Key Insights

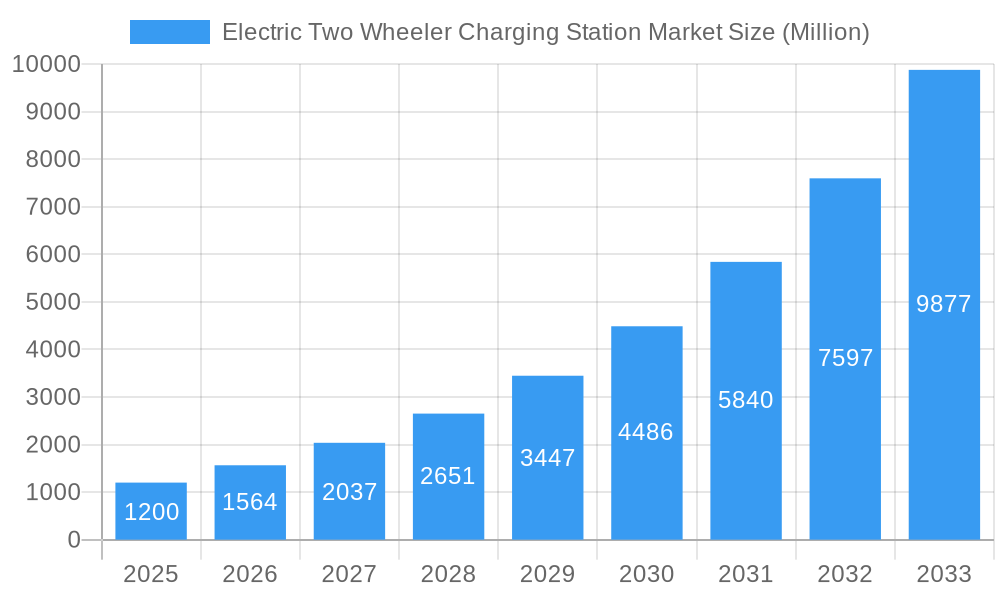

The Electric Two-Wheeler Charging Station Market is experiencing robust growth, propelled by increasing adoption of electric scooters, motorcycles, and e-bikes. With a projected Compound Annual Growth Rate (CAGR) of 14.1%, the market is anticipated to reach $2.79 billion by 2025, with significant expansion projected through 2033. Key growth drivers include supportive government policies, rising environmental consciousness, and the inherent cost-effectiveness and convenience of electric two-wheelers for urban mobility. Advancements in charging infrastructure, including faster charging solutions and expanded public and private charging networks, are crucial in mitigating range anxiety and enhancing user experience.

Electric Two Wheeler Charging Station Market Market Size (In Billion)

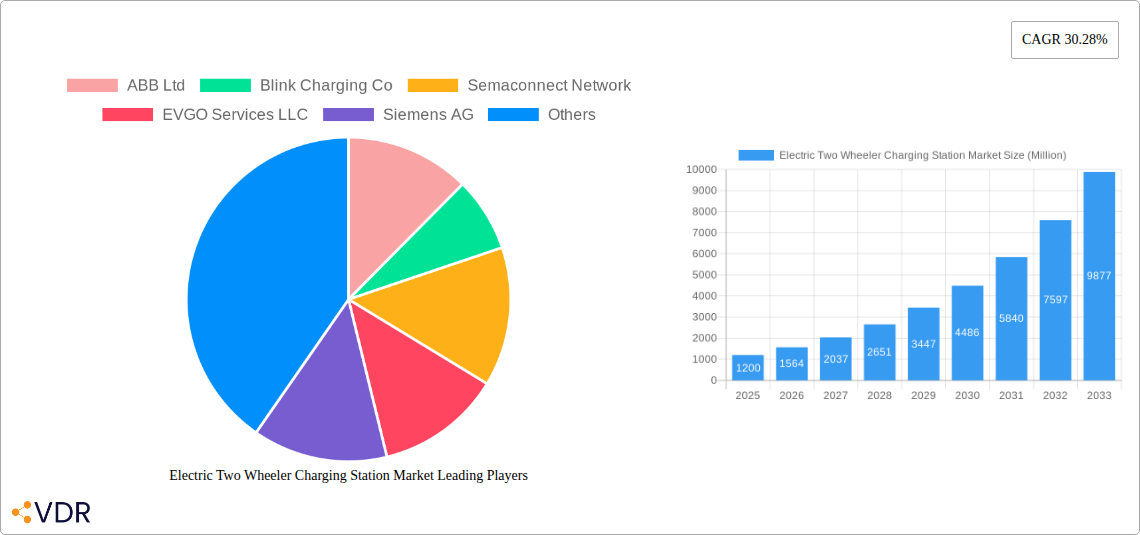

Market challenges, such as the initial investment for charging infrastructure and the need for standardized charging connectors and payment systems, are being addressed through innovation and strategic partnerships. Leading companies including ABB Ltd, Blink Charging Co, Semaconnect Network, EVGO Services LLC, Siemens AG, Schneider Electric SE, Electrify America LLC, EV Connect, Tesla Inc, BP Chargemaster, Shell Recharge Solutions, and Efacec Power Solutions are actively investing in R&D to overcome these hurdles and secure market share. The market is segmented by vehicle type into Electric Scooters/Motorcycles and E-bikes, with electric scooters and motorcycles currently leading market penetration. Geographically, the Asia Pacific region, particularly India and China, is expected to dominate due to high population density and strong governmental initiatives, followed by Europe and North America, which are rapidly transitioning to electric mobility.

Electric Two Wheeler Charging Station Market Company Market Share

This report offers a comprehensive analysis of the global Electric Two-Wheeler Charging Station Market, providing critical insights into its current status and future outlook. Covering the period from 2019 to 2033, with a base year of 2025 and an estimated market size of $2.79 billion, this study is essential for industry stakeholders, investors, policymakers, and technology providers looking to understand and leverage the dynamic EV charging infrastructure landscape for electric scooters, motorcycles, and e-bikes.

Electric Two Wheeler Charging Station Market Market Dynamics & Structure

The Electric Two Wheeler Charging Station Market is characterized by dynamic growth and increasing competition, driven by the burgeoning adoption of electric two-wheelers. Market concentration is moderately fragmented, with key players investing heavily in technological advancements and network expansion. Technological innovation is primarily focused on faster charging solutions, smart grid integration, and enhanced user experience through intuitive mobile applications. Regulatory frameworks globally are becoming more supportive, incentivizing the deployment of charging infrastructure and promoting EV adoption. Competitive product substitutes for charging primarily include battery swapping solutions and the continued reliance on traditional fueling for internal combustion engine vehicles, though the latter is rapidly losing ground. End-user demographics are diverse, encompassing urban commuters, delivery services, and recreational riders, all demanding convenient and accessible charging options. Mergers and acquisitions (M&A) are on the rise as companies seek to consolidate market share and expand their service offerings. For instance, the acquisition of controlling stakes in digital charging platforms by established players signifies a trend towards integrated solutions. Innovation barriers include high initial investment costs for infrastructure deployment and the need for standardization across charging connectors and payment systems.

- Market Concentration: Moderately fragmented with key players vying for dominance.

- Technological Innovation Drivers: Faster charging, smart grid integration, user-friendly apps.

- Regulatory Frameworks: Supportive government policies and incentives.

- Competitive Product Substitutes: Battery swapping, traditional fueling (declining).

- End-User Demographics: Urban commuters, delivery services, recreational riders.

- M&A Trends: Consolidation and acquisition of digital platforms for integrated services.

- Innovation Barriers: High initial investment, standardization challenges.

Electric Two Wheeler Charging Station Market Growth Trends & Insights

The Electric Two Wheeler Charging Station Market is poised for exponential growth, fueled by escalating environmental concerns, government mandates for emission reduction, and a significant shift in consumer preference towards sustainable mobility solutions. The market size evolution is projected to witness a substantial CAGR during the forecast period, driven by increasing electric two-wheeler sales and the subsequent demand for accessible charging infrastructure. Adoption rates of electric scooters and motorcycles are surging globally, especially in emerging economies where two-wheelers are a primary mode of transportation. Technological disruptions are continually reshaping the market, with advancements in charging speed, battery technology, and smart charging solutions becoming integral to user convenience and grid management. Consumer behavior shifts are evident, with riders prioritizing charging accessibility, cost-effectiveness, and the integration of charging services with their daily routines. The rise of app-based charging station locators and payment systems has significantly enhanced the user experience, further accelerating adoption. By 2025, the market is expected to reach an estimated value of approximately $XX million, with projections indicating a continued upward trend. The penetration of charging stations per electric two-wheeler is also anticipated to increase as infrastructure development keeps pace with vehicle sales.

- Market Size Evolution: Significant growth projected with a substantial CAGR.

- Adoption Rates: Surging for electric scooters and motorcycles globally.

- Technological Disruptions: Faster charging, smart grid integration, advanced battery tech.

- Consumer Behavior Shifts: Prioritizing convenience, cost, and integrated services.

- Market Penetration: Increasing ratio of charging stations to electric two-wheelers.

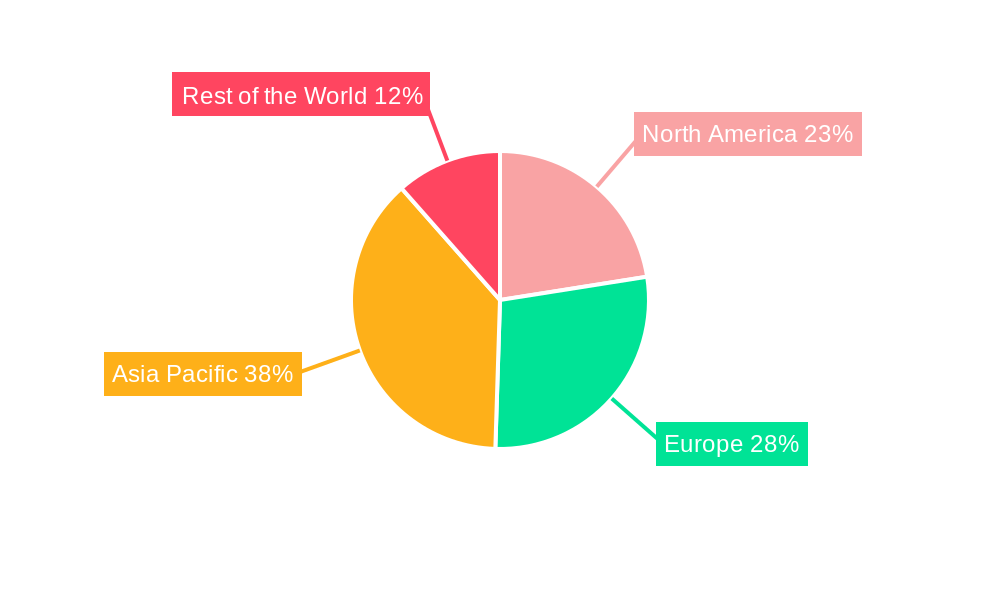

Dominant Regions, Countries, or Segments in Electric Two Wheeler Charging Station Market

The Electric Scooters/Motorcycles segment is unequivocally the dominant force driving growth within the global Electric Two Wheeler Charging Station Market. This dominance is attributed to the widespread popularity and affordability of electric scooters and motorcycles as a primary mode of urban transportation in densely populated regions and emerging economies. Countries like India, China, Vietnam, and Indonesia are leading this charge, propelled by favorable government policies, substantial investments in charging infrastructure, and a strong existing two-wheeler culture. Economic policies in these regions actively promote EV adoption through subsidies, tax breaks, and mandates for fleet electrification, creating a fertile ground for charging station deployment. The infrastructural development in these dominant regions often focuses on a dense network of charging points in residential areas, commercial hubs, and public spaces, catering to the daily commute needs of millions. The market share held by the electric scooter and motorcycle segment is significantly higher compared to e-bikes, reflecting their larger unit sales and the greater necessity for robust charging solutions. Growth potential in these regions is immense, driven by expanding middle-class populations and a growing awareness of environmental sustainability. The sheer volume of electric two-wheeler sales in Asia-Pacific, in particular, translates directly into a perpetual demand for accessible and efficient charging solutions.

- Dominant Vehicle Type: Electric Scooters/Motorcycles.

- Key Driving Regions: India, China, Vietnam, Indonesia.

- Key Drivers: Favorable government policies, infrastructure investments, existing two-wheeler culture.

- Market Share: Electric scooters/motorcycles hold a significantly larger share.

- Growth Potential: Immense due to expanding populations and environmental awareness.

Electric Two Wheeler Charging Station Market Product Landscape

The product landscape for Electric Two Wheeler Charging Stations is marked by continuous innovation, focusing on enhancing charging speed, interoperability, and user convenience. Products range from compact, home-charging solutions designed for residential use to robust, public charging stations offering Level 2 and DC fast charging capabilities. Key innovations include smart charging features that optimize energy consumption, integrate with renewable energy sources, and offer remote monitoring and management. Applications are diverse, catering to individual riders, fleet operators, and public charging networks. Performance metrics increasingly emphasize charging time reduction, energy efficiency, and durability in various environmental conditions. Unique selling propositions revolve around features like universal connector compatibility, secure payment integration, and real-time station availability displayed via mobile apps. Technological advancements are also seeing the integration of vehicle-to-grid (V2G) capabilities and wireless charging solutions for future applications.

Key Drivers, Barriers & Challenges in Electric Two Wheeler Charging Station Market

Key Drivers: The Electric Two Wheeler Charging Station Market is propelled by several significant drivers. Government initiatives and supportive policies globally, including subsidies and charging infrastructure mandates, are critical. The escalating cost of fossil fuels and growing environmental consciousness among consumers are leading to a surge in electric two-wheeler adoption. Technological advancements in battery efficiency and charging speeds are making EVs more practical and appealing. The expansion of charging networks, often supported by strategic partnerships between charging providers and two-wheeler manufacturers, is crucial for alleviating range anxiety.

Barriers & Challenges: Despite the robust growth, the market faces significant barriers. High upfront costs associated with deploying charging infrastructure, especially in developing regions, remain a substantial challenge. The lack of standardization in charging connectors and protocols across different manufacturers can create compatibility issues. Grid capacity limitations in certain areas can hinder the widespread deployment of high-power charging stations. Intense competition among charging providers, coupled with the need for continuous innovation to stay ahead, puts pressure on profit margins. Supply chain disruptions for critical components and the complex regulatory landscape for setting up charging businesses in different municipalities also pose challenges.

Emerging Opportunities in Electric Two Wheeler Charging Station Market

Emerging opportunities in the Electric Two Wheeler Charging Station Market are ripe for exploration. The integration of charging stations with smart city initiatives offers a significant avenue for growth, enabling optimized urban mobility and energy management. Untapped markets in developing nations, where electric two-wheelers are rapidly gaining traction, present substantial potential for infrastructure development. The development of innovative charging solutions, such as mobile charging units and solar-powered charging kiosks, caters to diverse user needs and remote locations. Evolving consumer preferences for integrated services, including battery-as-a-service models combined with charging, create new business models. Furthermore, the deployment of charging infrastructure in underserved areas, like apartment complexes and public parking lots, addresses a critical need.

Growth Accelerators in the Electric Two Wheeler Charging Station Market Industry

Several catalysts are accelerating growth in the Electric Two Wheeler Charging Station Market Industry. Technological breakthroughs in battery technology, leading to longer ranges and faster charging times, are significantly reducing range anxiety for riders. Strategic partnerships between electric two-wheeler manufacturers and charging infrastructure providers are crucial for creating seamless user experiences and expanding network coverage. Market expansion strategies, including the development of pay-as-you-go models and subscription services, are making charging more accessible and affordable for a wider customer base. Government incentives and favorable policies, such as tax credits and charging infrastructure grants, continue to stimulate investment and deployment. The increasing focus on sustainability and the reduction of carbon footprints by both consumers and corporations are further driving the demand for electric mobility and its supporting infrastructure.

Key Players Shaping the Electric Two Wheeler Charging Station Market Market

- ABB Ltd

- Blink Charging Co

- Semaconnect Network

- EVGO Services LLC

- Siemens AG

- Schneider Electric SE

- Electrify America LLC

- EV Connect

- Tesla Inc

- BP Chargemaster

- Shell Recharge Solutions

- Efacec Power Solutions

Notable Milestones in Electric Two Wheeler Charging Station Market Sector

- October 2022: Ather Energy announced its plan to install 820 more charging grids across India by the end of FY2023. The Ather Grid app supports EV owners in locating and checking the real-time availability of nearby charging stations.

- May 2022: ABB's E-mobility division agreed to acquire a controlling stake (72%) in Numocity, a leading digital platform for electric vehicle charging in India, with the option to become the sole owner by 2026.

In-Depth Electric Two Wheeler Charging Station Market Market Outlook

The future outlook for the Electric Two Wheeler Charging Station Market is exceptionally promising, characterized by sustained high growth and transformative innovation. Key growth accelerators include ongoing advancements in ultra-fast charging technology, the widespread adoption of smart grid integration for optimized energy distribution, and the increasing demand for integrated mobility solutions that combine vehicle ownership with charging and maintenance services. Strategic partnerships between charging infrastructure developers, utility companies, and electric two-wheeler manufacturers will continue to be pivotal in expanding network coverage and improving user experience. The growing global emphasis on sustainable transportation and the push for electrification across urban landscapes present significant opportunities for market players to establish dominant positions and cater to the evolving needs of environmentally conscious consumers.

Electric Two Wheeler Charging Station Market Segmentation

-

1. Vehicle Type

- 1.1. Electric Scooters/ Motorcycles

- 1.2. E - bikes

Electric Two Wheeler Charging Station Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Electric Two Wheeler Charging Station Market Regional Market Share

Geographic Coverage of Electric Two Wheeler Charging Station Market

Electric Two Wheeler Charging Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments In Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. High Cost Of Setting Up a Charging Station

- 3.4. Market Trends

- 3.4.1. Emergence Of Smart Charging Solutions To Encourage Electric Charging Stations Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Two Wheeler Charging Station Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Electric Scooters/ Motorcycles

- 5.1.2. E - bikes

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Two Wheeler Charging Station Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Electric Scooters/ Motorcycles

- 6.1.2. E - bikes

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Two Wheeler Charging Station Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Electric Scooters/ Motorcycles

- 7.1.2. E - bikes

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Two Wheeler Charging Station Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Electric Scooters/ Motorcycles

- 8.1.2. E - bikes

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Electric Two Wheeler Charging Station Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Electric Scooters/ Motorcycles

- 9.1.2. E - bikes

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Blink Charging Co

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Semaconnect Network

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 EVGO Services LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schneider Electric SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Electrify America LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 EV Connect

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tesla Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BP Chargemaster

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Shell Recharge Solutions

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Efacec Power Solutions

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Global Electric Two Wheeler Charging Station Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Electric Two Wheeler Charging Station Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Electric Two Wheeler Charging Station Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Electric Two Wheeler Charging Station Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Electric Two Wheeler Charging Station Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Electric Two Wheeler Charging Station Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: Europe Electric Two Wheeler Charging Station Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: Europe Electric Two Wheeler Charging Station Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Electric Two Wheeler Charging Station Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Electric Two Wheeler Charging Station Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Asia Pacific Electric Two Wheeler Charging Station Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Asia Pacific Electric Two Wheeler Charging Station Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Electric Two Wheeler Charging Station Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Electric Two Wheeler Charging Station Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Rest of the World Electric Two Wheeler Charging Station Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Rest of the World Electric Two Wheeler Charging Station Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Electric Two Wheeler Charging Station Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 16: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: India Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: South Korea Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Electric Two Wheeler Charging Station Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Middle East Electric Two Wheeler Charging Station Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Two Wheeler Charging Station Market?

The projected CAGR is approximately 14.1%.

2. Which companies are prominent players in the Electric Two Wheeler Charging Station Market?

Key companies in the market include ABB Ltd, Blink Charging Co, Semaconnect Network, EVGO Services LLC, Siemens AG, Schneider Electric SE, Electrify America LLC, EV Connect, Tesla Inc, BP Chargemaster, Shell Recharge Solutions, Efacec Power Solutions.

3. What are the main segments of the Electric Two Wheeler Charging Station Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments In Electric Vehicles.

6. What are the notable trends driving market growth?

Emergence Of Smart Charging Solutions To Encourage Electric Charging Stations Growth.

7. Are there any restraints impacting market growth?

High Cost Of Setting Up a Charging Station.

8. Can you provide examples of recent developments in the market?

October 2022: Ather Energy announced it would install 820 more grids across by end-FY2023 across India. The charging network is supported by the Ather Grid app, which allows all-electric vehicle (EV0 owners to locate and check the availability of the nearest charging stations in real time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Two Wheeler Charging Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Two Wheeler Charging Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Two Wheeler Charging Station Market?

To stay informed about further developments, trends, and reports in the Electric Two Wheeler Charging Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence