Key Insights

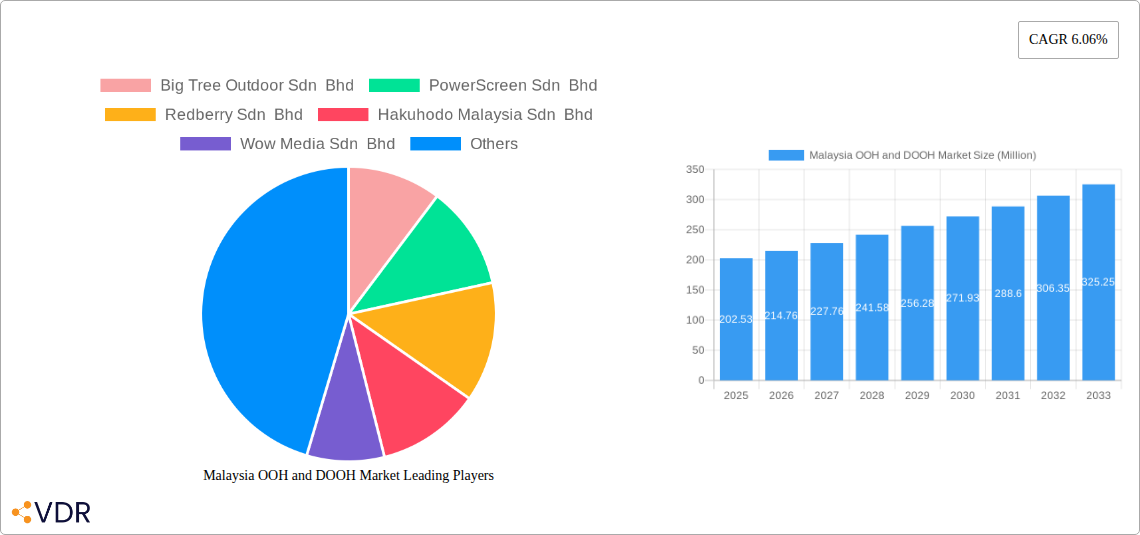

The Malaysia Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for significant expansion, with an estimated market size of USD 202.53 million in 2025. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of 6.06% projected over the forecast period from 2025 to 2033. A primary driver for this surge is the increasing adoption of DOOH technologies, particularly LED screens and programmatic OOH, which offer enhanced targeting, measurability, and dynamic content capabilities. This shift from traditional static OOH is attracting a broader range of advertisers seeking more impactful and data-driven campaigns. The evolving media landscape, coupled with strategic investments in digital infrastructure, is further fueling this upward trajectory, making Malaysia a dynamic hub for OOH advertising innovation.

Malaysia OOH and DOOH Market Market Size (In Million)

The market is segmented across various applications and end-users, reflecting its diverse reach. Billboards and transportation advertising, including airports and other transit mediums like buses, are expected to remain prominent. Street furniture and other place-based media also contribute significantly to the OOH ecosystem. Key end-user industries driving demand include the automotive sector, retail and consumer goods, healthcare, and BFSI. These sectors are leveraging OOH and DOOH to enhance brand visibility, drive foot traffic, and engage consumers effectively. Despite the strong growth outlook, potential restraints could include regulatory changes, high initial investment costs for DOOH infrastructure, and challenges in audience measurement standardization. However, the persistent demand for impactful advertising solutions and the continuous innovation in DOOH technologies are expected to largely overcome these hurdles, ensuring sustained market growth.

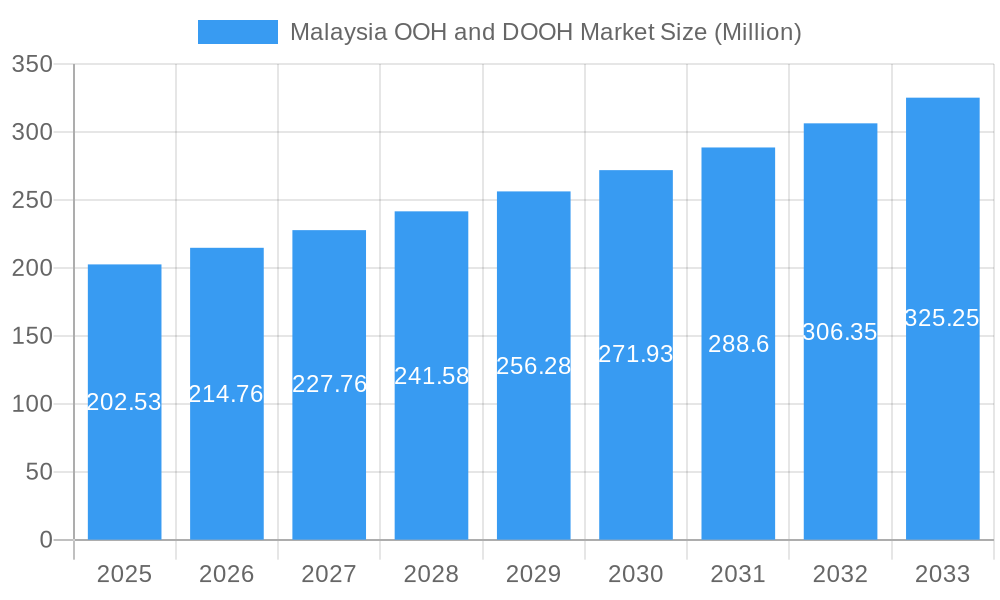

Malaysia OOH and DOOH Market Company Market Share

Malaysia OOH and DOOH Market Analysis: Navigating the Future of Out-of-Home Advertising (2019-2033)

Gain a comprehensive understanding of Malaysia's dynamic Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising landscape with this in-depth market report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, growth accelerators, and the pivotal players shaping the future of OOH advertising in Malaysia. Discover how static and digital formats, across various applications like billboards, transit, and street furniture, are reaching diverse end-users including Automotive, Retail & Consumer Goods, Healthcare, and BFSI sectors.

Malaysia OOH and DOOH Market Market Dynamics & Structure

The Malaysian OOH and DOOH market is characterized by a moderate to high degree of concentration, with a few dominant players like Big Tree Outdoor Sdn Bhd, PowerScreen Sdn Bhd, and Redberry Sdn Bhd holding significant market share. Technological innovation is a key driver, with the rapid adoption of Digital Out-of-Home (DOOH) technologies, including Programmatic OOH, leading to enhanced targeting and measurement capabilities. Regulatory frameworks, though evolving, are increasingly focused on standardizing measurement and ensuring ethical advertising practices. Competitive product substitutes include a growing digital media ecosystem, yet the unique advantages of OOH and DOOH, such as broad reach and impactful visibility, ensure their continued relevance. End-user demographics are diverse, with sectors like Retail & Consumer Goods and Automotive increasingly leveraging OOH for brand awareness and promotional campaigns. Mergers and acquisitions (M&A) are on the rise as companies seek to expand their digital inventories and programmatic offerings, further consolidating the market.

- Market Concentration: Moderate to High, with key players dominating significant portions of OOH inventory.

- Technological Innovation Drivers: Shift towards programmatic buying, programmatic OOH, interactive digital screens, and advanced audience measurement systems.

- Regulatory Frameworks: Focus on improving audience measurement, digital screen safety, and data privacy.

- Competitive Product Substitutes: Digital advertising (online, social media), television, radio.

- End-User Demographics: Strong presence of Retail & Consumer Goods, Automotive, BFSI, and growing interest from Healthcare.

- M&A Trends: Increasing consolidation for digital asset acquisition and programmatic capabilities.

Malaysia OOH and DOOH Market Growth Trends & Insights

The Malaysian OOH and DOOH market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer behavior, and increased advertiser investment. Over the historical period of 2019-2024, the market has witnessed a steady upward trajectory, with the base year of 2025 setting the stage for accelerated expansion throughout the forecast period of 2025-2033. The Compound Annual Growth Rate (CAGR) is projected to be robust, fueled by the increasing digitalization of OOH media. This shift from traditional static billboards to dynamic digital screens, including LED screens and programmatic OOH solutions, allows for more targeted campaigns and real-time adjustments, mirroring the agility of online advertising. Consumer behavior is also a significant factor, with a growing urban population and increased screen time making OOH media a more impactful touchpoint. The adoption rates for DOOH are climbing rapidly, as advertisers recognize its ability to deliver engaging content and measure campaign effectiveness more precisely. Technological disruptions, such as the integration of AI for audience analysis and the deployment of innovative DOOH formats, are further revolutionizing the advertising experience. Market penetration is expected to deepen, especially in secondary cities and transit hubs, as digital infrastructure expands. The ability of OOH and DOOH to offer unique, context-aware advertising opportunities, especially through place-based media and street furniture placements, enhances its appeal. The estimated market size in 2025 is projected to be in the range of RM 1,500-2,000 Million, with significant growth anticipated in the subsequent years, driven by strategic investments and innovation.

Dominant Regions, Countries, or Segments in Malaysia OOH and DOOH Market

The Malaysian OOH and DOOH market exhibits distinct patterns of dominance across its various segments, applications, and end-users. Digital OOH (LED Screens) is emerging as the most dominant segment, propelled by its inherent advantages in dynamism, interactivity, and programmatic capabilities. Within this segment, Programmatic OOH is rapidly gaining traction, allowing for data-driven targeting and efficient media buying, which appeals strongly to modern advertisers.

Across applications, Billboards continue to hold a strong presence, especially in high-traffic urban areas, but their evolution towards digital formats is a key trend. Transportation (Transit), particularly Airports and other high-footfall transit hubs like integrated public transportation networks, represents a significant growth area due to the captive audience and premium advertising opportunities. Street Furniture also plays a crucial role in urban landscapes, offering localized advertising and convenience.

The Retail & Consumer Goods sector consistently remains a top end-user, leveraging OOH and DOOH for brand visibility, product launches, and promotional campaigns. The Automotive industry also heavily relies on OOH for new model releases and brand messaging. The BFSI sector is increasingly adopting DOOH for financial product promotions and brand building, while Healthcare is exploring OOH for public health campaigns and pharmaceutical advertising.

- Dominant Segment (Type): Digital OOH (LED Screens), with Programmatic OOH as a key growth driver within this.

- Key Drivers: Enhanced targeting capabilities, real-time content updates, measurable ROI, dynamic creative execution.

- Growth Potential: Significant, as more advertisers shift budgets towards data-driven and programmatic solutions.

- Dominant Application: Billboards continue to be strong, but Transportation (Airports and transit hubs) is showing accelerated growth.

- Key Drivers for Transit: High dwell times, captive audiences, ability to reach diverse demographics, integration with smart city initiatives.

- Market Share: While exact figures are proprietary, Airports and major transit nodes are estimated to capture over 30% of DOOH ad spend within the transit sector.

- Dominant End-User: Retail & Consumer Goods, followed closely by Automotive.

- Key Drivers for Retail: High reach, brand recall, ability to drive foot traffic, seasonal campaign effectiveness.

- Market Share: Retail & Consumer Goods and Automotive combined are estimated to represent over 50% of the total OOH and DOOH ad spend.

- Regional Dominance: Major metropolitan areas like the Klang Valley are the primary hubs for OOH and DOOH advertising due to higher population density and economic activity.

Malaysia OOH and DOOH Market Product Landscape

The Malaysian OOH and DOOH market is defined by an evolving product landscape that blends traditional out-of-home strengths with digital innovations. Static OOH formats, primarily billboards and transit advertising, continue to offer broad reach and brand impact. However, the significant product development lies within Digital OOH (DOOH), encompassing a variety of LED screens, video walls, and interactive digital kiosks. Programmatic OOH platforms are revolutionizing how DOOH inventory is bought and sold, enabling automated, data-driven campaign execution. Innovative applications include smart rider bags, as demonstrated by foodpanda, which transform mobile assets into moving DOOH platforms, and the integration of DOOH with mobile and online advertising for a truly omnichannel experience. Performance metrics for DOOH are becoming increasingly sophisticated, with a focus on impression-based measurement, audience demographics, and even engagement analytics.

Key Drivers, Barriers & Challenges in Malaysia OOH and DOOH Market

Key Drivers:

- Increasing Digitalization: The rapid adoption of DOOH, including programmatic buying, enhances targeting and measurability, attracting more digital ad spend.

- Urbanization and Population Growth: A growing urban population in Malaysia increases the reach and impact of OOH advertising in high-density areas.

- Technological Advancements: Innovations in LED screen technology, audience measurement systems, and data analytics are enhancing the effectiveness of OOH campaigns.

- Strong Retail & Automotive Sectors: These industries are consistent and significant advertisers, driving demand for OOH placements.

- Government Initiatives: Support for smart city development and infrastructure improvements can create new OOH opportunities.

Barriers & Challenges:

- Measurement Standardization: While progress is being made, achieving universally accepted audience measurement standards remains a challenge for the industry.

- Regulatory Hurdles: Navigating local council regulations and obtaining permits for OOH installations can be complex and time-consuming.

- High Initial Investment: The cost of installing and maintaining digital OOH screens can be a barrier for smaller players.

- Competition from Digital Media: The continued growth of online and social media advertising presents a competitive challenge for OOH.

- Supply Chain and Maintenance: Ensuring the smooth operation and timely maintenance of digital OOH assets is crucial and can be subject to supply chain disruptions.

Emerging Opportunities in Malaysia OOH and DOOH Market

Emerging opportunities in the Malaysian OOH and DOOH market are centered around technological integration and innovative application. The development of advanced audience measurement systems, like the one launched by OAAM, offers a significant opportunity for increased advertiser confidence and investment. Programmatic DOOH is poised for substantial growth, enabling hyper-targeted campaigns and real-time optimization. The integration of AI and machine learning will further personalize ad experiences and improve campaign effectiveness. Untapped markets in smaller cities and rural areas present potential for expansion as digital infrastructure develops. Innovative applications, such as interactive DOOH, augmented reality (AR) integrations, and the utilization of data from IoT devices for contextual advertising, will also drive future growth and engagement. The increasing focus on sustainability will also create opportunities for eco-friendly OOH solutions.

Growth Accelerators in the Malaysia OOH and DOOH Market Industry

Several catalysts are accelerating the growth of the Malaysia OOH and DOOH market. The strategic partnerships between technology providers and OOH media owners, such as Unicom Marketing's collaboration with Location Media Xchange (LMX), are vital for enhancing measurement and automation capabilities. The continuous innovation in digital display technology, leading to brighter, more energy-efficient, and higher-resolution screens, is making DOOH more attractive. Furthermore, the expansion of smart city initiatives across Malaysia will create more placements for digital OOH media, integrating it into the urban fabric. The increasing demand for omnichannel marketing strategies, where OOH plays a crucial role in bridging the online and offline consumer journey, also serves as a significant growth accelerator. Finally, the proactive efforts by industry associations like OAAM to standardize practices and promote credibility are crucial for sustained long-term growth.

Key Players Shaping the Malaysia OOH and DOOH Market Market

- Big Tree Outdoor Sdn Bhd

- PowerScreen Sdn Bhd

- Redberry Sdn Bhd

- Hakuhodo Malaysia Sdn Bhd

- Wow Media Sdn Bhd

- Brandavision Sdn Bhd

- AsiaPac Net Media Limited

- JCDecaux

- Trade Desk

Notable Milestones in Malaysia OOH and DOOH Market Sector

- June 2024: The Outdoor Advertising Association of Malaysia (OAAM) launched Malaysia's first comprehensive audience measurement system for out-of-home (OOH) advertising to navigate emerging challenges. This initiative aims to bolster industry sustainability and credibility.

- July 2024: Pilot testing for OAAM's audience measurement system began, with full implementation planned for 2025.

- December 2023: Unicom Marketing partnered with Location Media Xchange (LMX), the supply-side arm of Moving Walls Group, to enhance measurement and automation for its mobile LED truck screens.

- November 2023: foodpanda Malaysia unveiled its advanced Smart Rider Bags solution, a pioneering DOOH advertising platform, as part of its panda ads suite.

In-Depth Malaysia OOH and DOOH Market Market Outlook

The Malaysia OOH and DOOH market outlook is exceptionally positive, driven by ongoing technological advancements and a growing advertiser appetite for measurable, impactful advertising solutions. The continued evolution of programmatic DOOH will unlock unprecedented levels of efficiency and precision in media buying. The development and widespread adoption of sophisticated audience measurement systems will significantly boost advertiser confidence and investment. Furthermore, the integration of OOH with other digital channels, creating seamless omnichannel customer journeys, will be a key focus for brands. Strategic partnerships, like those observed in recent years, will continue to foster innovation and market expansion. As Malaysia progresses with its smart city development and digital transformation agendas, the demand for dynamic and integrated OOH advertising solutions is set to surge, promising a robust and dynamic future for the market.

Malaysia OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other DOOH Types

-

2. Appli

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-Based Media

-

3. End-U

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End Users

Malaysia OOH and DOOH Market Segmentation By Geography

- 1. Malaysia

Malaysia OOH and DOOH Market Regional Market Share

Geographic Coverage of Malaysia OOH and DOOH Market

Malaysia OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry Aided the Spending on Airport Advertisement

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry Aided the Spending on Airport Advertisement

- 3.4. Market Trends

- 3.4.1. Billboards to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other DOOH Types

- 5.2. Market Analysis, Insights and Forecast - by Appli

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-Based Media

- 5.3. Market Analysis, Insights and Forecast - by End-U

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Big Tree Outdoor Sdn Bhd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PowerScreen Sdn Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Redberry Sdn Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hakuhodo Malaysia Sdn Bhd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wow Media Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brandavision Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AsiaPac Net Media Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JCDecaux

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trade Des

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Big Tree Outdoor Sdn Bhd

List of Figures

- Figure 1: Malaysia OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia OOH and DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Malaysia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Malaysia OOH and DOOH Market Revenue Million Forecast, by Appli 2020 & 2033

- Table 4: Malaysia OOH and DOOH Market Volume Million Forecast, by Appli 2020 & 2033

- Table 5: Malaysia OOH and DOOH Market Revenue Million Forecast, by End-U 2020 & 2033

- Table 6: Malaysia OOH and DOOH Market Volume Million Forecast, by End-U 2020 & 2033

- Table 7: Malaysia OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Malaysia OOH and DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Malaysia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Malaysia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Malaysia OOH and DOOH Market Revenue Million Forecast, by Appli 2020 & 2033

- Table 12: Malaysia OOH and DOOH Market Volume Million Forecast, by Appli 2020 & 2033

- Table 13: Malaysia OOH and DOOH Market Revenue Million Forecast, by End-U 2020 & 2033

- Table 14: Malaysia OOH and DOOH Market Volume Million Forecast, by End-U 2020 & 2033

- Table 15: Malaysia OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Malaysia OOH and DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia OOH and DOOH Market?

The projected CAGR is approximately 6.06%.

2. Which companies are prominent players in the Malaysia OOH and DOOH Market?

Key companies in the market include Big Tree Outdoor Sdn Bhd, PowerScreen Sdn Bhd, Redberry Sdn Bhd, Hakuhodo Malaysia Sdn Bhd, Wow Media Sdn Bhd, Brandavision Sdn Bhd, AsiaPac Net Media Limited, JCDecaux, Trade Des.

3. What are the main segments of the Malaysia OOH and DOOH Market?

The market segments include Type , Appli, End-U.

4. Can you provide details about the market size?

The market size is estimated to be USD 202.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry Aided the Spending on Airport Advertisement.

6. What are the notable trends driving market growth?

Billboards to Drive the Market.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry Aided the Spending on Airport Advertisement.

8. Can you provide examples of recent developments in the market?

June 2024: The Outdoor Advertising Association of Malaysia (OAAM) launched Malaysia's first comprehensive audience measurement system for out-of-home (OOH) advertising to navigate the emerging challenges in outdoor advertising. This initiative aims to bolster the industry's sustainability and credibility. The pilot test for this measurement system began in July 2024, and full implementation is planned for 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Malaysia OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence