Key Insights

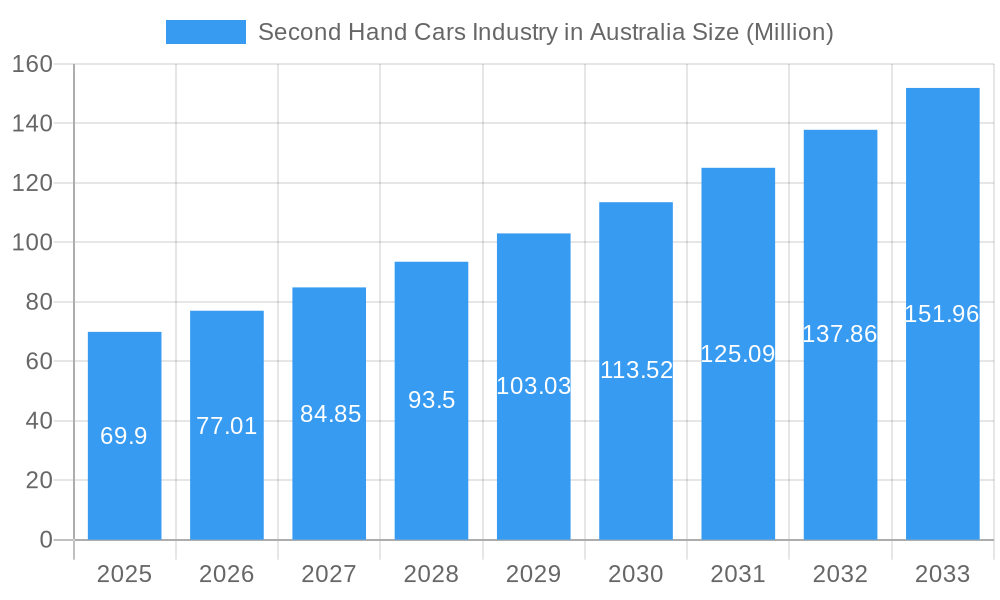

The Australian second-hand car market is poised for robust expansion, with an estimated market size of AUD 69.90 million in 2025. This growth is fueled by a compelling CAGR of 10.12%, indicating a dynamic and expanding sector. A primary driver of this surge is the increasing affordability concerns surrounding new vehicles, pushing a larger segment of consumers towards pre-owned options. Furthermore, a growing acceptance and trust in certified pre-owned programs offered by major manufacturers and dealerships contribute significantly. The digital transformation of the automotive industry, with online sales channels gaining substantial traction, is also playing a pivotal role in expanding reach and convenience for buyers. The market benefits from a diverse range of vehicle types, including popular SUVs and sedans, catering to a broad spectrum of consumer needs and preferences. The ongoing evolution of the electric vehicle segment, with more used EVs entering the market, presents a significant future growth avenue.

Second Hand Cars Industry in Australia Market Size (In Million)

While the market exhibits strong upward momentum, certain restraints need to be navigated. The perceived risk associated with purchasing used vehicles, including potential hidden mechanical issues, continues to be a concern for some buyers, although improved inspection and warranty programs are actively addressing this. The impact of fluctuating economic conditions and consumer confidence can also influence purchasing decisions. The dominance of organized players is expected to grow as they invest in technology and customer service to build trust, while the unorganized sector will likely face increased competition. Nonetheless, the overall outlook for the Australian second-hand car industry remains exceptionally positive, driven by a confluence of economic realities, technological advancements, and evolving consumer behaviors that prioritize value and accessibility in their vehicle acquisition journey.

Second Hand Cars Industry in Australia Company Market Share

Report Description: Australia's Second Hand Cars Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Australian second-hand cars market, meticulously detailing its structure, growth trajectories, and future potential. Leveraging high-traffic keywords like "used cars Australia," "second hand car market," "pre-owned vehicles," and "car sales Australia," this report is designed for industry professionals seeking to navigate this dynamic sector. We dissect the market by vendor type (Organized, Unorganized), fuel type (Petrol, Diesel, Electric, Others), body type (Hatchback, Sedan, SUV, MPV), and sales channel (Online, Offline), providing granular insights into parent and child market segments. The study spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, including historical data from 2019 to 2024. All values are presented in million units for clear quantitative understanding.

Second Hand Cars Industry in Australia Market Dynamics & Structure

The Australian second-hand car market is characterized by a dualistic structure, with both organized and unorganized vendor types playing significant roles. Market concentration varies across segments, with online platforms and larger dealership networks exhibiting increasing dominance in the organized sector. Technological innovation is a key driver, particularly in areas like vehicle history reporting, digital inspection tools, and online marketplaces that enhance transparency and accessibility for consumers seeking pre-owned vehicles. Regulatory frameworks, including consumer protection laws and emission standards, continue to shape market practices and influence the types of vehicles available. Competitive product substitutes include new car sales, car-sharing services, and public transportation. End-user demographics are diverse, encompassing first-time car buyers, budget-conscious families, and individuals seeking specific vehicle models no longer available new. Mergers and acquisitions (M&A) are becoming more prevalent as larger players consolidate their market positions and smaller entities seek strategic partnerships.

- Market Concentration: The organized sector, dominated by large dealership groups and online aggregators, holds a substantial market share. The unorganized sector, comprising independent dealers and private sellers, remains a significant, albeit fragmented, contributor.

- Technological Innovation Drivers: The adoption of AI for vehicle valuation, blockchain for immutable vehicle history records, and sophisticated online inspection technologies are transforming the used car market in Australia.

- Regulatory Frameworks: Consumer guarantees, odometer tampering laws, and evolving environmental regulations impact resale values and vehicle availability.

- Competitive Product Substitutes: New car financing offers, ridesharing services, and an expanding public transport network present alternatives to second-hand car ownership.

- End-User Demographics: Younger demographics are increasingly leveraging online platforms for research and purchase, while older buyers may still prefer traditional offline experiences.

- M&A Trends: Consolidation is evident, with larger automotive groups acquiring smaller dealerships and tech companies integrating into the used car sales ecosystem.

Second Hand Cars Industry in Australia Growth Trends & Insights

The Australian second-hand cars market is poised for sustained growth, driven by a confluence of economic factors, evolving consumer preferences, and technological advancements. The market size is projected to expand significantly over the forecast period, supported by increasing adoption rates of online purchasing channels and a growing demand for value-driven transportation solutions. Technological disruptions, such as the integration of advanced digital tools for vehicle assessment and enhanced online customer experiences, are playing a crucial role in shaping consumer behavior shifts. As more consumers prioritize affordability and sustainability, the appeal of well-maintained used vehicles continues to rise. This trend is further amplified by a maturing electric vehicle (EV) market, which is now contributing a growing number of pre-owned electric cars to the second-hand market. The average price of used cars in Australia has seen fluctuations, influenced by supply chain disruptions and evolving demand patterns, but the overall trend indicates a robust and resilient market. Insights into the total number of used cars sold in Australia reveal a consistent upward trajectory, with projected sales reaching xx million units by 2033. The compound annual growth rate (CAGR) is estimated to be around xx% during the forecast period, underscoring the sector's expansion. Market penetration of online used car sales is expected to climb as digital platforms become more sophisticated and trustworthy. The shift in consumer behavior towards embracing pre-owned vehicles as a primary mode of transport is a critical insight, reflecting a growing awareness of economic and environmental benefits.

Dominant Regions, Countries, or Segments in Second Hand Cars Industry in Australia

The Australian second-hand cars market exhibits distinct regional and segmental dominance, with specific attributes driving growth. In terms of Vendor Type, the Organized segment, encompassing franchised dealerships and dedicated used car retailers, commands a larger market share due to its perceived trustworthiness, warranty provisions, and wider selection of certified pre-owned vehicles. This dominance is bolstered by investments in digital infrastructure and customer service.

Regarding Fuel Type, Petrol vehicles continue to lead in terms of volume, reflecting the historical prevalence of internal combustion engine vehicles in Australia. However, the Electric vehicle segment, though smaller, is experiencing exponential growth. As the new electric car market expands, a growing supply of used EVs enters the second-hand market, appealing to environmentally conscious consumers and those seeking lower running costs.

Analyzing Body Type, Sport Utility Vehicles (SUVs) and Hatchbacks are the most dominant segments. SUVs appeal to families and individuals seeking versatility and higher driving positions, while hatchbacks remain popular for their practicality, fuel efficiency, and urban maneuverability.

The Sales Channel landscape is rapidly evolving, with Online sales channels demonstrating significant growth potential and increasingly capturing market share from traditional Offline methods. Online platforms offer convenience, wider reach, and often competitive pricing, attracting a younger demographic and those comfortable with digital transactions.

- Organized Vendor Dominance: Factors contributing to this include enhanced consumer confidence due to brand reputation, professional detailing, and certified pre-owned programs offering warranties and inspections.

- Petrol Vehicle Prevalence: Reflects the long-standing dominance of internal combustion engines in the new car market and the extensive existing fleet.

- SUV and Hatchback Popularity: Driven by lifestyle needs, family requirements, and urban commuting demands.

- Growth of Online Sales Channels: Accelerated by digital transformation, improved online inspection technologies, and the convenience of remote purchasing.

- Emerging Electric Vehicle Segment: Driven by environmental concerns, government incentives for new EVs, and a growing desire for lower operating costs.

Second Hand Cars Industry in Australia Product Landscape

The product landscape of the Australian second-hand cars industry is characterized by a wide array of makes, models, and specifications, catering to diverse consumer needs and budgets. Innovation in this sector focuses on enhancing transparency and trust, with advancements in vehicle history reporting and digital inspection tools becoming standard. Key product innovations include certified pre-owned (CPO) programs offered by manufacturers and dealerships, which provide buyers with peace of mind through rigorous inspections and extended warranties. Performance metrics for used vehicles are increasingly assessed through detailed diagnostic reports and pre-purchase inspections, allowing buyers to gauge the remaining lifespan and potential maintenance needs. Unique selling propositions often revolve around specific vehicle attributes such as low mileage, excellent condition, desirable trim levels, and the availability of rare or sought-after models. Technological advancements in diagnostic equipment enable more accurate assessments of engine health, transmission performance, and overall vehicle integrity, contributing to a more informed buying experience.

Key Drivers, Barriers & Challenges in Second Hand Cars Industry in Australia

The Australian second-hand cars market is propelled by several key drivers. Economic factors, such as rising new car prices and fluctuating interest rates, make pre-owned vehicles a more attractive and affordable option for a broad consumer base. The increasing availability of relatively young, well-maintained used cars, including those ex-fleet vehicles, also fuels demand. Furthermore, a growing environmental consciousness encourages many consumers to consider used vehicles as a more sustainable choice.

However, the industry faces significant barriers and challenges. Supply chain disruptions affecting new car production can indirectly impact the availability of quality used cars. Regulatory hurdles, including evolving safety standards and potential changes in emissions regulations, can create uncertainty. Competitive pressures from online-only used car retailers and evolving mobility solutions, such as car-sharing and subscription services, also pose challenges. Trust and transparency remain critical barriers, with lingering consumer concerns about undisclosed vehicle history or hidden defects. The impact of these challenges can lead to slower growth in specific segments or price volatility.

Emerging Opportunities in Second Hand Cars Industry in Australia

Emerging opportunities in the Australian second-hand cars sector are largely centered around leveraging technology and catering to evolving consumer preferences. The burgeoning electric vehicle (EV) market presents a significant opportunity, with the increasing supply of used EVs creating a more accessible entry point for consumers looking to adopt sustainable transportation. Online platforms are continuously innovating, offering enhanced virtual inspection tools, flexible financing options, and seamless delivery services, thereby expanding their reach and appeal. Furthermore, the demand for niche and classic vehicles is growing, presenting an opportunity for specialized dealers and online marketplaces to cater to collectors and enthusiasts. The development of subscription-based models for used cars also offers a new avenue for revenue and customer engagement.

Growth Accelerators in the Second Hand Cars Industry in Australia Industry

Several catalysts are driving long-term growth in Australia's second-hand cars industry. Technological breakthroughs in vehicle diagnostics and AI-powered valuation tools are enhancing market efficiency and consumer confidence. Strategic partnerships between traditional dealerships and online automotive marketplaces are creating synergistic models that combine online reach with offline service capabilities. Furthermore, the increasing integration of electric vehicles into the used car market, driven by both consumer demand and the lifecycle of new EV sales, is a significant growth accelerator. As government incentives for new EVs continue, a robust used EV market is expected to follow, broadening access to electric mobility. The expansion of vehicle inspection and certification services is also building trust and encouraging more hesitant buyers.

Key Players Shaping the Second Hand Cars Industry in Australia Market

- Gumtree AU Pty Limited

- Carsales com Limited

- Drive (Nine Entertainment Co Pty Limited)

- Cartopia Pty Ltd

- Brighton Suzuki Brighton

- Cars

- HELLOCARS SUBSCRIPTION PTY LTD

- BMW Premium Certified*List Not Exhaustive

- Carsguide Autotrader Media Solutions Pty Ltd

- Toyota Certified Pre-Owned Vehicle

Notable Milestones in Second Hand Cars Industry in Australia Sector

- March 2023: Hyundai Australia announced that it has begun selling used Ioniq 5 models on its company’s website, beginning with 23 vehicles initially.

- May 2023: Sojitz Corporation acquired full ownership of Albert Automotive Holdings Pty Ltd, which operates a wholesale and retail used car business as part of Dutton Group.

In-Depth Second Hand Cars Industry in Australia Market Outlook

The Australian second-hand cars market is set for continued robust growth, driven by persistent demand for affordable and accessible transportation. Key growth accelerators, including the expanding electric vehicle segment and advancements in online sales technologies, will further shape the industry. The market outlook is positive, with opportunities arising from enhanced consumer trust through transparent digital platforms and certified pre-owned programs. Strategic collaborations between established automotive players and innovative tech companies will likely unlock new business models and customer engagement strategies, solidifying the sector's resilience and upward trajectory.

Second Hand Cars Industry in Australia Segmentation

-

1. Vendor Type

- 1.1. Organized

- 1.2. Unorganized

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Electric

- 2.4. Others

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Sport Utility Vehicle and Multi-Purpose Vehicle

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Second Hand Cars Industry in Australia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Second Hand Cars Industry in Australia Regional Market Share

Geographic Coverage of Second Hand Cars Industry in Australia

Second Hand Cars Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Quality Assurance is Driving Market Growth in the Country

- 3.3. Market Restrains

- 3.3.1. Trust and Transparency in Used Car Remained a Key Challenge for Consumers

- 3.4. Market Trends

- 3.4.1. The Online Sales Channel Segment is Expected to be the Fastest Growing Segment Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Second Hand Cars Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 5.1.1. Organized

- 5.1.2. Unorganized

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Sport Utility Vehicle and Multi-Purpose Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 6. North America Second Hand Cars Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vendor Type

- 6.1.1. Organized

- 6.1.2. Unorganized

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Petrol

- 6.2.2. Diesel

- 6.2.3. Electric

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Body Type

- 6.3.1. Hatchback

- 6.3.2. Sedan

- 6.3.3. Sport Utility Vehicle and Multi-Purpose Vehicle

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. Online

- 6.4.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Vendor Type

- 7. South America Second Hand Cars Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vendor Type

- 7.1.1. Organized

- 7.1.2. Unorganized

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Petrol

- 7.2.2. Diesel

- 7.2.3. Electric

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Body Type

- 7.3.1. Hatchback

- 7.3.2. Sedan

- 7.3.3. Sport Utility Vehicle and Multi-Purpose Vehicle

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. Online

- 7.4.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Vendor Type

- 8. Europe Second Hand Cars Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vendor Type

- 8.1.1. Organized

- 8.1.2. Unorganized

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Petrol

- 8.2.2. Diesel

- 8.2.3. Electric

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Body Type

- 8.3.1. Hatchback

- 8.3.2. Sedan

- 8.3.3. Sport Utility Vehicle and Multi-Purpose Vehicle

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. Online

- 8.4.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Vendor Type

- 9. Middle East & Africa Second Hand Cars Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vendor Type

- 9.1.1. Organized

- 9.1.2. Unorganized

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Petrol

- 9.2.2. Diesel

- 9.2.3. Electric

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Body Type

- 9.3.1. Hatchback

- 9.3.2. Sedan

- 9.3.3. Sport Utility Vehicle and Multi-Purpose Vehicle

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. Online

- 9.4.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Vendor Type

- 10. Asia Pacific Second Hand Cars Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vendor Type

- 10.1.1. Organized

- 10.1.2. Unorganized

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Petrol

- 10.2.2. Diesel

- 10.2.3. Electric

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Body Type

- 10.3.1. Hatchback

- 10.3.2. Sedan

- 10.3.3. Sport Utility Vehicle and Multi-Purpose Vehicle

- 10.4. Market Analysis, Insights and Forecast - by Sales Channel

- 10.4.1. Online

- 10.4.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Vendor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gumtree AU Pty Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carsales com Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Drive (Nine Entertainment Co Pty Limited)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cartopia Pty Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Brighton Suzuki Brighton

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cars

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HELLOCARS SUBSCRIPTION PTY LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BMW Premium Certified*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carsguide Autotrader Media Solutions Pty Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toyota Certified Pre-Owned Vehicle

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gumtree AU Pty Limited

List of Figures

- Figure 1: Global Second Hand Cars Industry in Australia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Second Hand Cars Industry in Australia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 3: North America Second Hand Cars Industry in Australia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 4: North America Second Hand Cars Industry in Australia Revenue (Million), by Fuel Type 2025 & 2033

- Figure 5: North America Second Hand Cars Industry in Australia Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 6: North America Second Hand Cars Industry in Australia Revenue (Million), by Body Type 2025 & 2033

- Figure 7: North America Second Hand Cars Industry in Australia Revenue Share (%), by Body Type 2025 & 2033

- Figure 8: North America Second Hand Cars Industry in Australia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 9: North America Second Hand Cars Industry in Australia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 10: North America Second Hand Cars Industry in Australia Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Second Hand Cars Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Second Hand Cars Industry in Australia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 13: South America Second Hand Cars Industry in Australia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 14: South America Second Hand Cars Industry in Australia Revenue (Million), by Fuel Type 2025 & 2033

- Figure 15: South America Second Hand Cars Industry in Australia Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 16: South America Second Hand Cars Industry in Australia Revenue (Million), by Body Type 2025 & 2033

- Figure 17: South America Second Hand Cars Industry in Australia Revenue Share (%), by Body Type 2025 & 2033

- Figure 18: South America Second Hand Cars Industry in Australia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 19: South America Second Hand Cars Industry in Australia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 20: South America Second Hand Cars Industry in Australia Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Second Hand Cars Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Second Hand Cars Industry in Australia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 23: Europe Second Hand Cars Industry in Australia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 24: Europe Second Hand Cars Industry in Australia Revenue (Million), by Fuel Type 2025 & 2033

- Figure 25: Europe Second Hand Cars Industry in Australia Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 26: Europe Second Hand Cars Industry in Australia Revenue (Million), by Body Type 2025 & 2033

- Figure 27: Europe Second Hand Cars Industry in Australia Revenue Share (%), by Body Type 2025 & 2033

- Figure 28: Europe Second Hand Cars Industry in Australia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 29: Europe Second Hand Cars Industry in Australia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Europe Second Hand Cars Industry in Australia Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Second Hand Cars Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Second Hand Cars Industry in Australia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 33: Middle East & Africa Second Hand Cars Industry in Australia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 34: Middle East & Africa Second Hand Cars Industry in Australia Revenue (Million), by Fuel Type 2025 & 2033

- Figure 35: Middle East & Africa Second Hand Cars Industry in Australia Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 36: Middle East & Africa Second Hand Cars Industry in Australia Revenue (Million), by Body Type 2025 & 2033

- Figure 37: Middle East & Africa Second Hand Cars Industry in Australia Revenue Share (%), by Body Type 2025 & 2033

- Figure 38: Middle East & Africa Second Hand Cars Industry in Australia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 39: Middle East & Africa Second Hand Cars Industry in Australia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 40: Middle East & Africa Second Hand Cars Industry in Australia Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Second Hand Cars Industry in Australia Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Second Hand Cars Industry in Australia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 43: Asia Pacific Second Hand Cars Industry in Australia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 44: Asia Pacific Second Hand Cars Industry in Australia Revenue (Million), by Fuel Type 2025 & 2033

- Figure 45: Asia Pacific Second Hand Cars Industry in Australia Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 46: Asia Pacific Second Hand Cars Industry in Australia Revenue (Million), by Body Type 2025 & 2033

- Figure 47: Asia Pacific Second Hand Cars Industry in Australia Revenue Share (%), by Body Type 2025 & 2033

- Figure 48: Asia Pacific Second Hand Cars Industry in Australia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 49: Asia Pacific Second Hand Cars Industry in Australia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 50: Asia Pacific Second Hand Cars Industry in Australia Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Second Hand Cars Industry in Australia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 2: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 3: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Body Type 2020 & 2033

- Table 4: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Body Type 2020 & 2033

- Table 9: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 15: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 16: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Body Type 2020 & 2033

- Table 17: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 18: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 23: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 24: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Body Type 2020 & 2033

- Table 25: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 26: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 37: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 38: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Body Type 2020 & 2033

- Table 39: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 40: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 48: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 49: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Body Type 2020 & 2033

- Table 50: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 51: Global Second Hand Cars Industry in Australia Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Second Hand Cars Industry in Australia Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Second Hand Cars Industry in Australia?

The projected CAGR is approximately 10.12%.

2. Which companies are prominent players in the Second Hand Cars Industry in Australia?

Key companies in the market include Gumtree AU Pty Limited, Carsales com Limited, Drive (Nine Entertainment Co Pty Limited), Cartopia Pty Ltd, Brighton Suzuki Brighton, Cars, HELLOCARS SUBSCRIPTION PTY LTD, BMW Premium Certified*List Not Exhaustive, Carsguide Autotrader Media Solutions Pty Ltd, Toyota Certified Pre-Owned Vehicle.

3. What are the main segments of the Second Hand Cars Industry in Australia?

The market segments include Vendor Type, Fuel Type, Body Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Quality Assurance is Driving Market Growth in the Country.

6. What are the notable trends driving market growth?

The Online Sales Channel Segment is Expected to be the Fastest Growing Segment Between 2024 and 2029.

7. Are there any restraints impacting market growth?

Trust and Transparency in Used Car Remained a Key Challenge for Consumers.

8. Can you provide examples of recent developments in the market?

March 2023: Hyundai Australia announced that it has begun selling used Ioniq 5 models on its company’s website, beginning with 23 vehicles initially.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Second Hand Cars Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Second Hand Cars Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Second Hand Cars Industry in Australia?

To stay informed about further developments, trends, and reports in the Second Hand Cars Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence