Key Insights

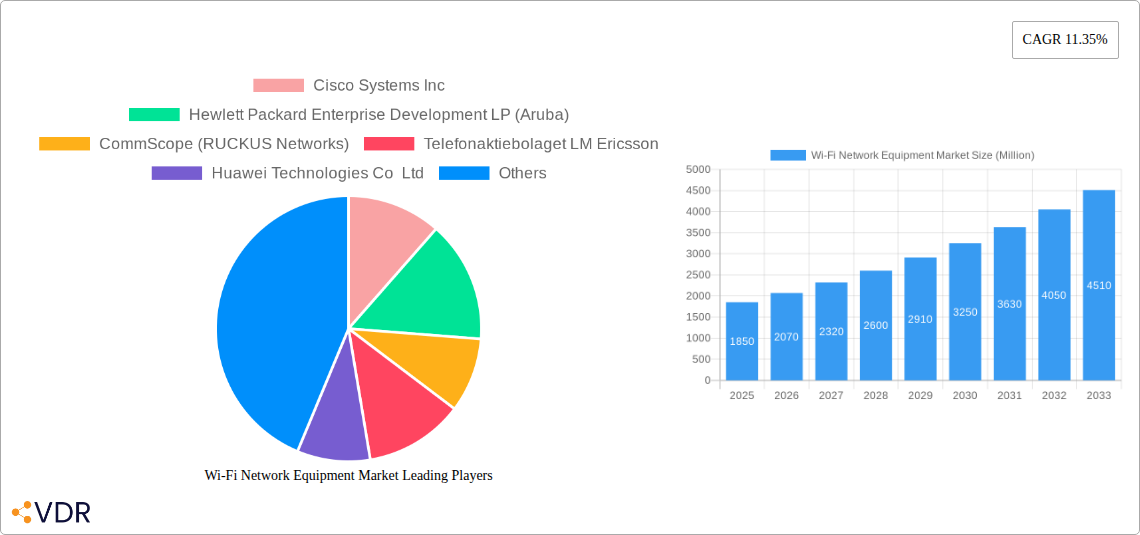

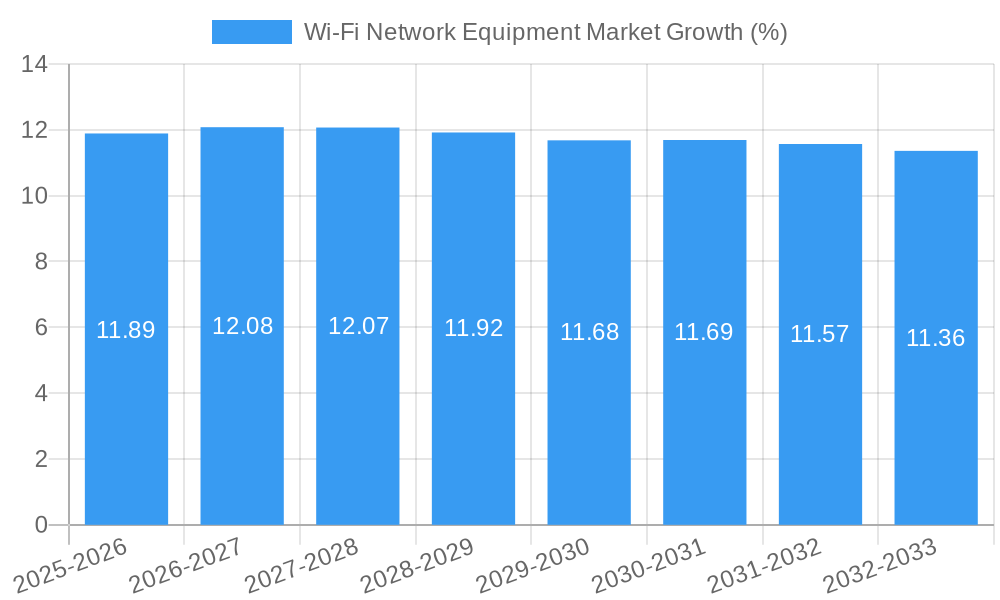

The Wi-Fi Network Equipment Market is poised for robust expansion, projected to reach $1.85 billion in value and grow at a Compound Annual Growth Rate (CAGR) of 11.35% from 2025 to 2033. This significant growth is fueled by the ever-increasing demand for high-speed, reliable wireless connectivity across both consumer and enterprise sectors. Key drivers include the proliferation of Wi-Fi-enabled devices, the escalating adoption of cloud computing and IoT solutions, and the continuous evolution towards newer Wi-Fi standards like Wi-Fi 6E and Wi-Fi 7, which offer enhanced performance and capacity. The market is characterized by a dynamic interplay of technological advancements and evolving user needs, pushing manufacturers to innovate and offer sophisticated solutions. Access Points and Gateways are expected to dominate the equipment type segments due to their critical role in establishing and managing wireless networks. Enterprises, in particular, are investing heavily in upgrading their existing infrastructure to support a growing number of connected devices and to enable new applications requiring seamless wireless access.

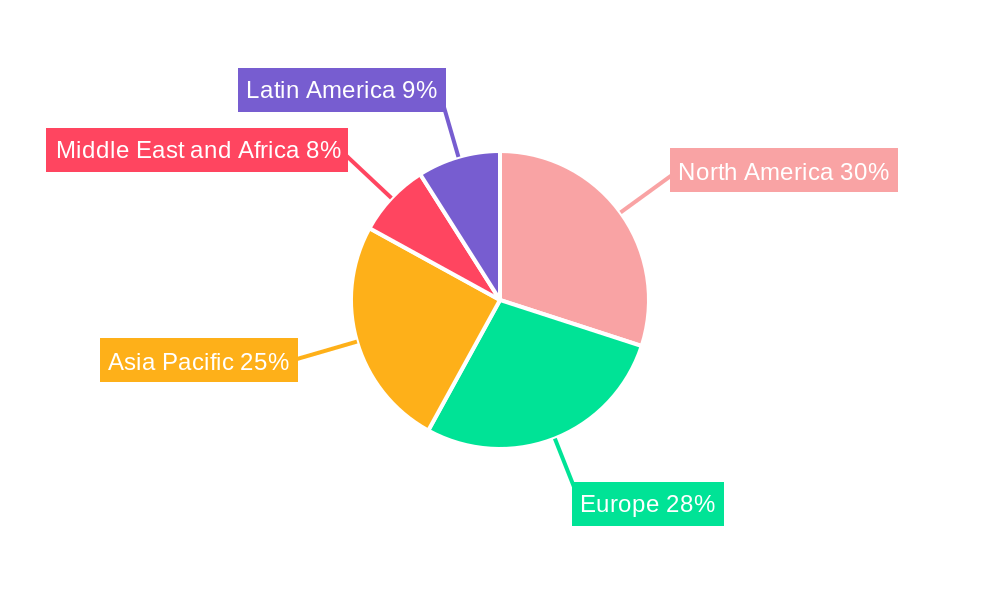

The market landscape is highly competitive, with established players like Cisco Systems Inc., Hewlett Packard Enterprise Development LP (Aruba), and CommScope (RUCKUS Networks) at the forefront, alongside emerging and agile companies such as Ubiquiti Inc. and TP-Link Corporation. These companies are actively engaged in research and development to introduce products that offer better performance, security, and ease of management. While growth is strong, the market also faces certain restraints. These may include the high cost of advanced Wi-Fi equipment, potential security vulnerabilities that require constant attention and upgrades, and the complexity of managing large-scale wireless networks. Geographically, North America and Europe are anticipated to remain dominant markets due to their advanced technological infrastructure and high adoption rates of wireless technologies. However, the Asia Pacific region, driven by rapid digitalization and increasing disposable incomes in countries like China and India, is expected to exhibit the fastest growth during the forecast period.

This in-depth report provides a detailed analysis of the global Wi-Fi Network Equipment Market, offering critical insights for industry professionals, investors, and strategic planners. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this report examines market dynamics, key growth trends, regional dominance, product landscape, drivers, barriers, opportunities, and the competitive ecosystem. With a focus on high-traffic keywords and segmented analysis, this report is optimized for maximum search engine visibility and delivers actionable intelligence.

Wi-Fi Network Equipment Market Market Dynamics & Structure

The Wi-Fi Network Equipment Market is characterized by a moderately concentrated landscape, driven by continuous technological innovation and evolving end-user demands. Key players like Cisco Systems Inc, Hewlett Packard Enterprise Development LP (Aruba), and CommScope (RUCKUS Networks) command significant market share through robust product portfolios and strategic partnerships. The market's growth is fueled by the relentless pursuit of higher speeds, lower latency, and improved reliability, with Wi-Fi 7 emerging as a significant technological leap. Regulatory frameworks, particularly those concerning spectrum allocation and security standards, play a crucial role in shaping market access and product development. Competitive product substitutes, such as wired Ethernet solutions, are present but are increasingly being surpassed by Wi-Fi's flexibility and mobility for many applications. End-user demographics reveal a dualistic demand: consumers seek seamless connectivity for entertainment and smart home devices, while enterprises prioritize secure, high-performance networks for business operations and digital transformation initiatives. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring innovative startups or complementary businesses to expand their technology offerings and market reach. For instance, an estimated 5-7 M&A deals are anticipated annually within the broader networking sector, often involving Wi-Fi focused entities. The primary innovation drivers include the need for enhanced bandwidth to support video streaming, gaming, and emerging technologies like augmented reality (AR) and virtual reality (VR), alongside the proliferation of Internet of Things (IoT) devices.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized vendors.

- Technological Innovation Drivers: Demand for higher speeds (Wi-Fi 6E, Wi-Fi 7), lower latency, enhanced security, and support for dense device environments.

- Regulatory Frameworks: Spectrum management (e.g., unlicensed 6 GHz band), security certifications, and national broadband initiatives influence adoption.

- Competitive Product Substitutes: Wired Ethernet, 5G private networks.

- End-User Demographics: Growing demand from consumers for seamless home networking and enterprises for robust, secure wireless solutions.

- M&A Trends: Strategic acquisitions to gain access to new technologies, talent, and market segments.

Wi-Fi Network Equipment Market Growth Trends & Insights

The global Wi-Fi Network Equipment Market is poised for substantial growth, driven by an insatiable demand for ubiquitous, high-speed wireless connectivity across all sectors. Market size evolution is a testament to this, with projected revenues in the hundreds of billions of units by the forecast period. Adoption rates for advanced Wi-Fi standards, such as Wi-Fi 6 and Wi-Fi 6E, have accelerated significantly, paving the way for the widespread integration of Wi-Fi 7. This latest iteration, with its advanced features prioritizing high throughput and deterministic latency, is set to revolutionize applications ranging from multi-user AR/VR/XR and immersive 3-D training to electronic gaming, hybrid work setups, industrial IoT, and automotive advancements. Technological disruptions, including the miniaturization of chipsets and the development of AI-powered network management solutions, are further enhancing performance and ease of deployment. Consumer behavior shifts are central to this growth; as more households embrace smart home ecosystems and remote work models, the need for robust and reliable Wi-Fi infrastructure becomes paramount. Enterprises are investing heavily in upgrading their wireless networks to support digital transformation initiatives, cloud migration, and the increasing number of connected devices. The CAGR of the Wi-Fi Network Equipment Market is estimated to be in the range of 10-15% over the forecast period, reflecting the strong underlying demand drivers. Market penetration of high-speed Wi-Fi solutions is expected to reach over 80% in developed economies by 2030. The increasing adoption of Wi-Fi HaLow (802.11ah) for long-range, low-power IoT applications, as demonstrated by innovations like the Edgecore EAP112 Wi-Fi HaLow router, signifies a broadening of the Wi-Fi ecosystem beyond traditional connectivity.

Dominant Regions, Countries, or Segments in Wi-Fi Network Equipment Market

The Wi-Fi Network Equipment Market exhibits strong regional variations, with North America and Asia-Pacific emerging as the dominant forces driving global growth. These regions benefit from a confluence of factors, including high disposable incomes, rapid technological adoption, robust digital infrastructure, and significant investments in both consumer and enterprise networking solutions. In North America, the demand for enterprise-grade Wi-Fi, particularly for applications in healthcare, education, and manufacturing, is substantial. The widespread adoption of smart home devices and the continued evolution of hybrid work models further bolster the consumer segment.

The Asia-Pacific region, on the other hand, is experiencing explosive growth fueled by rapid urbanization, a burgeoning middle class, and government initiatives promoting digital transformation and smart city development. Countries like China, India, and South Korea are leading this charge, with substantial investments in 5G infrastructure that often complements Wi-Fi deployments. The enterprise segment in this region is rapidly expanding, driven by the need for efficient wireless solutions in manufacturing, logistics, and retail.

Within the Equipment Type segment, Access Points consistently hold the largest market share due to their foundational role in any Wi-Fi network. However, Gateways are experiencing accelerated growth, driven by the integration of advanced functionalities such as security, routing, and IoT connectivity, exemplified by the Wi-Fi 6 2×2 Matter gateway. The Routers and Extenders segment remains critical for both consumer and small business deployments.

The End User segment clearly highlights Enterprises as the primary growth engine. The increasing complexity of enterprise networks, the need for secure and high-performance wireless access for a growing number of devices, and the adoption of technologies like IoT and AI are driving significant demand for advanced Wi-Fi equipment. While the Consumers segment remains a significant contributor, enterprise spending on network upgrades and new deployments is projecting a higher growth trajectory.

- Dominant Regions:

- North America: High adoption of advanced Wi-Fi, strong enterprise demand, and mature smart home market.

- Asia-Pacific: Rapid economic growth, increasing disposable income, government digital initiatives, and a large, growing population.

- Dominant Countries (within leading regions):

- North America: United States, Canada.

- Asia-Pacific: China, India, Japan, South Korea.

- Dominant Segments:

- Equipment Type: Access Points, Gateways (growing rapidly).

- End User: Enterprises (leading growth driver), Consumers.

Wi-Fi Network Equipment Market Product Landscape

The Wi-Fi Network Equipment Market is characterized by a dynamic product landscape driven by rapid innovation in wireless technology. Leading vendors are consistently introducing products that support the latest Wi-Fi standards, such as Wi-Fi 6E and the forthcoming Wi-Fi 7, offering enhanced throughput, reduced latency, and improved capacity. Product innovations focus on delivering seamless connectivity for a growing array of devices, including smartphones, laptops, smart home appliances, and industrial IoT sensors. Performance metrics such as maximum data rates, range, and interference mitigation capabilities are key differentiators. Unique selling propositions often revolve around advanced features like MU-MIMO (Multi-User, Multiple-Input, Multiple-Output), OFDMA (Orthogonal Frequency Division Multiple Access), and beamforming technology, which collectively enhance network efficiency and user experience. The integration of AI and machine learning into network management software is also a growing trend, enabling intelligent optimization and proactive troubleshooting. The introduction of Wi-Fi CERTIFIED 7 by the Wi-Fi Alliance signifies a new era of high-performance wireless, promising deterministic latency and enhanced reliability crucial for demanding applications.

Key Drivers, Barriers & Challenges in Wi-Fi Network Equipment Market

Key Drivers:

- Exponential Growth of Connected Devices: The proliferation of IoT devices, smartphones, tablets, and wearables creates a perpetual demand for robust wireless connectivity.

- Demand for High-Speed Internet: Increasing consumption of bandwidth-intensive applications like streaming video, online gaming, and video conferencing necessitates faster Wi-Fi standards.

- Digital Transformation Initiatives: Enterprises across industries are upgrading their network infrastructure to support cloud computing, AI, and data analytics, with Wi-Fi being a critical component.

- Advancements in Wi-Fi Technology: The continuous development of new Wi-Fi standards (Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7) offers significant performance improvements, driving upgrade cycles.

- Hybrid Work Models: The sustained prevalence of remote and hybrid work arrangements necessitates reliable and high-performance home and office Wi-Fi networks.

Barriers & Challenges:

- Spectrum Availability and Congestion: Limited availability of unlicensed spectrum in certain regions can lead to interference and performance degradation.

- Security Concerns: Ensuring robust security against evolving cyber threats remains a critical challenge for both manufacturers and users.

- Interoperability Issues: While standards are improving, ensuring seamless interoperability between devices from different manufacturers can still be a concern.

- Supply Chain Disruptions: Global supply chain volatility, particularly for semiconductor components, can impact production and lead times.

- Cost of Advanced Equipment: While prices are decreasing, the initial investment for cutting-edge Wi-Fi equipment can still be a barrier for some consumers and smaller businesses.

- Installation and Management Complexity: For advanced enterprise deployments, the complexity of installation and ongoing network management can pose a challenge.

Emerging Opportunities in Wi-Fi Network Equipment Market

Emerging opportunities in the Wi-Fi Network Equipment Market are abundant, driven by the continuous evolution of technology and user needs. The burgeoning Industrial IoT (IIoT) sector presents a significant avenue, with Wi-Fi HaLow and specialized enterprise-grade Wi-Fi solutions poised to enable reliable, long-range, and low-power connectivity in factory floors, warehouses, and logistics operations. The Metaverse and Extended Reality (XR) applications, including AR and VR, are creating a demand for ultra-low latency and high-bandwidth Wi-Fi, pushing the envelope for Wi-Fi 7 capabilities. Furthermore, the increasing adoption of Wi-Fi as a Service (WaaS) models presents opportunities for managed service providers and equipment manufacturers to offer integrated solutions, reducing upfront costs and simplifying deployment for businesses. The integration of Wi-Fi with 5G technologies for seamless indoor-outdoor handoffs and enhanced network performance is another burgeoning area, creating opportunities for hybrid networking solutions. Lastly, the development of AI-powered network analytics and automation offers a significant opportunity to enhance network performance, security, and user experience.

Growth Accelerators in the Wi-Fi Network Equipment Market Industry

Several catalysts are accelerating growth in the Wi-Fi Network Equipment Market. The continuous innovation in Wi-Fi standards, particularly the rollout and adoption of Wi-Fi 6, Wi-Fi 6E, and the imminent widespread implementation of Wi-Fi 7, is a primary driver, compelling enterprises and consumers to upgrade their existing infrastructure. Strategic partnerships between chipset manufacturers, equipment vendors, and service providers are fostering ecosystem development and faster product integration. The increasing penetration of smart home devices and the growing adoption of cloud-based services by businesses are creating sustained demand for reliable and high-performance wireless networks. Government initiatives promoting digital transformation and the expansion of broadband access in underserved areas also act as significant growth accelerators. Finally, the emergence of new applications like immersive gaming, remote healthcare, and advanced industrial automation are creating specialized demands that drive the development and adoption of cutting-edge Wi-Fi solutions.

Key Players Shaping the Wi-Fi Network Equipment Market Market

- Cisco Systems Inc

- Hewlett Packard Enterprise Development LP (Aruba)

- CommScope (RUCKUS Networks)

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co Ltd

- Extreme Networks

- Ubiquiti Inc

- D-Link Corporation

- TP-Link Corporation

- NETGEAR Inc

Notable Milestones in Wi-Fi Network Equipment Market Sector

- January 2024: Wi-Fi Alliance announced the launch of Wi-Fi CERTIFIED 7, with many new features designed to enhance Wi-Fi performance and connectivity in diverse settings. The advanced features of Wi-Fi CERTIFIED 7 prioritize high throughput, deterministic latency, and enhanced reliability, especially for crucial data streams. This latest Wi-Fi iteration is set to propel various applications, from multi-user AR/VR/XR and immersive 3-D training to electronic gaming, hybrid work setups, industrial IoT, and automotive advancements.

- January 2024: At CES 2024, Edgecore Networks, known for pioneering network solutions, and Morse Micro, a Wi-Fi HaLow silicon vendor, jointly introduced the Edgecore EAP112 Wi-Fi HaLow router. This router, named the EAP112, is a Wi-Fi 6 2×2 Matter gateway, boasting support for both HaLow (802.11ah) and 4G LTE. By leveraging 4G LTE for connectivity, the EAP112 offers Wi-Fi 6 services, with a specialized focus on long-range IoT applications through its HaLow feature.

In-Depth Wi-Fi Network Equipment Market Market Outlook

- January 2024: Wi-Fi Alliance announced the launch of Wi-Fi CERTIFIED 7, with many new features designed to enhance Wi-Fi performance and connectivity in diverse settings. The advanced features of Wi-Fi CERTIFIED 7 prioritize high throughput, deterministic latency, and enhanced reliability, especially for crucial data streams. This latest Wi-Fi iteration is set to propel various applications, from multi-user AR/VR/XR and immersive 3-D training to electronic gaming, hybrid work setups, industrial IoT, and automotive advancements.

- January 2024: At CES 2024, Edgecore Networks, known for pioneering network solutions, and Morse Micro, a Wi-Fi HaLow silicon vendor, jointly introduced the Edgecore EAP112 Wi-Fi HaLow router. This router, named the EAP112, is a Wi-Fi 6 2×2 Matter gateway, boasting support for both HaLow (802.11ah) and 4G LTE. By leveraging 4G LTE for connectivity, the EAP112 offers Wi-Fi 6 services, with a specialized focus on long-range IoT applications through its HaLow feature.

In-Depth Wi-Fi Network Equipment Market Market Outlook

The Wi-Fi Network Equipment Market is projected for robust and sustained growth, driven by foundational technological advancements and evolving global connectivity demands. The widespread adoption of Wi-Fi 7 will serve as a significant market catalyst, enabling unprecedented performance for emerging applications like AR/VR and industrial automation. The increasing convergence of Wi-Fi and 5G technologies will further enhance network capabilities, offering seamless indoor and outdoor connectivity. Strategic partnerships and ongoing research and development will continue to push the boundaries of speed, latency, and reliability, making Wi-Fi an indispensable technology. The market's future trajectory is also influenced by smart city initiatives and the expanding IoT ecosystem, creating vast opportunities for specialized and integrated Wi-Fi solutions. The forecast indicates a market poised for significant expansion, offering substantial strategic opportunities for stakeholders to capitalize on the ever-growing need for wireless connectivity.

Wi-Fi Network Equipment Market Segmentation

-

1. Equipment Type

- 1.1. Access Points

- 1.2. Gateways

- 1.3. Routers and Extenders

- 1.4. Others (Cables, Interface, Modules, etc.)

-

2. End User

- 2.1. Consumers

- 2.2. Enterprises

Wi-Fi Network Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Australia and New Zealand

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

-

6. Latin America

- 6.1. Brazil

- 6.2. Mexico

Wi-Fi Network Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth in the use of connected devices and BYOD policy; Rising Digital Transformation in the Enterprises; Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation

- 3.2.2 etc.)

- 3.3. Market Restrains

- 3.3.1 Growth in the use of connected devices and BYOD policy; Rising Digital Transformation in the Enterprises; Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation

- 3.3.2 etc.)

- 3.4. Market Trends

- 3.4.1. The Enterprises Segment is Expected to Hold a Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wi-Fi Network Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Access Points

- 5.1.2. Gateways

- 5.1.3. Routers and Extenders

- 5.1.4. Others (Cables, Interface, Modules, etc.)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Consumers

- 5.2.2. Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Australia and New Zealand

- 5.3.5. Middle East and Africa

- 5.3.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America Wi-Fi Network Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Access Points

- 6.1.2. Gateways

- 6.1.3. Routers and Extenders

- 6.1.4. Others (Cables, Interface, Modules, etc.)

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Consumers

- 6.2.2. Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe Wi-Fi Network Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Access Points

- 7.1.2. Gateways

- 7.1.3. Routers and Extenders

- 7.1.4. Others (Cables, Interface, Modules, etc.)

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Consumers

- 7.2.2. Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific Wi-Fi Network Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Access Points

- 8.1.2. Gateways

- 8.1.3. Routers and Extenders

- 8.1.4. Others (Cables, Interface, Modules, etc.)

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Consumers

- 8.2.2. Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Australia and New Zealand Wi-Fi Network Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Access Points

- 9.1.2. Gateways

- 9.1.3. Routers and Extenders

- 9.1.4. Others (Cables, Interface, Modules, etc.)

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Consumers

- 9.2.2. Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Middle East and Africa Wi-Fi Network Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10.1.1. Access Points

- 10.1.2. Gateways

- 10.1.3. Routers and Extenders

- 10.1.4. Others (Cables, Interface, Modules, etc.)

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Consumers

- 10.2.2. Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11. Latin America Wi-Fi Network Equipment Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11.1.1. Access Points

- 11.1.2. Gateways

- 11.1.3. Routers and Extenders

- 11.1.4. Others (Cables, Interface, Modules, etc.)

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Consumers

- 11.2.2. Enterprises

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cisco Systems Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hewlett Packard Enterprise Development LP (Aruba)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 CommScope (RUCKUS Networks)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Telefonaktiebolaget LM Ericsson

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Huawei Technologies Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Extreme Networks

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ubiquiti Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 D-Link Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 TP-Link Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 NETGEAR Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Global Wi-Fi Network Equipment Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Wi-Fi Network Equipment Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Wi-Fi Network Equipment Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 4: North America Wi-Fi Network Equipment Market Volume (Billion), by Equipment Type 2024 & 2032

- Figure 5: North America Wi-Fi Network Equipment Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 6: North America Wi-Fi Network Equipment Market Volume Share (%), by Equipment Type 2024 & 2032

- Figure 7: North America Wi-Fi Network Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 8: North America Wi-Fi Network Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 9: North America Wi-Fi Network Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 10: North America Wi-Fi Network Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 11: North America Wi-Fi Network Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Wi-Fi Network Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Wi-Fi Network Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Wi-Fi Network Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Wi-Fi Network Equipment Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 16: Europe Wi-Fi Network Equipment Market Volume (Billion), by Equipment Type 2024 & 2032

- Figure 17: Europe Wi-Fi Network Equipment Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 18: Europe Wi-Fi Network Equipment Market Volume Share (%), by Equipment Type 2024 & 2032

- Figure 19: Europe Wi-Fi Network Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 20: Europe Wi-Fi Network Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 21: Europe Wi-Fi Network Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Wi-Fi Network Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 23: Europe Wi-Fi Network Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Wi-Fi Network Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Wi-Fi Network Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Wi-Fi Network Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Pacific Wi-Fi Network Equipment Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 28: Asia Pacific Wi-Fi Network Equipment Market Volume (Billion), by Equipment Type 2024 & 2032

- Figure 29: Asia Pacific Wi-Fi Network Equipment Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 30: Asia Pacific Wi-Fi Network Equipment Market Volume Share (%), by Equipment Type 2024 & 2032

- Figure 31: Asia Pacific Wi-Fi Network Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 32: Asia Pacific Wi-Fi Network Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 33: Asia Pacific Wi-Fi Network Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Asia Pacific Wi-Fi Network Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 35: Asia Pacific Wi-Fi Network Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Pacific Wi-Fi Network Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Pacific Wi-Fi Network Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Wi-Fi Network Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia and New Zealand Wi-Fi Network Equipment Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 40: Australia and New Zealand Wi-Fi Network Equipment Market Volume (Billion), by Equipment Type 2024 & 2032

- Figure 41: Australia and New Zealand Wi-Fi Network Equipment Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 42: Australia and New Zealand Wi-Fi Network Equipment Market Volume Share (%), by Equipment Type 2024 & 2032

- Figure 43: Australia and New Zealand Wi-Fi Network Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 44: Australia and New Zealand Wi-Fi Network Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 45: Australia and New Zealand Wi-Fi Network Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 46: Australia and New Zealand Wi-Fi Network Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 47: Australia and New Zealand Wi-Fi Network Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia and New Zealand Wi-Fi Network Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Australia and New Zealand Wi-Fi Network Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Wi-Fi Network Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Middle East and Africa Wi-Fi Network Equipment Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 52: Middle East and Africa Wi-Fi Network Equipment Market Volume (Billion), by Equipment Type 2024 & 2032

- Figure 53: Middle East and Africa Wi-Fi Network Equipment Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 54: Middle East and Africa Wi-Fi Network Equipment Market Volume Share (%), by Equipment Type 2024 & 2032

- Figure 55: Middle East and Africa Wi-Fi Network Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 56: Middle East and Africa Wi-Fi Network Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 57: Middle East and Africa Wi-Fi Network Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 58: Middle East and Africa Wi-Fi Network Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 59: Middle East and Africa Wi-Fi Network Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Middle East and Africa Wi-Fi Network Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Middle East and Africa Wi-Fi Network Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Middle East and Africa Wi-Fi Network Equipment Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Latin America Wi-Fi Network Equipment Market Revenue (Million), by Equipment Type 2024 & 2032

- Figure 64: Latin America Wi-Fi Network Equipment Market Volume (Billion), by Equipment Type 2024 & 2032

- Figure 65: Latin America Wi-Fi Network Equipment Market Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 66: Latin America Wi-Fi Network Equipment Market Volume Share (%), by Equipment Type 2024 & 2032

- Figure 67: Latin America Wi-Fi Network Equipment Market Revenue (Million), by End User 2024 & 2032

- Figure 68: Latin America Wi-Fi Network Equipment Market Volume (Billion), by End User 2024 & 2032

- Figure 69: Latin America Wi-Fi Network Equipment Market Revenue Share (%), by End User 2024 & 2032

- Figure 70: Latin America Wi-Fi Network Equipment Market Volume Share (%), by End User 2024 & 2032

- Figure 71: Latin America Wi-Fi Network Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Latin America Wi-Fi Network Equipment Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Latin America Wi-Fi Network Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Latin America Wi-Fi Network Equipment Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Equipment Type 2019 & 2032

- Table 5: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 7: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 10: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Equipment Type 2019 & 2032

- Table 11: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 13: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 20: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Equipment Type 2019 & 2032

- Table 21: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 23: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Kingdom Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Germany Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: France Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 32: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Equipment Type 2019 & 2032

- Table 33: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 34: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 35: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 37: China Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: China Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: India Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: India Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Japan Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 44: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Equipment Type 2019 & 2032

- Table 45: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 46: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 47: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 49: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 50: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Equipment Type 2019 & 2032

- Table 51: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 53: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 55: Saudi Arabia Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Saudi Arabia Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: United Arab Emirates Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: United Arab Emirates Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 59: South Africa Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Africa Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 62: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Equipment Type 2019 & 2032

- Table 63: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 64: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by End User 2019 & 2032

- Table 65: Global Wi-Fi Network Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Global Wi-Fi Network Equipment Market Volume Billion Forecast, by Country 2019 & 2032

- Table 67: Brazil Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Brazil Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 69: Mexico Wi-Fi Network Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Mexico Wi-Fi Network Equipment Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wi-Fi Network Equipment Market?

The projected CAGR is approximately 11.35%.

2. Which companies are prominent players in the Wi-Fi Network Equipment Market?

Key companies in the market include Cisco Systems Inc, Hewlett Packard Enterprise Development LP (Aruba), CommScope (RUCKUS Networks), Telefonaktiebolaget LM Ericsson, Huawei Technologies Co Ltd, Extreme Networks, Ubiquiti Inc, D-Link Corporation, TP-Link Corporation, NETGEAR Inc.

3. What are the main segments of the Wi-Fi Network Equipment Market?

The market segments include Equipment Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the use of connected devices and BYOD policy; Rising Digital Transformation in the Enterprises; Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation. etc.).

6. What are the notable trends driving market growth?

The Enterprises Segment is Expected to Hold a Major Share.

7. Are there any restraints impacting market growth?

Growth in the use of connected devices and BYOD policy; Rising Digital Transformation in the Enterprises; Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation. etc.).

8. Can you provide examples of recent developments in the market?

January 2024: Wi-Fi Alliance announced the launch of Wi-Fi CERTIFIED 7, with many new features designed to enhance Wi-Fi performance and connectivity in diverse settings. The advanced features of Wi-Fi CERTIFIED 7 prioritize high throughput, deterministic latency, and enhanced reliability, especially for crucial data streams. This latest Wi-Fi iteration is set to propel various applications, from multi-user AR/VR/XR and immersive 3-D training to electronic gaming, hybrid work setups, industrial IoT, and automotive advancements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wi-Fi Network Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wi-Fi Network Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wi-Fi Network Equipment Market?

To stay informed about further developments, trends, and reports in the Wi-Fi Network Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence