Key Insights

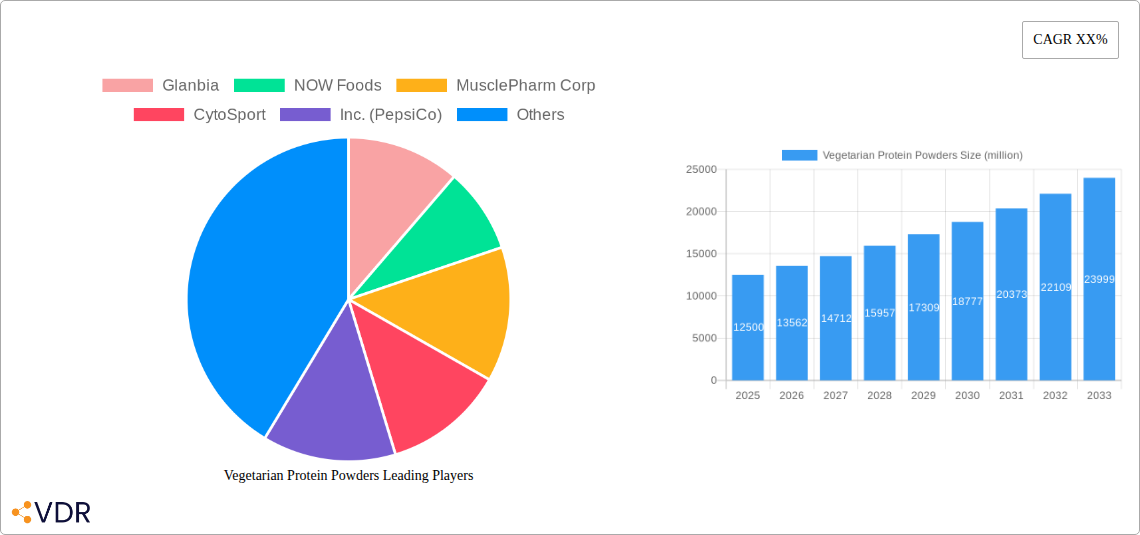

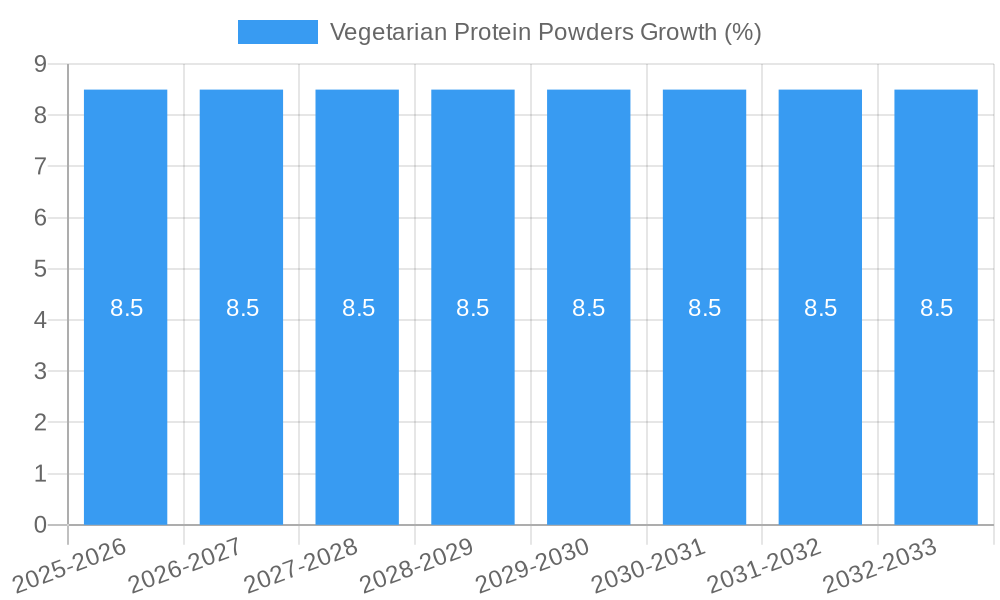

The global Vegetarian Protein Powders market is experiencing robust growth, projected to reach a significant market size of $12,500 million by 2025, driven by an increasing consumer shift towards plant-based diets and a heightened awareness of health and wellness. This trend is further amplified by the expanding availability of diverse vegetarian protein sources like soy, wheat, and pea protein, catering to a broader range of dietary preferences and nutritional needs. The market is anticipated to expand at a compound annual growth rate (CAGR) of 8.5% from 2025 to 2033, underscoring its strong upward trajectory. Key drivers include the perceived health benefits of plant-based proteins, such as improved digestion and lower cholesterol levels, coupled with growing concerns regarding the environmental impact and ethical considerations associated with animal agriculture. The burgeoning fitness and sports nutrition sectors also play a pivotal role, with vegetarian protein powders becoming a staple for athletes and fitness enthusiasts seeking to optimize muscle recovery and growth. The convenience offered by direct-to-customer (DTC) channels and the expanding reach of online stores are further facilitating market penetration and accessibility for consumers worldwide.

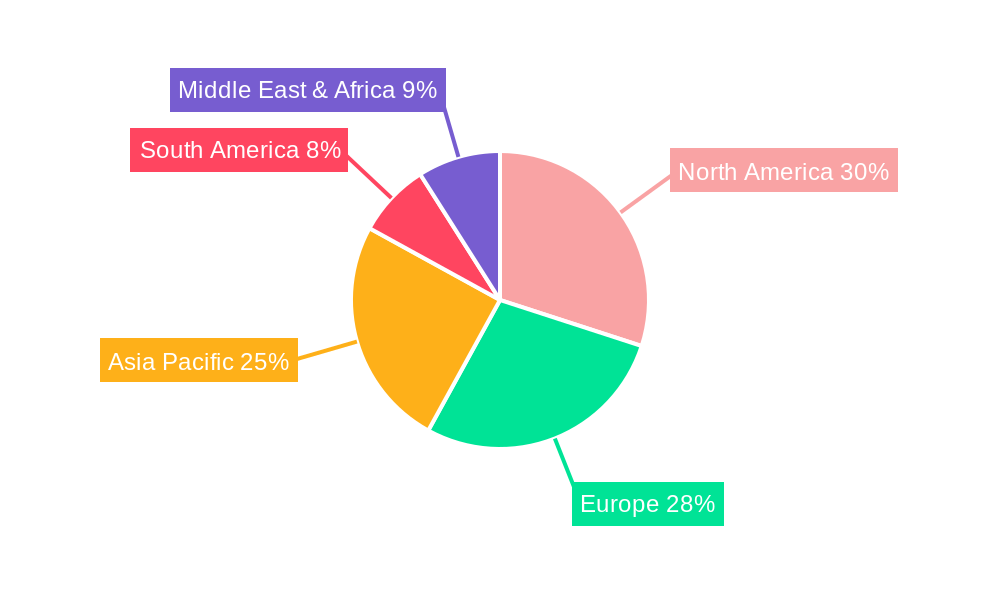

Despite the optimistic outlook, certain restraints could influence the market's pace. While protein quality and taste are continually improving, some consumers still perceive plant-based proteins as less effective or palatable than their animal-based counterparts. The higher cost of some specialized vegetarian protein sources compared to conventional whey protein can also act as a barrier for price-sensitive consumers. However, innovation in product formulation, including the development of novel protein blends and enhanced flavor profiles, is actively addressing these challenges. Emerging trends such as the demand for organic and non-GMO certified vegetarian protein powders, as well as the integration of functional ingredients like probiotics and digestive enzymes, are poised to shape future market dynamics. Geographically, North America and Europe are leading the charge in adoption, owing to well-established health and wellness trends and a higher prevalence of vegetarianism and veganism. The Asia Pacific region, with its rapidly growing middle class and increasing disposable income, presents a substantial growth opportunity for vegetarian protein powder manufacturers.

This in-depth report offers a definitive analysis of the global Vegetarian Protein Powders market, charting its trajectory from 2019 to 2033. With a base year of 2025, the report provides critical insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, challenges, emerging opportunities, and future outlook. Leveraging extensive data and industry expertise, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning vegetarian protein powders sector.

Vegetarian Protein Powders Market Dynamics & Structure

The global Vegetarian Protein Powders market exhibits a moderately concentrated structure, with a blend of large multinational corporations and agile niche players. Technological innovation, particularly in extraction and formulation techniques, is a significant driver, enhancing bioavailability and taste profiles. Regulatory frameworks, while generally supportive of food supplements, vary by region concerning labeling and permissible ingredients, influencing market entry and product development. Competitive product substitutes, including animal-based proteins and whole food sources, exert pressure, necessitating continuous product differentiation. End-user demographics are shifting towards a younger, health-conscious population, increasingly influenced by sustainability concerns and ethical considerations. Mergers and acquisitions (M&A) trends indicate strategic consolidation and expansion, with an estimated XX M&A deals in the historical period (2019-2024), aiming to broaden product portfolios and market reach.

- Market Concentration: Moderately consolidated, with key players holding substantial market share.

- Technological Innovation: Focus on improved taste, texture, and absorption rates.

- Regulatory Landscape: Evolving but generally favorable, with regional variations impacting market access.

- Competitive Substitutes: Animal proteins, whole foods, and alternative plant-based supplements.

- End-User Demographics: Growing demand from millennials and Gen Z, driven by health and ethical values.

- M&A Activity: Strategic acquisitions to enhance market position and expand product offerings.

Vegetarian Protein Powders Growth Trends & Insights

The vegetarian protein powders market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This expansion is fueled by escalating consumer awareness regarding the health benefits of plant-based diets, including improved digestion, weight management, and muscle building. The increasing prevalence of lifestyle diseases and a proactive approach to wellness further bolsters demand. Technological disruptions, such as advancements in plant protein isolation and flavoring technologies, are enhancing product appeal and overcoming traditional taste and texture challenges, leading to higher adoption rates. Consumer behavior is shifting significantly, with a growing preference for transparent ingredient sourcing, sustainable production methods, and personalized nutrition solutions. Market penetration is steadily increasing across various demographics, indicating a broadening consumer base beyond traditional vegan and vegetarian communities. The market size is estimated to reach XXX million units by 2033, reflecting a significant upward trend from the historical XX million units recorded in 2024.

Dominant Regions, Countries, or Segments in Vegetarian Protein Powders

North America currently dominates the global vegetarian protein powders market, driven by a strong consumer preference for health and wellness products and a well-established infrastructure for dietary supplements. The United States, in particular, leads in market share due to a high disposable income, a culture that embraces fitness, and robust distribution networks.

- Dominant Region: North America.

- Leading Country: United States.

- Key Application Segment: Online Stores are exhibiting the fastest growth, mirroring broader e-commerce trends, alongside strong performance from Supermarkets & Hypermarkets.

- Key Type Segment: Pea Protein is emerging as a dominant type due to its excellent amino acid profile, allergen-friendly nature, and sustainable sourcing, surpassing Soy Protein in certain sub-segments.

Factors Contributing to North American Dominance:

- High Disposable Income: Consumers can afford premium health and wellness products.

- Health and Wellness Culture: Widespread adoption of active lifestyles and dietary supplements.

- Robust Distribution Networks: Extensive availability through online platforms, supermarkets, and specialty stores.

- Government Support & Initiatives: Favorable policies promoting healthy eating and dietary supplements.

- Consumer Awareness: High awareness of the benefits of plant-based diets and protein supplementation.

Growth Potential in Other Regions:

- Europe: Strong growth driven by increasing veganism and vegetarianism, and a focus on sustainable food choices.

- Asia-Pacific: Rapidly expanding market fueled by rising health consciousness, increasing disposable incomes, and the adoption of Western dietary trends.

Vegetarian Protein Powders Product Landscape

The vegetarian protein powders landscape is characterized by continuous innovation, focusing on enhancing nutritional profiles and consumer experience. Products now offer complete amino acid profiles, often achieved through blends of different plant sources like pea, rice, and hemp. Innovations in natural flavoring and sweetening agents have significantly improved taste, addressing a key historical barrier. Applications extend beyond basic post-workout recovery to include meal replacements, healthy snacking options, and specialized dietary formulations for individuals with allergies or specific health goals. Performance metrics are increasingly scrutinized, with a focus on digestibility, absorption rates, and the absence of common allergens.

Key Drivers, Barriers & Challenges in Vegetarian Protein Powders

Key Drivers:

- Rising Health and Wellness Trends: Increasing global focus on healthy lifestyles and preventative healthcare.

- Growing Vegan and Vegetarian Population: A significant demographic shift towards plant-based diets.

- Ethical and Environmental Concerns: Consumer awareness of the sustainability and ethical implications of food choices.

- Product Innovation: Continuous development of improved taste, texture, and bioavailability.

- Availability and Accessibility: Expanding distribution channels, particularly online.

Barriers & Challenges:

- Taste and Texture Preferences: Historical challenges in mimicking the palatability of animal-based proteins.

- Regulatory Hurdles: Varying regulations on labeling, claims, and ingredient sourcing across different countries.

- Supply Chain Volatility: Dependence on agricultural outputs can lead to price fluctuations and availability issues.

- Competition from Animal Proteins: Established market and consumer familiarity with whey and casein proteins.

- Consumer Misconceptions: Lack of awareness or misinformation regarding the efficacy of plant-based proteins.

Emerging Opportunities in Vegetarian Protein Powders

Emerging opportunities lie in developing specialized vegetarian protein powders tailored for specific dietary needs, such as those for athletes with high protein demands or individuals with digestive sensitivities. The untapped potential in emerging economies, driven by a burgeoning middle class and increasing health consciousness, presents a significant growth avenue. Innovative applications in the food and beverage industry, including the incorporation of vegetarian protein powders into plant-based dairy alternatives, baked goods, and ready-to-drink beverages, offer new avenues for market penetration. Furthermore, advancements in sustainable sourcing and production, coupled with transparent labeling, will cater to the growing demand for eco-conscious products.

Growth Accelerators in the Vegetarian Protein Powders Industry

Technological breakthroughs in plant protein processing, leading to superior taste and texture, are key accelerators. Strategic partnerships between protein powder manufacturers and food & beverage companies are expanding product applications and market reach. Furthermore, aggressive marketing campaigns highlighting the health and environmental benefits of vegetarian protein powders are significantly contributing to market expansion. The increasing investment in research and development by major players, focusing on novel plant protein sources and enhanced functional properties, will further propel long-term growth.

Key Players Shaping the Vegetarian Protein Powders Market

- Glanbia

- NOW Foods

- MusclePharm Corp

- CytoSport, Inc. (PepsiCo)

- Simply Good Foods

- NBTY (The Bountiful Company)

- AMCO Proteins

- Iovate Health Sciences International

- Nutrabolt

- Dymatize Enterprises

- Jym Supplement Science

- RSP Nutrition

- BPI Sports LLC

- International Dehydrated Foods

- BRF

- Rousselot

- Gelita

- Hoogwegt

Notable Milestones in Vegetarian Protein Powders Sector

- 2020: Increased consumer adoption of plant-based diets due to health and environmental concerns, boosting sales.

- 2021: Launch of new pea protein isolate products with improved taste and solubility by major manufacturers.

- 2022: Growing investment in R&D for novel plant protein sources like fava bean and sunflower seed.

- 2023: Expansion of online retail channels, making vegetarian protein powders more accessible globally.

- 2024: Growing emphasis on sustainable sourcing and packaging initiatives by leading brands.

In-Depth Vegetarian Protein Powders Market Outlook

- 2020: Increased consumer adoption of plant-based diets due to health and environmental concerns, boosting sales.

- 2021: Launch of new pea protein isolate products with improved taste and solubility by major manufacturers.

- 2022: Growing investment in R&D for novel plant protein sources like fava bean and sunflower seed.

- 2023: Expansion of online retail channels, making vegetarian protein powders more accessible globally.

- 2024: Growing emphasis on sustainable sourcing and packaging initiatives by leading brands.

In-Depth Vegetarian Protein Powders Market Outlook

The vegetarian protein powders market is poised for sustained and significant growth, driven by a confluence of escalating health consciousness, ethical dietary choices, and continuous product innovation. The increasing demand for plant-based alternatives, coupled with technological advancements enhancing product quality and accessibility, positions the market for substantial expansion. Strategic partnerships and focused R&D will unlock new product categories and market segments, while growing awareness of sustainability will further fuel consumer preference. The outlook for vegetarian protein powders is exceptionally strong, presenting a wealth of opportunities for growth and market leadership in the coming decade.

Vegetarian Protein Powders Segmentation

-

1. Application

- 1.1. Supermarkets & Hypermarkets

- 1.2. Online Stores

- 1.3. Direct to Customers (DTC)

- 1.4. Others

-

2. Types

- 2.1. Soy Protein

- 2.2. Wheat Protein

- 2.3. Pea Protein

- 2.4. Others

Vegetarian Protein Powders Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vegetarian Protein Powders REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vegetarian Protein Powders Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Supermarkets & Hypermarkets

- 5.1.2. Online Stores

- 5.1.3. Direct to Customers (DTC)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Soy Protein

- 5.2.2. Wheat Protein

- 5.2.3. Pea Protein

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vegetarian Protein Powders Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Supermarkets & Hypermarkets

- 6.1.2. Online Stores

- 6.1.3. Direct to Customers (DTC)

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Soy Protein

- 6.2.2. Wheat Protein

- 6.2.3. Pea Protein

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Vegetarian Protein Powders Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Supermarkets & Hypermarkets

- 7.1.2. Online Stores

- 7.1.3. Direct to Customers (DTC)

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Soy Protein

- 7.2.2. Wheat Protein

- 7.2.3. Pea Protein

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Vegetarian Protein Powders Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Supermarkets & Hypermarkets

- 8.1.2. Online Stores

- 8.1.3. Direct to Customers (DTC)

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Soy Protein

- 8.2.2. Wheat Protein

- 8.2.3. Pea Protein

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Vegetarian Protein Powders Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Supermarkets & Hypermarkets

- 9.1.2. Online Stores

- 9.1.3. Direct to Customers (DTC)

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Soy Protein

- 9.2.2. Wheat Protein

- 9.2.3. Pea Protein

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Vegetarian Protein Powders Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Supermarkets & Hypermarkets

- 10.1.2. Online Stores

- 10.1.3. Direct to Customers (DTC)

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Soy Protein

- 10.2.2. Wheat Protein

- 10.2.3. Pea Protein

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Glanbia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NOW Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MusclePharm Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CytoSport

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inc. (PepsiCo)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Simply Good Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NBTY (The Bountiful Company)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AMCO Proteins

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Iovate Health Sciences International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nutrabolt

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dymatize Enterprises

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Jym Supplement Science

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 RSP Nutrition

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BPI Sports LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 International Dehydrated Foods

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 BRF

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Rousselot

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Gelita

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hoogwegt

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Glanbia

List of Figures

- Figure 1: Global Vegetarian Protein Powders Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Vegetarian Protein Powders Revenue (million), by Application 2024 & 2032

- Figure 3: North America Vegetarian Protein Powders Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Vegetarian Protein Powders Revenue (million), by Types 2024 & 2032

- Figure 5: North America Vegetarian Protein Powders Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Vegetarian Protein Powders Revenue (million), by Country 2024 & 2032

- Figure 7: North America Vegetarian Protein Powders Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Vegetarian Protein Powders Revenue (million), by Application 2024 & 2032

- Figure 9: South America Vegetarian Protein Powders Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Vegetarian Protein Powders Revenue (million), by Types 2024 & 2032

- Figure 11: South America Vegetarian Protein Powders Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Vegetarian Protein Powders Revenue (million), by Country 2024 & 2032

- Figure 13: South America Vegetarian Protein Powders Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Vegetarian Protein Powders Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Vegetarian Protein Powders Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Vegetarian Protein Powders Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Vegetarian Protein Powders Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Vegetarian Protein Powders Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Vegetarian Protein Powders Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Vegetarian Protein Powders Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Vegetarian Protein Powders Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Vegetarian Protein Powders Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Vegetarian Protein Powders Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Vegetarian Protein Powders Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Vegetarian Protein Powders Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Vegetarian Protein Powders Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Vegetarian Protein Powders Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Vegetarian Protein Powders Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Vegetarian Protein Powders Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Vegetarian Protein Powders Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Vegetarian Protein Powders Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vegetarian Protein Powders Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Vegetarian Protein Powders Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Vegetarian Protein Powders Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Vegetarian Protein Powders Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Vegetarian Protein Powders Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Vegetarian Protein Powders Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Vegetarian Protein Powders Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Vegetarian Protein Powders Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Vegetarian Protein Powders Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Vegetarian Protein Powders Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Vegetarian Protein Powders Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Vegetarian Protein Powders Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Vegetarian Protein Powders Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Vegetarian Protein Powders Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Vegetarian Protein Powders Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Vegetarian Protein Powders Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Vegetarian Protein Powders Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Vegetarian Protein Powders Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Vegetarian Protein Powders Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Vegetarian Protein Powders Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vegetarian Protein Powders?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Vegetarian Protein Powders?

Key companies in the market include Glanbia, NOW Foods, MusclePharm Corp, CytoSport, Inc. (PepsiCo), Simply Good Foods, NBTY (The Bountiful Company), AMCO Proteins, Iovate Health Sciences International, Nutrabolt, Dymatize Enterprises, Jym Supplement Science, RSP Nutrition, BPI Sports LLC, International Dehydrated Foods, BRF, Rousselot, Gelita, Hoogwegt.

3. What are the main segments of the Vegetarian Protein Powders?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vegetarian Protein Powders," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vegetarian Protein Powders report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vegetarian Protein Powders?

To stay informed about further developments, trends, and reports in the Vegetarian Protein Powders, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence