Key Insights

The Vietnam Diabetes Drugs and Devices Market is projected for significant expansion, anticipated to reach a market size of $12.57 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.04% during the forecast period of 2025-2033. This growth is propelled by increasing diabetes prevalence, rising healthcare expenditure, and heightened awareness of diabetes management. Key drivers include the surge in type 2 diabetes, attributed to lifestyle shifts and an aging population, alongside government initiatives to improve diabetes care access and public health infrastructure. Technological advancements in monitoring and management devices are also contributing to more sophisticated and convenient patient solutions.

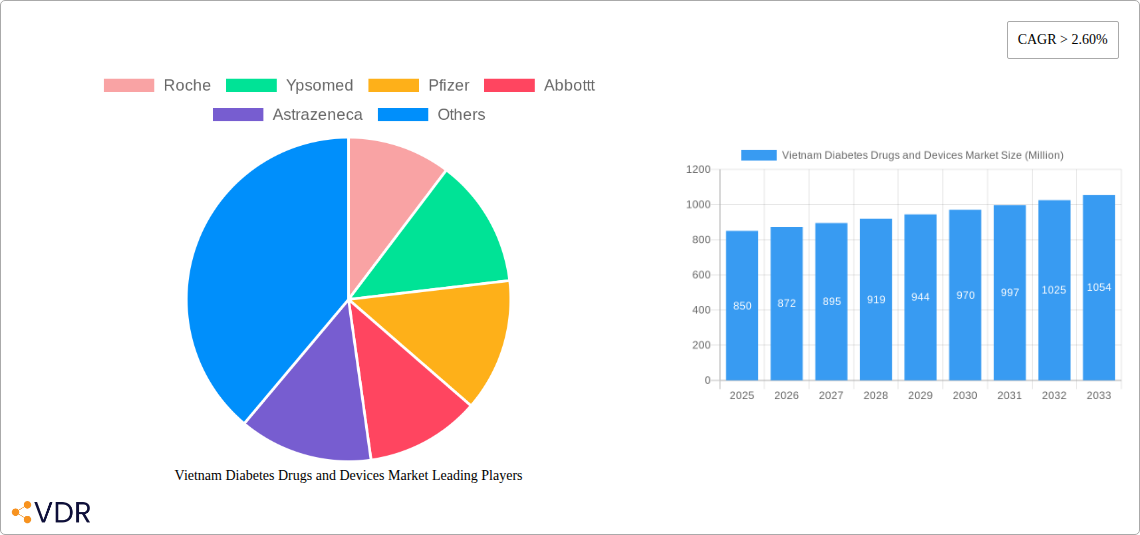

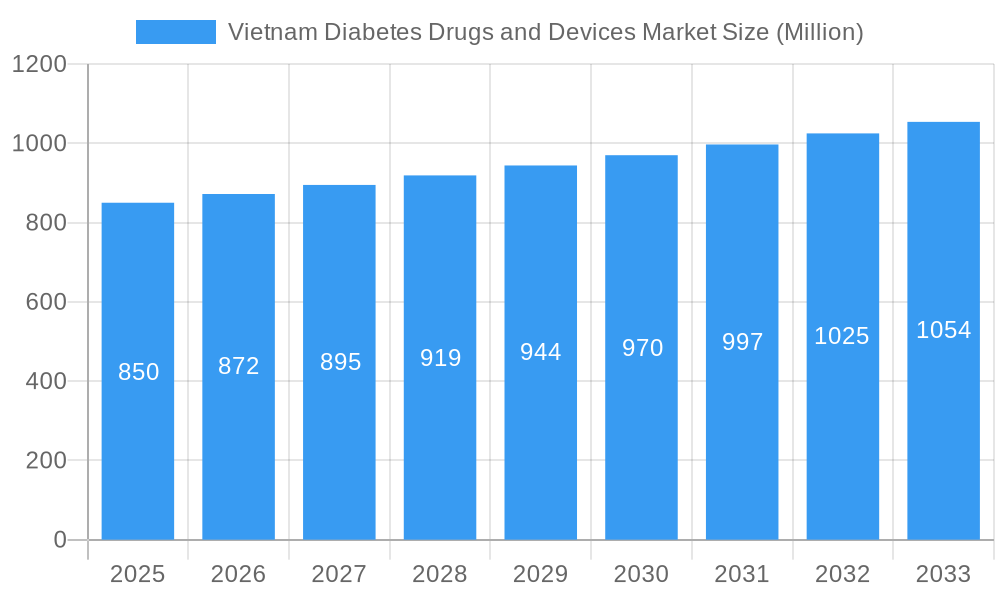

Vietnam Diabetes Drugs and Devices Market Market Size (In Billion)

Market segmentation reveals a dynamic landscape where both drugs and devices are critical. Within devices, monitoring solutions, including self-monitoring blood glucose devices and continuous glucose monitoring systems, are in high demand for real-time health data. Management devices, such as insulin pumps and delivery systems (syringes, cartridges, disposable pens), are vital for comprehensive care. On the drugs front, oral anti-diabetic medications, various insulin formulations, combination therapies, and non-insulin injectables cater to diverse patient needs. Leading global companies like Roche, Abbott, Medtronic, Novo Nordisk, and Sanofi are actively contributing innovative products and strategic partnerships within Vietnam, fostering competition and market growth.

Vietnam Diabetes Drugs and Devices Market Company Market Share

This comprehensive report offers a definitive analysis of the Vietnam Diabetes Drugs and Devices Market, providing crucial insights into market dynamics, growth trajectories, and key industry players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for understanding the evolving Vietnamese healthcare sector and its intersection with diabetes management. We meticulously dissect sub-markets within diabetes drugs and devices, delivering granular data and strategic perspectives. All values are presented in billion.

Vietnam Diabetes Drugs and Devices Market Market Dynamics & Structure

The Vietnam Diabetes Drugs and Devices Market exhibits a dynamic and evolving structure characterized by increasing market concentration, driven by strategic collaborations and the emergence of key players like Novo Nordisk, Roche, and Medtronic. Technological innovation is a primary driver, with advancements in Continuous Blood Glucose Monitoring (CGM) and insulin pump technology significantly impacting patient care and market demand. Robust regulatory frameworks are gradually aligning with international standards, fostering greater transparency and market access for innovative products. While competitive product substitutes exist, particularly within the oral anti-diabetes drugs segment, the demand for specialized diabetes management solutions is steadily rising. End-user demographics, characterized by a growing aging population and increasing prevalence of lifestyle-related diseases, are shaping market needs. Mergers and acquisitions (M&A) are anticipated to play a crucial role in consolidating market share and fostering innovation. For instance, we anticipate an increase in M&A activity by 15% over the forecast period, driven by the desire for market expansion and technological integration. Innovation barriers, such as stringent approval processes for novel insulin drugs and high initial investment costs for advanced diabetes devices, are present but are being addressed through strategic partnerships and government support initiatives.

- Market Concentration: Dominated by a few key global players, with increasing consolidation expected.

- Technological Innovation Drivers: Advancements in CGM, smart insulin pens, and artificial pancreas systems.

- Regulatory Frameworks: Maturing regulations promoting product quality and patient safety.

- Competitive Product Substitutes: Intense competition within oral anti-diabetes drugs, with growing differentiation in insulin therapy and device-based management.

- End-User Demographics: Rising incidence of Type 2 diabetes due to lifestyle changes and an aging population.

- M&A Trends: Expected increase in strategic acquisitions to gain market share and access new technologies.

Vietnam Diabetes Drugs and Devices Market Growth Trends & Insights

The Vietnam Diabetes Drugs and Devices Market is poised for significant expansion, fueled by a confluence of factors including increasing diabetes prevalence, rising healthcare expenditure, and growing awareness among the populace. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. Adoption rates for advanced diabetes management devices, such as insulin pumps and CGM systems, are expected to accelerate as awareness of their benefits in improving glycemic control and quality of life increases. Technological disruptions, including the integration of Artificial Intelligence (AI) in diabetes management platforms and the development of more affordable and user-friendly devices, will further propel market growth. Consumer behavior is shifting towards proactive health management, with a greater demand for personalized treatment solutions and preventative care. This trend is evident in the increasing uptake of self-monitoring tools and a growing willingness to invest in long-term diabetes management strategies. The estimated market value for diabetes drugs is projected to reach over USD 800 million by 2033, while the diabetes devices segment is anticipated to surpass USD 450 million within the same timeframe. Market penetration for insulin therapy is expected to rise from 35% in 2025 to 45% by 2033, reflecting the growing need for more sophisticated treatment options.

Dominant Regions, Countries, or Segments in Vietnam Diabetes Drugs and Devices Market

Within the Vietnam Diabetes Drugs and Devices Market, the Drugs segment, particularly Oral Anti-Diabetes Drugs, currently leads in terms of market volume. However, the Devices segment, specifically Monitoring Devices, is exhibiting the fastest growth rate, driven by increasing awareness and technological advancements.

Dominant Segment (Volume): Oral Anti-Diabetes Drugs

- Key Drivers: High prevalence of Type 2 diabetes, cost-effectiveness, and broad physician recommendation.

- Market Share (Estimated 2025): Approximately 45% of the total drugs market.

- Growth Potential: Stable but with increasing competition from newer drug classes.

Fastest Growing Segment (Growth Rate): Monitoring Devices (Continuous Blood Glucose Monitoring)

- Key Drivers: Improved patient outcomes, convenience, and data-driven insights for personalized care.

- Market Penetration (Estimated 2025): Expected to reach 15% and grow to 30% by 2033.

- Dominance Factors: Technological superiority of CGM over traditional Self-monitoring Blood Glucose Devices, increasing insurance coverage, and strategic marketing by companies like Dexcom.

Emerging Segment: Management Devices (Insulin Pumps)

- Key Drivers: Growing adoption among Type 1 diabetes patients and increasing suitability for Type 2 patients requiring intensive insulin therapy.

- Growth Potential: Significant, with an estimated CAGR of 10% over the forecast period.

- Factors: Innovations in closed-loop systems and user-friendly interfaces from companies like Tandem and Insulet.

The urban centers of Vietnam, such as Hanoi and Ho Chi Minh City, are the primary hubs for the adoption of advanced diabetes drugs and devices due to higher disposable incomes, better healthcare infrastructure, and greater access to specialized medical professionals. Economic policies supporting healthcare sector development and improved access to advanced medical technologies are crucial factors driving the dominance of these regions.

Vietnam Diabetes Drugs and Devices Market Product Landscape

The Vietnam Diabetes Drugs and Devices Market is characterized by continuous product innovation, enhancing both efficacy and patient convenience. In the drugs segment, advancements focus on novel formulations of oral anti-diabetes drugs with improved side-effect profiles and the development of next-generation insulin drugs offering more physiological action. Within devices, the landscape is rapidly evolving with the introduction of more accurate and user-friendly Continuous Blood Glucose Monitoring (CGM) systems and sophisticated insulin pumps featuring smart algorithms for automated insulin delivery. Unique selling propositions often lie in the integration of these devices with mobile applications, enabling seamless data tracking and sharing between patients and healthcare providers, exemplified by offerings from Roche Diagnostics and Abbott Diabetes Care.

Key Drivers, Barriers & Challenges in Vietnam Diabetes Drugs and Devices Market

The Vietnam Diabetes Drugs and Devices Market is propelled by several key drivers. The escalating prevalence of diabetes, particularly Type 2, due to changing lifestyles and an aging population, is a primary growth catalyst. Increasing healthcare expenditure and government initiatives to improve diabetes care access are also significant factors. Technological advancements, such as improved accuracy and connectivity in diabetes devices, are driving adoption.

- Key Drivers:

- Rising diabetes incidence and prevalence.

- Increased healthcare spending and government focus on chronic disease management.

- Technological innovations in drugs and devices.

- Growing patient awareness and demand for better diabetes management.

Conversely, the market faces considerable barriers and challenges. High costs associated with advanced diabetes devices and newer insulin drugs can limit accessibility for a significant portion of the population. Stringent regulatory approval processes and the need for robust clinical validation for novel therapies and devices pose a challenge. Supply chain complexities and potential disruptions for imported products, coupled with limited local manufacturing capabilities for certain advanced diabetes drugs and devices, represent significant hurdles.

- Key Barriers & Challenges:

- Affordability and accessibility of advanced treatments and devices.

- Complex regulatory pathways and lengthy approval timelines.

- Supply chain vulnerabilities and logistical challenges.

- Limited local manufacturing capacity for specialized diabetes products.

- Shortage of trained healthcare professionals for advanced device management.

Emerging Opportunities in Vietnam Diabetes Drugs and Devices Market

Emerging opportunities in the Vietnam Diabetes Drugs and Devices Market are significant and diverse. The growing demand for personalized medicine presents an avenue for targeted oral anti-diabetes drugs and specialized insulin formulations. The increasing adoption of telehealth and remote patient monitoring solutions creates a fertile ground for integrated diabetes devices and digital health platforms. Furthermore, the untapped potential in rural and underserved areas offers a substantial market for more affordable and accessible diabetes management solutions, including basic self-monitoring blood glucose devices and readily available insulin syringes. The focus on preventative healthcare and early diagnosis of diabetes also opens doors for innovative screening tools and risk assessment technologies.

Growth Accelerators in the Vietnam Diabetes Drugs and Devices Market Industry

Several catalysts are accelerating the long-term growth of the Vietnam Diabetes Drugs and Devices Market. Technological breakthroughs in drug delivery systems, such as smart insulin pens and micro-needles, are enhancing treatment efficacy and patient compliance. Strategic partnerships between pharmaceutical companies like AstraZeneca and device manufacturers like Ypsomed are fostering integrated solutions and expanding market reach. Government incentives aimed at promoting local manufacturing and R&D in the pharmaceutical and medical device sectors will further bolster domestic capabilities and reduce reliance on imports. Market expansion strategies targeting Type 2 diabetes patients with innovative combination drugs and non-invasive monitoring technologies will also be crucial growth accelerators.

Key Players Shaping the Vietnam Diabetes Drugs and Devices Market Market

- Roche

- Ypsomed

- Pfizer

- Abbott

- AstraZeneca

- Eli Lilly

- Sanofi

- Novartis

- Medtronic

- Tandem

- Insulet

- Novo Nordisk

- Dexcom

Notable Milestones in Vietnam Diabetes Drugs and Devices Market Sector

- December 2022: Viatris announced the expansion of an existing partnership with Cypriot pharmaceutical company Medochemie, aiming to boost drug production in Vietnam and improve patients' access to locally made medicines. Viatris expected to transfer technology for Medochemie to produce certain drugs from Viatris' noncommunicable disease portfolio under license.

- January 2022: The project 'Gestational Diabetes in Vietnam', funded by a DKK 5 million grant from the Danish Ministry of Foreign Affairs, commenced. This initiative collaborates with local researchers and healthcare workers to investigate Gestational Diabetes Mellitus (GDM) in Thai Binh province, where GDM affects an estimated one in five pregnant women, with limited understanding of management practices.

In-Depth Vietnam Diabetes Drugs and Devices Market Market Outlook

The Vietnam Diabetes Drugs and Devices Market is set for substantial growth, driven by increasing diabetes prevalence and improving healthcare infrastructure. Future market potential is anchored in the growing adoption of advanced diabetes management devices like CGM and insulin pumps, offering enhanced glycemic control and patient quality of life. Strategic opportunities lie in the development of more affordable and accessible diabetes solutions for a wider population, including oral anti-diabetes drugs and basic monitoring tools. Furthermore, the integration of digital health technologies and the potential for localized manufacturing of innovative diabetes drugs and devices present significant avenues for expansion and market leadership. The focus on preventative care and early intervention will also create a robust demand for novel diagnostic and therapeutic approaches.

Vietnam Diabetes Drugs and Devices Market Segmentation

-

1. Devices

-

1.1. Monitoring Devices

- 1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.2. Continuous Blood Glucose Monitoring

-

1.2. Management Devices

- 1.2.1. Insulin Pump

- 1.2.2. Insulin Syringes

- 1.2.3. Insulin Cartridges

- 1.2.4. Disposable Pens

-

1.1. Monitoring Devices

-

2. Drugs

- 2.1. Oral Anti-Diabetes Drugs

- 2.2. Insulin Drugs

- 2.3. Combination Drugs

- 2.4. Non-Insulin Injectable Drugs

Vietnam Diabetes Drugs and Devices Market Segmentation By Geography

- 1. Vietnam

Vietnam Diabetes Drugs and Devices Market Regional Market Share

Geographic Coverage of Vietnam Diabetes Drugs and Devices Market

Vietnam Diabetes Drugs and Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. The continuous Glucose Monitoring Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.2. Continuous Blood Glucose Monitoring

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Insulin Cartridges

- 5.1.2.4. Disposable Pens

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Drugs

- 5.2.1. Oral Anti-Diabetes Drugs

- 5.2.2. Insulin Drugs

- 5.2.3. Combination Drugs

- 5.2.4. Non-Insulin Injectable Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ypsomed

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pfizer

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbottt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astrazeneca

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novartis

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Medtronic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tandem

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Insulet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dexcom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: Vietnam Diabetes Drugs and Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Vietnam Diabetes Drugs and Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Diabetes Drugs and Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 2: Vietnam Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: Vietnam Diabetes Drugs and Devices Market Revenue billion Forecast, by Drugs 2020 & 2033

- Table 4: Vietnam Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 5: Vietnam Diabetes Drugs and Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Vietnam Diabetes Drugs and Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Vietnam Diabetes Drugs and Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 8: Vietnam Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 9: Vietnam Diabetes Drugs and Devices Market Revenue billion Forecast, by Drugs 2020 & 2033

- Table 10: Vietnam Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 11: Vietnam Diabetes Drugs and Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Vietnam Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Diabetes Drugs and Devices Market?

The projected CAGR is approximately 10.04%.

2. Which companies are prominent players in the Vietnam Diabetes Drugs and Devices Market?

Key companies in the market include Roche, Ypsomed, Pfizer, Abbottt, Astrazeneca, Eli Lilly, Sanofi, Novartis, Medtronic, Tandem, Insulet, Novo Nordisk, Dexcom.

3. What are the main segments of the Vietnam Diabetes Drugs and Devices Market?

The market segments include Devices, Drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.57 billion as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

The continuous Glucose Monitoring Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

December 2022: Viatris announced the expansion of an existing partnership with Cypriot pharmaceutical company Medochemie, which aimed to boost drug production in Vietnam and improve patients' access to locally made medicines there. Specifically, Viatris was expected to transfer the technology that Medochemie would use under license to make certain drugs from Viatris' noncommunicable disease portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Diabetes Drugs and Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Diabetes Drugs and Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Diabetes Drugs and Devices Market?

To stay informed about further developments, trends, and reports in the Vietnam Diabetes Drugs and Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence