Key Insights

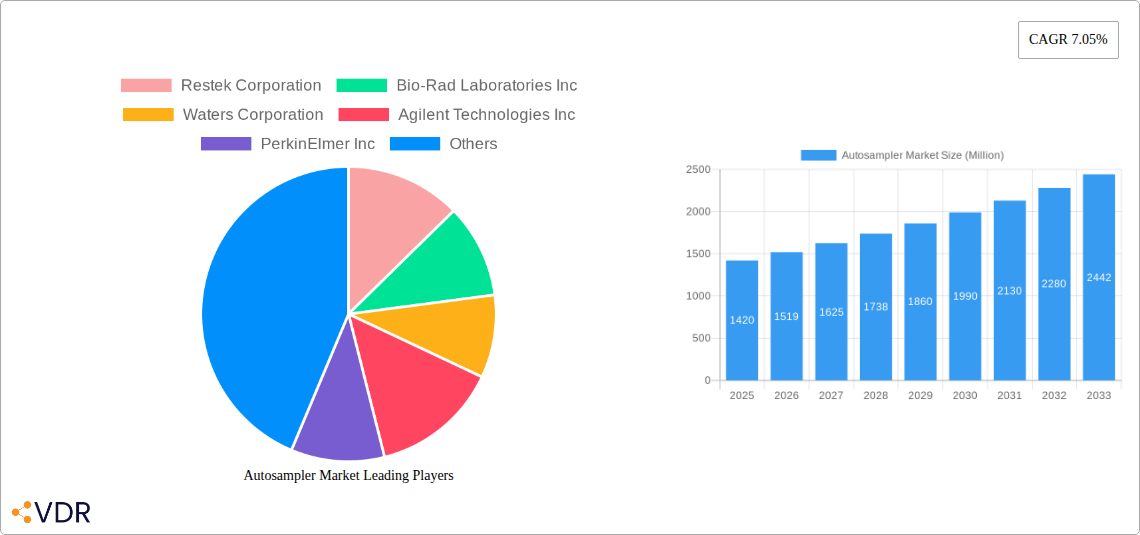

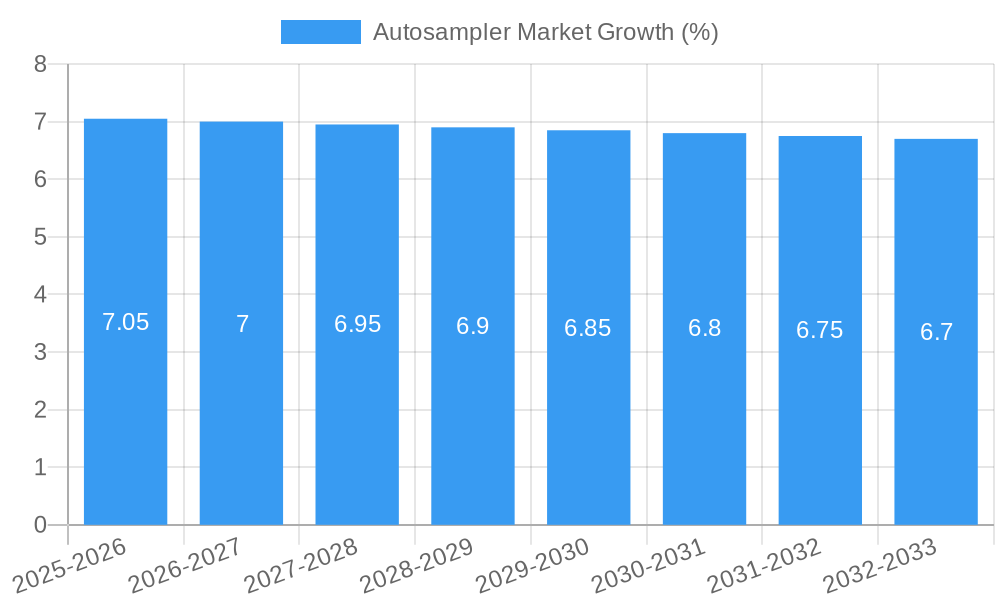

The global autosampler market is experiencing robust growth, projected to reach an estimated market size of approximately USD 1.42 billion in 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 7.05%, indicating sustained and significant market momentum throughout the forecast period extending to 2033. The increasing demand for automation in analytical laboratories across various sectors is a primary driver. Pharmaceutical and biopharmaceutical companies are leading this adoption, driven by the need for enhanced throughput, accuracy, and reliability in drug discovery, development, and quality control processes. Similarly, the food and beverage industry is leveraging autosamplers to ensure product safety and quality through rigorous testing, while environmental testing laboratories rely on these instruments for accurate and efficient analysis of pollutants and contaminants. The market's growth is further supported by continuous technological advancements, including the development of more sophisticated and versatile autosampler systems that offer improved performance, reduced sample consumption, and greater automation capabilities.

The autosampler market is characterized by a dynamic interplay of growth drivers, emerging trends, and certain restraining factors. Key trends include the increasing integration of autosamplers with advanced analytical instruments like Liquid Chromatography (LC) and Gas Chromatography (GC) systems, leading to fully automated analytical workflows. The development of miniaturized and portable autosamplers is also gaining traction, catering to field-based testing and reducing laboratory space requirements. While the market benefits from strong demand, potential restraints include the high initial cost of advanced autosampler systems and the need for skilled personnel to operate and maintain them. However, the long-term benefits of increased efficiency, reduced labor costs, and improved data quality are expected to outweigh these initial hurdles. Restek Corporation, Bio-Rad Laboratories Inc., Waters Corporation, Agilent Technologies Inc., PerkinElmer Inc., Scion Instruments, Gilson Inc., Thermo Fisher Scientific, and Shimadzu Corporation are prominent players actively shaping the competitive landscape through innovation and strategic partnerships.

Autosampler Market Report: Navigating Automation in Chromatography for Enhanced Efficiency

Unlock insights into the dynamic global autosampler market, a critical component of modern analytical laboratories. This comprehensive report provides an in-depth analysis of market size, growth trends, key players, and future opportunities in the automated sample handling sector. Discover how advancements in Liquid Chromatography Autosamplers and Gas Chromatography Autosamplers are revolutionizing industries from pharmaceuticals to environmental testing.

This report delves into the intricate landscape of the autosampler market, offering detailed forecasts and strategic recommendations for stakeholders. With a study period spanning from 2019 to 2033, and a base year of 2025, our analysis provides a robust outlook on market evolution. We explore the parent market of chromatography instrumentation and its child market, autosamplers, highlighting their symbiotic relationship and growth trajectories. All quantitative data is presented in Million units, offering a clear and actionable financial perspective.

Autosampler Market Market Dynamics & Structure

The global autosampler market exhibits a moderately concentrated structure, driven by significant technological innovation and stringent regulatory frameworks. Leading players like Thermo Fisher Scientific, Agilent Technologies Inc., and Waters Corporation dominate market share through continuous product development and strategic acquisitions. The primary drivers of innovation include the increasing demand for high-throughput screening, enhanced analytical accuracy, and miniaturization of laboratory workflows. Regulatory bodies globally are also pushing for greater standardization and automation, indirectly fueling autosampler adoption. Competitive product substitutes are limited, with manual sample preparation remaining the primary alternative, but its inefficiencies are increasingly being recognized. The end-user demographics reveal a strong reliance on the pharmaceutical and biopharmaceutical sectors, followed by the food and beverage industry and environmental testing, all seeking to improve efficiency and reduce human error. Mergers and acquisitions (M&A) activity, though not extremely high, often involve smaller, specialized technology providers being integrated into larger portfolios to enhance offerings.

- Market Concentration: Moderately concentrated with a few key global players.

- Key Innovation Drivers: High-throughput analysis, accuracy demands, lab automation trends.

- Regulatory Influence: Increasing emphasis on standardization and automation.

- End-User Dominance: Pharmaceutical & Biopharmaceutical, Food & Beverage, Environmental Testing.

- M&A Trends: Strategic acquisitions of niche technology providers.

Autosampler Market Growth Trends & Insights

The autosampler market is experiencing robust growth, projected to expand significantly from its estimated value in 2025. This expansion is propelled by an increasing global emphasis on laboratory automation across diverse analytical applications. The adoption rates for autosamplers are steadily rising as industries recognize the inherent benefits of increased sample throughput, reduced operational costs, and minimized risk of human error. Technological disruptions are continuously shaping the market, with advancements in robotics, artificial intelligence for sample tracking, and integration with sophisticated analytical instruments like LC-MS and GC-MS. Consumer behavior is shifting towards prioritizing efficiency and data integrity, making automated sample handling indispensable. The market penetration of autosamplers is expected to deepen, particularly in emerging economies where laboratory infrastructure is rapidly developing. The Compound Annual Growth Rate (CAGR) for the forecast period is strong, reflecting sustained demand. The parent market of chromatography instrumentation continues to expand, creating a fertile ground for the child market of autosamplers to flourish. This interconnected growth ensures a continuous cycle of innovation and demand.

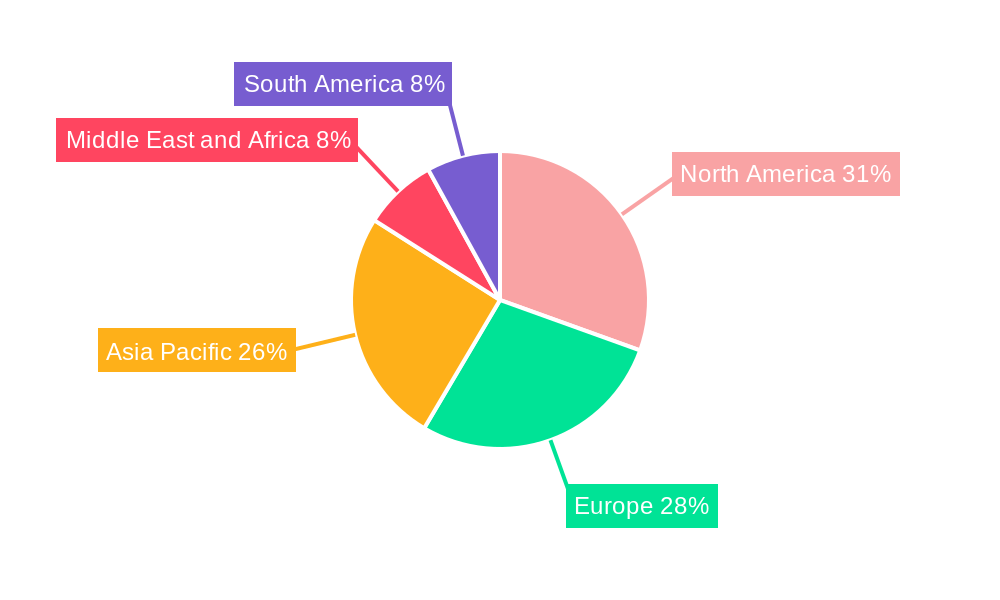

Dominant Regions, Countries, or Segments in Autosampler Market

North America currently leads the autosampler market, driven by a robust pharmaceutical and biotechnology industry, significant investment in research and development, and a well-established regulatory framework that encourages laboratory automation. The United States, in particular, is a powerhouse, owing to the presence of major pharmaceutical companies, advanced environmental testing facilities, and a high adoption rate of cutting-edge analytical technologies. The dominance of the Pharmaceutical and Biopharmaceutical Companies end-user segment is a primary growth driver within this region and globally. These companies rely heavily on autosamplers for drug discovery, quality control, and clinical trials, demanding high precision and throughput.

- North America's Leading Position: Fueled by strong R&D, pharmaceutical presence, and regulatory support.

- United States' Significance: Hub for pharmaceutical innovation, environmental monitoring, and tech adoption.

- Dominant End-User: Pharmaceutical & Biopharmaceutical Companies: Crucial for drug development, QC, and clinical research.

- Key Growth Drivers in North America:

- High R&D expenditure in life sciences.

- Strict quality control mandates.

- Government initiatives supporting technological advancement in healthcare.

- Presence of leading analytical instrument manufacturers.

- Global Impact of this Segment: The demand from pharmaceutical companies globally dictates trends and innovation in the autosampler market.

The Liquid Chromatography Autosamplers within the Product: Systems segment also represents a significant growth driver. The increasing sophistication of LC techniques and the need for automated injection processes in complex sample matrices contribute to its dominance. Furthermore, the Food and Beverage Industry is showing accelerated growth, driven by stringent food safety regulations and the demand for rapid quality control testing. Environmental testing, while smaller in market share, is a consistent contributor, with increasing global concerns about pollution and climate change necessitating more rigorous and frequent analysis.

Autosampler Market Product Landscape

The autosampler market is characterized by continuous product innovation focused on enhancing precision, speed, and versatility. Liquid Chromatography Autosamplers and Gas Chromatography Autosamplers are the primary system types, each offering specialized functionalities. Liquid Chromatography Autosamplers are increasingly incorporating advanced injection technologies and sample preparation automation for complex matrices, while Gas Chromatography Autosamplers are evolving with higher temperature capabilities and improved detection sensitivity. Accessories, such as vials, caps, and plates, play a crucial role in ensuring sample integrity and compatibility, with manufacturers offering a wide range of specialized consumables. Unique selling propositions include enhanced throughput, reduced carryover, user-friendly software integration, and robust build quality for continuous operation. Technological advancements are geared towards miniaturization, improved robotic arms for precise sample handling, and seamless integration with laboratory information management systems (LIMS).

Key Drivers, Barriers & Challenges in Autosampler Market

Key Drivers: The autosampler market is propelled by several factors. Technologically, the drive for increased analytical throughput and accuracy in research and quality control is paramount. Economically, the reduction in labor costs and operational expenses associated with automation is a significant incentive. Policy-driven factors, such as stricter regulatory compliance requirements in industries like pharmaceuticals and food safety, mandate the use of precise and reproducible analytical methods, often facilitated by autosamplers. The growing demand for sophisticated analytical techniques like LC-MS and GC-MS, which require precise sample introduction, further fuels market growth.

Barriers & Challenges: Despite the positive outlook, the market faces several challenges. High initial capital investment for advanced autosampler systems can be a barrier for smaller laboratories or those in resource-constrained regions, estimated to be a XX% barrier. Supply chain disruptions, particularly for specialized components and microfluidics, can impact production and lead times. Evolving regulatory landscapes, while often a driver, can also present challenges as manufacturers must adapt to new standards and validation requirements. Intense competition among established players and emerging companies can lead to price pressures and a need for continuous innovation to maintain market share.

Emerging Opportunities in Autosampler Market

Emerging opportunities in the autosampler market are diverse, spanning untapped geographical markets and innovative application areas. The growing adoption of laboratory automation in emerging economies in Asia-Pacific and Latin America presents significant growth potential. Furthermore, the application of autosamplers in novel fields such as personalized medicine, forensic science, and advanced materials research is creating new demand. The integration of AI and machine learning for predictive maintenance and intelligent sample scheduling within autosampler systems offers a path for enhanced operational efficiency and predictive analytics, representing a significant technological opportunity. Evolving consumer preferences lean towards more sustainable and eco-friendly laboratory practices, creating a niche for autosampler solutions that minimize solvent waste and energy consumption.

Growth Accelerators in the Autosampler Market Industry

Several key catalysts are accelerating growth in the autosampler industry. Technological breakthroughs in robotics, sensor technology, and data analytics are enabling the development of more sophisticated and intelligent autosampler systems. Strategic partnerships between analytical instrument manufacturers and autosampler specialists are fostering integrated solutions and expanding market reach. For instance, collaborations to create seamless workflows for automated process analysis are gaining traction. Market expansion strategies, including targeting niche applications and developing cost-effective solutions for mid-sized laboratories, are also playing a crucial role. The increasing outsourcing of analytical testing by various industries also contributes to sustained demand for efficient and reliable autosampling solutions.

Key Players Shaping the Autosampler Market Market

- Restek Corporation

- Bio-Rad Laboratories Inc.

- Waters Corporation

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Scion Instruments

- Gilson Inc.

- Thermo Fisher Scientific

- Shimadzu Corporation

- Bruker Corporation

Notable Milestones in Autosampler Market Sector

- May 2022: Agilent Technologies Inc. collaborated with APC Ltd., focusing on combining technologies to offer unique automated process analysis workflows via liquid chromatography (LC).

- February 2022: Thermo Scientific launched the SureStart portfolio of chromatography and mass spectrometry consumables, including a wide array of compatible caps, vials, and plates for all add-ons and chromatography autosamplers.

- January 2022: Bruker Corporation acquired Prolab Instruments GmbH, a specialist in low-flow, high-precision liquid chromatography technology and systems, enhancing its LC portfolio.

In-Depth Autosampler Market Market Outlook

The in-depth autosampler market outlook indicates a sustained period of strong growth, driven by ongoing technological advancements and increasing global demand for laboratory automation. The integration of artificial intelligence and machine learning into autosampler systems is poised to revolutionize sample management, offering predictive analytics and optimized workflows. Strategic partnerships and collaborations will continue to be pivotal in developing comprehensive solutions that address the evolving needs of industries like pharmaceuticals, biotechnology, and environmental science. The expansion into emerging markets, coupled with a focus on developing cost-effective and highly efficient autosampling solutions, will unlock new avenues for market penetration. The overall future market potential is significant, with continuous innovation promising to further enhance analytical capabilities and operational efficiencies.

Autosampler Market Segmentation

-

1. Product

-

1.1. Systems

- 1.1.1. Liquid Chromatography Autosamplers

- 1.1.2. Gas Chromatography Autosamplers

- 1.2. Accessories

-

1.1. Systems

-

2. End-User

- 2.1. Pharmaceutical and Biopharmaceutical Companies

- 2.2. Food and Beverage Industry

- 2.3. Environmental Testing Industry

- 2.4. Others

Autosampler Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Autosampler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Various Advantages of Autosamplers Coupled with Growing Importance of Chromatography in Drug Approval; Increasing Food Safety Concerns

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals; Limitations in Budget of Small and Mid-Size Market Players

- 3.4. Market Trends

- 3.4.1. Pharmaceutical and Biotechnology Companies are Expected to Witness High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Systems

- 5.1.1.1. Liquid Chromatography Autosamplers

- 5.1.1.2. Gas Chromatography Autosamplers

- 5.1.2. Accessories

- 5.1.1. Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Pharmaceutical and Biopharmaceutical Companies

- 5.2.2. Food and Beverage Industry

- 5.2.3. Environmental Testing Industry

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Systems

- 6.1.1.1. Liquid Chromatography Autosamplers

- 6.1.1.2. Gas Chromatography Autosamplers

- 6.1.2. Accessories

- 6.1.1. Systems

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Pharmaceutical and Biopharmaceutical Companies

- 6.2.2. Food and Beverage Industry

- 6.2.3. Environmental Testing Industry

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Systems

- 7.1.1.1. Liquid Chromatography Autosamplers

- 7.1.1.2. Gas Chromatography Autosamplers

- 7.1.2. Accessories

- 7.1.1. Systems

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Pharmaceutical and Biopharmaceutical Companies

- 7.2.2. Food and Beverage Industry

- 7.2.3. Environmental Testing Industry

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Systems

- 8.1.1.1. Liquid Chromatography Autosamplers

- 8.1.1.2. Gas Chromatography Autosamplers

- 8.1.2. Accessories

- 8.1.1. Systems

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Pharmaceutical and Biopharmaceutical Companies

- 8.2.2. Food and Beverage Industry

- 8.2.3. Environmental Testing Industry

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Systems

- 9.1.1.1. Liquid Chromatography Autosamplers

- 9.1.1.2. Gas Chromatography Autosamplers

- 9.1.2. Accessories

- 9.1.1. Systems

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Pharmaceutical and Biopharmaceutical Companies

- 9.2.2. Food and Beverage Industry

- 9.2.3. Environmental Testing Industry

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Systems

- 10.1.1.1. Liquid Chromatography Autosamplers

- 10.1.1.2. Gas Chromatography Autosamplers

- 10.1.2. Accessories

- 10.1.1. Systems

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Pharmaceutical and Biopharmaceutical Companies

- 10.2.2. Food and Beverage Industry

- 10.2.3. Environmental Testing Industry

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Autosampler Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Restek Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bio-Rad Laboratories Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Waters Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Agilent Technologies Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 PerkinElmer Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Scion Instruments

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Gilson Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Thermo Fisher Scientific

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Shimadzu Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Restek Corporation

List of Figures

- Figure 1: Global Autosampler Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Autosampler Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: Middle East and Africa Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Autosampler Market Revenue (Million), by Product 2024 & 2032

- Figure 24: North America Autosampler Market Volume (K Unit), by Product 2024 & 2032

- Figure 25: North America Autosampler Market Revenue Share (%), by Product 2024 & 2032

- Figure 26: North America Autosampler Market Volume Share (%), by Product 2024 & 2032

- Figure 27: North America Autosampler Market Revenue (Million), by End-User 2024 & 2032

- Figure 28: North America Autosampler Market Volume (K Unit), by End-User 2024 & 2032

- Figure 29: North America Autosampler Market Revenue Share (%), by End-User 2024 & 2032

- Figure 30: North America Autosampler Market Volume Share (%), by End-User 2024 & 2032

- Figure 31: North America Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Autosampler Market Revenue (Million), by Product 2024 & 2032

- Figure 36: Europe Autosampler Market Volume (K Unit), by Product 2024 & 2032

- Figure 37: Europe Autosampler Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: Europe Autosampler Market Volume Share (%), by Product 2024 & 2032

- Figure 39: Europe Autosampler Market Revenue (Million), by End-User 2024 & 2032

- Figure 40: Europe Autosampler Market Volume (K Unit), by End-User 2024 & 2032

- Figure 41: Europe Autosampler Market Revenue Share (%), by End-User 2024 & 2032

- Figure 42: Europe Autosampler Market Volume Share (%), by End-User 2024 & 2032

- Figure 43: Europe Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 44: Europe Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 45: Europe Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Europe Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 47: Asia Pacific Autosampler Market Revenue (Million), by Product 2024 & 2032

- Figure 48: Asia Pacific Autosampler Market Volume (K Unit), by Product 2024 & 2032

- Figure 49: Asia Pacific Autosampler Market Revenue Share (%), by Product 2024 & 2032

- Figure 50: Asia Pacific Autosampler Market Volume Share (%), by Product 2024 & 2032

- Figure 51: Asia Pacific Autosampler Market Revenue (Million), by End-User 2024 & 2032

- Figure 52: Asia Pacific Autosampler Market Volume (K Unit), by End-User 2024 & 2032

- Figure 53: Asia Pacific Autosampler Market Revenue Share (%), by End-User 2024 & 2032

- Figure 54: Asia Pacific Autosampler Market Volume Share (%), by End-User 2024 & 2032

- Figure 55: Asia Pacific Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 56: Asia Pacific Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 57: Asia Pacific Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East and Africa Autosampler Market Revenue (Million), by Product 2024 & 2032

- Figure 60: Middle East and Africa Autosampler Market Volume (K Unit), by Product 2024 & 2032

- Figure 61: Middle East and Africa Autosampler Market Revenue Share (%), by Product 2024 & 2032

- Figure 62: Middle East and Africa Autosampler Market Volume Share (%), by Product 2024 & 2032

- Figure 63: Middle East and Africa Autosampler Market Revenue (Million), by End-User 2024 & 2032

- Figure 64: Middle East and Africa Autosampler Market Volume (K Unit), by End-User 2024 & 2032

- Figure 65: Middle East and Africa Autosampler Market Revenue Share (%), by End-User 2024 & 2032

- Figure 66: Middle East and Africa Autosampler Market Volume Share (%), by End-User 2024 & 2032

- Figure 67: Middle East and Africa Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 68: Middle East and Africa Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 69: Middle East and Africa Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: Middle East and Africa Autosampler Market Volume Share (%), by Country 2024 & 2032

- Figure 71: South America Autosampler Market Revenue (Million), by Product 2024 & 2032

- Figure 72: South America Autosampler Market Volume (K Unit), by Product 2024 & 2032

- Figure 73: South America Autosampler Market Revenue Share (%), by Product 2024 & 2032

- Figure 74: South America Autosampler Market Volume Share (%), by Product 2024 & 2032

- Figure 75: South America Autosampler Market Revenue (Million), by End-User 2024 & 2032

- Figure 76: South America Autosampler Market Volume (K Unit), by End-User 2024 & 2032

- Figure 77: South America Autosampler Market Revenue Share (%), by End-User 2024 & 2032

- Figure 78: South America Autosampler Market Volume Share (%), by End-User 2024 & 2032

- Figure 79: South America Autosampler Market Revenue (Million), by Country 2024 & 2032

- Figure 80: South America Autosampler Market Volume (K Unit), by Country 2024 & 2032

- Figure 81: South America Autosampler Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: South America Autosampler Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Autosampler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Autosampler Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Autosampler Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Autosampler Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Global Autosampler Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Global Autosampler Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Global Autosampler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Autosampler Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: France Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Italy Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Spain Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: China Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: China Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Japan Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: India Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Australia Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: South Korea Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Korea Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: GCC Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: GCC Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: South Africa Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Africa Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Rest of Middle East and Africa Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East and Africa Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Brazil Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Brazil Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Argentina Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Argentina Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Rest of South America Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Global Autosampler Market Revenue Million Forecast, by Product 2019 & 2032

- Table 62: Global Autosampler Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 63: Global Autosampler Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 64: Global Autosampler Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 65: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: United States Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: United States Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Canada Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Canada Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Mexico Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Mexico Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Global Autosampler Market Revenue Million Forecast, by Product 2019 & 2032

- Table 74: Global Autosampler Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 75: Global Autosampler Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 76: Global Autosampler Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 77: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 79: Germany Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Germany Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: United Kingdom Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: United Kingdom Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: France Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: France Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Italy Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Italy Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Spain Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Spain Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Rest of Europe Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Rest of Europe Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Global Autosampler Market Revenue Million Forecast, by Product 2019 & 2032

- Table 92: Global Autosampler Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 93: Global Autosampler Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 94: Global Autosampler Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 95: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 96: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 97: China Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: China Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Japan Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Japan Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: India Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: India Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 103: Australia Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Australia Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 105: South Korea Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: South Korea Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 107: Rest of Asia Pacific Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: Rest of Asia Pacific Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 109: Global Autosampler Market Revenue Million Forecast, by Product 2019 & 2032

- Table 110: Global Autosampler Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 111: Global Autosampler Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 112: Global Autosampler Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 113: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 114: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 115: GCC Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: GCC Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 117: South Africa Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: South Africa Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 119: Rest of Middle East and Africa Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: Rest of Middle East and Africa Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 121: Global Autosampler Market Revenue Million Forecast, by Product 2019 & 2032

- Table 122: Global Autosampler Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 123: Global Autosampler Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 124: Global Autosampler Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 125: Global Autosampler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 126: Global Autosampler Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 127: Brazil Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: Brazil Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 129: Argentina Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: Argentina Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 131: Rest of South America Autosampler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 132: Rest of South America Autosampler Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autosampler Market?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the Autosampler Market?

Key companies in the market include Restek Corporation, Bio-Rad Laboratories Inc, Waters Corporation, Agilent Technologies Inc, PerkinElmer Inc, Scion Instruments, Gilson Inc, Thermo Fisher Scientific, Shimadzu Corporation.

3. What are the main segments of the Autosampler Market?

The market segments include Product, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Various Advantages of Autosamplers Coupled with Growing Importance of Chromatography in Drug Approval; Increasing Food Safety Concerns.

6. What are the notable trends driving market growth?

Pharmaceutical and Biotechnology Companies are Expected to Witness High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals; Limitations in Budget of Small and Mid-Size Market Players.

8. Can you provide examples of recent developments in the market?

In May 2022, Agilent Technologies Inc. collaborated with APC Ltd., committing to work towards combining their technologies to provide unique workflows to customers that support automated process analysis via liquid chromatography (LC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autosampler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autosampler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autosampler Market?

To stay informed about further developments, trends, and reports in the Autosampler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence