Key Insights

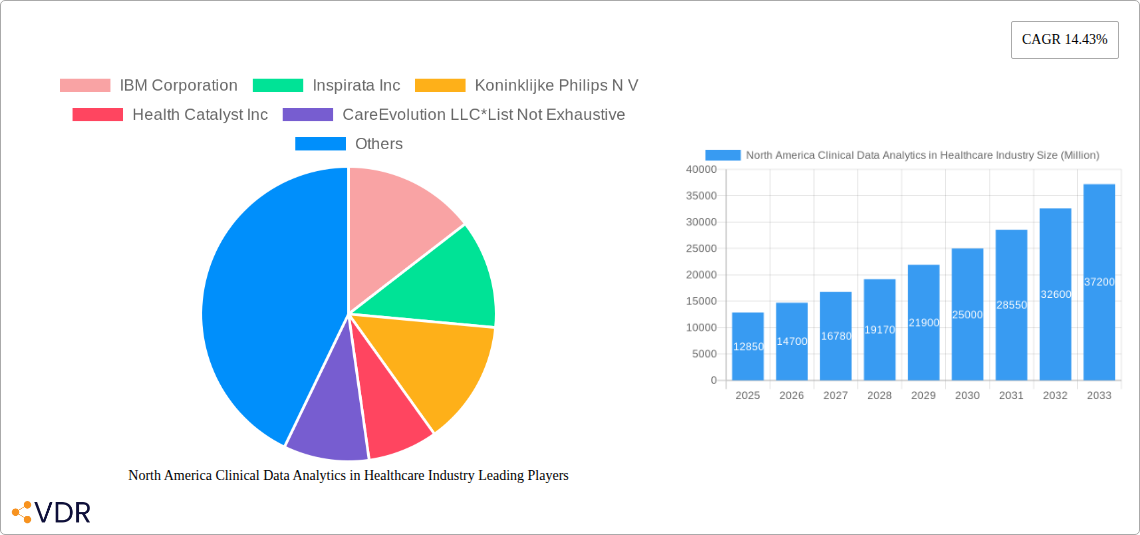

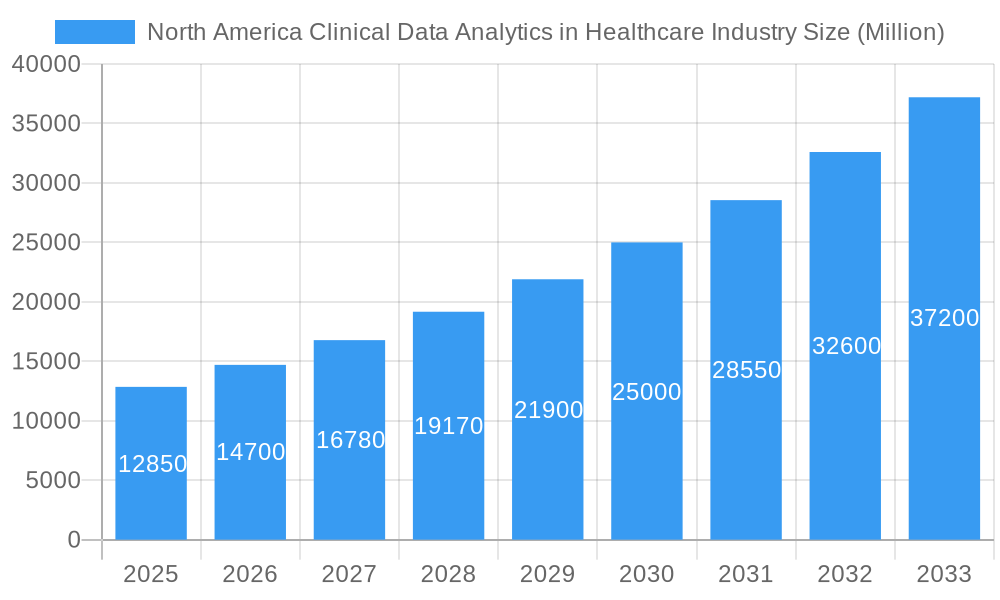

The North American Clinical Data Analytics in Healthcare market is poised for significant expansion, projected to reach a substantial USD 12.85 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 14.43% through 2033. This rapid growth is propelled by the increasing volume and complexity of healthcare data, coupled with the pressing need for improved patient outcomes, operational efficiency, and cost containment. Providers and payers are actively investing in advanced analytics to gain deeper insights into patient populations, identify disease patterns, predict outbreaks, and personalize treatment plans. The shift towards value-based care models further amplifies the demand for clinical data analytics, as organizations strive to demonstrate quality and efficiency. Cloud-based solutions are leading the charge in adoption due to their scalability, flexibility, and cost-effectiveness, although on-premise solutions will continue to cater to organizations with stringent data security requirements.

North America Clinical Data Analytics in Healthcare Industry Market Size (In Billion)

The market's dynamism is further fueled by the evolution of analytical capabilities, ranging from descriptive and diagnostic insights to sophisticated predictive and prescriptive models. These advanced functionalities empower healthcare stakeholders to move beyond understanding what happened to predicting future events and recommending optimal courses of action. Key players like IBM Corporation, Philips N.V., and Siemens Healthineers AG are at the forefront of this innovation, offering comprehensive solutions that integrate seamlessly with existing healthcare IT infrastructures. While the North American region, encompassing the United States, Canada, and Mexico, demonstrates strong adoption, potential restraints may arise from data privacy concerns, regulatory complexities, and the initial investment costs associated with implementing sophisticated analytics platforms. However, the overarching benefits of enhanced patient care, reduced medical errors, and optimized resource allocation are expected to outweigh these challenges, driving sustained market growth.

North America Clinical Data Analytics in Healthcare Industry Company Market Share

North America Clinical Data Analytics in Healthcare Industry Market: Comprehensive Analysis and Future Outlook

This report provides an in-depth analysis of the North America Clinical Data Analytics in Healthcare Industry market, examining its dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, and major players. The study covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending from 2025 to 2033, offering a comprehensive view of market evolution and future potential. We delve into both parent and child market segments to offer a granular understanding of this rapidly evolving sector.

North America Clinical Data Analytics in Healthcare Industry Market Dynamics & Structure

The North America clinical data analytics market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by advancements in AI, machine learning, and big data processing, enabling more sophisticated analytical capabilities. The regulatory framework, including HIPAA and evolving data privacy laws, plays a crucial role in shaping market access and data utilization strategies. Competitive product substitutes are emerging, but the unique value proposition of integrated clinical data analytics solutions remains strong. End-user demographics are shifting, with providers increasingly demanding tools for improving patient outcomes and operational efficiency, while payers seek cost reduction and fraud detection. Mergers and acquisitions (M&A) are a notable trend, with larger entities acquiring innovative startups to expand their offerings and market reach. For instance, the market witnessed several strategic partnerships and acquisitions aiming to consolidate market share and enhance technological portfolios. The adoption of cloud-based solutions is accelerating, presenting a significant shift from traditional on-premise deployments. Innovation barriers include the complexity of integrating disparate data sources, data security concerns, and the need for skilled data scientists.

North America Clinical Data Analytics in Healthcare Industry Growth Trends & Insights

The North America clinical data analytics market is poised for substantial growth, projected to reach an estimated market size of $XX,XXX million by 2033. This robust expansion is driven by an increasing volume of healthcare data generated from electronic health records (EHRs), medical imaging, wearable devices, and genomic sequencing. The adoption rates of clinical data analytics solutions are rapidly accelerating across healthcare organizations, with a projected CAGR of XX.X% during the forecast period. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) algorithms, are transforming the analytical capabilities from basic descriptive insights to advanced predictive and prescriptive models. These advancements are enabling healthcare providers to move beyond understanding "what happened" to predicting "what will happen" and prescribing "what should be done."

Consumer behavior shifts are also influencing market dynamics, with patients becoming more engaged in their healthcare decisions and demanding personalized treatment plans supported by data-driven insights. This increasing demand for personalized medicine is a significant growth catalyst. Furthermore, the focus on value-based care models by payers incentivizes providers to leverage data analytics for improving patient outcomes, reducing readmission rates, and optimizing resource allocation. The growing emphasis on population health management and preventative care strategies further propels the adoption of clinical data analytics solutions. The market penetration of these solutions is expected to increase significantly as the benefits of enhanced decision-making, improved operational efficiency, and better patient care become more widely recognized. The overall trend indicates a shift towards proactive, data-informed healthcare delivery.

Dominant Regions, Countries, or Segments in North America Clinical Data Analytics in Healthcare Industry

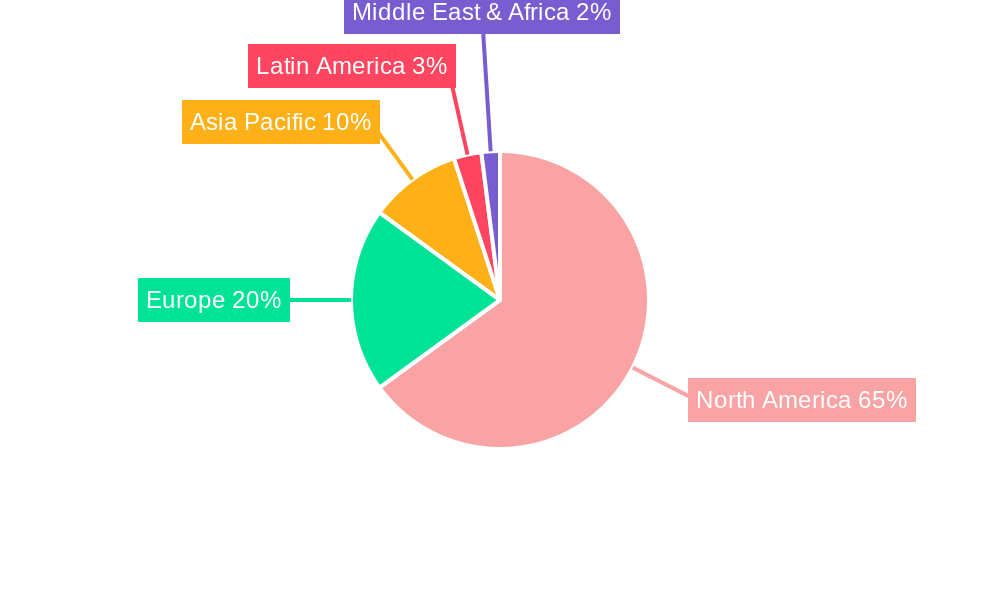

Within the North America clinical data analytics in healthcare industry, the United States stands out as the dominant country, driven by its advanced healthcare infrastructure, significant investment in healthcare technologies, and a large patient population generating vast amounts of clinical data. The Providers segment is currently the largest end-user, accounting for an estimated XX% market share in 2025. This dominance is fueled by the urgent need for providers to enhance patient care, improve operational efficiency, reduce healthcare costs, and comply with evolving regulatory requirements. The push towards value-based care models directly incentivizes providers to invest in analytics that can demonstrate improved outcomes and cost savings.

The Cloud mode of delivery is rapidly gaining traction, projected to capture over XX% of the market share by 2033. This shift is attributed to the scalability, flexibility, cost-effectiveness, and ease of implementation offered by cloud-based solutions. Cloud platforms enable healthcare organizations to access advanced analytical tools and process large datasets without significant upfront capital investment in hardware and infrastructure.

Among the types of analysis, Descriptive Analysis currently holds the largest market share, providing foundational insights into past and present healthcare trends. However, Predictive Analysis and Prescriptive Analysis are experiencing the fastest growth rates. Predictive analytics, with an estimated CAGR of XX.X%, is becoming indispensable for forecasting disease outbreaks, identifying at-risk patient populations, and anticipating resource needs. Prescriptive analytics, though still nascent, is expected to see significant growth as AI and ML capabilities mature, offering actionable recommendations for treatment protocols and operational adjustments. The combination of these analytical types empowers healthcare stakeholders with a comprehensive understanding and actionable intelligence from their clinical data.

North America Clinical Data Analytics in Healthcare Industry Product Landscape

The product landscape for North America clinical data analytics in healthcare is dynamic, marked by continuous innovation focused on enhancing analytical capabilities and user accessibility. Key product innovations include advanced AI-powered diagnostic tools that can analyze medical images with remarkable accuracy, predictive models for identifying patients at high risk of specific diseases or hospital readmissions, and prescriptive analytics platforms that offer real-time treatment recommendations. These solutions are increasingly integrated with existing EHR systems, ensuring seamless data flow and minimizing disruption to clinical workflows. Unique selling propositions often lie in the ability to provide real-time actionable insights, improve diagnostic accuracy, personalize treatment plans, and optimize operational efficiency. Technological advancements are prioritizing data security, privacy, and compliance with regulations like HIPAA, alongside improving the interpretability of complex analytical outputs.

Key Drivers, Barriers & Challenges in North America Clinical Data Analytics in Healthcare Industry

Key Drivers:

- Growing Volume of Healthcare Data: The exponential increase in data generated from EHRs, IoT devices, and genomics fuels the demand for advanced analytics.

- Shift Towards Value-Based Care: Payers and providers are increasingly focused on outcomes and cost-effectiveness, driving the need for data-driven decision-making.

- Technological Advancements: AI, machine learning, and big data technologies enable more sophisticated and insightful analytics.

- Increasing Demand for Personalized Medicine: Tailoring treatments based on individual patient data requires robust analytical capabilities.

- Government Initiatives and Regulations: Policies promoting data sharing and interoperability indirectly support the growth of clinical data analytics.

Barriers & Challenges:

- Data Silos and Interoperability Issues: Fragmented data across various systems hinders comprehensive analysis.

- Data Security and Privacy Concerns: Ensuring the confidentiality and integrity of sensitive patient data is paramount and complex.

- Shortage of Skilled Data Scientists: A lack of trained professionals to develop, implement, and interpret complex analytical models.

- High Implementation Costs: Initial investment in analytics platforms and infrastructure can be substantial for some organizations.

- Resistance to Change and Adoption Hurdles: Overcoming organizational inertia and integrating new analytical workflows into existing practices.

- Regulatory Compliance Complexity: Navigating evolving data privacy and security regulations adds an ongoing challenge.

- Data Quality and Standardization: Inconsistent data entry and lack of standardized formats can impact the accuracy of analyses.

Emerging Opportunities in North America Clinical Data Analytics in Healthcare Industry

Emerging opportunities in the North America clinical data analytics market are centered around leveraging advanced AI for drug discovery and development, enabling more efficient clinical trials by identifying ideal patient cohorts and predicting trial outcomes. The expansion of remote patient monitoring, coupled with real-time analytics, presents a significant opportunity to improve chronic disease management and reduce hospitalizations. Furthermore, there's a growing demand for analytics solutions that can support mental health services, identify individuals at risk, and personalize therapeutic interventions. The development of explainable AI (XAI) in healthcare analytics is also a key opportunity, fostering trust and wider adoption by making complex model decisions transparent to clinicians. The integration of real-world evidence (RWE) generated from diverse data sources into clinical decision-making and regulatory submissions represents another substantial growth avenue.

Growth Accelerators in the North America Clinical Data Analytics in Healthcare Industry Industry

Long-term growth in the North America clinical data analytics sector will be significantly accelerated by ongoing technological breakthroughs, particularly in federated learning and advanced AI/ML algorithms that enable privacy-preserving data analysis. Strategic partnerships between technology providers, healthcare institutions, and research organizations are crucial for co-developing innovative solutions and fostering broader market adoption. Market expansion strategies focusing on underserved segments, such as smaller clinics or specialized healthcare practices, will unlock new revenue streams. The increasing emphasis on population health management and preventative care strategies, supported by data-driven insights, will also act as a powerful growth accelerator, driving demand for analytics that can identify health risks at a community level and facilitate targeted interventions.

Key Players Shaping the North America Clinical Data Analytics in Healthcare Industry Market

- IBM Corporation

- Inspirata Inc

- Koninklijke Philips N V

- Health Catalyst Inc

- CareEvolution LLC

- Siemens Healthineers AG

- Cerner Corporation

- Oracle Corporation

- Allscripts Healthcare Solutions Inc

- McKesson Corporation

Notable Milestones in North America Clinical Data Analytics in Healthcare Industry Sector

- June 2023: MRO Corp. launched a new technology solution for clinical data exchange, implementing a digital and automated process for requesting and delivering patient information between providers and payers. This aims to remove manual burdens and reduce friction, with their Payer Exchange automating labor-intensive tasks previously done by hospital staff.

- April 2023: TripleBlind, a US-based healthcare analytics company, announced the launch of three new healthcare-focused products designed to provide secure accessibility to sensitive data, enabling detailed insights while maintaining privacy and compliance.

In-Depth North America Clinical Data Analytics in Healthcare Industry Market Outlook

The future outlook for the North America clinical data analytics in healthcare industry is exceptionally promising, driven by a convergence of technological advancements and evolving healthcare paradigms. Growth accelerators will continue to be fueled by the increasing sophistication of AI and machine learning, enabling more precise predictive and prescriptive analytics. The ongoing expansion of cloud infrastructure will democratize access to powerful analytics tools, benefiting a wider range of healthcare organizations. Strategic collaborations will foster innovation and accelerate the development of integrated solutions that address complex healthcare challenges. As the industry matures, there will be a greater emphasis on real-world evidence integration and the development of explainable AI, further solidifying the role of data analytics in driving better patient outcomes, operational efficiencies, and cost reductions across the North American healthcare ecosystem. The potential for personalized medicine and proactive health management will continue to unlock significant market potential and strategic opportunities.

North America Clinical Data Analytics in Healthcare Industry Segmentation

-

1. Mode of Delivery

- 1.1. Cloud

- 1.2. On-premise

-

2. Type

- 2.1. Descriptive Analysis

- 2.2. Diagnostic Analysis

- 2.3. Predictive Analysis

- 2.4. Prescriptive Analysis

-

3. End-user

- 3.1. Payers

- 3.2. Providers

North America Clinical Data Analytics in Healthcare Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Clinical Data Analytics in Healthcare Industry Regional Market Share

Geographic Coverage of North America Clinical Data Analytics in Healthcare Industry

North America Clinical Data Analytics in Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Healthcare Spending; Increasing Adoption of Big Data in Healthcare

- 3.3. Market Restrains

- 3.3.1. High Cost of Data Analytics Solutions

- 3.4. Market Trends

- 3.4.1. Cloud to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Clinical Data Analytics in Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Descriptive Analysis

- 5.2.2. Diagnostic Analysis

- 5.2.3. Predictive Analysis

- 5.2.4. Prescriptive Analysis

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Payers

- 5.3.2. Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Inspirata Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke Philips N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Health Catalyst Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CareEvolution LLC*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthineers AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cerner Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oracle Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allscripts Healthcare Solutions Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 McKesson Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: North America Clinical Data Analytics in Healthcare Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Clinical Data Analytics in Healthcare Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 2: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 6: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Clinical Data Analytics in Healthcare Industry?

The projected CAGR is approximately 14.43%.

2. Which companies are prominent players in the North America Clinical Data Analytics in Healthcare Industry?

Key companies in the market include IBM Corporation, Inspirata Inc, Koninklijke Philips N V, Health Catalyst Inc, CareEvolution LLC*List Not Exhaustive, Siemens Healthineers AG, Cerner Corporation, Oracle Corporation, Allscripts Healthcare Solutions Inc, McKesson Corporation.

3. What are the main segments of the North America Clinical Data Analytics in Healthcare Industry?

The market segments include Mode of Delivery, Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Healthcare Spending; Increasing Adoption of Big Data in Healthcare.

6. What are the notable trends driving market growth?

Cloud to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Data Analytics Solutions.

8. Can you provide examples of recent developments in the market?

June 2023: MRO Corp., a clinical data exchange The company said it has started a new technology solution. The company implemented a digital and automated process of requesting and delivering patient information between providers and payers by means of this solution. MRO aims at removing the manual burden and reducing friction between providers. Payer Exchange automates the labor-intensive work previously performed by hospital staff to streamline workflows.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Clinical Data Analytics in Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Clinical Data Analytics in Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Clinical Data Analytics in Healthcare Industry?

To stay informed about further developments, trends, and reports in the North America Clinical Data Analytics in Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence