Key Insights

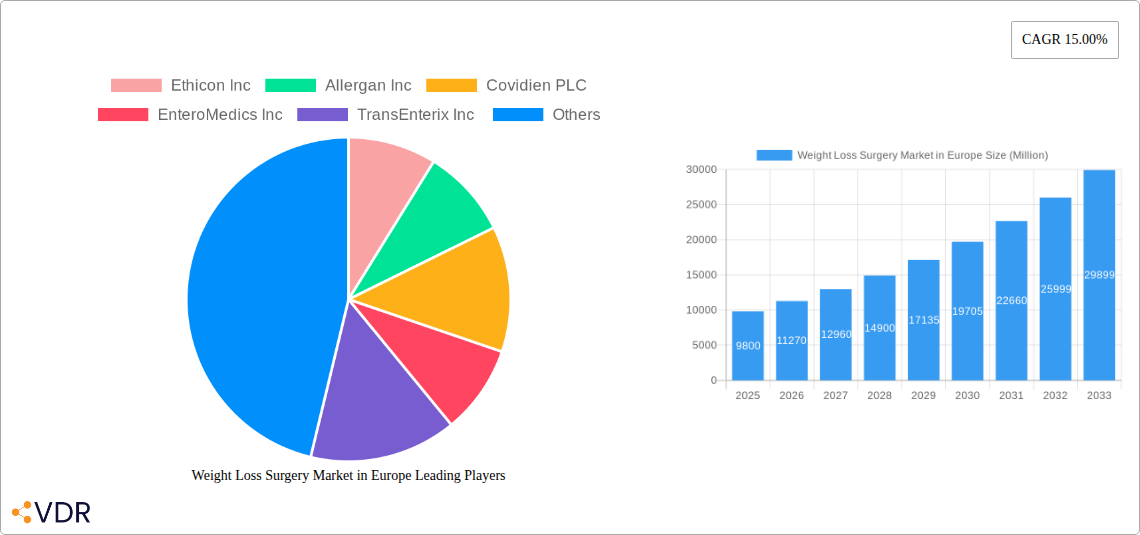

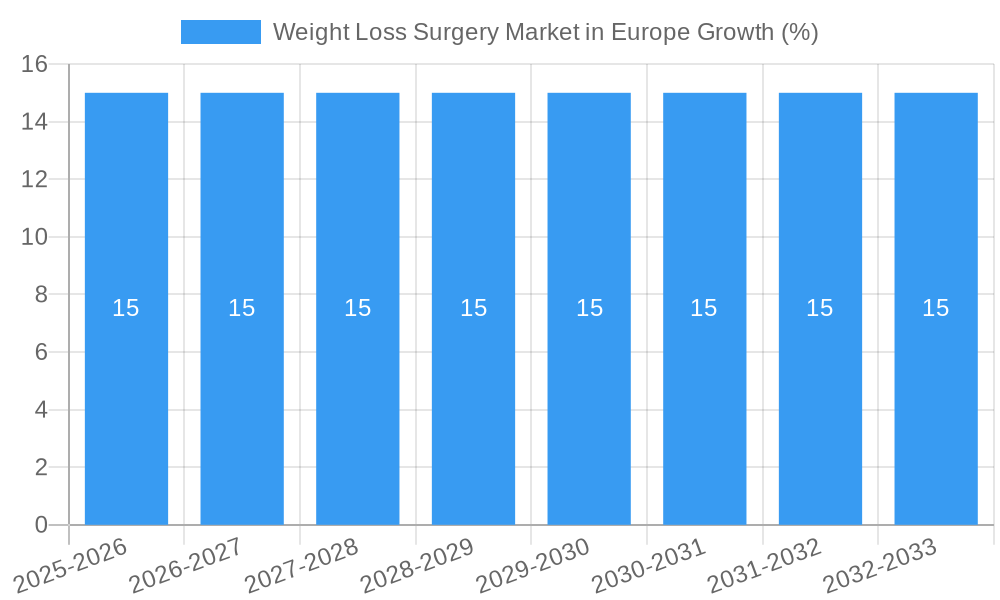

The European Weight Loss Surgery Market is experiencing robust growth, projected to reach an estimated market size of approximately $9,800 million by 2025. This expansion is driven by a confluence of factors, including the escalating prevalence of obesity and related comorbidities across the continent, a growing awareness of bariatric procedures as effective long-term solutions, and advancements in surgical technologies that enhance patient outcomes and reduce recovery times. The market's Compound Annual Growth Rate (CAGR) of 15.00% underscores its dynamic nature, signaling a significant increase in demand for both implantable and assisting devices. Key drivers include government initiatives promoting public health, increasing disposable incomes enabling individuals to opt for elective procedures, and the continuous innovation by leading market players in developing less invasive and more effective surgical interventions. The increasing adoption of minimally invasive techniques, such as laparoscopic surgeries, is a significant trend, contributing to improved patient safety and faster rehabilitation.

The market is segmented into crucial categories, with Assisting Devices such as suturing devices, closure devices, stapling devices, trocars, and clip appliers playing a vital role in procedural efficiency and success. Simultaneously, Implantable Devices, including gastric bands, electrical stimulation devices, gastric balloons, and gastric emptying devices, offer diverse therapeutic approaches to weight management. The competitive landscape is characterized by the presence of major players like Ethicon Inc., Allergan Inc., and Covidien PLC, who are actively involved in research and development, strategic collaborations, and market expansion initiatives. Restraints such as the high cost of procedures, potential post-operative complications, and varying reimbursement policies across European nations are being progressively addressed through technological advancements and increasing insurance coverage, paving the way for sustained market penetration and growth. The focus on patient education and the development of comprehensive bariatric programs are also crucial in overcoming these challenges and fostering greater acceptance of weight loss surgeries.

Unlocking European Health: A Comprehensive Report on the Weight Loss Surgery Market (2019-2033)

This in-depth report provides a definitive analysis of the European weight loss surgery market, exploring its dynamic landscape from 2019 to 2033. With a focus on bariatric surgery, obesity treatment, and minimally invasive procedures, this study delves into the intricate parent and child market structures, offering unparalleled insights for medical device manufacturers, healthcare providers, pharmaceutical companies, and investors. We meticulously dissect market segmentation, technological advancements, and regulatory shifts to equip you with the strategic intelligence needed to navigate this rapidly evolving sector.

Weight Loss Surgery Market in Europe Market Dynamics & Structure

The European weight loss surgery market is characterized by a moderate to high market concentration, with key players investing heavily in technological innovation and strategic alliances. The increasing prevalence of obesity across Europe acts as a primary growth driver, fueling demand for effective surgical weight loss solutions. Regulatory frameworks, while stringent, are progressively adapting to accommodate advancements in bariatric procedures and implantable medical devices. Competitive product substitutes, including advanced pharmaceutical interventions, are present but often complement rather than replace surgical options for severe obesity cases. End-user demographics reveal a growing segment of younger adults and women seeking long-term weight management strategies. Mergers and acquisitions (M&A) are becoming more prevalent as larger entities seek to consolidate market share and acquire innovative technologies.

- Technological Innovation Drivers: Development of less invasive surgical techniques, advanced robotic-assisted surgery, and smart implantable devices.

- Regulatory Frameworks: Strict approval processes by the EMA for medical devices and pharmaceuticals, ensuring patient safety and efficacy.

- Competitive Landscape: Intense competition among established medical device companies and emerging technology developers.

- End-User Demographics: Rising demand from individuals with a BMI exceeding 35-40 kg/m², often with comorbidities like diabetes and cardiovascular disease.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and geographical reach, with an estimated 2-5 significant M&A deals annually in the past three years.

Weight Loss Surgery Market in Europe Growth Trends & Insights

The European weight loss surgery market is poised for significant growth, projected to experience a compound annual growth rate (CAGR) of 6.5% from 2025 to 2033. This expansion is underpinned by increasing awareness of the health benefits of bariatric procedures, a rise in obesity rates, and advancements in surgical technology. Market penetration is steadily increasing, driven by healthcare reforms that favor preventative care and the management of chronic diseases linked to obesity. Technological disruptions, such as the widespread adoption of robotic-assisted surgery and the development of more sophisticated implantable gastric devices, are transforming patient outcomes and procedure efficiency. Consumer behavior shifts reflect a growing acceptance of surgical interventions as a viable and effective option for sustainable weight loss, moving beyond traditional dieting and exercise alone. The estimated market size in 2025 is €7,500 million, with a projected increase to €12,000 million by 2033. Adoption rates for minimally invasive bariatric procedures are expected to reach 70% by 2030.

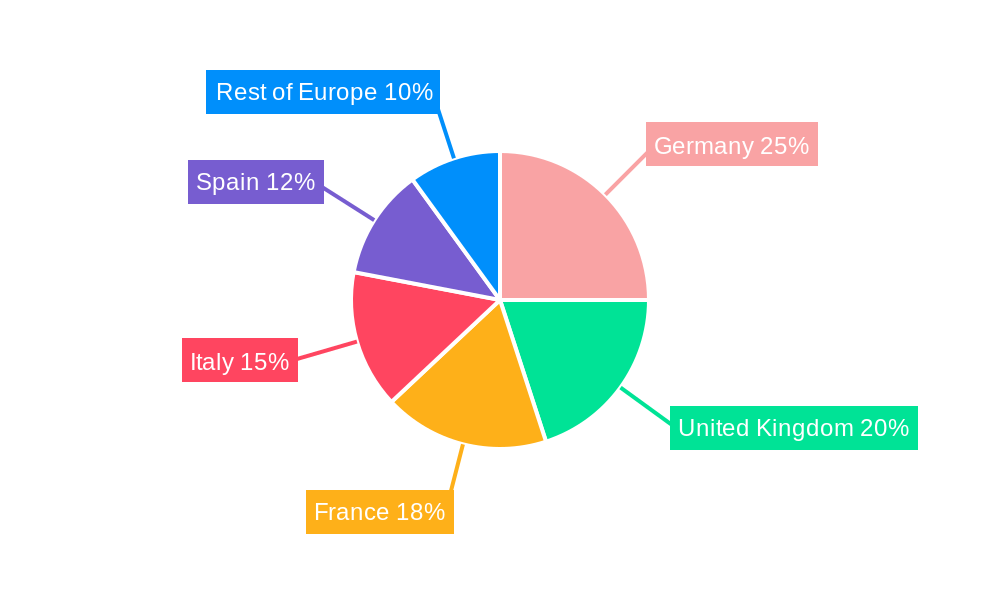

Dominant Regions, Countries, or Segments in Weight Loss Surgery Market in Europe

The Assisting Devices segment, within the broader Device category of the European weight loss surgery market, is a key growth driver, projected to capture a 45% market share by 2028. Within this segment, Stapling Devices and Suturing Devices are leading the charge, benefiting from their critical role in numerous bariatric procedures like sleeve gastrectomy and gastric bypass. Germany and the United Kingdom currently lead the market in terms of procedure volume and expenditure, driven by robust healthcare infrastructures and high rates of obesity. Economic policies that prioritize public health and preventive care initiatives further bolster the adoption of weight loss surgeries in these leading nations. Infrastructure development, including the expansion of specialized bariatric surgery centers and the integration of advanced surgical technologies, is crucial for sustained growth. The Implantable Devices segment, particularly Gastric Balloons, is also experiencing substantial growth, driven by demand for less invasive and reversible options.

- Leading Region: Western Europe, accounting for an estimated 60% of the total market revenue.

- Dominant Countries: Germany, United Kingdom, France, and Italy, due to high obesity prevalence and advanced healthcare systems.

- Key Segment Drivers (Assisting Devices):

- Stapling Devices: Essential for creating stomach pouches and sealing incisions, with an estimated market value of €1,800 million in 2025.

- Suturing Devices: Crucial for secure anastomoses and wound closure, with projected growth of 7% CAGR.

- Closure Devices: Facilitating faster and less painful wound healing.

- Emerging Trends in Implantable Devices:

- Gastric Balloons: Growing popularity due to their non-surgical nature and adjustable settings.

- Electrical Stimulation Devices: Emerging as a potential adjunct therapy for weight management.

Weight Loss Surgery Market in Europe Product Landscape

The European weight loss surgery market is defined by a constant stream of product innovations focused on enhancing patient safety, improving procedural efficiency, and optimizing long-term outcomes. Minimally invasive surgical instruments, including advanced laparoscopic and robotic-assisted devices, are becoming standard, reducing recovery times and patient discomfort. Implantable devices are evolving with smarter technologies, such as adjustable gastric bands and gastric emptying systems designed for personalized treatment. Unique selling propositions often revolve around reduced invasiveness, improved precision, and enhanced patient comfort. Technological advancements are also seen in bariatric disposables, with improved materials and designs promoting better hemostasis and tissue management.

Key Drivers, Barriers & Challenges in Weight Loss Surgery Market in Europe

Key Drivers: The European weight loss surgery market is propelled by the escalating global obesity epidemic, leading to a surge in demand for effective bariatric procedures. Technological advancements in minimally invasive surgery and implantable devices are making procedures safer and more accessible. Growing awareness among patients and healthcare professionals about the long-term health benefits of obesity surgery in managing comorbidities like diabetes and cardiovascular disease is a significant catalyst. Furthermore, favorable reimbursement policies in several European countries are expanding access to these life-changing treatments.

Barriers & Challenges: Despite robust growth, the market faces challenges. High initial costs associated with weight loss surgeries and the associated medical devices can be a barrier for some patients and healthcare systems. Stringent regulatory approvals for new bariatric devices can lead to extended market entry times. A shortage of trained bariatric surgeons and specialized healthcare professionals in certain regions poses a constraint on service delivery. The perception of obesity surgery as a last resort rather than a primary treatment option, coupled with potential post-operative complications, also presents hurdles. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical surgical equipment and implants. The estimated market impact of these challenges could lead to a 5-10% slowdown in adoption rates in certain segments.

Emerging Opportunities in Weight Loss Surgery Market in Europe

Emerging opportunities in the European weight loss surgery market lie in the development and widespread adoption of AI-powered surgical navigation systems for enhanced precision during procedures. The growing interest in personalized medicine opens avenues for developing tailored implantable devices and post-operative care programs based on individual patient profiles and genetic predispositions. Untapped markets in Eastern and Southern Europe, with rising obesity rates and increasing healthcare expenditure, present significant growth potential. Furthermore, the integration of telehealth platforms for remote patient monitoring and follow-up care post-bariatric surgery offers a scalable solution to address access and adherence challenges.

Growth Accelerators in the Weight Loss Surgery Market in Europe Industry

Several catalysts are accelerating the long-term growth of the European weight loss surgery industry. Continued breakthroughs in robotic surgery are leading to more precise and less invasive procedures, driving patient preference and surgeon adoption. Strategic partnerships between medical device manufacturers and healthcare providers are facilitating wider dissemination of advanced bariatric technologies and best practices. Market expansion strategies, particularly targeting regions with a growing prevalence of obesity and increasing healthcare investments, will fuel sustained growth. The development of innovative, less invasive weight loss devices and the exploration of novel therapeutic approaches, such as the use of bio-absorbable materials in surgical implants, are also key growth accelerators.

Key Players Shaping the Weight Loss Surgery Market in Europe Market

- Ethicon Inc

- Allergan Inc

- Covidien PLC

- EnteroMedics Inc

- TransEnterix Inc

- Apollo Endosurgery Inc

- ReShape Medical Inc

- Aspire Bariatrics Inc

Notable Milestones in Weight Loss Surgery Market in Europe Sector

- June 2022: Rhythm Pharmaceuticals, Inc. announced that IMCIVREE is available to patients in Germany. The European Commission granted IMCIVREE marketing authorization for the treatment of obesity and the management of hunger in adults and children aged 6 and older with genetically confirmed loss-of-function biallelic pro-opiomelanocortin, including proprotein convertase subtilisin/kexin type 1 deficiency or biallelic leptin receptor deficiency. This milestone signifies a breakthrough in pharmacotherapy for specific genetic obesity conditions.

- June 2022: The European Medicines Agency (EMA) safety committee Pharmacovigilance Risk Assessment Committee (PRAC) has recommended the withdrawal of European Union (EU) marketing authorisations for amfepramone obesity medicines. This decision highlights the ongoing regulatory scrutiny of weight management pharmaceuticals and shifts focus towards surgical and other therapeutic modalities.

In-Depth Weight Loss Surgery Market in Europe Market Outlook

The future outlook for the European weight loss surgery market is exceptionally positive, driven by a confluence of factors. Continued advancements in minimally invasive surgical techniques and the development of next-generation implantable devices will broaden patient eligibility and improve outcomes. The increasing recognition of bariatric surgery as a critical intervention for managing obesity-related comorbidities, such as type 2 diabetes and cardiovascular disease, will further fuel demand. Strategic collaborations, investment in research and development for novel weight loss solutions, and expansion into underserved markets are expected to accelerate growth. The market is poised for substantial expansion, with a strong emphasis on patient-centric care and technological innovation leading the way.

Weight Loss Surgery Market in Europe Segmentation

-

1. Device

-

1.1. Assisting Devices

- 1.1.1. Suturing Device

- 1.1.2. Closure Device

- 1.1.3. Stapling Device

- 1.1.4. Trocars

- 1.1.5. Clip Appliers

- 1.1.6. Other Devices

-

1.2. Implantable Devices

- 1.2.1. Gastric Bands

- 1.2.2. Electrical Stimulation Devices

- 1.2.3. Gastric Balloons

- 1.2.4. Gastric Emptyingns

-

1.1. Assisting Devices

Weight Loss Surgery Market in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Weight Loss Surgery Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Obese Population; Prevalence of Diabetes and Heart Diseases; Government Initiatives to Curb Obesity; Insurance Coverage of Surgeries

- 3.3. Market Restrains

- 3.3.1. Lack of Knowledge and Awareness in the Region; High Cost of Surgery

- 3.4. Market Trends

- 3.4.1. Gastric Balloons Segment is Expected to Witness the Highest CAGR in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Assisting Devices

- 5.1.1.1. Suturing Device

- 5.1.1.2. Closure Device

- 5.1.1.3. Stapling Device

- 5.1.1.4. Trocars

- 5.1.1.5. Clip Appliers

- 5.1.1.6. Other Devices

- 5.1.2. Implantable Devices

- 5.1.2.1. Gastric Bands

- 5.1.2.2. Electrical Stimulation Devices

- 5.1.2.3. Gastric Balloons

- 5.1.2.4. Gastric Emptyingns

- 5.1.1. Assisting Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Germany Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Assisting Devices

- 6.1.1.1. Suturing Device

- 6.1.1.2. Closure Device

- 6.1.1.3. Stapling Device

- 6.1.1.4. Trocars

- 6.1.1.5. Clip Appliers

- 6.1.1.6. Other Devices

- 6.1.2. Implantable Devices

- 6.1.2.1. Gastric Bands

- 6.1.2.2. Electrical Stimulation Devices

- 6.1.2.3. Gastric Balloons

- 6.1.2.4. Gastric Emptyingns

- 6.1.1. Assisting Devices

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. United Kingdom Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Assisting Devices

- 7.1.1.1. Suturing Device

- 7.1.1.2. Closure Device

- 7.1.1.3. Stapling Device

- 7.1.1.4. Trocars

- 7.1.1.5. Clip Appliers

- 7.1.1.6. Other Devices

- 7.1.2. Implantable Devices

- 7.1.2.1. Gastric Bands

- 7.1.2.2. Electrical Stimulation Devices

- 7.1.2.3. Gastric Balloons

- 7.1.2.4. Gastric Emptyingns

- 7.1.1. Assisting Devices

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. France Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Assisting Devices

- 8.1.1.1. Suturing Device

- 8.1.1.2. Closure Device

- 8.1.1.3. Stapling Device

- 8.1.1.4. Trocars

- 8.1.1.5. Clip Appliers

- 8.1.1.6. Other Devices

- 8.1.2. Implantable Devices

- 8.1.2.1. Gastric Bands

- 8.1.2.2. Electrical Stimulation Devices

- 8.1.2.3. Gastric Balloons

- 8.1.2.4. Gastric Emptyingns

- 8.1.1. Assisting Devices

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Italy Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Assisting Devices

- 9.1.1.1. Suturing Device

- 9.1.1.2. Closure Device

- 9.1.1.3. Stapling Device

- 9.1.1.4. Trocars

- 9.1.1.5. Clip Appliers

- 9.1.1.6. Other Devices

- 9.1.2. Implantable Devices

- 9.1.2.1. Gastric Bands

- 9.1.2.2. Electrical Stimulation Devices

- 9.1.2.3. Gastric Balloons

- 9.1.2.4. Gastric Emptyingns

- 9.1.1. Assisting Devices

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Spain Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. Assisting Devices

- 10.1.1.1. Suturing Device

- 10.1.1.2. Closure Device

- 10.1.1.3. Stapling Device

- 10.1.1.4. Trocars

- 10.1.1.5. Clip Appliers

- 10.1.1.6. Other Devices

- 10.1.2. Implantable Devices

- 10.1.2.1. Gastric Bands

- 10.1.2.2. Electrical Stimulation Devices

- 10.1.2.3. Gastric Balloons

- 10.1.2.4. Gastric Emptyingns

- 10.1.1. Assisting Devices

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. Rest of Europe Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Device

- 11.1.1. Assisting Devices

- 11.1.1.1. Suturing Device

- 11.1.1.2. Closure Device

- 11.1.1.3. Stapling Device

- 11.1.1.4. Trocars

- 11.1.1.5. Clip Appliers

- 11.1.1.6. Other Devices

- 11.1.2. Implantable Devices

- 11.1.2.1. Gastric Bands

- 11.1.2.2. Electrical Stimulation Devices

- 11.1.2.3. Gastric Balloons

- 11.1.2.4. Gastric Emptyingns

- 11.1.1. Assisting Devices

- 11.1. Market Analysis, Insights and Forecast - by Device

- 12. Germany Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Weight Loss Surgery Market in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Ethicon Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Allergan Inc

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Covidien PLC

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 EnteroMedics Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 TransEnterix Inc

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Apollo Endosurgery Inc

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 ReShape Medical Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Aspire Bariatrics Inc

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.1 Ethicon Inc

List of Figures

- Figure 1: Weight Loss Surgery Market in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Weight Loss Surgery Market in Europe Share (%) by Company 2024

List of Tables

- Table 1: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Device 2019 & 2032

- Table 4: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Device 2019 & 2032

- Table 5: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Germany Weight Loss Surgery Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Weight Loss Surgery Market in Europe Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: France Weight Loss Surgery Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Weight Loss Surgery Market in Europe Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Italy Weight Loss Surgery Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Weight Loss Surgery Market in Europe Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Weight Loss Surgery Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Weight Loss Surgery Market in Europe Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Netherlands Weight Loss Surgery Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Weight Loss Surgery Market in Europe Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Sweden Weight Loss Surgery Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Weight Loss Surgery Market in Europe Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Weight Loss Surgery Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Weight Loss Surgery Market in Europe Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Device 2019 & 2032

- Table 24: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Device 2019 & 2032

- Table 25: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Device 2019 & 2032

- Table 28: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Device 2019 & 2032

- Table 29: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Device 2019 & 2032

- Table 32: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Device 2019 & 2032

- Table 33: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Device 2019 & 2032

- Table 36: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Device 2019 & 2032

- Table 37: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Device 2019 & 2032

- Table 40: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Device 2019 & 2032

- Table 41: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Device 2019 & 2032

- Table 44: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Device 2019 & 2032

- Table 45: Weight Loss Surgery Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Weight Loss Surgery Market in Europe Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Weight Loss Surgery Market in Europe?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Weight Loss Surgery Market in Europe?

Key companies in the market include Ethicon Inc, Allergan Inc, Covidien PLC, EnteroMedics Inc, TransEnterix Inc , Apollo Endosurgery Inc, ReShape Medical Inc, Aspire Bariatrics Inc.

3. What are the main segments of the Weight Loss Surgery Market in Europe?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Obese Population; Prevalence of Diabetes and Heart Diseases; Government Initiatives to Curb Obesity; Insurance Coverage of Surgeries.

6. What are the notable trends driving market growth?

Gastric Balloons Segment is Expected to Witness the Highest CAGR in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Knowledge and Awareness in the Region; High Cost of Surgery.

8. Can you provide examples of recent developments in the market?

In June 2022, Rhythm Pharmaceuticals, Inc. announced that IMCIVREE is available to patients in Germany.The European Commission granted IMCIVREE marketing authorization for the treatment of obesity and the management of hunger in adults and children aged 6 and older with genetically confirmed loss-of-function biallelic pro-opiomelanocortin, including proprotein convertase subtilisin/kexin type 1 deficiency or biallelic leptin receptor deficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Weight Loss Surgery Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Weight Loss Surgery Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Weight Loss Surgery Market in Europe?

To stay informed about further developments, trends, and reports in the Weight Loss Surgery Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence