Key Insights

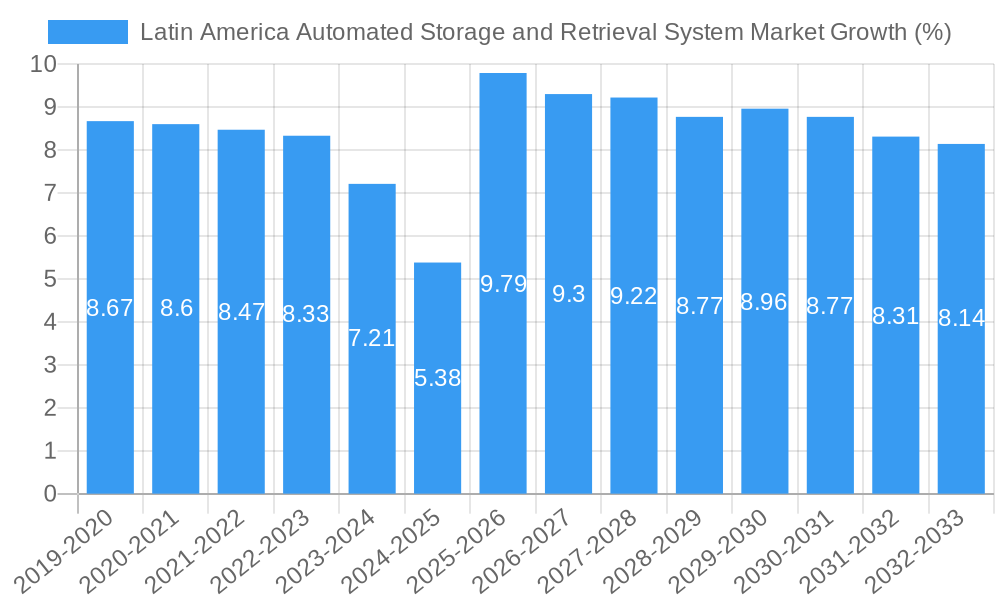

The Latin America Automated Storage and Retrieval System (AS/RS) market is poised for significant expansion, with an estimated market size of $2,350 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 9.88% through 2033. This robust growth is propelled by a confluence of factors, including increasing demand for operational efficiency and labor cost optimization across key industries. The automotive sector, driven by the need for streamlined production lines and just-in-time inventory management, is a major contributor. Similarly, the burgeoning e-commerce sector, particularly within retail and post and parcel logistics, is necessitating faster fulfillment and enhanced warehousing capabilities, making AS/RS solutions indispensable. Furthermore, the food and beverage industry is leveraging AS/RS for improved traceability, hygiene standards, and temperature-controlled storage. The general manufacturing segment also benefits from the space-saving and productivity gains offered by automated systems.

Key growth drivers for the Latin America AS/RS market include the escalating adoption of Industry 4.0 technologies, an increasing focus on supply chain resilience, and government initiatives promoting automation and digital transformation. Fixed aisle systems are expected to maintain a significant market share due to their proven reliability and scalability. However, innovative solutions like vertical lift modules and carousels (both horizontal and vertical) are gaining traction, especially in urban areas with limited warehouse space, offering high-density storage and rapid retrieval. Restraints, such as the high initial investment cost and the need for skilled personnel for implementation and maintenance, are being addressed by the growing availability of financing options and the development of user-friendly AS/RS technologies. The market's trajectory indicates a strong shift towards intelligent automation, with a particular emphasis on creating more agile and responsive supply chains across Latin America.

Latin America Automated Storage and Retrieval System Market: Navigating Growth & Innovation (2019-2033)

Unlock the future of logistics and material handling in Latin America. This comprehensive report delves into the dynamic Latin America Automated Storage and Retrieval System (AS/RS) Market, offering an in-depth analysis of its structure, growth trajectory, and key players from 2019 to 2033. Explore critical trends, identify dominant segments, and understand the forces shaping this rapidly evolving industry. With a base year of 2025, this report provides actionable insights for stakeholders seeking to capitalize on the burgeoning demand for efficient and automated warehousing solutions across the region.

Latin America Automated Storage and Retrieval System Market Market Dynamics & Structure

The Latin America Automated Storage and Retrieval System (AS/RS) Market is characterized by a moderately concentrated landscape, with key global players establishing a strong presence alongside emerging regional specialists. Technological innovation serves as a primary driver, fueled by the escalating need for enhanced operational efficiency, reduced labor costs, and improved inventory accuracy. The adoption of Artificial Intelligence (AI) and the Internet of Things (IoT) in AS/RS solutions is a significant innovation driver, enabling predictive maintenance, real-time data analytics, and optimized throughput. Regulatory frameworks are gradually evolving, with a growing emphasis on workplace safety and efficiency standards indirectly supporting AS/RS adoption. Competitive product substitutes include traditional manual storage systems and semi-automated solutions, but the superior throughput, space utilization, and error reduction offered by AS/RS are increasingly outweighing these alternatives. End-user demographics are shifting towards industries with higher inventory volumes and a critical need for rapid order fulfillment, such as e-commerce and food & beverage.

- Market Concentration: Dominated by a few large international AS/RS providers and a growing number of specialized local integrators.

- Technological Innovation Drivers: Demand for increased automation, labor cost reduction, supply chain visibility, and e-commerce growth.

- Regulatory Frameworks: Evolving safety standards and efficiency mandates indirectly favor automated solutions.

- Competitive Product Substitutes: Traditional racking, manual forklifts, and semi-automated picking systems.

- End-User Demographics: Growing adoption in retail, e-commerce fulfillment, automotive, and food & beverage sectors.

- M&A Trends: Limited but growing, with potential for consolidation as market leaders seek to expand their regional footprint and technological capabilities. Acquisitions are often focused on gaining local market access or acquiring specific technological expertise.

Latin America Automated Storage and Retrieval System Market Growth Trends & Insights

The Latin America Automated Storage and Retrieval System (AS/RS) Market is poised for significant expansion, driven by a confluence of factors including the relentless pursuit of operational efficiency and the transformative impact of digitalization across industries. The market size, estimated at XXX million units in 2025, is projected to witness a robust Compound Annual Growth Rate (CAGR) of xx% over the forecast period (2025-2033). This accelerated growth is underpinned by a substantial increase in AS/RS adoption rates, particularly within sectors experiencing explosive e-commerce growth and those with stringent quality control and traceability requirements, such as the food and beverage industry. Technological disruptions, including advancements in robotics, AI-powered control systems, and enhanced sensor technology, are continuously enhancing AS/RS capabilities, enabling greater precision, speed, and flexibility. These innovations are not merely incremental; they represent a paradigm shift in how businesses manage their inventory and streamline their logistics operations.

Consumer behavior shifts, particularly the demand for faster delivery times and a wider product selection, are compelling businesses to invest in more sophisticated warehousing solutions. AS/RS directly addresses these demands by enabling higher storage density, faster retrieval times, and a significant reduction in order fulfillment errors. The "Retail" segment, including both brick-and-mortar retailers expanding their online presence and pure-play e-commerce giants, is a primary beneficiary and driver of this trend. Furthermore, the "Automotive" sector's need for just-in-time inventory management and the "Food and Beverage" industry's requirements for precise temperature control and rapid product rotation are significant contributors to AS/RS market penetration. The "Post and Parcel" industry is also a key adopter, driven by the sheer volume of packages requiring efficient sorting and dispatch. The ongoing digital transformation within manufacturing plants across Latin America, often referred to as Industry 4.0, is also creating a fertile ground for AS/RS integration, leading to smarter factories and more resilient supply chains.

The increasing focus on sustainability and energy efficiency within businesses is another crucial factor. Modern AS/RS solutions are designed with energy conservation in mind, utilizing efficient motors and intelligent control systems that can significantly reduce power consumption compared to traditional manual operations. This aligns with corporate social responsibility goals and can lead to substantial operational cost savings. Moreover, the growing scarcity and rising cost of skilled labor in various Latin American countries are compelling organizations to explore automation as a viable and long-term solution for their material handling needs. The return on investment (ROI) for AS/RS, once a significant barrier for smaller enterprises, is becoming more accessible due to technological advancements, economies of scale in manufacturing, and flexible financing options. This wider accessibility is democratizing advanced automation, allowing a broader spectrum of businesses to benefit from its advantages. The inherent scalability of AS/RS solutions also appeals to businesses with fluctuating demand, allowing them to adapt their storage and retrieval capacity without significant disruptions.

Dominant Regions, Countries, or Segments in Latin America Automated Storage and Retrieval System Market

The Latin America Automated Storage and Retrieval System (AS/RS) Market's growth is multifaceted, with several segments and geographical regions exhibiting notable dominance. Within the Product Type segment, Fixed Aisle Systems currently lead the market due to their established reliability, cost-effectiveness for large-scale operations, and suitability for high-density storage requirements. These systems, often comprising high-bay storage structures with automated cranes or stacker cranes, are particularly prevalent in large distribution centers and manufacturing facilities. However, there's a discernible upward trend in the adoption of Vertical Lift Modules (VLMs) and Carousels (Horizontal and Vertical), especially in sectors requiring compact storage solutions for smaller, high-value items or for space-constrained facilities. The retail and automotive industries are increasingly leveraging VLMs for component storage and kitting operations, while the food and beverage sector benefits from carousels for their ability to maintain product freshness and facilitate first-in, first-out (FIFO) inventory management.

Geographically, Brazil and Mexico are emerging as the dominant countries in the Latin American AS/RS market. Brazil's large industrial base, booming e-commerce sector, and significant investments in logistics infrastructure make it a prime market. The country's robust automotive, food and beverage, and retail industries are all substantial adopters of AS/RS technology. Mexico, benefiting from its proximity to the United States and its role as a manufacturing hub, is experiencing similar growth, particularly in the automotive and general manufacturing sectors. Investments in modernizing warehouses and distribution centers to meet international standards are driving AS/RS demand.

Among the End-User Industries, the Retail sector, encompassing both traditional retail and the rapidly expanding e-commerce segment, is the most significant driver of AS/RS adoption. The need for efficient order picking, inventory management, and same-day or next-day delivery necessitates automated solutions. The Automotive industry also represents a substantial market share, driven by the demand for just-in-time (JIT) inventory, efficient component kitting, and the automation of sub-assembly processes. The Food and Beverage industry is a critical and growing segment, demanding AS/RS for maintaining product integrity, temperature control, high throughput for perishable goods, and strict traceability requirements. The Post and Parcel industry is also a major contributor, with automated sorting and retrieval systems crucial for handling the ever-increasing volume of shipments.

- Dominant Product Type: Fixed Aisle Systems, driven by their suitability for high-density storage and large-scale operations.

- Growing Segments: Vertical Lift Modules (VLMs) and Carousels are gaining traction for space-saving and specialized applications.

- Leading Countries: Brazil and Mexico are at the forefront due to their strong industrial bases, e-commerce growth, and logistics investments.

- Key End-User Industries: Retail (especially e-commerce), Automotive, Food and Beverage, and Post and Parcel are the primary demand generators.

- Drivers of Dominance:

- Economic Policies: Government initiatives promoting industrial modernization and logistics efficiency.

- Infrastructure Development: Investments in ports, roads, and warehousing facilities.

- E-commerce Boom: Exponential growth in online retail driving demand for efficient fulfillment centers.

- Labor Costs and Availability: Increasing labor expenses and shortages encouraging automation.

- Technological Adoption: Growing awareness and acceptance of advanced automation technologies.

- Supply Chain Resilience: Need for more robust and flexible supply chains in the face of global disruptions.

Latin America Automated Storage and Retrieval System Market Product Landscape

The Latin America Automated Storage and Retrieval System (AS/RS) market is witnessing a surge in innovative product developments designed to enhance efficiency, flexibility, and integration capabilities. Fixed Aisle Systems continue to evolve with sleeker, more agile stacker cranes and advanced control software for optimized traffic management. Carousel systems are seeing advancements in speed, load capacity, and temperature-controlled variants for specialized food and beverage applications. Vertical Lift Modules (VLMs) are becoming more compact and modular, offering tailored solutions for diverse inventory needs and space constraints. The integration of AI and machine learning is a key technological advancement, enabling predictive maintenance, real-time operational adjustments, and intelligent inventory tracking across all AS/RS types. These product innovations are directly addressing the industry's need for higher throughput, reduced operational costs, and improved order accuracy.

Key Drivers, Barriers & Challenges in Latin America Automated Storage and Retrieval System Market

Key Drivers:

The Latin America AS/RS market is propelled by several critical drivers. The escalating demand for e-commerce fulfillment is a paramount force, necessitating faster order processing and higher inventory throughput. Rising labor costs and a shortage of skilled warehouse personnel are compelling businesses to invest in automation for efficiency and reliability. Technological advancements in robotics, AI, and IoT are making AS/RS solutions more intelligent, adaptable, and cost-effective. Furthermore, the drive for enhanced operational efficiency, space optimization, and reduced errors across industries like automotive, food and beverage, and general manufacturing are significant catalysts. Growing government support for industrial automation and modernization also plays a crucial role.

Barriers & Challenges:

Despite the robust growth, several barriers and challenges impede market expansion. The high initial investment cost remains a significant hurdle, particularly for Small and Medium-sized Enterprises (SMEs) in developing economies within the region. Lack of skilled technical personnel for installation, maintenance, and operation of complex AS/RS systems poses a challenge. Inadequate existing infrastructure in some areas can limit the feasibility of large-scale AS/RS deployments. Resistance to change and inertia from traditional operational practices can slow down adoption. Cybersecurity concerns associated with interconnected automated systems are also a growing consideration. Supply chain disruptions and geopolitical instability can impact the availability of components and the overall project timelines.

Emerging Opportunities in Latin America Automated Storage and Retrieval System Market

Emerging opportunities in the Latin America AS/RS market are ripe for exploration. The burgeoning micro-fulfillment center (MFC) trend presents a significant avenue for smaller, more agile AS/RS solutions to serve urban areas and meet last-mile delivery demands. The increasing focus on sustainability and green logistics is creating opportunities for AS/RS providers to offer energy-efficient solutions and systems that minimize waste. The pharmaceutical and healthcare sectors, with their stringent requirements for temperature control, traceability, and sterile environments, represent a largely untapped market for specialized AS/RS. Furthermore, the expansion of automation into smaller enterprises through modular and scalable AS/RS offerings, potentially bundled with flexible financing or as-a-service models, can unlock significant growth potential.

Growth Accelerators in the Latin America Automated Storage and Retrieval System Market Industry

Several key catalysts are accelerating growth within the Latin America AS/RS industry. The ongoing digital transformation and adoption of Industry 4.0 principles across manufacturing and logistics sectors are creating a natural integration path for AS/RS. Strategic partnerships between AS/RS providers and technology firms are leading to the development of more integrated and intelligent solutions, such as AI-powered inventory management and predictive analytics. Market expansion strategies by leading players, including establishing local support and service centers, are crucial for overcoming adoption barriers and building customer trust. The increasing emphasis on supply chain resilience in the wake of global disruptions is also pushing businesses to invest in automated systems that offer greater control and visibility.

Key Players Shaping the Latin America Automated Storage and Retrieval System Market Market

- Flex Inc

- Murata Machinery Ltd

- Hanel Storage Systems

- Schaefer Systems International Pvt Ltd

- Automation Logistics Corporation

- Kubo systems

- KION GROUP AG

- KNAPP AG

- Beumer Group

- Bastian Solutions LLC

Notable Milestones in Latin America Automated Storage and Retrieval System Market Sector

- March 2020: BEUMER Group presented a new compact cross-belt sorter named BG Sorter Compact CB, which is more flexible with a tight footprint. This newly developed system from the sortation and distribution technology range optimizes performance and product life-cycle costs. This is ensured by the intelligent software and the possibility of data analysis. The sorter is easy to integrate and operates with low energy consumption and high precision.

In-Depth Latin America Automated Storage and Retrieval System Market Market Outlook

The future outlook for the Latin America Automated Storage and Retrieval System (AS/RS) Market is exceptionally promising. Continued advancements in AI, robotics, and IoT will drive the development of more sophisticated and adaptable AS/RS solutions, further enhancing efficiency and reducing operational costs. The growing e-commerce penetration across the region will remain a primary growth accelerator, necessitating sophisticated fulfillment infrastructure. Strategic investments in logistics and industrial automation by governments and private enterprises will create a conducive environment for AS/RS adoption. Opportunities lie in catering to the specific needs of burgeoning sectors like pharmaceuticals and the expansion of automation into SMEs through scalable and cost-effective solutions. The increasing focus on supply chain resilience and sustainability will further solidify the value proposition of AS/RS, making it an indispensable component of modern warehousing and logistics operations in Latin America.

Latin America Automated Storage and Retrieval System Market Segmentation

-

1. Product Type

- 1.1. Fixed Aisle System

- 1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 1.3. Vertical Lift Module

-

2. End-User Industries

- 2.1. Airports

- 2.2. Automotive

- 2.3. Food and Beverage

- 2.4. General Manufacturing

- 2.5. Post and Parcel

- 2.6. Retail

- 2.7. Other End-user Industries

Latin America Automated Storage and Retrieval System Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Automated Storage and Retrieval System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs

- 3.3. Market Restrains

- 3.3.1. Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Automated Storage and Retrieval System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fixed Aisle System

- 5.1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.1.3. Vertical Lift Module

- 5.2. Market Analysis, Insights and Forecast - by End-User Industries

- 5.2.1. Airports

- 5.2.2. Automotive

- 5.2.3. Food and Beverage

- 5.2.4. General Manufacturing

- 5.2.5. Post and Parcel

- 5.2.6. Retail

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil Latin America Automated Storage and Retrieval System Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Automated Storage and Retrieval System Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Automated Storage and Retrieval System Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Automated Storage and Retrieval System Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Automated Storage and Retrieval System Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Automated Storage and Retrieval System Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Flex Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Murata Machinery Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Hanel Storage Systems

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Schaefer Systems International Pvt Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Automation Logistics Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kubo systems

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 KION GROUP AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 KNAPP AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Beumer Group*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Bastian Solutions LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Flex Inc

List of Figures

- Figure 1: Latin America Automated Storage and Retrieval System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Automated Storage and Retrieval System Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by End-User Industries 2019 & 2032

- Table 4: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by End-User Industries 2019 & 2032

- Table 14: Latin America Automated Storage and Retrieval System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Automated Storage and Retrieval System Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Automated Storage and Retrieval System Market?

The projected CAGR is approximately 9.88%.

2. Which companies are prominent players in the Latin America Automated Storage and Retrieval System Market?

Key companies in the market include Flex Inc, Murata Machinery Ltd, Hanel Storage Systems, Schaefer Systems International Pvt Ltd, Automation Logistics Corporation, Kubo systems, KION GROUP AG, KNAPP AG, Beumer Group*List Not Exhaustive, Bastian Solutions LLC.

3. What are the main segments of the Latin America Automated Storage and Retrieval System Market?

The market segments include Product Type, End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs.

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Need for Skilled Workforce and Concerns over Replacement of Manual Labor.

8. Can you provide examples of recent developments in the market?

March 2020 - BEUMER Group presented a new compact cross-belt sorter named BG Sorter Compact CB, which is more flexible with a tight footprint. This newly developed system from the sortation and distribution technology range optimizes performance and product life-cycle costs. This is ensured by the intelligent software and the possibility of data analysis. The sorter is easy to integrate and operates with low energy consumption and high precision.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Automated Storage and Retrieval System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Automated Storage and Retrieval System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Automated Storage and Retrieval System Market?

To stay informed about further developments, trends, and reports in the Latin America Automated Storage and Retrieval System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence