Key Insights

The Italian ophthalmic diagnostic equipment market is projected for substantial growth, driven by an aging demographic, increasing eye disease prevalence, and heightened awareness of ocular health. With an estimated market size of $14.76 billion in 2025, and a projected Compound Annual Growth Rate (CAGR) of 4.8% from the base year 2025 through 2033, the sector demonstrates robust expansion. This growth is propelled by technological advancements in sophisticated diagnostic and monitoring devices, including Optical Coherence Tomography (OCT) scanners and advanced imaging systems, which enhance precision and facilitate early detection of conditions like glaucoma and diabetic retinopathy. The rising demand for minimally invasive surgical procedures also stimulates the market for specialized surgical devices, such as glaucoma drainage devices and advanced intraocular lenses. Furthermore, an increasing emphasis on preventative eye care and routine examinations across all age groups is a significant contributor to market expansion. The Italian healthcare system's commitment to improving patient outcomes and reducing the long-term burden of vision impairment further supports this positive market outlook.

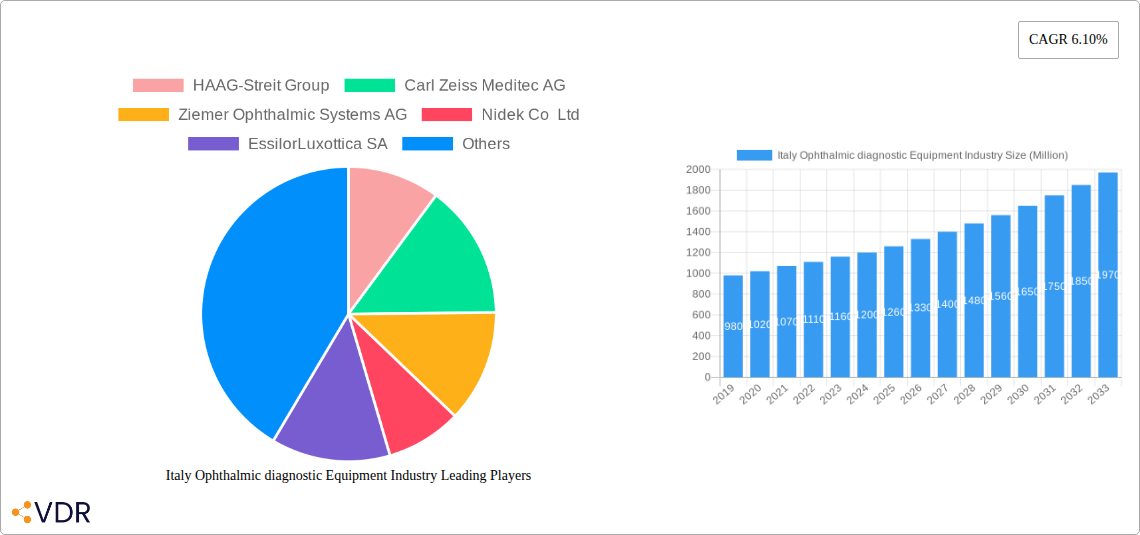

Italy Ophthalmic diagnostic Equipment Industry Market Size (In Billion)

Market segmentation highlights key growth areas. Diagnostic and monitoring devices, including OCT scanners, autorefractors, and ophthalmic ultrasound systems, are anticipated to see significant demand due to their pivotal role in early disease detection and management. Surgical devices, particularly for glaucoma and cataract surgery, are also trending upwards, supported by innovations in implantable devices and laser technologies. Vision correction devices, such as advanced spectacles and contact lenses, maintain a considerable market share, driven by refractive errors and the growing prevalence of age-related vision issues. While growth drivers are strong, potential restraints include the high cost of advanced equipment, which may challenge smaller clinics, and the necessity for continuous training to operate sophisticated tools. However, the overarching trend towards personalized eye care and the ongoing development of more accessible technologies are expected to mitigate these challenges, ensuring sustained growth for the Italian ophthalmic diagnostic equipment market.

Italy Ophthalmic diagnostic Equipment Industry Company Market Share

Italy Ophthalmic Diagnostic Equipment Market: Comprehensive Analysis & Future Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the Italy Ophthalmic Diagnostic Equipment Market, providing critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. Spanning a study period of 2019–2033, with a base year of 2025, this report equips industry professionals with actionable intelligence to navigate the evolving landscape of ophthalmic diagnostics and surgical solutions. Explore market segmentation by Devices, including Surgical Devices (Glaucoma Drainage Devices, Glaucoma Stents and Implants, Intraocular Lenses, Lasers, Other Surgical Devices), Diagnostic and Monitoring Devices (Autorefractors and Keratometers, Corneal Topography Systems, Ophthalmic Ultrasound Imaging Systems, Ophthalmoscopes, Optical Coherence Tomography Scanners, Other Diagnostic and Monitoring Devices), and Vision Correction Devices (Spectacles, Contact Lenses). Gain a strategic advantage with detailed forecasts, competitive intelligence on key players like HAAG-Streit Group, Carl Zeiss Meditec AG, Ziemer Ophthalmic Systems AG, Nidek Co Ltd, EssilorLuxottica SA, Johnson and Johnson, Topcon Corporation, Alcon Inc, Bausch Health Companies Inc, and Hoya Corporation, and an understanding of significant industry developments.

Italy Ophthalmic diagnostic Equipment Industry Market Dynamics & Structure

The Italian ophthalmic diagnostic equipment market is characterized by a moderately concentrated structure, with a few key global players holding significant market share. Technological innovation is a primary driver, fueled by advancements in imaging, AI-driven diagnostics, and miniaturization of surgical tools. The regulatory framework, guided by European Union directives and national health policies, ensures high standards for safety and efficacy, influencing product development and market entry. Competitive product substitutes exist, particularly in the broader medical imaging space, but specialized ophthalmic devices offer distinct advantages in accuracy and disease-specific detection. End-user demographics are shifting due to an aging population, increasing the prevalence of age-related eye conditions and driving demand for advanced diagnostic and therapeutic solutions. Merger and acquisition (M&A) trends are observed as larger companies seek to expand their portfolios and market reach, consolidating specialized technologies and distribution networks.

- Market Concentration: Dominated by a mix of global giants and specialized Italian manufacturers, with an estimated XX% of the market held by the top 5 players.

- Technological Innovation Drivers: Continuous R&D in OCT, AI-powered diagnostics, adaptive optics, and minimally invasive surgical technologies.

- Regulatory Frameworks: Compliance with MDR (Medical Device Regulation) and adherence to national healthcare reimbursement policies.

- Competitive Product Substitutes: While direct substitutes are limited, advancements in general imaging technologies can indirectly impact niche segments.

- End-User Demographics: Increasing prevalence of cataracts, glaucoma, AMD, and diabetic retinopathy driving demand for early detection and advanced treatments.

- M&A Trends: Strategic acquisitions by major players to gain access to innovative technologies and expand market share. Estimated XX M&A deals in the historical period (2019-2024).

Italy Ophthalmic diagnostic Equipment Industry Growth Trends & Insights

The Italy Ophthalmic Diagnostic Equipment market is poised for robust growth, driven by a confluence of factors including an increasing aging population, rising awareness of eye health, and significant technological advancements. The market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. Adoption rates for advanced diagnostic devices such as Optical Coherence Tomography (OCT) scanners and automated perimeters are accelerating as healthcare providers recognize their value in early disease detection and precise management. Technological disruptions are primarily originating from the integration of artificial intelligence (AI) in image analysis and diagnostic decision-making, leading to improved accuracy and efficiency. Furthermore, the development of non-invasive and less time-consuming diagnostic procedures is enhancing patient comfort and compliance.

Consumer behavior shifts are also playing a crucial role. There is a growing preference for proactive eye care and regular screenings, especially among individuals with a family history of eye diseases or those in high-risk age groups. This trend is further supported by increasing disposable incomes and greater accessibility to advanced healthcare services. The market penetration of sophisticated diagnostic tools is steadily increasing, moving beyond major metropolitan hospitals to smaller clinics and even primary care settings, facilitated by more portable and user-friendly equipment. The demand for personalized treatment plans, informed by detailed diagnostic data, is also on the rise, pushing manufacturers to develop integrated solutions that seamlessly connect diagnostic information with treatment modalities. The economic landscape of Italy, with its strong healthcare infrastructure and government initiatives to improve public health, provides a supportive environment for the growth of this vital medical sector. The continued investment in R&D by both domestic and international companies will ensure a steady stream of innovative products that cater to the evolving needs of ophthalmologists and patients.

Dominant Regions, Countries, or Segments in Italy Ophthalmic Diagnostic Equipment Industry

Within the Italian ophthalmic diagnostic equipment industry, the Diagnostic and Monitoring Devices segment consistently emerges as the dominant force, underpinning the entire spectrum of ophthalmic care. This supremacy is driven by the foundational need for accurate and early detection of a wide array of ocular conditions. Within this segment, Optical Coherence Tomography (OCT) Scanners are experiencing exceptional growth and market penetration, accounting for an estimated XX% of the diagnostic device market share. Their ability to provide cross-sectional images of the retina and optic nerve with microscopic precision makes them indispensable for diagnosing and monitoring conditions like macular degeneration, glaucoma, and diabetic retinopathy, which are prevalent in Italy's aging population.

The dominance of Diagnostic and Monitoring Devices is further bolstered by other critical sub-segments. Autorefractors and Keratometers, essential for refractive error assessment, maintain consistent demand due to their widespread use in optometry practices and eye clinics. Corneal Topography Systems are gaining traction for their role in diagnosing conditions like keratoconus and astigmatism, and in pre-operative planning for refractive surgeries. The economic policies supporting public health initiatives and the reimbursement schemes for diagnostic procedures in Italy significantly contribute to the demand for these devices. Moreover, the robust healthcare infrastructure, with a high density of specialized eye clinics and hospitals, particularly in regions like Lombardy and Lazio, ensures widespread accessibility and utilization of these diagnostic tools.

While Surgical Devices and Vision Correction Devices are crucial, they often rely on the insights provided by diagnostic equipment. For instance, the choice of Intraocular Lenses (IOLs) for cataract surgery is heavily influenced by pre-operative diagnostic data obtained from OCT and other imaging devices. Similarly, the precise fitting of Contact Lenses and the prescription of Spectacles are optimized through autorefraction and corneal topography. The market share of Diagnostic and Monitoring Devices is projected to hold approximately XX% of the overall ophthalmic equipment market in Italy during the forecast period, showcasing its pivotal role.

Italy Ophthalmic Diagnostic Equipment Industry Product Landscape

The Italian ophthalmic diagnostic equipment market is characterized by a dynamic product landscape defined by continuous innovation and a focus on enhanced diagnostic capabilities. Key product innovations include the integration of Artificial Intelligence (AI) into imaging devices for automated anomaly detection and predictive diagnostics. High-resolution Optical Coherence Tomography (OCT) scanners with advanced angiography capabilities are enabling earlier and more precise diagnosis of retinal vascular diseases. Furthermore, portable and handheld diagnostic devices are expanding accessibility to eye care in remote areas and primary care settings. Applications span from routine eye exams to specialized diagnostics for complex conditions like glaucoma, diabetic retinopathy, and age-related macular degeneration. Performance metrics such as scan speed, resolution, depth penetration, and user-friendliness are continually being improved.

Key Drivers, Barriers & Challenges in Italy Ophthalmic Diagnostic Equipment Industry

Key Drivers:

- Aging Population: A growing elderly demographic in Italy leads to an increased incidence of age-related eye diseases like cataracts, glaucoma, and macular degeneration, escalating the demand for diagnostic and therapeutic equipment.

- Technological Advancements: Continuous innovation in imaging technologies (e.g., AI-integrated OCT, advanced retinal imaging) drives demand for upgraded and sophisticated diagnostic tools.

- Increased Awareness of Eye Health: Growing public awareness about the importance of regular eye check-ups and early detection of vision impairments fuels market growth.

- Government Initiatives & Reimbursement Policies: Supportive healthcare policies and reimbursement schemes for ophthalmic procedures and diagnostic tests encourage adoption of advanced equipment.

Barriers & Challenges:

- High Cost of Advanced Equipment: The substantial initial investment required for cutting-edge diagnostic and surgical equipment can be a significant barrier for smaller clinics and healthcare providers.

- Regulatory Compliance: Navigating complex EU and national medical device regulations (e.g., MDR) requires substantial resources and expertise, potentially slowing down product launches.

- Skilled Workforce Shortage: A lack of adequately trained professionals to operate and interpret data from highly advanced ophthalmic equipment can limit adoption.

- Economic Fluctuations: Economic downturns can impact healthcare spending, affecting the procurement of high-value medical equipment. Estimated XX% impact on market growth during economic slowdowns.

Emerging Opportunities in Italy Ophthalmic Diagnostic Equipment Industry

Emerging opportunities in the Italian ophthalmic diagnostic equipment industry lie in the increasing adoption of AI-powered diagnostic solutions, which promise enhanced accuracy and efficiency in disease detection. The growing demand for telemedicine and remote patient monitoring presents a significant avenue for growth, with opportunities for portable, connected diagnostic devices. Furthermore, the development of integrated diagnostic and treatment platforms that offer a seamless patient journey from diagnosis to post-operative care is a key trend. Untapped markets in less developed regions of Italy, coupled with a growing interest in preventative eye care, offer substantial expansion potential for both diagnostic and vision correction devices. Innovative applications of existing technologies, such as the use of OCT in neuro-ophthalmology, also present new avenues for market penetration.

Growth Accelerators in the Italy Ophthalmic Diagnostic Equipment Industry Industry

The long-term growth of the Italy Ophthalmic Diagnostic Equipment industry is being significantly accelerated by breakthroughs in digital health and artificial intelligence. The integration of AI algorithms into diagnostic devices is revolutionizing early disease detection and personalized treatment planning, leading to improved patient outcomes and operational efficiencies. Strategic partnerships between technology developers, medical device manufacturers, and healthcare institutions are fostering collaborative innovation and accelerating the adoption of new technologies. Furthermore, market expansion strategies, including the development of more affordable and user-friendly diagnostic solutions, are broadening access to advanced ophthalmic care, especially in underserved regions. The ongoing research into novel therapeutic approaches, which often rely on advanced diagnostic capabilities, also acts as a strong growth catalyst, ensuring a continuous demand for state-of-the-art ophthalmic equipment.

Key Players Shaping the Italy Ophthalmic Diagnostic Equipment Industry Market

- HAAG-Streit Group

- Carl Zeiss Meditec AG

- Ziemer Ophthalmic Systems AG

- Nidek Co Ltd

- EssilorLuxottica SA

- Johnson and Johnson

- Topcon Corporation

- Alcon Inc

- Bausch Health Companies Inc

- Hoya Corporation

Notable Milestones in Italy Ophthalmic Diagnostic Equipment Industry Sector

- September 2022: SIFI Spa launched Evolux, an intraocular lens, in Italy and other European countries, enhancing surgical treatment options.

- February 2022: Samsara Vision announced the first three successful clinical cases in Italy using its SING IMT (Smaller-Incision New-Generation Implantable Miniature Telescope) for individuals with late-stage age-related macular degeneration (AMD), showcasing advancements in vision restoration technology.

In-Depth Italy Ophthalmic Diagnostic Equipment Industry Market Outlook

The future outlook for the Italy Ophthalmic Diagnostic Equipment market is exceptionally promising, driven by ongoing technological advancements and a sustained demand for advanced eye care solutions. Growth accelerators, including the pervasive integration of AI and machine learning for enhanced diagnostic accuracy and personalized treatment, will continue to shape the market. The expansion of telemedicine and remote diagnostic capabilities presents a substantial opportunity to increase market penetration, particularly in geographically diverse areas of Italy. Strategic collaborations between key industry players and research institutions will foster a pipeline of innovative products and applications, further solidifying market growth. The increasing focus on preventative healthcare and the rising prevalence of age-related eye conditions will ensure a robust and expanding market for diagnostic and surgical ophthalmic equipment.

Italy Ophthalmic diagnostic Equipment Industry Segmentation

-

1. Devices

-

1.1. Surgical Devices

- 1.1.1. Glaucoma Drainage Devices

- 1.1.2. Glaucoma Stents and Implants

- 1.1.3. Intraocular Lenses

- 1.1.4. Lasers

- 1.1.5. Other Surgical Devices

-

1.2. Diagnostic and Monitoring Devices

- 1.2.1. Autorefractors and Keratometers

- 1.2.2. Corneal Topography Systems

- 1.2.3. Ophthalmic Ultrasound Imaging Systems

- 1.2.4. Ophthalmoscopes

- 1.2.5. Optical Coherence Tomography Scanners

- 1.2.6. Other Diagnostic and Monitoring Devices

-

1.3. Vision Correction Devices

- 1.3.1. Spectacles

- 1.3.2. Contact Lenses

-

1.1. Surgical Devices

Italy Ophthalmic diagnostic Equipment Industry Segmentation By Geography

- 1. Italy

Italy Ophthalmic diagnostic Equipment Industry Regional Market Share

Geographic Coverage of Italy Ophthalmic diagnostic Equipment Industry

Italy Ophthalmic diagnostic Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demographic Shift and Increasing Prevalence of Eye Diseases; Rising Geriatric Population; Technological Advancements in Ophthalmic Devices

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Ophthalmic Procedures

- 3.4. Market Trends

- 3.4.1. The Growth of Spectacle Lenses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Ophthalmic diagnostic Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Surgical Devices

- 5.1.1.1. Glaucoma Drainage Devices

- 5.1.1.2. Glaucoma Stents and Implants

- 5.1.1.3. Intraocular Lenses

- 5.1.1.4. Lasers

- 5.1.1.5. Other Surgical Devices

- 5.1.2. Diagnostic and Monitoring Devices

- 5.1.2.1. Autorefractors and Keratometers

- 5.1.2.2. Corneal Topography Systems

- 5.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 5.1.2.4. Ophthalmoscopes

- 5.1.2.5. Optical Coherence Tomography Scanners

- 5.1.2.6. Other Diagnostic and Monitoring Devices

- 5.1.3. Vision Correction Devices

- 5.1.3.1. Spectacles

- 5.1.3.2. Contact Lenses

- 5.1.1. Surgical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HAAG-Streit Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carl Zeiss Meditec AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ziemer Ophthalmic Systems AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nidek Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EssilorLuxottica SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson and Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topcon Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alcon Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bausch Health Companies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hoya Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 HAAG-Streit Group

List of Figures

- Figure 1: Italy Ophthalmic diagnostic Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Ophthalmic diagnostic Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Ophthalmic diagnostic Equipment Industry Revenue billion Forecast, by Devices 2020 & 2033

- Table 2: Italy Ophthalmic diagnostic Equipment Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: Italy Ophthalmic diagnostic Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Ophthalmic diagnostic Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Italy Ophthalmic diagnostic Equipment Industry Revenue billion Forecast, by Devices 2020 & 2033

- Table 6: Italy Ophthalmic diagnostic Equipment Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 7: Italy Ophthalmic diagnostic Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Italy Ophthalmic diagnostic Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Ophthalmic diagnostic Equipment Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Italy Ophthalmic diagnostic Equipment Industry?

Key companies in the market include HAAG-Streit Group, Carl Zeiss Meditec AG, Ziemer Ophthalmic Systems AG, Nidek Co Ltd, EssilorLuxottica SA, Johnson and Johnson, Topcon Corporation, Alcon Inc, Bausch Health Companies Inc, Hoya Corporation.

3. What are the main segments of the Italy Ophthalmic diagnostic Equipment Industry?

The market segments include Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Demographic Shift and Increasing Prevalence of Eye Diseases; Rising Geriatric Population; Technological Advancements in Ophthalmic Devices.

6. What are the notable trends driving market growth?

The Growth of Spectacle Lenses.

7. Are there any restraints impacting market growth?

Risk Associated with Ophthalmic Procedures.

8. Can you provide examples of recent developments in the market?

In September 2022, SIFI Spa, one of the leading international ophthalmic companies, launched Evolux, an intraocular lens, in Italy and other European countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Ophthalmic diagnostic Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Ophthalmic diagnostic Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Ophthalmic diagnostic Equipment Industry?

To stay informed about further developments, trends, and reports in the Italy Ophthalmic diagnostic Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence