation is conceived and executed. The increasing focus on reducing operational expenditures, coupled with a growing awareness of the environmental impact of fleet operations, are powerful motivators for businesses to electrify their light commercial vehicle fleets. Furthermore, innovations in vehicle-to-grid (V2G) technology and smart charging solutions are enhancing the appeal of eLCVs by offering additional revenue streams and grid stabilization benefits. The expanding ecosystem of charging solutions, including fast-charging networks and home/depot charging options, is also crucial in mitigating range anxiety and improving the overall usability of eLCVs for commercial operations. As battery technology continues to improve, leading to longer ranges and reduced charging times, the operational limitations that once hindered adoption are steadily diminishing. This creates a virtuous cycle where increased adoption drives further investment in infrastructure and technology, leading to even greater accessibility and affordability of eLCVs. The demand for quiet, zero-emission vehicles in urban environments, driven by regulatory pressures and public health concerns, also plays a significant role in shaping market trends and accelerating the transition.

Dominant Regions, Countries, or Segments in Electric Light Commercial Vehicles Market

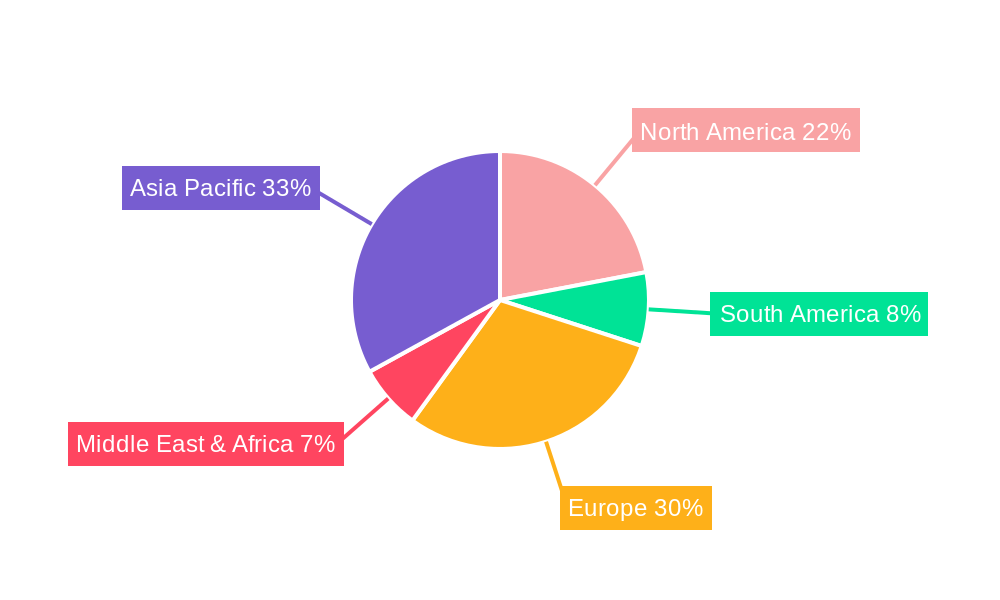

The Electric Light Commercial Vehicles (eLCV) market is witnessing significant growth across various regions and segments, with North America and Europe leading the charge in adoption, particularly for Battery Electric Vehicles (BEV) within the Light Commercial Vehicles configuration.

North America: This region exhibits strong growth driven by robust government incentives, a rapidly expanding e-commerce sector fueling last-mile delivery demand, and a growing fleet electrification commitment from major corporations. The United States, in particular, is a key market, with states like California setting ambitious emission reduction targets. The increasing availability of diverse eLCV models from established manufacturers and innovative startups is further stimulating demand.

- Key Drivers:

- Federal and state tax credits for EV purchases.

- Expansion of charging infrastructure networks.

- Corporate sustainability initiatives and fleet electrification goals.

- Growing demand for last-mile delivery services.

- Market Share: North America is projected to capture a significant share of the global eLCV market by 2033.

- Growth Potential: High, with substantial room for market penetration and infrastructure development.

- Key Drivers:

Europe: Europe stands as a trailblazer in eLCV adoption, propelled by stringent emission regulations, substantial subsidies, and a strong focus on urban sustainability. Countries like Norway, Germany, and the UK are at the forefront, with dedicated policies encouraging the transition to electric commercial vehicles. The expansion of charging infrastructure and the growing number of urban low-emission zones are key enablers of this regional dominance.

- Key Drivers:

- European Union's CO2 emission standards for commercial vehicles.

- National and local government grants and subsidies.

- Well-developed public and private charging infrastructure.

- Increasing consumer and business preference for eco-friendly logistics.

- Market Share: Europe is expected to maintain its leadership position in the eLCV market.

- Growth Potential: Strong, with continued regulatory support and evolving consumer preferences.

- Key Drivers:

Asia Pacific: While currently lagging behind North America and Europe, the Asia Pacific region, particularly China, presents immense growth potential for eLCVs. China's established dominance in EV manufacturing and significant government backing for electric mobility are key factors. As other countries in the region prioritize sustainability and urban air quality, the adoption of eLCVs is expected to accelerate.

- Key Drivers:

- Government support for EV adoption in China.

- Growing urbanization and logistics needs.

- Technological advancements and falling battery costs.

- Market Share: Expected to grow substantially in the coming years.

- Growth Potential: Very high, driven by market size and increasing policy focus.

- Key Drivers:

The BEV fuel category is overwhelmingly dominating the eLCV market due to its established charging infrastructure and improving battery technology. While FCEV, HEV, and PHEV technologies offer specific advantages, BEVs currently present the most practical and cost-effective solution for a wide range of light commercial vehicle applications.

Electric Light Commercial Vehicles Market Product Landscape

The Electric Light Commercial Vehicles (eLCV) market is witnessing an explosion of innovative products designed to meet diverse commercial needs. Manufacturers are introducing a range of eLCVs, from compact urban delivery vans to larger cargo vans and pickup trucks, emphasizing payload capacity, range, and charging speed. Key product innovations include modular battery systems allowing for optimized range and payload configurations, advanced regenerative braking systems for enhanced energy recovery, and smart telematics for efficient fleet management. Applications are expanding beyond traditional logistics to include mobile services, waste management, and trades, highlighting the versatility of electric powertrains. Performance metrics such as extended driving ranges (up to xx miles on a single charge), rapid charging capabilities (e.g., 80% charge in under 30 minutes), and lower operating costs are becoming standard selling propositions. Technological advancements are focused on improving battery longevity, reducing vehicle weight through lightweight materials, and enhancing driver comfort and safety features in these workhorse vehicles.

Key Drivers, Barriers & Challenges in Electric Light Commercial Vehicles Market

Key Drivers: The Electric Light Commercial Vehicles (eLCV) market is propelled by a powerful combination of factors. Technological advancements in battery technology, leading to longer ranges and faster charging, are crucial. Government incentives, including tax credits and subsidies, significantly reduce upfront costs. Environmental regulations mandating lower emissions and the growing demand for sustainable logistics solutions from businesses are also major drivers. Furthermore, the total cost of ownership (TCO) advantage, stemming from lower fuel and maintenance expenses compared to internal combustion engine (ICE) vehicles, is increasingly appealing to fleet operators.

Barriers & Challenges: Despite the positive outlook, several challenges persist. High upfront costs remain a significant barrier, although decreasing battery prices are mitigating this. The availability and accessibility of charging infrastructure, especially for fleet depots and public charging in certain regions, need substantial expansion. Range anxiety, though diminishing, can still be a concern for businesses with extended daily routes. Supply chain disruptions for critical components like batteries can impact production volumes. Finally, customer education and adoption inertia require concerted efforts to overcome traditional fleet purchasing habits.

Emerging Opportunities in Electric Light Commercial Vehicles Market

Emerging opportunities in the Electric Light Commercial Vehicles (eLCV) market are vast and multifaceted. The significant growth in e-commerce and last-mile delivery continues to fuel demand for efficient and sustainable delivery vans and cargo vehicles. Untapped markets in developing regions, where urbanization and industrialization are accelerating, present substantial growth potential. Innovative applications, such as mobile service units for healthcare, repair, and maintenance, are gaining traction, leveraging the quiet and emissions-free operation of eLCVs. Evolving consumer preferences for eco-friendly businesses are pushing more companies to adopt electric fleets, creating new market segments. Furthermore, advancements in battery swapping technology and vehicle-to-grid (V2G) integration offer potential for enhanced operational flexibility and new revenue streams for fleet operators.

Growth Accelerators in the Electric Light Commercial Vehicles Market Industry

Several catalysts are significantly accelerating the growth of the Electric Light Commercial Vehicles (eLCV) industry. Continuous improvements in battery technology, leading to higher energy density, lower costs, and faster charging times, are fundamentally transforming the viability and appeal of eLCVs. Strategic partnerships between automakers, technology providers, and charging infrastructure companies are crucial for building a robust ecosystem that supports widespread adoption. Government policies and supportive regulations, including stricter emission standards and fleet electrification mandates, are creating a strong push factor. Furthermore, increasing corporate sustainability commitments and the pursuit of ESG (Environmental, Social, and Governance) goals are driving demand from large fleet operators, compelling them to electrify their vehicle fleets.

Key Players Shaping the Electric Light Commercial Vehicles Market Market

- Nissan Motor Co Ltd

- General Motors Company

- Volkswagen AG

- Dongfeng Motor Corporation

- Daimler AG (Mercedes-Benz AG)

- BAIC Motor Corporation Ltd

- BYD Auto Co Ltd

- Groupe Renault

- Rivian Automotive Inc

- Ford Motor Company

Notable Milestones in Electric Light Commercial Vehicles Market Sector

- August 2023: General Motors will launch an all-electric Cadillac Escalade in late 2024.

- August 2023: General Motors doubles down on plans for an electric future in the Middle East.

- June 2023: FORD NEXT launches New pilot program creates flexible electric solutions for drivers who use the Uber platform in select U.S. markets, allowing them to lease a vehicle for more customized time periods.

In-Depth Electric Light Commercial Vehicles Market Market Outlook

The Electric Light Commercial Vehicles (eLCV) market outlook is exceptionally promising, characterized by sustained growth driven by technological innovation and supportive policy environments. Future market potential is deeply rooted in the continuous advancements in battery technology, leading to greater range and reduced charging times, thereby mitigating range anxiety. Strategic opportunities lie in expanding charging infrastructure, especially in urban logistics hubs and rural areas, to facilitate seamless operations. The increasing adoption of eLCVs by e-commerce giants and last-mile delivery services will continue to be a primary growth engine. Furthermore, the integration of advanced telematics and AI for optimized fleet management presents a significant avenue for enhancing operational efficiency and profitability for businesses transitioning to electric fleets. The commitment to sustainability and the drive for reduced operational costs will collectively shape a robust and expanding eLCV market in the years ahead.

Electric Light Commercial Vehicles Market Segmentation

-

1. Vehicle Configuration

- 1.1. Light Commercial Vehicles

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Electric Light Commercial Vehicles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Light Commercial Vehicles Market Regional Market Share

Geographic Coverage of Electric Light Commercial Vehicles Market

Electric Light Commercial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 37.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Light Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. North America Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6.1.1. Light Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Fuel Category

- 6.2.1. BEV

- 6.2.2. FCEV

- 6.2.3. HEV

- 6.2.4. PHEV

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 7. South America Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 7.1.1. Light Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Fuel Category

- 7.2.1. BEV

- 7.2.2. FCEV

- 7.2.3. HEV

- 7.2.4. PHEV

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 8. Europe Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 8.1.1. Light Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Fuel Category

- 8.2.1. BEV

- 8.2.2. FCEV

- 8.2.3. HEV

- 8.2.4. PHEV

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 9. Middle East & Africa Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 9.1.1. Light Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Fuel Category

- 9.2.1. BEV

- 9.2.2. FCEV

- 9.2.3. HEV

- 9.2.4. PHEV

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 10. Asia Pacific Electric Light Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 10.1.1. Light Commercial Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Fuel Category

- 10.2.1. BEV

- 10.2.2. FCEV

- 10.2.3. HEV

- 10.2.4. PHEV

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nissan Motor Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Motors Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Volkswagen A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dongfeng Motor Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daimler AG (Mercedes-Benz AG)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BAIC Motor Corporation Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BYD Auto Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Groupe Renault

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rivian Automotive Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ford Motor Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nissan Motor Co Ltd

List of Figures

- Figure 1: Global Electric Light Commercial Vehicles Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Electric Light Commercial Vehicles Market Revenue (billion), by Vehicle Configuration 2025 & 2033

- Figure 3: North America Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2025 & 2033

- Figure 4: North America Electric Light Commercial Vehicles Market Revenue (billion), by Fuel Category 2025 & 2033

- Figure 5: North America Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2025 & 2033

- Figure 6: North America Electric Light Commercial Vehicles Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Electric Light Commercial Vehicles Market Revenue (billion), by Vehicle Configuration 2025 & 2033

- Figure 9: South America Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2025 & 2033

- Figure 10: South America Electric Light Commercial Vehicles Market Revenue (billion), by Fuel Category 2025 & 2033

- Figure 11: South America Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2025 & 2033

- Figure 12: South America Electric Light Commercial Vehicles Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Electric Light Commercial Vehicles Market Revenue (billion), by Vehicle Configuration 2025 & 2033

- Figure 15: Europe Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2025 & 2033

- Figure 16: Europe Electric Light Commercial Vehicles Market Revenue (billion), by Fuel Category 2025 & 2033

- Figure 17: Europe Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2025 & 2033

- Figure 18: Europe Electric Light Commercial Vehicles Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Electric Light Commercial Vehicles Market Revenue (billion), by Vehicle Configuration 2025 & 2033

- Figure 21: Middle East & Africa Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2025 & 2033

- Figure 22: Middle East & Africa Electric Light Commercial Vehicles Market Revenue (billion), by Fuel Category 2025 & 2033

- Figure 23: Middle East & Africa Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2025 & 2033

- Figure 24: Middle East & Africa Electric Light Commercial Vehicles Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Electric Light Commercial Vehicles Market Revenue (billion), by Vehicle Configuration 2025 & 2033

- Figure 27: Asia Pacific Electric Light Commercial Vehicles Market Revenue Share (%), by Vehicle Configuration 2025 & 2033

- Figure 28: Asia Pacific Electric Light Commercial Vehicles Market Revenue (billion), by Fuel Category 2025 & 2033

- Figure 29: Asia Pacific Electric Light Commercial Vehicles Market Revenue Share (%), by Fuel Category 2025 & 2033

- Figure 30: Asia Pacific Electric Light Commercial Vehicles Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Electric Light Commercial Vehicles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 2: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 3: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 5: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 6: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 11: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 12: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 17: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 18: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 29: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 30: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 38: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 39: Global Electric Light Commercial Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Electric Light Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Light Commercial Vehicles Market?

The projected CAGR is approximately 37.9%.

2. Which companies are prominent players in the Electric Light Commercial Vehicles Market?

Key companies in the market include Nissan Motor Co Ltd, General Motors Company, Volkswagen A, Dongfeng Motor Corporation, Daimler AG (Mercedes-Benz AG), BAIC Motor Corporation Ltd, BYD Auto Co Ltd, Groupe Renault, Rivian Automotive Inc, Ford Motor Company.

3. What are the main segments of the Electric Light Commercial Vehicles Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

August 2023: General Motors will launch an all-electric Cadillac Escalade in late 2024August 2023: General Motors doubles down on plans for an electric future in the Middle East.June 2023: FORD NEXT launches New pilot program creates flexible electric solutions for drivers who use the Uber platform in select U.S. markets, allowing them to lease a vehicle for more customized time periods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Light Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Light Commercial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Light Commercial Vehicles Market?

To stay informed about further developments, trends, and reports in the Electric Light Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence