Key Insights

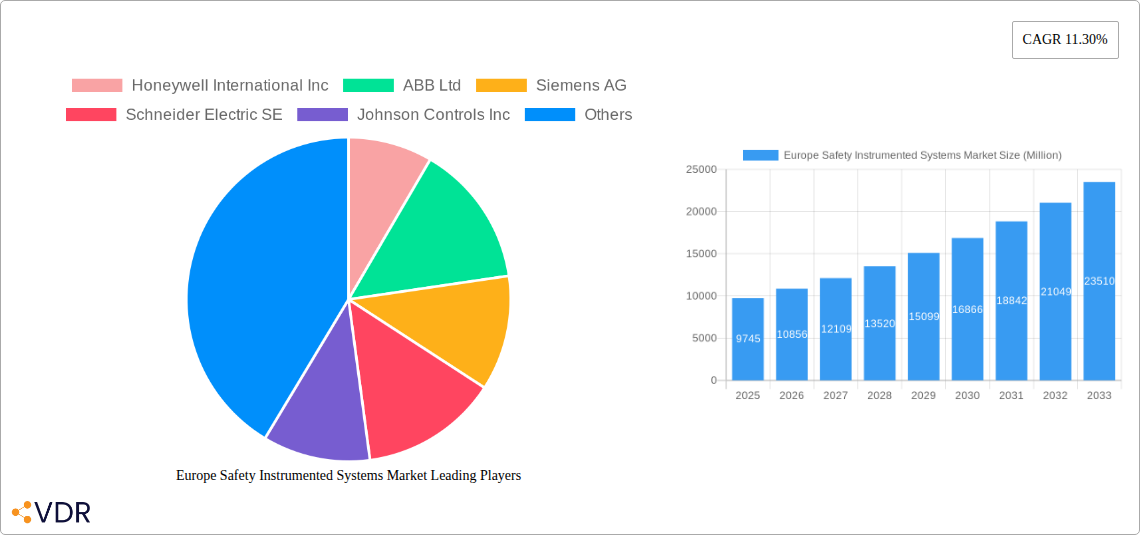

The European Safety Instrumented Systems (SIS) market is poised for substantial growth, projected to reach approximately $9,745 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 11.30% throughout the forecast period of 2025-2033. This expansion is primarily fueled by the increasing adoption of stringent safety regulations across critical industrial sectors, coupled with the growing demand for automation and advanced process control solutions. Industries such as Chemicals and Petrochemicals, Oil and Gas, and Power Generation are at the forefront, investing heavily in SIS to mitigate risks, prevent catastrophic failures, and ensure operational integrity. The rising complexity of industrial processes and the inherent dangers associated with them necessitate sophisticated safety systems that can respond rapidly and reliably to hazardous conditions. Consequently, there's a significant drive towards integrating state-of-the-art components like advanced sensors, programmable logic controllers (PLCs), and high-performance actuators and valves within SIS architectures.

Key market drivers include the imperative to comply with evolving safety standards such as IEC 61511 and IEC 61508, which mandate the implementation of SIL-rated systems. Furthermore, technological advancements, including the development of more intelligent and interconnected SIS solutions, are enhancing their efficacy and driving adoption. The increasing focus on predictive maintenance and operational efficiency also plays a crucial role, as robust SIS contributes to minimizing unplanned downtime and associated financial losses. However, the market faces certain restraints, including the high initial investment costs associated with implementing comprehensive SIS solutions and the challenge of finding skilled personnel for installation, maintenance, and operation. Despite these challenges, the overarching emphasis on safety, driven by both regulatory pressures and a proactive approach to risk management by industrial leaders, is expected to propel the European SIS market to new heights in the coming years.

This in-depth report provides a definitive analysis of the Europe Safety Instrumented Systems (SIS) market, offering critical insights into its structure, dynamics, growth trajectory, and future outlook. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033, this study is an indispensable resource for industry stakeholders, investors, and policymakers seeking to understand the evolving landscape of industrial safety. Our analysis leverages high-traffic keywords such as "industrial safety systems," "functional safety," "SIS market Europe," "process safety," and "emergency shutdown systems" to ensure maximum search engine visibility. We meticulously examine parent and child market segments to deliver granular intelligence and actionable strategies. All values are presented in Million units.

Europe Safety Instrumented Systems Market Market Dynamics & Structure

The European Safety Instrumented Systems (SIS) market is characterized by a moderate to high degree of market concentration, with key players like Honeywell International Inc., ABB Ltd, Siemens AG, Schneider Electric SE, and Johnson Controls Inc. holding significant market shares. The market's structure is heavily influenced by stringent regulatory frameworks, including IEC 61508 and IEC 61511, which mandate the implementation of robust safety systems across various high-risk industries. Technological innovation serves as a primary driver, with continuous advancements in sensor technology, programmable logic controllers (PLCs), and human-machine interfaces (HMIs) enhancing system reliability and performance.

- Market Concentration: Dominated by a few large multinational corporations, but with growing participation from specialized providers.

- Technological Innovation Drivers: Increasing demand for higher safety integrity levels (SIL), integration of Industry 4.0 technologies (IoT, AI), and the need for predictive maintenance solutions.

- Regulatory Frameworks: Robust and evolving standards drive the adoption of certified SIS solutions. Compliance remains a key factor influencing investment decisions.

- Competitive Product Substitutes: While direct substitutes are limited for certified SIS, advancements in non-SIS safety solutions and integrated process control systems can influence market dynamics.

- End-User Demographics: A strong reliance on established industrial sectors like oil & gas, chemicals, and power generation, with increasing adoption in pharmaceuticals and food & beverage.

- M&A Trends: Strategic acquisitions and partnerships are common as companies seek to expand their product portfolios, geographical reach, and technological capabilities in the competitive SIS landscape. M&A deal volumes are expected to remain steady, driven by consolidation and specialization.

Europe Safety Instrumented Systems Market Growth Trends & Insights

The Europe Safety Instrumented Systems (SIS) market is projected for substantial growth, driven by an escalating emphasis on industrial safety, stringent regulatory mandates, and the increasing complexity of industrial operations. Over the forecast period of 2025–2033, the market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% to 8.2%, reaching an estimated market size of over $6,500 million units by 2033. This expansion is underpinned by the continuous need to mitigate risks associated with hazardous industrial processes, prevent accidents, and ensure operational continuity.

The adoption rates for advanced SIS solutions are on an upward trend, particularly in sectors such as Chemicals and Petrochemicals, and Power Generation, where the potential for catastrophic incidents is highest. Technological disruptions, including the integration of artificial intelligence (AI) for predictive analytics and machine learning for anomaly detection, are enhancing the capabilities of SIS, moving them from reactive safety measures to proactive risk management tools. The shift towards digital transformation within industries is also a significant catalyst, as companies invest in connected safety systems that offer real-time monitoring, remote diagnostics, and improved data analysis.

Consumer behavior shifts are evident, with end-users increasingly prioritizing lifecycle services, including installation, commissioning, maintenance, and obsolescence management, alongside the initial product purchase. This move towards a service-oriented model indicates a mature market where reliability, long-term support, and total cost of ownership are key decision-making factors. The growing awareness of the economic and reputational damage caused by industrial accidents further solidifies the demand for high-integrity SIS. Furthermore, the increasing focus on environmental protection regulations is indirectly boosting the SIS market, as effective safety systems are crucial for preventing accidental releases of hazardous substances. The integration of safety systems with broader enterprise risk management frameworks is becoming a strategic imperative for many organizations, driving further investment and innovation in the European SIS market.

Dominant Regions, Countries, or Segments in Europe Safety Instrumented Systems Market

The European Safety Instrumented Systems (SIS) market exhibits a clear dominance in specific regions and segments, driven by a confluence of economic, regulatory, and industrial factors. Among the end-users, the Chemicals and Petrochemicals sector is a primary growth engine, accounting for an estimated 28% of the total market share in 2025. This dominance is attributed to the inherently hazardous nature of processes involved, the stringent safety regulations governing this industry, and the significant investment in maintaining high safety integrity levels (SIL) to prevent major accidents and environmental damage. The presence of numerous large-scale chemical and petrochemical complexes across Europe, particularly in countries like Germany, the Netherlands, and the UK, further solidifies this segment's leading position.

- Leading End-User Segment: Chemicals and Petrochemicals is the dominant segment due to high-risk operations and stringent regulatory compliance.

- Key Drivers in Chemicals & Petrochemicals:

- Strict adherence to IEC 61508 and IEC 61511 standards.

- High value of assets requiring robust protection.

- Increasing focus on environmental safety and preventing leaks.

- Significant investment in plant upgrades and modernization.

- Dominant Application Segment: Emergency Shutdown Systems (ESD) is a critical application across all end-user industries. Its high adoption rate is driven by its fundamental role in immediately halting hazardous operations during emergencies. The market share for ESD is estimated to be around 25% of the total application segment.

- Key Drivers for ESD:

- Mandatory requirement for immediate process termination.

- Integration with other safety systems for comprehensive protection.

- Advancements in faster response times and diagnostics.

- Dominant Component Segment: Programmable Devices, including Safety PLCs, are pivotal to the functionality of SIS. They are expected to capture approximately 35% of the components market share in 2025. Their versatility, programmability, and ability to manage complex safety logic make them indispensable for modern SIS.

- Key Drivers for Programmable Devices:

- Increased complexity of safety functions requiring sophisticated logic.

- Integration capabilities with other control and safety systems.

- Availability of certified hardware and software for various SIL ratings.

- Leading Geographic Regions: Germany consistently emerges as the leading country in the European SIS market, driven by its robust industrial base, strong manufacturing sector, and a proactive approach to industrial safety and regulatory compliance. Its significant presence in the chemicals, automotive, and power generation industries fuels the demand for advanced SIS. Other significant markets include the UK, France, and the Nordic countries.

- Growth Potential in Emerging Regions: Eastern European countries are showing promising growth potential due to industrialization and increasing adoption of safety standards.

Europe Safety Instrumented Systems Market Product Landscape

The Europe Safety Instrumented Systems (SIS) product landscape is defined by continuous innovation aimed at enhancing reliability, performance, and ease of integration. Key product developments focus on miniaturization, increased processing power for complex safety algorithms, and enhanced diagnostic capabilities. Programmable safety controllers are evolving with multi-core processors and advanced communication protocols, enabling them to handle more intricate safety functions and integrate seamlessly with enterprise-level systems. Sensors are becoming more robust and intelligent, offering self-diagnostic features and improved accuracy in harsh environments. Actuators and valves are designed for faster response times and fail-safe operation, ensuring immediate action during critical events. The overall trend is towards intelligent, interconnected safety components that contribute to a more proactive and comprehensive safety ecosystem.

Key Drivers, Barriers & Challenges in Europe Safety Instrumented Systems Market

Key Drivers:

The European Safety Instrumented Systems (SIS) market is propelled by a confluence of critical factors. Stringent regulatory compliance with international standards like IEC 61508 and IEC 61511 is a primary driver, compelling industries to invest in robust safety solutions. The increasing awareness of the significant financial and reputational damage caused by industrial accidents fuels demand for high-integrity SIS. Technological advancements in sensors, programmable devices, and communication systems offer enhanced performance and reliability. Furthermore, the ongoing digital transformation and the adoption of Industry 4.0 principles are leading to the integration of SIS with broader plant automation and data analytics platforms, creating a more sophisticated safety environment.

Barriers & Challenges:

Despite robust growth, the market faces certain barriers and challenges. The high initial cost of implementing certified SIS solutions can be a deterrent for small and medium-sized enterprises (SMEs). A shortage of skilled personnel capable of designing, implementing, and maintaining complex SIS can also hinder adoption. Evolving and sometimes fragmented regulatory landscapes across different European countries can create complexity. Moreover, cybersecurity threats targeting industrial control systems pose a significant challenge, requiring robust protection for safety-critical networks. Competition from less specialized or non-certified safety solutions, while not direct substitutes for high-SIL applications, can influence purchasing decisions in lower-risk scenarios.

Emerging Opportunities in Europe Safety Instrumented Systems Market

Emerging opportunities within the Europe Safety Instrumented Systems (SIS) market lie in the expanding adoption of advanced diagnostic and predictive maintenance capabilities, driven by the Internet of Things (IoT) and AI. The growing focus on sustainability and environmental protection is creating a demand for SIS solutions that specifically mitigate risks associated with emissions and hazardous material releases. Furthermore, the increasing digitalization of industries is opening avenues for integrated safety and operational intelligence platforms, where SIS data is leveraged for broader risk management and efficiency improvements. The expansion of renewable energy sectors, such as offshore wind farms, presents a growing market for specialized SIS tailored to their unique operational challenges.

Growth Accelerators in the Europe Safety Instrumented Systems Market Industry

The long-term growth of the Europe Safety Instrumented Systems (SIS) market is being significantly accelerated by key technological breakthroughs and strategic market expansion. The continuous miniaturization and increased processing power of safety programmable devices are enabling more complex and distributed safety functions. Strategic partnerships between SIS vendors and automation solution providers are fostering greater integration and offering comprehensive safety packages. Market expansion is also being driven by the increasing demand for retrofitting older industrial facilities with modern SIS to meet current safety standards, particularly in sectors undergoing significant modernization. The growing emphasis on functional safety as a critical component of overall operational excellence is a sustained growth accelerator.

Key Players Shaping the Europe Safety Instrumented Systems Market Market

- Honeywell International Inc.

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- Johnson Controls Inc.

- HIMA Paul Hildebrandt GmbH

- OMRON Corporation

- Yokogawa Electric Corporation

- General Electric Company

- Emerson Process Management

- Tyco International Plc

- List Not Exhaustive

Notable Milestones in Europe Safety Instrumented Systems Market Sector

- February 2021: Yokogawa Electric Corporation announced the addition of new turbidity detectors, chlorine sensor units, and liquid analyzers lineup in its product portfolio for water treatment facilities, enhancing monitoring capabilities for critical process parameters.

- November 2020: Siemens Energy partnered with Houston-based ProFlex Technologies to provide spontaneous leak detection services for pipeline operators. As part of the agreement, Siemens Energy gains exclusive access to ProFlex Technologies' digital Pipe-Safe advanced leak detection technology. The technology, combined with Siemens Energy's Internet of Things (IoT) system, will enable operators to reduce the environmental risk associated with operating their infrastructure by minimizing unplanned releases of products into the ecosystem, highlighting advancements in leak detection and IoT integration for enhanced safety.

In-Depth Europe Safety Instrumented Systems Market Market Outlook

- February 2021: Yokogawa Electric Corporation announced the addition of new turbidity detectors, chlorine sensor units, and liquid analyzers lineup in its product portfolio for water treatment facilities, enhancing monitoring capabilities for critical process parameters.

- November 2020: Siemens Energy partnered with Houston-based ProFlex Technologies to provide spontaneous leak detection services for pipeline operators. As part of the agreement, Siemens Energy gains exclusive access to ProFlex Technologies' digital Pipe-Safe advanced leak detection technology. The technology, combined with Siemens Energy's Internet of Things (IoT) system, will enable operators to reduce the environmental risk associated with operating their infrastructure by minimizing unplanned releases of products into the ecosystem, highlighting advancements in leak detection and IoT integration for enhanced safety.

In-Depth Europe Safety Instrumented Systems Market Market Outlook

The future outlook for the Europe Safety Instrumented Systems (SIS) market is exceptionally promising, characterized by sustained growth and evolving technological integration. The continued emphasis on regulatory compliance, coupled with a proactive approach to risk mitigation by industries, will remain a core growth accelerator. The pervasive adoption of Industry 4.0 technologies, including AI-driven predictive analytics and IoT-enabled remote monitoring, will unlock new levels of operational safety and efficiency. Strategic collaborations and mergers are expected to consolidate the market and foster innovation, leading to more comprehensive and intelligent safety solutions. The increasing demand for lifecycle services will also contribute to market expansion, shifting focus from product sales to integrated safety management.

Europe Safety Instrumented Systems Market Segmentation

-

1. Components

- 1.1. Sensors

- 1.2. Switches

- 1.3. Programable Devices

- 1.4. Actuators and Valves

-

2. Application

- 2.1. Emergency Shutdown Systems (ESD)

- 2.2. Fire and Gas Monitoring and Control (F&GC)

- 2.3. High Integrity Pressure Protection Systems (HIPPS)

- 2.4. Burner Management Systems (BMS)

- 2.5. Turbo Machinery Control

-

3. End-User

- 3.1. Chemicals and Petrochemicals

- 3.2. Power Generation

- 3.3. Pharmaceutical

- 3.4. Food and Beverage

- 3.5. Oil and Gas

Europe Safety Instrumented Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Safety Instrumented Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industry Safety Standards; Rise in Automotive Manufacturing

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness and Complexity of Standards; Low Response Rate; High Operational Costs

- 3.4. Market Trends

- 3.4.1. The Emergency Shutdown Systems are Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Components

- 5.1.1. Sensors

- 5.1.2. Switches

- 5.1.3. Programable Devices

- 5.1.4. Actuators and Valves

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Emergency Shutdown Systems (ESD)

- 5.2.2. Fire and Gas Monitoring and Control (F&GC)

- 5.2.3. High Integrity Pressure Protection Systems (HIPPS)

- 5.2.4. Burner Management Systems (BMS)

- 5.2.5. Turbo Machinery Control

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Chemicals and Petrochemicals

- 5.3.2. Power Generation

- 5.3.3. Pharmaceutical

- 5.3.4. Food and Beverage

- 5.3.5. Oil and Gas

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Components

- 6. Germany Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Safety Instrumented Systems Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Siemens AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Schneider Electric SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Johnson Controls Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 HIMA Paul Hildebrandt GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 OMRON Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yokogawa Electric Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 General Electric Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Emerson Process Management

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Tyco International Plc*List Not Exhaustive

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Safety Instrumented Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Safety Instrumented Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Components 2019 & 2032

- Table 3: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Safety Instrumented Systems Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Components 2019 & 2032

- Table 15: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Safety Instrumented Systems Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Europe Safety Instrumented Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Safety Instrumented Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Safety Instrumented Systems Market?

The projected CAGR is approximately 11.30%.

2. Which companies are prominent players in the Europe Safety Instrumented Systems Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Siemens AG, Schneider Electric SE, Johnson Controls Inc, HIMA Paul Hildebrandt GmbH, OMRON Corporation, Yokogawa Electric Corporation, General Electric Company, Emerson Process Management, Tyco International Plc*List Not Exhaustive.

3. What are the main segments of the Europe Safety Instrumented Systems Market?

The market segments include Components, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Industry Safety Standards; Rise in Automotive Manufacturing.

6. What are the notable trends driving market growth?

The Emergency Shutdown Systems are Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness and Complexity of Standards; Low Response Rate; High Operational Costs.

8. Can you provide examples of recent developments in the market?

February 2021 - Yokogawa Electric Corporation announced the addition of new turbidity detectors, chlorine sensor units, and liquid analyzers lineup in its product portfolio for water treatment facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Safety Instrumented Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Safety Instrumented Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Safety Instrumented Systems Market?

To stay informed about further developments, trends, and reports in the Europe Safety Instrumented Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence