Key Insights

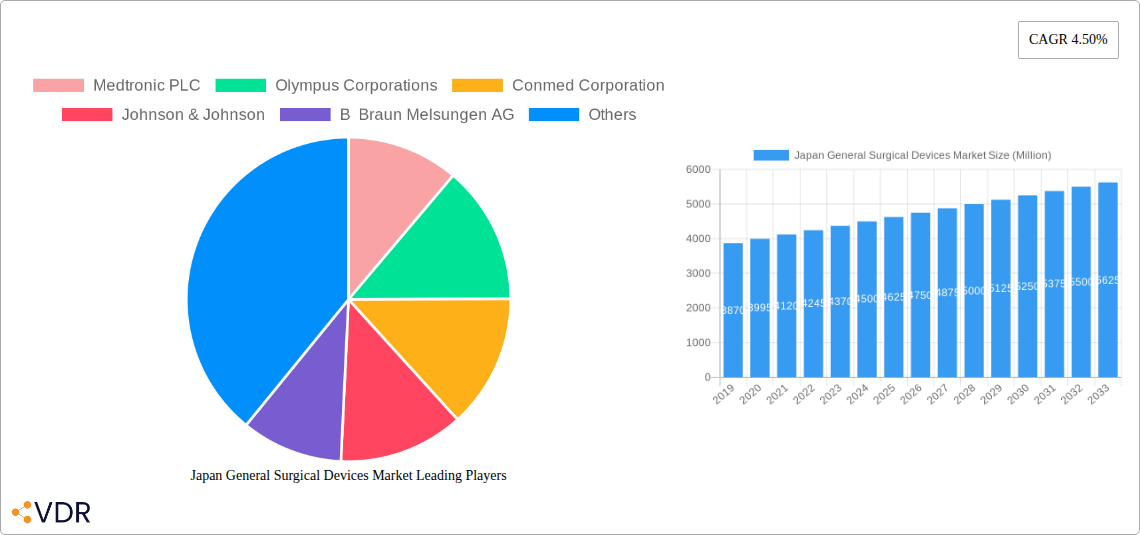

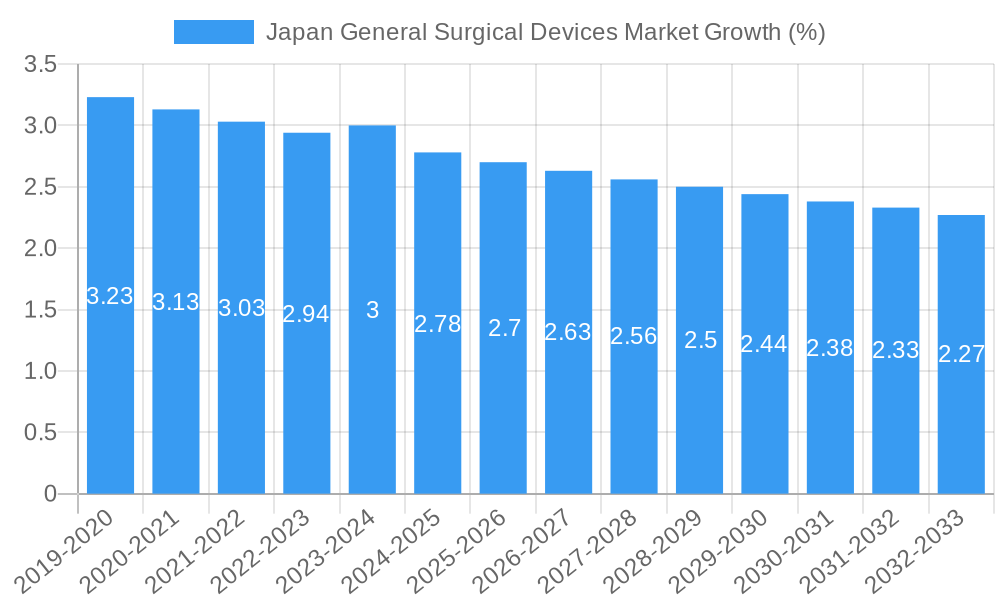

The Japanese General Surgical Devices Market is poised for steady growth, projected to reach approximately USD 4,500 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.50% through 2033. This expansion is primarily fueled by an aging population, which naturally leads to an increased demand for surgical interventions across various specialties. Furthermore, the growing prevalence of chronic diseases such as cardiovascular conditions, orthopedic ailments, and neurological disorders necessitates advanced surgical treatments, thereby driving the adoption of innovative general surgical devices. Technological advancements in minimally invasive surgical techniques, including the increasing use of handheld devices, laparoscopic instruments, and electro-surgical tools, are also significant growth enablers. These technologies offer improved patient outcomes, reduced recovery times, and lower healthcare costs, making them increasingly attractive to both healthcare providers and patients. The focus on precision and efficiency in surgical procedures further accentuates the demand for sophisticated devices.

The market's trajectory will be shaped by a combination of key drivers and emerging trends. Significant drivers include the rising adoption of advanced surgical technologies, government initiatives promoting healthcare infrastructure development, and increasing patient awareness regarding minimally invasive procedures. The demand for specialized devices in gynecology and urology, cardiology, and orthopedics is expected to remain robust. However, certain restraints could temper this growth. High acquisition costs for advanced surgical equipment and stringent regulatory approval processes in Japan might pose challenges. Moreover, the need for skilled healthcare professionals to operate these sophisticated devices and the potential for reimbursement challenges could also influence market dynamics. Despite these restraints, the overarching trend towards sophisticated and patient-centric surgical solutions, coupled with continuous innovation from leading companies like Medtronic, Olympus, and Stryker, suggests a positive and resilient market outlook for general surgical devices in Japan.

This in-depth report provides a critical analysis of the Japan General Surgical Devices Market, offering unparalleled insights into its dynamics, growth trajectory, and key players. We delve into parent and child markets, providing a granular view of segments such as handheld surgical devices, laparoscopic surgical instruments, electrosurgical devices, wound closure solutions, trocars and access devices, and other specialized surgical tools. For applications, we dissect the market across gynecology and urology, cardiology, orthopaedics, neurology, and a spectrum of other vital medical fields. This report is meticulously crafted to equip medical device manufacturers, distributors, healthcare providers, investors, and policy makers with actionable intelligence for strategic decision-making. All unit values are presented in Million units.

Japan General Surgical Devices Market Market Dynamics & Structure

The Japan General Surgical Devices Market is characterized by a moderately concentrated competitive landscape, with established global players like Medtronic PLC, Olympus Corporations, Johnson & Johnson, and Stryker Corporation holding significant market shares. Technological innovation remains a primary driver, with continuous advancements in minimally invasive surgical technologies, robotic surgery integration, and smart devices enhancing precision and patient outcomes. Japan's stringent regulatory framework, overseen by the Pharmaceuticals and Medical Devices Agency (PMDA), ensures high product quality and safety standards, acting as both a benchmark and a potential barrier to entry. Competitive product substitutes, particularly in areas like wound closure and minimally invasive tools, foster innovation but also intensify competition. The aging demographic in Japan fuels demand for procedures in orthopaedics and cardiology, influencing end-user purchasing patterns. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to expand their product portfolios and geographical reach. For instance, in 2021, the M&A deal volume in the broader medical device sector aimed at acquiring innovative technologies was approximately 15 deals with a total value of over USD 2.5 billion, reflecting strategic moves to enhance competitive positioning. Barriers to innovation are often associated with lengthy R&D cycles and the high cost of clinical trials.

- Market Concentration: Dominated by a mix of multinational corporations and specialized domestic manufacturers.

- Technological Innovation: Driven by miniaturization, automation, AI integration, and advanced imaging for minimally invasive procedures.

- Regulatory Landscape: Strict PMDA approvals necessitate rigorous testing and compliance, influencing market entry and product development.

- Competitive Substitution: Ongoing development of novel devices across all product categories, particularly in advanced wound care and energy-based devices.

- End-User Demographics: An aging population drives demand for specific surgical applications, influencing product focus.

- M&A Trends: Strategic acquisitions are common for gaining access to new technologies and market segments.

Japan General Surgical Devices Market Growth Trends & Insights

The Japan General Surgical Devices Market is poised for robust expansion, projected to witness a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033, reaching an estimated market size of USD 8.5 Billion in 2025 and expanding to USD 13.6 Billion by 2033. This growth is underpinned by several key trends. Increasing adoption of minimally invasive surgical techniques, facilitated by advancements in laparoscopic devices and electrosurgical devices, is a significant driver. These technologies offer reduced patient trauma, shorter recovery times, and lower healthcare costs, aligning with the objectives of healthcare providers and patients alike. The rise in the prevalence of chronic diseases, particularly in cardiology and orthopaedics, necessitates more frequent and sophisticated surgical interventions, directly impacting the demand for specialized surgical instruments and devices. For example, the market for cardiovascular surgical devices alone is expected to grow at a CAGR of 5.8% during the forecast period.

Technological disruptions, such as the integration of artificial intelligence (AI) in surgical planning and intraoperative guidance, are set to revolutionize surgical practices. AI-powered diagnostic tools and robotic-assisted surgery platforms are gaining traction, promising enhanced precision and improved patient outcomes. The market penetration of advanced wound closure devices, including bio-absorbable sutures and advanced adhesives, is also on the rise, driven by a focus on faster healing and reduced scarring. Consumer behavior is shifting towards valuing less invasive procedures and faster recovery, further accelerating the demand for innovative surgical solutions. The Japanese government's focus on healthcare innovation and digitalization is also playing a crucial role in fostering market growth. Investments in advanced medical infrastructure and incentives for adopting new technologies are creating a conducive environment for market expansion. The increasing preference for specialized surgical tools tailored to specific applications like gynecology and urology and neurology is also contributing to market segmentation and growth. The market size for laparoscopic devices is estimated to reach USD 1.9 Billion in 2025.

Dominant Regions, Countries, or Segments in Japan General Surgical Devices Market

Within the Japan General Surgical Devices Market, the Kanto region, encompassing Tokyo and its surrounding prefectures, stands out as the dominant force, accounting for approximately 35% of the total market value in 2025. This dominance is attributed to several intertwined factors, including the highest concentration of advanced medical facilities, leading research institutions, and a substantial patient population seeking specialized and cutting-edge surgical treatments. The Kanto region benefits from robust healthcare infrastructure, a high density of board-certified surgeons, and a strong emphasis on adopting new technologies.

Examining the Product segments, Laparoscopic Devices are projected to exhibit the most significant growth, with an estimated market size of USD 1.9 Billion in 2025 and a projected CAGR of 7.0% through 2033. This surge is propelled by the increasing adoption of minimally invasive surgery across a wide array of procedures, driven by benefits such as reduced scarring, faster patient recovery, and shorter hospital stays. The technological advancements in camera systems, instruments, and energy devices for laparoscopic surgery continue to expand its applicability.

In terms of Application, Gynecology and Urology represent the largest and a rapidly expanding segment, estimated at USD 2.1 Billion in 2025 and forecasted to grow at a CAGR of 6.8% by 2033. This segment's growth is fueled by an increasing incidence of gynecological disorders and urological conditions, coupled with the growing preference for less invasive surgical approaches in these fields. Furthermore, advancements in specialized instruments for these applications are driving innovation and adoption. The demand for advanced Electrosurgical Devices is also noteworthy, driven by their versatility in cutting, coagulation, and dissection across various surgical specialties.

- Dominant Region: Kanto region, due to its advanced healthcare infrastructure and concentration of leading hospitals.

- Leading Product Segment: Laparoscopic Devices, driven by the trend towards minimally invasive surgery.

- Key Drivers: Technological advancements in imaging and instrumentation, patient preference for faster recovery.

- Market Share (2025): Estimated at 22.4% of the total market value.

- Leading Application Segment: Gynecology and Urology, due to rising disease prevalence and adoption of minimally invasive techniques.

- Key Drivers: Increasing incidence of related conditions, development of specialized surgical tools.

- Market Share (2025): Estimated at 24.7% of the total market value.

- Growth Potential: High growth anticipated in Orthopaedic and Cardiology applications due to an aging population.

Japan General Surgical Devices Market Product Landscape

The Japan General Surgical Devices Market showcases a dynamic product landscape characterized by continuous innovation and specialization. Handheld surgical devices remain foundational, encompassing a vast array of instruments like scalpels, forceps, and retractors, essential for open surgical procedures. However, the market is increasingly shifting towards advanced solutions. Laparoscopic devices are experiencing significant traction, with sophisticated endoscopic cameras, specialized graspers, dissectors, and energy devices enabling complex procedures through small incisions. Electro surgical devices, including monopolar and bipolar generators and electrodes, are vital for precise tissue cutting and coagulation, finding applications across nearly all surgical specialties. The wound closure devices segment is witnessing innovation in materials science, with advancements in bio-resorbable sutures, advanced wound dressings, and tissue adhesives offering improved healing and reduced scarring. Trocars and access devices are becoming more refined, focusing on smaller diameters and less traumatic insertion techniques. The overarching trend is towards miniaturization, enhanced ergonomics, improved visualization, and integrated functionalities for greater surgical efficiency and patient safety.

Key Drivers, Barriers & Challenges in Japan General Surgical Devices Market

Key Drivers:

- Aging Population: A steadily increasing elderly demographic drives demand for surgical interventions, particularly in orthopaedics and cardiology.

- Technological Advancements: Continuous innovation in minimally invasive surgical technologies, robotics, and diagnostic imaging is expanding the scope and efficacy of surgical procedures.

- Government Support for Healthcare Innovation: Initiatives promoting R&D and adoption of advanced medical technologies create a favorable market environment.

- Focus on Minimally Invasive Surgery: Patient and healthcare provider preference for reduced trauma, faster recovery, and shorter hospital stays fuels demand for specialized devices.

Barriers & Challenges:

- Stringent Regulatory Approvals: The rigorous PMDA approval process can extend time-to-market and increase development costs, posing a barrier for new entrants.

- High Cost of Advanced Devices: The initial investment in cutting-edge surgical technologies can be substantial for healthcare facilities, leading to slower adoption in some segments.

- Reimbursement Policies: Evolving reimbursement landscapes for new surgical procedures and devices can impact market access and profitability.

- Skilled Workforce Shortage: A need for adequately trained surgeons and technicians proficient in utilizing advanced surgical equipment can be a limiting factor.

Emerging Opportunities in Japan General Surgical Devices Market

Emerging opportunities within the Japan General Surgical Devices Market lie in the burgeoning field of robot-assisted surgery, which, while still nascent, holds immense potential for growth as technology matures and costs decrease. The development of AI-powered surgical analytics and predictive tools presents another significant avenue, promising to optimize surgical planning and enhance intraoperative decision-making. Furthermore, there is a growing demand for customized and patient-specific surgical implants and devices, particularly in orthopaedics, driven by advancements in 3D printing and additive manufacturing. The expansion of telehealth and remote surgical monitoring capabilities also offers a novel pathway for delivering specialized surgical expertise and support across geographically dispersed areas.

Growth Accelerators in the Japan General Surgical Devices Market Industry

The Japan General Surgical Devices Market is poised for accelerated growth driven by several key catalysts. Continued investment in research and development by leading companies, focusing on the integration of artificial intelligence and machine learning into surgical platforms, will unlock new levels of precision and automation. Strategic partnerships between technology firms and medical device manufacturers are expected to foster rapid innovation and market penetration of novel solutions. Furthermore, the increasing adoption of value-based healthcare models is pushing for surgical procedures that offer demonstrably better patient outcomes at a lower cost, which directly benefits the market for efficient and effective surgical devices. Market expansion strategies, including partnerships with local distributors and increased focus on emerging applications, will also play a pivotal role.

Key Players Shaping the Japan General Surgical Devices Market Market

- Medtronic PLC

- Olympus Corporations

- Conmed Corporation

- Johnson & Johnson

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Smith & Nephew Plc

- Maquet Holding BV & Co KG (Getinge AB)

- Integer Holdings Corporation

Notable Milestones in Japan General Surgical Devices Market Sector

- September 2022: Olympus Corporation announced the launch of VISERA ELITE III, its newest surgical visualization platform designed for endoscopic procedures across multiple medical disciplines, enhancing diagnostic and therapeutic capabilities.

- September 2021: Bolder Surgical announced its CoolSeal device received CE mark and Japan PMDA approval. The CoolSeal Vessel Sealing suite, featuring advanced bipolar Radio Frequency vessel sealing technology, offers enhanced efficacy for surgical sealing and division.

In-Depth Japan General Surgical Devices Market Market Outlook

- September 2022: Olympus Corporation announced the launch of VISERA ELITE III, its newest surgical visualization platform designed for endoscopic procedures across multiple medical disciplines, enhancing diagnostic and therapeutic capabilities.

- September 2021: Bolder Surgical announced its CoolSeal device received CE mark and Japan PMDA approval. The CoolSeal Vessel Sealing suite, featuring advanced bipolar Radio Frequency vessel sealing technology, offers enhanced efficacy for surgical sealing and division.

In-Depth Japan General Surgical Devices Market Market Outlook

The future of the Japan General Surgical Devices Market is exceptionally promising, driven by a convergence of technological innovation and demographic shifts. The anticipated growth is largely propelled by the continued embrace of minimally invasive techniques, the increasing sophistication of robotic surgery, and the integration of AI for enhanced surgical precision. Market participants are strategically focusing on expanding their portfolios in high-growth segments such as laparoscopic devices and those catering to gynecology and urology and cardiology. Collaboration between research institutions and industry leaders will continue to be a crucial factor in accelerating the development and adoption of next-generation surgical technologies. The market's outlook is further bolstered by the Japanese government's commitment to advancing its healthcare sector through digitalization and innovation, creating a fertile ground for sustained expansion and improved patient care.

Japan General Surgical Devices Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electro Surgical Devices

- 1.4. Wound Closure Devices

- 1.5. Trocars and Access Devices

- 1.6. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopaedic

- 2.4. Neurology

- 2.5. Other Applications

Japan General Surgical Devices Market Segmentation By Geography

- 1. Japan

Japan General Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally Invasive Devices; Growing Cases of Injuries and Accidents

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Improper Reimbursement for Surgical Devices

- 3.4. Market Trends

- 3.4.1. Handheld Devices is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan General Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electro Surgical Devices

- 5.1.4. Wound Closure Devices

- 5.1.5. Trocars and Access Devices

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopaedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Medtronic PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Olympus Corporations

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Conmed Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson & Johnson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 B Braun Melsungen AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stryker Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smith & Nephew Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Maquet Holding BV & Co KG (Getinge AB)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Integer Holdings Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Medtronic PLC

List of Figures

- Figure 1: Japan General Surgical Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan General Surgical Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Japan General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan General Surgical Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Japan General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Japan General Surgical Devices Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Japan General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Japan General Surgical Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Japan General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan General Surgical Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Japan General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Japan General Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Japan General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: Japan General Surgical Devices Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: Japan General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Japan General Surgical Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 15: Japan General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Japan General Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan General Surgical Devices Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Japan General Surgical Devices Market?

Key companies in the market include Medtronic PLC, Olympus Corporations, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Smith & Nephew Plc, Maquet Holding BV & Co KG (Getinge AB), Integer Holdings Corporation.

3. What are the main segments of the Japan General Surgical Devices Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally Invasive Devices; Growing Cases of Injuries and Accidents.

6. What are the notable trends driving market growth?

Handheld Devices is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Improper Reimbursement for Surgical Devices.

8. Can you provide examples of recent developments in the market?

In September 2022, Olympus Corporation, based in Japan, announced the launch of VISERA ELITE III, its newest surgical visualization platform that addresses the needs of healthcare professionals (HCPs) for endoscopic procedures across multiple medical disciplines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan General Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan General Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan General Surgical Devices Market?

To stay informed about further developments, trends, and reports in the Japan General Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence