Key Insights

The APAC Marine Satellite Communications Market is projected to achieve significant expansion, reaching an estimated market size of 21394.7 million by 2033, driven by a Compound Annual Growth Rate (CAGR) of 10.8% from the base year: 2024. This growth is fueled by increasing demand for advanced connectivity across government, merchant shipping, and offshore sectors. Key catalysts include the adoption of digital technologies for enhanced operational efficiency, crew welfare, and maritime safety. The rise of smart shipping initiatives and stringent regulations mandating real-time data transmission further accelerate market adoption. Growing demand for high-speed internet on passenger vessels and the necessity of reliable communication in remote offshore activities also contribute to this upward trend. Advanced solutions like Very Small Aperture Terminals (VSAT) and integrated mobile satellite systems are increasingly deployed, offering superior bandwidth and reliability.

APAC Marine Satellite Communications Market Market Size (In Billion)

The competitive environment features prominent global and regional players focused on innovation and service diversification to meet the varied needs of the APAC maritime industry. Emerging trends point towards integrated service packages, including cybersecurity, vessel management software, and IoT solutions. Challenges include high initial investment costs for advanced hardware and infrastructure, alongside potential impacts from geopolitical factors and regulatory shifts. Alternative connectivity solutions such as High-Altitude Platform Stations (HAPS) and Low Earth Orbit (LEO) satellites may pose long-term competition, although current investments in geostationary (GEO) and medium Earth orbit (MEO) systems remain substantial for maritime applications. The Asia Pacific region, with its extensive coastlines, major shipping routes, and expanding offshore industries, represents a critical and dynamic market for marine satellite communications.

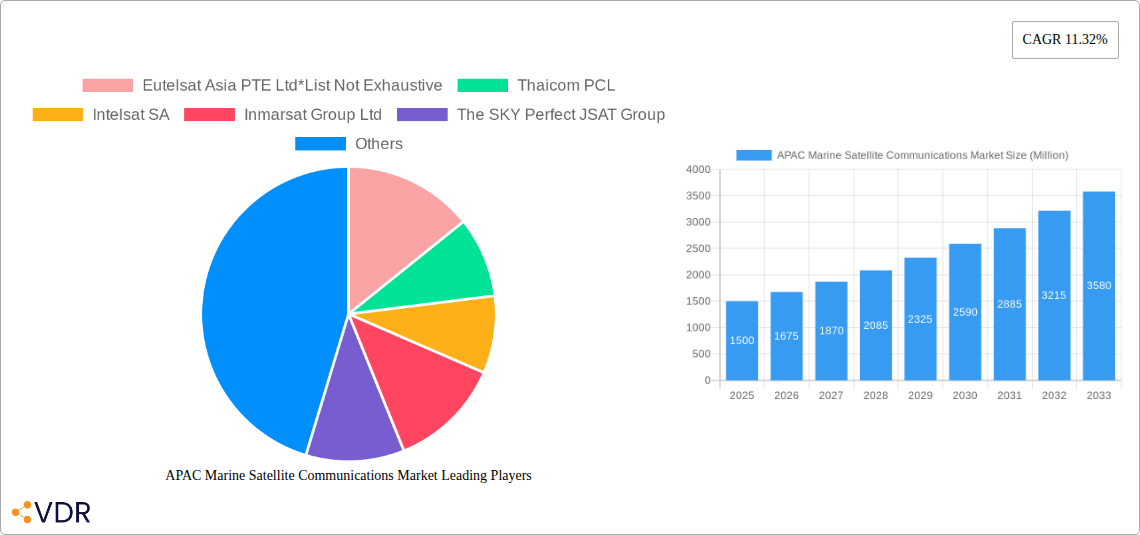

APAC Marine Satellite Communications Market Company Market Share

This comprehensive report delivers an in-depth analysis of the APAC Marine Satellite Communications Market, providing unparalleled insights into its dynamics, growth trajectory, and future potential. Covering the historical period up to 2024 and projecting to 2033, with 2024 as the base year, this report is essential for industry stakeholders. Gain data-driven understanding of market size, segmentation, key players, and emerging trends within this rapidly evolving sector.

APAC Marine Satellite Communications Market Market Dynamics & Structure

The APAC Marine Satellite Communications Market is characterized by a dynamic interplay of technological advancements, evolving regulatory landscapes, and shifting end-user demands. Market concentration remains moderate, with a few key players dominating the satellite capacity provision and service delivery. Technological innovation is a significant driver, particularly the increasing adoption of High-Throughput Satellites (HTS) and the development of software-defined satellites, enabling greater flexibility and efficiency. Regulatory frameworks across APAC nations are gradually adapting to accommodate the growing demand for maritime connectivity, fostering a more conducive environment for market expansion. Competitive product substitutes, such as terrestrial broadband, present a challenge in certain coastal areas, but satellite remains indispensable for deep-sea and remote operations. End-user demographics are increasingly diversified, with a surge in demand from merchant shipping for enhanced operational efficiency and crew welfare, and from offshore sectors for critical data transmission. Mergers and acquisitions (M&A) trends, while not dominant, are present as companies seek to consolidate their market position and expand their service portfolios.

- Market Concentration: Dominated by a mix of global and regional satellite operators, with increasing consolidation.

- Technological Innovation Drivers: HTS, software-defined satellites, LEO constellations for low-latency applications, and advanced antenna technologies.

- Regulatory Frameworks: Evolving regulations related to spectrum allocation, cybersecurity, and data privacy across various APAC countries.

- Competitive Product Substitutes: Terrestrial broadband in coastal regions; however, satellite remains the only viable option for open-sea connectivity.

- End-User Demographics: Growing demand from merchant shipping, offshore exploration, passenger vessels, and fishing fleets for reliable connectivity.

- M&A Trends: Strategic acquisitions to expand service offerings, geographic reach, and technological capabilities.

APAC Marine Satellite Communications Market Growth Trends & Insights

The APAC Marine Satellite Communications Market is poised for substantial growth, driven by the escalating demand for data-intensive applications, the digitalization of maritime operations, and the increasing focus on crew welfare. The market size has witnessed a consistent upward trend from 2019, with an accelerated growth trajectory anticipated in the forecast period. Adoption rates for advanced satellite communication solutions are on the rise, fueled by the realization of cost efficiencies and operational benefits. Technological disruptions, such as the proliferation of LEO constellations, are expected to introduce new service paradigms, offering lower latency and higher bandwidth options for specific maritime use cases. Consumer behavior shifts are evident, with a greater expectation for seamless connectivity akin to terrestrial experiences, pushing service providers to enhance service quality and user experience. The CAGR for the APAC Marine Satellite Communications Market is projected to be robust, indicating a significant expansion in market penetration across various maritime sectors.

- Market Size Evolution: Projected to grow from approximately \$1,800 million in 2019 to an estimated \$5,500 million by 2033.

- Adoption Rates: Increasing adoption of VSAT services and mobile satellite communication solutions across all maritime segments.

- Technological Disruptions: Integration of LEO satellite services, AI-powered network management, and IoT for maritime applications.

- Consumer Behavior Shifts: Demand for high-speed internet for crew welfare, real-time data for navigation and operations, and enhanced digital services.

- Market Penetration: Expected to reach over 70% across key maritime sectors by 2033.

Dominant Regions, Countries, or Segments in APAC Marine Satellite Communications Market

The Merchant Shipping segment is identified as a dominant force driving growth within the APAC Marine Satellite Communications Market. This segment's leadership is attributed to the sheer volume of vessels operating in and transiting through APAC waters, coupled with the increasing imperative for efficient operations, enhanced safety, and improved crew connectivity. Governments in the region are also increasingly adopting satellite communications for maritime surveillance, security, and disaster management, contributing to the Government segment's growth.

From a regional perspective, Southeast Asia and East Asia are leading the market due to their extensive coastlines, major shipping lanes, and significant port infrastructure. Countries like China, Japan, South Korea, Singapore, and the Philippines are pivotal hubs for maritime activity, thus driving substantial demand for satellite communication services.

- Dominant End-User Industry: Merchant Shipping

- Key Drivers: Global trade volumes, regulatory mandates for vessel tracking and communication, increasing digitalization of shipping operations, and the growing importance of crew welfare.

- Market Share: Expected to account for over 45% of the total market revenue by 2033.

- Growth Potential: High, driven by the ongoing need for reliable connectivity for business-critical applications and crew well-being.

- Dominant Regions: Southeast Asia and East Asia

- Key Drivers: Major shipping lanes, extensive port networks, government initiatives to modernize maritime infrastructure, and a growing number of offshore energy projects.

- Market Share: Combined, these regions are projected to hold over 60% of the APAC market by 2033.

- Growth Potential: Strong, supported by ongoing investments in maritime technology and infrastructure development.

- Dominant Segment (Type): Very Small Aperture Terminal (VSAT)

- Key Drivers: Demand for high bandwidth and continuous connectivity for data-intensive applications like real-time navigation, operational monitoring, and crew internet access.

- Market Share: Expected to represent over 65% of the market revenue by 2033.

- Growth Potential: Significant, as VSAT technology becomes more affordable and capable.

APAC Marine Satellite Communications Market Product Landscape

The APAC Marine Satellite Communications Market's product landscape is characterized by continuous innovation focused on delivering higher bandwidth, improved reliability, and greater flexibility. Key product innovations include the development of Ka-band and Ku-band High-Throughput Satellites (HTS) that offer significantly more capacity than traditional satellites. Advanced antenna systems, such as flat-panel and phased-array antennas, are enabling smaller, more efficient, and easier-to-install terminals. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into network management systems is optimizing data traffic and improving service quality. Software-defined satellites, like Eutelsat's Flexsat, are revolutionizing in-orbit adaptability, allowing for real-time adjustments to meet evolving customer needs and maximize resource utilization. These advancements are crucial for supporting the increasing demand for real-time data, video conferencing, and robust connectivity across diverse maritime operations.

Key Drivers, Barriers & Challenges in APAC Marine Satellite Communications Market

Key Drivers: The primary forces propelling the APAC Marine Satellite Communications Market are the escalating demand for high-speed internet and data services for both operational efficiency and crew welfare. The increasing digitalization of the maritime industry, with a focus on smart shipping and IoT integration, necessitates reliable and robust connectivity. Government initiatives promoting maritime safety, security, and surveillance further drive the adoption of satellite solutions. Technological advancements in satellite technology, including HTS and LEO constellations, are making satellite communications more accessible and cost-effective.

Barriers & Challenges: Significant barriers include the high initial investment cost for satellite terminals and service subscriptions, particularly for smaller operators. Regulatory complexities and differing standards across APAC nations can hinder seamless service deployment. The availability of skilled technicians for installation and maintenance in remote maritime locations also poses a challenge. Furthermore, competition from increasingly capable terrestrial broadband networks in coastal areas requires satellite providers to constantly innovate and demonstrate clear value propositions for open-sea operations. Supply chain disruptions can impact the availability of hardware components.

Emerging Opportunities in the APAC Marine Satellite Communications Market

Emerging opportunities in the APAC Marine Satellite Communications Market lie in the untapped potential of small and medium-sized fishing fleets to adopt basic connectivity solutions for improved safety and communication. The growing trend of "smart shipping" presents a significant opportunity for providing integrated IoT solutions for real-time monitoring of vessel performance, cargo, and environmental conditions. The expansion of offshore renewable energy projects, such as wind farms in challenging oceanic environments, will create a demand for dedicated and reliable satellite communication networks. Furthermore, the increasing focus on cybersecurity in the maritime sector opens avenues for specialized secure communication solutions. The development and deployment of next-generation LEO constellations promise to unlock new applications requiring ultra-low latency, catering to specialized needs like autonomous shipping and advanced remote operations.

Growth Accelerators in the APAC Marine Satellite Communications Market Industry

The APAC Marine Satellite Communications Market is experiencing significant growth acceleration driven by several key catalysts. The continuous innovation in satellite technology, particularly the deployment of HTS and the forthcoming expansion of LEO satellite networks, offers unprecedented bandwidth and lower latency, making satellite solutions more competitive and versatile. Strategic partnerships between satellite operators, service providers, and maritime technology companies are crucial for developing integrated solutions that address specific end-user needs. Market expansion strategies, including aggressive pricing models and bundled service offerings, are making satellite connectivity more accessible to a wider range of maritime stakeholders. The increasing adoption of cloud-based services and data analytics in the maritime sector further amplifies the demand for robust and continuous connectivity, acting as a significant growth accelerator.

Key Players Shaping the APAC Marine Satellite Communications Market Market

- Eutelsat Asia PTE Ltd

- Thaicom PCL

- Intelsat SA

- Inmarsat Group Ltd

- The SKY Perfect JSAT Group

- Network Innovation Inc

- Thales Group

- Asia Satellite Telecommunications Holdings Ltd

- Speedcast International Ltd (Globecomm Systems Inc)

- Thuraya Telecommunications Company

- Singapore Telecommunications Ltd

Notable Milestones in APAC Marine Satellite Communications Market Sector

- December 2022: Eutelsat Communications selected Thales Alenia Space (SDS) for its future, highly adaptable, software-defined satellite, Flexsat. This initiative leverages Thales Alenia Space's "Space Inspire" product line for seamless in-orbit reconfiguration, enhancing customer service and satellite resource efficiency.

- August 2022: SKY Perfect JSAT Holdings Inc. chose SpaceX's Starship for the launch of its Superbird-9 communications satellite. Superbird-9 is a highly adaptable HTS designed for customized payload missions, offering broadcast and broadband services in the Ku band over Japan and Eastern Asia, with a planned launch in 2024.

In-Depth APAC Marine Satellite Communications Market Market Outlook

The APAC Marine Satellite Communications Market is set for sustained and robust growth, underpinned by a confluence of technological advancements and evolving industry demands. The ongoing transition towards smart shipping, coupled with the critical need for reliable connectivity for enhanced operational efficiency, safety, and crew well-being, will continue to be primary demand drivers. Strategic investments in next-generation satellite constellations, including LEO and MEO systems, are poised to unlock new service possibilities, offering lower latency and higher bandwidth that will cater to increasingly sophisticated maritime applications. The increasing adoption of cloud-based solutions and the integration of IoT devices across the maritime sector will further necessitate advanced connectivity, reinforcing the market's upward trajectory. Companies that can offer integrated, end-to-end solutions, encompassing hardware, software, and value-added services, are best positioned to capitalize on the significant future market potential and capitalize on emerging strategic opportunities.

APAC Marine Satellite Communications Market Segmentation

-

1. Type

- 1.1. Mobile Satellite Communication

- 1.2. Very Small Aperture Terminal (VSAT)

-

2. Offerings

- 2.1. Solution

- 2.2. Services

-

3. End-user Industry

- 3.1. Government

- 3.2. Merchant Shipping

- 3.3. Offshore

- 3.4. Passenger Ships

- 3.5. Leisure Vessels

- 3.6. Fishing

APAC Marine Satellite Communications Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Marine Satellite Communications Market Regional Market Share

Geographic Coverage of APAC Marine Satellite Communications Market

APAC Marine Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Sea-borne Threats and Ambiguous Maritime Security Policies; Need for Advanced Communications along SLOC

- 3.3. Market Restrains

- 3.3.1. Reliance on High-Cost Satellite Equipment

- 3.4. Market Trends

- 3.4.1. Government Agencies are Expected to Have the Largest Market Share in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Marine Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile Satellite Communication

- 5.1.2. Very Small Aperture Terminal (VSAT)

- 5.2. Market Analysis, Insights and Forecast - by Offerings

- 5.2.1. Solution

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Government

- 5.3.2. Merchant Shipping

- 5.3.3. Offshore

- 5.3.4. Passenger Ships

- 5.3.5. Leisure Vessels

- 5.3.6. Fishing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Marine Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mobile Satellite Communication

- 6.1.2. Very Small Aperture Terminal (VSAT)

- 6.2. Market Analysis, Insights and Forecast - by Offerings

- 6.2.1. Solution

- 6.2.2. Services

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Government

- 6.3.2. Merchant Shipping

- 6.3.3. Offshore

- 6.3.4. Passenger Ships

- 6.3.5. Leisure Vessels

- 6.3.6. Fishing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Marine Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mobile Satellite Communication

- 7.1.2. Very Small Aperture Terminal (VSAT)

- 7.2. Market Analysis, Insights and Forecast - by Offerings

- 7.2.1. Solution

- 7.2.2. Services

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Government

- 7.3.2. Merchant Shipping

- 7.3.3. Offshore

- 7.3.4. Passenger Ships

- 7.3.5. Leisure Vessels

- 7.3.6. Fishing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Marine Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mobile Satellite Communication

- 8.1.2. Very Small Aperture Terminal (VSAT)

- 8.2. Market Analysis, Insights and Forecast - by Offerings

- 8.2.1. Solution

- 8.2.2. Services

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Government

- 8.3.2. Merchant Shipping

- 8.3.3. Offshore

- 8.3.4. Passenger Ships

- 8.3.5. Leisure Vessels

- 8.3.6. Fishing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Marine Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mobile Satellite Communication

- 9.1.2. Very Small Aperture Terminal (VSAT)

- 9.2. Market Analysis, Insights and Forecast - by Offerings

- 9.2.1. Solution

- 9.2.2. Services

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Government

- 9.3.2. Merchant Shipping

- 9.3.3. Offshore

- 9.3.4. Passenger Ships

- 9.3.5. Leisure Vessels

- 9.3.6. Fishing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Marine Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mobile Satellite Communication

- 10.1.2. Very Small Aperture Terminal (VSAT)

- 10.2. Market Analysis, Insights and Forecast - by Offerings

- 10.2.1. Solution

- 10.2.2. Services

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Government

- 10.3.2. Merchant Shipping

- 10.3.3. Offshore

- 10.3.4. Passenger Ships

- 10.3.5. Leisure Vessels

- 10.3.6. Fishing

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eutelsat Asia PTE Ltd*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thaicom PCL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intelsat SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inmarsat Group Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The SKY Perfect JSAT Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Network Innovation Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thales Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Asia Satellite Telecommunications Holdings Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Speedcast International Ltd (Globecomm Systems Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thuraya Telecommunications Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Singapore Telecommunications Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Eutelsat Asia PTE Ltd*List Not Exhaustive

List of Figures

- Figure 1: Global APAC Marine Satellite Communications Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America APAC Marine Satellite Communications Market Revenue (million), by Type 2025 & 2033

- Figure 3: North America APAC Marine Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Marine Satellite Communications Market Revenue (million), by Offerings 2025 & 2033

- Figure 5: North America APAC Marine Satellite Communications Market Revenue Share (%), by Offerings 2025 & 2033

- Figure 6: North America APAC Marine Satellite Communications Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: North America APAC Marine Satellite Communications Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America APAC Marine Satellite Communications Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America APAC Marine Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Marine Satellite Communications Market Revenue (million), by Type 2025 & 2033

- Figure 11: South America APAC Marine Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America APAC Marine Satellite Communications Market Revenue (million), by Offerings 2025 & 2033

- Figure 13: South America APAC Marine Satellite Communications Market Revenue Share (%), by Offerings 2025 & 2033

- Figure 14: South America APAC Marine Satellite Communications Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: South America APAC Marine Satellite Communications Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America APAC Marine Satellite Communications Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America APAC Marine Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Marine Satellite Communications Market Revenue (million), by Type 2025 & 2033

- Figure 19: Europe APAC Marine Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe APAC Marine Satellite Communications Market Revenue (million), by Offerings 2025 & 2033

- Figure 21: Europe APAC Marine Satellite Communications Market Revenue Share (%), by Offerings 2025 & 2033

- Figure 22: Europe APAC Marine Satellite Communications Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 23: Europe APAC Marine Satellite Communications Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe APAC Marine Satellite Communications Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe APAC Marine Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Marine Satellite Communications Market Revenue (million), by Type 2025 & 2033

- Figure 27: Middle East & Africa APAC Marine Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa APAC Marine Satellite Communications Market Revenue (million), by Offerings 2025 & 2033

- Figure 29: Middle East & Africa APAC Marine Satellite Communications Market Revenue Share (%), by Offerings 2025 & 2033

- Figure 30: Middle East & Africa APAC Marine Satellite Communications Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa APAC Marine Satellite Communications Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa APAC Marine Satellite Communications Market Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Marine Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Marine Satellite Communications Market Revenue (million), by Type 2025 & 2033

- Figure 35: Asia Pacific APAC Marine Satellite Communications Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific APAC Marine Satellite Communications Market Revenue (million), by Offerings 2025 & 2033

- Figure 37: Asia Pacific APAC Marine Satellite Communications Market Revenue Share (%), by Offerings 2025 & 2033

- Figure 38: Asia Pacific APAC Marine Satellite Communications Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific APAC Marine Satellite Communications Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific APAC Marine Satellite Communications Market Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Marine Satellite Communications Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Offerings 2020 & 2033

- Table 3: Global APAC Marine Satellite Communications Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Offerings 2020 & 2033

- Table 7: Global APAC Marine Satellite Communications Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Offerings 2020 & 2033

- Table 14: Global APAC Marine Satellite Communications Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Offerings 2020 & 2033

- Table 21: Global APAC Marine Satellite Communications Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Offerings 2020 & 2033

- Table 34: Global APAC Marine Satellite Communications Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Type 2020 & 2033

- Table 43: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Offerings 2020 & 2033

- Table 44: Global APAC Marine Satellite Communications Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global APAC Marine Satellite Communications Market Revenue million Forecast, by Country 2020 & 2033

- Table 46: China APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Marine Satellite Communications Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Marine Satellite Communications Market?

The projected CAGR is approximately 10.8%.

2. Which companies are prominent players in the APAC Marine Satellite Communications Market?

Key companies in the market include Eutelsat Asia PTE Ltd*List Not Exhaustive, Thaicom PCL, Intelsat SA, Inmarsat Group Ltd, The SKY Perfect JSAT Group, Network Innovation Inc, Thales Group, Asia Satellite Telecommunications Holdings Ltd, Speedcast International Ltd (Globecomm Systems Inc ), Thuraya Telecommunications Company, Singapore Telecommunications Ltd.

3. What are the main segments of the APAC Marine Satellite Communications Market?

The market segments include Type, Offerings, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 21394.7 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Sea-borne Threats and Ambiguous Maritime Security Policies; Need for Advanced Communications along SLOC.

6. What are the notable trends driving market growth?

Government Agencies are Expected to Have the Largest Market Share in the Region.

7. Are there any restraints impacting market growth?

Reliance on High-Cost Satellite Equipment.

8. Can you provide examples of recent developments in the market?

December 2022: In order to create a future, highly adaptable, software-defined satellite, Eutelsat Communications chose Thales Alenia Space (SDS). The Flexsat, short for "flexible satellite," will be based on Thales Alenia Space's state-of-the-art "Space Inspire" (instant space in-orbit reconfiguration) product line, which enables seamless reconfiguration and instant in-orbit adjustment to provide an exceptional level of customer service while maximizing the efficient use of satellite resources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Marine Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Marine Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Marine Satellite Communications Market?

To stay informed about further developments, trends, and reports in the APAC Marine Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence