Key Insights

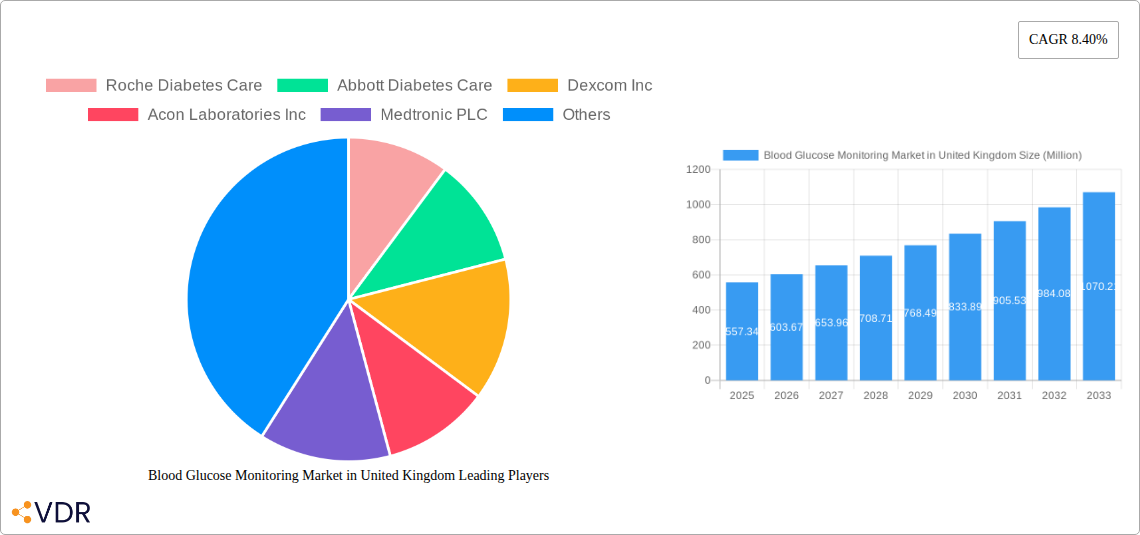

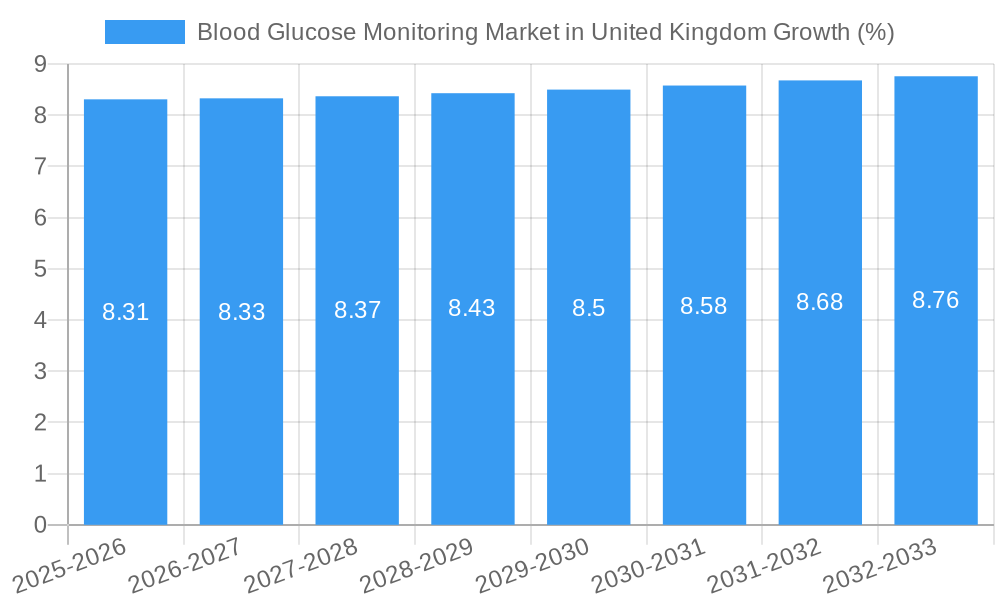

The United Kingdom blood glucose monitoring market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 8.40% from a base of approximately $557.34 million. This robust growth is primarily fueled by the escalating prevalence of diabetes within the UK, driven by factors such as an aging population, sedentary lifestyles, and increasing rates of obesity. The continuous rise in diagnosed and undiagnosed diabetes cases directly translates to a higher demand for effective blood glucose monitoring solutions. Furthermore, heightened patient awareness regarding proactive diabetes management and the associated long-term health complications is a critical driver, encouraging individuals to regularly monitor their glucose levels to prevent or delay disease progression. Technological advancements also play a pivotal role, with the introduction of more user-friendly, accurate, and connected devices, including continuous glucose monitoring (CGM) systems, which offer greater convenience and real-time insights for both patients and healthcare providers. The increasing adoption of these innovative technologies is expected to further stimulate market growth.

The market is segmented into self-monitoring blood glucose devices, encompassing glucometers, test strips, and lancets, and continuous blood glucose monitoring devices, which include sensors and durables like receivers and transmitters. While self-monitoring devices currently hold a substantial market share due to their affordability and widespread availability, the continuous glucose monitoring segment is experiencing rapid growth. This surge is attributed to the superior benefits of CGM in providing comprehensive data, enabling better treatment adjustments, and improving the quality of life for individuals with diabetes. The distribution channels are also evolving, with a noticeable shift towards online platforms, offering greater accessibility and convenience to consumers, alongside traditional offline channels. Key players such as Roche Diabetes Care, Abbott Diabetes Care, and Dexcom Inc. are actively investing in research and development, expanding their product portfolios, and forging strategic partnerships to capture a larger share of this dynamic market. The UK government's focus on preventative healthcare and diabetes management initiatives further underpins the positive market outlook.

United Kingdom Blood Glucose Monitoring Market Analysis: A Comprehensive Report

This report offers a detailed examination of the United Kingdom's blood glucose monitoring market, a vital sector within the healthcare industry. It provides in-depth analysis of market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, and the strategic initiatives of leading players. With a focus on both self-monitoring blood glucose devices (SMBG) and continuous blood glucose monitoring (CGM) devices, this report is an indispensable resource for manufacturers, distributors, investors, and healthcare professionals seeking to understand and capitalize on the evolving UK market. The study covers the historical period of 2019–2024, the base and estimated year of 2025, and a robust forecast period extending to 2033. All values are presented in Million Units.

Blood Glucose Monitoring Market in United Kingdom Market Dynamics & Structure

The United Kingdom's blood glucose monitoring market exhibits a dynamic and evolving structure, characterized by increasing technological integration and a growing awareness of diabetes management. Market concentration is moderately high, with key global players like Roche Diabetes Care and Abbott Diabetes Care holding significant shares, particularly in the SMBG segment. However, the rise of CGM technologies is introducing new competitive dynamics and fragmenting market share. Technological innovation is a primary driver, fueled by advancements in sensor accuracy, connectivity, and user-friendliness. Regulatory frameworks, overseen by bodies such as the MHRA, play a crucial role in ensuring product safety and efficacy, influencing market entry and product development strategies. Competitive product substitutes are emerging, especially in the realm of non-invasive monitoring technologies, posing a potential threat to traditional blood glucose meters. End-user demographics are shifting, with an aging population and a rising prevalence of type 2 diabetes contributing to sustained demand. Mergers and acquisitions (M&A) trends are observed as larger companies seek to consolidate their market position and acquire innovative technologies.

- Market Concentration: Moderate to High, with key global players dominating.

- Technological Innovation Drivers: Accuracy, miniaturization, connectivity, user experience, and data analytics.

- Regulatory Frameworks: MHRA approval, data privacy (GDPR).

- Competitive Product Substitutes: Non-invasive glucose monitoring technologies, emerging diagnostic tools.

- End-User Demographics: Aging population, increasing diabetes prevalence, growing demand for personalized care.

- M&A Trends: Consolidation of market share, acquisition of innovative technologies, strategic partnerships.

Blood Glucose Monitoring Market in United Kingdom Growth Trends & Insights

The United Kingdom blood glucose monitoring market is projected to experience significant growth, driven by a confluence of factors including an increasing prevalence of diabetes, a growing focus on proactive health management, and substantial advancements in monitoring technologies. The market size is expected to witness a compound annual growth rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated value of 250 Million Units by 2033, up from 150 Million Units in 2025. This upward trajectory is largely attributed to the expanding adoption rates of continuous blood glucose monitoring (CGM) devices, which offer unparalleled insights into glucose fluctuations and trends, thereby enabling more effective diabetes management. Technological disruptions, such as the development of more affordable and user-friendly CGM systems and the integration of AI-powered predictive analytics, are further accelerating market penetration. Consumer behavior is shifting towards proactive health monitoring, with individuals increasingly seeking convenient and less invasive methods to track their health parameters. The increasing awareness campaigns regarding diabetes complications and the benefits of early detection and consistent monitoring are also playing a pivotal role. The shift from reactive to proactive healthcare strategies within the UK healthcare system further supports the adoption of advanced blood glucose monitoring solutions. The demand for integrated diabetes management platforms, which combine glucose readings with insulin delivery data and lifestyle tracking, is also on the rise, indicating a move towards holistic patient care.

Dominant Regions, Countries, or Segments in Blood Glucose Monitoring Market in United Kingdom

Within the United Kingdom blood glucose monitoring market, the segment of Continuous Blood Glucose Monitoring (CGM) Devices is emerging as the primary growth engine, demonstrating the most significant market share and highest projected expansion. This dominance is primarily driven by the inherent advantages of CGM over traditional Self-Monitoring Blood Glucose (SMBG) devices, including the ability to provide real-time glucose data, trend information, and alerts for hypoglycemia and hyperglycemia, thereby empowering users with proactive diabetes management capabilities. The Sensors sub-segment within CGM devices is particularly noteworthy, experiencing rapid growth due to technological advancements that enhance accuracy, longevity, and ease of use. Durables (Receivers and Transmitters) are also seeing increased adoption as they form the core infrastructure for CGM systems.

The Online distribution channel is rapidly gaining traction, mirroring broader e-commerce trends in the UK. This channel offers convenience, competitive pricing, and wider product availability, particularly for CGM consumables like sensors. While Offline channels, including pharmacies and medical supply stores, remain significant, their market share in the CGM segment is gradually being supplemented by online retail. The increasing number of individuals diagnosed with diabetes, coupled with a growing awareness of the benefits of advanced monitoring technologies, is a fundamental driver for the entire market, but it disproportionately benefits the CGM segment. Government initiatives promoting preventative healthcare and the National Health Service (NHS)’s increasing focus on chronic disease management further bolster the demand for effective monitoring solutions. The economic policies supporting healthcare innovation and the established healthcare infrastructure in the UK provide a fertile ground for the widespread adoption of advanced blood glucose monitoring technologies.

- Dominant Segment: Continuous Blood Glucose Monitoring Devices (CGM)

- Key Sub-Segments Driving Growth: Sensors, Durables (Receivers and Transmitters)

- Dominant Distribution Channel: Online

- Drivers: Convenience, competitive pricing, accessibility.

- Underlying Market Drivers:

- Rising diabetes prevalence in the UK.

- Increased patient and physician awareness of CGM benefits.

- Government initiatives for proactive healthcare.

- NHS focus on chronic disease management.

- Supportive healthcare infrastructure and economic policies.

Blood Glucose Monitoring Market in United Kingdom Product Landscape

The United Kingdom blood glucose monitoring market is characterized by a continuous stream of innovative products aimed at improving user experience and therapeutic outcomes. Key product innovations include the development of smaller, more discreet CGM sensors with extended wear times, and "all-in-one" disposable CGM systems that simplify the insertion process. Advancements in sensor technology are leading to enhanced accuracy and reduced need for fingerstick calibrations. Smart insulin pens integrated with CGM data are also gaining traction, offering real-time dosing guidance. These products offer unique selling propositions such as seamless integration with smartphone applications for data tracking and sharing, improved comfort, and reduced invasiveness, all contributing to better adherence and overall diabetes management.

Key Drivers, Barriers & Challenges in Blood Glucose Monitoring Market in United Kingdom

Key Drivers:

- Rising Diabetes Prevalence: The increasing incidence of type 1 and type 2 diabetes in the UK creates a consistent and growing demand for blood glucose monitoring solutions.

- Technological Advancements: Innovations in CGM accuracy, connectivity, and usability, alongside the development of integrated diabetes management platforms, are key growth catalysts.

- Growing Health Consciousness: An increasing number of individuals are proactively managing their health, leading to higher adoption of home monitoring devices.

- Government Support and Healthcare Policies: Initiatives promoting preventative care and chronic disease management within the NHS encourage the use of advanced monitoring tools.

Barriers & Challenges:

- Cost of Advanced Devices: The higher price point of CGM devices compared to traditional SMBG can be a significant barrier to widespread adoption, especially for those with limited financial resources or without adequate insurance coverage.

- Reimbursement Policies: Inconsistent or limited reimbursement policies for CGM devices within the NHS can hinder uptake.

- Data Overload and Interpretation: While data is valuable, managing and interpreting the vast amounts of information generated by CGM can be challenging for some users and healthcare providers.

- User Training and Education: Proper understanding and utilization of advanced monitoring systems require adequate training, which may not always be readily available.

- Competition and Market Saturation: Intense competition among established players and emerging entrants can lead to price pressures and market saturation in certain segments.

Emerging Opportunities in Blood Glucose Monitoring Market in United Kingdom

Emerging opportunities in the UK blood glucose monitoring market lie in the development and wider adoption of non-invasive glucose monitoring technologies, which promise to revolutionize diabetes care by eliminating the need for finger pricks. The integration of artificial intelligence (AI) and machine learning (ML) into diabetes management platforms presents a significant opportunity to offer personalized insights, predictive analytics for glucose trends, and automated treatment recommendations. Expansion of remote patient monitoring programs leveraging connected glucose monitoring devices is another key area, facilitating better chronic disease management and reducing hospitalizations. Furthermore, the increasing demand for integrated solutions that combine glucose monitoring with insulin delivery systems and lifestyle tracking offers a promising avenue for innovation and market growth.

Growth Accelerators in the Blood Glucose Monitoring Market in United Kingdom Industry

Several catalysts are accelerating the growth of the UK blood glucose monitoring industry. Technological breakthroughs, particularly in sensor accuracy and miniaturization for CGM devices, are making them more appealing and accessible. Strategic partnerships between device manufacturers and healthcare providers, including NHS trusts, are crucial for driving adoption and ensuring devices are integrated into clinical pathways. Market expansion strategies, such as increased direct-to-consumer marketing and wider availability through online channels, are also playing a significant role. The increasing focus on value-based healthcare within the UK is also a growth accelerator, as effective glucose monitoring contributes to better patient outcomes and reduced long-term healthcare costs.

Key Players Shaping the Blood Glucose Monitoring Market in United Kingdom Market

- Roche Diabetes Care

- Abbott Diabetes Care

- Dexcom Inc

- Acon Laboratories Inc

- Medtronic PLC

- Agamatrix Inc

- Bionime Corporation

- Trivida Health

- Arkray Inc

- Ascensia Diabetes Care

Notable Milestones in Blood Glucose Monitoring Market in United Kingdom Sector

- September 2023: Medtronic received the CE (Conformité Européenne) Mark approval for its new all-in-one, disposable Simplera continuous glucose monitor (CGM) featuring a simple, two-step insertion process. The no-fingerstick sensor does not require overtape and is seamlessly integrated with the InPen smart insulin pen, which provides real-time, personalized dosing guidance to help simplify diabetes management.

- June 2023: Afon Technology, a Welsh-based med-tech startup, is working to develop Glucowear, a non-invasive, real-time, continuous wearable glucose monitor.

In-Depth Blood Glucose Monitoring Market in United Kingdom Market Outlook

The United Kingdom blood glucose monitoring market is poised for robust and sustained growth, driven by a synergistic interplay of technological innovation, evolving healthcare policies, and increasing patient empowerment. The continued advancement and wider adoption of continuous glucose monitoring systems will be a primary growth accelerator, offering unprecedented insights for diabetes management. The trend towards connected health and the integration of AI for personalized insights and predictive analytics will further enhance the value proposition of these devices. Strategic collaborations between technology providers and healthcare systems are expected to streamline access and ensure these advanced tools are effectively utilized to improve patient outcomes. The market's future outlook is characterized by a commitment to innovation, patient-centricity, and the pursuit of more accessible and effective diabetes management solutions, paving the way for significant market expansion in the coming years.

Blood Glucose Monitoring Market in United Kingdom Segmentation

-

1. Type

-

1.1. Self-monitoring blood glucose devices

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuous blood glucose monitoring devices

- 1.2.1. Sensors

- 1.2.2. Durables (Receivers and Transmitters)

-

1.1. Self-monitoring blood glucose devices

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

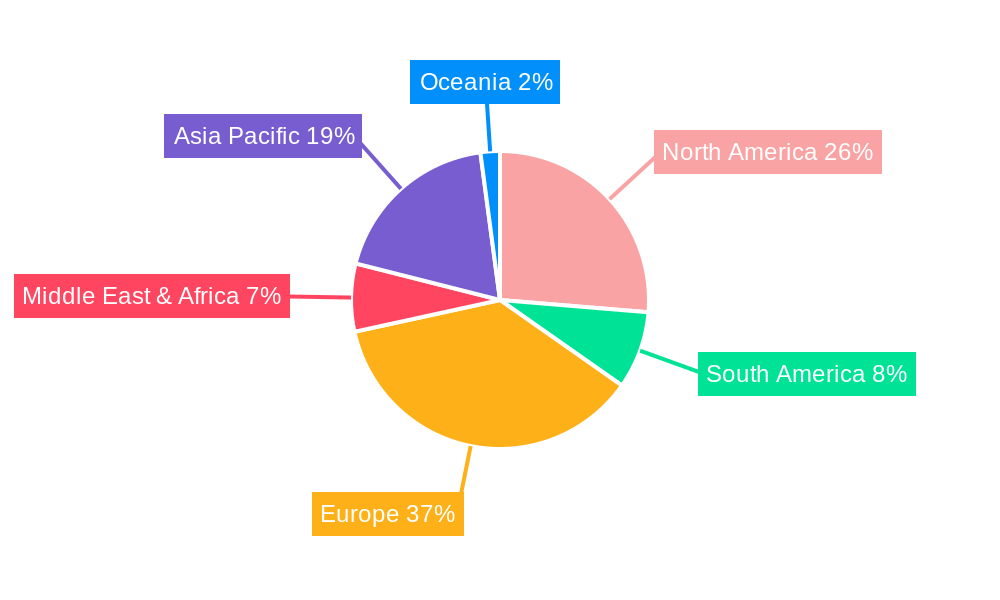

Blood Glucose Monitoring Market in United Kingdom Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blood Glucose Monitoring Market in United Kingdom REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Growing Diabetes Population in the United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Self-monitoring blood glucose devices

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous blood glucose monitoring devices

- 5.1.2.1. Sensors

- 5.1.2.2. Durables (Receivers and Transmitters)

- 5.1.1. Self-monitoring blood glucose devices

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Self-monitoring blood glucose devices

- 6.1.1.1. Glucometer Devices

- 6.1.1.2. Test Strips

- 6.1.1.3. Lancets

- 6.1.2. Continuous blood glucose monitoring devices

- 6.1.2.1. Sensors

- 6.1.2.2. Durables (Receivers and Transmitters)

- 6.1.1. Self-monitoring blood glucose devices

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Self-monitoring blood glucose devices

- 7.1.1.1. Glucometer Devices

- 7.1.1.2. Test Strips

- 7.1.1.3. Lancets

- 7.1.2. Continuous blood glucose monitoring devices

- 7.1.2.1. Sensors

- 7.1.2.2. Durables (Receivers and Transmitters)

- 7.1.1. Self-monitoring blood glucose devices

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Self-monitoring blood glucose devices

- 8.1.1.1. Glucometer Devices

- 8.1.1.2. Test Strips

- 8.1.1.3. Lancets

- 8.1.2. Continuous blood glucose monitoring devices

- 8.1.2.1. Sensors

- 8.1.2.2. Durables (Receivers and Transmitters)

- 8.1.1. Self-monitoring blood glucose devices

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Self-monitoring blood glucose devices

- 9.1.1.1. Glucometer Devices

- 9.1.1.2. Test Strips

- 9.1.1.3. Lancets

- 9.1.2. Continuous blood glucose monitoring devices

- 9.1.2.1. Sensors

- 9.1.2.2. Durables (Receivers and Transmitters)

- 9.1.1. Self-monitoring blood glucose devices

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Self-monitoring blood glucose devices

- 10.1.1.1. Glucometer Devices

- 10.1.1.2. Test Strips

- 10.1.1.3. Lancets

- 10.1.2. Continuous blood glucose monitoring devices

- 10.1.2.1. Sensors

- 10.1.2.2. Durables (Receivers and Transmitters)

- 10.1.1. Self-monitoring blood glucose devices

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United States Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. United Kingdom Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Japan Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. China Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. Australia Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. Indonesia Blood Glucose Monitoring Market in United Kingdom Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Roche Diabetes Care

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Abbott Diabetes Care

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Dexcom Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Acon Laboratories Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Medtronic PLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Agamatrix Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Bionime Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Trivida Health

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Arkray Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Ascensia Diabetes Care

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Roche Diabetes Care

List of Figures

- Figure 1: Global Blood Glucose Monitoring Market in United Kingdom Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Blood Glucose Monitoring Market in United Kingdom Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: United States Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 4: United States Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 5: United States Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 6: United States Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 7: United Kingdom Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 8: United Kingdom Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 9: United Kingdom Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 10: United Kingdom Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 11: Japan Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 12: Japan Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 13: Japan Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 14: Japan Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 15: China Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 16: China Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 17: China Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 18: China Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 19: Australia Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 20: Australia Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 21: Australia Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 22: Australia Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 23: Indonesia Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 24: Indonesia Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 25: Indonesia Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 26: Indonesia Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Type 2024 & 2032

- Figure 28: North America Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Type 2024 & 2032

- Figure 29: North America Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Type 2024 & 2032

- Figure 30: North America Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Type 2024 & 2032

- Figure 31: North America Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 32: North America Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 33: North America Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: North America Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 35: North America Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 37: North America Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 39: South America Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Type 2024 & 2032

- Figure 40: South America Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Type 2024 & 2032

- Figure 41: South America Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Type 2024 & 2032

- Figure 42: South America Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Type 2024 & 2032

- Figure 43: South America Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 44: South America Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 45: South America Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 46: South America Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 47: South America Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 48: South America Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 49: South America Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 50: South America Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 51: Europe Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Type 2024 & 2032

- Figure 52: Europe Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Type 2024 & 2032

- Figure 53: Europe Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Type 2024 & 2032

- Figure 54: Europe Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Type 2024 & 2032

- Figure 55: Europe Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 56: Europe Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 57: Europe Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 58: Europe Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 59: Europe Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 60: Europe Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 61: Europe Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 62: Europe Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 63: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Type 2024 & 2032

- Figure 64: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Type 2024 & 2032

- Figure 65: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Type 2024 & 2032

- Figure 66: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Type 2024 & 2032

- Figure 67: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 68: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 69: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 70: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 71: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 73: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

- Figure 75: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Type 2024 & 2032

- Figure 76: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Type 2024 & 2032

- Figure 77: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Type 2024 & 2032

- Figure 78: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Type 2024 & 2032

- Figure 79: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 80: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Distribution Channel 2024 & 2032

- Figure 81: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 82: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Distribution Channel 2024 & 2032

- Figure 83: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Revenue (Million), by Country 2024 & 2032

- Figure 84: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Volume (K Unit), by Country 2024 & 2032

- Figure 85: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Revenue Share (%), by Country 2024 & 2032

- Figure 86: Asia Pacific Blood Glucose Monitoring Market in United Kingdom Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Type 2019 & 2032

- Table 23: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: United States Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Canada Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Mexico Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Type 2019 & 2032

- Table 35: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Brazil Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Brazil Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Argentina Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Argentina Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Rest of South America Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of South America Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Type 2019 & 2032

- Table 47: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 49: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: United Kingdom Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: United Kingdom Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Germany Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Germany Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: France Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: France Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Italy Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Italy Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Spain Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Spain Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Russia Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Russia Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Benelux Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Benelux Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Nordics Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Nordics Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Rest of Europe Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Europe Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Type 2019 & 2032

- Table 70: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Type 2019 & 2032

- Table 71: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 72: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 73: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 75: Turkey Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Turkey Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Israel Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Israel Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: GCC Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: GCC Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: North Africa Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: North Africa Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: South Africa Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: South Africa Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Rest of Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Rest of Middle East & Africa Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Type 2019 & 2032

- Table 88: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Type 2019 & 2032

- Table 89: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 90: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 91: Global Blood Glucose Monitoring Market in United Kingdom Revenue Million Forecast, by Country 2019 & 2032

- Table 92: Global Blood Glucose Monitoring Market in United Kingdom Volume K Unit Forecast, by Country 2019 & 2032

- Table 93: China Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: China Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: India Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: India Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: Japan Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Japan Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: South Korea Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: South Korea Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: ASEAN Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: ASEAN Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 103: Oceania Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Oceania Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 105: Rest of Asia Pacific Blood Glucose Monitoring Market in United Kingdom Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: Rest of Asia Pacific Blood Glucose Monitoring Market in United Kingdom Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blood Glucose Monitoring Market in United Kingdom?

The projected CAGR is approximately 8.40%.

2. Which companies are prominent players in the Blood Glucose Monitoring Market in United Kingdom?

Key companies in the market include Roche Diabetes Care, Abbott Diabetes Care, Dexcom Inc, Acon Laboratories Inc, Medtronic PLC, Agamatrix Inc, Bionime Corporation, Trivida Health, Arkray Inc, Ascensia Diabetes Care.

3. What are the main segments of the Blood Glucose Monitoring Market in United Kingdom?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 557.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Growing Diabetes Population in the United Kingdom.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

September 2023: Medtronic received the CE (Conformité Européenne) Mark approval for its new all-in-one, disposable Simplera continuous glucose monitor (CGM) featuring a simple, two-step insertion process. The no-fingerstick sensor does not require overtape and is seamlessly integrated with the InPen smart insulin pen, which provides real-time, personalized dosing guidance to help simplify diabetes management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blood Glucose Monitoring Market in United Kingdom," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blood Glucose Monitoring Market in United Kingdom report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blood Glucose Monitoring Market in United Kingdom?

To stay informed about further developments, trends, and reports in the Blood Glucose Monitoring Market in United Kingdom, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence