Key Insights

The North America 3D Printing in Medical Applications Market is set for substantial expansion, projected to reach a market size of $5.95 billion by 2025. With a robust Compound Annual Growth Rate (CAGR) of 15.1%, this dynamic sector is expected to continue its upward trajectory, reaching an estimated $11,000 million by 2033. Key growth drivers include the increasing demand for personalized medicine, particularly for patient-specific implants and prosthetics. Advances in 3D printing technologies and biocompatible materials are enabling greater precision, complexity, and affordability in medical device manufacturing. Furthermore, the growing adoption of 3D printing for tissue engineering and the development of complex anatomical models for surgical planning and training are also contributing to market dynamism. The competitive landscape features established players and innovative startups capitalizing on these burgeoning opportunities.

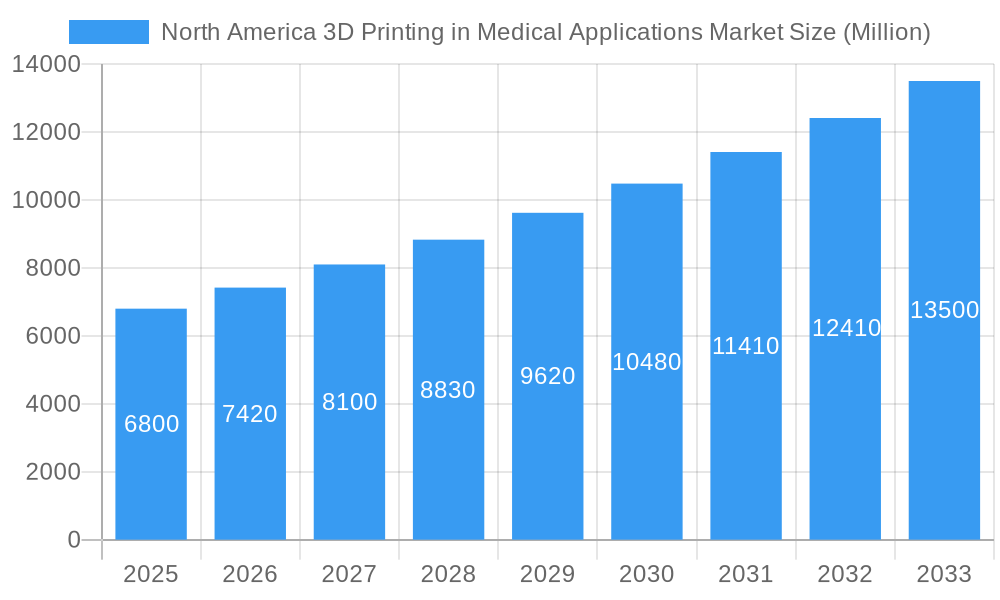

North America 3D Printing in Medical Applications Market Market Size (In Billion)

The market's impressive growth is underpinned by the increasing integration of 3D printing across various medical applications. Medical implants and prosthetics represent the largest segments, with significant advancements also seen in wearable devices for enhanced functionality and customization. Tissue engineering, though nascent, holds immense long-term potential for regenerative medicine. Geographically, the United States leads the market, driven by substantial investments in healthcare innovation, a favorable regulatory environment, and a high prevalence of chronic diseases. Canada and Mexico are also demonstrating considerable growth, propelled by increasing healthcare expenditures and the expanding adoption of additive manufacturing technologies. Despite the promising outlook, stringent regulatory approvals for novel medical devices and the initial high cost of advanced 3D printing equipment may temper immediate widespread adoption in some niche areas. Nevertheless, the overarching trend points towards a future where 3D printing becomes an indispensable tool in revolutionizing healthcare delivery and patient outcomes across North America.

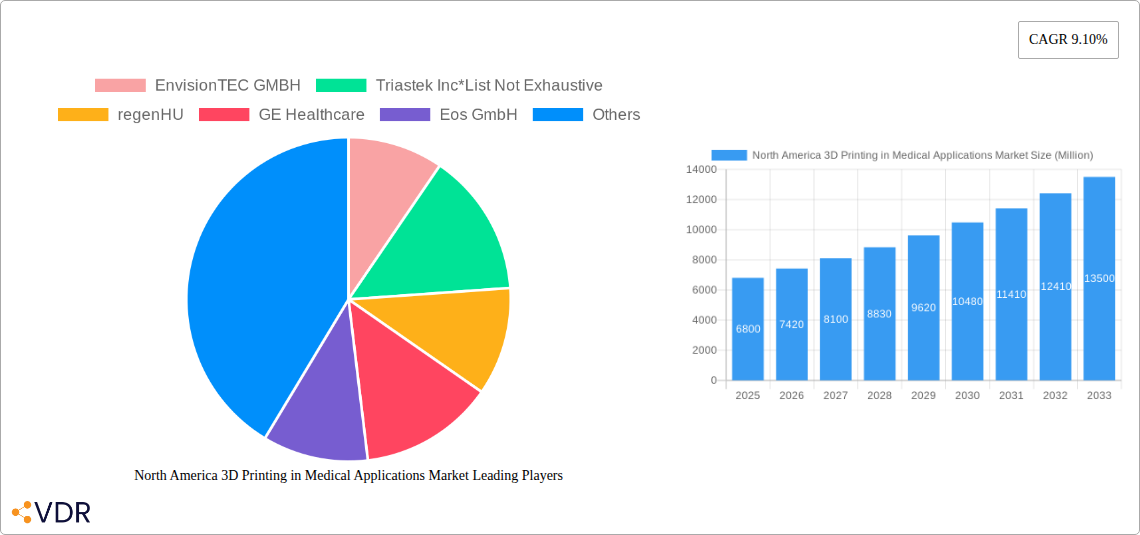

North America 3D Printing in Medical Applications Market Company Market Share

North America 3D Printing in Medical Applications Market: In-Depth Analysis & Future Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the North America 3D Printing in Medical Applications Market, encompassing a detailed forecast from 2025 to 2033. Leveraging extensive research, the report delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the competitive landscape. With a base year of 2025, this study provides critical insights for stakeholders seeking to capitalize on the burgeoning demand for personalized and advanced medical solutions enabled by additive manufacturing. The market size is projected to reach USD 5,500 Million units in 2025.

North America 3D Printing in Medical Applications Market Market Dynamics & Structure

The North America 3D Printing in Medical Applications Market is characterized by a moderately concentrated structure, with key players actively engaging in technological innovation and strategic expansions. The integration of advanced 3D printing technologies, such as Stereolithography and Electron Beam Melting, into the production of intricate medical devices like implants and prosthetics, fuels market growth. Regulatory frameworks, particularly in the United States, are evolving to accommodate these novel manufacturing processes, albeit with ongoing scrutiny to ensure patient safety and efficacy. Competitive product substitutes, primarily from traditional manufacturing methods, are gradually being displaced by the superior customization and efficiency offered by 3D printing. End-user demographics, including an aging population and increasing prevalence of chronic diseases, further drive demand for tailored medical solutions. Mergers and acquisitions (M&A) activity is a notable trend, as larger entities seek to acquire specialized expertise and expand their additive manufacturing portfolios. For instance, recent M&A activities indicate a consolidation trend aiming to achieve economies of scale and broaden product offerings, with an estimated 15-20 M&A deals observed historically. Technological innovation drivers include advancements in biocompatible materials and software for intricate design, while innovation barriers are primarily associated with the cost of sophisticated equipment and the need for specialized training.

North America 3D Printing in Medical Applications Market Growth Trends & Insights

The North America 3D printing in medical applications market is experiencing robust growth, driven by a confluence of factors that are reshaping healthcare delivery. The market size is projected to witness a significant expansion, evolving from an estimated USD 5,500 Million units in 2025 to USD 12,800 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 11.2% during the forecast period (2025-2033). This impressive growth trajectory is underpinned by increasing adoption rates across various medical specialties. Technological disruptions, such as the development of multi-material printing and enhanced resolution capabilities, are enabling the creation of increasingly complex and functional anatomical models, surgical guides, and patient-specific implants. Consumer behavior shifts are also playing a pivotal role, with growing patient awareness and demand for personalized treatments and prosthetics that offer improved comfort and efficacy. The rising incidence of orthopedic conditions and the increasing preference for minimally invasive surgical procedures are further augmenting the demand for 3D-printed medical devices. Furthermore, advancements in materials science have led to the development of a wider range of biocompatible and advanced polymers and metals, expanding the application scope of 3D printing in critical medical areas like tissue engineering. The market penetration of 3D printing in niche medical segments is expected to rise, indicating a gradual shift from traditional manufacturing to additive technologies for high-value applications. The ability of 3D printing to facilitate rapid prototyping and on-demand production is a key differentiator, leading to reduced lead times and costs in the development and deployment of new medical devices. The integration of AI and machine learning in design and simulation is further accelerating innovation, enabling more precise and predictive outcomes for patient treatments.

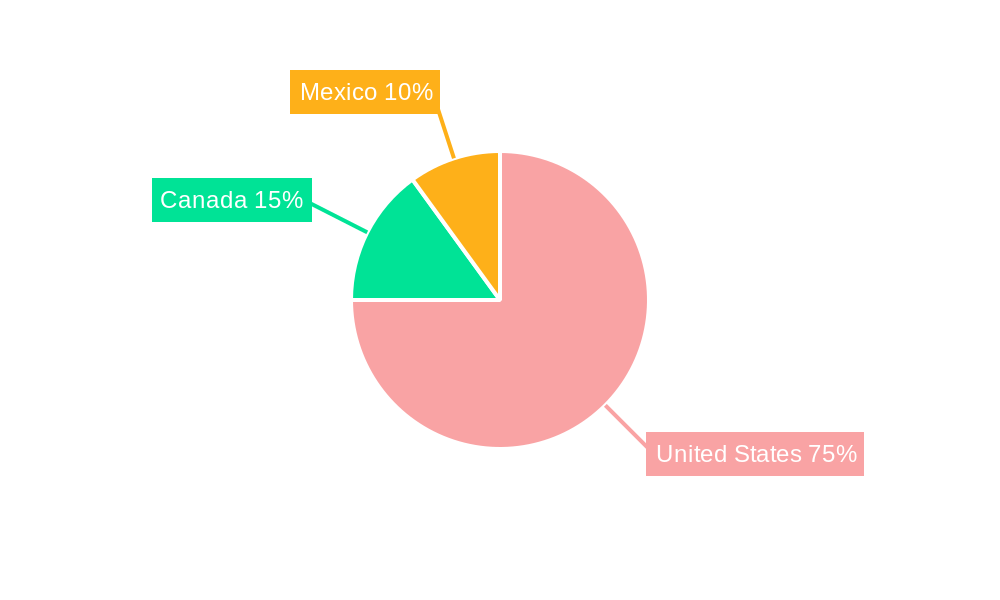

Dominant Regions, Countries, or Segments in North America 3D Printing in Medical Applications Market

The United States stands as the undisputed dominant region in the North America 3D Printing in Medical Applications Market, accounting for an estimated 75-80% of the total market share. This dominance is attributed to a confluence of factors including advanced healthcare infrastructure, significant investment in research and development, a favorable regulatory environment for medical innovation, and the presence of leading global 3D printing companies and medical device manufacturers. The country’s robust healthcare spending and a high prevalence of chronic diseases necessitate personalized and advanced medical solutions, which 3D printing is ideally positioned to provide.

Within the technology segment, Jetting Technology is emerging as a significant growth driver, particularly in the pharmaceutical and bioprinting applications, alongside established technologies like Laser Sintering and Electron Beam Melting which remain crucial for metal implants.

In terms of applications, Medical Implants continue to represent the largest market segment, driven by the demand for patient-specific orthopedic, dental, and craniofacial implants. However, the Tissue Engineering segment is poised for substantial growth, fueled by breakthroughs in regenerative medicine and the development of complex biological constructs.

Geographically, beyond the United States, Canada and Mexico are also witnessing increased adoption, albeit at a slower pace. Canada benefits from a universal healthcare system that is increasingly open to adopting innovative cost-effective solutions, while Mexico’s medical tourism industry is beginning to leverage 3D printing for specialized procedures.

- United States: Dominant market share due to strong R&D, favorable regulatory landscape, and high healthcare expenditure.

- Medical Implants: Largest application segment due to growing demand for personalized orthopedic and dental solutions.

- Jetting Technology: Emerging as a key driver, especially in pharmaceuticals and bioprinting, complementing established technologies like Laser Sintering for implants.

- Tissue Engineering: High growth potential due to rapid advancements in regenerative medicine and bioprinting research.

North America 3D Printing in Medical Applications Market Product Landscape

The product landscape within the North America 3D Printing in Medical Applications Market is characterized by continuous innovation aimed at enhancing precision, biocompatibility, and functionality. Companies are developing advanced 3D printers capable of handling a wider range of sophisticated materials, including specialized biocompatible polymers and high-strength metal alloys. Innovations are particularly focused on creating patient-specific implants with intricate geometries that perfectly match anatomical structures, thereby improving surgical outcomes and reducing recovery times. Furthermore, advancements in bioprinting technologies are paving the way for the development of functional tissues and organs for research and therapeutic purposes. The performance metrics of these 3D-printed medical products are continuously improving, with a focus on mechanical strength, bio-integration, and long-term durability. The unique selling proposition lies in the ability to offer mass customization at a cost-effective rate, a significant departure from traditional mass production methods.

Key Drivers, Barriers & Challenges in North America 3D Printing in Medical Applications Market

Key Drivers:

- Technological Advancements: Continuous innovation in 3D printing hardware, software, and materials is expanding application possibilities and improving product quality.

- Demand for Personalization: Growing patient preference for customized medical devices, implants, and prosthetics that offer enhanced fit and function.

- Cost-Effectiveness: Potential for reduced manufacturing costs and shorter lead times for complex, low-volume medical devices compared to traditional methods.

- Regulatory Support: Evolving regulatory frameworks in countries like the US are becoming more receptive to additive manufacturing in healthcare.

- Advancements in Biocompatible Materials: Development of novel materials that are safe for implantation and exhibit excellent biological integration.

Barriers & Challenges:

- High Initial Investment: The significant cost of advanced 3D printers and associated software can be a barrier for smaller healthcare providers and research institutions.

- Regulatory Hurdles: While improving, the validation and approval processes for 3D-printed medical devices can still be complex and time-consuming.

- Standardization and Quality Control: Ensuring consistent quality and performance across different printing platforms and materials remains a challenge.

- Limited Skilled Workforce: A shortage of trained professionals with expertise in 3D printing for medical applications can hinder adoption.

- Supply Chain Disruptions: Reliance on specialized raw materials and intricate supply chains can lead to vulnerabilities. The cost of medical-grade filaments and powders can also be a restraint, estimated to impact market growth by 5-10% if not addressed.

Emerging Opportunities in North America 3D Printing in Medical Applications Market

Emerging opportunities in the North America 3D Printing in Medical Applications Market lie in the burgeoning field of personalized medicine, particularly in the development of patient-specific drug delivery systems and advanced prosthetics. The growing interest in regenerative medicine and bioprinting presents a significant avenue for growth, with the potential to create functional tissues and organs for transplantation and drug testing. Furthermore, the increasing adoption of 3D printing for surgical planning and anatomical modeling offers a valuable tool for surgeons, enhancing precision and improving patient outcomes. The integration of AI and machine learning in design and simulation processes is also unlocking new possibilities for optimizing product performance and patient-specific treatments. Untapped markets include the development of affordable 3D-printed assistive devices for individuals with disabilities and the expansion of 3D printing in veterinary medicine.

Growth Accelerators in the North America 3D Printing in Medical Applications Market Industry

Several catalysts are accelerating the long-term growth of the North America 3D Printing in Medical Applications Market. Technological breakthroughs in printing speed, resolution, and material capabilities are consistently expanding the range of applicable medical devices and treatments. Strategic partnerships between 3D printing companies, medical device manufacturers, and research institutions are fostering collaborative innovation and accelerating the translation of research into commercial products. Market expansion strategies, including increasing awareness campaigns and educational initiatives, are driving broader adoption across the healthcare ecosystem. The development of more robust and standardized post-processing techniques is also enhancing the reliability and widespread use of 3D-printed medical products.

Key Players Shaping the North America 3D Printing in Medical Applications Market Market

- EnvisionTEC GMBH

- Triastek Inc

- regenHU

- GE Healthcare

- Eos GmbH

- BICO (Nanoscribe GmbH & Co KG)

- 3D Systems Inc

- Fathom

- Materialise NV

- Stratasys Ltd

Notable Milestones in North America 3D Printing in Medical Applications Market Sector

- January 2023: RMS Company, a United States-based medical device manufacturer, incorporated the DMP Flex 350 Dual into its production process, enhancing its direct metal printing capabilities with 3D Systems' technology.

- November 2022: Triastek, Inc. obtained clearance from the United States FDA for its Investigational New Drug (IND) application for T21, a 3D-printed medicine with the potential to treat ulcerative colitis, marking a significant step towards clinical trials for 3D-printed pharmaceuticals.

In-Depth North America 3D Printing in Medical Applications Market Market Outlook

The future outlook for the North America 3D Printing in Medical Applications Market is exceptionally promising, driven by sustained innovation and increasing demand for personalized healthcare solutions. Growth accelerators, including advancements in bioprinting for tissue regeneration and the development of sophisticated patient-specific implants, will continue to propel market expansion. Strategic partnerships and collaborations will foster a more integrated approach to product development and regulatory approval. As the technology matures and becomes more accessible, its application will broaden across various medical disciplines, from complex surgical interventions to the creation of advanced wearable devices. The market is poised to witness a paradigm shift, with 3D printing becoming an indispensable tool in modern healthcare, offering unprecedented opportunities for improved patient care and medical breakthroughs. The projected market size of USD 12,800 Million units by 2033 underscores the significant growth potential and the transformative impact of additive manufacturing on the healthcare landscape.

North America 3D Printing in Medical Applications Market Segmentation

-

1. Technology

- 1.1. Stereolithography

- 1.2. Deposition Modeling

- 1.3. Electron Beam Melting

- 1.4. Laser Sintering

- 1.5. Jetting Technology

- 1.6. Laminated Object Manufacturing

- 1.7. Other Technologies

-

2. Application

- 2.1. Medical Implants

- 2.2. Prosthetics

- 2.3. Wearable Devices

- 2.4. Tissue Engineering

- 2.5. Other Applications

-

3. Material

- 3.1. Metals and Alloys

- 3.2. Polymers

- 3.3. Other Materials

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America 3D Printing in Medical Applications Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America 3D Printing in Medical Applications Market Regional Market Share

Geographic Coverage of North America 3D Printing in Medical Applications Market

North America 3D Printing in Medical Applications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Customized Additive Manufacturing; Patent Expiration

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Additive Manufacturing; Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Polymers are Expected to Register a High Growth in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereolithography

- 5.1.2. Deposition Modeling

- 5.1.3. Electron Beam Melting

- 5.1.4. Laser Sintering

- 5.1.5. Jetting Technology

- 5.1.6. Laminated Object Manufacturing

- 5.1.7. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical Implants

- 5.2.2. Prosthetics

- 5.2.3. Wearable Devices

- 5.2.4. Tissue Engineering

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Metals and Alloys

- 5.3.2. Polymers

- 5.3.3. Other Materials

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereolithography

- 6.1.2. Deposition Modeling

- 6.1.3. Electron Beam Melting

- 6.1.4. Laser Sintering

- 6.1.5. Jetting Technology

- 6.1.6. Laminated Object Manufacturing

- 6.1.7. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical Implants

- 6.2.2. Prosthetics

- 6.2.3. Wearable Devices

- 6.2.4. Tissue Engineering

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Metals and Alloys

- 6.3.2. Polymers

- 6.3.3. Other Materials

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereolithography

- 7.1.2. Deposition Modeling

- 7.1.3. Electron Beam Melting

- 7.1.4. Laser Sintering

- 7.1.5. Jetting Technology

- 7.1.6. Laminated Object Manufacturing

- 7.1.7. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical Implants

- 7.2.2. Prosthetics

- 7.2.3. Wearable Devices

- 7.2.4. Tissue Engineering

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Metals and Alloys

- 7.3.2. Polymers

- 7.3.3. Other Materials

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Mexico North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereolithography

- 8.1.2. Deposition Modeling

- 8.1.3. Electron Beam Melting

- 8.1.4. Laser Sintering

- 8.1.5. Jetting Technology

- 8.1.6. Laminated Object Manufacturing

- 8.1.7. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical Implants

- 8.2.2. Prosthetics

- 8.2.3. Wearable Devices

- 8.2.4. Tissue Engineering

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Metals and Alloys

- 8.3.2. Polymers

- 8.3.3. Other Materials

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 EnvisionTEC GMBH

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Triastek Inc*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 regenHU

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GE Healthcare

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Eos GmbH

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BICO (Nanoscribe GmbH & Co KG)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 3D Systems Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Fathom

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Materialise NV

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Stratasys Ltd

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 EnvisionTEC GMBH

List of Figures

- Figure 1: North America 3D Printing in Medical Applications Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America 3D Printing in Medical Applications Market Share (%) by Company 2025

List of Tables

- Table 1: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Material 2020 & 2033

- Table 4: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Material 2020 & 2033

- Table 9: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Material 2020 & 2033

- Table 14: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 17: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Material 2020 & 2033

- Table 19: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America 3D Printing in Medical Applications Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America 3D Printing in Medical Applications Market?

The projected CAGR is approximately 15.1%.

2. Which companies are prominent players in the North America 3D Printing in Medical Applications Market?

Key companies in the market include EnvisionTEC GMBH, Triastek Inc*List Not Exhaustive, regenHU, GE Healthcare, Eos GmbH, BICO (Nanoscribe GmbH & Co KG), 3D Systems Inc, Fathom, Materialise NV, Stratasys Ltd.

3. What are the main segments of the North America 3D Printing in Medical Applications Market?

The market segments include Technology, Application, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Customized Additive Manufacturing; Patent Expiration.

6. What are the notable trends driving market growth?

Polymers are Expected to Register a High Growth in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs Associated with Additive Manufacturing; Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

January 2023: RMS Company, a United States-based medical device manufacturer, incorporated the DMP Flex 350 Dual into its production process. This new addition belongs to 3D Systems' Direct Metal Printing (DMP) portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America 3D Printing in Medical Applications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America 3D Printing in Medical Applications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America 3D Printing in Medical Applications Market?

To stay informed about further developments, trends, and reports in the North America 3D Printing in Medical Applications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence