Key Insights

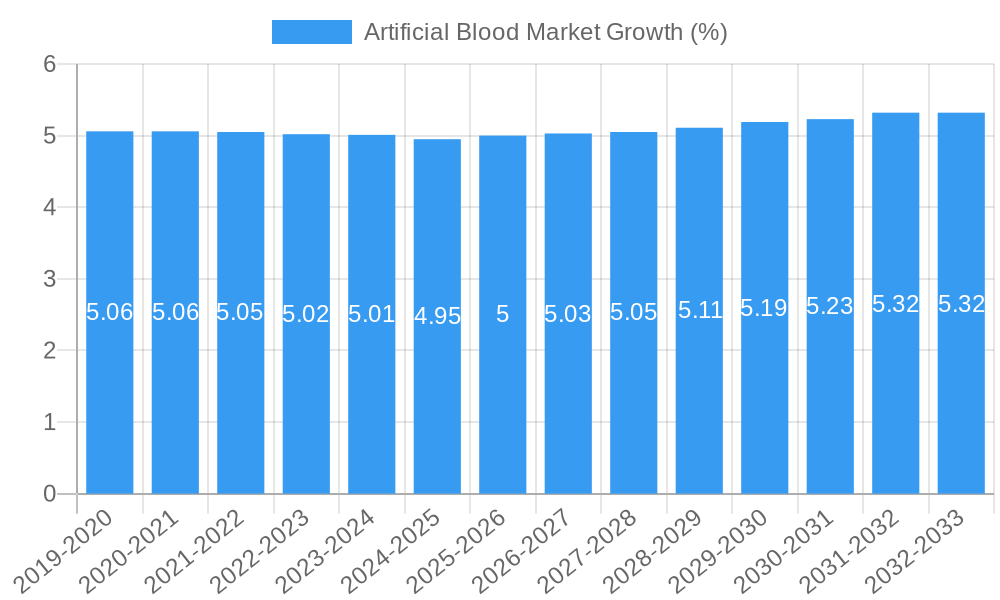

The global Artificial Blood Market is poised for significant expansion, projected to reach a substantial market size of approximately USD 5,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.30% expected to propel it through 2033. This growth trajectory is primarily driven by advancements in hemopurification technologies and the increasing prevalence of chronic diseases requiring blood-related interventions. Key applications such as Aortic Disease and Peripheral Artery Disease are expected to witness augmented demand for artificial blood substitutes, owing to their efficacy in managing complex vascular conditions and improving patient outcomes. Furthermore, the burgeoning need for efficient Hemodialysis treatments, especially in aging populations and individuals with kidney ailments, will continue to be a cornerstone of market expansion. The development of innovative polymer technologies, particularly in Polydioxanone and Elastomer-based formulations, is crucial for enhancing the safety, biocompatibility, and efficacy of artificial blood products, thereby fueling market penetration and adoption rates across diverse healthcare settings.

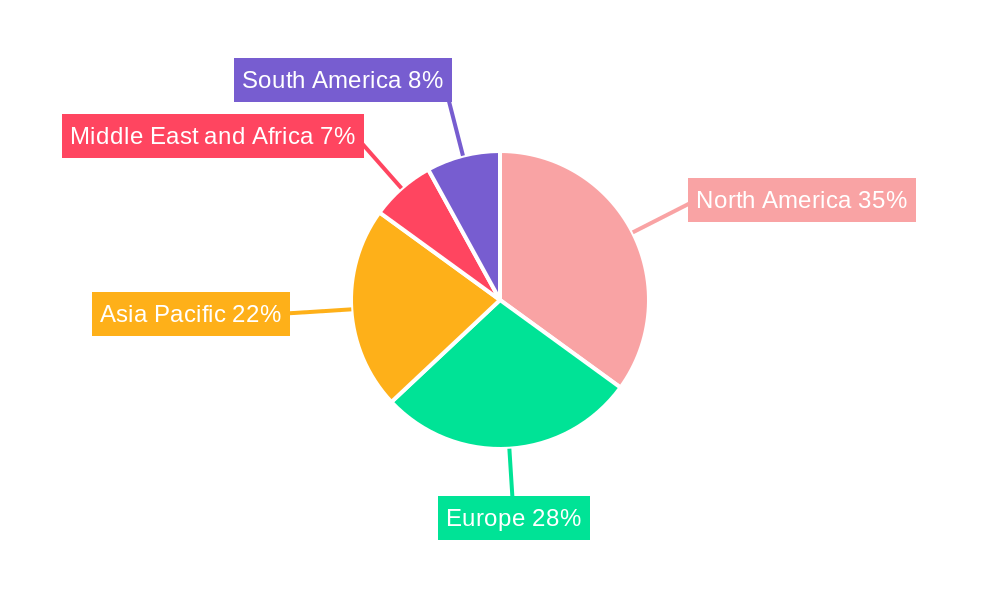

The market landscape is characterized by intense competition and strategic collaborations among leading players such as Becton Dickinson and Company, Medtronic, and W L Gore and Associates, who are at the forefront of research and development for next-generation artificial blood solutions. Emerging trends include a heightened focus on personalized medicine and the development of oxygen-carrying blood substitutes with extended shelf lives and improved delivery mechanisms. However, the market faces certain restraints, including the high cost of research and development, stringent regulatory approval processes, and the inherent challenge of replicating the complex functionalities of natural blood. Despite these hurdles, the consistent innovation in material science and the growing understanding of blood physiology are expected to pave the way for novel applications and expanded market access, particularly in regions like North America and Europe, which are characterized by advanced healthcare infrastructure and a high burden of cardiovascular diseases. The Asia Pacific region, with its rapidly growing healthcare sector and increasing disposable incomes, presents a significant untapped market opportunity for artificial blood solutions in the coming years.

This in-depth report offers a definitive analysis of the global Artificial Blood Market, meticulously examining its growth trajectory, key drivers, and future potential. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025, this research provides actionable insights for stakeholders navigating this dynamic sector. We delve into the intricate market structure, dissecting dominant regions, evolving product landscapes, and the strategic moves of key industry players. This report is essential for understanding the current state and projected evolution of artificial blood technologies, including their applications in treating Aortic Disease, Peripheral Artery Disease, and Hemodialysis, and the role of polymers like Polydioxanone, Elastomer, and Polyethylene Terephthalate.

Artificial Blood Market Dynamics & Structure

The Artificial Blood Market exhibits a moderately concentrated structure, characterized by the presence of established medical device manufacturers and innovative biotechnology firms. Technological innovation remains a primary driver, with ongoing research focused on developing more biocompatible, oxygen-carrying, and longer-lasting artificial blood substitutes. Regulatory frameworks, while crucial for patient safety, also present a significant hurdle, with stringent approval processes impacting the speed of market entry for new products. Competitive product substitutes include traditional blood transfusions, autologous blood donation, and emerging regenerative medicine approaches. End-user demographics are primarily driven by aging populations, rising incidences of cardiovascular diseases, and increasing demand for emergency medical interventions. Mergers & Acquisitions (M&A) trends are beginning to emerge, as larger players seek to acquire promising technologies and expand their portfolios.

- Market Concentration: Dominated by a few key players with significant R&D capabilities, alongside a growing number of specialized startups.

- Technological Innovation: Driven by advancements in biomaterials, nanotechnology, and drug delivery systems for enhanced oxygen transport and reduced immune responses.

- Regulatory Hurdles: FDA and EMA approvals are critical; lengthy clinical trials and safety assessments influence market penetration.

- Competitive Landscape: Competition from traditional blood products and alternative therapies necessitates continuous innovation and cost-effectiveness.

- End-User Base: Patients with chronic conditions, trauma victims, and individuals requiring complex surgical procedures.

- M&A Activity: Expected to increase as companies seek to consolidate market share and acquire innovative technologies, with an estimated xx M&A deals anticipated between 2025-2033.

Artificial Blood Market Growth Trends & Insights

The global Artificial Blood Market is poised for significant expansion, driven by an increasing unmet medical need for blood transfusions and innovative solutions for critical care. The market size is projected to evolve from an estimated XX Million units in 2025 to a substantial XX Million units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates are steadily increasing as awareness of the benefits of artificial blood substitutes, such as reduced risk of transfusion-transmitted infections and a longer shelf-life compared to donated blood, gains traction. Technological disruptions are central to this growth, with advancements in hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbons (PFCs) enhancing their efficacy and safety profiles. Consumer behavior shifts are also playing a role, with a growing preference for readily available and reliable blood alternatives, particularly in remote areas or during mass casualty events. Market penetration is currently at an early stage but is expected to accelerate with improved product performance and wider clinical adoption.

- Market Size Evolution: Projected to reach XX Million units by 2033 from an estimated XX Million units in 2025.

- Adoption Rates: Steadily increasing due to improved safety, availability, and patient outcomes.

- Technological Disruptions: Advancements in HBOCs and PFCs are crucial for overcoming previous limitations.

- Consumer Behavior Shifts: Growing demand for reliable and accessible blood alternatives.

- Market Penetration: Expected to see significant acceleration in the coming years.

- CAGR: Estimated at XX% during the 2025-2033 forecast period.

Dominant Regions, Countries, or Segments in Artificial Blood Market

North America, particularly the United States, is anticipated to emerge as a dominant region in the Artificial Blood Market. This dominance is propelled by a confluence of factors including advanced healthcare infrastructure, substantial investments in research and development, and a high prevalence of conditions requiring blood transfusions, such as Aortic Disease and Peripheral Artery Disease. The region also boasts a strong presence of key market players and a well-established regulatory framework that, while stringent, fosters innovation.

Within the application segment, Peripheral Artery Disease is expected to be a significant growth driver, owing to the increasing incidence of diabetes and lifestyle-related diseases leading to vascular complications. Hemodialysis also presents a substantial application, with the growing number of patients requiring renal replacement therapies.

From a polymer perspective, Elastomer-based materials are gaining traction due to their flexibility and biocompatibility, making them suitable for various cardiovascular applications. However, ongoing research into biodegradable polymers like Polydioxanone and advanced materials like Polyethylene Terephthalate is also contributing to the diverse polymer landscape. The presence of robust funding for biomedical research and a proactive approach to adopting novel medical technologies further solidify North America's leading position. The favorable reimbursement policies and a growing awareness among healthcare professionals regarding the benefits of artificial blood substitutes will continue to fuel market expansion in this region, with an estimated market share of XX% in 2025, projected to reach XX% by 2033.

- Dominant Region: North America (specifically the United States).

- Key Drivers in North America: Advanced healthcare infrastructure, R&D investments, high disease prevalence, presence of key players, and supportive regulatory environment.

- Dominant Application Segments: Peripheral Artery Disease and Hemodialysis.

- Growth Factors for Peripheral Artery Disease: Rising rates of diabetes and cardiovascular diseases.

- Growth Factors for Hemodialysis: Increasing demand for renal replacement therapies.

- Prominent Polymer Types: Elastomer, with growing interest in Polydioxanone and Polyethylene Terephthalate.

- Market Share (North America): Estimated XX% in 2025, projected XX% by 2033.

Artificial Blood Market Product Landscape

The product landscape of the Artificial Blood Market is characterized by continuous innovation aimed at improving oxygen-carrying capacity, biocompatibility, and shelf-life. Key product types include Hemoglobin-Based Oxygen Carriers (HBOCs) and Perfluorocarbon-based Oxygen Carriers (PFCs). HBOCs, derived from modified human or animal hemoglobin, offer promising potential for emergency transfusion and oxygen delivery. PFCs, synthetic compounds capable of dissolving large amounts of oxygen, are being explored for applications in organ preservation and as contrast agents. Innovations focus on reducing side effects such as vasoconstriction and nitric oxide scavenging associated with early HBOCs, while PFCs are being refined for better biocompatibility and targeted delivery. The performance metrics of these products are evaluated based on their oxygen transport efficiency, half-life in circulation, immunogenicity, and overall safety profile.

Key Drivers, Barriers & Challenges in Artificial Blood Market

Key Drivers:

- Growing Blood Shortages: The persistent global shortage of donated blood drives the demand for artificial blood substitutes.

- Advancements in Biomaterials: Innovations in nanotechnology and polymer science are enabling the development of safer and more effective artificial blood.

- Increasing Incidence of Chronic Diseases: The rising prevalence of cardiovascular diseases, cancer, and diabetes necessitates improved treatment options, including blood substitutes.

- Technological Breakthroughs in Oxygen Carriers: Development of novel HBOCs and PFCs with enhanced oxygen-carrying capabilities.

- Government Initiatives and Funding: Increased government support for R&D in life sciences and healthcare.

Barriers & Challenges:

- High Development and Manufacturing Costs: The complex R&D and manufacturing processes lead to high product costs, limiting accessibility.

- Regulatory Hurdles and Clinical Trial Duration: Stringent approval processes and lengthy clinical trials can delay market entry and increase investment risk.

- Limited Shelf-Life and Stability Issues: Ensuring long-term stability and efficacy of artificial blood substitutes remains a technical challenge.

- Potential Side Effects and Immunogenicity: Concerns regarding adverse reactions, such as vasoconstriction and immune responses, need to be addressed.

- Competition from Traditional Blood Transfusions: The established infrastructure and familiarity with donated blood pose a competitive challenge.

- Supply Chain Complexities: Sourcing raw materials and maintaining a consistent supply chain for specialized components can be difficult, impacting a potential XX% of market growth.

Emerging Opportunities in Artificial Blood Market

Emerging opportunities in the Artificial Blood Market lie in the development of next-generation oxygen carriers with improved biocompatibility and reduced side effects. Untapped markets in developing nations, where blood bank infrastructure is often lacking, present a significant growth avenue. Innovative applications such as targeted drug delivery, organ preservation, and even wound healing therapies are also poised to expand the market's scope. Evolving consumer preferences for personalized medicine and preventative healthcare could also drive demand for tailored artificial blood solutions. The potential for integration with other advanced medical technologies, like microfluidics for diagnostics, opens up further avenues for innovation and market penetration.

Growth Accelerators in the Artificial Blood Market Industry

Long-term growth in the Artificial Blood Market will be significantly accelerated by continued technological breakthroughs in biomimicry and nanotechnology, enabling the creation of artificial blood that more closely mimics the function of natural blood. Strategic partnerships between biotechnology firms, academic institutions, and large pharmaceutical companies will expedite the translation of research into commercially viable products. Market expansion strategies targeting specific unmet medical needs, such as in remote areas or during mass casualty events, will further fuel growth. The development of cost-effective manufacturing processes and improved distribution networks will also be critical catalysts for widespread adoption. Furthermore, increased investment in regenerative medicine and stem cell therapies could create synergistic opportunities for artificial blood applications.

Key Players Shaping the Artificial Blood Market Market

- Becton Dickinson and Company

- Humacyte Inc

- Techshot Inc

- Medtronic

- W L Gore and Associates

- Cook Medical Incorporated

- LeMaitre Vascular Inc

- B Braun Melsungen

- Terumo Medical Corporation

- Jotec GmbH

Notable Milestones in Artificial Blood Market Sector

- 2020: Humacyte Inc. receives FDA Fast Track Designation for its investigational bioengineered blood vessel for hemodialysis.

- 2021: Techshot Inc. receives FDA clearance for its first 3D bioprinter for human cells and tissues.

- 2022: W. L. Gore & Associates announces significant advancements in its cardiovascular device portfolio, indirectly impacting the need for blood management.

- 2023 (Q4): Becton Dickinson and Company partners with a leading research institution to explore novel drug delivery systems leveraging biomaterials.

- 2024 (Q1): LeMaitre Vascular Inc. expands its product offerings in endovascular treatments, indirectly influencing the demand for related blood management solutions.

In-Depth Artificial Blood Market Market Outlook

- 2020: Humacyte Inc. receives FDA Fast Track Designation for its investigational bioengineered blood vessel for hemodialysis.

- 2021: Techshot Inc. receives FDA clearance for its first 3D bioprinter for human cells and tissues.

- 2022: W. L. Gore & Associates announces significant advancements in its cardiovascular device portfolio, indirectly impacting the need for blood management.

- 2023 (Q4): Becton Dickinson and Company partners with a leading research institution to explore novel drug delivery systems leveraging biomaterials.

- 2024 (Q1): LeMaitre Vascular Inc. expands its product offerings in endovascular treatments, indirectly influencing the demand for related blood management solutions.

In-Depth Artificial Blood Market Market Outlook

The outlook for the Artificial Blood Market is exceptionally promising, driven by a confluence of factors poised to unlock significant future potential. Continued advancements in material science and bioengineering will pave the way for artificial blood substitutes that offer superior oxygen transport, extended shelf-life, and enhanced safety profiles, effectively addressing many of the limitations of current technologies. Strategic collaborations and mergers will consolidate expertise and accelerate product development cycles, bringing innovative solutions to market more efficiently. The growing global demand for blood products, coupled with an increasing incidence of conditions requiring transfusions, provides a strong foundation for market expansion. Furthermore, the exploration of novel applications beyond traditional transfusion support, such as in tissue engineering and regenerative medicine, will create entirely new revenue streams and market segments, positioning artificial blood as a transformative technology in modern healthcare.

Artificial Blood Market Segmentation

-

1. Application

- 1.1. Aortic Disease

- 1.2. Peripheral Artery Disease

- 1.3. Hemodialysis

-

2. Polymer

- 2.1. Polydioxanone

- 2.2. Elastomer

- 2.3. Polyethylene Terephthalate

- 2.4. Others

Artificial Blood Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Artificial Blood Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Prevalence of Aortic Diseases; Growing Adoption of Minimally Invasive Surgeries; Technoloigical Advancements in Development of Artificial Blood Vessels

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Transplants and Surgeries

- 3.4. Market Trends

- 3.4.1. Application in Aortic Disease is Expected to cover a Large Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aortic Disease

- 5.1.2. Peripheral Artery Disease

- 5.1.3. Hemodialysis

- 5.2. Market Analysis, Insights and Forecast - by Polymer

- 5.2.1. Polydioxanone

- 5.2.2. Elastomer

- 5.2.3. Polyethylene Terephthalate

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aortic Disease

- 6.1.2. Peripheral Artery Disease

- 6.1.3. Hemodialysis

- 6.2. Market Analysis, Insights and Forecast - by Polymer

- 6.2.1. Polydioxanone

- 6.2.2. Elastomer

- 6.2.3. Polyethylene Terephthalate

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aortic Disease

- 7.1.2. Peripheral Artery Disease

- 7.1.3. Hemodialysis

- 7.2. Market Analysis, Insights and Forecast - by Polymer

- 7.2.1. Polydioxanone

- 7.2.2. Elastomer

- 7.2.3. Polyethylene Terephthalate

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aortic Disease

- 8.1.2. Peripheral Artery Disease

- 8.1.3. Hemodialysis

- 8.2. Market Analysis, Insights and Forecast - by Polymer

- 8.2.1. Polydioxanone

- 8.2.2. Elastomer

- 8.2.3. Polyethylene Terephthalate

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aortic Disease

- 9.1.2. Peripheral Artery Disease

- 9.1.3. Hemodialysis

- 9.2. Market Analysis, Insights and Forecast - by Polymer

- 9.2.1. Polydioxanone

- 9.2.2. Elastomer

- 9.2.3. Polyethylene Terephthalate

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aortic Disease

- 10.1.2. Peripheral Artery Disease

- 10.1.3. Hemodialysis

- 10.2. Market Analysis, Insights and Forecast - by Polymer

- 10.2.1. Polydioxanone

- 10.2.2. Elastomer

- 10.2.3. Polyethylene Terephthalate

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Artificial Blood Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Humacyte Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Techshot Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Medtronic

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 W L Gore and Associates*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cook Medical Incorporated

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 LeMaitre Vascular Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 B Braun Melsungen

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Terumo Medical Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Jotec GmbH

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Artificial Blood Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Artificial Blood Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Artificial Blood Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Artificial Blood Market Revenue (Million), by Polymer 2024 & 2032

- Figure 15: North America Artificial Blood Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 16: North America Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Artificial Blood Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Artificial Blood Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Artificial Blood Market Revenue (Million), by Polymer 2024 & 2032

- Figure 21: Europe Artificial Blood Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 22: Europe Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Artificial Blood Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Artificial Blood Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Artificial Blood Market Revenue (Million), by Polymer 2024 & 2032

- Figure 27: Asia Pacific Artificial Blood Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 28: Asia Pacific Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Artificial Blood Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Middle East and Africa Artificial Blood Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Middle East and Africa Artificial Blood Market Revenue (Million), by Polymer 2024 & 2032

- Figure 33: Middle East and Africa Artificial Blood Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 34: Middle East and Africa Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Artificial Blood Market Revenue (Million), by Application 2024 & 2032

- Figure 37: South America Artificial Blood Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: South America Artificial Blood Market Revenue (Million), by Polymer 2024 & 2032

- Figure 39: South America Artificial Blood Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 40: South America Artificial Blood Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Artificial Blood Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Artificial Blood Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Artificial Blood Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Artificial Blood Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 4: Global Artificial Blood Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Artificial Blood Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Artificial Blood Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 33: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Artificial Blood Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Global Artificial Blood Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 39: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Artificial Blood Market Revenue Million Forecast, by Application 2019 & 2032

- Table 47: Global Artificial Blood Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 48: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Artificial Blood Market Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global Artificial Blood Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 57: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Artificial Blood Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Artificial Blood Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 63: Global Artificial Blood Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Artificial Blood Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Blood Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Artificial Blood Market?

Key companies in the market include Becton Dickinson and Company, Humacyte Inc, Techshot Inc, Medtronic, W L Gore and Associates*List Not Exhaustive, Cook Medical Incorporated, LeMaitre Vascular Inc, B Braun Melsungen, Terumo Medical Corporation, Jotec GmbH.

3. What are the main segments of the Artificial Blood Market?

The market segments include Application, Polymer.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Prevalence of Aortic Diseases; Growing Adoption of Minimally Invasive Surgeries; Technoloigical Advancements in Development of Artificial Blood Vessels.

6. What are the notable trends driving market growth?

Application in Aortic Disease is Expected to cover a Large Share of the Market.

7. Are there any restraints impacting market growth?

; High Cost Associated with Transplants and Surgeries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Blood Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Blood Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Blood Market?

To stay informed about further developments, trends, and reports in the Artificial Blood Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence