Key Insights

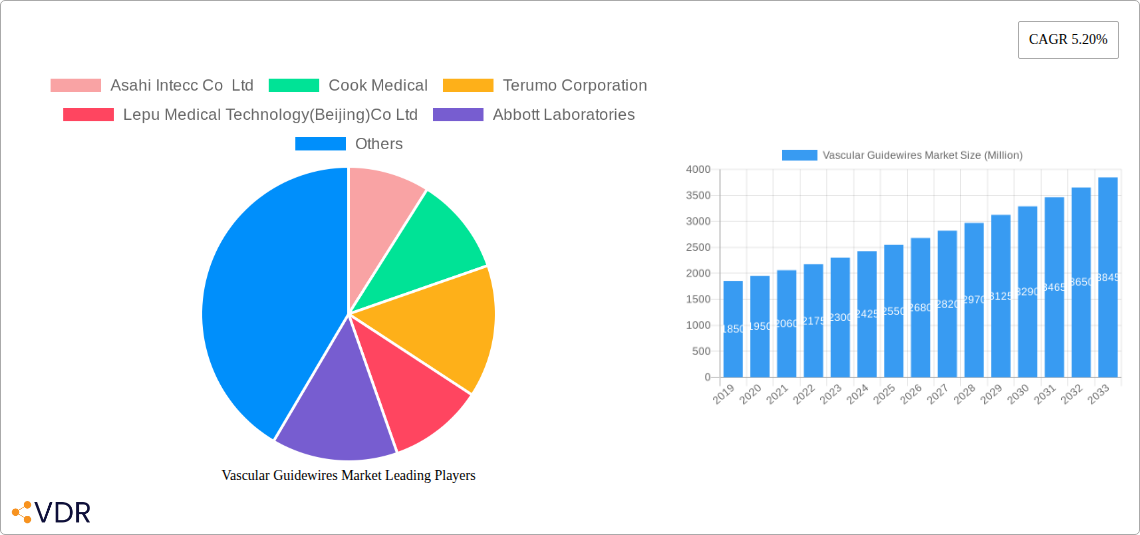

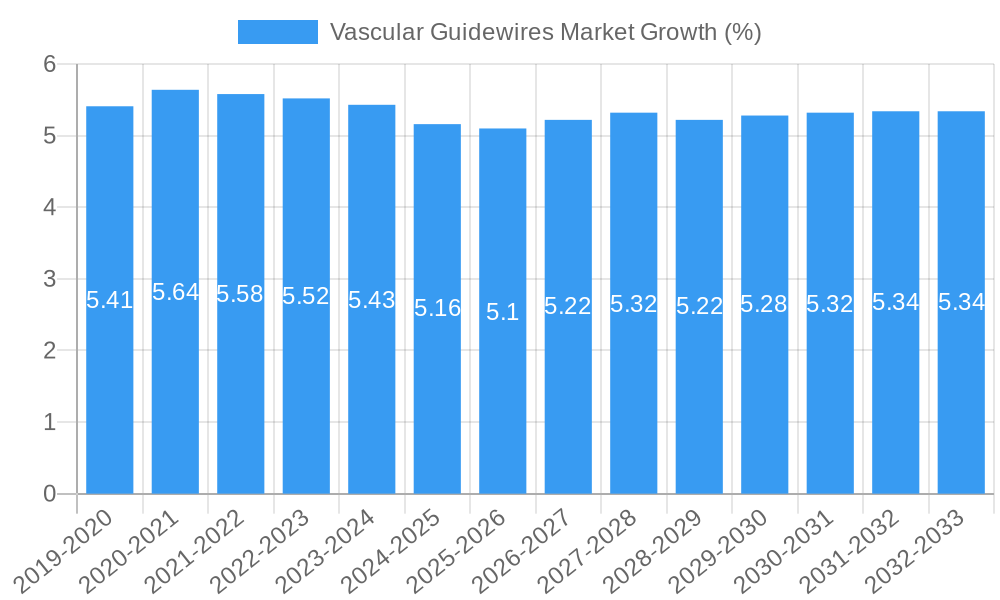

The global Vascular Guidewires Market is poised for significant expansion, projected to reach a substantial market size of approximately $2,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.20% through 2033. This robust growth is primarily fueled by an increasing prevalence of cardiovascular and neurovascular diseases worldwide, necessitating advanced minimally invasive procedures. The rising global geriatric population, which is more susceptible to vascular conditions, further amplifies the demand for these critical interventional devices. Technological advancements in guidewire design, including the development of highly lubricious coatings and advanced materials like nitinol for enhanced flexibility and kink resistance, are also key drivers. These innovations enable clinicians to navigate complex vascular anatomies with greater precision and safety, thereby improving patient outcomes and driving market adoption. The growing preference for percutaneous coronary interventions (PCIs) and other endovascular procedures over traditional open surgeries also contributes significantly to the market's upward trajectory.

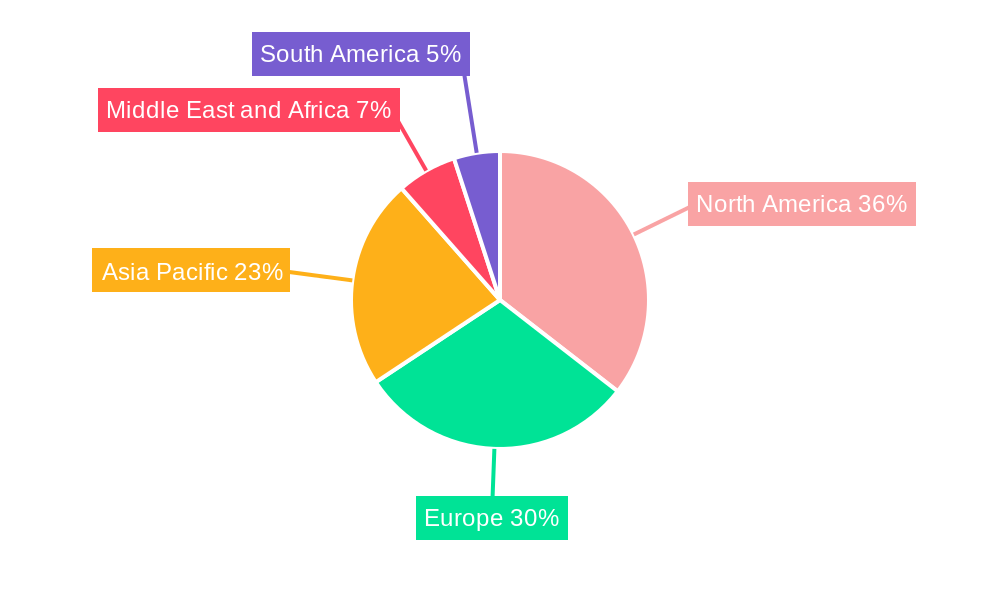

The market is segmented across various product types, with Peripheral Guidewires and Coronary Guidewires expected to command the largest shares due to the high incidence of peripheral artery disease and coronary artery disease, respectively. Similarly, coated guidewires are gaining prominence over non-coated alternatives owing to their superior performance and reduced risk of complications. Hospitals are anticipated to remain the dominant end-user segment, driven by their comprehensive infrastructure for interventional procedures. However, ambulatory surgical centers are expected to witness considerable growth as outpatient interventions become more common. Geographically, North America and Europe currently lead the market, supported by advanced healthcare systems and high adoption rates of new technologies. The Asia Pacific region, particularly China and India, presents a high-growth opportunity, fueled by a large population, increasing healthcare expenditure, and a growing number of interventional procedures. Emerging economies are expected to witness increased adoption of vascular guidewires as healthcare access and quality improve.

Unlock critical insights into the dynamic Vascular Guidewires Market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides a detailed breakdown of market size, growth trends, key players, and future opportunities. Discover the intricate interplay of technological advancements, regulatory landscapes, and evolving end-user demands that are shaping this vital segment of the medical device industry. With a focus on peripheral guidewires, coronary guidewires, urology guidewires, and neurovascular guidewires, this report offers a granular view of product segmentation and market penetration.

The report delves into the child markets of coated and non-coated guidewires, exploring the impact of raw materials such as Nitinol, Stainless Steel, and Other Raw Materials. Understanding the preferences of hospitals, ambulatory surgical centers, and other end-users is paramount, and this report delivers precisely that intelligence. Analyze current market conditions, forecast future trajectories, and identify strategic advantages within the global vascular guidewires market.

Vascular Guidewires Market Market Dynamics & Structure

The Vascular Guidewires Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, while a growing number of emerging companies vie for niche opportunities. Technological innovation is a primary driver, fueled by the continuous pursuit of improved device navigability, reduced patient trauma, and enhanced procedural efficacy. Advancements in material science, such as the development of novel coatings and alloys like Nitinol, are crucial for creating guidewires with superior flexibility, torque control, and lubricity. Regulatory frameworks, particularly those set forth by the FDA and EMA, play a pivotal role in dictating product approval processes and market access. The competitive landscape is influenced by the availability of effective product substitutes, including alternative interventional techniques and advanced imaging technologies, though guidewires remain indispensable tools. End-user demographics, primarily interventional cardiologists, neurologists, and vascular surgeons, dictate demand patterns based on procedural volumes and preferences for specific guidewire characteristics. Mergers and acquisitions (M&A) are notable trends, as larger companies seek to consolidate market share, acquire innovative technologies, and expand their product portfolios.

- Market Concentration: Moderate, with key players like Asahi Intecc, Boston Scientific, and Medtronic holding substantial influence.

- Technological Innovation Drivers: Enhanced navigability, minimal invasiveness, improved torque control, and advanced coating technologies (e.g., hydrophilic, hydrophobic).

- Regulatory Frameworks: Stringent FDA and EMA approvals influencing product development and market entry.

- Competitive Product Substitutes: Advanced imaging guidance, alternative therapeutic devices, and evolving interventional techniques.

- End-User Demographics: Demand driven by interventional cardiologists, neurovascular specialists, and vascular surgeons.

- M&A Trends: Strategic acquisitions to broaden product portfolios and gain market access.

Vascular Guidewires Market Growth Trends & Insights

The Vascular Guidewires Market is poised for robust growth, driven by a confluence of factors including an aging global population, a rising prevalence of cardiovascular and peripheral vascular diseases, and an increasing demand for minimally invasive surgical procedures. The market size evolution is directly correlated with the increasing adoption rates of interventional cardiology and endovascular therapies. Technological disruptions are continuously shaping the market, with a focus on developing guidewires that offer superior trackability, torque transmission, and kink resistance, thereby improving procedural outcomes and patient safety. Consumer behavior shifts, influenced by the desire for less invasive treatments with faster recovery times, are further propelling the demand for sophisticated vascular guidewires. The projected Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033 is estimated to be around 6.8%, reaching an estimated market value of $3,500 million in 2025, and projected to reach $5,950 million by 2033. Market penetration is expected to deepen, particularly in emerging economies where healthcare infrastructure is rapidly improving and access to advanced medical technologies is expanding. The increasing number of percutaneous coronary interventions (PCI) and peripheral angioplasty procedures directly translates to higher demand for various types of vascular guidewires. Furthermore, the growing application of guidewires in neurovascular interventions for stroke treatment and in urology for stone removal and other procedures is contributing significantly to market expansion. The shift towards coated guidewires, offering enhanced lubricity and reduced friction, is a dominant trend, improving ease of use for clinicians and reducing potential vessel trauma. Innovations in raw materials, particularly the use of advanced alloys and biocompatible coatings, are enabling the development of guidewires with tailored properties for specific anatomical challenges and procedural requirements.

Dominant Regions, Countries, or Segments in Vascular Guidewires Market

North America currently dominates the Vascular Guidewires Market, driven by a high prevalence of cardiovascular diseases, an aging population, advanced healthcare infrastructure, and a strong emphasis on adopting cutting-edge medical technologies. The United States, in particular, represents a significant market due to a high volume of interventional cardiology, neurovascular, and peripheral vascular procedures. The robust reimbursement policies and the presence of leading medical device manufacturers further solidify North America's leading position. In terms of product segmentation, Coronary Guidewires are a dominant segment, reflecting the widespread incidence of coronary artery disease and the extensive use of percutaneous coronary intervention (PCI) for treatment. The demand for these guidewires is sustained by the continuous innovation in stent technology and angioplasty balloons, which necessitate highly specialized and precise guidewire navigation. The Coated segment of guidewires also commands a significant market share, as hydrophilic and hydrophobic coatings enhance lubricity, reduce friction, and minimize the risk of vessel damage during complex procedures. This preference for coated guidewires is driven by improved ease of use for clinicians and better patient outcomes.

- Dominant Region: North America, with the United States as a key market.

- Drivers: High incidence of cardiovascular diseases, aging population, advanced healthcare infrastructure, favorable reimbursement policies, and strong R&D investments.

- Market Share: Estimated to hold over 40% of the global market.

- Dominant Product Segment: Coronary Guidewires.

- Drivers: High prevalence of coronary artery disease, extensive use of PCI, and advancements in angioplasty and stenting.

- Growth Potential: Steady growth driven by ongoing procedural volumes and technological enhancements.

- Dominant Coating Segment: Coated Guidewires (Hydrophilic & Hydrophobic).

- Drivers: Enhanced lubricity, reduced friction, improved trackability, and minimized vessel trauma.

- Market Penetration: Increasing adoption due to improved procedural efficiency and safety.

- Dominant Raw Material: Nitinol and Stainless Steel.

- Drivers: Nitinol offers excellent flexibility and shape memory, while stainless steel provides strength and torqueability for specific applications.

- Dominant End User: Hospitals.

- Drivers: Concentration of advanced medical facilities, specialized interventional labs, and high patient volumes for complex procedures.

Vascular Guidewires Market Product Landscape

The Vascular Guidewires Market product landscape is characterized by continuous innovation focused on enhancing guidewire performance and expanding their application range. Key product developments include advanced hydrophilic coatings that significantly reduce friction for seamless navigation through tortuous anatomy, and hydrophobic coatings designed for improved grip and torqueability. Nitinol alloys are increasingly being utilized for their superior flexibility, kink resistance, and shape-memory properties, enabling guidewires to navigate complex vascular structures with greater precision. Innovations in tip design, including tapered and flexible tips, cater to specific procedural needs, minimizing the risk of intimal damage. The development of specialized guidewires for neurovascular interventions, requiring extreme maneuverability and micro-catheter compatibility, is a rapidly growing area. Similarly, advancements in peripheral guidewires are addressing the challenges of treating complex blockages below the knee, with enhanced support and steerability.

Key Drivers, Barriers & Challenges in Vascular Guidewires Market

Key Drivers:

- Rising Prevalence of Cardiovascular and Peripheral Vascular Diseases: An aging global population and lifestyle factors contribute to a growing patient pool requiring interventional treatments.

- Technological Advancements: Continuous innovation in material science, coating technologies, and tip design leads to improved guidewire performance and navigability.

- Increasing Adoption of Minimally Invasive Procedures: Guidewires are essential tools for less invasive surgeries, leading to faster patient recovery and reduced healthcare costs.

- Growing Demand in Emerging Markets: Expanding healthcare infrastructure and increasing access to advanced medical technologies in developing economies.

Barriers & Challenges:

- Stringent Regulatory Approvals: The complex and time-consuming approval processes for new medical devices can delay market entry.

- High Research and Development Costs: Significant investment is required for innovating and bringing new guidewire technologies to market.

- Intense Competition and Price Sensitivity: A crowded market can lead to price pressures, impacting profit margins for manufacturers.

- Reimbursement Policies: Variations in reimbursement policies across different regions can affect market access and adoption rates.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and manufacturing components.

Emerging Opportunities in Vascular Guidewires Market

Emerging opportunities within the Vascular Guidewires Market lie in the development of highly specialized guidewires for niche applications. The growing field of interventional oncology, utilizing guidewires for targeted drug delivery and tumor ablation, presents a significant avenue for growth. Furthermore, the advancement of robotics in minimally invasive surgery opens doors for intelligent guidewires with enhanced teleoperation capabilities. The untapped potential in emerging economies, particularly in Asia and Africa, where access to advanced vascular treatments is expanding, offers substantial growth prospects. Focus on biodegradable or bioresorbable guidewire materials for specific applications could also reduce long-term patient burden.

Growth Accelerators in the Vascular Guidewires Market Industry

Several catalysts are accelerating growth in the Vascular Guidewires Market. Technological breakthroughs in advanced materials, such as novel biocompatible polymers and superelastic alloys, are enabling the creation of guidewires with unprecedented performance characteristics. Strategic partnerships and collaborations between medical device manufacturers and research institutions are fostering a faster pace of innovation and product development. Market expansion strategies, particularly focusing on penetration into underserved geographical regions and developing economies, are crucial growth accelerators. The increasing emphasis on value-based healthcare is also driving the adoption of more efficient and effective interventional tools, including advanced guidewires that can reduce procedure times and complication rates.

Key Players Shaping the Vascular Guidewires Market Market

- Asahi Intecc Co Ltd

- Cook Medical

- Terumo Corporation

- Lepu Medical Technology (Beijing) Co Ltd

- Abbott Laboratories

- AngioDynamics

- Medtronic PLC

- Cardinal Health

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- FMD Co Ltd

- Integer Holdings Corporation

Notable Milestones in Vascular Guidewires Market Sector

- June 2022: Cardio Flow, Inc. received US FDA clearance for the company's FreedomFlow Peripheral Guidewire, developed for enhanced support in treating arterial plaque blockages above and below the knee.

- April 2022: Boston Scientific Corporation launched its new Kinetix Guidewire, designed for percutaneous coronary intervention (PCI) procedures, initiating a phased market rollout.

In-Depth Vascular Guidewires Market Market Outlook

The Vascular Guidewires Market is set for continued expansion, driven by persistent demand for effective and minimally invasive vascular interventions. Growth accelerators such as technological advancements in materials science and the increasing prevalence of chronic vascular diseases will fuel market potential. Strategic opportunities lie in the expansion into emerging economies, the development of specialized guidewires for complex neurovascular and oncological interventions, and the integration of smart technologies for enhanced procedural guidance. The industry's focus on improving patient outcomes and reducing healthcare costs will continue to drive innovation and adoption of next-generation vascular guidewires.

Vascular Guidewires Market Segmentation

-

1. Product

- 1.1. Peripheral Guidewires

- 1.2. Coronary Guidewires

- 1.3. Urology Guidewires

- 1.4. Neurovascular Guidewires

-

2. Coating

- 2.1. Coated

- 2.2. Non-coated

-

3. Raw Material

- 3.1. Nitinol

- 3.2. Stainless Steel

- 3.3. Other Raw Materials

-

4. End User

- 4.1. Hospitals

- 4.2. Ambulatory Surgical Centers

- 4.3. Others

Vascular Guidewires Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Vascular Guidewires Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Cardiovascular Disease Burden; Growing Preference for Minimally Invasive Surgeries; Technological Advancements in Guidewires

- 3.3. Market Restrains

- 3.3.1. Increasing Number of Product Recalls

- 3.4. Market Trends

- 3.4.1. Coronary Guidewires Segment is Anticipated to Significantly Grow Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Peripheral Guidewires

- 5.1.2. Coronary Guidewires

- 5.1.3. Urology Guidewires

- 5.1.4. Neurovascular Guidewires

- 5.2. Market Analysis, Insights and Forecast - by Coating

- 5.2.1. Coated

- 5.2.2. Non-coated

- 5.3. Market Analysis, Insights and Forecast - by Raw Material

- 5.3.1. Nitinol

- 5.3.2. Stainless Steel

- 5.3.3. Other Raw Materials

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals

- 5.4.2. Ambulatory Surgical Centers

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Peripheral Guidewires

- 6.1.2. Coronary Guidewires

- 6.1.3. Urology Guidewires

- 6.1.4. Neurovascular Guidewires

- 6.2. Market Analysis, Insights and Forecast - by Coating

- 6.2.1. Coated

- 6.2.2. Non-coated

- 6.3. Market Analysis, Insights and Forecast - by Raw Material

- 6.3.1. Nitinol

- 6.3.2. Stainless Steel

- 6.3.3. Other Raw Materials

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals

- 6.4.2. Ambulatory Surgical Centers

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Peripheral Guidewires

- 7.1.2. Coronary Guidewires

- 7.1.3. Urology Guidewires

- 7.1.4. Neurovascular Guidewires

- 7.2. Market Analysis, Insights and Forecast - by Coating

- 7.2.1. Coated

- 7.2.2. Non-coated

- 7.3. Market Analysis, Insights and Forecast - by Raw Material

- 7.3.1. Nitinol

- 7.3.2. Stainless Steel

- 7.3.3. Other Raw Materials

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals

- 7.4.2. Ambulatory Surgical Centers

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Peripheral Guidewires

- 8.1.2. Coronary Guidewires

- 8.1.3. Urology Guidewires

- 8.1.4. Neurovascular Guidewires

- 8.2. Market Analysis, Insights and Forecast - by Coating

- 8.2.1. Coated

- 8.2.2. Non-coated

- 8.3. Market Analysis, Insights and Forecast - by Raw Material

- 8.3.1. Nitinol

- 8.3.2. Stainless Steel

- 8.3.3. Other Raw Materials

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals

- 8.4.2. Ambulatory Surgical Centers

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Peripheral Guidewires

- 9.1.2. Coronary Guidewires

- 9.1.3. Urology Guidewires

- 9.1.4. Neurovascular Guidewires

- 9.2. Market Analysis, Insights and Forecast - by Coating

- 9.2.1. Coated

- 9.2.2. Non-coated

- 9.3. Market Analysis, Insights and Forecast - by Raw Material

- 9.3.1. Nitinol

- 9.3.2. Stainless Steel

- 9.3.3. Other Raw Materials

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Hospitals

- 9.4.2. Ambulatory Surgical Centers

- 9.4.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Peripheral Guidewires

- 10.1.2. Coronary Guidewires

- 10.1.3. Urology Guidewires

- 10.1.4. Neurovascular Guidewires

- 10.2. Market Analysis, Insights and Forecast - by Coating

- 10.2.1. Coated

- 10.2.2. Non-coated

- 10.3. Market Analysis, Insights and Forecast - by Raw Material

- 10.3.1. Nitinol

- 10.3.2. Stainless Steel

- 10.3.3. Other Raw Materials

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Hospitals

- 10.4.2. Ambulatory Surgical Centers

- 10.4.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Vascular Guidewires Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Asahi Intecc Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cook Medical

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Terumo Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Lepu Medical Technology(Beijing)Co Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Abbott Laboratories

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AngioDynamics

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Medtronic PLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Cardinal Health

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 B Braun Melsungen AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Stryker Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Boston Scientific Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 FMD Co Ltd *List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Integer Holdings Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Asahi Intecc Co Ltd

List of Figures

- Figure 1: Global Vascular Guidewires Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Vascular Guidewires Market Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Vascular Guidewires Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Vascular Guidewires Market Revenue (Million), by Coating 2024 & 2032

- Figure 15: North America Vascular Guidewires Market Revenue Share (%), by Coating 2024 & 2032

- Figure 16: North America Vascular Guidewires Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 17: North America Vascular Guidewires Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 18: North America Vascular Guidewires Market Revenue (Million), by End User 2024 & 2032

- Figure 19: North America Vascular Guidewires Market Revenue Share (%), by End User 2024 & 2032

- Figure 20: North America Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Vascular Guidewires Market Revenue (Million), by Product 2024 & 2032

- Figure 23: Europe Vascular Guidewires Market Revenue Share (%), by Product 2024 & 2032

- Figure 24: Europe Vascular Guidewires Market Revenue (Million), by Coating 2024 & 2032

- Figure 25: Europe Vascular Guidewires Market Revenue Share (%), by Coating 2024 & 2032

- Figure 26: Europe Vascular Guidewires Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 27: Europe Vascular Guidewires Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 28: Europe Vascular Guidewires Market Revenue (Million), by End User 2024 & 2032

- Figure 29: Europe Vascular Guidewires Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Vascular Guidewires Market Revenue (Million), by Product 2024 & 2032

- Figure 33: Asia Pacific Vascular Guidewires Market Revenue Share (%), by Product 2024 & 2032

- Figure 34: Asia Pacific Vascular Guidewires Market Revenue (Million), by Coating 2024 & 2032

- Figure 35: Asia Pacific Vascular Guidewires Market Revenue Share (%), by Coating 2024 & 2032

- Figure 36: Asia Pacific Vascular Guidewires Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 37: Asia Pacific Vascular Guidewires Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 38: Asia Pacific Vascular Guidewires Market Revenue (Million), by End User 2024 & 2032

- Figure 39: Asia Pacific Vascular Guidewires Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: Asia Pacific Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Vascular Guidewires Market Revenue (Million), by Product 2024 & 2032

- Figure 43: Middle East and Africa Vascular Guidewires Market Revenue Share (%), by Product 2024 & 2032

- Figure 44: Middle East and Africa Vascular Guidewires Market Revenue (Million), by Coating 2024 & 2032

- Figure 45: Middle East and Africa Vascular Guidewires Market Revenue Share (%), by Coating 2024 & 2032

- Figure 46: Middle East and Africa Vascular Guidewires Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 47: Middle East and Africa Vascular Guidewires Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 48: Middle East and Africa Vascular Guidewires Market Revenue (Million), by End User 2024 & 2032

- Figure 49: Middle East and Africa Vascular Guidewires Market Revenue Share (%), by End User 2024 & 2032

- Figure 50: Middle East and Africa Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: South America Vascular Guidewires Market Revenue (Million), by Product 2024 & 2032

- Figure 53: South America Vascular Guidewires Market Revenue Share (%), by Product 2024 & 2032

- Figure 54: South America Vascular Guidewires Market Revenue (Million), by Coating 2024 & 2032

- Figure 55: South America Vascular Guidewires Market Revenue Share (%), by Coating 2024 & 2032

- Figure 56: South America Vascular Guidewires Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 57: South America Vascular Guidewires Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 58: South America Vascular Guidewires Market Revenue (Million), by End User 2024 & 2032

- Figure 59: South America Vascular Guidewires Market Revenue Share (%), by End User 2024 & 2032

- Figure 60: South America Vascular Guidewires Market Revenue (Million), by Country 2024 & 2032

- Figure 61: South America Vascular Guidewires Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vascular Guidewires Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Vascular Guidewires Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Vascular Guidewires Market Revenue Million Forecast, by Coating 2019 & 2032

- Table 4: Global Vascular Guidewires Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 5: Global Vascular Guidewires Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Vascular Guidewires Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: GCC Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Brazil Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Argentina Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Vascular Guidewires Market Revenue Million Forecast, by Product 2019 & 2032

- Table 34: Global Vascular Guidewires Market Revenue Million Forecast, by Coating 2019 & 2032

- Table 35: Global Vascular Guidewires Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 36: Global Vascular Guidewires Market Revenue Million Forecast, by End User 2019 & 2032

- Table 37: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Canada Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Mexico Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Vascular Guidewires Market Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global Vascular Guidewires Market Revenue Million Forecast, by Coating 2019 & 2032

- Table 43: Global Vascular Guidewires Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 44: Global Vascular Guidewires Market Revenue Million Forecast, by End User 2019 & 2032

- Table 45: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Vascular Guidewires Market Revenue Million Forecast, by Product 2019 & 2032

- Table 53: Global Vascular Guidewires Market Revenue Million Forecast, by Coating 2019 & 2032

- Table 54: Global Vascular Guidewires Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 55: Global Vascular Guidewires Market Revenue Million Forecast, by End User 2019 & 2032

- Table 56: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Australia Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Vascular Guidewires Market Revenue Million Forecast, by Product 2019 & 2032

- Table 64: Global Vascular Guidewires Market Revenue Million Forecast, by Coating 2019 & 2032

- Table 65: Global Vascular Guidewires Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 66: Global Vascular Guidewires Market Revenue Million Forecast, by End User 2019 & 2032

- Table 67: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: GCC Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Africa Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Middle East and Africa Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Global Vascular Guidewires Market Revenue Million Forecast, by Product 2019 & 2032

- Table 72: Global Vascular Guidewires Market Revenue Million Forecast, by Coating 2019 & 2032

- Table 73: Global Vascular Guidewires Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 74: Global Vascular Guidewires Market Revenue Million Forecast, by End User 2019 & 2032

- Table 75: Global Vascular Guidewires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Brazil Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Argentina Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Vascular Guidewires Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vascular Guidewires Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Vascular Guidewires Market?

Key companies in the market include Asahi Intecc Co Ltd, Cook Medical, Terumo Corporation, Lepu Medical Technology(Beijing)Co Ltd, Abbott Laboratories, AngioDynamics, Medtronic PLC, Cardinal Health, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, FMD Co Ltd *List Not Exhaustive, Integer Holdings Corporation.

3. What are the main segments of the Vascular Guidewires Market?

The market segments include Product, Coating, Raw Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cardiovascular Disease Burden; Growing Preference for Minimally Invasive Surgeries; Technological Advancements in Guidewires.

6. What are the notable trends driving market growth?

Coronary Guidewires Segment is Anticipated to Significantly Grow Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Number of Product Recalls.

8. Can you provide examples of recent developments in the market?

In June 2022, Cardio Flow, Inc., a medical device company and developer of minimally invasive peripheral vascular devices received US FDA clearance for the company's FreedomFlow Peripheral Guidewire. The FreedomFlow guidewire was developed to provide better support for diagnostic and therapeutic devices used to treat plaque blockages in arteries both above and below the knee.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vascular Guidewires Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vascular Guidewires Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vascular Guidewires Market?

To stay informed about further developments, trends, and reports in the Vascular Guidewires Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence