Key Insights

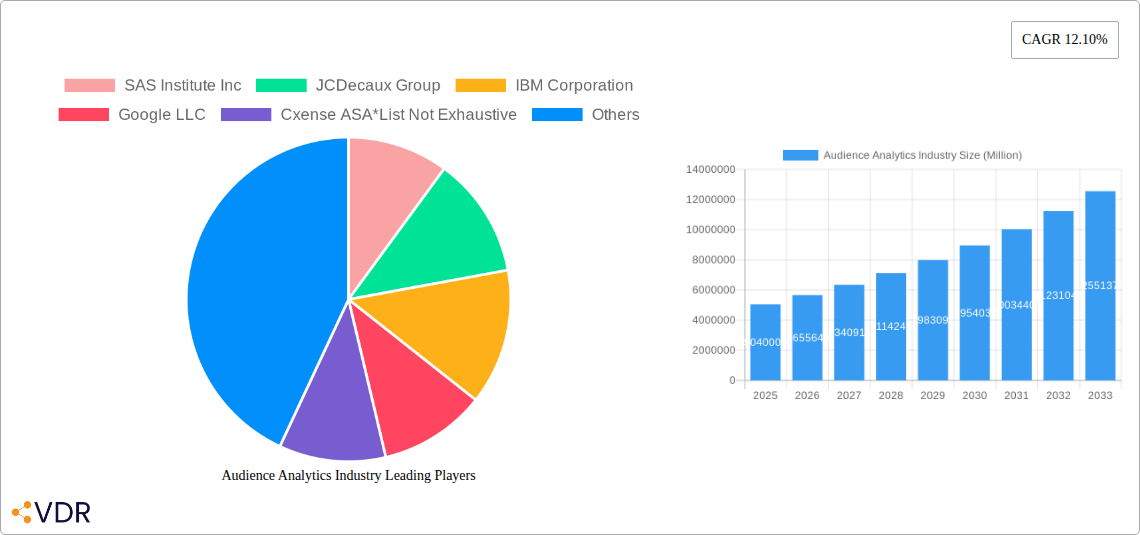

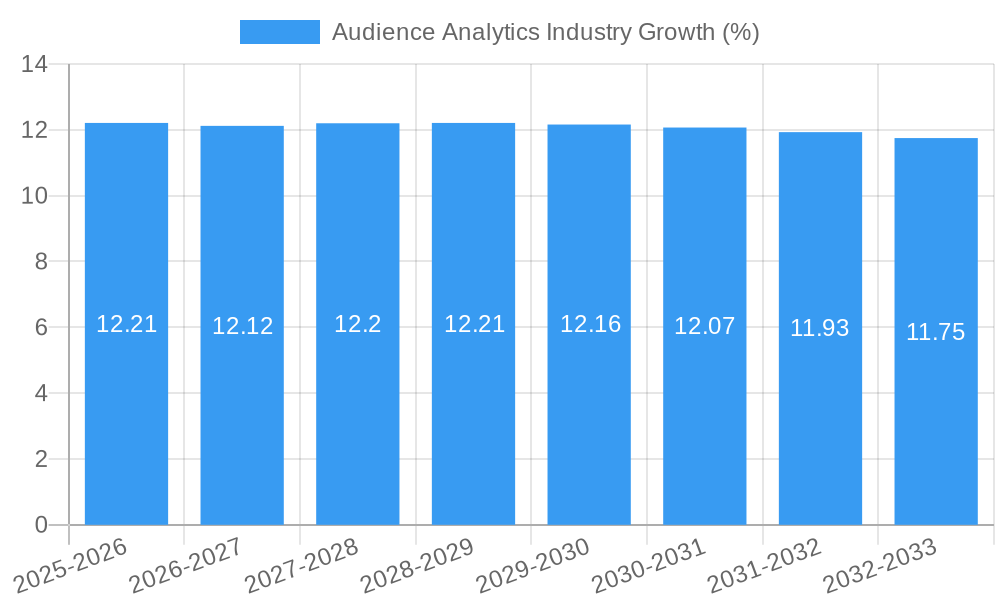

The Audience Analytics Industry is poised for substantial growth, with a current market size of approximately $5.04 million and an impressive Compound Annual Growth Rate (CAGR) of 12.10% projected from 2025 to 2033. This robust expansion is primarily fueled by the escalating demand for data-driven decision-making across various sectors. Businesses are increasingly recognizing the critical importance of understanding consumer behavior, preferences, and engagement patterns to tailor their products, services, and marketing strategies effectively. The proliferation of digital channels and the resulting explosion of user data have created an urgent need for sophisticated audience analytics solutions that can process, interpret, and derive actionable insights from this complex information. Key drivers include the growing adoption of AI and machine learning for advanced data analysis, the necessity for personalized customer experiences, and the continuous pursuit of optimized marketing ROI.

The market is segmented across diverse applications, with Sales & Marketing and Customer Experience emerging as dominant areas. These segments benefit directly from the ability of audience analytics to enhance lead generation, campaign effectiveness, customer retention, and overall brand loyalty. The BFSI, Telecom & IT, and Healthcare sectors are leading the adoption, driven by their large customer bases and the critical need for personalized services and regulatory compliance. Emerging trends indicate a shift towards predictive analytics, real-time insights, and the integration of audience data with other business intelligence tools. However, the industry faces restraints such as data privacy concerns and stringent regulations (e.g., GDPR, CCPA), which necessitate robust data governance frameworks and ethical data handling practices. Furthermore, the high cost of implementing advanced analytics solutions and the shortage of skilled data scientists can pose challenges to widespread adoption, particularly for small and medium-sized enterprises.

This report offers an in-depth analysis of the global Audience Analytics Industry, a dynamic sector pivotal for understanding consumer behavior and optimizing business strategies. Leveraging advanced analytics, this market empowers organizations to gain actionable insights, drive sales and marketing effectiveness, enhance customer experience, and unlock new revenue streams across diverse end-user industries including BFSI, Telecom & IT, Healthcare, Media & Entertainment, and Retail. Our study spans the historical period of 2019–2024 and provides a detailed forecast period of 2025–2033, with the base year 2025.

Audience Analytics Industry Market Dynamics & Structure

The Audience Analytics Industry is characterized by a moderately concentrated market, driven by significant technological innovation, particularly in artificial intelligence and machine learning, which are key drivers for audience intelligence platforms. Regulatory frameworks, such as GDPR and CCPA, are increasingly shaping data privacy and usage, influencing how audience data is collected and analyzed. Competitive product substitutes exist in the form of traditional market research and in-house analytics tools, but the sophistication and real-time capabilities of dedicated audience analytics solutions offer a distinct advantage. End-user demographics are broadening, with an increasing demand from SMEs alongside large enterprises. Mergers and acquisitions (M&A) activity is prevalent as larger players seek to consolidate market share and acquire innovative technologies. For instance, the audience analytics market saw approximately xx significant M&A deals in the last fiscal year, with a combined deal value of an estimated xx Million dollars. Barriers to innovation include the high cost of data infrastructure and the need for skilled data scientists.

- Market Concentration: Moderately concentrated, with key players holding substantial market share.

- Technological Innovation Drivers: AI, machine learning, predictive analytics, real-time data processing.

- Regulatory Frameworks: GDPR, CCPA, data privacy compliance is paramount.

- Competitive Product Substitutes: Traditional market research, basic CRM analytics.

- End-User Demographics: Growing adoption across enterprise and SME segments.

- M&A Trends: Active consolidation for technology acquisition and market expansion.

- Innovation Barriers: Data infrastructure costs, talent acquisition for data science.

Audience Analytics Industry Growth Trends & Insights

The Audience Analytics Industry is poised for robust growth, driven by the escalating need for personalized marketing and customer engagement. The global audience analytics market size is projected to reach an estimated xx Billion dollars by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Adoption rates for sophisticated audience analytics tools are accelerating across all end-user industries as businesses recognize the critical role of data-driven decision-making. Technological disruptions, such as the advancement of AI in natural language processing for sentiment analysis and the proliferation of IoT devices generating new data streams, are continuously redefining the capabilities of audience analytics. Consumer behavior shifts, characterized by an increased demand for personalized experiences and privacy-conscious interactions, are further propelling the adoption of advanced audience analytics solutions. The market penetration of advanced audience analytics solutions is expected to rise from approximately xx% in 2025 to xx% by 2033, indicating a significant expansion of its influence. This growth is underpinned by the increasing ability of these platforms to provide granular insights into consumer journeys, preferences, and potential future actions, thereby enabling businesses to proactively tailor their offerings and communication strategies. The digital audience analytics market, in particular, is experiencing rapid expansion due to the ever-growing digital footprint of consumers.

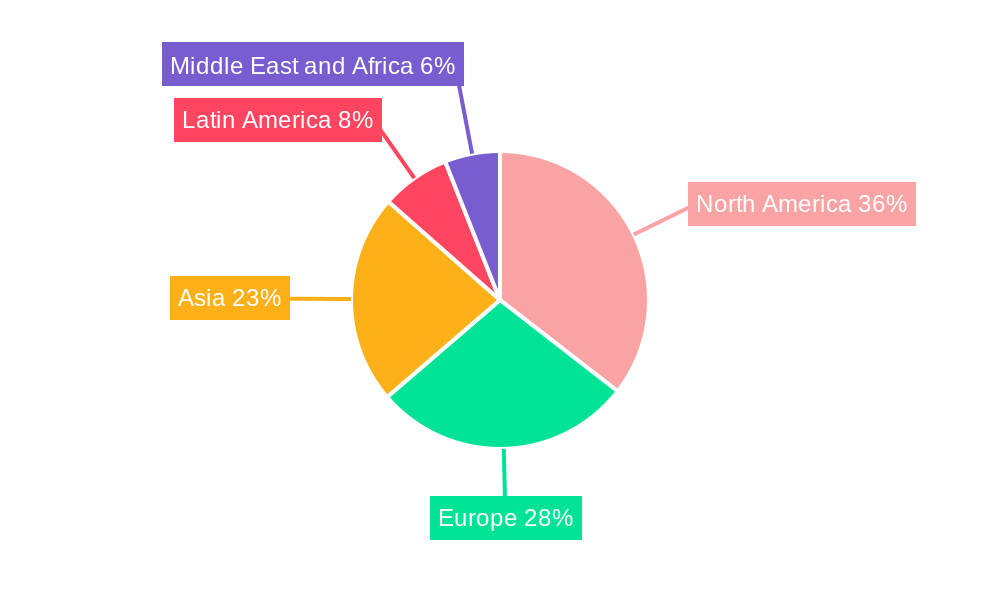

Dominant Regions, Countries, or Segments in Audience Analytics Industry

The North America region currently dominates the Audience Analytics Industry, driven by its advanced technological infrastructure, high adoption rates of digital technologies, and a mature market for customer experience analytics. The United States, a key country within this region, is a frontrunner due to the presence of major technology companies and a strong emphasis on data-driven business strategies across all sectors, particularly in BFSI, Media & Entertainment, and Retail. The Sales & Marketing application segment is the primary growth engine, accounting for an estimated xx% of the total market revenue in 2025, owing to its direct impact on revenue generation and customer acquisition. However, the Customer Experience segment is witnessing rapid growth at a CAGR of xx%, indicating a strategic shift towards customer retention and loyalty. Within end-user industries, Telecom & IT is a significant contributor, leveraging audience analytics for network optimization, service personalization, and churn prediction. The Media & Entertainment sector also heavily relies on these insights for content recommendation, audience segmentation, and advertising efficacy.

- Dominant Region: North America, driven by technological advancement and adoption.

- Key Country: United States, leading in innovation and market penetration.

- Leading Application Segment: Sales & Marketing, with strong contribution from Customer Experience growth.

- Key End-User Industries: Telecom & IT and Media & Entertainment, leveraging analytics for critical operations.

- Market Share in Sales & Marketing: Estimated at xx% in 2025.

- CAGR for Customer Experience: Projected at xx% during the forecast period.

- Growth Potential in BFSI: Significant due to the need for personalized financial services and risk assessment.

Audience Analytics Industry Product Landscape

The Audience Analytics Industry product landscape is characterized by continuous innovation, with platforms evolving to offer more sophisticated features for audience intelligence and campaign optimization. Key product advancements include real-time data integration from multiple sources, AI-powered predictive modeling for customer lifetime value, and enhanced visualization tools for intuitive data interpretation. These solutions are increasingly being applied to personalize customer journeys, optimize advertising spend, and improve product development based on direct consumer feedback. Unique selling propositions often revolve around the accuracy of predictions, the breadth of data sources integrated, and the ease of actionable insights generation. Technological advancements are focused on democratizing access to complex analytics, making them more user-friendly for non-technical professionals.

Key Drivers, Barriers & Challenges in Audience Analytics Industry

Key Drivers:

- Demand for Personalization: Businesses are compelled to deliver hyper-personalized experiences to retain customers and drive engagement.

- Data Proliferation: The exponential growth of data from digital channels provides rich insights for analysis.

- ROI Focus: Organizations seek to maximize marketing spend and operational efficiency through data-driven decisions.

- Technological Advancements: AI and machine learning capabilities are enhancing the accuracy and predictive power of analytics.

- Competitive Advantage: Companies leveraging audience analytics gain a significant edge in understanding market dynamics and consumer needs.

Barriers & Challenges:

- Data Privacy Concerns: Evolving regulations (e.g., GDPR) and consumer awareness necessitate stringent data protection measures, impacting data accessibility.

- Data Integration Complexity: Consolidating data from disparate sources (e.g., CRM, social media, web analytics) remains a significant technical challenge.

- Talent Shortage: A scarcity of skilled data scientists and analysts limits the effective utilization of advanced analytics tools.

- High Implementation Costs: Initial investment in analytics software, hardware, and training can be substantial, especially for smaller businesses.

- Interpreting Data Effectively: The sheer volume of data can be overwhelming, requiring sophisticated tools and expertise to extract actionable insights.

- Ethical Considerations: Ensuring fair and unbiased data analysis and application is crucial.

Emerging Opportunities in Audience Analytics Industry

Emerging opportunities in the Audience Analytics Industry lie in the untapped potential of predictive audience analytics for proactive customer service and the expansion into emerging markets with growing digital footprints. The integration of AI audience analytics with voice and IoT data presents a new frontier for understanding consumer behavior in a more holistic manner. Furthermore, the development of ethical AI frameworks within audience analytics can unlock trust and adoption in privacy-sensitive sectors like healthcare. Opportunities also exist in creating more accessible, low-code/no-code analytics platforms tailored for specific industry needs, broadening market reach.

Growth Accelerators in the Audience Analytics Industry Industry

Growth accelerators in the Audience Analytics Industry are significantly bolstered by continuous technological breakthroughs, particularly in AI and machine learning, enabling more sophisticated audience segmentation and predictive capabilities. Strategic partnerships between analytics providers and technology giants are expanding the reach and integration of these solutions across diverse platforms. Furthermore, the increasing focus on customer lifetime value (CLTV) analytics is driving demand for advanced tools that can forecast future customer behavior and optimize retention strategies. The growing acceptance of data-driven decision-making across all business functions is a critical accelerator, pushing more companies to invest in audience analytics for competitive differentiation.

Key Players Shaping the Audience Analytics Industry Market

- SAS Institute Inc

- JCDecaux Group

- IBM Corporation

- Google LLC

- Cxense ASA

- Adobe Inc

- Akamai Technologies

- Oracle Corporation

- comScore Inc

Notable Milestones in Audience Analytics Industry Sector

- June 2022: Alfi, an artificial intelligence visual recognition SaaS advertising platform, unveiled the introduction of AI Audience Analytics. This innovative tool is designed to tackle substantial challenges in gauging digital out-of-home audience metrics and campaign performance.

- February 2022: StatSocial, a social audience insights platform, launched an enhanced edition of its audience analytics solution, Silhouette. This latest release boasts a range of pioneering features and utilities, empowering marketers with deeper insights into their customer base and strategies for effective engagement across major social platforms.

In-Depth Audience Analytics Industry Market Outlook

- June 2022: Alfi, an artificial intelligence visual recognition SaaS advertising platform, unveiled the introduction of AI Audience Analytics. This innovative tool is designed to tackle substantial challenges in gauging digital out-of-home audience metrics and campaign performance.

- February 2022: StatSocial, a social audience insights platform, launched an enhanced edition of its audience analytics solution, Silhouette. This latest release boasts a range of pioneering features and utilities, empowering marketers with deeper insights into their customer base and strategies for effective engagement across major social platforms.

In-Depth Audience Analytics Industry Market Outlook

The Audience Analytics Industry market outlook is exceptionally strong, fueled by the relentless pursuit of deeper customer understanding and the drive for hyper-personalized experiences. Growth accelerators such as advanced AI algorithms, cloud-based analytics platforms, and the increasing demand for real-time insights will continue to propel market expansion. Strategic opportunities lie in developing specialized audience analytics solutions for niche industries and leveraging the growing volume of unstructured data for richer insights. The future promises a market where audience analytics is not just a tool, but an integral part of every business strategy, enabling unprecedented levels of customer engagement and operational efficiency. The projected market size of xx Billion dollars by 2033 underscores its pivotal role in the global economy.

Audience Analytics Industry Segmentation

-

1. Application

- 1.1. Sales & Marketing

- 1.2. Customer Experience

- 1.3. Other Applications

-

2. End-User Industry

- 2.1. BFSI

- 2.2. Telecom & IT

- 2.3. Healthcare

- 2.4. Media & Entertainment

- 2.5. Retail

- 2.6. Other End-User Industries

Audience Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. Australia and New Zealand

- 3.4. Singapore

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Audience Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Huge Demand for Personalised Content; Strong Focus on Competitive Intelligence

- 3.3. Market Restrains

- 3.3.1. Complexities in Analysis

- 3.4. Market Trends

- 3.4.1. Media & Entertainment is Expected to Experience Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sales & Marketing

- 5.1.2. Customer Experience

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. BFSI

- 5.2.2. Telecom & IT

- 5.2.3. Healthcare

- 5.2.4. Media & Entertainment

- 5.2.5. Retail

- 5.2.6. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sales & Marketing

- 6.1.2. Customer Experience

- 6.1.3. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. BFSI

- 6.2.2. Telecom & IT

- 6.2.3. Healthcare

- 6.2.4. Media & Entertainment

- 6.2.5. Retail

- 6.2.6. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sales & Marketing

- 7.1.2. Customer Experience

- 7.1.3. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. BFSI

- 7.2.2. Telecom & IT

- 7.2.3. Healthcare

- 7.2.4. Media & Entertainment

- 7.2.5. Retail

- 7.2.6. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sales & Marketing

- 8.1.2. Customer Experience

- 8.1.3. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. BFSI

- 8.2.2. Telecom & IT

- 8.2.3. Healthcare

- 8.2.4. Media & Entertainment

- 8.2.5. Retail

- 8.2.6. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sales & Marketing

- 9.1.2. Customer Experience

- 9.1.3. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. BFSI

- 9.2.2. Telecom & IT

- 9.2.3. Healthcare

- 9.2.4. Media & Entertainment

- 9.2.5. Retail

- 9.2.6. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sales & Marketing

- 10.1.2. Customer Experience

- 10.1.3. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. BFSI

- 10.2.2. Telecom & IT

- 10.2.3. Healthcare

- 10.2.4. Media & Entertainment

- 10.2.5. Retail

- 10.2.6. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 13. Asia Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Australia and New Zealand

- 13.1.4 Singapore

- 14. Latin America Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 15. Middle East and Africa Audience Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SAS Institute Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 JCDecaux Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 IBM Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Google LLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cxense ASA*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Adobe Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Akamai Technologies

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Oracle Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 comScore Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Audience Analytics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Audience Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Audience Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Audience Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 15: North America Audience Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 16: North America Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Audience Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Audience Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Audience Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 21: Europe Audience Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 22: Europe Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Audience Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Audience Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Audience Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 27: Asia Audience Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 28: Asia Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Audience Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Audience Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Audience Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 33: Latin America Audience Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 34: Latin America Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Audience Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East and Africa Audience Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East and Africa Audience Analytics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 39: Middle East and Africa Audience Analytics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 40: Middle East and Africa Audience Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Audience Analytics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Audience Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Audience Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Audience Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Audience Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Australia and New Zealand Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Singapore Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Mexico Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Brazil Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Arab Emirates Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Saudi Arabia Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Africa Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Audience Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Audience Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 26: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United States Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Audience Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global Audience Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 31: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Audience Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Audience Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 37: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: China Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia and New Zealand Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Singapore Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Audience Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 43: Global Audience Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 44: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Mexico Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Brazil Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Audience Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Audience Analytics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 49: Global Audience Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: United Arab Emirates Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Saudi Arabia Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Africa Audience Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Audience Analytics Industry?

The projected CAGR is approximately 12.10%.

2. Which companies are prominent players in the Audience Analytics Industry?

Key companies in the market include SAS Institute Inc, JCDecaux Group, IBM Corporation, Google LLC, Cxense ASA*List Not Exhaustive, Adobe Inc, Akamai Technologies, Oracle Corporation, comScore Inc.

3. What are the main segments of the Audience Analytics Industry?

The market segments include Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Huge Demand for Personalised Content; Strong Focus on Competitive Intelligence.

6. What are the notable trends driving market growth?

Media & Entertainment is Expected to Experience Major Market Share.

7. Are there any restraints impacting market growth?

Complexities in Analysis.

8. Can you provide examples of recent developments in the market?

June 2022: Alfi, an artificial intelligence visual recognition SaaS advertising platform, unveiled the introduction of AI Audience Analytics. This innovative tool is designed to tackle substantial challenges in gauging digital out-of-home audience metrics and campaign performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Audience Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Audience Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Audience Analytics Industry?

To stay informed about further developments, trends, and reports in the Audience Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence