Key Insights

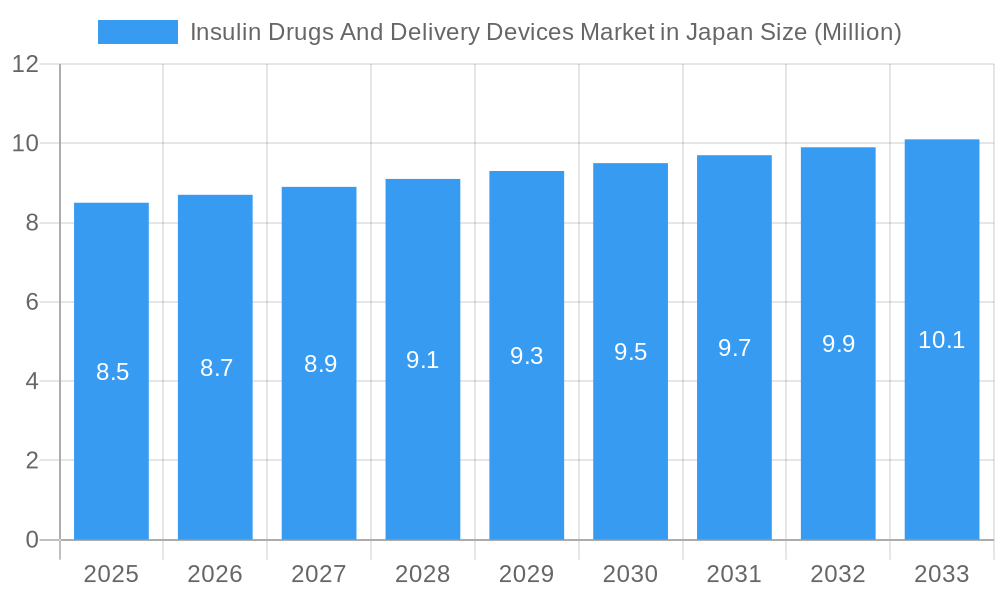

The Japanese market for Insulin Drugs and Delivery Devices is projected to reach approximately $8.5 million by 2025, demonstrating steady growth with a Compound Annual Growth Rate (CAGR) of 2.40% during the forecast period of 2025-2033. This expansion is fueled by a confluence of factors including the increasing prevalence of diabetes within Japan's aging population, enhanced awareness regarding diabetes management, and continuous technological advancements in insulin delivery systems. The demand for both innovative drug formulations, such as biosimilar insulins offering cost-effectiveness, and sophisticated delivery devices like insulin pumps and pens, is anticipated to drive market value. Traditional human insulins, while still relevant, are gradually being complemented by newer, more convenient options. The market is segmented into various insulin drug types, including basal, bolus, traditional human, combination, and biosimilar insulins, alongside a diverse range of delivery devices encompassing insulin pumps, pens, syringes, and jet injectors. This comprehensive offering caters to a wide spectrum of patient needs and treatment regimens, further solidifying the market's trajectory.

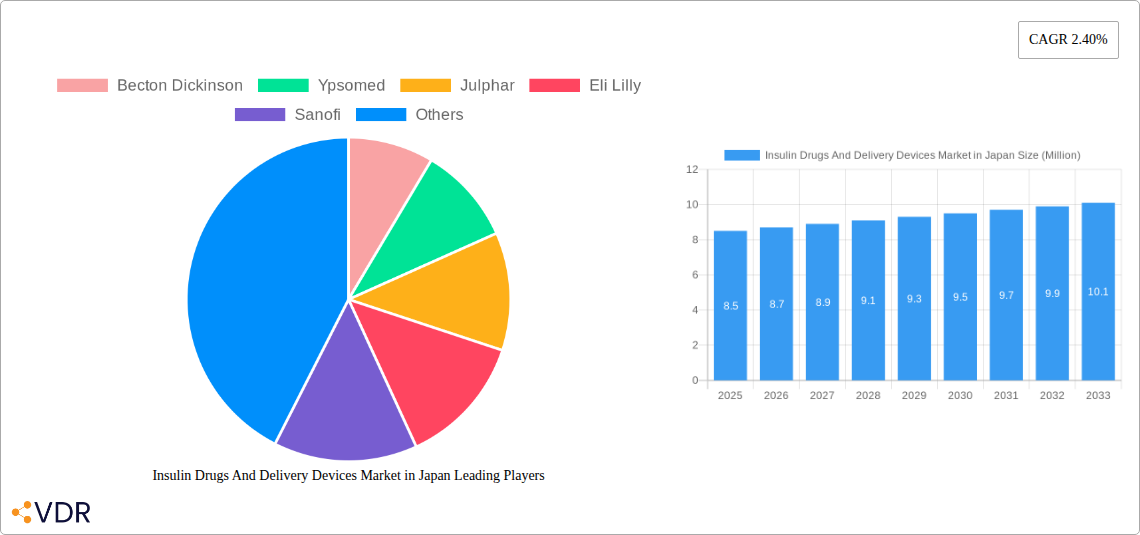

Insulin Drugs And Delivery Devices Market in Japan Market Size (In Million)

Key players such as Novo Nordisk, Eli Lilly, Sanofi, Medtronic, Becton Dickinson, Ypsomed, Julphar, and Biocon are actively innovating and competing within this dynamic landscape. Their strategic initiatives, including product launches, research and development investments, and market penetration strategies, are critical in shaping market trends and addressing unmet patient needs. The market's growth is underpinned by the ongoing shift towards personalized diabetes management, where patients benefit from a wider array of insulin types and delivery mechanisms that offer improved glycemic control, convenience, and quality of life. The increasing adoption of connected insulin devices that facilitate data logging and remote monitoring also represents a significant trend, empowering both patients and healthcare providers with better insights into treatment efficacy. Despite the positive outlook, potential restraints such as reimbursement policies and the high cost of advanced delivery devices could pose challenges to widespread adoption, necessitating strategic approaches from market participants to ensure accessibility and affordability.

Insulin Drugs And Delivery Devices Market in Japan Company Market Share

Unlock critical insights into Japan's burgeoning insulin market. This in-depth report, spanning 2019-2033, delivers a meticulous examination of the Insulin Drugs and Delivery Devices Market in Japan, providing unparalleled intelligence for stakeholders. Featuring a robust analysis of market dynamics, growth trends, dominant segments, product landscape, key players, and emerging opportunities, this report is your essential guide to navigating this dynamic sector. All quantitative data is presented in Million units for your convenience.

Insulin Drugs And Delivery Devices Market in Japan Market Dynamics & Structure

The Insulin Drugs and Delivery Devices Market in Japan exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Technological innovation acts as a primary driver, fueled by the increasing prevalence of diabetes and the continuous pursuit of improved patient outcomes. Japan's stringent regulatory frameworks, while ensuring product safety and efficacy, can also present barriers to entry for novel treatments and devices. Competitive product substitutes, including alternative diabetes management therapies and advanced insulin formulations, constantly pressure market incumbents. End-user demographics, characterized by an aging population and a growing awareness of chronic disease management, significantly influence demand. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate their market position, expand their product portfolios, and gain access to new technologies. For instance, recent M&A activities within the broader Asia-Pacific region indicate a strategic consolidation aimed at enhancing R&D capabilities and market reach, with an estimated xx M&A deals anticipated in the forecast period. The market share of traditional human insulins is projected to decline to approximately 15% by 2033, while biosimilar insulins are expected to capture a substantial XX% of the market. Innovation barriers include the high cost of R&D, the lengthy approval processes for new insulin formulations and advanced delivery devices, and the need for extensive clinical validation.

Insulin Drugs And Delivery Devices Market in Japan Growth Trends & Insights

The Insulin Drugs and Delivery Devices Market in Japan is poised for substantial growth, driven by an increasing diabetes prevalence and a proactive healthcare system. The market size is projected to grow from approximately $XXX million in 2019 to an estimated $XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates for advanced insulin delivery devices, such as insulin pumps and smart pens, are accelerating, reflecting a growing patient preference for convenience and improved glycemic control. Technological disruptions, including the development of continuous glucose monitoring (CGM) systems integrated with insulin pumps for automated insulin delivery (AID), are significantly reshaping treatment paradigms. Consumer behavior shifts are evident, with patients increasingly seeking personalized treatment options and digital health solutions to manage their diabetes effectively. This includes a growing demand for insulin pens with advanced features and the adoption of mobile applications for insulin dose tracking and management. Market penetration of insulin pumps, currently at XX% of the insulin-dependent diabetic population, is expected to reach XX% by 2033. The shift towards biosimilar insulins, driven by cost-effectiveness, is also a significant growth factor, projected to contribute XX% to the overall drug segment revenue by 2033. The integration of artificial intelligence (AI) in diabetes management platforms is another burgeoning trend, offering predictive analytics for glycemic fluctuations and personalized insulin dosing recommendations. The increasing number of patients with type 2 diabetes, which often requires insulin therapy, further fuels market expansion.

Dominant Regions, Countries, or Segments in Insulin Drugs And Delivery Devices Market in Japan

Within the Insulin Drugs and Delivery Devices Market in Japan, the Drug: Biosimilar Insulins segment is identified as a dominant force driving market growth. This dominance is underpinned by several key factors, including economic policies promoting cost-effective healthcare solutions, an increasing emphasis on accessible diabetes management, and the growing body of clinical evidence supporting the efficacy and safety of biosimilar insulins.

Key Drivers of Biosimilar Insulin Dominance:

- Cost-Effectiveness and Reimbursement Policies: The Japanese government's focus on controlling healthcare expenditure has created a favorable environment for biosimilar insulins. Their lower price point compared to originator biologics makes them an attractive option for both healthcare providers and patients, leading to higher adoption rates. Reimbursement policies actively encourage the use of biosimilars, further bolstering their market share.

- Expanding Manufacturing Capabilities: The rise of domestic and international biopharmaceutical companies investing in biosimilar insulin production in Japan has increased supply and competition, driving down prices and enhancing availability.

- Growing Diabetes Patient Pool: The persistent increase in diabetes diagnoses, particularly among the adult population, necessitates a wider range of affordable treatment options. Biosimilar insulins fulfill this critical need.

- Enhanced Accessibility and Patient Adherence: By offering a more affordable alternative to traditional insulins, biosimilars improve patient adherence to prescribed therapy, leading to better disease management and reduced long-term healthcare costs.

- Technological Advancements in Biomanufacturing: Continuous improvements in biomanufacturing technologies have enabled the production of high-quality biosimilar insulins with comparable efficacy and safety profiles to their reference products, instilling confidence among prescribers and patients.

While other segments like Device: Insulin Pumps are experiencing significant growth due to technological advancements and patient preference for automated systems, the sheer volume and the cost-sensitive nature of insulin therapy place Biosimilar Insulins at the forefront of market expansion in Japan. The market share of biosimilar insulins is projected to reach an impressive XX% of the total insulin drug market by 2033, a substantial increase from its current XX% share. The market penetration of insulin pumps, while growing, is expected to reach XX% of the insulin-dependent diabetic population by 2033, highlighting the broader reach of biosimilar insulin drugs.

Insulin Drugs And Delivery Devices Market in Japan Product Landscape

The product landscape for insulin drugs and delivery devices in Japan is characterized by continuous innovation aimed at enhancing patient convenience, glycemic control, and overall quality of life. Key product innovations include ultra-long-acting basal insulins offering once-daily or even less frequent dosing, and rapid-acting bolus insulins that closely mimic the body's natural insulin response after meals. In the device segment, smart insulin pens with built-in memory and connectivity, and advanced insulin pumps with sophisticated algorithms for automated insulin delivery (AID) are gaining traction. These advancements focus on improving dosing accuracy, reducing the risk of hypoglycemia, and providing real-time data for better treatment management.

Key Drivers, Barriers & Challenges in Insulin Drugs And Delivery Devices Market in Japan

Key Drivers:

- Rising Diabetes Prevalence: The escalating incidence of diabetes in Japan, driven by lifestyle changes and an aging population, is the primary catalyst for market growth.

- Technological Advancements: Continuous innovation in insulin formulations and delivery devices, such as smart pens and automated insulin delivery systems, enhances patient convenience and treatment efficacy.

- Government Initiatives and Reimbursement Policies: Supportive government policies and favorable reimbursement frameworks for insulin therapy and advanced devices encourage market expansion.

- Growing Awareness and Patient Demand: Increased patient awareness about diabetes management and a growing demand for convenient and personalized treatment solutions.

Barriers & Challenges:

- High Cost of Novel Therapies: The substantial research and development costs associated with new insulin drugs and sophisticated delivery devices can translate into high prices, posing affordability challenges for some patient segments.

- Regulatory Hurdles and Approval Timelines: Navigating Japan's stringent regulatory landscape for pharmaceutical products and medical devices can be time-consuming and complex.

- Competition from Alternative Therapies: The availability of non-insulin diabetes medications and emerging therapeutic options presents competitive pressure.

- Supply Chain Complexities: Ensuring a consistent and efficient supply chain for insulin drugs and devices across the diverse geography of Japan can be challenging, particularly for specialized products. The cost of innovative insulin delivery devices, such as insulin pumps, can range from $XXX to $XXX million, posing a significant barrier for a considerable portion of the patient population.

Emerging Opportunities in Insulin Drugs And Delivery Devices Market in Japan

Emerging opportunities in the Insulin Drugs and Delivery Devices Market in Japan lie in the burgeoning field of digital therapeutics and personalized medicine. The integration of AI-powered diabetes management platforms, offering predictive analytics for glucose fluctuations and personalized insulin dosing, presents a significant growth avenue. Furthermore, the expansion of telehealth services facilitating remote patient monitoring and consultations for diabetes management opens up new possibilities. The development of novel insulin delivery systems with enhanced user-friendliness and reduced invasiveness, catering to the preferences of an aging population, also represents a key opportunity. The untapped potential in rural areas, where access to specialized diabetes care might be limited, can be addressed through innovative distribution models and digital solutions.

Growth Accelerators in the Insulin Drugs And Delivery Devices Market in Japan Industry

Several key catalysts are accelerating the long-term growth of the Insulin Drugs and Delivery Devices Market in Japan. Technological breakthroughs in insulin formulation, leading to more precise and longer-acting insulins, are significantly improving treatment outcomes. Strategic partnerships between pharmaceutical companies, device manufacturers, and digital health solution providers are fostering innovation and expanding market reach. For instance, the collaboration between Health2Sync and Sanofi exemplifies the trend of digitizing insulin management to enhance patient engagement and data-driven care. Furthermore, market expansion strategies focusing on educating healthcare professionals and patients about the benefits of advanced insulin therapies and devices will continue to drive adoption. The increasing focus on preventative healthcare and early intervention in diabetes management also acts as a significant growth accelerator.

Key Players Shaping the Insulin Drugs And Delivery Devices Market in Japan Market

- Becton Dickinson

- Ypsomed

- Julphar

- Eli Lilly

- Sanofi

- Medtronic

- Biocon

- Novo Nordisk

Notable Milestones in Insulin Drugs And Delivery Devices Market in Japan Sector

- June 2022: Health2Sync and Sanofi partnered to digitize insulin management in Japan. Both companies still have plans to extend their partnership in bringing digital therapeutic solutions to patients and healthcare professionals in Japan and other markets.

- November 2021: Terumo Corporation, based in Japan, and the French company Diabeloop, have signed an agreement for a comprehensive strategic partnership. With this agreement, in addition to the current joint development of the AID system for Japan, they will work closely to bring Automated Insulin Delivery (AID) solutions to Europe with potential further global expansion.

In-Depth Insulin Drugs And Delivery Devices Market in Japan Market Outlook

The future outlook for the Insulin Drugs and Delivery Devices Market in Japan is exceptionally promising, driven by sustained growth accelerators. The continued advancements in biosimilar insulin production are expected to enhance affordability and accessibility, catering to a broader patient base. The integration of artificial intelligence and machine learning in diabetes management platforms will revolutionize personalized treatment approaches, leading to improved glycemic control and reduced complications. Strategic collaborations between diverse stakeholders, including technology firms and healthcare providers, will foster innovation in smart delivery devices and digital health solutions. The market is on track to witness significant expansion, with a projected increase in market value to $XXX million by 2033. The increasing adoption of connected devices and data-driven insights will empower both patients and healthcare providers, creating a more efficient and effective diabetes care ecosystem.

Insulin Drugs And Delivery Devices Market in Japan Segmentation

-

1. Drug

- 1.1. Basal or Long-acting Insulins

- 1.2. Bolus or Fast-acting Insulins

- 1.3. Traditional Human Insulins

- 1.4. Combination Insulins

- 1.5. Biosimilar Insulins

-

2. Device

- 2.1. Insulin Pumps

- 2.2. Insulin Pens

- 2.3. Insulin Syringes

- 2.4. Insulin Jet Injectors

Insulin Drugs And Delivery Devices Market in Japan Segmentation By Geography

- 1. Japan

Insulin Drugs And Delivery Devices Market in Japan Regional Market Share

Geographic Coverage of Insulin Drugs And Delivery Devices Market in Japan

Insulin Drugs And Delivery Devices Market in Japan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Growing Diabetes and Obesity Population in Japan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Insulin Drugs And Delivery Devices Market in Japan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Basal or Long-acting Insulins

- 5.1.2. Bolus or Fast-acting Insulins

- 5.1.3. Traditional Human Insulins

- 5.1.4. Combination Insulins

- 5.1.5. Biosimilar Insulins

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Insulin Pumps

- 5.2.2. Insulin Pens

- 5.2.3. Insulin Syringes

- 5.2.4. Insulin Jet Injectors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ypsomed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Julphar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eli Lilly

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sanofi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biocon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novo Nordisk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson

List of Figures

- Figure 1: Insulin Drugs And Delivery Devices Market in Japan Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Insulin Drugs And Delivery Devices Market in Japan Share (%) by Company 2025

List of Tables

- Table 1: Insulin Drugs And Delivery Devices Market in Japan Revenue Million Forecast, by Drug 2020 & 2033

- Table 2: Insulin Drugs And Delivery Devices Market in Japan Volume K Unit Forecast, by Drug 2020 & 2033

- Table 3: Insulin Drugs And Delivery Devices Market in Japan Revenue Million Forecast, by Device 2020 & 2033

- Table 4: Insulin Drugs And Delivery Devices Market in Japan Volume K Unit Forecast, by Device 2020 & 2033

- Table 5: Insulin Drugs And Delivery Devices Market in Japan Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Insulin Drugs And Delivery Devices Market in Japan Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Insulin Drugs And Delivery Devices Market in Japan Revenue Million Forecast, by Drug 2020 & 2033

- Table 8: Insulin Drugs And Delivery Devices Market in Japan Volume K Unit Forecast, by Drug 2020 & 2033

- Table 9: Insulin Drugs And Delivery Devices Market in Japan Revenue Million Forecast, by Device 2020 & 2033

- Table 10: Insulin Drugs And Delivery Devices Market in Japan Volume K Unit Forecast, by Device 2020 & 2033

- Table 11: Insulin Drugs And Delivery Devices Market in Japan Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Insulin Drugs And Delivery Devices Market in Japan Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insulin Drugs And Delivery Devices Market in Japan?

The projected CAGR is approximately 2.40%.

2. Which companies are prominent players in the Insulin Drugs And Delivery Devices Market in Japan?

Key companies in the market include Becton Dickinson, Ypsomed, Julphar, Eli Lilly, Sanofi, Medtronic, Biocon, Novo Nordisk.

3. What are the main segments of the Insulin Drugs And Delivery Devices Market in Japan?

The market segments include Drug, Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.5 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Growing Diabetes and Obesity Population in Japan.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

June 2022: Health2Sync and Sanofi partnered to digitize insulin management in Japan. Both companies still have plans to extend their partnership in bringing digital therapeutic solutions to patients and healthcare professionals in Japan and other markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insulin Drugs And Delivery Devices Market in Japan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insulin Drugs And Delivery Devices Market in Japan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insulin Drugs And Delivery Devices Market in Japan?

To stay informed about further developments, trends, and reports in the Insulin Drugs And Delivery Devices Market in Japan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence