Key Insights

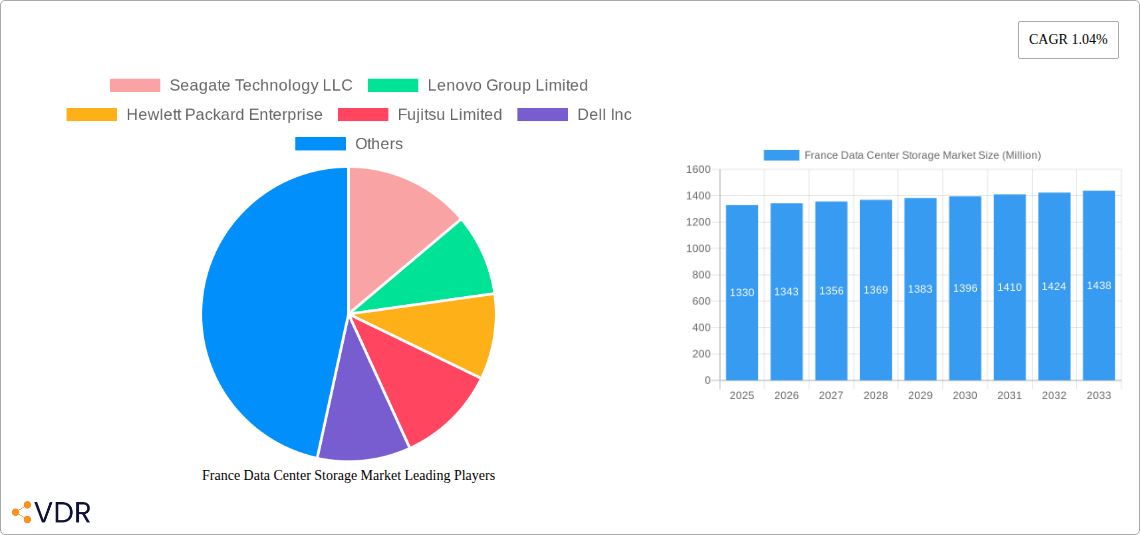

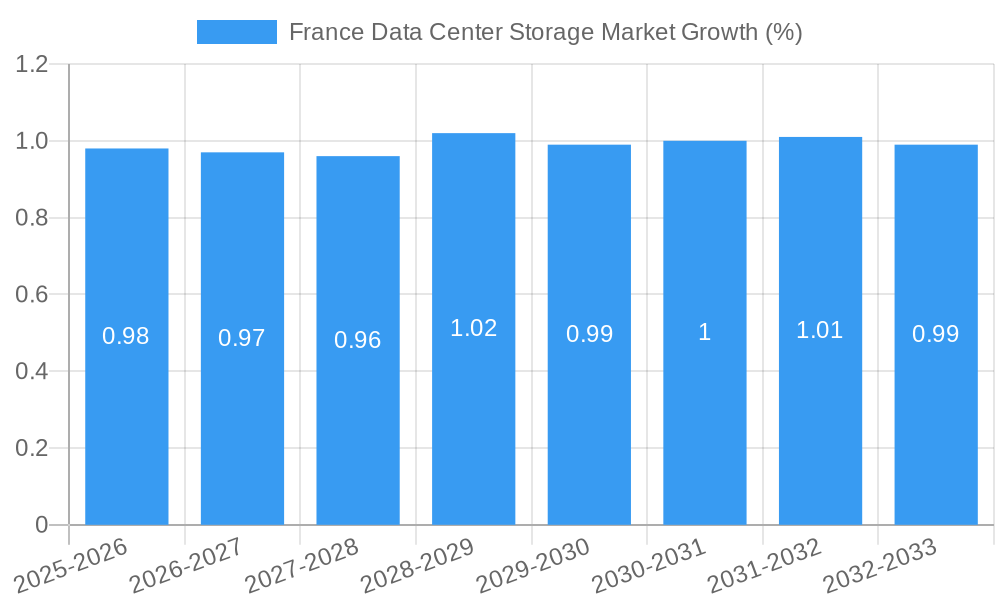

The France Data Center Storage Market is poised for steady growth, projected to reach approximately €1.33 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 1.04% anticipated over the forecast period. This sustained expansion is primarily fueled by the escalating demand for robust data storage solutions driven by digital transformation initiatives across various industries. Key growth drivers include the burgeoning volume of data generated by organizations, the increasing adoption of cloud computing services, and the imperative for enhanced data security and regulatory compliance. The market segmentation reveals a dynamic landscape, with Network Attached Storage (NAS) and Storage Area Network (SAN) technologies dominating the infrastructure, while the shift towards All-Flash and Hybrid Storage solutions signifies a trend towards higher performance and efficiency. End-user segments such as IT & Telecommunication, BFSI, and Government are leading the charge in adopting advanced storage, reflecting their critical reliance on data for operations and strategic decision-making.

While the market exhibits consistent growth, certain factors may moderate its pace. High initial investment costs for advanced storage systems and the increasing complexity of data management present potential restraints. However, ongoing technological advancements in storage efficiency, such as data deduplication and compression, alongside the increasing availability of cost-effective storage solutions, are expected to mitigate these challenges. The ongoing evolution of data center infrastructure, coupled with the rising adoption of AI and IoT technologies, will further necessitate sophisticated and scalable storage capabilities. France's commitment to digital innovation and its strong presence in key enterprise sectors will continue to underpin the demand for advanced data center storage solutions, ensuring a resilient and evolving market.

France Data Center Storage Market: Market Dynamics & Structure

The France data center storage market is characterized by a moderate to high concentration, with leading players like Seagate Technology LLC, Lenovo Group Limited, Hewlett Packard Enterprise, Dell Inc., and NetApp Inc. actively shaping the landscape through continuous innovation and strategic acquisitions. Technological advancements, particularly in flash storage and software-defined storage, are the primary drivers, compelling businesses to upgrade their infrastructure for enhanced performance and scalability. Regulatory frameworks, such as GDPR, are indirectly influencing storage decisions by emphasizing data security and privacy, thereby driving demand for robust and compliant storage solutions. Competitive product substitutes, ranging from cloud-based storage to on-premises solutions, offer a diverse range of options, pushing vendors to differentiate through advanced features and competitive pricing. End-user demographics are increasingly sophisticated, with sectors like IT & Telecommunication, BFSI, and Government leading the adoption of high-performance storage to manage vast datasets and complex workloads. Mergers and acquisitions (M&A) trends, while less frequent than in some other tech markets, are observed as companies seek to consolidate market share, acquire innovative technologies, or expand their service offerings.

- Market Concentration: Dominant presence of established global vendors.

- Technological Innovation Drivers: Rapid advancements in flash, NVMe, and software-defined storage solutions.

- Regulatory Frameworks: GDPR compliance influencing data management strategies.

- Competitive Product Substitutes: Cloud storage, hybrid solutions, and on-premises offerings.

- End-User Demographics: Strong adoption in IT, BFSI, and Government sectors.

- M&A Trends: Strategic consolidation and technology acquisition observed.

France Data Center Storage Market Growth Trends & Insights

The France data center storage market is poised for significant expansion driven by the relentless digital transformation across various industries. Fueled by the increasing generation and consumption of data, enterprises are compelled to invest in scalable, high-performance storage solutions. The adoption of Network Attached Storage (NAS) and Storage Area Network (SAN) technologies continues to be robust, catering to the needs of large enterprises for centralized data access and high-speed connectivity. Furthermore, the burgeoning demand for All-Flash Storage is a pivotal trend, as organizations seek to accelerate application performance and reduce latency for mission-critical workloads. This shift is supported by declining costs of flash memory and the increasing efficiency of flash-based arrays. The IT & Telecommunication sector remains a primary consumer, driven by cloud computing initiatives, 5G deployment, and the need to manage massive volumes of user data. The BFSI sector is also a substantial contributor, owing to stringent regulatory requirements for data integrity, security, and rapid transaction processing.

The market is witnessing a growing preference for hybrid storage solutions, which offer a balance of performance, capacity, and cost-effectiveness by combining the speed of flash with the affordability of traditional disk-based storage. This approach allows businesses to optimize their storage investments by tiering data based on access frequency and performance requirements. The Media & Entertainment industry is another key growth area, with the increasing adoption of high-definition content creation and distribution necessitating significant storage capacity and bandwidth. The forecast period (2025–2033) is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5%, reaching an estimated market size of $3,500 million by 2033. This growth will be further propelled by government initiatives aimed at fostering digital infrastructure and smart city development, leading to increased demand from the Government sector. The evolution of Other Technologies, including object storage and hyperconverged infrastructure, will also contribute to market diversification and adoption. Consumer behavior shifts towards data-intensive applications and services are indirectly stimulating enterprise storage investments.

Dominant Regions, Countries, or Segments in France Data Center Storage Market

The IT & Telecommunication segment is unequivocally the dominant force driving the France data center storage market. This sector's insatiable appetite for data management solutions stems from its foundational role in the digital economy. The continuous expansion of cloud infrastructure, the deployment of advanced networking technologies like 5G, and the proliferation of data-intensive services create an ever-growing demand for robust, scalable, and high-performance storage. As the backbone of digital connectivity, the IT & Telecommunication industry necessitates solutions that can handle massive data volumes, ensure high availability, and facilitate rapid data access for applications ranging from AI/ML workloads to content delivery networks.

Within the Storage Technology segment, Network Attached Storage (NAS) and Storage Area Network (SAN) are pivotal. NAS solutions are crucial for centralized file sharing and data access across an organization, while SANs provide high-speed block-level access for demanding applications and databases, making them indispensable for large-scale enterprise deployments within the dominant IT & Telecommunication sector. The Storage Type segment sees a rapid surge in All-Flash Storage adoption, directly correlating with the performance demands of modern applications within the leading end-user segments. While Traditional Storage still holds a significant market share due to its cost-effectiveness for archival and less critical data, the trend is undeniably towards flash, driven by the need for enhanced application performance. Hybrid Storage also plays a critical role, offering a balanced approach for a wide range of use cases.

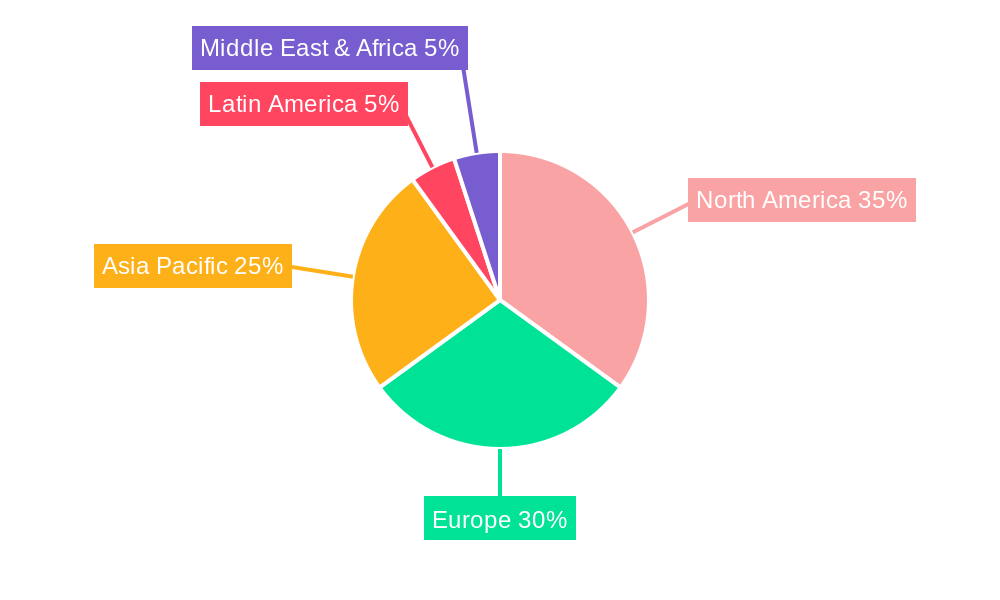

Geographically, while the entire nation contributes, the Île-de-France region, encompassing Paris and its surrounding areas, emerges as the most significant hub. This region concentrates a vast number of corporate headquarters, data centers, and technology service providers, leading to higher demand for advanced data center storage solutions. Economic policies fostering innovation and digital transformation, coupled with robust existing infrastructure, further solidify Île-de-France's dominance. The presence of major research institutions and a skilled workforce also contributes to this concentration. The market share within the IT & Telecommunication sector is estimated to be over 35%, with a growth potential of 9% CAGR over the forecast period.

- Dominant Segment (End-User): IT & Telecommunication (Estimated Market Share: ~35%, CAGR: ~9%).

- Dominant Segments (Storage Technology): Network Attached Storage (NAS) and Storage Area Network (SAN).

- Dominant Segments (Storage Type): All-Flash Storage (rapidly growing) and Hybrid Storage (balanced approach).

- Dominant Region: Île-de-France (due to concentration of businesses and data centers).

- Key Drivers for Dominance: Digital transformation, cloud adoption, AI/ML, 5G, stringent regulatory compliance in BFSI, government digital initiatives.

France Data Center Storage Market Product Landscape

The France data center storage market is abuzz with product innovations focused on delivering superior performance, enhanced scalability, and intelligent data management. Vendors are increasingly introducing solutions powered by NVMe flash technology, offering significantly reduced latency and higher throughput for demanding enterprise applications. Software-defined storage (SDS) platforms are gaining traction, providing greater flexibility and automation in storage provisioning, management, and data protection. Innovations in data deduplication and compression technologies are also prominent, enabling organizations to maximize storage utilization and reduce costs. The integration of AI and machine learning capabilities within storage arrays is emerging, facilitating predictive analytics for performance optimization and proactive issue resolution. Products like Pure Storage Inc.'s FlashBlade//E are redefining the landscape by efficiently storing non-hot data, while Huawei Technologies Co Ltd's F2F2X architecture provides a robust data foundation for financial institutions.

Key Drivers, Barriers & Challenges in France Data Center Storage Market

Key Drivers:

- Digital Transformation: The pervasive adoption of digital technologies across all industries necessitates robust data storage solutions.

- Data Growth: Exponential increase in data generation from IoT devices, social media, and business operations.

- Cloud Adoption: Growing reliance on cloud services drives demand for both on-premises and hybrid storage infrastructure.

- Technological Advancements: Innovations in flash storage, NVMe, and software-defined storage offer enhanced performance and efficiency.

- Regulatory Compliance: Stringent data protection regulations like GDPR compel organizations to invest in secure and compliant storage.

Barriers & Challenges:

- High Initial Investment: The cost of advanced storage hardware and software can be a significant barrier for some organizations.

- Complexity of Management: Managing diverse storage environments, especially hybrid and multi-cloud setups, can be complex.

- Data Security Concerns: Evolving cyber threats necessitate continuous investment in advanced security measures.

- Skills Gap: A shortage of skilled IT professionals capable of managing modern data storage infrastructure.

- Legacy System Integration: Integrating new storage solutions with existing legacy systems can be challenging and costly.

Emerging Opportunities in France Data Center Storage Market

Emerging opportunities in the France data center storage market lie in the burgeoning demand for specialized storage solutions tailored for AI and machine learning workloads, which require extremely high performance and low latency. The continued expansion of IoT deployments across industries like manufacturing and healthcare presents a significant opportunity for edge storage solutions that can process and store data closer to the source. Furthermore, the increasing focus on sustainability and energy efficiency in data centers is driving demand for eco-friendly storage technologies that minimize power consumption and environmental impact. The growing adoption of hyperconverged infrastructure (HCI) and composable infrastructure offers new avenues for integrated storage solutions.

Growth Accelerators in the France Data Center Storage Market Industry

Several catalysts are accelerating long-term growth in the France data center storage market. The ongoing digital transformation initiatives spearheaded by the French government, aimed at modernizing public services and fostering innovation, are creating sustained demand for advanced data infrastructure. Strategic partnerships between storage vendors, cloud providers, and system integrators are expanding market reach and facilitating the adoption of integrated solutions. Furthermore, the continuous decline in the cost of flash storage, coupled with significant performance improvements, is making all-flash arrays increasingly accessible for a broader range of businesses. The growing maturity of the French startup ecosystem, particularly in areas like big data analytics and AI, is also a key growth accelerator, driving demand for high-performance storage to support their innovative applications.

Key Players Shaping the France Data Center Storage Market Market

- Seagate Technology LLC

- Lenovo Group Limited

- Hewlett Packard Enterprise

- Fujitsu Limited

- Dell Inc.

- NetApp Inc.

- Kingston Technology Company Inc.

- Huawei Technologies Co Ltd

- Oracle Corporation

- Pure Storage Inc.

Notable Milestones in France Data Center Storage Market Sector

- May 2023: Pure Storage Inc. expanded its flash-based platform into the data center with the introduction of FlashBlade//E, addressing the storage of approximately 80% of data currently stored on disk-based systems, which is considered non-hot" or primary data and is predominantly low-cost in nature.

- June 2023: Huawei unveiled its cutting-edge data center data infrastructure architecture known as F2F2X (Flash-to-Flash-to-Anything). This architecture serves as a robust data foundation specifically designed to assist financial institutions in navigating the challenges posed by new data, new applications, and new resilience requirements.

In-Depth France Data Center Storage Market Market Outlook

The France data center storage market is on an upward trajectory, driven by sustained digital transformation and the ever-increasing volume of data. The future market potential is immense, fueled by advancements in AI, IoT, and edge computing, which will demand more sophisticated and performant storage solutions. Strategic opportunities lie in catering to the specific needs of emerging sectors and developing solutions that emphasize data security, scalability, and sustainability. The continued evolution of cloud and hybrid multi-cloud strategies will also shape the market, requiring vendors to offer flexible and integrated storage offerings that can seamlessly operate across diverse environments.

France Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End-User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End-Users

France Data Center Storage Market Segmentation By Geography

- 1. France

France Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Cost To Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Seagate Technology LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett Packard Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fujitsu Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NetApp Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pure Storage Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Seagate Technology LLC

List of Figures

- Figure 1: France Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: France Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: France Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: France Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: France Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: France Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: France Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 8: France Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 9: France Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: France Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Data Center Storage Market?

The projected CAGR is approximately 1.04%.

2. Which companies are prominent players in the France Data Center Storage Market?

Key companies in the market include Seagate Technology LLC, Lenovo Group Limited, Hewlett Packard Enterprise, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Pure Storage Inc.

3. What are the main segments of the France Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment Cost To Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Pure Storage Inc. made significant strides by expanding its flash-based platform into the data center with the introduction of FlashBlade//E. This innovative solution addresses the storage of approximately 80% of data currently stored on disk-based systems, which is considered non-hot" or primary data and is predominantly low-cost in nature.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Data Center Storage Market?

To stay informed about further developments, trends, and reports in the France Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence