Key Insights

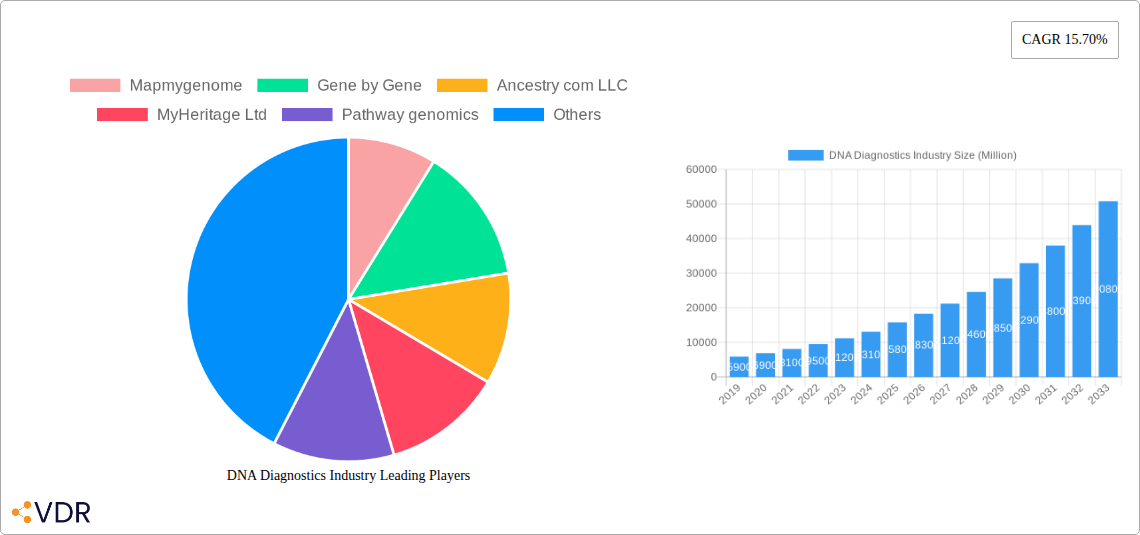

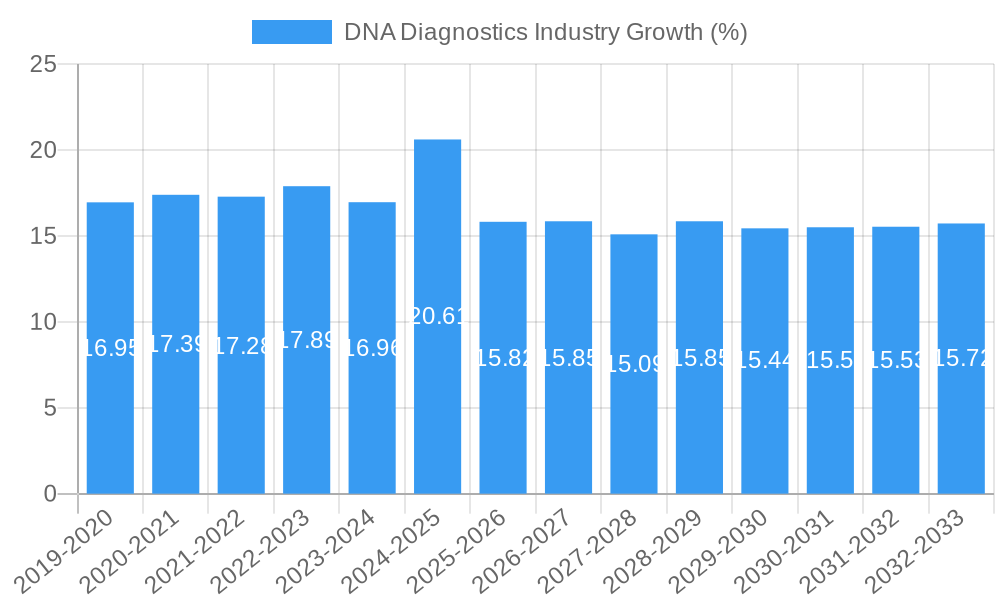

The global DNA diagnostics market is experiencing robust expansion, projected to reach a substantial size of approximately $15,800 million by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 15.70%, indicating a dynamic and rapidly evolving industry. The increasing consumer awareness regarding genetic predispositions to diseases, coupled with advancements in genetic testing technologies, are primary drivers behind this surge. The convenience and accessibility of direct-to-consumer (DTC) genetic testing, particularly through non-invasive sample types like saliva and cheek swabs, are democratizing genetic insights. Applications such as genetic relatedness testing, health and fitness optimization, and detailed ancestry tracing are gaining significant traction, appealing to a broad consumer base. Furthermore, the rising incidence of chronic diseases and the growing demand for personalized medicine are creating a strong impetus for DNA diagnostics in clinical settings.

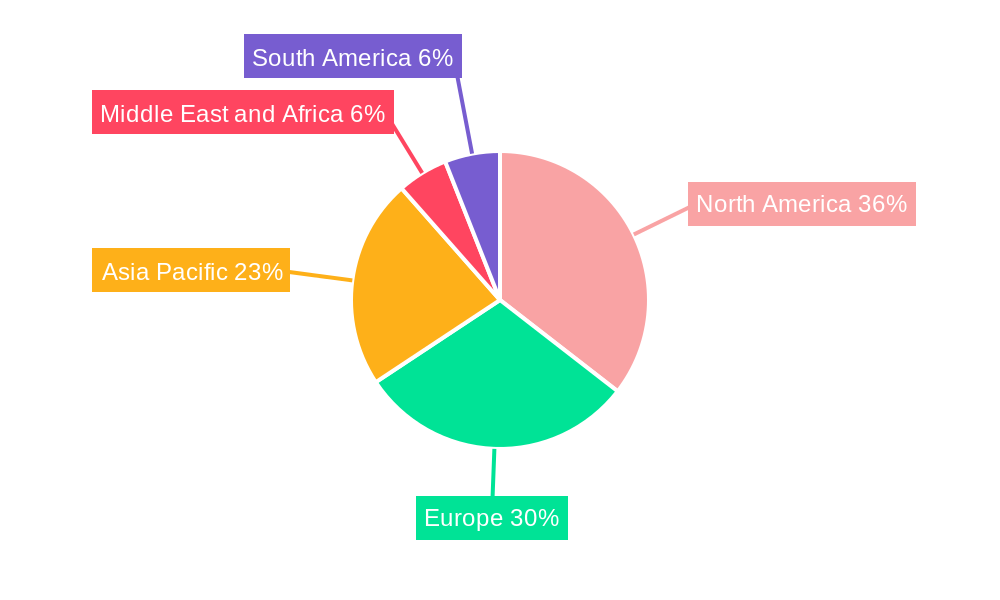

The market is characterized by intense competition among key players including 23andMe, Ancestry.com LLC, and MyHeritage Ltd, who are continuously innovating to offer more comprehensive and user-friendly genetic testing solutions. The Asia Pacific region, driven by burgeoning economies like China, Japan, and India, is emerging as a significant growth frontier, alongside the established dominance of North America and Europe. While the market offers immense opportunities, challenges such as stringent regulatory frameworks in certain regions, ethical concerns surrounding data privacy, and the cost of advanced genetic sequencing technologies present potential restraints. Nevertheless, the overarching trend towards proactive health management and the deep-seated human curiosity about genetic heritage position the DNA diagnostics market for sustained and significant growth throughout the forecast period extending to 2033.

This comprehensive report offers an in-depth analysis of the global DNA Diagnostics industry, a rapidly evolving sector vital for personalized medicine, ancestry tracing, and health and fitness optimization. Delving into market dynamics, growth trajectories, regional dominance, and key players, this report provides actionable insights for stakeholders navigating this transformative landscape. We explore the intricate interplay between parent and child markets, highlighting opportunities in direct-to-consumer (DTC) and clinical diagnostics, with all monetary values presented in Million units.

DNA Diagnostics Industry Market Dynamics & Structure

The DNA Diagnostics industry is characterized by a dynamic market structure driven by continuous technological advancements and increasing consumer awareness. Market concentration varies across different segments, with a blend of established giants and innovative startups. Technological innovation remains a paramount driver, fueled by breakthroughs in Next-Generation Sequencing (NGS) and CRISPR technologies, enabling more accessible and affordable genetic testing. Regulatory frameworks are evolving to address data privacy, ethical considerations, and clinical utility of genetic information, posing both opportunities and challenges for market participants. Competitive product substitutes include traditional diagnostic methods, but the unique value proposition of DNA diagnostics, offering predictive and preventative health insights, is steadily gaining traction. End-user demographics are broadening, encompassing individuals interested in personal health, disease predisposition, reproductive genetics, and familial connections. Mergers and acquisitions (M&A) trends indicate consolidation as larger players seek to expand their portfolios and technological capabilities.

- Market Concentration: Moderate to high in established DTC ancestry testing, with increasing fragmentation in specialized health diagnostics.

- Technological Innovation Drivers: Advancements in NGS, bioinformatics, AI for data analysis, and direct-to-consumer accessibility.

- Regulatory Frameworks: Evolving regulations for genetic data privacy (e.g., GDPR, CCPA), data security, and the clinical validation of DTC tests.

- Competitive Product Substitutes: Traditional medical diagnostics, lifestyle coaching, and generic health information.

- End-User Demographics: Diverse, including individuals seeking health insights, disease risk assessment, family history exploration, and personalized wellness.

- M&A Trends: Strategic acquisitions of specialized genetic testing companies by larger healthcare and technology firms to expand service offerings and market reach.

DNA Diagnostics Industry Growth Trends & Insights

The DNA Diagnostics industry is poised for significant expansion, driven by a convergence of factors including increasing per capita income, a growing emphasis on preventative healthcare, and a surge in consumer interest in understanding their genetic makeup. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) from xx Million units in the historical period of 2019-2024 to an estimated xx Million units by 2033. Adoption rates are accelerating, particularly within the direct-to-consumer (DTC) segment, as companies like 23andMe, Ancestry.com LLC, and MyHeritage Ltd. have successfully democratized genetic testing. Technological disruptions, such as the decreasing cost of sequencing and the development of user-friendly platforms, are further enhancing market penetration. Consumer behavior shifts are evident, with individuals becoming more proactive about their health and well-being, actively seeking genetic information to inform lifestyle choices, manage chronic conditions, and explore familial heritage. The integration of genetic data with electronic health records (EHRs) and wearable technology represents a significant future trend, promising more holistic and personalized health management solutions. The parent market, encompassing broader genetic research and diagnostic technologies, continues to underpin the growth of child markets like DTC testing and clinical genetic services, each with its unique growth trajectory and market penetration strategies.

Dominant Regions, Countries, or Segments in DNA Diagnostics Industry

The North America region stands as a dominant force in the DNA Diagnostics industry, with the United States leading the charge in both market penetration and technological innovation. This dominance is fueled by a combination of robust healthcare infrastructure, high consumer disposable income, and a strong research and development ecosystem. The US market exhibits a high adoption rate for both clinical and direct-to-consumer genetic testing, driven by a proactive approach to personal health and a burgeoning interest in ancestry.

- Sample Type Dominance: Saliva samples represent a significant segment due to their ease of collection and non-invasiveness, making them ideal for direct-to-consumer applications. Cheek swabs also hold considerable market share for similar reasons.

- Application Dominance: Ancestry Testing has historically been a primary growth driver, with companies like Ancestry.com LLC and MyHeritage Ltd. amassing vast customer bases. However, the Health & Fitness segment is rapidly gaining prominence as consumers seek to understand their predisposition to certain conditions and optimize their lifestyle based on genetic insights. Genetic Relatedness testing, crucial for familial connections and legal purposes, also contributes a steady demand.

- Key Drivers in North America:

- Economic Policies: Favorable reimbursement policies for genetic testing in certain clinical applications and a strong venture capital landscape supporting innovation.

- Infrastructure: Advanced laboratory facilities, widespread internet access for online ordering and result delivery, and a well-established e-commerce ecosystem.

- Consumer Awareness and Demand: High public awareness of genetic testing benefits, driven by educational initiatives and compelling marketing campaigns by key players.

- Regulatory Environment: While evolving, the existing regulatory framework in the US has, in many aspects, facilitated the growth of the DTC market.

- Market Share and Growth Potential: North America, particularly the United States, commands a substantial market share estimated at xx% of the global DNA diagnostics market. The region is expected to continue its growth trajectory, driven by ongoing technological advancements and increasing demand for personalized health solutions. The child market of specialized genetic health reports is witnessing particularly rapid expansion within North America.

DNA Diagnostics Industry Product Landscape

The DNA Diagnostics industry is defined by an expanding and increasingly sophisticated product landscape. Innovations range from user-friendly direct-to-consumer (DTC) kits that offer ancestry insights and basic health predispositions, to highly specialized clinical diagnostic panels for rare diseases and pharmacogenomics. Companies like 23andMe and Helix OpCo LLC are at the forefront of offering broad genetic insights, while Veritas Genetics and Pathway Genomics focus on more in-depth health and disease risk assessments. Product performance is measured by accuracy, comprehensiveness of reports, ease of use, and the actionable nature of the insights provided. Unique selling propositions often lie in the integration of genetic data with lifestyle recommendations, advanced bioinformatics for data interpretation, and secure, privacy-conscious data management. Technological advancements in DNA sequencing, microarray technology, and AI-driven data analysis are continually enhancing the capabilities and accessibility of these diagnostic tools.

Key Drivers, Barriers & Challenges in DNA Diagnostics Industry

The DNA Diagnostics industry is propelled by several key drivers that fuel its impressive growth. The increasing consumer demand for personalized health information and ancestry exploration is a primary catalyst. Technological advancements in sequencing and bioinformatics have made genetic testing more affordable and accessible. Growing awareness of the role of genetics in disease predisposition and treatment is further accelerating adoption. Furthermore, strategic partnerships between diagnostic companies and healthcare providers are expanding clinical applications.

- Key Drivers:

- Consumer Demand: Growing interest in personal health, ancestry, and proactive wellness.

- Technological Advancements: Decreasing sequencing costs, improved accuracy, and faster turnaround times.

- Personalized Medicine: Increasing application of genetic insights in healthcare decision-making.

- Research & Development: Continuous innovation in genetic discovery and diagnostic methodologies.

Conversely, significant barriers and challenges temper this growth. Regulatory hurdles surrounding data privacy and the clinical validity of DTC tests can slow market entry and adoption. The ethical implications of genetic information, including potential discrimination, remain a concern. Furthermore, the cost of advanced genetic tests can still be prohibitive for some segments of the population. Ensuring data security and patient privacy against cyber threats is a constant challenge.

- Key Barriers & Challenges:

- Regulatory Compliance: Navigating complex and evolving data privacy and genetic testing regulations.

- Ethical Concerns: Addressing potential misuse of genetic information and ensuring responsible data handling.

- Cost & Accessibility: High costs for certain specialized genetic tests limiting broad accessibility.

- Data Security: Protecting sensitive genetic information from breaches and unauthorized access.

- Interpretation Complexity: The need for expert interpretation of complex genetic data to provide actionable insights.

Emerging Opportunities in DNA Diagnostics Industry

Emerging opportunities within the DNA Diagnostics industry are ripe for exploration. The expansion of pharmacogenomics, tailoring drug prescriptions based on individual genetic profiles, presents a significant growth avenue. The integration of DNA diagnostics with artificial intelligence (AI) and machine learning for predictive health modeling offers immense potential. Untapped markets in emerging economies with increasing healthcare expenditure are also attractive. Furthermore, the growing demand for niche genetic testing, such as carrier screening for reproductive health and forensic DNA analysis, provides specialized avenues for growth. The evolving consumer preference for at-home testing solutions and virtual consultations further opens doors for innovative service delivery models.

Growth Accelerators in the DNA Diagnostics Industry Industry

Several catalysts are accelerating the long-term growth of the DNA Diagnostics industry. Breakthroughs in gene editing technologies and the development of novel diagnostic markers are expanding the scope of what can be detected and treated. Strategic partnerships between DTC companies, healthcare providers, and research institutions are fostering greater integration of genetic insights into mainstream healthcare. Market expansion strategies targeting underserved populations and geographical regions are also key growth accelerators. The increasing focus on preventative and precision medicine by global health organizations and governments is creating a supportive ecosystem for industry expansion.

Key Players Shaping the DNA Diagnostics Industry Market

- Mapmygenome

- Gene by Gene

- Ancestry com LLC

- MyHeritage Ltd

- Pathway genomics

- Helix OpCo LLC

- Genesis Healthcare Co

- 23andMe

- Living DNA Ltd

- Veritas Genetics

- Futura Genetics

- Identigene (DNA Diagnostics Center)

Notable Milestones in DNA Diagnostics Industry Sector

- May 2021: South Korean Telecommunications partnered with Direct-to-Consumer genetic testing companies to send test results to consumers' mobile devices, streamlining access to health information.

- September 2021: MedGenome Labs launched its direct-to-consumer genetic screening test brand, Genessense, marking its foray into the consumer market with online and e-commerce platform accessibility.

In-Depth DNA Diagnostics Industry Market Outlook

- May 2021: South Korean Telecommunications partnered with Direct-to-Consumer genetic testing companies to send test results to consumers' mobile devices, streamlining access to health information.

- September 2021: MedGenome Labs launched its direct-to-consumer genetic screening test brand, Genessense, marking its foray into the consumer market with online and e-commerce platform accessibility.

In-Depth DNA Diagnostics Industry Market Outlook

The future outlook for the DNA Diagnostics industry is exceptionally promising, driven by a confluence of accelerating factors. The continued advancement and cost reduction of sequencing technologies will further democratize access to genetic information. The increasing integration of genetic data with other health modalities, such as wearables and electronic health records, will pave the way for truly personalized and preventative healthcare. Strategic partnerships, particularly between DTC providers and clinical healthcare systems, will bridge the gap between consumer curiosity and actionable medical insights. The growing global awareness and demand for understanding one's genetic predispositions for health and ancestry will fuel market expansion into new demographics and geographical regions. Consequently, the industry is poised for sustained high growth, offering transformative potential in health management and personal discovery.

DNA Diagnostics Industry Segmentation

-

1. Sample Type

- 1.1. Saliva

- 1.2. Cheek Swab

-

2. Application

- 2.1. Genetic Relatedness

- 2.2. Health & Fitness

- 2.3. Ancestry Testing

- 2.4. Other Applications

DNA Diagnostics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

DNA Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Paternity Testing & Increasing Number of Hereditary Diseases; Increasing Demand for Personalized DTC Genetic Services in Developed Countries

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges Pertaining to the Use of DTC Genetic Tests

- 3.4. Market Trends

- 3.4.1. Ancestry Testing Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sample Type

- 5.1.1. Saliva

- 5.1.2. Cheek Swab

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Genetic Relatedness

- 5.2.2. Health & Fitness

- 5.2.3. Ancestry Testing

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Sample Type

- 6. North America DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sample Type

- 6.1.1. Saliva

- 6.1.2. Cheek Swab

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Genetic Relatedness

- 6.2.2. Health & Fitness

- 6.2.3. Ancestry Testing

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Sample Type

- 7. Europe DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sample Type

- 7.1.1. Saliva

- 7.1.2. Cheek Swab

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Genetic Relatedness

- 7.2.2. Health & Fitness

- 7.2.3. Ancestry Testing

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Sample Type

- 8. Asia Pacific DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sample Type

- 8.1.1. Saliva

- 8.1.2. Cheek Swab

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Genetic Relatedness

- 8.2.2. Health & Fitness

- 8.2.3. Ancestry Testing

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Sample Type

- 9. Middle East and Africa DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sample Type

- 9.1.1. Saliva

- 9.1.2. Cheek Swab

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Genetic Relatedness

- 9.2.2. Health & Fitness

- 9.2.3. Ancestry Testing

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Sample Type

- 10. South America DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sample Type

- 10.1.1. Saliva

- 10.1.2. Cheek Swab

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Genetic Relatedness

- 10.2.2. Health & Fitness

- 10.2.3. Ancestry Testing

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Sample Type

- 11. North America DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America DNA Diagnostics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Mapmygenome

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Gene by Gene

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Ancestry com LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 MyHeritage Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Pathway genomics

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Helix OpCo LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Genesis Healthcare Co

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 23andMe

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Living DNA Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Veritas Genetics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Futura Genetics

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Identigene (DNA Diagnostics Center)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Mapmygenome

List of Figures

- Figure 1: Global DNA Diagnostics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global DNA Diagnostics Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: Middle East and Africa DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: South America DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: South America DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America DNA Diagnostics Industry Revenue (Million), by Sample Type 2024 & 2032

- Figure 24: North America DNA Diagnostics Industry Volume (K Unit), by Sample Type 2024 & 2032

- Figure 25: North America DNA Diagnostics Industry Revenue Share (%), by Sample Type 2024 & 2032

- Figure 26: North America DNA Diagnostics Industry Volume Share (%), by Sample Type 2024 & 2032

- Figure 27: North America DNA Diagnostics Industry Revenue (Million), by Application 2024 & 2032

- Figure 28: North America DNA Diagnostics Industry Volume (K Unit), by Application 2024 & 2032

- Figure 29: North America DNA Diagnostics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: North America DNA Diagnostics Industry Volume Share (%), by Application 2024 & 2032

- Figure 31: North America DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 32: North America DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe DNA Diagnostics Industry Revenue (Million), by Sample Type 2024 & 2032

- Figure 36: Europe DNA Diagnostics Industry Volume (K Unit), by Sample Type 2024 & 2032

- Figure 37: Europe DNA Diagnostics Industry Revenue Share (%), by Sample Type 2024 & 2032

- Figure 38: Europe DNA Diagnostics Industry Volume Share (%), by Sample Type 2024 & 2032

- Figure 39: Europe DNA Diagnostics Industry Revenue (Million), by Application 2024 & 2032

- Figure 40: Europe DNA Diagnostics Industry Volume (K Unit), by Application 2024 & 2032

- Figure 41: Europe DNA Diagnostics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Europe DNA Diagnostics Industry Volume Share (%), by Application 2024 & 2032

- Figure 43: Europe DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 44: Europe DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 45: Europe DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Europe DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 47: Asia Pacific DNA Diagnostics Industry Revenue (Million), by Sample Type 2024 & 2032

- Figure 48: Asia Pacific DNA Diagnostics Industry Volume (K Unit), by Sample Type 2024 & 2032

- Figure 49: Asia Pacific DNA Diagnostics Industry Revenue Share (%), by Sample Type 2024 & 2032

- Figure 50: Asia Pacific DNA Diagnostics Industry Volume Share (%), by Sample Type 2024 & 2032

- Figure 51: Asia Pacific DNA Diagnostics Industry Revenue (Million), by Application 2024 & 2032

- Figure 52: Asia Pacific DNA Diagnostics Industry Volume (K Unit), by Application 2024 & 2032

- Figure 53: Asia Pacific DNA Diagnostics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific DNA Diagnostics Industry Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Asia Pacific DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 57: Asia Pacific DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East and Africa DNA Diagnostics Industry Revenue (Million), by Sample Type 2024 & 2032

- Figure 60: Middle East and Africa DNA Diagnostics Industry Volume (K Unit), by Sample Type 2024 & 2032

- Figure 61: Middle East and Africa DNA Diagnostics Industry Revenue Share (%), by Sample Type 2024 & 2032

- Figure 62: Middle East and Africa DNA Diagnostics Industry Volume Share (%), by Sample Type 2024 & 2032

- Figure 63: Middle East and Africa DNA Diagnostics Industry Revenue (Million), by Application 2024 & 2032

- Figure 64: Middle East and Africa DNA Diagnostics Industry Volume (K Unit), by Application 2024 & 2032

- Figure 65: Middle East and Africa DNA Diagnostics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 66: Middle East and Africa DNA Diagnostics Industry Volume Share (%), by Application 2024 & 2032

- Figure 67: Middle East and Africa DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Middle East and Africa DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 69: Middle East and Africa DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Middle East and Africa DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: South America DNA Diagnostics Industry Revenue (Million), by Sample Type 2024 & 2032

- Figure 72: South America DNA Diagnostics Industry Volume (K Unit), by Sample Type 2024 & 2032

- Figure 73: South America DNA Diagnostics Industry Revenue Share (%), by Sample Type 2024 & 2032

- Figure 74: South America DNA Diagnostics Industry Volume Share (%), by Sample Type 2024 & 2032

- Figure 75: South America DNA Diagnostics Industry Revenue (Million), by Application 2024 & 2032

- Figure 76: South America DNA Diagnostics Industry Volume (K Unit), by Application 2024 & 2032

- Figure 77: South America DNA Diagnostics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 78: South America DNA Diagnostics Industry Volume Share (%), by Application 2024 & 2032

- Figure 79: South America DNA Diagnostics Industry Revenue (Million), by Country 2024 & 2032

- Figure 80: South America DNA Diagnostics Industry Volume (K Unit), by Country 2024 & 2032

- Figure 81: South America DNA Diagnostics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 82: South America DNA Diagnostics Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global DNA Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global DNA Diagnostics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global DNA Diagnostics Industry Revenue Million Forecast, by Sample Type 2019 & 2032

- Table 4: Global DNA Diagnostics Industry Volume K Unit Forecast, by Sample Type 2019 & 2032

- Table 5: Global DNA Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global DNA Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Global DNA Diagnostics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global DNA Diagnostics Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: France DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Italy DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Spain DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: China DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: China DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Japan DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: India DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Australia DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: South Korea DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Korea DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: GCC DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: GCC DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: South Africa DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Africa DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Rest of Middle East and Africa DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East and Africa DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Brazil DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Brazil DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Argentina DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Argentina DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Rest of South America DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Global DNA Diagnostics Industry Revenue Million Forecast, by Sample Type 2019 & 2032

- Table 62: Global DNA Diagnostics Industry Volume K Unit Forecast, by Sample Type 2019 & 2032

- Table 63: Global DNA Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Global DNA Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 65: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: United States DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: United States DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Canada DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Canada DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Mexico DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Mexico DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Global DNA Diagnostics Industry Revenue Million Forecast, by Sample Type 2019 & 2032

- Table 74: Global DNA Diagnostics Industry Volume K Unit Forecast, by Sample Type 2019 & 2032

- Table 75: Global DNA Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 76: Global DNA Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 77: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 79: Germany DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Germany DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: United Kingdom DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: United Kingdom DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: France DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: France DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Italy DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Italy DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Spain DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Spain DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Rest of Europe DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Rest of Europe DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Global DNA Diagnostics Industry Revenue Million Forecast, by Sample Type 2019 & 2032

- Table 92: Global DNA Diagnostics Industry Volume K Unit Forecast, by Sample Type 2019 & 2032

- Table 93: Global DNA Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 94: Global DNA Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 95: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 96: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 97: China DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: China DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Japan DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Japan DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: India DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: India DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 103: Australia DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Australia DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 105: South Korea DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: South Korea DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 107: Rest of Asia Pacific DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: Rest of Asia Pacific DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 109: Global DNA Diagnostics Industry Revenue Million Forecast, by Sample Type 2019 & 2032

- Table 110: Global DNA Diagnostics Industry Volume K Unit Forecast, by Sample Type 2019 & 2032

- Table 111: Global DNA Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 112: Global DNA Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 113: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 114: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 115: GCC DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: GCC DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 117: South Africa DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: South Africa DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 119: Rest of Middle East and Africa DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: Rest of Middle East and Africa DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 121: Global DNA Diagnostics Industry Revenue Million Forecast, by Sample Type 2019 & 2032

- Table 122: Global DNA Diagnostics Industry Volume K Unit Forecast, by Sample Type 2019 & 2032

- Table 123: Global DNA Diagnostics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 124: Global DNA Diagnostics Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 125: Global DNA Diagnostics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 126: Global DNA Diagnostics Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 127: Brazil DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: Brazil DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 129: Argentina DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: Argentina DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 131: Rest of South America DNA Diagnostics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 132: Rest of South America DNA Diagnostics Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DNA Diagnostics Industry?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the DNA Diagnostics Industry?

Key companies in the market include Mapmygenome, Gene by Gene, Ancestry com LLC, MyHeritage Ltd, Pathway genomics, Helix OpCo LLC, Genesis Healthcare Co, 23andMe, Living DNA Ltd, Veritas Genetics, Futura Genetics, Identigene (DNA Diagnostics Center).

3. What are the main segments of the DNA Diagnostics Industry?

The market segments include Sample Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Paternity Testing & Increasing Number of Hereditary Diseases; Increasing Demand for Personalized DTC Genetic Services in Developed Countries.

6. What are the notable trends driving market growth?

Ancestry Testing Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Regulatory Challenges Pertaining to the Use of DTC Genetic Tests.

8. Can you provide examples of recent developments in the market?

In May 2021, South Korean Telecommunications partnered with Direct-to-Consumer genetic testing companies to send test results to consumers' mobile devices. DTC genetic testing organizations and telecommunications companies in South Korea are collaborating with each other with an aim to help consumers by informing them about their health status by sending lab test results directly to their mobile devices without involving healthcare professionals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DNA Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DNA Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DNA Diagnostics Industry?

To stay informed about further developments, trends, and reports in the DNA Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence