Key Insights

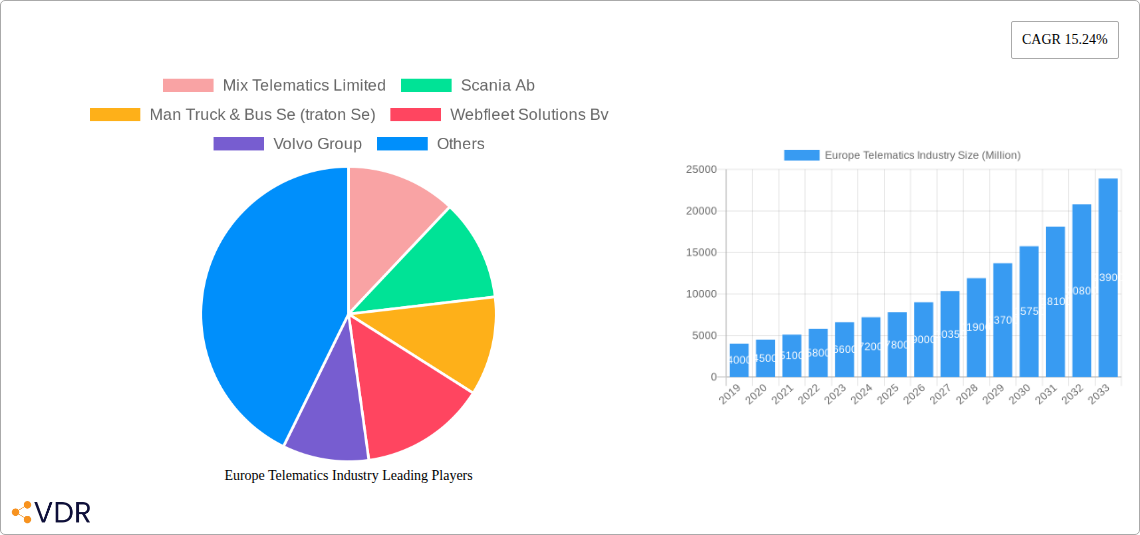

The European telematics market is projected for substantial growth, anticipated to reach 49.77 million units by 2025, with a Compound Annual Growth Rate (CAGR) of 15.24% through 2033. This expansion is driven by the increasing adoption of connected vehicle technologies for enhanced fleet efficiency, improved safety, and regulatory compliance. Key drivers include demand for real-time vehicle tracking, driver behavior monitoring, and predictive maintenance across commercial fleets. Sustainability initiatives and the need to reduce operational costs are also pushing investments in telematics for fuel optimization and route planning. Supportive government initiatives promoting transport digitalization and a strong presence of leading telematics providers foster innovation and competitive pricing.

Europe Telematics Industry Market Size (In Million)

The market encompasses production, consumption, import/export analysis, and price trends. Leading telematics players such as Volvo Group, Verizon Communications Inc., and Webfleet Solutions BV are actively shaping the market through product development and strategic partnerships. Emerging trends include the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) for advanced data analytics. Potential restraints involve data privacy concerns and initial implementation costs for smaller enterprises, but long-term operational savings and enhanced fleet management are expected to drive positive market trajectory.

Europe Telematics Industry Company Market Share

This report provides a definitive analysis of the Europe Telematics Industry, examining market dynamics, growth trajectories, regional dominance, product landscape, and key players. Leveraging high-traffic keywords like "fleet management solutions," "vehicle tracking," "asset tracking," "connected vehicles," and "IoT in transportation," this report is meticulously crafted for search engine visibility. We delve into both parent and child market segments, offering a holistic view of market penetration and future potential. All values are presented in million.

Europe Telematics Industry Market Dynamics & Structure

The Europe Telematics Industry is characterized by a moderately concentrated market, driven by increasing adoption of connected vehicle technologies and a growing demand for enhanced fleet efficiency and safety. Key innovation drivers include advancements in IoT, AI, and cloud computing, enabling sophisticated data analytics for operational optimization. Regulatory frameworks, such as GDPR and evolving emissions standards, also shape market strategies, pushing for data security and sustainability. Competitive product substitutes are emerging, particularly in the form of integrated OEM telematics solutions, intensifying competition for aftermarket providers. End-user demographics are diverse, spanning logistics, transportation, construction, and public services, each with specific telematics requirements. Mergers and acquisitions (M&A) trends are prominent as larger players consolidate to expand their service offerings and geographical reach.

- Market Concentration: A blend of established global providers and specialized regional players, with a trend towards consolidation.

- Technological Innovation Drivers: AI-powered predictive maintenance, real-time data analytics, and enhanced driver behavior monitoring.

- Regulatory Frameworks: Strict data privacy regulations (GDPR) and an increasing focus on environmental compliance.

- Competitive Product Substitutes: Integrated OEM telematics systems and burgeoning in-vehicle infotainment with connectivity features.

- End-User Demographics: Primarily fleet operators in logistics, construction, public transport, and field service industries.

- M&A Trends: Strategic acquisitions aimed at expanding service portfolios, acquiring technological capabilities, and gaining market share. For instance, recent M&A activity has seen significant consolidation in the fleet management software domain.

Europe Telematics Industry Growth Trends & Insights

The Europe Telematics Industry is poised for substantial growth, projected to reach XX Million units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is underpinned by the continuous evolution of market size, driven by increasing vehicle parc and a heightened awareness of the tangible benefits of telematics solutions. Adoption rates for advanced fleet management solutions are accelerating across various sectors, fueled by the demonstrable return on investment in terms of fuel efficiency, reduced operational costs, and improved driver safety. Technological disruptions, including the widespread deployment of 5G networks, are enabling real-time data transmission and processing, leading to more sophisticated applications like predictive maintenance and advanced route optimization. Consumer behavior shifts are also playing a crucial role, with businesses increasingly prioritizing data-driven decision-making and sustainable operational practices. The penetration of vehicle tracking systems and asset tracking solutions is deepening, moving beyond basic location services to comprehensive fleet intelligence platforms. The integration of the Internet of Things (IoT) in transportation is further catalyzing this growth, creating a more interconnected and efficient ecosystem.

Dominant Regions, Countries, or Segments in Europe Telematics Industry

The Europe Telematics Industry witnesses significant regional disparities in production and consumption, with Western Europe, particularly Germany, emerging as a dominant force across various market analyses.

- Production Analysis: Germany leads in the manufacturing and development of advanced telematics hardware and software solutions, driven by its strong automotive industry and commitment to technological innovation. The region benefits from a robust R&D infrastructure and a skilled workforce.

- Consumption Analysis: Germany, followed closely by the United Kingdom and France, exhibits the highest consumption of telematics solutions. This is attributed to a large commercial vehicle parc, stringent safety regulations, and a proactive approach to adopting efficiency-enhancing technologies in logistics and transportation. The demand for connected vehicles and comprehensive fleet management platforms is particularly high in these countries.

- Import Market Analysis (Value & Volume): While there is significant intra-European trade, countries with substantial manufacturing bases like Germany also act as key importers of specialized components and advanced software modules, especially from North America and Asia. The Benelux region often serves as a crucial hub for the import and distribution of telematics devices due to its strategic port infrastructure.

- Export Market Analysis (Value & Volume): European manufacturers, particularly those from Germany, the UK, and Sweden, are significant exporters of telematics solutions to other global markets. The established reputation for quality and innovation in these countries fuels international demand for vehicle tracking systems and fleet management software.

- Price Trend Analysis: The price of telematics solutions in Europe is influenced by factors such as technological sophistication, subscription models, and market competition. While hardware costs have generally stabilized or decreased due to mass production, the value of advanced software features and data analytics continues to rise, indicating a trend towards value-based pricing for comprehensive solutions. The ongoing push for sustainability and efficiency is also driving demand for higher-value, feature-rich telematics packages.

Europe Telematics Industry Product Landscape

The Europe Telematics Industry product landscape is characterized by a sophisticated array of solutions designed to enhance fleet management, driver safety, and operational efficiency. Innovations focus on real-time data acquisition and analysis, enabling features like advanced driver assistance systems (ADAS) integration, predictive maintenance alerts, and optimized route planning. Applications span across commercial vehicle fleets, passenger cars for fleet services, and specialized industrial equipment. Key performance metrics include improved fuel economy, reduced downtime, enhanced driver safety scores, and streamlined compliance reporting. Unique selling propositions often revolve around seamless integration with existing enterprise systems, AI-powered insights, and robust data security. Technological advancements in miniaturization of hardware, enhanced sensor capabilities, and sophisticated software algorithms are continuously pushing the boundaries of what telematics can achieve.

Key Drivers, Barriers & Challenges in Europe Telematics Industry

Key Drivers:

- Cost Reduction & Efficiency Gains: The primary driver for telematics adoption remains the significant potential for fuel savings, reduced maintenance costs, and optimized route planning.

- Enhanced Safety & Compliance: Stringent safety regulations and a growing emphasis on driver well-being are pushing fleets to adopt telematics for monitoring driver behavior and ensuring compliance with driving hour regulations.

- Technological Advancements: The proliferation of IoT, 5G connectivity, and AI fuels the development of more sophisticated and valuable telematics features.

- Growing Demand for Data-Driven Insights: Businesses are increasingly leveraging telematics data for strategic decision-making, performance analysis, and operational optimization.

- Sustainability Initiatives: Telematics solutions aid in monitoring and reducing emissions, aligning with corporate sustainability goals and government mandates.

Barriers & Challenges:

- Initial Investment Costs: While the ROI is clear, the upfront cost of hardware and software implementation can be a barrier for smaller businesses.

- Data Privacy Concerns: Strict GDPR regulations require careful management of driver and vehicle data, posing compliance challenges.

- Integration Complexity: Integrating telematics systems with existing legacy IT infrastructure can be complex and time-consuming.

- Cybersecurity Threats: The increasing reliance on connected systems makes fleets vulnerable to cyberattacks, necessitating robust security measures.

- Resistance to Change: Some fleet managers and drivers may exhibit resistance to adopting new technologies due to concerns about surveillance or perceived complexity.

Emerging Opportunities in Europe Telematics Industry

Emerging opportunities in the Europe Telematics Industry are driven by evolving technological landscapes and shifting market demands. The burgeoning field of Electric Vehicle (EV) telematics presents a significant growth area, focusing on battery management, charging infrastructure integration, and optimized route planning for EVs. The increasing adoption of AI and machine learning in telematics is creating opportunities for predictive analytics in areas such as predictive maintenance and fraud detection. Furthermore, the integration of telematics with smart city initiatives offers potential for optimizing urban logistics and traffic management. The demand for specialized asset tracking solutions beyond vehicles, such as for trailers, equipment, and even cargo, is also expanding. Finally, the development of API-driven platforms that allow seamless integration with a wider ecosystem of business applications is creating new avenues for value creation and market penetration.

Growth Accelerators in the Europe Telematics Industry Industry

Several key catalysts are accelerating the growth of the Europe Telematics Industry. Technological breakthroughs in sensor technology and connectivity, particularly the widespread rollout of 5G, are enabling more real-time and data-rich telematics services. Strategic partnerships between telematics providers, OEMs, and other technology companies are expanding service offerings and market reach, as seen in the integration of telematics with existing OEM hardware. Market expansion strategies, including focusing on underserved segments like small and medium-sized enterprises (SMEs) with tailored, cost-effective solutions, are also driving adoption. The increasing regulatory push towards greener transportation and enhanced safety standards further acts as a significant growth accelerator, compelling businesses to invest in advanced telematics for compliance and efficiency. The growing understanding of the financial and operational benefits derived from comprehensive data analytics is fostering a culture of proactive investment in telematics across diverse industries.

Key Players Shaping the Europe Telematics Industry Market

- Mix Telematics Limited

- Scania Ab

- Man Truck & Bus Se (traton Se)

- Webfleet Solutions Bv

- Volvo Group

- Verizon Communications Inc

- Targa Telematics Spa

- Masternaut Limited

- Abax Uk Ltd

- Daf Trucks Nv (paccar Inc )

- Mercedes-benz Group Ag (daimler Ag)

- Gurtam Inc

Notable Milestones in Europe Telematics Industry Sector

- May 2023: Webfleet announced a strategic partnership with RIO, a digital service provider, to provide integrated fleet management solutions for MAN trucks with the existing OEM hardware, RIO Box, from MAN. Through this partnership, both companies aim to provide customers with easy access to advanced telematics solutions and the possibility to work with leading fleet management applications independent of pre-installed hardware and mixed fleets.

- May 2023: Targa Telematics announced to work with Service Vill, a chauffeur-driven car rental company, to monitor its fleet, which consists of several models of high-end and luxury cars used to provide tailored and reliable logistics services to its customers. Targa will help Service Vill monitor and manage the fleet and achieve its three main objectives: increased operational efficiency, greater control of costs, and improved safety for drivers and vehicles.

In-Depth Europe Telematics Industry Market Outlook

The outlook for the Europe Telematics Industry remains exceptionally strong, driven by the convergence of technological advancements and increasing market demand for intelligent transportation solutions. Growth accelerators such as the widespread adoption of IoT, the expansion of 5G infrastructure, and sophisticated AI-powered analytics are paving the way for innovative applications in areas like predictive maintenance, autonomous driving support, and enhanced supply chain visibility. Strategic partnerships between established players and emerging technology firms are continuously broadening the scope of services and driving market penetration. The inherent value proposition of telematics in achieving significant cost savings, improving operational efficiency, and ensuring compliance with evolving environmental and safety regulations positions the industry for sustained high growth. Future market potential will be further unlocked by addressing the specific needs of segments like electric vehicle fleets and by developing more integrated and user-friendly platforms that offer comprehensive data insights for informed business decision-making.

Europe Telematics Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Telematics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

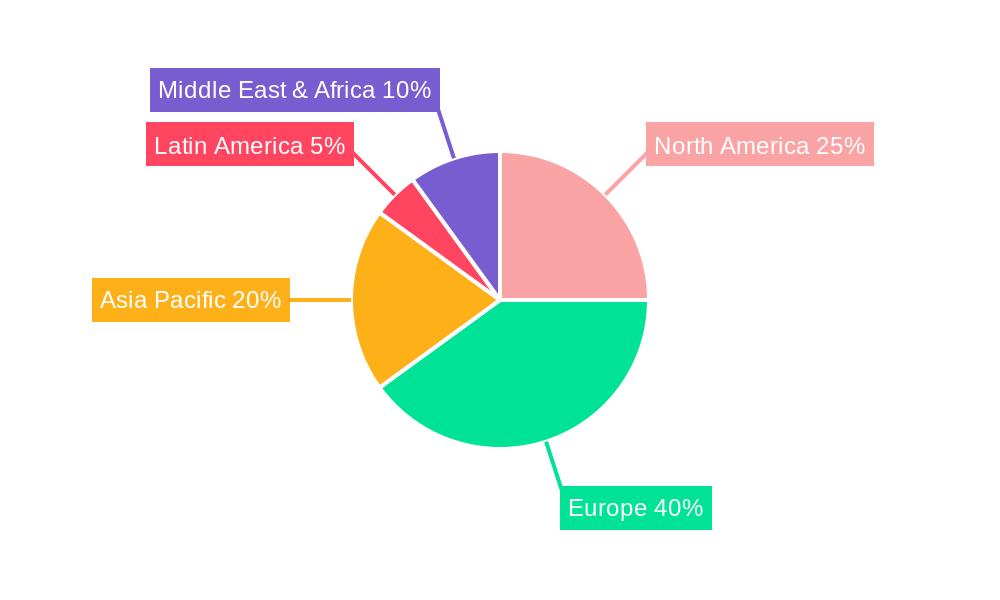

Europe Telematics Industry Regional Market Share

Geographic Coverage of Europe Telematics Industry

Europe Telematics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in EU Regulations and Local Policy Rules; Advancements Such as Route Calculation

- 3.2.2 Vehicle Tracking

- 3.2.3 and Fuel Pilferage

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Passenger Vehicles to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mix Telematics Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Scania Ab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Man Truck & Bus Se (traton Se)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Webfleet Solutions Bv

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volvo Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Verizon Communications Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Targa Telematics Spa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Masternaut Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abax Uk Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daf Trucks Nv (paccar Inc )*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mercedes-benz Group Ag (daimler Ag)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gurtam Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Mix Telematics Limited

List of Figures

- Figure 1: Europe Telematics Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Telematics Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Telematics Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Telematics Industry Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 3: Europe Telematics Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Europe Telematics Industry Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Europe Telematics Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Europe Telematics Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Europe Telematics Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Europe Telematics Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Europe Telematics Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Europe Telematics Industry Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Europe Telematics Industry Revenue million Forecast, by Region 2020 & 2033

- Table 12: Europe Telematics Industry Volume Million Forecast, by Region 2020 & 2033

- Table 13: Europe Telematics Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 14: Europe Telematics Industry Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 15: Europe Telematics Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Europe Telematics Industry Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Europe Telematics Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Europe Telematics Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Europe Telematics Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Europe Telematics Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Europe Telematics Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Europe Telematics Industry Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Europe Telematics Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Telematics Industry Volume Million Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Germany Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Germany Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: France Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: France Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Italy Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Italy Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Spain Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Spain Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Netherlands Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Netherlands Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Belgium Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Belgium Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 39: Sweden Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Sweden Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 41: Norway Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Norway Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: Poland Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Poland Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Denmark Europe Telematics Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Denmark Europe Telematics Industry Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Telematics Industry?

The projected CAGR is approximately 15.24%.

2. Which companies are prominent players in the Europe Telematics Industry?

Key companies in the market include Mix Telematics Limited, Scania Ab, Man Truck & Bus Se (traton Se), Webfleet Solutions Bv, Volvo Group, Verizon Communications Inc, Targa Telematics Spa, Masternaut Limited, Abax Uk Ltd, Daf Trucks Nv (paccar Inc )*List Not Exhaustive, Mercedes-benz Group Ag (daimler Ag), Gurtam Inc.

3. What are the main segments of the Europe Telematics Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.77 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in EU Regulations and Local Policy Rules; Advancements Such as Route Calculation. Vehicle Tracking. and Fuel Pilferage.

6. What are the notable trends driving market growth?

Passenger Vehicles to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

May 2023: Webfleet announced a strategic partnership with RIO, a digital service provider, to provide integrated fleet management solutions for MAN trucks with the existing OEM hardware, RIO Box, from MAN. Through this partnership, both companies aim to provide customers with easy access to advanced telematics solutions and the possibility to work with leading fleet management applications independent of pre-installed hardware and mixed fleets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Telematics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Telematics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Telematics Industry?

To stay informed about further developments, trends, and reports in the Europe Telematics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence