Key Insights

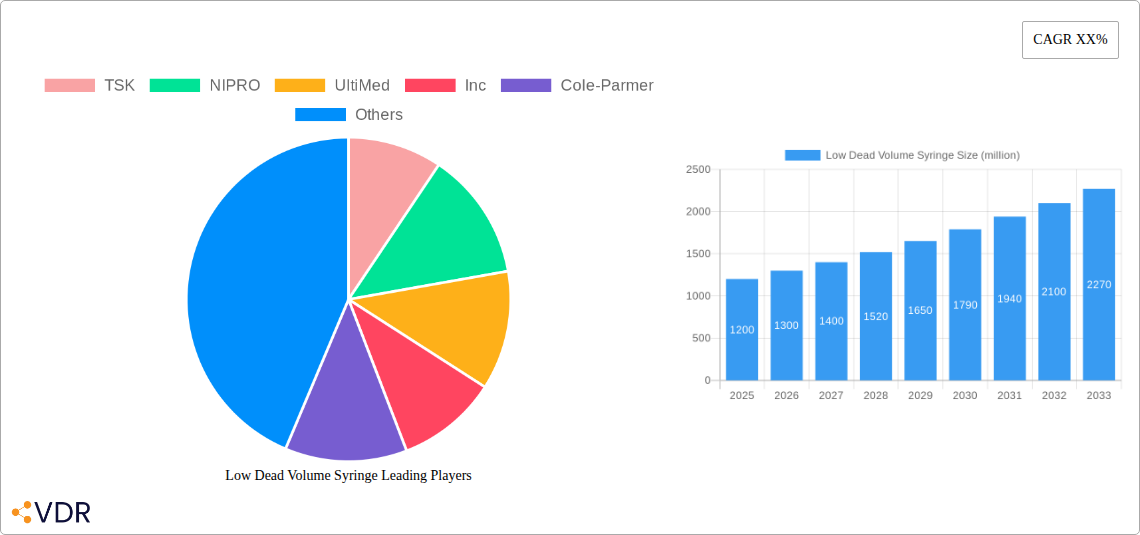

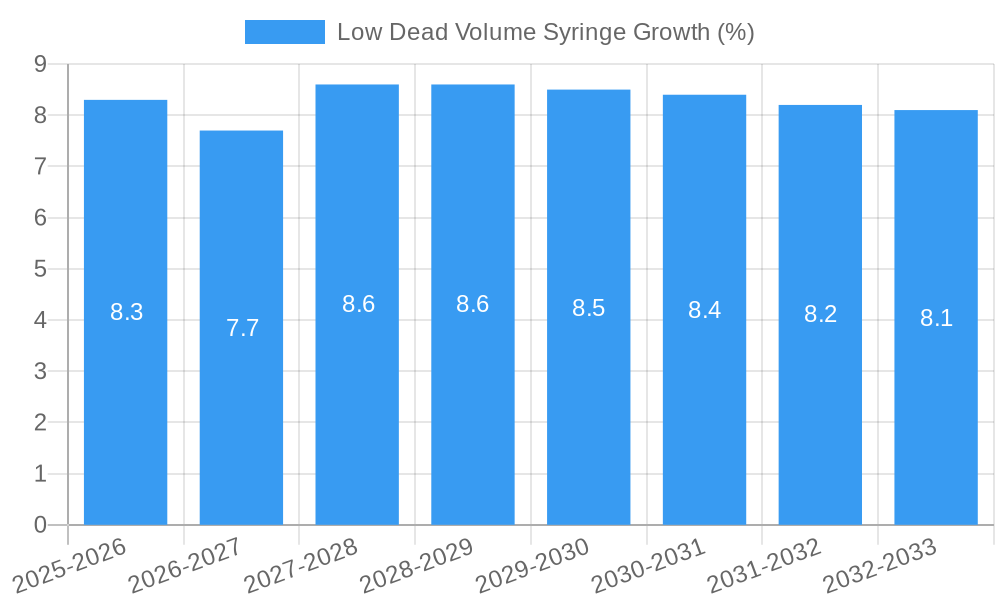

The global Low Dead Volume (LDV) Syringe market is poised for significant expansion, projected to reach an estimated USD 1.2 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% anticipated between 2025 and 2033. This impressive growth trajectory is primarily fueled by the increasing demand for advanced drug delivery systems that minimize medication waste, thereby optimizing therapeutic efficacy and cost-effectiveness. The rising prevalence of chronic diseases and the escalating need for precise drug administration, especially in oncology and vaccination programs, are key drivers. The market's expansion is further bolstered by technological advancements in syringe design, leading to the development of innovative fixed and detachable needle configurations that ensure minimal residual volume. Pharmaceutical companies and healthcare providers are increasingly recognizing the economic and clinical benefits of LDV syringes, leading to their wider adoption in hospitals, clinics, and research laboratories.

The market is segmented across crucial applications, with "High Cost Drugs" and "Covid Vaccine" emerging as dominant categories, reflecting the significant investment and widespread use of these specialized medical products. The "Other Vaccine" segment also contributes substantially to market growth, driven by ongoing global immunization efforts. The increasing sophistication of drug formulations and the critical need for accurate dosing in sensitive patient populations further underscore the indispensable role of LDV syringes. While the market exhibits strong growth potential, certain restraints such as the higher initial cost of some LDV syringe models compared to conventional syringes and the need for comprehensive training for healthcare professionals on their optimal usage, could present minor challenges. However, the long-term economic and therapeutic advantages are expected to outweigh these concerns, paving the way for sustained market leadership and innovation in drug delivery.

Low Dead Volume Syringe Market Dynamics & Structure

The global low dead volume (LDV) syringe market is characterized by moderate concentration, driven by increasing demand for efficient drug delivery systems and minimizing waste of high-value pharmaceuticals. Technological innovation, particularly in needle design and material science to reduce residual volume, is a primary driver. Regulatory frameworks, such as those promoting drug wastage reduction and patient safety, also significantly influence market adoption. Competitive product substitutes include standard syringes, but their inherent dead space leads to drug loss, making LDV syringes preferable for specific applications. End-user demographics are expanding beyond traditional healthcare settings to include home healthcare and specialized research facilities. Mergers and acquisitions (M&A) are limited, reflecting a stable competitive landscape with established players.

- Market Concentration: Moderate, with key players holding significant market share.

- Technological Innovation: Focus on needle design, material science, and leak-proof seals to minimize residual volume.

- Regulatory Frameworks: Favorable regulations encouraging waste reduction and improved drug efficacy.

- Competitive Product Substitutes: Standard syringes, but with significant drug wastage.

- End-User Demographics: Hospitals, clinics, pharmaceutical companies, research institutions, and home healthcare.

- M&A Trends: Limited, indicating a mature market with established competitors.

Low Dead Volume Syringe Growth Trends & Insights

The low dead volume (LDV) syringe market is poised for robust growth, driven by an increasing global emphasis on pharmaceutical cost-efficiency and optimal drug utilization. The market size is projected to expand from approximately 550 million units in 2019 to an estimated 950 million units by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of around 4.5% from 2019 to 2024 and an accelerated CAGR of 5.2% during the forecast period of 2025–2033. This growth is fueled by the escalating adoption of LDV syringes in critical applications, particularly for high-cost drugs and vaccines, where even minute losses can translate into substantial financial implications. The COVID-19 pandemic significantly boosted the demand for vaccines, and consequently, LDV syringes capable of extracting the maximum dose from each vial. This surge has highlighted the inherent advantages of LDV technology to a broader audience and healthcare providers.

Consumer behavior shifts are also playing a pivotal role. Healthcare professionals and institutions are increasingly prioritizing products that enhance patient outcomes and reduce operational costs. The ability of LDV syringes to deliver the full intended dose, thereby improving treatment efficacy and reducing the need for additional drug administration, is a compelling proposition. Furthermore, growing awareness among patients and caregivers about the benefits of precise drug delivery and waste reduction contributes to the market's upward trajectory. Technological disruptions, such as advancements in materials that further minimize residual volume and the development of integrated LDV syringe systems, are expected to enhance product performance and user experience. The penetration of LDV syringes is also deepening in emerging markets, as healthcare infrastructure improves and access to advanced medical devices expands.

The market penetration of LDV syringes, while substantial, still offers considerable room for expansion. Historical data from 2019–2024 indicates a steady increase in adoption, driven by early adopters in developed nations. The base year of 2025 sees an estimated market size of 800 million units, setting the stage for continued expansion through 2033. Factors such as increased R&D investments by manufacturers to develop even more efficient LDV designs and targeted marketing campaigns aimed at educating healthcare providers about the long-term cost savings associated with these syringes will further accelerate this growth. The shift towards value-based healthcare models, where treatment effectiveness and cost containment are paramount, positions LDV syringes as indispensable tools in the modern pharmaceutical landscape.

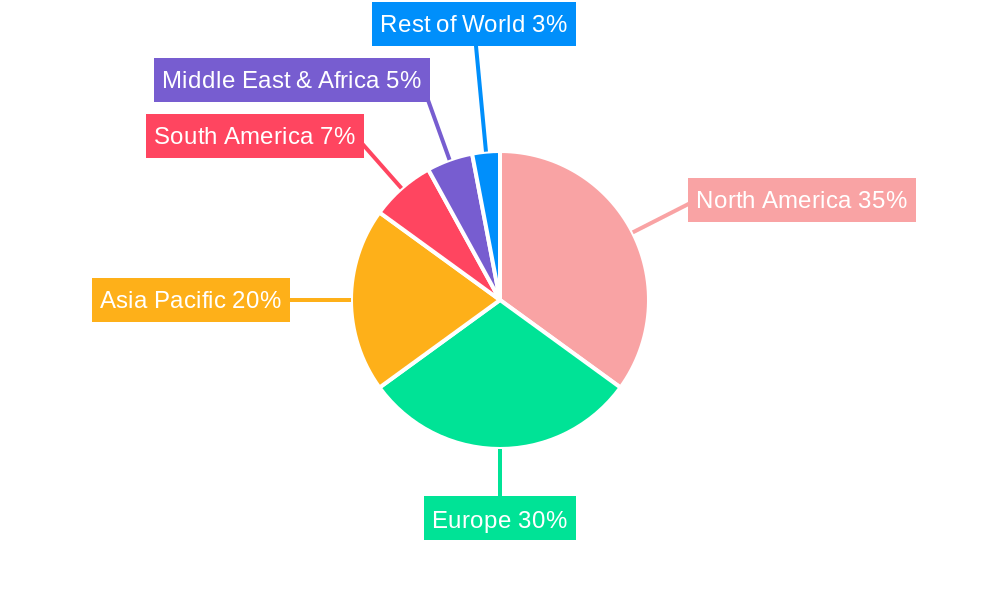

Dominant Regions, Countries, or Segments in Low Dead Volume Syringe

The low dead volume (LDV) syringe market's dominance is multifaceted, with key regions and specific segments exhibiting significant growth and adoption. North America and Europe currently lead the market, primarily due to their advanced healthcare infrastructure, higher prevalence of chronic diseases requiring expensive medications, and strong emphasis on pharmaceutical waste reduction. Within these regions, countries like the United States, Germany, and the United Kingdom are significant contributors. The strong presence of leading pharmaceutical companies and research institutions, coupled with favorable reimbursement policies for advanced medical devices, further bolsters their market leadership.

The Application segment of High Cost Drugs is a primary driver of growth within the LDV syringe market. These medications, often biologics and specialized therapies, are extremely expensive, making the waste of even small residual volumes in standard syringes financially detrimental. LDV syringes ensure that the full therapeutic dose is administered, maximizing the value of these critical treatments. The Covid Vaccine application, which saw an unprecedented surge in demand, also played a crucial role in highlighting the importance of LDV technology, demonstrating its capacity to extract maximum doses from vials, thereby optimizing vaccine supply during a global health crisis. While Other Vaccines also benefit from LDV technology, the economic imperative associated with high-cost drugs and the critical nature of pandemic response vaccines currently position these segments as leading growth engines.

In terms of Types, the Fixed Needle Design segment holds a significant share and is expected to maintain its dominance. Fixed needle LDV syringes are designed to minimize dead space at the needle hub and plunger tip, offering a highly efficient and integrated solution. Their inherent simplicity and reduced risk of needle detachment contribute to their widespread use, particularly in high-volume vaccination programs and routine drug administration. The Detachable Needle Design, while offering flexibility in needle gauge and length selection, often presents a greater challenge in achieving absolute zero dead space due to the connection point. However, advancements in detachable needle LDV technology are steadily improving their performance and reducing residual volumes, making them increasingly competitive, especially in specialized therapeutic areas requiring customized needle specifications.

- Dominant Regions: North America, Europe.

- Leading Countries: United States, Germany, United Kingdom.

- Key Application Drivers: High Cost Drugs, Covid Vaccine.

- Dominant Type: Fixed Needle Design.

- Growth Factors: Advanced healthcare infrastructure, pharmaceutical cost efficiency, regulatory support for waste reduction, R&D investment.

Low Dead Volume Syringe Product Landscape

The low dead volume (LDV) syringe product landscape is characterized by innovative designs aimed at minimizing residual volume, thereby maximizing drug delivery and reducing waste. Key innovations include specially engineered plunger tips and needle hubs that eliminate or significantly reduce the space where medication can remain trapped. These syringes are crucial for administering expensive pharmaceuticals, biologics, and vaccines, where every drop counts. Performance metrics focus on the amount of residual volume, typically measured in microliters, with leading products achieving near-zero dead space. Applications span from routine injections to complex therapeutic regimens, including oncology treatments, fertility medications, and vaccinations. Unique selling propositions revolve around enhanced drug utilization, improved patient outcomes through accurate dosing, and cost savings for healthcare providers and patients.

Key Drivers, Barriers & Challenges in Low Dead Volume Syringe

Key Drivers:

- Pharmaceutical Cost Containment: The high cost of modern drugs, particularly biologics and specialty medications, makes minimizing wastage through LDV syringes a crucial economic imperative.

- Increased Awareness of Drug Waste: Growing recognition of the financial and environmental impact of pharmaceutical waste is driving demand for efficient drug delivery systems.

- Advancements in Needle and Syringe Technology: Continuous innovation in materials and design is leading to syringes with even lower dead volumes, enhancing their efficacy and attractiveness.

- Favorable Regulatory Environments: Policies encouraging waste reduction and patient safety indirectly promote the adoption of LDV syringes.

- Growing Demand for Vaccines: Mass vaccination campaigns, especially highlighted by the COVID-19 pandemic, have underscored the value of LDV syringes for maximizing doses from limited vials.

Barriers & Challenges:

- Higher Initial Cost: LDV syringes often carry a higher unit cost compared to standard syringes, which can be a barrier to adoption in cost-sensitive markets or for routine applications where waste is less critical.

- Perception and Education: A lack of widespread awareness and understanding of the long-term economic benefits of LDV syringes among some healthcare professionals and institutions can hinder adoption.

- Manufacturing Complexity: Producing LDV syringes with consistently low dead space can require more intricate manufacturing processes and quality control, potentially impacting production volume and cost.

- Supply Chain Disruptions: Global supply chain vulnerabilities can affect the availability of specialized components and materials needed for LDV syringe manufacturing.

- Competition from Standard Syringes: The widespread availability and lower cost of standard syringes continue to pose a competitive challenge, especially in less regulated markets.

Emerging Opportunities in Low Dead Volume Syringe

Emerging opportunities in the low dead volume (LDV) syringe market lie in expanding applications for advanced therapies and in catering to the growing home healthcare sector. The increasing development of personalized medicine and gene therapies, which are often high-cost and administered in precise dosages, presents a significant avenue for LDV syringe adoption. Furthermore, the rise of biosimil medications, aiming to provide more affordable alternatives to biologics, will still require precise dosing, creating a sustained demand for LDV technology. The global expansion of home-based medical care and self-administration of drugs also opens new market segments. Manufacturers can leverage these trends by developing user-friendly, pre-filled LDV syringe systems tailored for patient self-administration, enhancing convenience and adherence. Untapped markets in developing economies, with improving healthcare infrastructure, also represent substantial growth potential.

Growth Accelerators in the Low Dead Volume Syringe Industry

Several key catalysts are accelerating the growth of the low dead volume (LDV) syringe industry. Technological breakthroughs in material science, leading to the development of novel plastics and coatings that further minimize residual drug adhesion, are continuously enhancing product performance. Strategic partnerships between syringe manufacturers and pharmaceutical companies, particularly those developing high-value biologics and vaccines, are crucial for co-developing and promoting the use of LDV syringes for specific drug formulations. Market expansion strategies, including targeted educational initiatives for healthcare providers about the economic and clinical benefits of LDV technology, and increased penetration into emerging markets with their burgeoning healthcare sectors, are also significant growth drivers. The ongoing research into new therapeutic areas requiring precise dosing will further propel the demand for innovative LDV syringe solutions.

Key Players Shaping the Low Dead Volume Syringe Market

- TSK

- NIPRO

- UltiMed, Inc.

- Cole-Parmer

Notable Milestones in Low Dead Volume Syringe Sector

- 2019: Increased focus on optimizing vaccine delivery for routine immunization programs, driving demand for LDV syringes.

- 2020: Global COVID-19 pandemic accelerates demand for LDV syringes for vaccine administration, highlighting their critical role in maximizing vial yields.

- 2021: Continued innovation in needle hub designs and materials to further reduce dead space, leading to next-generation LDV syringes.

- 2022: Growing adoption of LDV syringes in the home healthcare market for self-administered medications.

- 2023: Pharmaceutical companies increasingly specifying LDV syringes for new high-cost drug approvals.

- 2024: Enhanced regulatory discussions around pharmaceutical waste reduction and the role of specialized delivery devices.

In-Depth Low Dead Volume Syringe Market Outlook

The in-depth market outlook for low dead volume (LDV) syringes is exceptionally positive, fueled by persistent and evolving market demands. The continuous development of high-value pharmaceuticals, coupled with a global drive for cost optimization in healthcare, ensures a sustained need for technologies that maximize drug utilization. Technological advancements are expected to yield even more efficient LDV designs, potentially leading to near-zero residual volumes and further solidifying their market position. Strategic collaborations between manufacturers and pharmaceutical giants will be instrumental in driving innovation and market penetration for niche and specialized drug applications. The expanding scope of home healthcare and the increasing demand for patient self-administered therapies present a significant growth frontier. Emerging economies, as their healthcare infrastructures mature, will offer substantial untapped market potential. The overall outlook points towards continued robust growth and increasing importance of LDV syringes as a standard of care in pharmaceutical delivery.

Low Dead Volume Syringe Segmentation

-

1. Application

- 1.1. High Cost Drugs

- 1.2. Covid Vaccine

- 1.3. Other Vaccine

-

2. Types

- 2.1. Fixed Needle Design

- 2.2. Detachable Needle Design

Low Dead Volume Syringe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Low Dead Volume Syringe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Dead Volume Syringe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. High Cost Drugs

- 5.1.2. Covid Vaccine

- 5.1.3. Other Vaccine

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fixed Needle Design

- 5.2.2. Detachable Needle Design

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Low Dead Volume Syringe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. High Cost Drugs

- 6.1.2. Covid Vaccine

- 6.1.3. Other Vaccine

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fixed Needle Design

- 6.2.2. Detachable Needle Design

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Low Dead Volume Syringe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. High Cost Drugs

- 7.1.2. Covid Vaccine

- 7.1.3. Other Vaccine

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fixed Needle Design

- 7.2.2. Detachable Needle Design

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Low Dead Volume Syringe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. High Cost Drugs

- 8.1.2. Covid Vaccine

- 8.1.3. Other Vaccine

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fixed Needle Design

- 8.2.2. Detachable Needle Design

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Low Dead Volume Syringe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. High Cost Drugs

- 9.1.2. Covid Vaccine

- 9.1.3. Other Vaccine

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fixed Needle Design

- 9.2.2. Detachable Needle Design

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Low Dead Volume Syringe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. High Cost Drugs

- 10.1.2. Covid Vaccine

- 10.1.3. Other Vaccine

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fixed Needle Design

- 10.2.2. Detachable Needle Design

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TSK

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NIPRO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UltiMed

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cole-Parmer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 TSK

List of Figures

- Figure 1: Global Low Dead Volume Syringe Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Low Dead Volume Syringe Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Low Dead Volume Syringe Revenue (million), by Application 2024 & 2032

- Figure 4: North America Low Dead Volume Syringe Volume (K), by Application 2024 & 2032

- Figure 5: North America Low Dead Volume Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Low Dead Volume Syringe Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Low Dead Volume Syringe Revenue (million), by Types 2024 & 2032

- Figure 8: North America Low Dead Volume Syringe Volume (K), by Types 2024 & 2032

- Figure 9: North America Low Dead Volume Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Low Dead Volume Syringe Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Low Dead Volume Syringe Revenue (million), by Country 2024 & 2032

- Figure 12: North America Low Dead Volume Syringe Volume (K), by Country 2024 & 2032

- Figure 13: North America Low Dead Volume Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Low Dead Volume Syringe Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Low Dead Volume Syringe Revenue (million), by Application 2024 & 2032

- Figure 16: South America Low Dead Volume Syringe Volume (K), by Application 2024 & 2032

- Figure 17: South America Low Dead Volume Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Low Dead Volume Syringe Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Low Dead Volume Syringe Revenue (million), by Types 2024 & 2032

- Figure 20: South America Low Dead Volume Syringe Volume (K), by Types 2024 & 2032

- Figure 21: South America Low Dead Volume Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Low Dead Volume Syringe Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Low Dead Volume Syringe Revenue (million), by Country 2024 & 2032

- Figure 24: South America Low Dead Volume Syringe Volume (K), by Country 2024 & 2032

- Figure 25: South America Low Dead Volume Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Low Dead Volume Syringe Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Low Dead Volume Syringe Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Low Dead Volume Syringe Volume (K), by Application 2024 & 2032

- Figure 29: Europe Low Dead Volume Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Low Dead Volume Syringe Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Low Dead Volume Syringe Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Low Dead Volume Syringe Volume (K), by Types 2024 & 2032

- Figure 33: Europe Low Dead Volume Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Low Dead Volume Syringe Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Low Dead Volume Syringe Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Low Dead Volume Syringe Volume (K), by Country 2024 & 2032

- Figure 37: Europe Low Dead Volume Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Low Dead Volume Syringe Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Low Dead Volume Syringe Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Low Dead Volume Syringe Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Low Dead Volume Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Low Dead Volume Syringe Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Low Dead Volume Syringe Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Low Dead Volume Syringe Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Low Dead Volume Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Low Dead Volume Syringe Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Low Dead Volume Syringe Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Low Dead Volume Syringe Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Low Dead Volume Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Low Dead Volume Syringe Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Low Dead Volume Syringe Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Low Dead Volume Syringe Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Low Dead Volume Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Low Dead Volume Syringe Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Low Dead Volume Syringe Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Low Dead Volume Syringe Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Low Dead Volume Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Low Dead Volume Syringe Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Low Dead Volume Syringe Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Low Dead Volume Syringe Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Low Dead Volume Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Low Dead Volume Syringe Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Low Dead Volume Syringe Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Low Dead Volume Syringe Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Low Dead Volume Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Low Dead Volume Syringe Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Low Dead Volume Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Low Dead Volume Syringe Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Low Dead Volume Syringe Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Low Dead Volume Syringe Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Low Dead Volume Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Low Dead Volume Syringe Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Low Dead Volume Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Low Dead Volume Syringe Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Low Dead Volume Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Low Dead Volume Syringe Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Low Dead Volume Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Low Dead Volume Syringe Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Low Dead Volume Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Low Dead Volume Syringe Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Low Dead Volume Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Low Dead Volume Syringe Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Low Dead Volume Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Low Dead Volume Syringe Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Low Dead Volume Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Low Dead Volume Syringe Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Low Dead Volume Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Low Dead Volume Syringe Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Low Dead Volume Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Low Dead Volume Syringe Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Low Dead Volume Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Low Dead Volume Syringe Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Low Dead Volume Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Low Dead Volume Syringe Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Low Dead Volume Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Low Dead Volume Syringe Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Low Dead Volume Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Low Dead Volume Syringe Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Low Dead Volume Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Low Dead Volume Syringe Volume K Forecast, by Country 2019 & 2032

- Table 81: China Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Low Dead Volume Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Low Dead Volume Syringe Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Dead Volume Syringe?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Low Dead Volume Syringe?

Key companies in the market include TSK, NIPRO, UltiMed, Inc, Cole-Parmer.

3. What are the main segments of the Low Dead Volume Syringe?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Dead Volume Syringe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Dead Volume Syringe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Dead Volume Syringe?

To stay informed about further developments, trends, and reports in the Low Dead Volume Syringe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence