Key Insights

The Europe Soft Facility Management market is forecast to reach 350.13 billion by 2025, expanding at a CAGR of 2.95%. This growth is driven by increasing business outsourcing to enhance operational efficiency and focus on core competencies. Demand for specialized services like cleaning, catering, and security, particularly in commercial and institutional sectors, is a key catalyst. Evolving health, safety, and environmental regulations also necessitate professional facility management solutions. The integration of smart building technologies and advanced service delivery platforms is further improving service quality and market adoption.

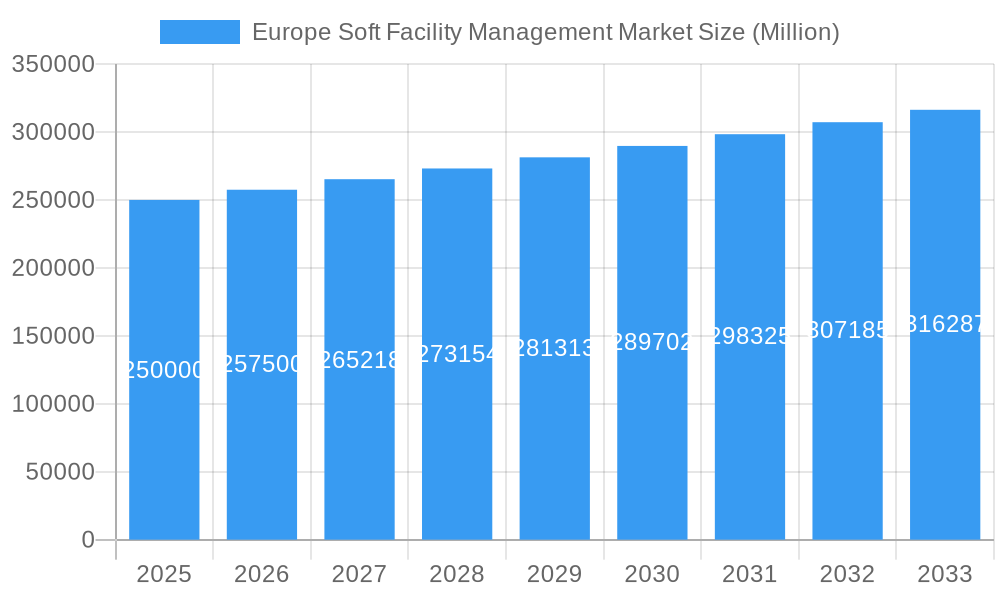

Europe Soft Facility Management Market Market Size (In Billion)

Cleaning Services and Office Support segments are projected to dominate due to their universal need. Security and Catering Services are also growing significantly, supporting employee well-being and operational continuity. Key markets include the United Kingdom, Germany, and France. Despite competitive pressures and potential price sensitivity, a sustained focus on sustainability and creating safe, productive work environments will propel market expansion through 2033. Major players like Sodexo Inc., ISS Global, and CBRE Group are influencing the competitive landscape.

Europe Soft Facility Management Market Company Market Share

This comprehensive report analyzes the Europe Soft Facility Management market, including its segments, growth drivers, opportunities, and competitive dynamics. Optimized for SEO, it is an indispensable resource for understanding market trends and future forecasts. The analysis covers 2019-2033, with 2025 as the base year. All figures are in billions.

Europe Soft Facility Management Market Market Dynamics & Structure

The Europe Soft Facility Management market exhibits a moderately fragmented structure, characterized by the presence of several large global players and a significant number of regional and specialized service providers. Market concentration is influenced by the increasing demand for integrated facility management solutions and strategic mergers and acquisitions aimed at expanding service portfolios and geographical reach. Technological innovation is a key driver, with advancements in AI-powered analytics for predictive maintenance, IoT for real-time monitoring, and sustainable practices shaping service delivery. Regulatory frameworks across European nations, particularly concerning health, safety, and environmental standards, play a crucial role in standardizing services and influencing operational strategies. Competitive product substitutes are emerging, with some organizations opting for in-house facility management for specific functions, though the trend favors outsourcing for cost-efficiency and expertise. End-user demographics are shifting, with a growing demand for flexible and customized service packages across commercial, institutional, and industrial sectors. The M&A trend is active, with companies like Atalian Serviesr and ISS Global actively pursuing acquisitions to consolidate market share and diversify offerings. For instance, the €500 million acquisition of Rentokil Initial's acquired business in the Nordics by ISS in 2022 highlights this trend. Innovation barriers include high initial investment costs for advanced technologies and the challenge of standardizing service quality across diverse geographical and cultural landscapes.

- Market Concentration: Moderately fragmented with a mix of global and regional players.

- Technological Innovation: Driven by AI, IoT, and sustainability initiatives.

- Regulatory Influence: Strict health, safety, and environmental standards across Europe.

- Competitive Landscape: Outsourcing is preferred over in-house management for many functions.

- End-User Demand: Growing for integrated and customizable FM solutions.

- M&A Activity: Active consolidation for market expansion and portfolio diversification.

Europe Soft Facility Management Market Growth Trends & Insights

The Europe Soft Facility Management market is projected for robust growth, driven by an increasing recognition of the value of outsourcing non-core business functions to specialized providers. The market size evolution is expected to see a significant upward trajectory, fueled by rising operational complexities in various industries and a sustained focus on cost optimization by businesses. Adoption rates for comprehensive facility management services are steadily increasing as organizations realize the benefits of improved efficiency, enhanced employee well-being, and better resource management. Technological disruptions, such as the integration of smart building technologies and data analytics for service optimization, are redefining service delivery models. Consumer behavior shifts are evident in the demand for sustainable and environmentally friendly FM practices, aligning with broader corporate social responsibility goals. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025–2033. Market penetration is expected to deepen, particularly in sectors with high operational demands and a strong emphasis on workplace experience. The increasing adoption of hybrid work models is also influencing the demand for agile and adaptable facility management services, focusing on space optimization and employee comfort. The shift towards a circular economy and reduced environmental impact is further boosting the demand for green cleaning solutions and energy-efficient building management. Overall, the market is poised for sustained expansion, propelled by both operational necessities and evolving corporate values. The estimated market size for 2025 is xx million units, projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Europe Soft Facility Management Market

The United Kingdom is anticipated to emerge as a dominant region within the Europe Soft Facility Management market. This dominance is propelled by a mature outsourcing market, a strong presence of large corporations, and a continuous drive for operational efficiency and cost savings. The country's well-established regulatory framework for facility management services also contributes to its leadership. The Commercial end-user segment is expected to drive significant growth, fueled by the expansion of office spaces, retail outlets, and the increasing demand for professional environments that foster productivity and employee satisfaction. Within the Type segment, Cleaning Services are consistently a foundational element and a major revenue generator. However, Office Support and Landscaping Services are experiencing rapid growth due to the evolving nature of workplaces and the increasing importance of creating sustainable and aesthetically pleasing working environments.

- Dominant Region: United Kingdom.

- Key Drivers: Mature outsourcing market, strong corporate presence, emphasis on efficiency.

- Growth Potential: High due to continuous business expansion and technological integration.

- Dominant End-User Segment: Commercial.

- Key Drivers: Office space expansion, retail sector growth, focus on employee experience.

- Market Share: Expected to hold a significant portion of the market due to widespread adoption across various commercial entities.

- Dominant Type Segment: Cleaning Services and Office Support & Landscaping Services.

- Cleaning Services: Essential and high-demand service across all sectors.

- Office Support & Landscaping Services: Growing demand driven by modern workplace design and sustainability initiatives.

Europe Soft Facility Management Market Product Landscape

The Europe Soft Facility Management market is characterized by a landscape of evolving service offerings and innovative applications. Companies are increasingly focusing on integrated solutions that combine multiple soft FM services into a single package, simplifying procurement and management for clients. Product innovations include the deployment of advanced cleaning technologies, such as robotic cleaning systems and eco-friendly cleaning agents, designed to enhance efficiency and reduce environmental impact. In security services, the integration of smart surveillance systems and access control technologies is becoming standard. Landscaping services are seeing a rise in sustainable and biodiversity-focused designs, aligning with environmental goals. Performance metrics are heavily influenced by client satisfaction surveys, operational efficiency improvements (e.g., reduced energy consumption, faster response times), and adherence to stringent quality and safety standards. The emphasis is on delivering tangible value, such as enhanced employee productivity, improved building aesthetics, and a safer working environment. Technological advancements are enabling predictive maintenance for building systems, reducing downtime and operational costs.

Key Drivers, Barriers & Challenges in Europe Soft Facility Management Market

Key Drivers:

- Cost Optimization: Businesses are increasingly outsourcing non-core functions to reduce operational expenses and gain economies of scale.

- Focus on Core Competencies: Companies aim to concentrate on their primary business activities by entrusting facility management to specialized providers.

- Technological Advancements: Integration of AI, IoT, and smart technologies enhances efficiency, sustainability, and service quality.

- Growing Demand for Sustainability: Increasing environmental consciousness drives the adoption of eco-friendly FM practices.

- Complex Operational Needs: Modern businesses require specialized expertise for managing diverse facility requirements.

Barriers & Challenges:

- High Initial Investment: Implementing advanced technologies and training skilled personnel requires significant capital outlay.

- Regulatory Compliance: Navigating diverse and evolving regulations across different European countries can be complex.

- Service Quality Standardization: Ensuring consistent high-quality service delivery across varied client sites and geographical locations is challenging.

- Talent Acquisition and Retention: A shortage of skilled labor in specialized FM roles can hinder growth.

- Client Retention: Intense competition and price sensitivity can make retaining clients a continuous effort.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of materials and equipment, affecting service delivery timelines.

Emerging Opportunities in Europe Soft Facility Management Market

Emerging opportunities in the Europe Soft Facility Management market are abundant, driven by evolving client needs and technological advancements. The growing demand for smart building integration presents a significant opportunity for FM providers to offer services that leverage IoT and data analytics for optimized building performance and predictive maintenance. Furthermore, the increasing focus on sustainability and ESG (Environmental, Social, and Governance) compliance creates a niche for specialized green FM solutions, including waste management optimization, energy efficiency programs, and the implementation of circular economy principles. The rise of hybrid work models necessitates flexible and adaptable workspace management, opening avenues for FM providers to offer services focused on space utilization, employee well-being, and agile office support. Elderly care facility management and specialized healthcare FM services are also burgeoning sectors, requiring tailored solutions and stringent hygiene protocols. The development of digital platforms and AI-driven service management tools offers opportunities for enhanced client communication, real-time reporting, and streamlined operations.

Growth Accelerators in the Europe Soft Facility Management Market Industry

Several key growth accelerators are propelling the Europe Soft Facility Management market forward. Technological breakthroughs, particularly in automation, AI, and data analytics, are revolutionizing service delivery, leading to greater efficiency and cost savings. Strategic partnerships and collaborations between FM providers and technology companies, as well as with other service providers, are expanding service offerings and market reach. Market expansion strategies, including mergers and acquisitions, are enabling companies to consolidate their positions, enter new geographical markets, and diversify their service portfolios. The increasing emphasis on outsourcing non-core business functions by a wider range of industries remains a fundamental accelerator. Furthermore, government initiatives and mandates promoting sustainability and energy efficiency are creating a favorable environment for green FM solutions. The growing awareness and adoption of integrated facility management (IFM) models, which offer a single point of contact for multiple services, are also significantly boosting growth.

Key Players Shaping the Europe Soft Facility Management Market Market

- Atalian Serviesr ( Atalian Global Services)

- Emcor Facilities Services WLL

- JLL Limited

- ISS Global

- Andron Facilities Management

- CBRE Group

- CCS Cleaning

- Atlas FM Ltd

- Sodexo Inc

- Mitie Group PLC

Notable Milestones in Europe Soft Facility Management Market Sector

- October 2022: SBFM signed a five-year contract with the UK's largest gym operator, PureGym, to deliver a full suite of commercial cleaning services across all PureGym locations. This expansion signifies a significant win in the leisure sector.

- July 2022: CBRE Group was appointed to support the fragrance shop's store expansion across the United Kingdom and Ireland, planning to open an additional 100 sites over the next three years, including beauty and niche fragrance stores. This highlights CBRE's role in retail expansion support.

- March 2022: Mitie signed a five-year contract with BAE Systems to supply a fully integrated facilities management (FM) service across 26 BAE Systems sites throughout the UK. This contract unified multiple agreements and encompasses a wide range of services including catering, pest control, mechanical, electrical, building fabric maintenance, cleaning, reception, waste management, gardening, and mailroom. This demonstrates Mitie's capability in delivering comprehensive IFM solutions to major industrial clients.

In-Depth Europe Soft Facility Management Market Market Outlook

The outlook for the Europe Soft Facility Management market is exceptionally positive, driven by a confluence of factors that underscore its essential role in modern business operations. Growth accelerators such as the relentless pursuit of operational efficiency, the strategic advantage of outsourcing, and the transformative impact of technology will continue to shape the market. The increasing demand for sustainable and environmentally responsible practices, coupled with the evolving needs of hybrid work environments, presents substantial untapped potential for specialized service providers. Strategic partnerships and the consolidation of market players through mergers and acquisitions are expected to further optimize service delivery and expand geographical footprints. The market is poised for sustained growth, with a strong emphasis on innovation, client-centric solutions, and the integration of smart technologies to enhance building performance and occupant experience. Future growth will be significantly influenced by the ability of FM providers to adapt to changing regulatory landscapes and meet the escalating demands for integrated, sustainable, and technologically advanced facility management services.

Europe Soft Facility Management Market Segmentation

-

1. Type

- 1.1. Office Support and Landscaping Services

- 1.2. Cleaning Services

- 1.3. Catering Services

- 1.4. Security Services

- 1.5. Other Types

-

2. End-User

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public/Infrastructure

- 2.4. Industrial

- 2.5. Other End-Users

Europe Soft Facility Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Soft Facility Management Market Regional Market Share

Geographic Coverage of Europe Soft Facility Management Market

Europe Soft Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mega Projects in Pipline is Expected to Boost the Construction Sector Driving the Need for Facility Managment Services; Increasing Investment in Healthcare Infractructure and the Construction of Healthcare Facilities

- 3.3. Market Restrains

- 3.3.1. Increased Instance of Data Breaches and Security Threats

- 3.4. Market Trends

- 3.4.1. Infractructure developments is expected to bring new opportunities for the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Soft Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Support and Landscaping Services

- 5.1.2. Cleaning Services

- 5.1.3. Catering Services

- 5.1.4. Security Services

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public/Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Atalian Servesr ( Atalian Global Services)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emcor Facilities Services WLL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JLL Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ISS Global

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Andron Facilities Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CBRE Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CCS Cleaning

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlas FM Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sodexo Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitie Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Atalian Servesr ( Atalian Global Services)

List of Figures

- Figure 1: Europe Soft Facility Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Soft Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Soft Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe Soft Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Soft Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Soft Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe Soft Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Soft Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Soft Facility Management Market?

The projected CAGR is approximately 2.95%.

2. Which companies are prominent players in the Europe Soft Facility Management Market?

Key companies in the market include Atalian Servesr ( Atalian Global Services), Emcor Facilities Services WLL, JLL Limited, ISS Global, Andron Facilities Management, CBRE Group, CCS Cleaning, Atlas FM Ltd, Sodexo Inc, Mitie Group PLC.

3. What are the main segments of the Europe Soft Facility Management Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 350.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Mega Projects in Pipline is Expected to Boost the Construction Sector Driving the Need for Facility Managment Services; Increasing Investment in Healthcare Infractructure and the Construction of Healthcare Facilities.

6. What are the notable trends driving market growth?

Infractructure developments is expected to bring new opportunities for the market.

7. Are there any restraints impacting market growth?

Increased Instance of Data Breaches and Security Threats.

8. Can you provide examples of recent developments in the market?

October 2022 - SBFM signed a five-year contract with the UK's largest gym operator, PureGym. Through this contract, SBFM delivered a full suite of commercial cleaning services across PureGym.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Soft Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Soft Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Soft Facility Management Market?

To stay informed about further developments, trends, and reports in the Europe Soft Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence