Key Insights

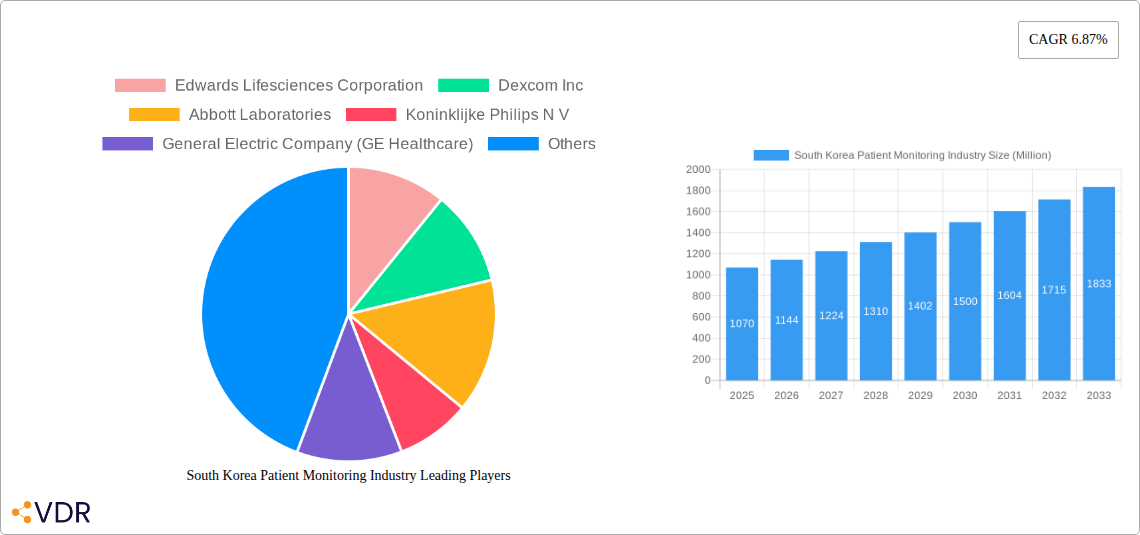

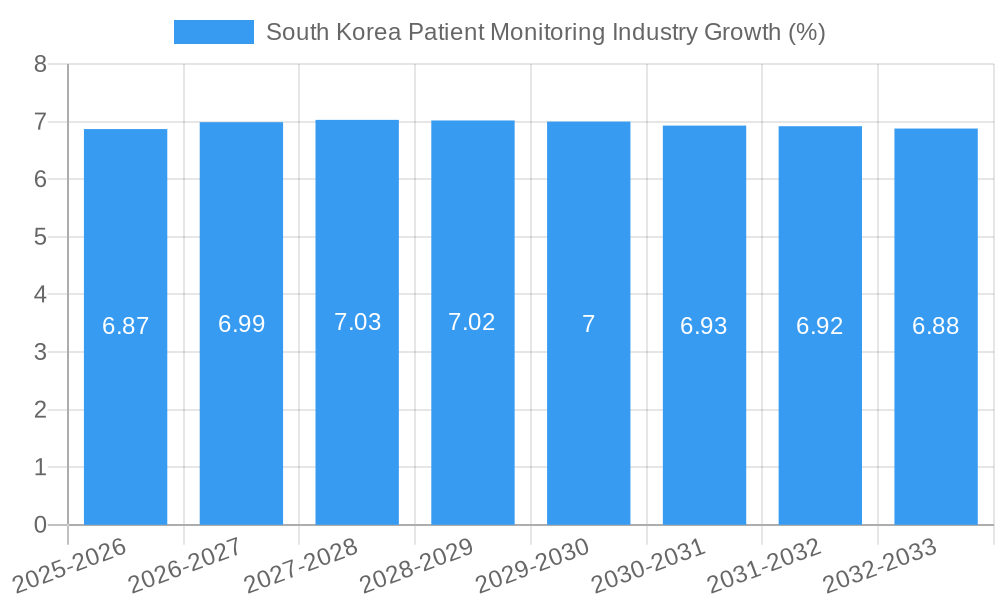

The South Korean patient monitoring market is poised for substantial growth, projected to reach $1.07 billion in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 6.87%, indicating a dynamic and expanding sector. The increasing prevalence of chronic diseases such as cardiovascular conditions and respiratory ailments, coupled with an aging population, directly fuels the demand for advanced patient monitoring solutions. Furthermore, technological advancements, particularly in remote patient monitoring (RPM) and wearable devices, are significantly reshaping the market landscape. The integration of AI and IoT in these devices enhances diagnostic accuracy, enables continuous patient oversight, and facilitates proactive healthcare interventions, thereby improving patient outcomes and reducing healthcare costs.

The market's trajectory is further bolstered by the growing adoption of these technologies in both hospital settings and home healthcare environments. Hospitals are increasingly investing in multi-parameter monitors and neuromonitoring devices to manage complex patient cases effectively, while the shift towards home-based care is accelerating the demand for wearable and remote monitoring solutions. Key segments like Cardiac Monitoring Devices and Respiratory Monitoring Devices are expected to witness considerable uptake due to the high burden of related diseases. Companies like Samsung Medison (as a proxy for potential local players or significant market participants in a country like South Korea, given the exclusion of XXX in the original prompt), Philips, and GE Healthcare are at the forefront of innovation, offering a wide array of sophisticated devices. Despite this positive outlook, potential restraints such as the high initial cost of advanced monitoring systems and the need for robust data security and privacy frameworks might temper rapid adoption in certain segments. However, the overall trend points towards a significant expansion, driven by technological innovation and an increasing focus on preventative and personalized healthcare.

South Korea Patient Monitoring Industry: Market Insights and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the South Korea patient monitoring industry, offering critical insights into market dynamics, growth trends, and future opportunities. Covering the historical period from 2019-2024 and a forecast period extending to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on this rapidly evolving market. The analysis delves into parent and child market segments, providing a granular view of market segmentation by device type, application, and end-user.

Keywords: South Korea patient monitoring, patient monitoring devices, remote patient monitoring, cardiac monitoring, hemodynamic monitoring, neuromonitoring, respiratory monitoring, multi-parameter monitors, home healthcare devices, hospital patient monitoring, medical AI, wearable biosensors, South Korea healthcare market, medical device market South Korea.

South Korea Patient Monitoring Industry Market Dynamics & Structure

The South Korea patient monitoring industry is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and shifting end-user demographics. Market concentration is moderately fragmented, with both established global players and agile domestic companies vying for market share. Key drivers of technological innovation include the growing demand for advanced diagnostic tools, the integration of artificial intelligence and machine learning into medical devices, and the proliferation of connected health solutions. Regulatory bodies, such as the Ministry of Food and Drug Safety, play a crucial role in ensuring product safety and efficacy, influencing market entry and product development strategies. Competitive product substitutes are emerging, particularly in the realm of non-invasive monitoring and AI-powered diagnostic algorithms, posing a challenge to traditional monitoring devices. End-user demographics are increasingly leaning towards an aging population and a growing prevalence of chronic diseases, fueling the demand for continuous and remote patient monitoring solutions. Mergers and acquisitions (M&A) are a notable trend, as companies seek to expand their product portfolios, gain access to new technologies, and strengthen their market presence.

- Market Concentration: Moderately fragmented with a mix of global and domestic players.

- Technological Innovation Drivers: AI integration, IoT, wearable biosensors, miniaturization.

- Regulatory Frameworks: Ministry of Food and Drug Safety (MFDS) oversight, stringent approval processes.

- Competitive Product Substitutes: AI-driven diagnostics, advanced wearable fitness trackers with health monitoring capabilities.

- End-User Demographics: Aging population, increasing chronic disease prevalence, rising demand for home healthcare.

- M&A Trends: Strategic acquisitions for technology and market access.

South Korea Patient Monitoring Industry Growth Trends & Insights

The South Korea patient monitoring industry is poised for significant growth, driven by a confluence of factors including a burgeoning elderly population, increasing adoption of advanced healthcare technologies, and a robust government focus on digital healthcare initiatives. The market size is projected to expand at a healthy Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033), with the base year (2025) reflecting an estimated market value of $XXXX million units. Adoption rates for remote patient monitoring (RPM) devices are rapidly increasing, fueled by their ability to provide continuous patient oversight outside traditional healthcare settings, thereby reducing hospital readmissions and improving patient outcomes. Technological disruptions, such as the development of sophisticated wearable biosensors and AI-powered diagnostic algorithms, are transforming the landscape by enabling more accurate and personalized patient monitoring. Consumer behavior is also shifting, with a greater emphasis on proactive health management and a willingness to embrace digital health solutions for self-monitoring and early disease detection. The integration of these technologies not only enhances clinical decision-making but also empowers patients to take a more active role in their health journeys. Furthermore, the increasing prevalence of chronic conditions such as cardiovascular diseases, diabetes, and respiratory ailments necessitates continuous monitoring, further accelerating market expansion.

Dominant Regions, Countries, or Segments in South Korea Patient Monitoring Industry

Within the South Korea patient monitoring industry, Hospitals and Clinics are the dominant end-user segment, accounting for an estimated XX% of the market share in 2025 and projected to grow at a CAGR of XX% through 2033. This dominance is attributed to the centralized nature of advanced medical treatment, the necessity for critical care monitoring in acute settings, and the significant capital investment in sophisticated patient monitoring infrastructure by healthcare institutions. The Multi-parameter Monitors segment within "Type of Device" is also a key growth driver, expected to capture XX% of the market by 2025, owing to its versatility in tracking multiple vital signs simultaneously, which is crucial for comprehensive patient assessment in critical care and post-operative recovery. In terms of applications, Cardiology remains the leading application, driven by the high incidence of cardiovascular diseases in South Korea and the continuous need for ECG monitoring, arrhythmia detection, and hemodynamic assessment. The growing adoption of Remote Patient Monitoring Devices is also noteworthy, propelled by government initiatives promoting telehealth and the increasing demand for home-based care solutions, particularly for chronic disease management. The economic policies supporting healthcare digitalization and the robust healthcare infrastructure in major metropolitan areas like Seoul further solidify the importance of hospitals and clinics as primary end-users.

- Dominant End User: Hospitals and Clinics (estimated XX% market share in 2025).

- High demand for critical care and acute monitoring.

- Significant investment in advanced medical technology.

- Centralized point for complex patient management.

- Leading Device Type Segment: Multi-parameter Monitors (projected XX% market share by 2025).

- Versatile monitoring of multiple vital signs.

- Essential for comprehensive patient assessment.

- Widely adopted in intensive care and surgical recovery.

- Primary Application Segment: Cardiology.

- High prevalence of cardiovascular diseases.

- Continuous need for ECG and hemodynamic monitoring.

- Advancements in cardiac monitoring technologies.

- Growing Segment: Remote Patient Monitoring Devices.

- Government support for telehealth and digital health.

- Increasing demand for chronic disease management at home.

- Technological advancements enabling remote data transmission.

South Korea Patient Monitoring Industry Product Landscape

The product landscape for the South Korea patient monitoring industry is marked by continuous innovation and a focus on enhancing patient care through advanced technology. Key product developments include the integration of artificial intelligence for predictive analytics, the miniaturization of devices for greater patient comfort and mobility, and the seamless connectivity of devices to electronic health records (EHRs) and cloud platforms. For instance, the development of advanced hemodynamic monitoring devices offers real-time, non-invasive assessment of cardiovascular function, while sophisticated neuromonitoring devices provide critical insights into brain activity for neurological patients. The rise of wearable biosensors, as exemplified by the novel electronic tattoo ink developed at KAIST, promises to revolutionize patient monitoring by offering discreet and continuous tracking of vital signs and biomarkers. These advancements are driving improved diagnostic accuracy, personalized treatment strategies, and enhanced patient outcomes across various medical disciplines.

Key Drivers, Barriers & Challenges in South Korea Patient Monitoring Industry

Key Drivers:

- Technological Advancements: The rapid evolution of AI, IoT, and wearable technology is creating new possibilities for more accurate, continuous, and non-invasive patient monitoring. The development of sophisticated algorithms for data analysis and predictive diagnostics further propels market growth.

- Aging Population & Chronic Diseases: South Korea's rapidly aging demographic and the increasing prevalence of chronic conditions like cardiovascular disease and diabetes necessitate constant patient oversight, driving demand for monitoring solutions.

- Government Support for Digital Health: Initiatives promoting telehealth, e-health, and smart healthcare infrastructure create a favorable environment for the adoption of patient monitoring technologies.

Key Barriers & Challenges:

- High Initial Investment Costs: The sophisticated nature of advanced patient monitoring equipment can entail substantial upfront costs for healthcare providers, potentially limiting adoption in smaller institutions or less affluent regions.

- Data Security and Privacy Concerns: The increasing reliance on connected devices and cloud-based data storage raises significant concerns regarding the security and privacy of sensitive patient information, requiring robust cybersecurity measures and stringent compliance.

- Regulatory Hurdles and Approval Processes: Navigating the complex regulatory landscape for medical devices, including obtaining necessary approvals from bodies like the MFDS, can be time-consuming and resource-intensive, potentially slowing down market entry for new products.

- Integration Challenges: Ensuring seamless interoperability and integration of diverse monitoring devices with existing hospital IT infrastructure and EHR systems can present significant technical challenges.

Emerging Opportunities in South Korea Patient Monitoring Industry

Emerging opportunities in the South Korea patient monitoring industry lie in the expanding realm of personalized medicine and preventative healthcare. The growing demand for remote patient monitoring (RPM) solutions, particularly for chronic disease management and post-operative care, presents a significant avenue for growth. The development of AI-powered diagnostic tools that can analyze patient data to predict disease progression or identify anomalies early on offers immense potential. Furthermore, the integration of wearable biosensors for continuous, non-invasive monitoring of a wider range of physiological parameters, such as glucose levels and lactate, is an untapped market. The increasing focus on home healthcare and the desire of an aging population to age in place will also drive demand for user-friendly, portable monitoring devices.

Growth Accelerators in the South Korea Patient Monitoring Industry Industry

Several key catalysts are accelerating the growth of the South Korea patient monitoring industry. Technological breakthroughs, such as the development of advanced AI algorithms capable of real-time anomaly detection and predictive analytics, are transforming diagnostic capabilities and improving patient outcomes. The increasing focus on preventative healthcare and the desire for personalized health management are driving consumer adoption of wearable monitoring devices. Strategic partnerships between technology developers and healthcare providers are crucial for fostering innovation and ensuring the successful implementation of new monitoring solutions. Furthermore, government initiatives aimed at promoting digital health and telehealth services are creating a fertile ground for market expansion, encouraging both the development and adoption of advanced patient monitoring systems.

Key Players Shaping the South Korea Patient Monitoring Industry Market

- Edwards Lifesciences Corporation

- Dexcom Inc

- Abbott Laboratories

- Koninklijke Philips N V

- General Electric Company (GE Healthcare)

- OMRON Corporation

- Medtronic Plc

- Dragerwerk AG & Co KGaA

- Nihon Kohden Corporation

- SCHILLER

Notable Milestones in South Korea Patient Monitoring Industry Sector

- August 2022: The South Korean Ministry of Food and Drug Safety granted clearance to VUNO for its portable ECG device, Hativ Pro, enhancing remote cardiac monitoring capabilities.

- August 2022: Researchers at KAIST developed an electronic tattoo ink functioning as a bioelectrode, capable of sending vital sign data like heart rate, glucose, and lactate to a monitor, signaling a breakthrough in non-invasive biosensing.

In-Depth South Korea Patient Monitoring Industry Market Outlook

The South Korea patient monitoring industry is poised for substantial expansion, driven by its strong commitment to technological innovation and its proactive approach to healthcare digitalization. Future market potential lies in the increasing integration of artificial intelligence for predictive diagnostics and personalized treatment plans, further enhancing the efficacy of existing monitoring devices. Strategic opportunities exist in expanding the adoption of remote patient monitoring solutions, especially in catering to the growing needs of an aging population and individuals with chronic conditions. The continuous development and application of advanced wearable biosensors will unlock new avenues for non-invasive and continuous health tracking. The industry's trajectory suggests a future where patient monitoring is more proactive, personalized, and seamlessly integrated into daily life, leading to improved health outcomes and a more efficient healthcare system.

South Korea Patient Monitoring Industry Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Multi-parameter Monitors

- 1.5. Respiratory Monitoring Devices

- 1.6. Remote Patient Monitoring Devices

- 1.7. Other Types of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End Users

- 3.1. Home Healthcare

- 3.2. Hospitals and Clinics

- 3.3. Other End Users

South Korea Patient Monitoring Industry Segmentation By Geography

- 1. South Korea

South Korea Patient Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. High Cost of Technology

- 3.4. Market Trends

- 3.4.1. Remote Patient Monitoring Devices Segment Expects to Register a High CAGR in the South Korea Patient Monitoring Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Patient Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Multi-parameter Monitors

- 5.1.5. Respiratory Monitoring Devices

- 5.1.6. Remote Patient Monitoring Devices

- 5.1.7. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals and Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Edwards Lifesciences Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dexcom Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Laboratories

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company (GE Healthcare)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OMRON Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dragerwerk AG & Co KGaA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nihon Kohden Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SCHILLER*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Edwards Lifesciences Corporation

List of Figures

- Figure 1: South Korea Patient Monitoring Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Patient Monitoring Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Patient Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: South Korea Patient Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South Korea Patient Monitoring Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 5: South Korea Patient Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Korea Patient Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Korea Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 8: South Korea Patient Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 9: South Korea Patient Monitoring Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 10: South Korea Patient Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Patient Monitoring Industry?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the South Korea Patient Monitoring Industry?

Key companies in the market include Edwards Lifesciences Corporation, Dexcom Inc, Abbott Laboratories, Koninklijke Philips N V, General Electric Company (GE Healthcare), OMRON Corporation, Medtronic Plc, Dragerwerk AG & Co KGaA, Nihon Kohden Corporation, SCHILLER*List Not Exhaustive.

3. What are the main segments of the South Korea Patient Monitoring Industry?

The market segments include Type of Device, Application, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

Remote Patient Monitoring Devices Segment Expects to Register a High CAGR in the South Korea Patient Monitoring Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Technology.

8. Can you provide examples of recent developments in the market?

In August 2022, the South Korean Ministry of Food and Drug Safety granted clearance to VUNO, a medical artificial intelligence company, for its ECG device, Hativ Pro, a portable medical device that measures a user's heart rate and sends this data through a connected mobile phone app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Patient Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Patient Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Patient Monitoring Industry?

To stay informed about further developments, trends, and reports in the South Korea Patient Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence