Key Insights

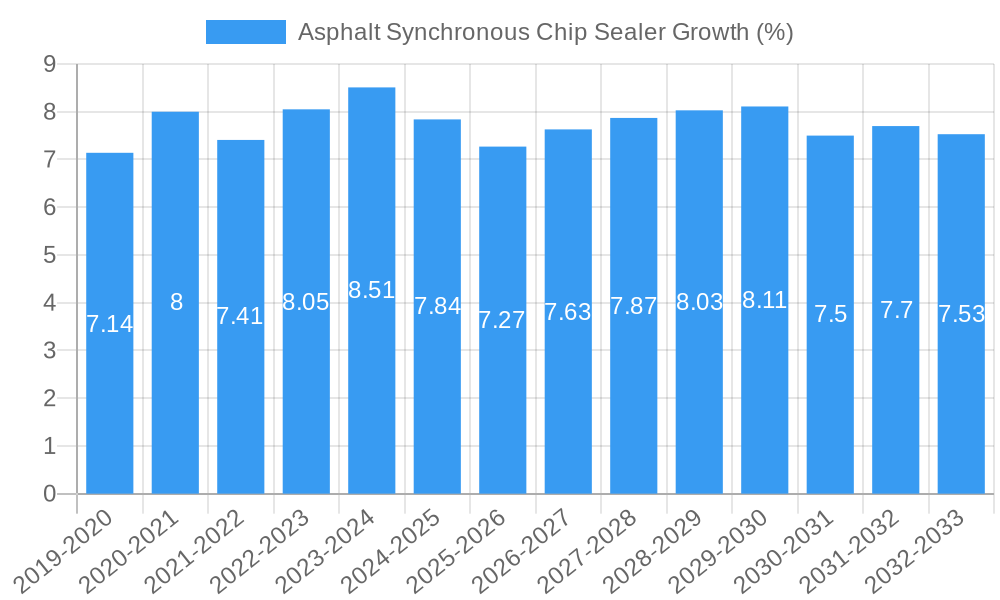

The global Asphalt Synchronous Chip Sealer market is poised for robust expansion, projected to reach approximately $550 million by 2025 and climb to an estimated $900 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 7%. This substantial growth is fueled by an increasing emphasis on road infrastructure development and maintenance worldwide, driven by economic growth and urbanization. Governments and private entities are investing heavily in creating durable and safe road networks, directly benefiting the demand for advanced chip sealing equipment. The technology's ability to efficiently apply a uniform layer of asphalt binder and aggregate in a single pass, ensuring superior sealing and longevity, makes it an indispensable tool for both preventive and corrective road maintenance. This efficiency translates to reduced labor costs and minimized traffic disruption, further accelerating adoption.

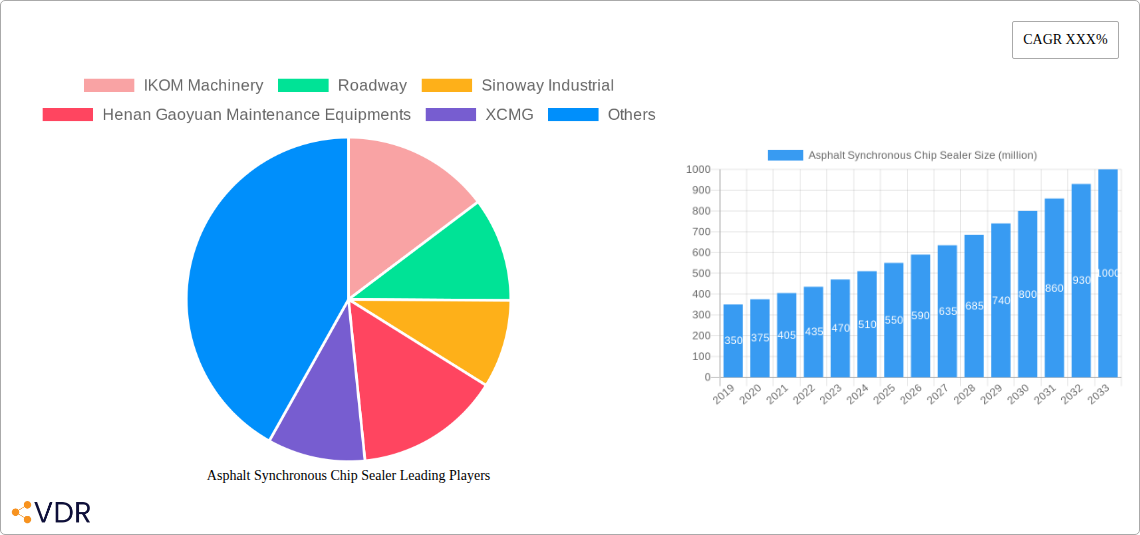

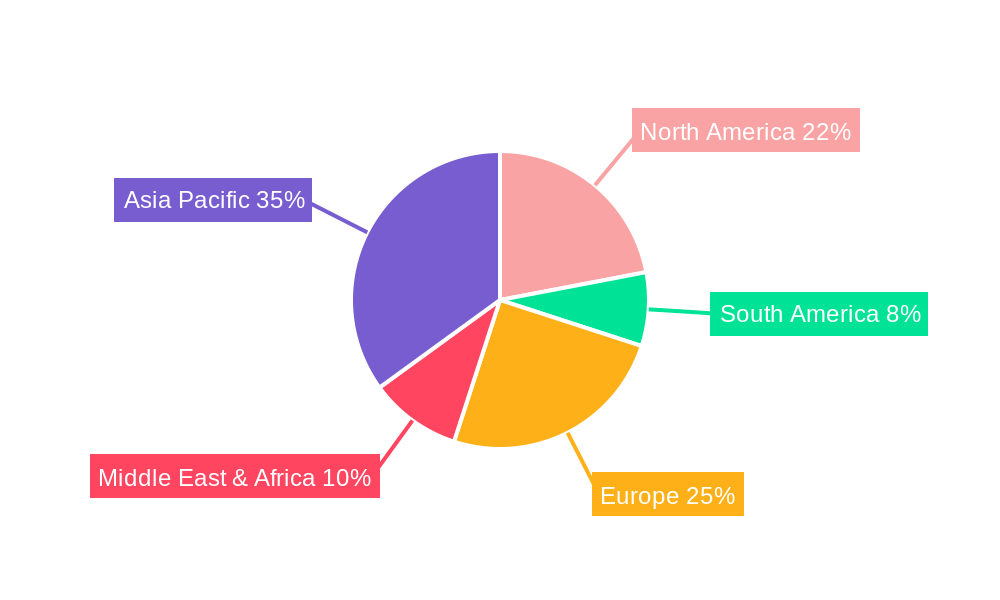

The market is segmented by application into Road Preventive Maintenance and Road Correction Maintenance, with preventive maintenance likely dominating due to the proactive approach to extending road life and reducing long-term repair expenses. In terms of type, both Power-sharing Type Synchronous Chip Sealers and Power-separation Synchronous Chip Sealers cater to diverse operational needs, with technological advancements aiming for increased efficiency, fuel economy, and precision in aggregate distribution. Geographically, Asia Pacific, led by China and India, is expected to be a significant growth engine, owing to massive infrastructure projects and rapid urbanization. North America and Europe will continue to be mature markets with consistent demand driven by the need to maintain aging road networks. Emerging economies in the Middle East & Africa and South America also present substantial untapped potential. Key players are actively engaged in research and development to enhance machine capabilities, expand their product portfolios, and strengthen their global presence through strategic partnerships and acquisitions to capture market share.

Here is a compelling, SEO-optimized report description for the Asphalt Synchronous Chip Sealer market, designed for industry professionals and to maximize search engine visibility.

Asphalt Synchronous Chip Sealer Market Dynamics & Structure

The global Asphalt Synchronous Chip Sealer market is characterized by a moderately concentrated landscape, with key players investing heavily in technological advancements and strategic expansions. Innovation drivers are primarily focused on enhancing the efficiency, durability, and environmental sustainability of chip sealing operations. Regulatory frameworks, particularly those related to road maintenance standards and emissions, are increasingly influencing product development and adoption. Competitive product substitutes, such as slurry sealers and micro-surfacing, pose a moderate threat, but the superior performance and cost-effectiveness of synchronous chip sealing in specific applications maintain its strong market position. End-user demographics are shifting towards a greater demand for advanced, automated, and environmentally friendly road maintenance solutions, driven by governmental infrastructure initiatives and an increasing awareness of road longevity. Mergers and acquisitions (M&A) activity, though not at extreme levels, are present as larger entities seek to consolidate their market share and acquire innovative technologies. For instance, M&A deal volumes are projected to see a steady rise, potentially reaching 5-7 deals annually over the forecast period, with an average deal value of $20-$40 million. Innovation barriers include high initial capital investment for advanced equipment and the need for specialized operator training.

- Market Concentration: Moderate to High, driven by a few dominant global manufacturers.

- Technological Innovation Drivers: Enhanced durability, faster application times, reduced material waste, advanced automation, IoT integration for real-time monitoring.

- Regulatory Frameworks: Stringent environmental regulations (e.g., emissions standards), road quality mandates, and public procurement policies.

- Competitive Product Substitutes: Slurry Sealers, Micro-surfacing, Traditional Chip Sealers.

- End-User Demographics: Government agencies, private road construction and maintenance companies, airport authorities, industrial facilities.

- M&A Trends: Strategic acquisitions for technology integration and market expansion, with an estimated 6 M&A deals annually in the base year 2025.

Asphalt Synchronous Chip Sealer Growth Trends & Insights

The global Asphalt Synchronous Chip Sealer market is poised for significant expansion, driven by the increasing global emphasis on robust road infrastructure and the demand for cost-effective, long-lasting pavement maintenance solutions. The market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2019 to 2033, reaching an estimated market value of $1.8 billion by the end of the forecast period in 2033. Adoption rates are steadily increasing, fueled by the inherent benefits of synchronous chip sealing, including its ability to provide a uniform chip spread, superior adhesion, and a highly durable surface in a single pass. This technology significantly reduces labor costs and application time compared to traditional methods. Technological disruptions are primarily centered on the integration of advanced control systems for precise material application, real-time data analytics for performance monitoring, and the development of more fuel-efficient and environmentally friendly equipment. Consumer behavior shifts are evident, with a growing preference for lifecycle cost-effectiveness and the long-term performance benefits offered by synchronous chip sealing. Market penetration is expected to rise from an estimated 25% in the base year 2025 to over 35% by 2033, particularly in regions with extensive road networks and a proactive approach to preventive maintenance. The adoption of power-sharing type synchronous chip sealers, offering enhanced maneuverability and versatility, is particularly gaining traction in urban and complex terrain applications. The rising investment in smart city initiatives and the need for resilient transportation networks further underscore the growth trajectory. The demand for eco-friendly construction practices is also influencing the market, with manufacturers focusing on reducing material wastage and emissions.

Dominant Regions, Countries, or Segments in Asphalt Synchronous Chip Sealer

The Application: Road Preventive Maintenance segment is the undisputed leader in driving growth within the global Asphalt Synchronous Chip Sealer market. This dominance is a direct consequence of the increasing global recognition of preventive maintenance as a critical strategy for extending the lifespan of road infrastructure, thereby reducing long-term rehabilitation costs.

- Key Drivers for Road Preventive Maintenance Dominance:

- Economic Policies: Governments worldwide are prioritizing infrastructure investment and maintenance, recognizing the economic benefits of well-maintained roads for commerce and connectivity.

- Infrastructure Longevity: The inherent ability of synchronous chip sealers to create a durable, waterproof, and wear-resistant surface makes them ideal for preserving existing road networks.

- Cost-Effectiveness: Proactive maintenance through chip sealing is significantly more economical than reactive major repairs or reconstruction, leading to substantial savings for public and private road owners.

- Reduced Traffic Disruption: The relatively fast application time of synchronous chip sealing minimizes traffic congestion and inconvenience compared to more extensive repair methods.

- Environmental Benefits: By extending road life, preventive maintenance reduces the need for new material production and the associated environmental impact.

In terms of regional dominance, North America currently holds a significant market share, estimated at 35% in the base year 2025. This is attributed to its extensive existing road network, mature infrastructure maintenance practices, and strong government funding for road upkeep. The United States, in particular, with its vast highway systems and ongoing repair initiatives, is a major consumer of asphalt synchronous chip sealers. Europe follows closely, with countries like Germany, the UK, and France actively investing in road network preservation. Asia-Pacific, led by China and India, represents the fastest-growing region due to rapid infrastructure development and increasing investments in road construction and maintenance.

Within the Type segment, the Power-sharing Type Synchronous Chipsealer is emerging as a key growth driver. While the Power-separation type remains substantial, the power-sharing models offer enhanced maneuverability, greater operational flexibility, and often a more integrated, user-friendly system, making them increasingly attractive for a wider range of project sizes and complexities.

Asphalt Synchronous Chip Sealer Product Landscape

The Asphalt Synchronous Chip Sealer product landscape is characterized by continuous innovation aimed at enhancing application precision, material efficiency, and operational safety. Manufacturers are integrating advanced control systems that allow for real-time adjustment of aggregate spread rates and asphalt application, ensuring a uniform and high-quality seal. Performance metrics such as enhanced skid resistance, improved waterproofing, and extended pavement lifespan are key selling propositions. Unique selling propositions often lie in the proprietary aggregate distribution mechanisms and the precise asphalt emulsion spray bar technology, which collectively contribute to reduced material waste and superior bonding. Technological advancements include the development of automated operator interfaces, GPS-guided application, and integrated data logging for project reporting and quality control.

Key Drivers, Barriers & Challenges in Asphalt Synchronous Chip Sealer

Key Drivers: The asphalt synchronous chip sealer market is propelled by the escalating global demand for efficient and cost-effective road maintenance solutions. Government investments in infrastructure development and preservation, coupled with the inherent benefits of synchronous chip sealing such as its ability to extend pavement life, improve road safety, and reduce long-term repair costs, are significant growth catalysts. Technological advancements in automation and control systems further enhance efficiency and application quality.

Key Barriers & Challenges: High initial capital investment for advanced equipment remains a primary barrier for smaller contractors. Fluctuations in asphalt binder and aggregate prices can impact project profitability. Stringent environmental regulations, while driving innovation, can also increase operational compliance costs. Furthermore, a shortage of skilled operators trained to effectively utilize advanced chip sealing machinery poses a challenge. Competitive pressures from alternative pavement maintenance techniques and the need for consistent weather conditions during application can also constrain growth. Supply chain disruptions for specialized components can lead to production delays, estimated to affect 10-15% of new equipment orders in the short term.

Emerging Opportunities in Asphalt Synchronous Chip Sealer

Emerging opportunities for asphalt synchronous chip sealers lie in the increasing adoption of smart road technologies and the growing focus on sustainable construction practices. The development of chip sealers equipped with IoT sensors for real-time performance monitoring and predictive maintenance presents a significant untapped market. Furthermore, expanding applications into industrial areas, mining sites, and private infrastructure projects, beyond traditional public roads, offers new revenue streams. The demand for eco-friendly sealing agents and biodegradable release agents is also an evolving preference, presenting opportunities for manufacturers to develop greener product lines.

Growth Accelerators in the Asphalt Synchronous Chip Sealer Industry

Long-term growth in the asphalt synchronous chip sealer industry is being accelerated by ongoing technological breakthroughs, particularly in autonomous operation and artificial intelligence for optimized application. Strategic partnerships between equipment manufacturers and material suppliers are fostering integrated solutions and driving innovation. Market expansion strategies focusing on emerging economies with burgeoning infrastructure needs, coupled with the increasing awareness of the lifecycle cost benefits of synchronous chip sealing, are key growth accelerators. The continuous improvement in the durability and performance of chip seal surfaces, leading to extended road lifecycles, further solidifies market expansion.

Key Players Shaping the Asphalt Synchronous Chip Sealer Market

- IKOM Machinery

- Roadway

- Sinoway Industrial

- Henan Gaoyuan Maintenance Equipments

- XCMG

- Dagang

- Xinxiang Minxiu Road Machinery

- Liangshan Guangtong Special Vehicle Manufacturing

- China National Heavy Duty Truck Group(SINOTRUK)

- CLW Special Automobile

- Shandong Luda Machinery

- Shaanxi Heavy Duty Automobile

- Hubei Wanglong Special Purpose Vehicle

- Zhejiang MeTong Road Construction Machinery

- Hubei Tongxing Special Vehicle

Notable Milestones in Asphalt Synchronous Chip Sealer Sector

- 2019: Introduction of advanced GPS-guided chip distribution systems by leading manufacturers, enhancing precision and reducing manual intervention.

- 2020: Increased focus on electric or hybrid-powered chip sealing equipment prototypes, responding to environmental concerns.

- 2021: Launch of integrated data logging and reporting features in new models, facilitating better project management and quality assurance.

- 2022: Significant adoption of power-sharing type chip sealers for greater maneuverability in urban and complex road networks.

- 2023: Development of enhanced asphalt emulsion spray bar technology for more uniform and controlled application, improving chip adhesion.

- 2024: Growing market interest in modular chip sealing units adaptable to various chassis, offering greater flexibility.

- 2025 (Projected): Anticipated introduction of AI-driven predictive maintenance alerts for chip sealer equipment.

In-Depth Asphalt Synchronous Chip Sealer Market Outlook

The Asphalt Synchronous Chip Sealer market outlook is exceptionally positive, driven by a confluence of factors that underscore its indispensable role in modern infrastructure management. Growth accelerators, including the relentless pursuit of technological innovation in automation and data analytics, alongside strategic global partnerships, are charting a course for sustained market expansion. The increasing integration of sustainable practices and materials will further bolster demand. As economies worldwide continue to prioritize robust and resilient transportation networks, the cost-effectiveness and superior performance of synchronous chip sealing will remain a cornerstone of road maintenance strategies. The market is projected to capitalize on emerging opportunities in developing regions and specialized applications, ensuring a dynamic and growing industry.

Asphalt Synchronous Chip Sealer Segmentation

-

1. Application

- 1.1. Road Preventive Maintenance

- 1.2. Road Correction Maintenance

-

2. Type

- 2.1. Power-sharing Type Synchronous Chipsealer

- 2.2. Power-separation Synchronous Chipsealer

Asphalt Synchronous Chip Sealer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Asphalt Synchronous Chip Sealer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asphalt Synchronous Chip Sealer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Road Preventive Maintenance

- 5.1.2. Road Correction Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Power-sharing Type Synchronous Chipsealer

- 5.2.2. Power-separation Synchronous Chipsealer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Asphalt Synchronous Chip Sealer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Road Preventive Maintenance

- 6.1.2. Road Correction Maintenance

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Power-sharing Type Synchronous Chipsealer

- 6.2.2. Power-separation Synchronous Chipsealer

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Asphalt Synchronous Chip Sealer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Road Preventive Maintenance

- 7.1.2. Road Correction Maintenance

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Power-sharing Type Synchronous Chipsealer

- 7.2.2. Power-separation Synchronous Chipsealer

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Asphalt Synchronous Chip Sealer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Road Preventive Maintenance

- 8.1.2. Road Correction Maintenance

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Power-sharing Type Synchronous Chipsealer

- 8.2.2. Power-separation Synchronous Chipsealer

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Asphalt Synchronous Chip Sealer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Road Preventive Maintenance

- 9.1.2. Road Correction Maintenance

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Power-sharing Type Synchronous Chipsealer

- 9.2.2. Power-separation Synchronous Chipsealer

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Asphalt Synchronous Chip Sealer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Road Preventive Maintenance

- 10.1.2. Road Correction Maintenance

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Power-sharing Type Synchronous Chipsealer

- 10.2.2. Power-separation Synchronous Chipsealer

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IKOM Machinery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Roadway

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sinoway Industrial

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Henan Gaoyuan Maintenance Equipments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XCMG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dagang

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Xinxiang Minxiu Road Machinery

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Liangshan Guangtong Special Vehicle Manufacturing

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China National Heavy Duty Truck Group(SINOTRUK)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CLW Special Automobile

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shandong Luda Machinery

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shaanxi Heavy Duty Automobile

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hubei Wanglong Special Purpose Vehicle

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zhejiang MeTong Road Construction Machinery

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hubei Tongxing Special Vehicle

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 IKOM Machinery

List of Figures

- Figure 1: Global Asphalt Synchronous Chip Sealer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Asphalt Synchronous Chip Sealer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Asphalt Synchronous Chip Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Asphalt Synchronous Chip Sealer Revenue (million), by Type 2024 & 2032

- Figure 5: North America Asphalt Synchronous Chip Sealer Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Asphalt Synchronous Chip Sealer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Asphalt Synchronous Chip Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Asphalt Synchronous Chip Sealer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Asphalt Synchronous Chip Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Asphalt Synchronous Chip Sealer Revenue (million), by Type 2024 & 2032

- Figure 11: South America Asphalt Synchronous Chip Sealer Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Asphalt Synchronous Chip Sealer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Asphalt Synchronous Chip Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Asphalt Synchronous Chip Sealer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Asphalt Synchronous Chip Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Asphalt Synchronous Chip Sealer Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Asphalt Synchronous Chip Sealer Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Asphalt Synchronous Chip Sealer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Asphalt Synchronous Chip Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Asphalt Synchronous Chip Sealer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Asphalt Synchronous Chip Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Asphalt Synchronous Chip Sealer Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Asphalt Synchronous Chip Sealer Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Asphalt Synchronous Chip Sealer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Asphalt Synchronous Chip Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Asphalt Synchronous Chip Sealer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Asphalt Synchronous Chip Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Asphalt Synchronous Chip Sealer Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Asphalt Synchronous Chip Sealer Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Asphalt Synchronous Chip Sealer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Asphalt Synchronous Chip Sealer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Asphalt Synchronous Chip Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Asphalt Synchronous Chip Sealer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asphalt Synchronous Chip Sealer?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Asphalt Synchronous Chip Sealer?

Key companies in the market include IKOM Machinery, Roadway, Sinoway Industrial, Henan Gaoyuan Maintenance Equipments, XCMG, Dagang, Xinxiang Minxiu Road Machinery, Liangshan Guangtong Special Vehicle Manufacturing, China National Heavy Duty Truck Group(SINOTRUK), CLW Special Automobile, Shandong Luda Machinery, Shaanxi Heavy Duty Automobile, Hubei Wanglong Special Purpose Vehicle, Zhejiang MeTong Road Construction Machinery, Hubei Tongxing Special Vehicle.

3. What are the main segments of the Asphalt Synchronous Chip Sealer?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asphalt Synchronous Chip Sealer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asphalt Synchronous Chip Sealer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asphalt Synchronous Chip Sealer?

To stay informed about further developments, trends, and reports in the Asphalt Synchronous Chip Sealer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence