Key Insights

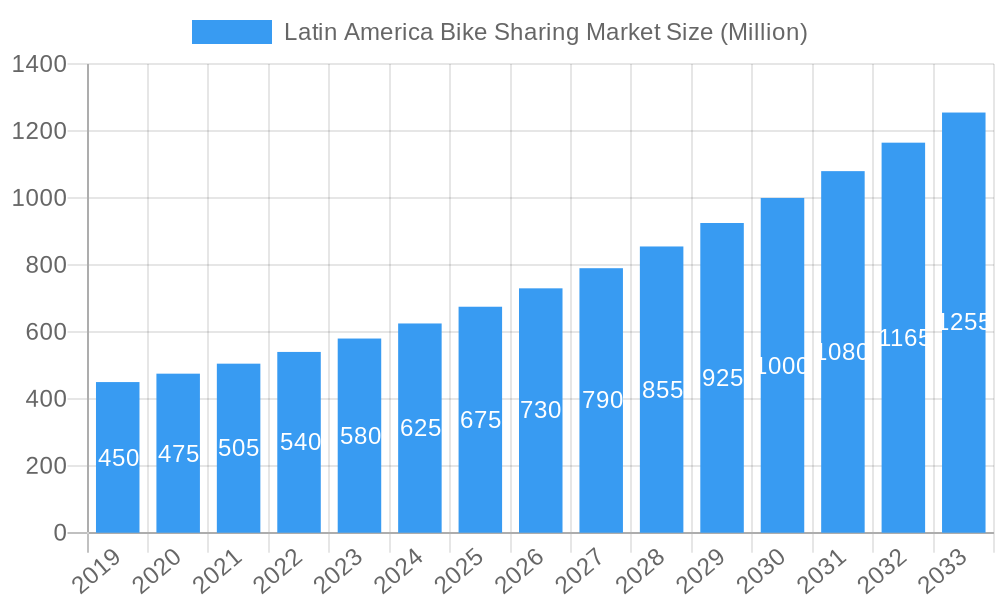

The Latin America Bike Sharing Market is forecast for substantial growth, projected to reach 5.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.4%. This expansion is driven by increasing urbanization, heightened environmental awareness, and government initiatives promoting sustainable transport. Cities are enhancing cycling infrastructure, boosting demand for traditional and electric bike-sharing. Technological advancements, including GPS tracking and mobile app integration, are improving user experience and operational efficiency, making bike sharing a convenient option for commuting and leisure.

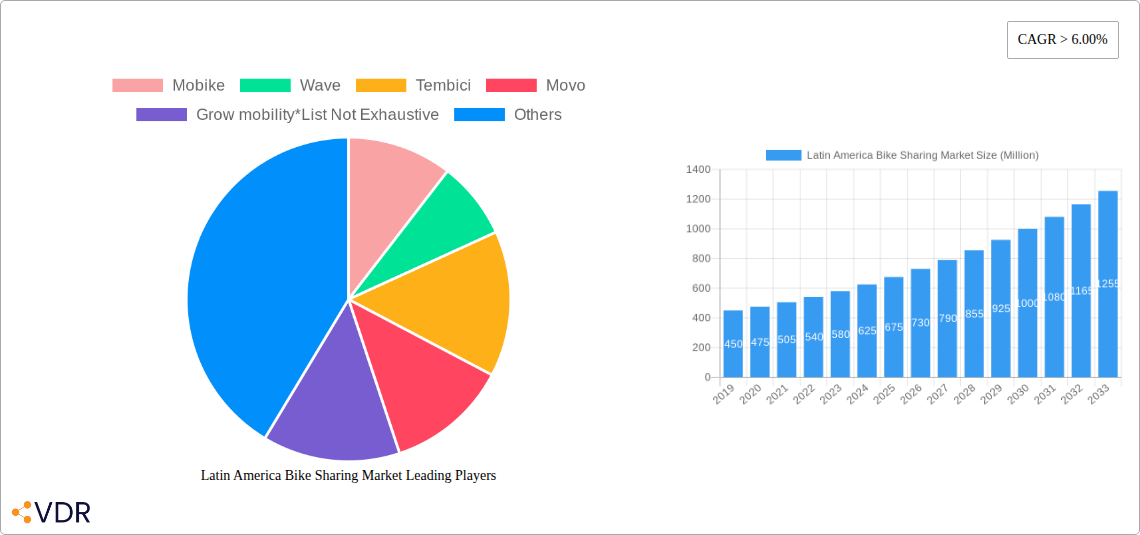

Latin America Bike Sharing Market Market Size (In Billion)

Key growth catalysts include the rising costs of conventional transportation and fuel, alongside growing recognition of cycling's health benefits. The market is seeing a significant shift towards e-bikes, which offer greater range and ease on varied terrain, appealing to a broader user base. Dockless models are gaining traction for their flexibility and accessibility. Leading companies such as Mobike, Wave, Tembici, Grow Mobility, and Bird are innovating and expanding services in countries like Brazil, Mexico, and Colombia. Potential challenges include regional regulatory complexities, vandalism, and infrastructure needs.

Latin America Bike Sharing Market Company Market Share

Gain strategic insights into the Latin America Bike Sharing Market. This comprehensive report, covering 2019-2033 with a base year of 2025, offers detailed analysis of market size, growth forecasts, key players, and emerging opportunities, essential for stakeholders in the region's micromobility sector. All figures are in billion units.

Latin America Bike Sharing Market Market Dynamics & Structure

The Latin America Bike Sharing Market is characterized by a moderate to high concentration, with significant players vying for market share through strategic expansion and technological innovation. Leading companies like Mobike, Wave, Tembici, Movo, Grow Mobility, Bird, Loop, and Bim Bim Bikes are at the forefront, driving advancements in both docked and dockless systems, as well as the integration of traditional/regular bikes and e-bikes. Technological innovation is primarily fueled by advancements in GPS tracking, app-based payment systems, and battery technology for e-bikes, enhancing user experience and operational efficiency. Regulatory frameworks are evolving, with cities implementing diverse policies regarding operational permits, parking zones, and safety standards, impacting market entry and expansion. Competitive product substitutes, such as public transportation, ride-hailing services, and personal mobility devices, continue to influence user adoption. End-user demographics are broad, encompassing urban commuters, tourists, and environmentally conscious individuals, with a growing demand for convenient and sustainable last-mile transportation solutions. Mergers and acquisitions (M&A) are a notable trend, as companies seek to consolidate their market positions, expand their service areas, and acquire complementary technologies. For instance, the period between 2019 and 2024 saw an estimated 15 M&A deals aimed at market consolidation.

- Market Concentration: Moderately consolidated, with a few key players holding significant market shares.

- Technological Innovation Drivers: Enhanced GPS accuracy, seamless app integration, and improvements in e-bike battery life.

- Regulatory Frameworks: A patchwork of city-specific regulations, creating both opportunities and challenges.

- Competitive Product Substitutes: Public transit, ride-hailing, personal scooters, and walking.

- End-User Demographics: Urban dwellers, students, tourists, and eco-conscious individuals.

- M&A Trends: Active consolidation to gain market share and technological advantage.

Latin America Bike Sharing Market Growth Trends & Insights

The Latin America Bike Sharing Market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18.5% between 2025 and 2033. This expansion is driven by increasing urbanization across the region, a growing awareness of environmental sustainability, and a rising demand for convenient and affordable last-mile transportation solutions. The market size, estimated at $750.8 million units in 2025, is expected to reach $2,750.4 million units by 2033. Adoption rates are accelerating, particularly in major metropolitan areas like Mexico City, São Paulo, and Buenos Aires, where traffic congestion and the need for efficient city navigation are paramount. Technological disruptions, such as the widespread integration of IoT devices for real-time bike tracking and predictive maintenance, are further enhancing operational efficiency and user experience. Consumer behavior is shifting towards embracing shared mobility options as a viable alternative to private vehicle ownership. The market penetration is currently at 12.3% in major urban centers and is projected to reach 35.7% by 2033. The increasing availability of e-bikes is also a significant growth catalyst, catering to a wider demographic and making longer commutes more feasible. Government initiatives promoting sustainable urban transport and cycling infrastructure development are further bolstering market growth. The pandemic period, while initially disruptive, has ultimately highlighted the importance of flexible and individual mobility solutions, contributing to a long-term positive outlook for bike sharing.

- Market Size Evolution: Projected to grow from $750.8 million units in 2025 to $2,750.4 million units by 2033.

- Adoption Rates: Steadily increasing, driven by urbanization and environmental consciousness.

- Technological Disruptions: IoT integration for real-time tracking and predictive maintenance.

- Consumer Behavior Shifts: Growing preference for shared, sustainable mobility options.

- Market Penetration: Expected to rise from 12.3% (2025) to 35.7% (2033) in major urban centers.

- E-bike Integration: A key factor in expanding the user base and service reach.

Dominant Regions, Countries, or Segments in Latin America Bike Sharing Market

Brazil stands out as the dominant region in the Latin America Bike Sharing Market, driven by its large urban populations, proactive government initiatives towards sustainable mobility, and significant investment in micromobility infrastructure. Major cities like São Paulo and Rio de Janeiro have embraced bike sharing as a crucial component of their urban transportation strategies. Within Brazil, e-bikes are emerging as the fastest-growing segment, accounting for an estimated 45% of the market share in 2025, due to their ability to cover longer distances and overcome hilly terrains, making them ideal for a wider range of users. The dockless sharing system type is also predominant, offering greater flexibility and convenience for users. In terms of country-specific dominance, Mexico is a close contender, with Mexico City leading the charge in adopting bike-sharing solutions. Mexico's market share is projected to reach 22% by 2025, fueled by policy support and increasing private sector investment. The traditional/regular bike segment still holds a substantial share, especially in more compact urban areas and for short-distance travel, accounting for 55% of the market in 2025. However, the rapid technological advancements and user preference for ease of use are steadily increasing the demand for e-bikes. The market share of dockless systems is expected to reach 70% by 2027, surpassing docked systems due to lower infrastructure costs and greater scalability.

- Dominant Region: Brazil, with key cities like São Paulo and Rio de Janeiro leading adoption.

- Dominant Country: Brazil is expected to hold a significant market share, followed closely by Mexico.

- Fastest-Growing Segment (Bike Type): E-bike, driven by enhanced utility and user appeal.

- Dominant Sharing System Type: Dockless, due to its flexibility and scalability.

- Key Drivers: Economic policies supporting sustainable transport, robust urban infrastructure, and growing environmental consciousness.

- Market Share (2025 Estimates):

- E-bike: 45%

- Traditional/Regular Bike: 55%

- Dockless: 68%

- Docked: 32%

Latin America Bike Sharing Market Product Landscape

The product landscape of the Latin America Bike Sharing Market is evolving rapidly, with companies focusing on enhancing durability, safety, and user experience. Innovations include lightweight frame designs, integrated smart locks, GPS trackers for real-time location monitoring, and advanced anti-theft features. E-bikes are increasingly incorporating more powerful yet efficient motors and longer-lasting battery packs, extending their operational range. Many platforms now offer in-app diagnostics for real-time bike condition monitoring, allowing for proactive maintenance. Unique selling propositions revolve around the convenience of the mobile app for unlocking, locating, and payment, alongside the eco-friendly nature of the service.

Key Drivers, Barriers & Challenges in Latin America Bike Sharing Market

Key Drivers:

- Urbanization: Rapid population growth in cities necessitates efficient last-mile solutions.

- Environmental Consciousness: Growing public awareness of climate change and the desire for sustainable transport options.

- Cost-Effectiveness: Bike sharing offers a more affordable alternative to private car ownership and traditional public transport for short trips.

- Government Support: Policies promoting cycling infrastructure and micromobility initiatives.

- Technological Advancements: Improved app functionality, GPS tracking, and e-bike technology.

Barriers & Challenges:

- Regulatory Hurdles: Inconsistent and evolving regulations across different municipalities can hinder expansion.

- Vandalism and Theft: Damage to bikes and batteries poses a significant operational and financial challenge.

- Infrastructure Gaps: Lack of dedicated bike lanes and safe parking facilities in some areas.

- Competitive Landscape: Intense competition from other mobility providers, including ride-hailing services and public transport.

- Operational Costs: Maintenance, rebalancing of bikes, and fleet management require significant investment.

Emerging Opportunities in Latin America Bike Sharing Market

Emerging opportunities lie in the expansion of services to secondary cities, where the demand for affordable and sustainable transport is high but currently unmet. The integration of bike sharing with public transport networks through unified payment systems presents a significant opportunity to enhance multimodal travel. Furthermore, the development of specialized e-bikes for cargo delivery and corporate fleet solutions are untapped markets. There is also a growing demand for subscription-based models and personalized user experiences, catering to diverse commuting needs and preferences.

Growth Accelerators in the Latin America Bike Sharing Market Industry

Long-term growth in the Latin America Bike Sharing Market will be accelerated by strategic partnerships between operators and municipal governments to co-develop urban mobility plans and infrastructure. Technological breakthroughs in battery swapping solutions for e-bikes will significantly improve operational efficiency and vehicle uptime. Market expansion into peri-urban areas and the integration of bike sharing with smart city initiatives will also act as key growth catalysts. The increasing adoption of data analytics to optimize fleet deployment and predict demand patterns will further drive scalability and profitability.

Key Players Shaping the Latin America Bike Sharing Market Market

- Mobike

- Wave

- Tembici

- Movo

- Grow Mobility

- Bird

- Loop

- Bim Bim Bikes

Notable Milestones in Latin America Bike Sharing Market Sector

- 2019: Grow Mobility (formed from the merger of Grin and Yellow) expands its operations across several Latin American countries.

- 2020: Tembici secures significant funding to expand its bike-sharing services in Brazil and Argentina, focusing on e-bike integration.

- 2021: Movo launches its integrated mobility platform in multiple Latin American cities, combining bike and scooter sharing.

- 2022: Several cities implement new regulations for micromobility operators, impacting operational models and fleet sizes.

- 2023: Bird and other global players explore strategic acquisitions and partnerships to strengthen their presence in the region.

- 2024: Increased investment in e-bike technology and battery infrastructure to improve service reliability and user experience.

In-Depth Latin America Bike Sharing Market Market Outlook

The Latin America Bike Sharing Market is on a robust upward trajectory, fueled by a convergence of favorable demographics, increasing environmental awareness, and supportive government policies. Future growth will be significantly propelled by the continued expansion of e-bike fleets, offering enhanced convenience and accessibility to a broader user base. Strategic alliances between operators and urban planners will be crucial for developing integrated mobility solutions and dedicated infrastructure, thereby fostering a more sustainable and efficient urban transportation ecosystem. The increasing adoption of data-driven operational strategies will unlock new levels of efficiency and personalization, further solidifying the indispensable role of bike sharing in Latin America's evolving urban landscapes.

Latin America Bike Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Regular Bike

- 1.2. E-bike

-

2. Sharing System Type

- 2.1. Docked

- 2.2. Dockless

Latin America Bike Sharing Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Bike Sharing Market Regional Market Share

Geographic Coverage of Latin America Bike Sharing Market

Latin America Bike Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. E-Bike Rental is providing the growth in Bike Sharing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Bike Sharing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Regular Bike

- 5.1.2. E-bike

- 5.2. Market Analysis, Insights and Forecast - by Sharing System Type

- 5.2.1. Docked

- 5.2.2. Dockless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mobike

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wave

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tembici

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grow mobility*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bird

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Loop

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bim Bim Bikes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mobike

List of Figures

- Figure 1: Latin America Bike Sharing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Bike Sharing Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Bike Sharing Market Revenue billion Forecast, by Bike Type 2020 & 2033

- Table 2: Latin America Bike Sharing Market Revenue billion Forecast, by Sharing System Type 2020 & 2033

- Table 3: Latin America Bike Sharing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Bike Sharing Market Revenue billion Forecast, by Bike Type 2020 & 2033

- Table 5: Latin America Bike Sharing Market Revenue billion Forecast, by Sharing System Type 2020 & 2033

- Table 6: Latin America Bike Sharing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Bike Sharing Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Latin America Bike Sharing Market?

Key companies in the market include Mobike, Wave, Tembici, Movo, Grow mobility*List Not Exhaustive, Bird, Loop, Bim Bim Bikes.

3. What are the main segments of the Latin America Bike Sharing Market?

The market segments include Bike Type, Sharing System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

E-Bike Rental is providing the growth in Bike Sharing Market.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Bike Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Bike Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Bike Sharing Market?

To stay informed about further developments, trends, and reports in the Latin America Bike Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence