Key Insights

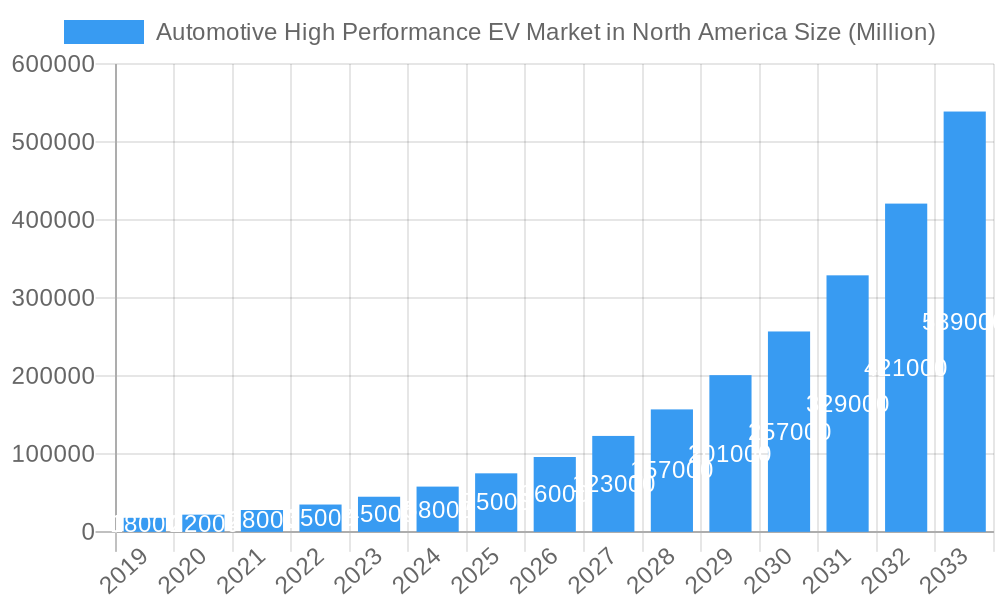

The North American Automotive High-Performance EV Market is projected for substantial expansion, with an estimated market size of 203.53 billion in 2025. This growth trajectory is driven by a compelling Compound Annual Growth Rate (CAGR) of 28% from 2025 to 2033. Key growth factors include escalating consumer demand for exhilarating driving experiences, heightened environmental awareness, supportive government incentives for EV adoption, and rapid advancements in battery technology enhancing range and performance. Significant investments by leading automotive manufacturers in developing advanced electric powertrains and high-performance chassis designs are also fueling market dynamism.

Automotive High Performance EV Market in North America Market Size (In Billion)

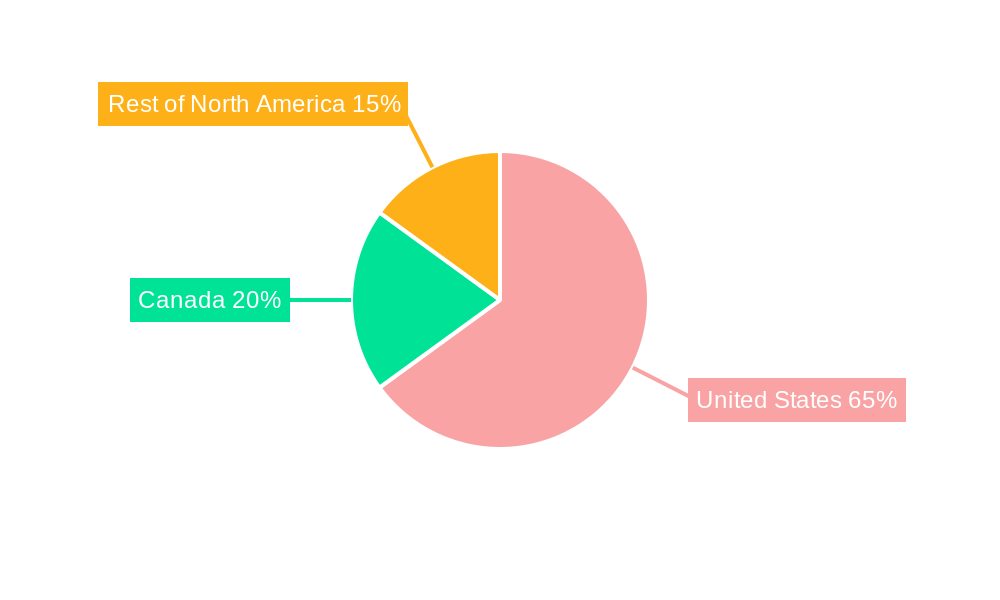

The market is segmented by drive type, with Battery Electric Vehicles (BEVs) anticipated to lead due to their superior performance and zero-emission capabilities. Plug-in Hybrid Vehicles (PHEVs) provide a valuable transitional option. Both passenger cars and commercial vehicles are seeing an increase in high-performance electric variants. Geographically, the United States holds the leading position, followed by Canada and the Rest of North America, reflecting diverse EV infrastructure development and adoption rates. Key industry players, including Tesla, Volkswagen, General Motors, and Ford, are actively introducing innovative models that redefine electric performance standards.

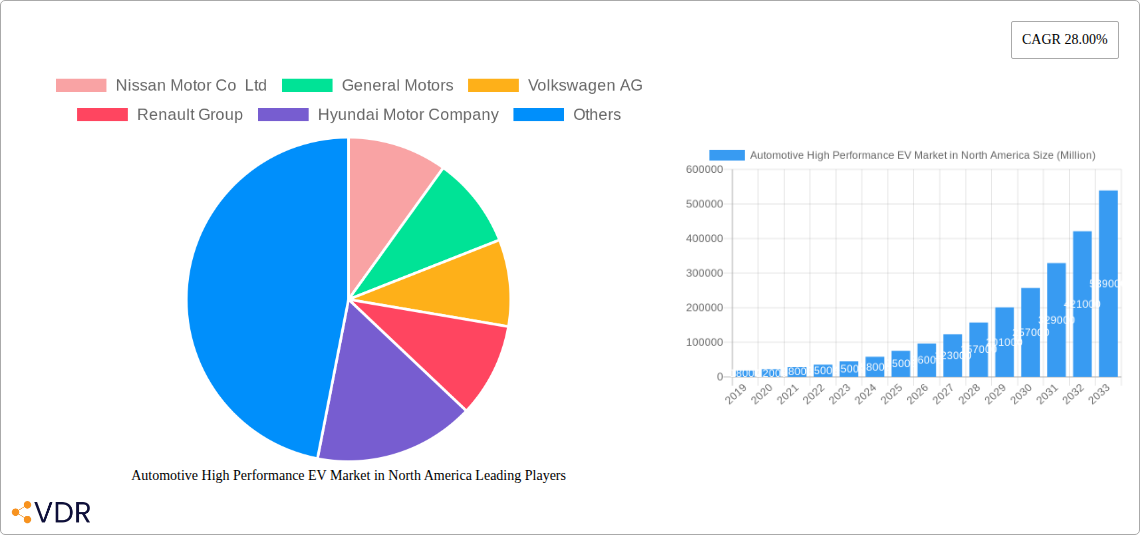

Automotive High Performance EV Market in North America Company Market Share

This SEO-optimized market overview for the "Automotive High-Performance EV Market in North America" is designed for enhanced search engine visibility and professional engagement.

Automotive High Performance EV Market in North America: Forecast to 2033 – Segmented Analysis & Growth Drivers

Unlock insights into the dynamic North American automotive high-performance electric vehicle market with this comprehensive report. Covering the period 2019-2033, with a base year of 2025, this study delves into the intricate market structure, growth trends, regional dominance, product landscape, and key influencing factors. Explore the accelerating adoption of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Vehicles (PHEVs) within passenger cars and commercial vehicles, driven by technological innovation, evolving consumer preferences, and robust regulatory frameworks. With estimated market size and CAGR projections, understand the competitive landscape shaped by industry leaders like Tesla Inc., Ford Motor Company, and General Motors.

Automotive High Performance EV Market in North America Market Dynamics & Structure

The North American automotive high-performance EV market is characterized by a dynamic interplay of innovation, regulation, and evolving consumer demand. Market concentration is notably influenced by the presence of established automotive giants and agile EV startups, each vying for market share through advanced technological offerings. Key drivers of innovation include breakthroughs in battery technology, powertrain efficiency, and autonomous driving capabilities, pushing the boundaries of electric vehicle performance. Regulatory frameworks, such as government incentives for EV adoption and stricter emission standards, are instrumental in shaping the market's trajectory. Competitive product substitutes, primarily high-performance internal combustion engine (ICE) vehicles, are increasingly being challenged by the superior acceleration and lower running costs of electric counterparts. End-user demographics are shifting towards affluent consumers and fleet operators prioritizing performance, sustainability, and cutting-edge technology. Mergers and acquisitions (M&A) are a growing trend, as companies seek to consolidate resources, acquire new technologies, and expand their market reach. The market is expected to see significant consolidation as smaller players merge with larger entities or are acquired to gain a competitive edge.

- Market Concentration: A blend of established OEMs and specialized EV manufacturers, with increasing M&A activity to consolidate power.

- Technological Innovation Drivers: Advancements in battery energy density, faster charging capabilities, and sophisticated motor technologies are paramount.

- Regulatory Frameworks: Government incentives, emissions mandates, and charging infrastructure development are crucial growth enablers.

- Competitive Product Substitutes: High-performance ICE vehicles are facing increasing competition from the superior acceleration and lower operating costs of EVs.

- End-User Demographics: Shifting towards eco-conscious affluent consumers and businesses seeking performance and operational efficiency.

- M&A Trends: Expect continued consolidation as companies seek economies of scale and technological synergy, with an estimated xx M&A deals projected over the forecast period.

Automotive High Performance EV Market in North America Growth Trends & Insights

The North American automotive high-performance EV market is experiencing unprecedented growth, fueled by a confluence of technological advancements, supportive government policies, and a significant shift in consumer preferences towards sustainable and exhilarating driving experiences. The market size is projected to expand significantly, driven by a robust Compound Annual Growth Rate (CAGR) estimated at xx% during the forecast period of 2025–2033. This surge is primarily attributed to the accelerating adoption rates of both Battery Electric Vehicles (BEVs) and Plug-in Hybrid Vehicles (PHEVs), as manufacturers introduce increasingly sophisticated and powerful models. Technological disruptions, particularly in battery technology leading to longer ranges and faster charging times, are overcoming previous adoption barriers. Furthermore, the evolving consumer behavior, characterized by a growing appreciation for the instant torque, quiet operation, and advanced features offered by high-performance EVs, is a key growth catalyst. The market penetration of these vehicles is set to rise sharply, moving beyond early adopters to mainstream consumers seeking performance without compromising on environmental responsibility. The increasing availability of charging infrastructure, both public and private, is also playing a pivotal role in alleviating range anxiety and encouraging wider adoption. This period will witness a profound transformation in the automotive landscape, with high-performance EVs becoming a dominant force.

Dominant Regions, Countries, or Segments in Automotive High Performance EV Market in North America

The United States stands as the undisputed dominant region in the North American automotive high-performance EV market, accounting for a substantial majority of sales and innovation. This dominance is underpinned by a robust economy, a large affluent consumer base with a strong appetite for high-performance vehicles, and progressive government policies aimed at accelerating EV adoption. Key drivers include federal and state-level incentives, such as tax credits for EV purchases, which significantly reduce the upfront cost of these premium vehicles. Furthermore, significant investments in charging infrastructure across major metropolitan areas and along key transportation corridors have made EV ownership more practical and appealing.

Within the United States, Battery Electric Vehicles (BEVs) are emerging as the leading segment within high-performance offerings. This is driven by the inherent performance advantages of electric powertrains, including instant torque and rapid acceleration, which align perfectly with the expectations of performance-oriented consumers. Manufacturers are heavily investing in developing BEV platforms that deliver exhilarating driving dynamics, competing directly with and often surpassing their ICE counterparts in acceleration and handling.

The Passenger Cars vehicle type segment is experiencing the most rapid growth in the high-performance EV space. This is due to the higher disposable incomes and early adoption tendencies of passenger car buyers who are often at the forefront of technological trends. Luxury and performance sedan and SUV segments are particularly strong, with a growing number of models offering impressive horsepower, range, and advanced technological features.

- United States Dominance: Fueled by strong consumer demand, substantial government incentives, and extensive charging infrastructure development.

- Battery Electric Vehicles (BEVs) Segment: Leading growth due to inherent performance advantages like instant torque and rapid acceleration.

- Passenger Cars Vehicle Type: Experiencing the fastest growth, driven by affluent consumers seeking premium performance and technology.

- Economic Policies: Supportive federal and state incentives, including tax credits, are crucial enablers of high-performance EV adoption.

- Infrastructure Development: Widespread deployment of charging stations, both public and private, significantly reduces range anxiety.

Automotive High Performance EV Market in North America Product Landscape

The North American automotive high-performance EV market is defined by an exhilarating wave of product innovation focused on pushing the boundaries of electric vehicle performance. Manufacturers are unveiling models that boast unparalleled acceleration, sophisticated handling dynamics, and advanced technological integration. Unique selling propositions include the instant torque delivery of electric powertrains, offering sub-three-second 0-60 mph times on many models. Technological advancements are centered on high-output electric motors, advanced battery management systems for sustained performance, and aerodynamic designs optimized for both speed and efficiency. These vehicles often feature multi-motor powertrains, offering sophisticated torque vectoring for enhanced agility and grip. Expect to see further integration of AI-powered performance tuning and adaptive suspension systems, delivering a driving experience that is both thrilling and refined.

Key Drivers, Barriers & Challenges in Automotive High Performance EV Market in North America

Key Drivers:

The North American automotive high-performance EV market is propelled by several key drivers. Technological innovation in battery technology, leading to increased energy density and faster charging, is crucial. Supportive government policies, including federal and state incentives for EV purchases and stringent emission regulations, are significant enablers. The growing consumer awareness and desire for sustainable transportation coupled with the superior performance characteristics of EVs, such as instant torque and rapid acceleration, are also major drivers. The expansion of charging infrastructure is further reducing barriers to adoption.

Barriers & Challenges:

Despite the positive trajectory, the market faces several challenges. The high upfront cost of high-performance EVs remains a significant barrier for a substantial portion of the consumer base. Supply chain disruptions, particularly for critical battery components and semiconductors, can impact production volumes and timelines, leading to potential price volatility. While improving, the availability and speed of public charging infrastructure, especially in rural areas, can still pose range anxiety concerns. Intense competition from established automotive players and emerging EV startups necessitates continuous innovation and strategic pricing. Ensuring the ethical sourcing of raw materials for batteries and addressing battery recycling infrastructure are also growing considerations.

Emerging Opportunities in Automotive High Performance EV Market in North America

Emerging opportunities in the North American automotive high-performance EV market lie in the expansion of the performance-oriented PHEV segment, catering to consumers seeking a blend of electric efficiency and long-range capability. Untapped markets include the commercial vehicle sector, with high-performance electric trucks and vans offering significant operational cost savings and environmental benefits. Innovative applications are appearing in the development of specialized performance EVs for track use and niche enthusiast segments. Evolving consumer preferences are also pointing towards personalized driving experiences, with opportunities in offering customizable performance profiles and advanced connectivity features. The growing demand for sustainable luxury is also a significant avenue for growth.

Growth Accelerators in the Automotive High Performance EV Market in North America Industry

Several catalysts are accelerating the long-term growth of the automotive high-performance EV market in North America. Technological breakthroughs in solid-state battery technology promise to deliver higher energy densities, faster charging, and enhanced safety, further diminishing range anxiety and performance limitations. Strategic partnerships between traditional automakers and technology firms are fostering rapid innovation in software, artificial intelligence for vehicle dynamics, and autonomous driving capabilities, creating more compelling and integrated performance offerings. Market expansion strategies, including the introduction of more affordable performance EV models and the development of specialized charging networks for high-performance vehicles, will broaden accessibility and appeal.

Key Players Shaping the Automotive High Performance EV Market in North America Market

- Tesla Inc.

- Ford Motor Company

- General Motors

- Nissan Motor Co Ltd

- Volkswagen AG

- Hyundai Motor Company

- Kia America Inc

- BMW AG

- Mercedes-Benz Group AG

- Renault Group

- Mitsubishi Motors North America Inc

Notable Milestones in Automotive High Performance EV Market in North America Sector

- August 2022: Lucid Motors launched a new high-performance luxury brand called Sapphire electric sedan vehicle. The new electric vehicle consists of a three-motor powertrain and has more than 1,200 hp. The vehicle has ranged between 406 and 520 miles on a single charge, significantly raising the bar for EV performance and range.

- November 2021: BMW introduced a new high-performance concept vehicle that previews an electrified crossover expected to begin production at the end of 2022, in South Carolina, signaling a strong commitment to expanding their performance EV portfolio in the region.

- June 2021: General Motors announced the investment of USD 35 billion over the 2021-2025 period to improve the United States battery factories for the company and new hydrogen fuel cell projects, demonstrating a substantial commitment to electrification and advanced powertrain technologies critical for performance EVs.

In-Depth Automotive High Performance EV Market in North America Market Outlook

The outlook for the North American automotive high-performance EV market remains exceptionally bright, driven by a robust convergence of technological innovation and evolving consumer demand. The continued advancement in battery technology, leading to enhanced range and faster charging, alongside breakthroughs in electric motor efficiency and powertrain integration, will further solidify the performance advantages of EVs. Strategic partnerships and ongoing investments in charging infrastructure are critical growth accelerators, making high-performance EVs more accessible and practical for a wider audience. Future market potential lies in the increasing sophistication of software-defined performance, personalized driving experiences, and the expansion of these offerings into more vehicle segments, including performance-oriented commercial applications. Industry players will focus on capitalizing on the demand for exhilarating, sustainable, and technologically advanced transportation.

Automotive High Performance EV Market in North America Segmentation

-

1. Drive Type

- 1.1. Plug-in Hybrid Vehicles

- 1.2. Battery Electric Vehicles

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of the North America

Automotive High Performance EV Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of the North America

Automotive High Performance EV Market in North America Regional Market Share

Geographic Coverage of Automotive High Performance EV Market in North America

Automotive High Performance EV Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Production; Emphasis on Fuel Efficiency and Emission Reduction

- 3.3. Market Restrains

- 3.3.1. Complexity and Cost of Pneumatic Systems; Adoption of Alternative Actuation Technologies

- 3.4. Market Trends

- 3.4.1. Growing Demand for High Performance Electric Commercial Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Automotive High Performance EV Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 5.1.1. Plug-in Hybrid Vehicles

- 5.1.2. Battery Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of the North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of the North America

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 6. United States Automotive High Performance EV Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drive Type

- 6.1.1. Plug-in Hybrid Vehicles

- 6.1.2. Battery Electric Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of the North America

- 6.1. Market Analysis, Insights and Forecast - by Drive Type

- 7. Canada Automotive High Performance EV Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drive Type

- 7.1.1. Plug-in Hybrid Vehicles

- 7.1.2. Battery Electric Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of the North America

- 7.1. Market Analysis, Insights and Forecast - by Drive Type

- 8. Rest of the North America Automotive High Performance EV Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drive Type

- 8.1.1. Plug-in Hybrid Vehicles

- 8.1.2. Battery Electric Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of the North America

- 8.1. Market Analysis, Insights and Forecast - by Drive Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nissan Motor Co Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 General Motors

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Volkswagen AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Renault Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Hyundai Motor Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BMW AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Tesla Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kia America Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Mercedes-Benz Group AG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Mitsubishi Motors North America Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Ford Motor Company

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Nissan Motor Co Ltd

List of Figures

- Figure 1: Automotive High Performance EV Market in North America Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Automotive High Performance EV Market in North America Share (%) by Company 2025

List of Tables

- Table 1: Automotive High Performance EV Market in North America Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 2: Automotive High Performance EV Market in North America Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Automotive High Performance EV Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Automotive High Performance EV Market in North America Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Automotive High Performance EV Market in North America Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Automotive High Performance EV Market in North America Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Automotive High Performance EV Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Automotive High Performance EV Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Automotive High Performance EV Market in North America Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 10: Automotive High Performance EV Market in North America Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 11: Automotive High Performance EV Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Automotive High Performance EV Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Automotive High Performance EV Market in North America Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 14: Automotive High Performance EV Market in North America Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Automotive High Performance EV Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Automotive High Performance EV Market in North America Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive High Performance EV Market in North America?

The projected CAGR is approximately 28%.

2. Which companies are prominent players in the Automotive High Performance EV Market in North America?

Key companies in the market include Nissan Motor Co Ltd, General Motors, Volkswagen AG, Renault Group, Hyundai Motor Company, BMW AG, Tesla Inc, Kia America Inc, Mercedes-Benz Group AG, Mitsubishi Motors North America Inc, Ford Motor Company.

3. What are the main segments of the Automotive High Performance EV Market in North America?

The market segments include Drive Type, Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 203.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Production; Emphasis on Fuel Efficiency and Emission Reduction.

6. What are the notable trends driving market growth?

Growing Demand for High Performance Electric Commercial Vehicles.

7. Are there any restraints impacting market growth?

Complexity and Cost of Pneumatic Systems; Adoption of Alternative Actuation Technologies.

8. Can you provide examples of recent developments in the market?

In August 2022, Lucid Motors launched a new high-performance luxury brand called Sapphire electric sedan vehicle. The new electric vehicle consists of a three-motor powertrain and has more than 1,200 hp. The vehicle has ranged between 406 and 520 miles on a single charge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive High Performance EV Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive High Performance EV Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive High Performance EV Market in North America?

To stay informed about further developments, trends, and reports in the Automotive High Performance EV Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence