Key Insights

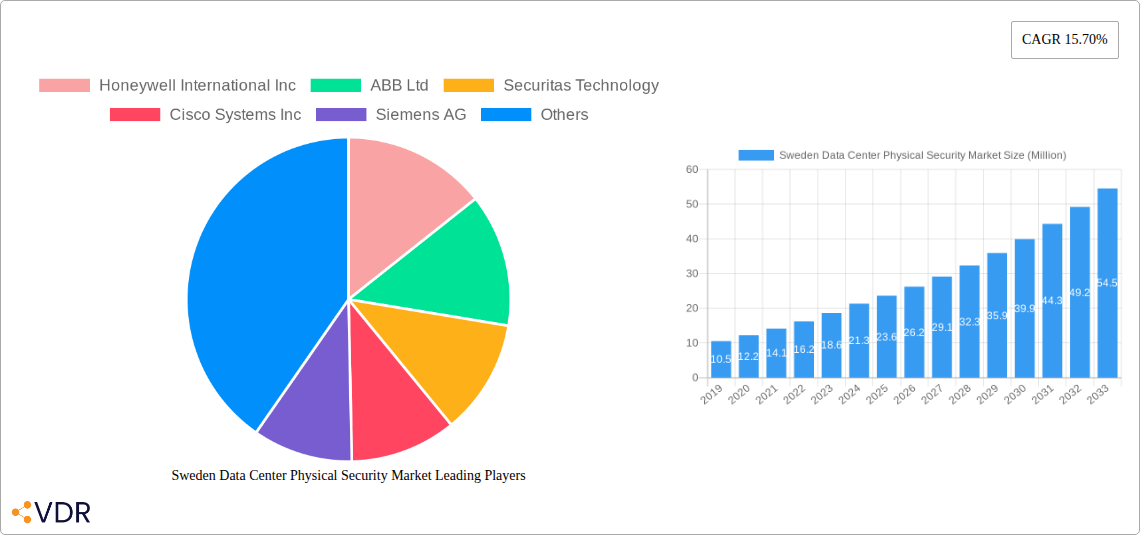

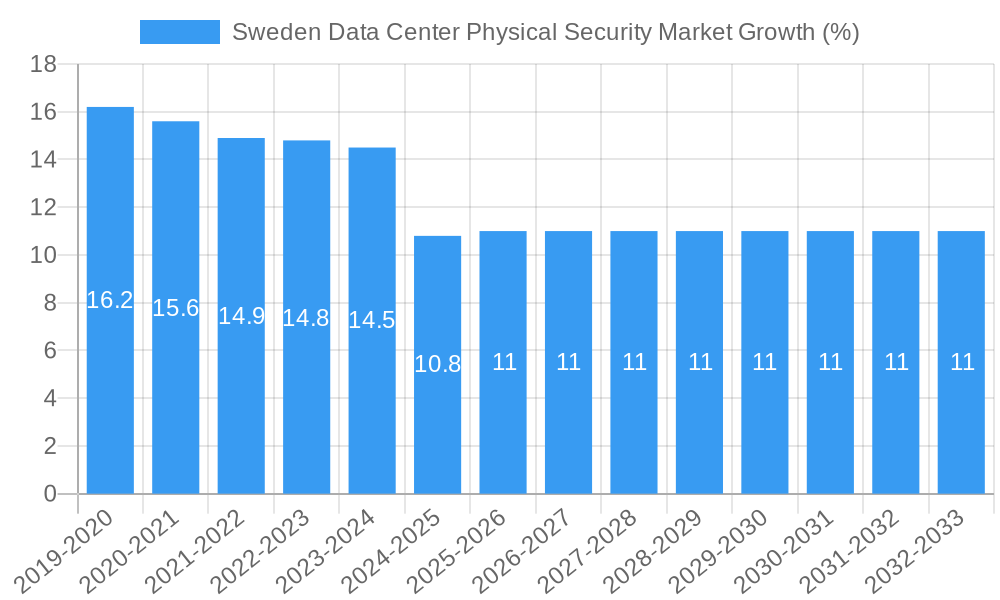

The Sweden Data Center Physical Security Market is poised for significant expansion, projected to reach a substantial valuation of approximately USD 23.60 million by 2025, and continuing its robust growth trajectory with a Compound Annual Growth Rate (CAGR) of 15.70% through 2033. This impressive expansion is primarily fueled by the escalating demand for secure and reliable data storage infrastructure, driven by the relentless digitization of businesses across all sectors, including IT & Telecommunication, BFSI, Government, and Healthcare. As Sweden solidifies its position as a hub for data processing and storage, the imperative for advanced physical security measures becomes paramount. Key growth drivers include the increasing complexity of cyber threats that necessitate multi-layered physical defenses, the ongoing need for compliance with stringent data protection regulations, and the continuous evolution of technology that enables more sophisticated and integrated security solutions. The market is witnessing a pronounced shift towards advanced video surveillance systems with AI-driven analytics and intelligent access control solutions that offer granular control and real-time monitoring.

The market's growth is further augmented by substantial investments in new data center construction and the modernization of existing facilities to meet higher security standards. While the market enjoys strong growth prospects, certain restraints warrant attention. The initial capital expenditure for sophisticated physical security systems can be a deterrent for some smaller enterprises. Furthermore, the rapid pace of technological advancements necessitates ongoing investment in upgrades and training, posing a potential challenge for budget-conscious organizations. However, the long-term benefits of enhanced data integrity, reduced risk of breaches, and operational resilience are increasingly outweighing these concerns. The market is expected to see significant contributions from consulting and professional services, aiding organizations in designing, implementing, and managing their complex physical security infrastructures. System integration services will also play a crucial role in ensuring seamless operation of diverse security components.

Sweden Data Center Physical Security Market Report: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a comprehensive analysis of the Sweden Data Center Physical Security Market, forecasting its trajectory from 2025–2033. With a base year of 2025, the study covers historical data from 2019–2024 and offers detailed insights into market dynamics, growth trends, regional dominance, product landscape, and key player strategies. Designed for industry professionals seeking actionable intelligence, this report leverages high-traffic keywords and a structured format to maximize SEO visibility and deliver crucial market insights in millions of units.

Sweden Data Center Physical Security Market Market Dynamics & Structure

The Sweden Data Center Physical Security Market is characterized by a moderate to high market concentration, with a few key players dominating significant portions of the landscape. Technological innovation remains a primary driver, propelled by the increasing sophistication of cyber threats and the ever-growing need for robust data protection. Stringent regulatory frameworks, including GDPR and Swedish data privacy laws, mandate advanced security measures, compelling data center operators to invest in cutting-edge physical security solutions. Competitive product substitutes are emerging, particularly in areas like AI-powered analytics for video surveillance and advanced biometric access control systems, fostering innovation and price competition. End-user demographics are shifting, with a growing demand from IT & Telecommunication and BFSI sectors for highly secure, scalable, and compliant data center environments. Mergers & Acquisitions (M&A) trends are observed, indicating a strategic consolidation aimed at expanding market reach and enhancing technological capabilities. For instance, recent M&A activities have focused on integrating advanced cybersecurity solutions with traditional physical security offerings.

- Market Concentration: Dominated by a mix of global security giants and specialized local providers.

- Technological Innovation Drivers: AI-driven analytics, IoT integration, cloud-based security management platforms.

- Regulatory Frameworks: GDPR compliance, national data security standards, industry-specific mandates.

- Competitive Product Substitutes: Rise of integrated physical and cybersecurity platforms, advanced biometrics.

- End-User Demographics: Increasing demand from hyperscale cloud providers and mission-critical data centers.

- M&A Trends: Focus on acquisitions that bolster AI capabilities and cloud integration.

Sweden Data Center Physical Security Market Growth Trends & Insights

The Sweden Data Center Physical Security Market is poised for significant growth, driven by an escalating demand for secure and resilient data infrastructure. Over the study period of 2019–2033, the market is projected to witness a robust Compound Annual Growth Rate (CAGR). This expansion is fueled by the increasing digitalization across all sectors of the Swedish economy, leading to a surge in data generation and the subsequent need for secure data storage facilities. The adoption rate of advanced physical security solutions, including intelligent video surveillance with AI-powered threat detection and multi-factor biometric access control systems, is accelerating. Technological disruptions, such as the integration of IoT devices for real-time monitoring and the development of advanced threat intelligence platforms, are reshaping the market landscape. Consumer behavior shifts are also evident, with data center operators prioritizing proactive security measures over reactive responses to breaches. The market's evolution reflects a transition from basic perimeter security to comprehensive, intelligent, and integrated physical security ecosystems.

The market size evolution indicates a consistent upward trend, with substantial investments being channeled into upgrading existing facilities and building new, state-of-the-art data centers. The adoption rates for solutions like advanced video analytics, which can detect anomalies and potential security breaches in real-time, are particularly high in sectors like BFSI and Government, where data integrity and confidentiality are paramount. Furthermore, the increasing adoption of cloud computing services by enterprises necessitates robust physical security for the underlying data center infrastructure, thus expanding the addressable market for physical security providers.

Technological disruptions are not limited to software but also encompass hardware innovations, such as high-resolution cameras with advanced low-light capabilities, tamper-proof sensor technologies, and sophisticated drone-based perimeter surveillance. These advancements contribute to enhanced situational awareness and faster response times. The shift towards a more proactive security posture, where predictive analytics are used to anticipate and mitigate potential threats, is a key trend that will continue to drive growth.

Consumer behavior shifts are characterized by a greater emphasis on total cost of ownership, return on investment (ROI), and the ability of security solutions to integrate seamlessly with existing IT infrastructure. Data center operators are increasingly looking for partners who can provide end-to-end security solutions, encompassing design, installation, maintenance, and ongoing support. This demand for integrated services is fostering a market where comprehensive solutions are favored over standalone products. The growing awareness of the financial and reputational damage caused by physical security breaches further solidifies the importance of investing in advanced solutions. The estimated market size for the Sweden Data Center Physical Security Market is expected to reach significant figures by 2025 and beyond, reflecting the robust demand and the critical role of physical security in safeguarding digital assets.

Dominant Regions, Countries, or Segments in Sweden Data Center Physical Security Market

Within the Sweden Data Center Physical Security Market, several key segments and end-user categories are driving significant growth and demand. The IT & Telecommunication sector stands out as a dominant force, owing to the continuous expansion of cloud infrastructure, the proliferation of 5G networks, and the increasing demand for data processing and storage capabilities. This sector requires highly secure, scalable, and resilient data center environments, making it a primary consumer of advanced physical security solutions.

The BFSI (Banking, Financial Services, and Insurance) sector also represents a crucial segment, driven by stringent regulatory requirements for data protection and the imperative to safeguard sensitive financial information from physical threats. The increasing reliance on digital banking platforms and online transactions further amplifies the need for robust physical security to protect data centers that house critical financial systems.

In terms of Solution Type, Video Surveillance is a leading segment. The evolution of video analytics, including AI-powered facial recognition, object detection, and anomaly detection, has transformed video surveillance from a passive monitoring tool to an active threat detection and incident response system. This is particularly crucial for Sweden's data centers, which are increasingly sophisticated and interconnected. Access Control Solutions are another critical segment, encompassing biometric readers, smart cards, and advanced intrusion detection systems. These solutions ensure that only authorized personnel can access sensitive areas within data centers, thereby preventing unauthorized entry and potential data breaches.

Regarding Service Type, Professional Services are witnessing substantial growth. This includes system integration, installation, maintenance, and consulting services. Data center operators are increasingly outsourcing these complex tasks to specialized providers who can ensure seamless implementation and ongoing optimal performance of security systems. System Integration Services are particularly vital as they enable the interoperability of various physical security components and their integration with IT infrastructure.

The dominance of these segments is further underscored by economic policies that encourage investment in digital infrastructure and infrastructure development that supports the growth of secure data center facilities. Sweden's commitment to technological advancement and its strong economy create a favorable environment for the adoption of cutting-edge physical security solutions. The market share and growth potential within these dominant segments are substantial, indicating continued investment and innovation in the coming years.

- Dominant End User: IT & Telecommunication, BFSI.

- Key Solution Type Drivers: Advanced Video Analytics, Multi-Factor Access Control.

- Leading Service Type: Professional Services (System Integration, Consulting).

- Economic Policies: Support for digital transformation and data center investment.

- Infrastructure Development: Expansion of high-speed networks and power grids for data centers.

- Growth Potential: High demand for integrated security solutions within these sectors.

Sweden Data Center Physical Security Market Product Landscape

The product landscape in the Sweden Data Center Physical Security Market is characterized by continuous innovation focused on enhancing security, efficiency, and integration. Advanced video surveillance systems are now equipped with artificial intelligence for real-time threat detection, anomaly identification, and facial recognition, offering unparalleled situational awareness. Access control solutions have evolved beyond traditional keycards to incorporate sophisticated biometric technologies such as fingerprint, iris, and facial recognition, ensuring stringent authentication. Integrated platforms are emerging, combining video, access control, intrusion detection, and environmental monitoring into a single, cohesive management system. These solutions are designed for scalability, allowing data centers to adapt their security infrastructure to evolving needs and an increasing number of physical locations. Unique selling propositions often revolve around AI-powered analytics for proactive threat mitigation, seamless integration with existing IT systems, and compliance with strict data protection regulations. Technological advancements are prioritizing cybersecurity for physical security devices themselves, to prevent them from becoming attack vectors.

Key Drivers, Barriers & Challenges in Sweden Data Center Physical Security Market

Key Drivers: The Sweden Data Center Physical Security Market is propelled by several key forces. The relentless growth of digitalization and the increasing volume of data generated across industries necessitate robust protection of data centers. Stringent regulatory compliance, including GDPR and national data privacy laws, mandates advanced physical security measures to prevent unauthorized access and data breaches. Technological advancements in AI-powered video analytics, biometric access control, and IoT integration offer more sophisticated and proactive security solutions. The rising threat landscape, encompassing both cyber and physical attacks, compels organizations to invest heavily in comprehensive physical security.

Barriers & Challenges: Despite the strong growth drivers, the market faces certain barriers and challenges. The high initial investment cost for cutting-edge physical security systems can be a deterrent for some smaller data center operators. Integration complexities with existing IT infrastructure and legacy systems can also pose challenges. Supply chain disruptions for specialized hardware components can lead to project delays and increased costs. Furthermore, the rapid evolution of technology requires continuous upgrades and maintenance, adding to the operational expenditure. Intense competition among solution providers can also lead to price pressures.

Emerging Opportunities in Sweden Data Center Physical Security Market

Emerging opportunities in the Sweden Data Center Physical Security Market are primarily centered around the growing demand for intelligent, integrated, and cloud-based security solutions. The expansion of edge computing and the increasing adoption of hybrid cloud environments present new avenues for providing localized and federated physical security management. Opportunities also lie in developing solutions tailored for the unique security needs of hyperscale data centers and colocation facilities. Furthermore, the increasing focus on sustainability and energy efficiency within data center operations could lead to the development of security solutions that also contribute to resource optimization. The growing importance of cybersecurity for OT (Operational Technology) systems within data centers opens up possibilities for integrated physical and cybersecurity solutions that protect critical infrastructure from both physical and digital threats.

Growth Accelerators in the Sweden Data Center Physical Security Market Industry

Catalysts driving long-term growth in the Sweden Data Center Physical Security Market industry include ongoing technological breakthroughs in AI, machine learning, and IoT, which are continuously enhancing the capabilities of physical security systems. Strategic partnerships between physical security providers and IT security firms are accelerating the development of comprehensive, end-to-end security solutions. Market expansion strategies, particularly in emerging regions within Sweden or in response to growing demand from specific industry verticals, are also key growth accelerators. The increasing adoption of automation in security operations, reducing reliance on manual interventions and improving response times, will further fuel market growth. Investments in research and development by leading players to create next-generation security technologies are also crucial for sustained growth.

Key Players Shaping the Sweden Data Center Physical Security Market Market

- Honeywell International Inc

- ABB Ltd

- Securitas Technology

- Cisco Systems Inc

- Siemens AG

- Johnson Controls

- Schneider Electric

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- AMAG Technology Inc

- Dahua Technology Co Ltd

- ASSA ABLOY

Notable Milestones in Sweden Data Center Physical Security Market Sector

- 2021: Increased adoption of AI-powered video analytics for enhanced threat detection in data centers.

- 2022: Significant investments in biometric access control systems for higher security data facilities.

- 2023: Growing trend towards integrated physical security platforms combining video, access, and intrusion detection.

- 2024: Rise in demand for cloud-based security management solutions for remote monitoring and control.

In-Depth Sweden Data Center Physical Security Market Market Outlook

The Sweden Data Center Physical Security Market is set for sustained growth, driven by the indispensable need for secure digital infrastructure. The convergence of physical and cybersecurity, coupled with advancements in AI and IoT, will continue to redefine security paradigms. Opportunities in integrated solutions, edge computing security, and sustainable security practices will shape the future landscape. Strategic collaborations and continuous innovation will be pivotal for players aiming to capitalize on the evolving demands of data center operators. The market's future outlook is one of increasing sophistication, proactive threat mitigation, and a holistic approach to data center protection.

Sweden Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Sweden Data Center Physical Security Market Segmentation By Geography

- 1. Sweden

Sweden Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Video Surveillance is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Securitas Technology

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Controls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch Sicherheitssysteme GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axis Communications AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AMAG Technology Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ASSA ABLOY

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Sweden Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: Sweden Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Sweden Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Sweden Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Sweden Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Sweden Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 8: Sweden Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 9: Sweden Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Sweden Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Data Center Physical Security Market?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the Sweden Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Securitas Technology, Cisco Systems Inc, Siemens AG, Johnson Controls, Schneider Electric, Bosch Sicherheitssysteme GmbH, Axis Communications AB, AMAG Technology Inc, Dahua Technology Co Ltd, ASSA ABLOY.

3. What are the main segments of the Sweden Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth.

6. What are the notable trends driving market growth?

Video Surveillance is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

The High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Sweden Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence