Key Insights

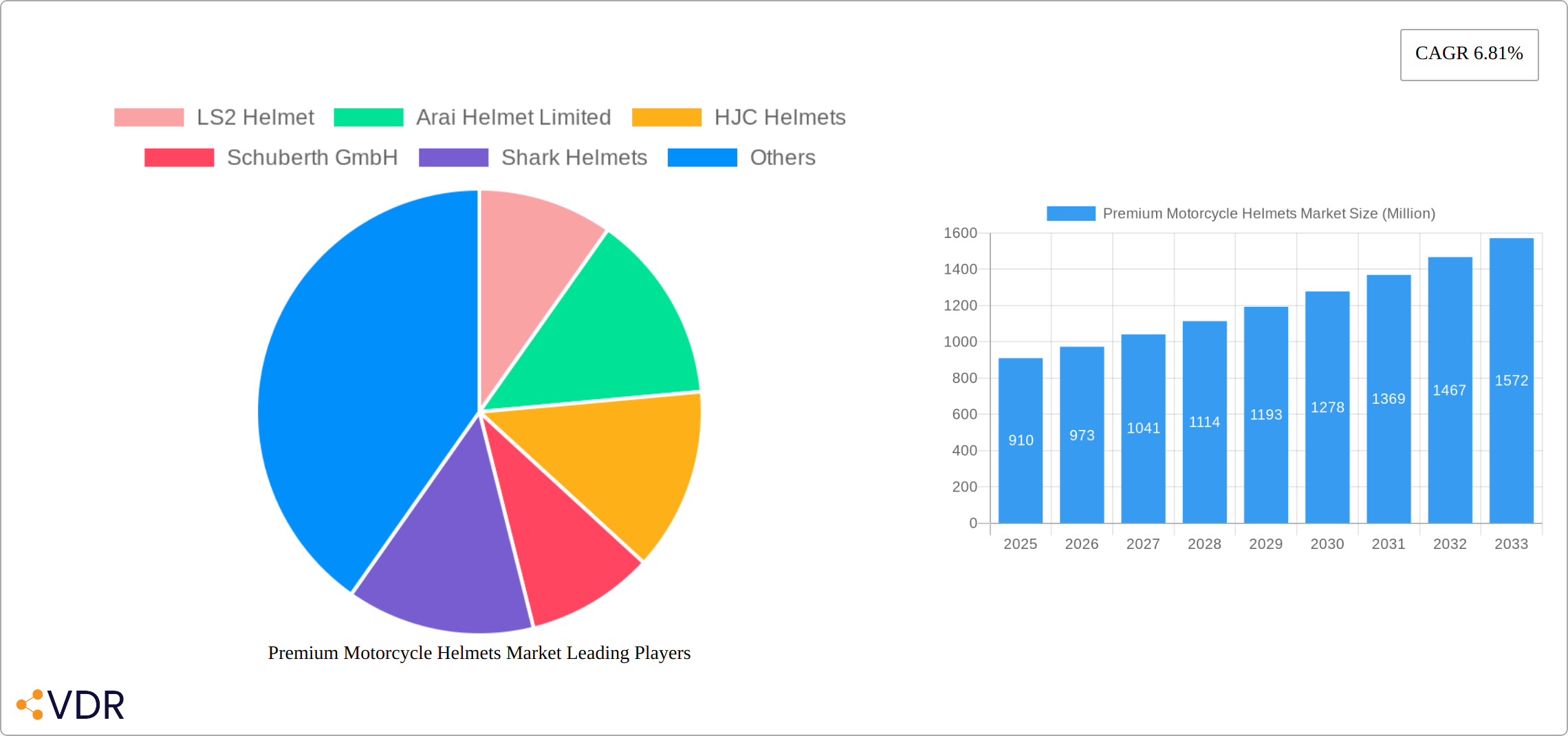

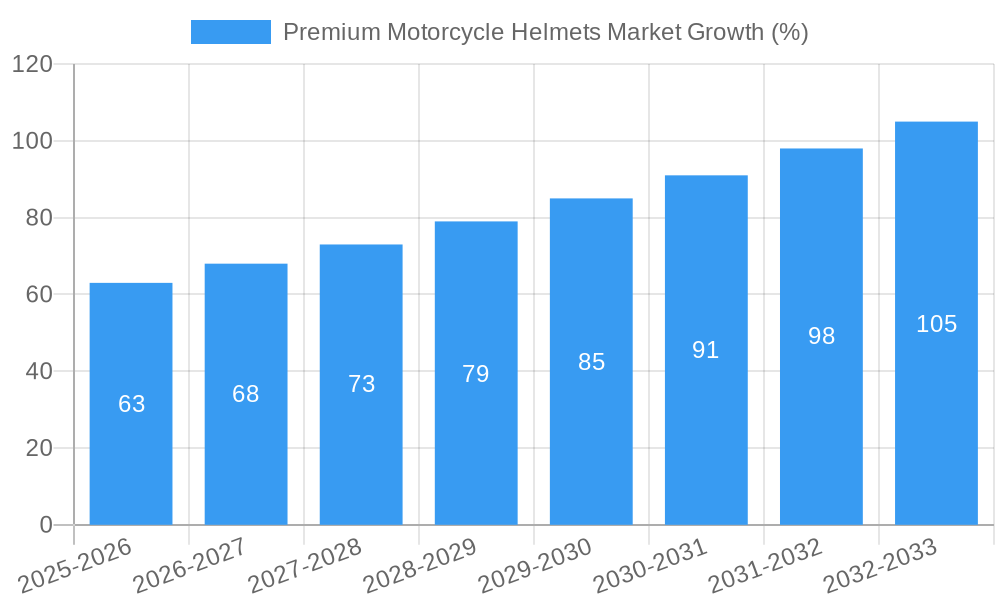

The premium motorcycle helmet market, valued at $0.91 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.81% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rising popularity of motorcycling, particularly among younger demographics, creates significant demand for high-quality, safety-focused helmets. Secondly, advancements in materials science, such as the increasing use of carbon fiber for enhanced protection and lighter weight, are driving premiumization within the segment. Consumers are increasingly willing to invest in superior safety features and technological innovations, such as integrated communication systems and improved aerodynamics. The market's segmentation reveals further nuances: the commuter segment is the largest, reflecting the everyday use of motorcycles. However, the racer segment is experiencing rapid growth, driven by the demand for specialized helmets offering optimal performance and protection during high-speed riding. Finally, online distribution channels are gaining traction, offering consumers wider selection and competitive pricing.

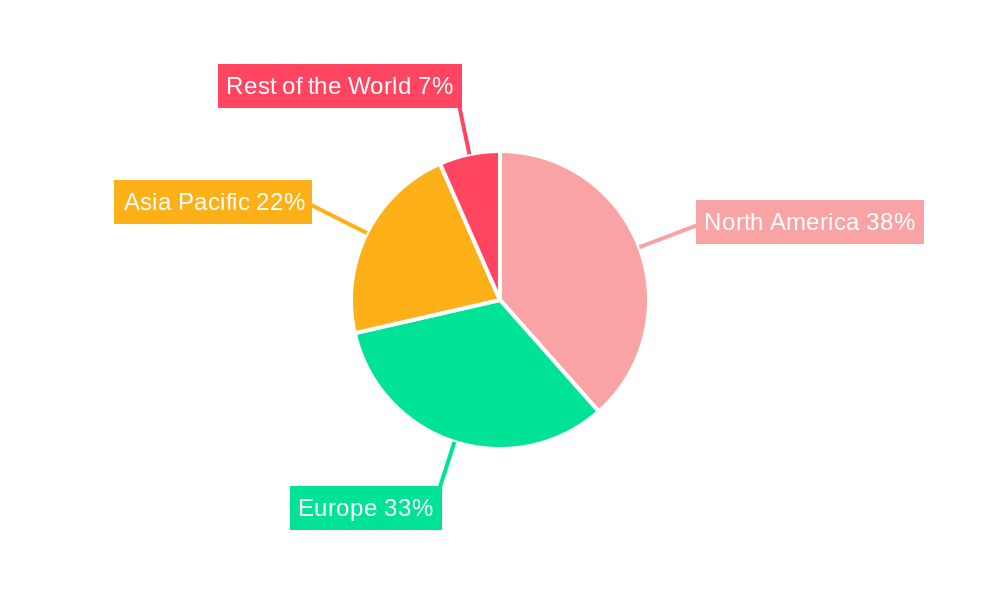

Geographical distribution reveals North America and Europe as established markets, while the Asia-Pacific region presents substantial growth potential due to rising disposable incomes and increasing motorcycle ownership. Key players such as LS2, Arai, HJC, and Shoei are competing through product innovation, brand recognition, and strategic distribution networks. The market faces some challenges, primarily related to price sensitivity in certain regions and increasing competition from less expensive alternatives. Nevertheless, the long-term outlook for the premium motorcycle helmet market remains positive, driven by the enduring demand for safety and performance, particularly as technological advancements continue to shape the industry. The market's continued growth will depend on factors such as economic stability in key regions, the introduction of new safety regulations, and ongoing technological innovation in helmet design and materials.

Premium Motorcycle Helmets Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global premium motorcycle helmets market, encompassing market dynamics, growth trends, regional dominance, product landscapes, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by end-user (commuters, racers), material type (fiber glass, carbon fiber, plastics, other), and distribution channel (offline, online aftermarket), offering granular insights into each segment's performance. The market size is presented in Million units.

Premium Motorcycle Helmets Market Market Dynamics & Structure

The premium motorcycle helmets market is characterized by a dynamic and evolving landscape, showcasing a moderately concentrated structure. Leading manufacturers such as LS2 Helmet, Arai Helmet Limited, HJC Helmets, and Shoei Co Ltd continue to command a significant market share (estimated at xx%). A primary growth catalyst is the relentless pace of technological innovation, particularly in advanced materials science, with breakthroughs in carbon fiber composites and cutting-edge safety features like enhanced ventilation systems and superior impact absorption technologies. The market's trajectory is also significantly influenced by stringent safety regulations, including DOT FMVSS No. 218 and ECE 2206, which not only shape product development but also act as crucial benchmarks for market entry. While competition from more budget-friendly helmet alternatives exists, impacting price-sensitive consumer decisions, the demand for premium safety and performance remains robust. End-user demographics are actively shifting, with a growing segment of younger, tech-savvy consumers seeking helmets that integrate advanced features with sophisticated aesthetic designs. Mergers and acquisitions (M&A) activity in this sector is moderately active (approximately xx deals in the past five years), with strategic acquisitions primarily aimed at broadening product portfolios and expanding global market penetration.

- Market Concentration: Moderately concentrated, with the top 5 players collectively holding an estimated xx% of the market share.

- Innovation Drivers: Continuous advancements in lightweight and high-strength materials (e.g., carbon fiber), integration of next-generation safety technologies, and a focus on aerodynamic and aesthetically pleasing designs.

- Regulatory Framework: Adherence to rigorous global safety certifications such as DOT and ECE standards is paramount, driving innovation in protective technologies.

- Competitive Landscape: While premium helmets face competition from lower-priced alternatives, the demand for superior safety, performance, and brand prestige sustains market segment growth.

- End-User Demographics: A significant shift towards a younger demographic, valuing integrated technology, advanced safety features, and personalized style.

- M&A Trends: Moderate deal activity, with strategic focus on portfolio diversification, market expansion, and acquisition of innovative technologies.

Premium Motorcycle Helmets Market Growth Trends & Insights

The premium motorcycle helmets market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx Million units in 2024. This growth is fueled by increasing motorcycle ownership, rising disposable incomes in emerging economies, and growing awareness of safety among riders. Technological advancements, such as the integration of smart features (e.g., communication systems, heads-up displays), are driving adoption rates among premium segment consumers. Consumer behavior is shifting towards prioritizing safety, comfort, and style, influencing purchasing decisions. The market is expected to witness continued growth during the forecast period (2025-2033), with a projected CAGR of xx%, driven by factors such as increasing motorcycle sales, particularly in Asia and emerging markets, alongside the launch of innovative products and expansion of distribution channels. Market penetration of premium helmets remains relatively low (xx%), indicating significant growth potential.

Dominant Regions, Countries, or Segments in Premium Motorcycle Helmets Market

North America and Europe currently stand as the leading markets for premium motorcycle helmets, collectively accounting for approximately xx% and xx% of the global market share, respectively. This dominance is underpinned by high motorcycle ownership rates, strong economic stability, and a deeply ingrained culture of prioritizing high-quality safety equipment. Conversely, the Asia-Pacific region, with a particular focus on burgeoning markets like India and China, presents substantial growth opportunities. This expansion is fueled by a rising middle class with increasing disposable incomes and a surge in motorcycle sales. Within specific market segments, the commuter segment currently holds the largest market share (estimated at xx%), catering to everyday riders. However, the racer segment is exhibiting a more rapid growth trajectory (projected at xx% CAGR), driven by the escalating popularity of both professional and amateur motorcycle racing circuits. In terms of materials, helmets constructed from Carbon Fiber command a premium segment share due to their exceptional protective capabilities and remarkably lightweight construction. While other materials such as ABS constitute the largest volume segment due to their cost-effectiveness, the trend towards advanced materials in premium helmets is undeniable. Offline retail channels continue to be the primary mode of sales; however, online aftermarket sales are experiencing robust and accelerating growth.

- Key Drivers (North America & Europe): High rates of motorcycle ownership, robust economic conditions, and a strong emphasis on rider safety and quality protective gear.

- Growth Potential (Asia-Pacific): Driven by increasing disposable incomes within the growing middle class and a significant expansion in motorcycle sales across the region.

- Dominant Segment (End-User): The commuter segment, representing approximately xx% of the market, serves the daily rider needs.

- High-Growth Segment (End-User): The racer segment is projected to experience a significant xx% CAGR, propelled by the booming motorsports industry.

- Premium Material Segment: Carbon Fiber helmets are highly sought after for their superior strength-to-weight ratio and advanced safety properties.

- High-Volume Material Segment: Helmets made from materials like ABS dominate in terms of volume due to their affordability and widespread availability.

- Dominant Distribution Channel: Traditional offline retail remains the primary sales channel, though online channels are rapidly gaining traction.

Premium Motorcycle Helmets Market Product Landscape

Premium motorcycle helmets are increasingly incorporating advanced features like improved ventilation systems, lighter yet stronger materials (e.g., carbon fiber, aramid), enhanced aerodynamic designs, integrated communication systems, and advanced safety technologies like MIPS (Multi-directional Impact Protection System). These advancements cater to the growing demand for superior comfort, safety, and style among riders. Unique selling propositions (USPs) often focus on specific technological innovations or superior design features to differentiate products in a competitive market.

Key Drivers, Barriers & Challenges in Premium Motorcycle Helmets Market

Key Drivers: The global increase in motorcycle ownership, coupled with a heightened consumer awareness regarding the paramount importance of rider safety, acts as a significant growth impetus. Technological advancements are continuously improving helmet comfort, functionality, and safety features, further stimulating demand. Moreover, rising disposable incomes, particularly in developing economies, are enabling a larger consumer base to invest in premium protective gear. Supportive government regulations that promote road safety also contribute positively to market expansion.

Key Challenges: The market faces considerable challenges, including intense competition from both established, reputable brands and agile new entrants. Fluctuations in the cost of raw materials, especially for specialized components like carbon fiber, can impact profitability. Geopolitical factors can also lead to potential supply chain disruptions, affecting production and delivery timelines. Furthermore, increasingly stringent safety regulations, while beneficial for rider safety, can also lead to higher manufacturing costs and necessitate significant R&D investment.

Emerging Opportunities in Premium Motorcycle Helmets Market

Significant emerging opportunities lie in the expansion into previously underserved or emerging markets within developing economies, where the demand for premium safety equipment is on the rise. The integration of smart technologies, such as advanced connectivity features, integrated communication systems, and even health monitoring capabilities, presents a fertile ground for innovation. Furthermore, offering enhanced customization options to cater to the unique preferences and styles of individual riders is becoming increasingly important. The growing consumer preference for sustainability is also creating opportunities for the development and adoption of eco-friendly and recyclable materials in helmet manufacturing.

Growth Accelerators in the Premium Motorcycle Helmets Market Industry

Strategic partnerships between helmet manufacturers and technology companies to integrate advanced features, expansion into new geographic markets (especially in developing economies), and focused marketing campaigns targeting specific rider segments will accelerate growth. Investing in research and development of innovative materials and safety technologies is crucial for long-term success.

Key Players Shaping the Premium Motorcycle Helmets Market Market

- LS2 Helmet

- Arai Helmet Limited

- HJC Helmets

- Schuberth GmbH

- Shark Helmets

- Suomy Motorsport SRL

- Studds Helmets

- Shoei Co Ltd

- Airoh Helmets

- Bell Helmets

- AGV (Subsidiary of Dainese)

- MT Helmets

- Nolan Helmets

Notable Milestones in Premium Motorcycle Helmets Market Sector

- August 2023: SteelBird Hi-Tech India Limited launched the IGN-8 helmet, emphasizing style and safety with DOT and BIS certifications.

- June 2023: Airoh launched the MATRYX helmet, featuring an innovative ventilation system and carbon fiber construction.

- October 2022: Steelbird Hi-tech India Limited opened 1000 RiderZ Shoppe stores, expanding its retail presence.

- May 2022: Vega Auto Accessories Pvt. Ltd invested USD 26.2 million in a new manufacturing plant.

In-Depth Premium Motorcycle Helmets Market Market Outlook

The future of the premium motorcycle helmets market is promising, with continued growth driven by technological advancements, expanding market reach, and increasing consumer demand for safety and comfort. Strategic partnerships and investments in research and development will be crucial for maintaining a competitive edge. The market holds significant potential for innovation in materials, safety features, and smart technologies, offering lucrative opportunities for both established players and new entrants.

Premium Motorcycle Helmets Market Segmentation

-

1. Material Type

- 1.1. Fiber Glass

- 1.2. Carbon Fiber

- 1.3. Plastics

- 1.4. Other Ma

-

2. Distribution Channel

-

2.1. Offline

- 2.1.1. Motorcycle Showrooms

- 2.1.2. Helmet Manufacturer Showrooms

- 2.1.3. Aftermarket

- 2.2. Online

-

2.1. Offline

-

3. End-User

- 3.1. Commuters

- 3.2. Racers

Premium Motorcycle Helmets Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Premium Motorcycle Helmets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Sports Bike to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Premium Helmets Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Commuters Segment of the Market to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Fiber Glass

- 5.1.2. Carbon Fiber

- 5.1.3. Plastics

- 5.1.4. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.1.1. Motorcycle Showrooms

- 5.2.1.2. Helmet Manufacturer Showrooms

- 5.2.1.3. Aftermarket

- 5.2.2. Online

- 5.2.1. Offline

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commuters

- 5.3.2. Racers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Fiber Glass

- 6.1.2. Carbon Fiber

- 6.1.3. Plastics

- 6.1.4. Other Ma

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline

- 6.2.1.1. Motorcycle Showrooms

- 6.2.1.2. Helmet Manufacturer Showrooms

- 6.2.1.3. Aftermarket

- 6.2.2. Online

- 6.2.1. Offline

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Commuters

- 6.3.2. Racers

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Fiber Glass

- 7.1.2. Carbon Fiber

- 7.1.3. Plastics

- 7.1.4. Other Ma

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline

- 7.2.1.1. Motorcycle Showrooms

- 7.2.1.2. Helmet Manufacturer Showrooms

- 7.2.1.3. Aftermarket

- 7.2.2. Online

- 7.2.1. Offline

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Commuters

- 7.3.2. Racers

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Fiber Glass

- 8.1.2. Carbon Fiber

- 8.1.3. Plastics

- 8.1.4. Other Ma

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline

- 8.2.1.1. Motorcycle Showrooms

- 8.2.1.2. Helmet Manufacturer Showrooms

- 8.2.1.3. Aftermarket

- 8.2.2. Online

- 8.2.1. Offline

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Commuters

- 8.3.2. Racers

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Rest of the World Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Fiber Glass

- 9.1.2. Carbon Fiber

- 9.1.3. Plastics

- 9.1.4. Other Ma

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline

- 9.2.1.1. Motorcycle Showrooms

- 9.2.1.2. Helmet Manufacturer Showrooms

- 9.2.1.3. Aftermarket

- 9.2.2. Online

- 9.2.1. Offline

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Commuters

- 9.3.2. Racers

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. North America Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Premium Motorcycle Helmets Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 LS2 Helmet

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Arai Helmet Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 HJC Helmets

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Schuberth GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Shark Helmets

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Suomy Motorsport SRL

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Studds Helmets

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Shoei Co Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Airoh Helmets

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Bell Helmets

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 AGV (Subsidiary of Dainese)

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 MT Helmets

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Nolan Helmets

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 LS2 Helmet

List of Figures

- Figure 1: Global Premium Motorcycle Helmets Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Premium Motorcycle Helmets Market Revenue (Million), by Material Type 2024 & 2032

- Figure 11: North America Premium Motorcycle Helmets Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 12: North America Premium Motorcycle Helmets Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: North America Premium Motorcycle Helmets Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: North America Premium Motorcycle Helmets Market Revenue (Million), by End-User 2024 & 2032

- Figure 15: North America Premium Motorcycle Helmets Market Revenue Share (%), by End-User 2024 & 2032

- Figure 16: North America Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Premium Motorcycle Helmets Market Revenue (Million), by Material Type 2024 & 2032

- Figure 19: Europe Premium Motorcycle Helmets Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 20: Europe Premium Motorcycle Helmets Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Premium Motorcycle Helmets Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Premium Motorcycle Helmets Market Revenue (Million), by End-User 2024 & 2032

- Figure 23: Europe Premium Motorcycle Helmets Market Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Europe Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Premium Motorcycle Helmets Market Revenue (Million), by Material Type 2024 & 2032

- Figure 27: Asia Pacific Premium Motorcycle Helmets Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 28: Asia Pacific Premium Motorcycle Helmets Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Premium Motorcycle Helmets Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Premium Motorcycle Helmets Market Revenue (Million), by End-User 2024 & 2032

- Figure 31: Asia Pacific Premium Motorcycle Helmets Market Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Asia Pacific Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Premium Motorcycle Helmets Market Revenue (Million), by Material Type 2024 & 2032

- Figure 35: Rest of the World Premium Motorcycle Helmets Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 36: Rest of the World Premium Motorcycle Helmets Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 37: Rest of the World Premium Motorcycle Helmets Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 38: Rest of the World Premium Motorcycle Helmets Market Revenue (Million), by End-User 2024 & 2032

- Figure 39: Rest of the World Premium Motorcycle Helmets Market Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Rest of the World Premium Motorcycle Helmets Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Premium Motorcycle Helmets Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: South America Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 26: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 28: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 33: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 35: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Italy Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 42: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 43: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 44: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 51: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 53: Global Premium Motorcycle Helmets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: South America Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Middle East and Africa Premium Motorcycle Helmets Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Premium Motorcycle Helmets Market?

The projected CAGR is approximately 6.81%.

2. Which companies are prominent players in the Premium Motorcycle Helmets Market?

Key companies in the market include LS2 Helmet, Arai Helmet Limited, HJC Helmets, Schuberth GmbH, Shark Helmets, Suomy Motorsport SRL, Studds Helmets, Shoei Co Ltd, Airoh Helmets, Bell Helmets, AGV (Subsidiary of Dainese), MT Helmets, Nolan Helmets.

3. What are the main segments of the Premium Motorcycle Helmets Market?

The market segments include Material Type, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Sports Bike to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Commuters Segment of the Market to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Premium Helmets Deter Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: SteelBird Hi-Tech India Limited introduced the IGN-8 helmet from its IGNITE series, which focuses on combining style and safety, meeting strict safety standards set by DOT FMVSS No. 218 and BIS IS 4151:2015. The helmet includes a chrome border visor with an anti-scratch coating and a Pin Lock 30-anti-fog lens.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Premium Motorcycle Helmets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Premium Motorcycle Helmets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Premium Motorcycle Helmets Market?

To stay informed about further developments, trends, and reports in the Premium Motorcycle Helmets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence