Key Insights

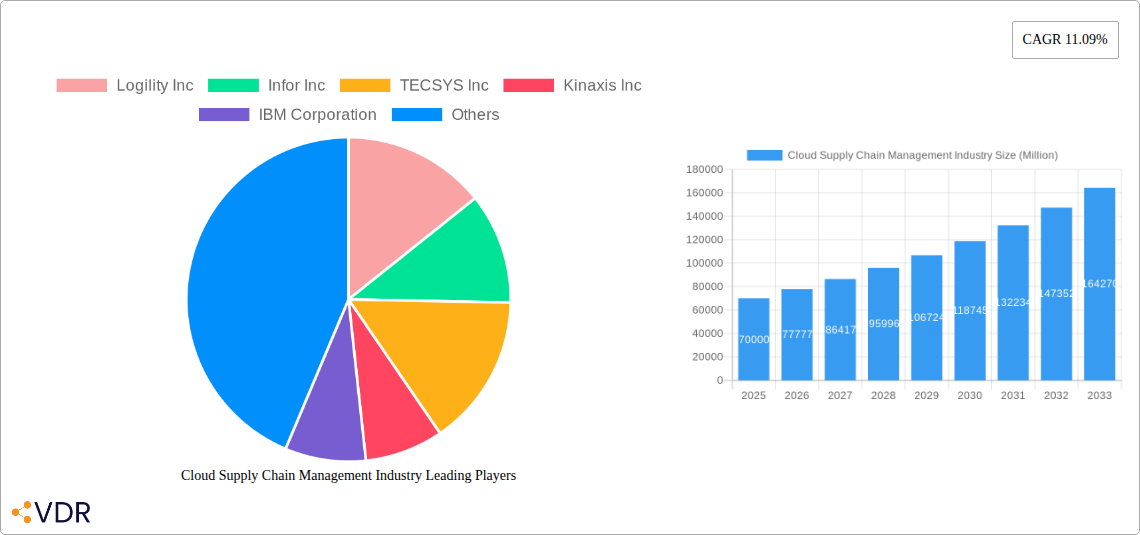

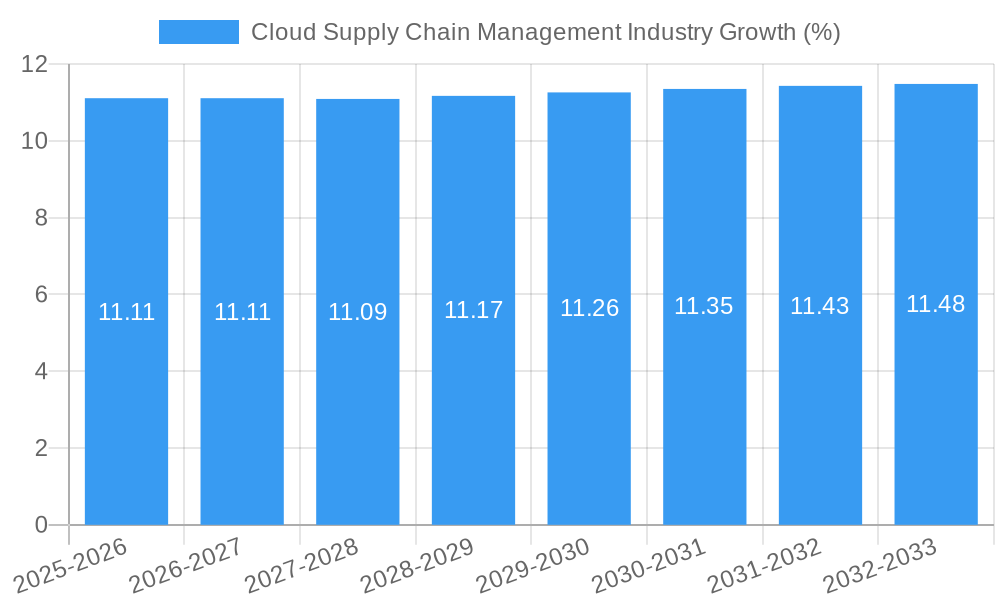

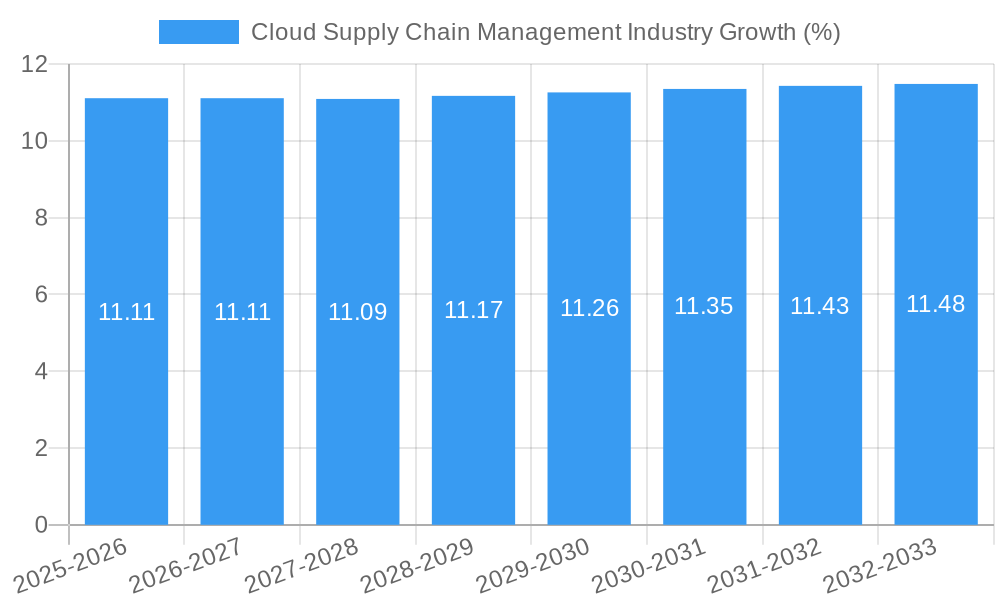

The Cloud Supply Chain Management (SCM) market is poised for substantial expansion, projected to reach a significant market size of approximately $70,000 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.09% through 2033. This robust growth is fueled by critical market drivers including the increasing demand for enhanced visibility and agility across complex global supply chains, the imperative for cost optimization through efficient resource allocation, and the growing adoption of digital transformation initiatives by enterprises. The inherent scalability, flexibility, and cost-effectiveness offered by cloud-based SCM solutions make them increasingly attractive to organizations of all sizes, especially in the face of evolving consumer expectations and the need for resilient supply chain operations. Emerging trends such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, the rise of blockchain for enhanced transparency and security, and the growing emphasis on sustainable supply chain practices are further accelerating market adoption.

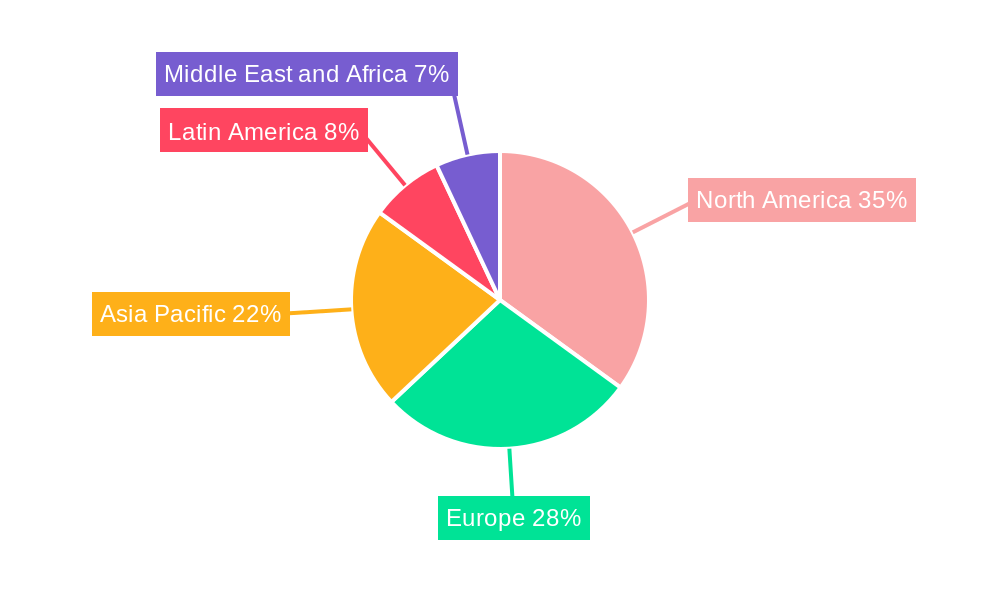

Despite the positive outlook, certain restraints may temper the pace of growth. Concerns surrounding data security and privacy within cloud environments, alongside the complexities of integrating cloud SCM solutions with existing legacy systems, present significant challenges. Furthermore, a shortage of skilled professionals with expertise in cloud SCM technologies could also impede widespread adoption. The market is segmented across various solutions, including Demand Planning and Forecasting, Inventory and Warehouse Management, Product Life-Cycle Management, Transportation & Logistics Management, and Sales and Operations Planning, each contributing to the overall market value. Deployment types, such as Hybrid Cloud, Public Cloud, and Private Cloud, cater to diverse organizational needs. Large enterprises and Small and Medium Enterprises (SMEs) are both key consumers, with significant demand expected across pivotal end-user industries like Retail, Food & Beverage, Manufacturing, Automotive, Oil & Gas, and Healthcare. North America is anticipated to lead the market, followed closely by Europe, with the Asia Pacific region showcasing the fastest growth trajectory.

Cloud Supply Chain Management Industry Report: Market Analysis, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Cloud Supply Chain Management (SCM) industry, forecasting market evolution from 2019 to 2033. With a base year of 2025, the report offers critical insights into market dynamics, growth drivers, regional dominance, key players, and future opportunities. Dive deep into the strategic landscape shaped by advancements in AI, ML, and data analytics, crucial for modern supply chain optimization. The report quantifies market size and growth in Million units, offering actionable intelligence for stakeholders.

Cloud Supply Chain Management Industry Market Dynamics & Structure

The Cloud Supply Chain Management industry is characterized by a dynamic and evolving market structure. Market concentration is moderate, with leading players like Oracle Corporation, SAP SE, and Manhattan Associates Inc. holding significant shares, but the rise of specialized cloud-native providers such as CloudLogix Inc. and the increasing adoption by mid-market players like Logility Inc. and Infor Inc. are fostering a more competitive landscape. Technological innovation is the primary driver, fueled by the relentless pursuit of enhanced efficiency, visibility, and agility in global supply chains. The integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) is transforming traditional SCM processes. Regulatory frameworks, while generally supportive of digital transformation, can present challenges related to data privacy and security across different jurisdictions. Competitive product substitutes are largely limited to on-premise SCM solutions, which are steadily losing ground to the cost-effectiveness and scalability of cloud-based alternatives. End-user demographics reveal a strong demand from large enterprises across manufacturing and retail, while small and medium enterprises are increasingly leveraging cloud SCM for competitive parity. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger vendors acquiring innovative startups to bolster their cloud offerings and expand their market reach. For instance, recent M&A activity aims to integrate advanced analytics and specialized functionalities into broader cloud SCM platforms.

- Market Share Dynamics: Leading vendors hold a combined XX% market share, with a steady growth in the market share of specialized cloud SCM providers.

- Innovation Barriers: Integration complexities with legacy systems and the need for skilled personnel can pose adoption barriers.

- M&A Trends: Over the historical period (2019-2024), an estimated XX M&A deals occurred, focusing on acquiring AI/ML capabilities and niche market expertise.

- Competitive Landscape: Dominated by established ERP vendors and specialized SCM solution providers, with new entrants focusing on niche functionalities.

Cloud Supply Chain Management Industry Growth Trends & Insights

The global Cloud Supply Chain Management industry is poised for robust growth, driven by an escalating need for resilient, agile, and transparent supply chains. The market size evolution reflects a significant shift from on-premise solutions to cloud-based offerings, spurred by their inherent scalability, flexibility, and cost-efficiency. Adoption rates are accelerating across all organization sizes, from large enterprises seeking to optimize complex global networks to SMEs aiming to enhance their operational efficiency and competitiveness. Technological disruptions, particularly the proliferation of AI, ML, and advanced analytics, are fundamentally reshaping SCM capabilities. These technologies enable predictive insights, intelligent automation, and enhanced decision-making, leading to reduced lead times, optimized inventory levels, and proactive risk mitigation. Consumer behavior shifts, characterized by increased demand for faster deliveries, personalized products, and greater transparency, are placing immense pressure on businesses to modernize their supply chains. Cloud SCM solutions provide the agility and responsiveness required to meet these evolving expectations. The market penetration of cloud SCM is expected to reach XX% by 2033, indicating a substantial transformation of the industry's technological infrastructure. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be XX%, underscoring the industry's significant expansion potential. This growth is further substantiated by increasing investments in digital transformation initiatives by companies worldwide, seeking to gain a competitive edge in a volatile global market. The ability of cloud SCM to integrate disparate supply chain functions, from procurement and logistics to demand planning and customer service, into a unified, intelligent platform is a key factor driving its widespread adoption and market dominance. The ongoing development of advanced features, such as real-time tracking, automated anomaly detection, and predictive maintenance for logistics assets, will continue to fuel this growth trajectory.

- Market Size Growth: Projected to grow from an estimated XX Million units in 2025 to XX Million units by 2033, representing a significant expansion.

- Adoption Rate: Expected to see an increase in adoption rates by XX% across all organization sizes during the forecast period.

- Technological Disruption Impact: AI and ML integration leading to a XX% improvement in supply chain efficiency and a XX% reduction in operational costs.

- Consumer Behavior Influence: Rising consumer expectations for speed and transparency are compelling businesses to invest in agile cloud SCM solutions.

- Market Penetration: Forecasted to reach XX% by the end of the study period, signaling a widespread shift towards cloud-based SCM.

Dominant Regions, Countries, or Segments in Cloud Supply Chain Management Industry

North America currently stands as the dominant region in the Cloud Supply Chain Management industry, driven by a mature market, significant investments in technology, and a high concentration of large enterprises across key end-user industries. The United States, in particular, leads with its strong adoption of advanced SCM solutions, fueled by a robust manufacturing sector and a dynamic retail landscape. The country's emphasis on digital transformation and its established cloud infrastructure provide fertile ground for SCM innovation and deployment. Among the segments, Inventory and Warehouse Management emerges as a significant driver of market growth. Businesses are increasingly recognizing the critical need for optimized inventory levels and efficient warehouse operations to reduce costs, improve order fulfillment, and enhance customer satisfaction. This segment is propelled by the demand for automated warehousing solutions, real-time inventory tracking, and predictive analytics for stock management.

Public Cloud deployment type is also a major contributor to market expansion, owing to its scalability, cost-effectiveness, and ease of implementation, making it accessible to a broader range of businesses. Large Enterprises continue to be the primary consumers, leveraging cloud SCM to manage their extensive and complex global supply chains. However, the Small and Medium Enterprises (SMEs) segment is demonstrating impressive growth, driven by the availability of affordable and scalable cloud SCM solutions that enable them to compete more effectively.

In terms of end-user industries, Retail and Manufacturing are at the forefront of cloud SCM adoption. The retail sector's need for rapid inventory turnover, efficient order fulfillment, and responsive demand forecasting, coupled with the manufacturing sector's focus on production optimization, lean operations, and global sourcing, makes them prime candidates for cloud SCM solutions. The integration of AI and ML in these sectors is further enhancing their supply chain capabilities.

- Dominant Region: North America, with XX% market share, driven by the United States' technological adoption and robust industrial base.

- Leading Segment (Solution): Inventory and Warehouse Management, accounting for an estimated XX% of the market.

- Leading Deployment Type: Public Cloud, favored for its scalability and cost-efficiency, with an expected XX% market penetration.

- Dominant Organization Size: Large Enterprises, contributing XX% to the market revenue, with SMEs showing rapid growth.

- Key End-User Industries: Retail and Manufacturing, collectively representing over XX% of cloud SCM adoption due to their complex operational needs.

- Growth Potential in Other Regions: Asia Pacific is expected to witness the highest CAGR (XX%) during the forecast period, driven by increasing industrialization and digital transformation initiatives.

Cloud Supply Chain Management Industry Product Landscape

The product landscape of the Cloud Supply Chain Management industry is characterized by an array of sophisticated solutions designed to enhance end-to-end supply chain visibility and efficiency. Innovations are heavily focused on the integration of advanced technologies like AI, ML, and blockchain to deliver predictive analytics, automated decision-making, and real-time traceability. Solutions offer modules for demand planning and forecasting, enabling businesses to anticipate market needs with greater accuracy. Inventory and warehouse management functionalities are enhanced with smart automation and real-time tracking capabilities. Product lifecycle management (PLM) features facilitate better product development and introduction into the market. Transportation and logistics management solutions optimize routing, carrier selection, and shipment tracking, while sales and operations planning (S&OP) tools create a cohesive strategy across departments. Unique selling propositions include the seamless integration of these modules, the ability to adapt to dynamic market conditions, and the provision of actionable insights through intuitive dashboards. Technological advancements are continuously pushing the boundaries, with an increasing emphasis on predictive capabilities and prescriptive actions.

Key Drivers, Barriers & Challenges in Cloud Supply Chain Management Industry

The Cloud Supply Chain Management industry is propelled by several key drivers. The relentless pursuit of operational efficiency and cost reduction across global supply chains is a primary catalyst. The increasing complexity of supply chains, coupled with the need for enhanced visibility and agility in the face of disruptions, further fuels adoption. Technological advancements, particularly AI, ML, and IoT, are enabling more intelligent and automated SCM processes, leading to significant improvements in forecasting, inventory management, and logistics. Government initiatives promoting digitalization and e-commerce also contribute to market growth.

Conversely, several barriers and challenges exist. The initial cost of implementation and integration with existing legacy systems can be a significant hurdle, especially for smaller organizations. Data security and privacy concerns remain paramount, with companies seeking robust assurance of data protection in cloud environments. A shortage of skilled professionals capable of managing and leveraging complex cloud SCM solutions also presents a challenge. Furthermore, the ever-evolving regulatory landscape and the need for compliance across different regions can add to implementation complexities. The competitive pressure to constantly innovate and offer cutting-edge features also adds to the dynamic nature of this industry.

- Key Drivers:

- Demand for enhanced operational efficiency and cost savings.

- Increasing supply chain complexity and disruption mitigation needs.

- Advancements in AI, ML, and IoT for intelligent automation.

- Government support for digital transformation and e-commerce.

- Key Barriers & Challenges:

- High initial implementation and integration costs.

- Data security, privacy, and compliance concerns.

- Shortage of skilled SCM professionals.

- Evolving regulatory environments.

- Intense competitive pressure and the need for continuous innovation.

Emerging Opportunities in Cloud Supply Chain Management Industry

Emerging opportunities in the Cloud Supply Chain Management industry are largely centered around the expansion of AI and ML capabilities, leading to more predictive and prescriptive SCM. The increasing demand for sustainable and ethical supply chains presents a significant avenue for growth, with cloud SCM solutions offering enhanced traceability and reporting for environmental, social, and governance (ESG) metrics. The rise of the circular economy model also opens up new applications for cloud SCM, focusing on reverse logistics and product lifecycle management for reuse and recycling. Furthermore, the untapped potential in emerging economies, as they industrialize and embrace digital transformation, offers substantial growth prospects for cloud SCM providers. The integration of blockchain technology for enhanced transparency and security in transactions is another promising area.

- Sustainable Supply Chains: Growing demand for ESG-compliant and ethically sourced products.

- Circular Economy Integration: Opportunities in reverse logistics and resource management.

- Emerging Market Expansion: Untapped potential in developing economies with increasing industrialization.

- Blockchain Adoption: Enhanced security and transparency in supply chain transactions.

Growth Accelerators in the Cloud Supply Chain Management Industry Industry

Several catalysts are accelerating the long-term growth of the Cloud Supply Chain Management industry. Technological breakthroughs, such as the advancement of real-time data analytics platforms and the development of more sophisticated AI algorithms for demand forecasting and risk prediction, are fundamentally transforming SCM capabilities. Strategic partnerships between cloud providers and specialized SCM software vendors are creating integrated solutions that offer enhanced functionalities and broader market reach. Furthermore, the increasing adoption of cloud SCM by small and medium enterprises (SMEs) due to its scalability and affordability is expanding the market base. The growing emphasis on supply chain resilience and agility in response to global events like pandemics and geopolitical shifts is also a significant growth accelerator, pushing companies to invest in robust cloud-based SCM solutions.

Key Players Shaping the Cloud Supply Chain Management Industry Market

- Logility Inc.

- Infor Inc.

- TECSYS Inc.

- Kinaxis Inc.

- IBM Corporation

- Manhattan Associates Inc.

- JDA Software Group Inc.

- Descartes Systems Group Inc.

- Oracle Corporation

- HighJump Software Inc.

- CloudLogix Inc.

- SAP SE

Notable Milestones in Cloud Supply Chain Management Industry Sector

- June 2022: XPO Logistics collaborated with Google Cloud to enhance supply chain commodity flow, leveraging Google Cloud's AI, ML, and data analytics for faster, more effective, and visible supply chains in a multi-year partnership.

In-Depth Cloud Supply Chain Management Industry Market Outlook

The future outlook for the Cloud Supply Chain Management industry is exceptionally promising, driven by an ongoing digital transformation imperative across all sectors. Growth accelerators will continue to be fueled by advancements in AI and ML, enabling highly predictive and prescriptive SCM capabilities that can proactively mitigate risks and optimize operations. Strategic partnerships between technology giants and specialized SCM providers will lead to more integrated and comprehensive solutions. The increasing accessibility of cloud SCM for SMEs will significantly expand market penetration. The overarching trend towards building resilient, agile, and sustainable supply chains will ensure sustained demand for cloud-based solutions. The industry is set to witness substantial market expansion, offering significant opportunities for innovation and strategic investments in the coming years.

Cloud Supply Chain Management Industry Segmentation

-

1. Solution

- 1.1. Demand Planning and Forecasting

- 1.2. Inventory and Warehouse Management

- 1.3. Product Life-Cycle Management

- 1.4. Transportation & Logistics Management

- 1.5. Sales and Operations Planning

- 1.6. Other So

-

2. Deployment Type

- 2.1. Hybrid Cloud

- 2.2. Public Cloud

- 2.3. Private Cloud

-

3. Organization Size

- 3.1. Large Enterprises

- 3.2. Small and Medium Enterprises

-

4. End-user Industries

- 4.1. Retail

- 4.2. Food & Beverage

- 4.3. Manufacturing

- 4.4. Automotive

- 4.5. Oil & Gas

- 4.6. Healthcare

- 4.7. Other End-user Industries

Cloud Supply Chain Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud Supply Chain Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.09% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Adoption of Cloud -based Solution for Demand Management by SMEs; Increasing Growth of E - commerce Sector Has Fueled the Adoption of Technological Solutions to Retain Customers

- 3.3. Market Restrains

- 3.3.1. Increasing Security and Privacy Concerns Among Enterprises

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Demand Planning and Forecasting

- 5.1.2. Inventory and Warehouse Management

- 5.1.3. Product Life-Cycle Management

- 5.1.4. Transportation & Logistics Management

- 5.1.5. Sales and Operations Planning

- 5.1.6. Other So

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. Hybrid Cloud

- 5.2.2. Public Cloud

- 5.2.3. Private Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Large Enterprises

- 5.3.2. Small and Medium Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. Retail

- 5.4.2. Food & Beverage

- 5.4.3. Manufacturing

- 5.4.4. Automotive

- 5.4.5. Oil & Gas

- 5.4.6. Healthcare

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Demand Planning and Forecasting

- 6.1.2. Inventory and Warehouse Management

- 6.1.3. Product Life-Cycle Management

- 6.1.4. Transportation & Logistics Management

- 6.1.5. Sales and Operations Planning

- 6.1.6. Other So

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. Hybrid Cloud

- 6.2.2. Public Cloud

- 6.2.3. Private Cloud

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Large Enterprises

- 6.3.2. Small and Medium Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-user Industries

- 6.4.1. Retail

- 6.4.2. Food & Beverage

- 6.4.3. Manufacturing

- 6.4.4. Automotive

- 6.4.5. Oil & Gas

- 6.4.6. Healthcare

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Demand Planning and Forecasting

- 7.1.2. Inventory and Warehouse Management

- 7.1.3. Product Life-Cycle Management

- 7.1.4. Transportation & Logistics Management

- 7.1.5. Sales and Operations Planning

- 7.1.6. Other So

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. Hybrid Cloud

- 7.2.2. Public Cloud

- 7.2.3. Private Cloud

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Large Enterprises

- 7.3.2. Small and Medium Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-user Industries

- 7.4.1. Retail

- 7.4.2. Food & Beverage

- 7.4.3. Manufacturing

- 7.4.4. Automotive

- 7.4.5. Oil & Gas

- 7.4.6. Healthcare

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Demand Planning and Forecasting

- 8.1.2. Inventory and Warehouse Management

- 8.1.3. Product Life-Cycle Management

- 8.1.4. Transportation & Logistics Management

- 8.1.5. Sales and Operations Planning

- 8.1.6. Other So

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. Hybrid Cloud

- 8.2.2. Public Cloud

- 8.2.3. Private Cloud

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Large Enterprises

- 8.3.2. Small and Medium Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-user Industries

- 8.4.1. Retail

- 8.4.2. Food & Beverage

- 8.4.3. Manufacturing

- 8.4.4. Automotive

- 8.4.5. Oil & Gas

- 8.4.6. Healthcare

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Demand Planning and Forecasting

- 9.1.2. Inventory and Warehouse Management

- 9.1.3. Product Life-Cycle Management

- 9.1.4. Transportation & Logistics Management

- 9.1.5. Sales and Operations Planning

- 9.1.6. Other So

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. Hybrid Cloud

- 9.2.2. Public Cloud

- 9.2.3. Private Cloud

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Large Enterprises

- 9.3.2. Small and Medium Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-user Industries

- 9.4.1. Retail

- 9.4.2. Food & Beverage

- 9.4.3. Manufacturing

- 9.4.4. Automotive

- 9.4.5. Oil & Gas

- 9.4.6. Healthcare

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Demand Planning and Forecasting

- 10.1.2. Inventory and Warehouse Management

- 10.1.3. Product Life-Cycle Management

- 10.1.4. Transportation & Logistics Management

- 10.1.5. Sales and Operations Planning

- 10.1.6. Other So

- 10.2. Market Analysis, Insights and Forecast - by Deployment Type

- 10.2.1. Hybrid Cloud

- 10.2.2. Public Cloud

- 10.2.3. Private Cloud

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Large Enterprises

- 10.3.2. Small and Medium Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-user Industries

- 10.4.1. Retail

- 10.4.2. Food & Beverage

- 10.4.3. Manufacturing

- 10.4.4. Automotive

- 10.4.5. Oil & Gas

- 10.4.6. Healthcare

- 10.4.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. North America Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Logility Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Infor Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 TECSYS Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Kinaxis Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 IBM Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Manhattan Associates Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 JDA Software Group Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Descartes Systems Group Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Oracle Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 HighJump Software Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 CloudLogix Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 SAP SE

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Logility Inc

List of Figures

- Figure 1: Global Cloud Supply Chain Management Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Cloud Supply Chain Management Industry Revenue (Million), by Solution 2024 & 2032

- Figure 13: North America Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 14: North America Cloud Supply Chain Management Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 15: North America Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 16: North America Cloud Supply Chain Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 17: North America Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 18: North America Cloud Supply Chain Management Industry Revenue (Million), by End-user Industries 2024 & 2032

- Figure 19: North America Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2024 & 2032

- Figure 20: North America Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Cloud Supply Chain Management Industry Revenue (Million), by Solution 2024 & 2032

- Figure 23: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 24: Europe Cloud Supply Chain Management Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 25: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 26: Europe Cloud Supply Chain Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 27: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 28: Europe Cloud Supply Chain Management Industry Revenue (Million), by End-user Industries 2024 & 2032

- Figure 29: Europe Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2024 & 2032

- Figure 30: Europe Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Cloud Supply Chain Management Industry Revenue (Million), by Solution 2024 & 2032

- Figure 33: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 34: Asia Pacific Cloud Supply Chain Management Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 35: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 36: Asia Pacific Cloud Supply Chain Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 37: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 38: Asia Pacific Cloud Supply Chain Management Industry Revenue (Million), by End-user Industries 2024 & 2032

- Figure 39: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2024 & 2032

- Figure 40: Asia Pacific Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Cloud Supply Chain Management Industry Revenue (Million), by Solution 2024 & 2032

- Figure 43: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 44: Latin America Cloud Supply Chain Management Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 45: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 46: Latin America Cloud Supply Chain Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 47: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 48: Latin America Cloud Supply Chain Management Industry Revenue (Million), by End-user Industries 2024 & 2032

- Figure 49: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2024 & 2032

- Figure 50: Latin America Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Cloud Supply Chain Management Industry Revenue (Million), by Solution 2024 & 2032

- Figure 53: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 54: Middle East and Africa Cloud Supply Chain Management Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 55: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 56: Middle East and Africa Cloud Supply Chain Management Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 57: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 58: Middle East and Africa Cloud Supply Chain Management Industry Revenue (Million), by End-user Industries 2024 & 2032

- Figure 59: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2024 & 2032

- Figure 60: Middle East and Africa Cloud Supply Chain Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 3: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 4: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 5: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 6: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Cloud Supply Chain Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Cloud Supply Chain Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Cloud Supply Chain Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Cloud Supply Chain Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Cloud Supply Chain Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 18: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 19: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 20: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 21: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 23: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 24: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 25: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 26: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 28: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 29: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 30: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 31: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 33: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 34: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 35: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 36: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 38: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 39: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 40: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 41: Global Cloud Supply Chain Management Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Supply Chain Management Industry?

The projected CAGR is approximately 11.09%.

2. Which companies are prominent players in the Cloud Supply Chain Management Industry?

Key companies in the market include Logility Inc, Infor Inc, TECSYS Inc, Kinaxis Inc, IBM Corporation, Manhattan Associates Inc, JDA Software Group Inc, Descartes Systems Group Inc, Oracle Corporation, HighJump Software Inc, CloudLogix Inc, SAP SE.

3. What are the main segments of the Cloud Supply Chain Management Industry?

The market segments include Solution, Deployment Type, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption of Cloud -based Solution for Demand Management by SMEs; Increasing Growth of E - commerce Sector Has Fueled the Adoption of Technological Solutions to Retain Customers.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Security and Privacy Concerns Among Enterprises.

8. Can you provide examples of recent developments in the market?

In June 2022 - XPO Logistics, based in Connecticut, collaborated with Google Cloud to improve how commodities flow through supply chains. In a multi-year partnership, XPO will make use of Google Cloud's artificial intelligence (AI), machine learning (ML), and data analytics capabilities to create supply chains that are quicker, more effective, and more visible.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Supply Chain Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Supply Chain Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Supply Chain Management Industry?

To stay informed about further developments, trends, and reports in the Cloud Supply Chain Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence