Key Insights

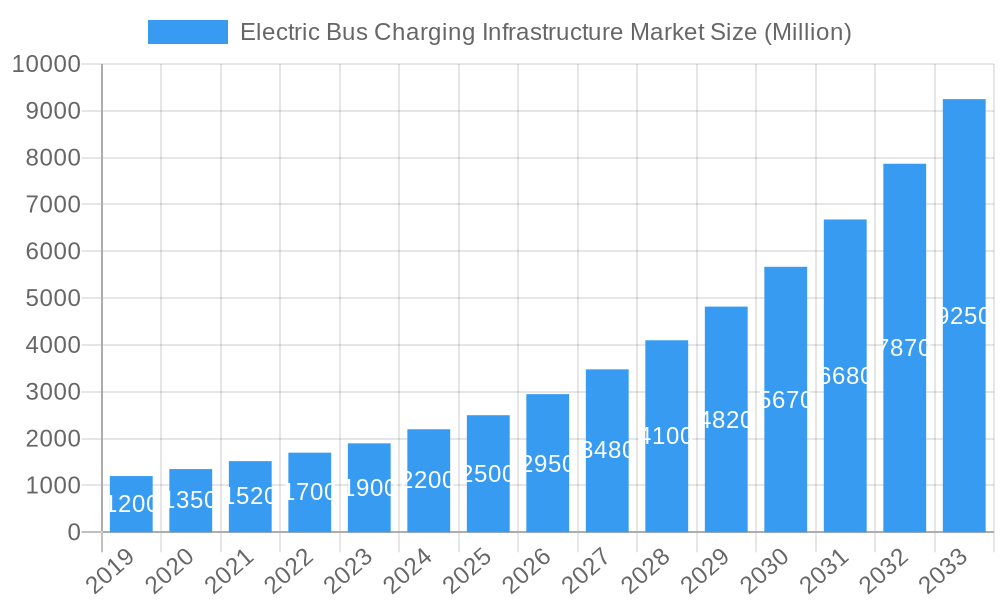

The global Electric Bus Charging Infrastructure Market is poised for substantial expansion, projected to reach a market size of approximately \$2,500 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 19.00% anticipated through 2033. This robust growth is propelled by a confluence of factors, most notably the escalating adoption of electric buses driven by stringent environmental regulations and a global push towards sustainable public transportation. Governments worldwide are incentivizing the transition to zero-emission fleets, directly fueling demand for the necessary charging infrastructure. Furthermore, advancements in charging technology, leading to faster charging times and increased efficiency, are alleviating range anxiety and making electric buses a more viable and attractive option for transit authorities. The market is experiencing a surge in investment from both public and private entities, recognizing the critical role of charging solutions in enabling the widespread electrification of bus fleets.

Electric Bus Charging Infrastructure Market Market Size (In Billion)

Key market drivers include supportive government policies and subsidies, growing environmental consciousness among urban populations, and the declining total cost of ownership for electric buses compared to their diesel counterparts over their lifecycle. Emerging trends such as the integration of smart grid technologies, bidirectional charging capabilities, and the development of high-power charging solutions are further shaping the market landscape. While the market demonstrates significant upward momentum, certain restraints, such as the high initial investment costs for charging infrastructure and the need for grid upgrades in some regions, could pose challenges. However, these are being addressed through innovative financing models and technological advancements. The market is segmented into Plug-in Charging and Overhead Charging, with Plug-in Charging likely dominating in the near term due to its widespread applicability. Geographically, Asia Pacific, particularly China, is expected to lead the market due to its aggressive promotion of electric vehicles and extensive public transportation networks, followed closely by Europe and North America.

Electric Bus Charging Infrastructure Market Company Market Share

Here is a compelling, SEO-optimized report description for the Electric Bus Charging Infrastructure Market, designed for maximum search engine visibility and engagement with industry professionals.

This comprehensive report provides an in-depth analysis of the global Electric Bus Charging Infrastructure Market, a critical sector driving the transition to sustainable urban transportation. Exploring the intricate dynamics of charging solutions for electric buses, this study offers invaluable insights into market size, growth trends, key players, and emerging opportunities. With a detailed examination of both plug-in and overhead charging technologies, this report is essential for stakeholders seeking to navigate the rapidly evolving electric bus ecosystem. Our analysis spans the historical period of 2019-2024, with a base year of 2025 and a detailed forecast for 2025-2033, offering a robust outlook on the future of electric bus charging.

Electric Bus Charging Infrastructure Market Market Dynamics & Structure

The Electric Bus Charging Infrastructure Market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and strategic consolidations. Market concentration is increasing as major Electric Charging Infrastructure Suppliers and Electric Bus Manufacturers invest heavily in R&D and expand their operational footprints. Technological innovation is a primary driver, with advancements in charging speed, grid integration, and smart charging solutions constantly emerging. Regulatory frameworks, including government incentives for electric bus adoption and charging infrastructure deployment, play a pivotal role in shaping market growth. Competitive product substitutes are minimal within the dedicated electric bus charging segment, though advancements in battery technology for electric buses indirectly influence infrastructure demand. End-user demographics are shifting towards municipalities and public transport authorities prioritizing fleet electrification for reduced emissions and operational costs. Mergers and acquisitions (M&A) are on the rise as companies seek to gain market share, acquire new technologies, and expand their service offerings.

- Market Concentration: Growing consolidation among key Electric Charging Infrastructure Suppliers and Electric Bus Manufacturers.

- Technological Innovation Drivers: Focus on faster charging, bidirectional charging, smart grid integration, and V2G capabilities.

- Regulatory Frameworks: Government subsidies, emission standards, and charging infrastructure mandates are key influencers.

- Competitive Product Substitutes: Limited direct substitutes, but advancements in electric vehicle battery tech indirectly impact infrastructure needs.

- End-User Demographics: Driven by public transport authorities, fleet operators, and urban planners seeking sustainability and cost efficiencies.

- M&A Trends: Strategic acquisitions to enhance technology portfolios and expand geographical reach.

Electric Bus Charging Infrastructure Market Growth Trends & Insights

The Electric Bus Charging Infrastructure Market is poised for significant expansion, driven by a confluence of factors accelerating the adoption of electric buses worldwide. Market size is projected to grow substantially as cities and countries prioritize decarbonization goals and invest in cleaner public transportation. Adoption rates for electric buses are steadily increasing, fueled by declining battery costs, improved vehicle range, and supportive government policies. Technological disruptions, such as the development of ultra-fast charging and wireless charging solutions, are further enhancing the appeal and practicality of electric buses. Consumer behavior shifts, primarily driven by a growing awareness of environmental issues and the demand for quieter, emission-free urban environments, are pushing public transport authorities to accelerate fleet electrification. The demand for robust and reliable charging infrastructure is directly correlated with electric bus sales, creating a symbiotic growth trajectory. The estimated market size in 2025 is expected to be USD 8,500 Million units, with a projected CAGR of 18.5% during the forecast period (2025-2033). Market penetration is expected to reach xx% of the total bus market by 2033.

Dominant Regions, Countries, or Segments in Electric Bus Charging Infrastructure Market

The Electric Bus Charging Infrastructure Market is witnessing robust growth across various regions and segments, with specific geographies and charging types leading the charge. Europe stands out as a dominant region, driven by stringent emission regulations, ambitious climate targets, and substantial government investments in sustainable transport infrastructure. Countries like Norway, the UK, Germany, and France are at the forefront of electric bus adoption, supported by comprehensive policies and a mature charging infrastructure ecosystem. The Plug-in Charging segment is currently the dominant charging type, offering a reliable and widely adopted solution for fleet operators. Its widespread availability, established technological standards, and relatively lower initial investment compared to some advanced overhead systems contribute to its dominance. Key drivers for this segment's growth include the increasing number of electric bus deployments, the development of smart charging software, and the continuous expansion of charging networks in urban and suburban areas. The economic policies in these leading regions, including subsidies for electric bus purchases and charging infrastructure development, along with the availability of suitable grid connections and public-private partnerships, are instrumental in fostering this dominance. Market share for plug-in charging is estimated at 75% of the total market in 2025.

- Dominant Region: Europe, with countries like Germany, the UK, and Norway leading in adoption and infrastructure.

- Key Drivers in Europe: Ambitious climate targets, supportive government policies, and technological advancements.

- Dominant Segment: Plug-in Charging, due to its established technology and widespread adoption.

- Key Drivers for Plug-in Charging: Increasing electric bus fleets, smart charging solutions, and network expansion.

- Market Share (Plug-in Charging): Projected at 75% in 2025.

- Growth Potential: Significant opportunities in Asia-Pacific and North America as their adoption rates accelerate.

Electric Bus Charging Infrastructure Market Product Landscape

The product landscape of the Electric Bus Charging Infrastructure Market is characterized by continuous innovation focused on efficiency, speed, and interoperability. Key product developments include high-power DC fast chargers capable of replenishing bus batteries in significantly reduced timeframes, often ranging from 150 kW to 600 kW. Smart charging solutions are also a significant innovation, enabling optimized charging schedules to manage grid load and reduce electricity costs. These solutions often incorporate remote monitoring and diagnostics, enhancing operational efficiency for fleet managers. Furthermore, advancements in connector technology and standardized communication protocols are improving interoperability between different charging hardware and electric bus models. The integration of renewable energy sources with charging infrastructure, through solar panels and battery storage systems, is also a notable trend, contributing to the overall sustainability of electric bus operations.

Key Drivers, Barriers & Challenges in Electric Bus Charging Infrastructure Market

The Electric Bus Charging Infrastructure Market is propelled by several key drivers, including the urgent need for decarbonization in urban transportation, government mandates for fleet electrification, and the declining total cost of ownership for electric buses. Technological advancements in charging speed and efficiency are also crucial enablers.

- Key Drivers:

- Global push for emission reduction and climate change mitigation.

- Government incentives, subsidies, and regulatory mandates for EV adoption.

- Falling battery costs and improving electric bus performance.

- Technological advancements in charging infrastructure.

Conversely, the market faces significant barriers and challenges. High initial capital investment for charging infrastructure, grid capacity limitations in certain areas, and the need for standardized charging protocols pose considerable hurdles. Supply chain disruptions for critical components and the complexity of urban planning for charging station deployment also present challenges.

- Barriers & Challenges:

- High upfront investment costs for charging infrastructure.

- Grid capacity and stability concerns in some regions.

- Need for interoperability and standardization across different systems.

- Supply chain vulnerabilities for electronic components.

- Complex urban planning and permitting processes.

Emerging Opportunities in Electric Bus Charging Infrastructure Market

Emerging opportunities in the Electric Bus Charging Infrastructure Market lie in the development and deployment of innovative charging solutions. Wireless charging technology for electric buses presents a significant untapped market, offering convenience and reducing the need for physical connections, especially in depots and at termini. The integration of Vehicle-to-Grid (V2G) technology, allowing electric buses to supply power back to the grid during peak demand, opens up new revenue streams and enhances grid stability. Furthermore, the expansion of charging infrastructure into underserved rural and suburban areas, as well as the development of specialized charging solutions for different bus types and operational needs, represent considerable growth potential. The increasing focus on sustainable energy integration, such as solar-powered charging hubs, also presents a lucrative avenue.

Growth Accelerators in the Electric Bus Charging Infrastructure Market Industry

Growth accelerators in the Electric Bus Charging Infrastructure Market industry are multi-faceted, encompassing technological breakthroughs, strategic market expansion, and evolving business models. The continuous improvement in charging speed and efficiency directly impacts operational feasibility for transit agencies, driving faster adoption. The development of advanced battery management systems and smart charging algorithms that optimize charging cycles for fleet operations are crucial catalysts. Strategic partnerships between Electric Bus Manufacturers, Electric Charging Infrastructure Suppliers, and energy providers are essential for developing integrated solutions and ensuring seamless deployment. Furthermore, the increasing global commitment to sustainability and the United Nations Sustainable Development Goals are creating a favorable policy environment that incentivizes investment and accelerates market growth. The successful demonstration of the economic and environmental benefits of electric bus fleets is also a significant accelerator.

Key Players Shaping the Electric Bus Charging Infrastructure Market Market

- ABB Ltd

- Proterra Inc

- Siemens AG

- BYD Auto Co Ltd

- ChargePoint Inc

- Mercedes-Benz AG

- Schneider Electric SE

- Zhengzhou Yutong Bus Co Ltd

- Traton SE

- ALSTOM

- IVECO S p A

- Heliox Energy

- NFI Group Inc

- Starline Holdings LLC

- SemaConnect Inc

- Vital EV Solutions

- EV Solutions (Webasto)

- 4 AB Volvo

- 5 Zhengzhou Yutong Bus Co Ltd

- 7 SemaConnect Inc

- 2 Mercedes-Benz AG

- 3 Traton SE

- 4 Siemens AG

- 7 NFI Group Inc

- 5 Schneider Electric SE

- 6 IVECO S p A

- 9 Vital EV Solutions

- 10 Starline Holdings LLC

- 11 EV Solutions (Webasto)

Notable Milestones in Electric Bus Charging Infrastructure Market Sector

- November 2022: ABB E-Mobility raised CHF 200 million (USD 214 million) in a pre-IPO private placement, bolstering its growth strategy and potential M&A activities.

- September 2022: ABB E-Mobility commenced manufacturing operations in Columbia, South Carolina, investing in a new facility with an annual production capacity of up to 10,000 chargers, designed for fleets and public charging.

- August 2022: Siemens and MAHLE Group partnered to develop and test cutting-edge wireless charging systems for electric vehicles, focusing on establishing technological standards for inductive charging.

In-Depth Electric Bus Charging Infrastructure Market Market Outlook

The Electric Bus Charging Infrastructure Market outlook is exceptionally positive, driven by a sustained commitment to sustainable urban mobility and ongoing technological advancements. Growth accelerators such as increasing government support, a growing fleet of electric buses, and continuous innovation in charging solutions will shape the market's trajectory. Strategic partnerships between key industry players, coupled with the expansion into new geographical markets, will further fuel this growth. The market's future potential lies in the widespread adoption of advanced charging technologies like V2G and wireless charging, alongside the integration of renewable energy sources. Stakeholders who can effectively navigate regulatory landscapes and address infrastructure deployment challenges are well-positioned for significant success in this dynamic and expanding sector.

Electric Bus Charging Infrastructure Market Segmentation

-

1. Charging Type

- 1.1. Plug-in Charging

- 1.2. Overhead Charging

Electric Bus Charging Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Bus Charging Infrastructure Market Regional Market Share

Geographic Coverage of Electric Bus Charging Infrastructure Market

Electric Bus Charging Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Electric Buses

- 3.3. Market Restrains

- 3.3.1. High Upfront Investment

- 3.4. Market Trends

- 3.4.1. Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 5.1.1. Plug-in Charging

- 5.1.2. Overhead Charging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 6. North America Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 6.1.1. Plug-in Charging

- 6.1.2. Overhead Charging

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 7. Europe Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 7.1.1. Plug-in Charging

- 7.1.2. Overhead Charging

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 8. Asia Pacific Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 8.1.1. Plug-in Charging

- 8.1.2. Overhead Charging

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 9. Rest of the World Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 9.1.1. Plug-in Charging

- 9.1.2. Overhead Charging

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 10 Starline Holdings LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Electric Bus Manufacturers

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Proterra Inc (also an electric bus manufacturer)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 11 EV Solutions (Webasto)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 4 AB Volvo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3 ChargePoint Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 1 BYD Auto Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 1 ABB Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 8 Heliox Energy

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 6 ALSTOM

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 5 Zhengzhou Yutong Bus Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 7 SemaConnect Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 2 Mercedes-Benz AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 3 Traton SE

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 4 Siemens AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 7 NFI Group Inc

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 5 Schneider Electric SE

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 6 IVECO S p A

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 9 Vital EV Solutions

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Electric Charging Infrastructure Suppliers

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 10 Starline Holdings LLC

List of Figures

- Figure 1: Global Electric Bus Charging Infrastructure Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 3: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 4: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 7: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 8: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 11: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 12: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 15: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 16: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 2: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 4: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 9: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 17: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 24: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: South America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bus Charging Infrastructure Market?

The projected CAGR is approximately 19.00%.

2. Which companies are prominent players in the Electric Bus Charging Infrastructure Market?

Key companies in the market include 10 Starline Holdings LLC, Electric Bus Manufacturers, 2 Proterra Inc (also an electric bus manufacturer), 11 EV Solutions (Webasto), 4 AB Volvo, 3 ChargePoint Inc, 1 BYD Auto Co Ltd, 1 ABB Ltd, 8 Heliox Energy, 6 ALSTOM, 5 Zhengzhou Yutong Bus Co Ltd, 7 SemaConnect Inc, 2 Mercedes-Benz AG, 3 Traton SE, 4 Siemens AG, 7 NFI Group Inc, 5 Schneider Electric SE, 6 IVECO S p A, 9 Vital EV Solutions, Electric Charging Infrastructure Suppliers.

3. What are the main segments of the Electric Bus Charging Infrastructure Market?

The market segments include Charging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Electric Buses.

6. What are the notable trends driving market growth?

Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type.

7. Are there any restraints impacting market growth?

High Upfront Investment.

8. Can you provide examples of recent developments in the market?

November 2022: ABB E-Mobility, the electric vehicle charging solutions subsidiary of ABB Ltd., successfully raised CHF 200 million (USD 214 million) in a pre-IPO private placement led by a group of minority investors. The capital infusion will play a crucial role in supporting the company's growth strategy, which includes pursuing both organic and inorganic opportunities, such as potential mergers and acquisitions. The transaction is expected to be finalized in the fourth quarter of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bus Charging Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bus Charging Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bus Charging Infrastructure Market?

To stay informed about further developments, trends, and reports in the Electric Bus Charging Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence