Key Insights

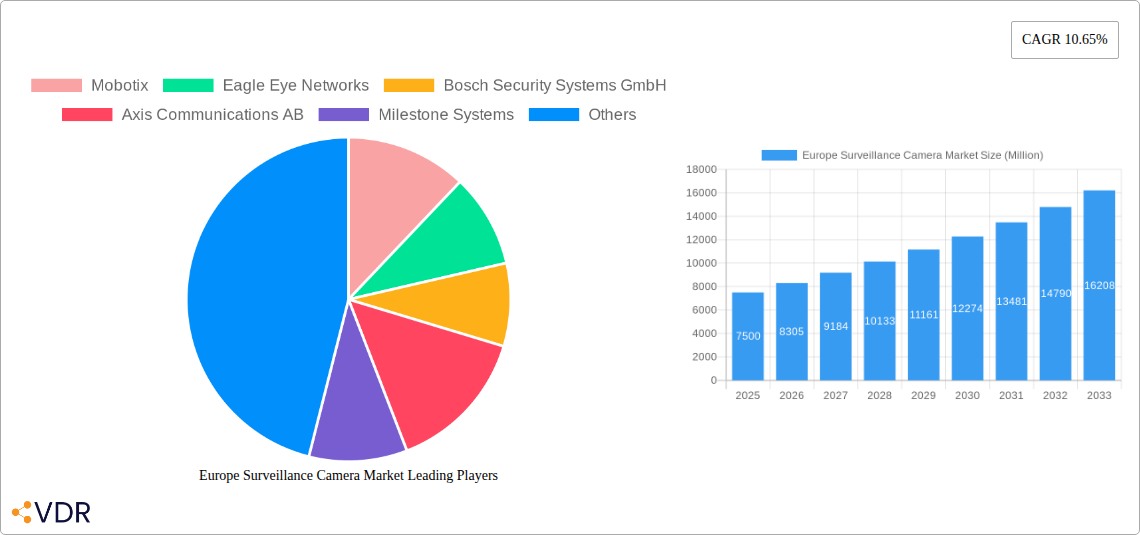

The Europe Surveillance Camera Market is poised for significant expansion, driven by increasing security concerns across various sectors and the growing adoption of advanced surveillance technologies. With a current market size estimated at $7.5 billion, the market is projected to witness robust growth at a Compound Annual Growth Rate (CAGR) of 10.65% over the forecast period of 2025-2033. This upward trajectory is propelled by key drivers such as the escalating demand for enhanced public safety, the need for sophisticated security solutions in critical infrastructure, and the rising adoption of IP-based cameras offering superior image quality and remote accessibility. The surge in smart city initiatives and the integration of artificial intelligence (AI) and machine learning (ML) capabilities into surveillance systems further fuel this growth, enabling advanced analytics for threat detection and incident response. The market is segmented by type into Analog-based, IP-based, and Hybrid solutions, with IP-based systems gaining considerable traction due to their scalability and feature-rich capabilities. End-user industries like Government, Banking, Healthcare, Transportation and Logistics, and Industrial sectors are all contributing to the demand, each with unique security imperatives. For instance, the government sector is prioritizing public safety and border security, while financial institutions are focusing on fraud prevention and asset protection.

Europe Surveillance Camera Market Market Size (In Billion)

The European region, with its diverse economic landscape and varying security requirements, presents a dynamic market for surveillance cameras. Key countries within Europe, including the United Kingdom, Germany, France, Italy, and Spain, are leading the adoption of advanced surveillance technologies, driven by stringent regulations and a proactive approach to security. The market's growth is further supported by continuous innovation, with companies actively developing solutions that incorporate features like high-resolution imaging, low-light performance, video analytics, and cloud-based management. While the market benefits from strong demand, certain restraints, such as high initial investment costs for advanced systems and data privacy concerns, need to be addressed. However, the clear benefits in terms of crime deterrence, evidence collection, and operational efficiency are likely to outweigh these challenges. The competitive landscape is characterized by the presence of major global players and regional specialists, fostering a climate of innovation and driving down costs, ultimately making advanced surveillance solutions more accessible across a wider range of applications within Europe.

Europe Surveillance Camera Market Company Market Share

Europe Surveillance Camera Market: Comprehensive Report 2019-2033

This in-depth report offers a definitive analysis of the Europe surveillance camera market, encompassing its current state and future trajectory from 2019 to 2033. We delve into the intricate dynamics, growth trends, dominant segments, and key players shaping this rapidly evolving industry. With a focus on actionable insights and quantitative data, this report is essential for stakeholders seeking to understand market opportunities, competitive landscapes, and strategic imperatives within Europe's burgeoning surveillance technology sector. The report covers parent and child markets extensively, providing a holistic view of market evolution. All values are presented in Million units.

Europe Surveillance Camera Market Market Dynamics & Structure

The Europe surveillance camera market is characterized by a moderate to high level of competition, with key players investing heavily in technological innovation to maintain their market standing. The concentration of market share is distributed among established multinational corporations and emerging regional players, fostering a dynamic competitive environment. Drivers of technological innovation include the increasing demand for high-resolution imaging, advanced analytics capabilities like AI-powered object recognition and behavioral analysis, and the growing adoption of cloud-based surveillance solutions. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR), significantly influence product development and deployment strategies, often acting as a barrier to entry for less compliant solutions. Competitive product substitutes are emerging in the form of integrated smart home security systems and advanced alarm systems that incorporate video monitoring. End-user demographics are diverse, with increasing adoption across both commercial and residential sectors, driven by heightened security concerns and the need for remote monitoring. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger companies acquiring innovative startups to expand their technology portfolios and market reach. For instance, in the historical period 2019-2024, a notable volume of M&A deals occurred, averaging approximately 5-7 significant transactions annually, aimed at strengthening market positions and acquiring specialized technologies.

- Market Concentration: Moderate to High, with key players holding significant shares.

- Technological Innovation Drivers: AI/ML integration, 4K resolution, cloud-based solutions, IoT connectivity.

- Regulatory Frameworks: GDPR compliance is paramount, influencing product design and data handling.

- Competitive Product Substitutes: Smart home security systems, advanced alarm systems with video capabilities.

- End-User Demographics: Growing adoption in government, retail, industrial, and residential sectors.

- M&A Trends: Strategic acquisitions to enhance technology, market reach, and customer base.

Europe Surveillance Camera Market Growth Trends & Insights

The Europe surveillance camera market is poised for robust expansion, driven by a confluence of factors including escalating security concerns, advancements in video analytics, and increasing government initiatives for public safety. The market size has seen consistent growth, evolving from approximately 8.5 million units in 2019 to an estimated 12.3 million units in 2024. Projections indicate a continued upward trajectory, with the market anticipated to reach an estimated 21.8 million units by 2033. The adoption rate of IP-based cameras, which offer superior image quality, remote accessibility, and integration capabilities, has significantly outpaced analog systems, now dominating market penetration. Technological disruptions are a constant, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing surveillance capabilities. Features such as facial recognition, anomaly detection, and predictive analytics are becoming standard, transforming cameras from mere recording devices into intelligent security tools. Consumer behavior shifts are also playing a crucial role; individuals and businesses are increasingly prioritizing proactive security measures over reactive responses. This heightened awareness, coupled with the declining costs of advanced surveillance technology, is accelerating market penetration. The compound annual growth rate (CAGR) for the forecast period 2025–2033 is estimated at a healthy xx%, reflecting sustained demand and innovation. The increasing digitalization of various sectors further amplifies the need for comprehensive surveillance solutions, fostering significant market growth.

Dominant Regions, Countries, or Segments in Europe Surveillance Camera Market

The IP-based camera segment is the undisputed leader within the Europe surveillance camera market, driven by its superior functionality, scalability, and network integration capabilities compared to analog-based and hybrid systems. As of the base year 2025, IP-based cameras are estimated to account for approximately 70% of the total market in terms of units sold, with analog-based cameras holding around 20% and hybrid systems the remaining 10%. This dominance is further amplified by the growing demand for high-resolution video and advanced analytics, which are inherently better supported by IP technology.

Among the end-user industries, the Government sector emerges as the most significant contributor to market growth, followed closely by Industrial and Transportation and Logistics. In 2025, the government sector is projected to represent roughly 25% of the market share in units, driven by national security initiatives, urban surveillance projects, and law enforcement requirements. The Industrial sector, accounting for an estimated 22% in 2025, benefits from the need for enhanced operational oversight, asset protection, and workplace safety. The Transportation and Logistics segment, with an approximate 18% market share in 2025, is rapidly adopting surveillance for infrastructure monitoring, traffic management, and cargo security.

Geographically, Western Europe, particularly countries like Germany, the United Kingdom, and France, represents the largest regional market due to their advanced infrastructure, higher disposable incomes, and strong emphasis on security. Germany, in particular, is a key market, estimated to contribute over 18% of the total European market share in 2025, bolstered by stringent security regulations and a robust industrial base. The UK follows closely, with its extensive deployment of CCTV in public spaces and commercial establishments. France’s growing investment in smart city initiatives and security for major events like the Olympics further solidifies its position. Economic policies favoring technological adoption, coupled with substantial infrastructure development, are key drivers of this regional dominance. Growth potential in Eastern European countries is also significant, albeit from a smaller base, as they increasingly invest in modernizing their security infrastructure.

- Dominant Segment (Type): IP-based Cameras

- Estimated Market Share (Units, 2025): 70%

- Key Drivers: Superior image quality, remote access, analytics integration, scalability.

- Dominant End-User Industry: Government

- Estimated Market Share (Units, 2025): 25%

- Key Drivers: Public safety initiatives, border control, urban surveillance, law enforcement needs.

- Leading Region: Western Europe

- Key Countries: Germany, United Kingdom, France

- Drivers: Advanced infrastructure, economic strength, stringent security focus, technological adoption.

Europe Surveillance Camera Market Product Landscape

The Europe surveillance camera market is defined by an ever-evolving product landscape characterized by a strong emphasis on high-resolution imaging, advanced analytics, and enhanced connectivity. Manufacturers are continuously introducing cameras with superior optical zoom capabilities, wider dynamic range (WDR) for challenging lighting conditions, and improved low-light performance, often leveraging AI for intelligent image processing. The integration of AI and machine learning algorithms is a key technological advancement, enabling features like object detection, facial recognition, intrusion alerts, and behavioral analysis, transforming surveillance from passive recording to active threat detection. Innovations in PTZ (Pan-Tilt-Zoom) cameras, thermal imaging for comprehensive all-weather surveillance, and specialized cameras for niche applications like license plate recognition (LPR) are also prominent. Furthermore, there is a growing trend towards miniaturization and discreet camera designs for aesthetic integration and covert surveillance. The product ecosystem is increasingly interconnected, with seamless integration into VMS (Video Management Systems) and cloud platforms, offering enhanced accessibility and scalability.

Key Drivers, Barriers & Challenges in Europe Surveillance Camera Market

Key Drivers:

- Increasing Security Threats: Rising incidents of crime and terrorism globally fuel the demand for advanced surveillance systems across public and private sectors.

- Technological Advancements: The integration of AI, IoT, and high-resolution imaging capabilities enhances functionality and effectiveness, driving adoption.

- Government Initiatives: Public safety projects, smart city development, and infrastructure upgrades in various European nations are significant market stimulants.

- Cost-Effectiveness of IP Cameras: Declining prices and superior performance of IP-based systems make them increasingly accessible.

- Remote Monitoring and Cloud Adoption: The need for real-time monitoring and data accessibility from anywhere fuels the growth of cloud-based surveillance solutions.

Barriers & Challenges:

- Data Privacy Regulations (GDPR): Strict compliance requirements can increase development costs and implementation complexities, particularly for cloud-based solutions and facial recognition technologies.

- Cybersecurity Risks: The interconnected nature of surveillance systems makes them vulnerable to cyberattacks, requiring robust security measures and constant vigilance.

- High Initial Investment Costs: While prices are decreasing, the initial outlay for comprehensive surveillance systems, including installation and infrastructure, can still be a barrier for smaller businesses and individuals.

- Interoperability Issues: Lack of standardization among different manufacturers can lead to integration challenges with existing systems.

- Public Perception and Ethical Concerns: Issues surrounding privacy and the potential for misuse of surveillance technology can lead to public apprehension and resistance in certain applications.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as experienced in recent years, can impact the availability and cost of components, affecting market stability.

Emerging Opportunities in Europe Surveillance Camera Market

Emerging opportunities within the Europe surveillance camera market lie in the burgeoning demand for AI-powered video analytics solutions that offer proactive threat detection and business intelligence. The expansion of smart cities across Europe presents significant potential for integrated surveillance networks that enhance public safety, traffic management, and urban planning. The increasing adoption of surveillance in niche sectors like smart agriculture and retail analytics, focusing on loss prevention and customer behavior analysis, offers untapped market segments. Furthermore, the development of edge computing capabilities within cameras, allowing for on-device processing of data, reduces reliance on cloud infrastructure and opens avenues for real-time, localized analytics. The growing trend of subscription-based surveillance services and the integration of cameras with other smart home and building management systems also represent significant growth avenues.

Growth Accelerators in the Europe Surveillance Camera Market Industry

Several catalysts are accelerating the long-term growth of the Europe surveillance camera market. Key among these is the continuous innovation in Artificial Intelligence and Machine Learning, leading to more sophisticated analytical capabilities that offer tangible value beyond basic monitoring. Strategic partnerships between hardware manufacturers, software developers, and cybersecurity firms are crucial for creating comprehensive, secure, and feature-rich solutions. Market expansion strategies, including the penetration of underserved regions within Eastern Europe and the development of tailored solutions for specific industry verticals, are also driving growth. Furthermore, the increasing global emphasis on homeland security and public safety, coupled with proactive government investments in surveillance infrastructure, acts as a powerful growth accelerator.

Key Players Shaping the Europe Surveillance Camera Market Market

- Mobotix

- Eagle Eye Networks

- Bosch Security Systems GmbH

- Axis Communications AB

- Milestone Systems

- Anviz Global Inc

- Genetec Inc

- i-PRO

- Teledyne FLIR LLC

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision Co Ltd

- Dahua Technology Co Ltd

- Honeywell International Inc

- Securitas AB

Notable Milestones in Europe Surveillance Camera Market Sector

- June 2024: Reolink introduced the Argus 4 Pro, featuring proprietary technology and a 4K UHD 180° view, enhancing home and business surveillance with superior low-light color vision and panoramic coverage.

- June 2024: German Police Department enhanced border control security by deploying CCTV surveillance in preparation for the UEFA European Football Championship.

- June 2024: French Police Department began implementing AI surveillance systems throughout Paris in preparation for the summer Olympics, focusing on enhanced public safety and crowd management.

In-Depth Europe Surveillance Camera Market Market Outlook

The Europe surveillance camera market is on a robust growth trajectory, propelled by relentless technological advancements, particularly in AI-driven analytics, and an ever-increasing global focus on security and safety. The market's future potential is immense, driven by the continuous integration of cameras into broader IoT ecosystems and smart city frameworks. Strategic opportunities lie in addressing evolving data privacy concerns with innovative encryption and anonymization techniques, alongside developing cybersecurity solutions to mitigate increasing threats. The shift towards subscription-based models for cloud VMS and analytics services will further enhance recurring revenue streams and customer loyalty. As surveillance technology becomes more intelligent, accessible, and integrated, it will play an increasingly vital role in safeguarding communities and optimizing operations across all sectors in Europe.

Europe Surveillance Camera Market Segmentation

-

1. Type

- 1.1. Analog-based

- 1.2. IP-based

- 1.3. Hybrid

-

2. End-user Industry

- 2.1. Government

- 2.2. Banking

- 2.3. Healthcare

- 2.4. Transportation and Logistics

- 2.5. Industrial

- 2.6. Other En

Europe Surveillance Camera Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Surveillance Camera Market Regional Market Share

Geographic Coverage of Europe Surveillance Camera Market

Europe Surveillance Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Security Concerns; Diminishing Surveillance Camera Prices

- 3.3. Market Restrains

- 3.3.1. Increasing Security Concerns; Diminishing Surveillance Camera Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Cameras for Ensuring Public Security

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Surveillance Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog-based

- 5.1.2. IP-based

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government

- 5.2.2. Banking

- 5.2.3. Healthcare

- 5.2.4. Transportation and Logistics

- 5.2.5. Industrial

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mobotix

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eagle Eye Networks

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bosch Security Systems GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axis Communications AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Milestone Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Anviz Global Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genetec Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 i-PRO

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Teledyne FLIR LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hanwha Vision Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dahua Technology Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Honeywell International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Securitas AB*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Mobotix

List of Figures

- Figure 1: Europe Surveillance Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Surveillance Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Surveillance Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Surveillance Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Surveillance Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Surveillance Camera Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Surveillance Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Surveillance Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Surveillance Camera Market?

The projected CAGR is approximately 10.65%.

2. Which companies are prominent players in the Europe Surveillance Camera Market?

Key companies in the market include Mobotix, Eagle Eye Networks, Bosch Security Systems GmbH, Axis Communications AB, Milestone Systems, Anviz Global Inc, Genetec Inc, i-PRO, Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision Co Ltd, Dahua Technology Co Ltd, Honeywell International Inc, Securitas AB*List Not Exhaustive.

3. What are the main segments of the Europe Surveillance Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Security Concerns; Diminishing Surveillance Camera Prices.

6. What are the notable trends driving market growth?

Increasing Demand for Cameras for Ensuring Public Security.

7. Are there any restraints impacting market growth?

Increasing Security Concerns; Diminishing Surveillance Camera Prices.

8. Can you provide examples of recent developments in the market?

June 2024: Reolink introduced the latest addition to its Argus camera series, the Argus 4 Pro. Featuring proprietary technology and a user-centric design, the Argus 4 Pro establishes a new benchmark in home and business surveillance. It offers a 4K UHD 180° view, eliminating blind spots and providing color vision even in low-light conditions. With its wide panoramic view in vibrant color, the Argus 4 Pro enhances user security and peace of mind.June 2024: The German Police Department enhanced security protocols by focusing on border control and deploying CCTV surveillance in preparation for the UEFA European Football Championship. Similarly, the French Police Department is preparing for the summer Olympics by implementing AI surveillance systems throughout Paris, France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Surveillance Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Surveillance Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Surveillance Camera Market?

To stay informed about further developments, trends, and reports in the Europe Surveillance Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence