Key Insights

The European Access Control Software Market is poised for significant expansion, projected to reach an estimated \$153.30 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.90% expected to drive its trajectory through 2033. This substantial growth is fueled by an escalating demand for enhanced security solutions across diverse sectors, from the commercial and residential realms to critical government, industrial, and transportation infrastructure. The increasing sophistication of cyber threats and the imperative to safeguard sensitive data and physical assets are compelling organizations to invest in advanced access control systems. Cloud-based solutions are emerging as a dominant force, offering scalability, flexibility, and cost-effectiveness compared to traditional on-premise deployments, thereby attracting a broader range of businesses, including SMEs and large enterprises alike. Furthermore, the growing adoption of smart technologies and the Internet of Things (IoT) is creating new avenues for innovation, integrating access control with other building management and security systems to create more intelligent and responsive environments.

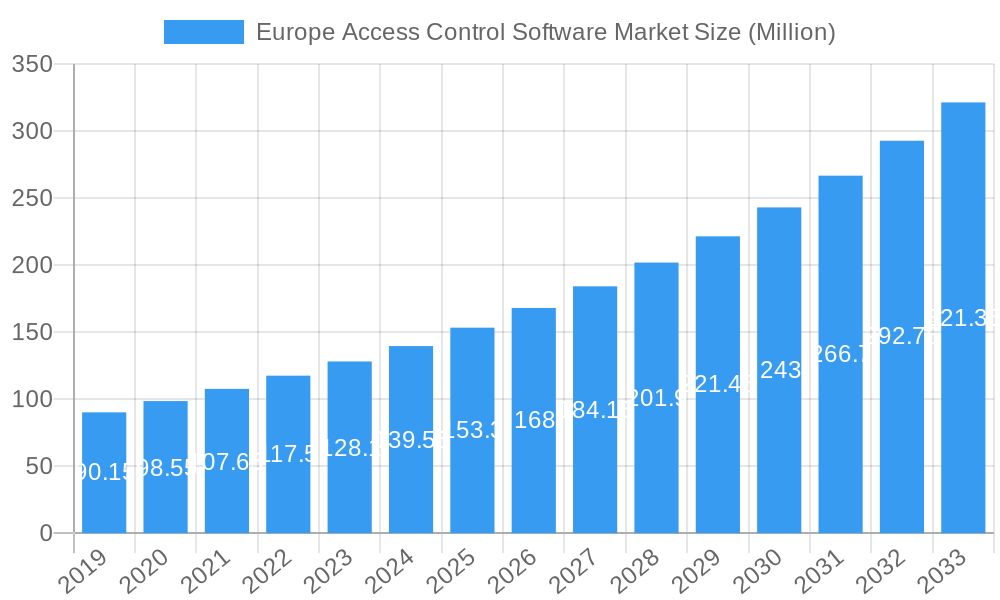

Europe Access Control Software Market Market Size (In Million)

Key drivers propelling this market forward include the increasing regulatory compliance requirements, the need for streamlined visitor management, and the desire for centralized control over access permissions. However, certain restraints, such as the initial implementation costs and concerns around data privacy and cybersecurity, may temper the pace of adoption in some segments. Despite these challenges, the market is characterized by dynamic trends like the rise of biometric authentication, mobile access solutions, and AI-powered analytics for threat detection and predictive security. Leading players such as Honeywell International Inc., Bosch Security and Safety Systems, Axis Communications AB, and Johnson Controls are actively innovating and expanding their portfolios to cater to the evolving needs of the European market. The region's strong emphasis on technological advancement and security infrastructure positions Europe as a pivotal market for access control software development and deployment.

Europe Access Control Software Market Company Market Share

This in-depth report provides a definitive analysis of the Europe Access Control Software Market. Explore market dynamics, growth trends, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive landscape. This research leverages data from the historical period (2019-2024), with the base year at 2025 and an estimated year of 2025, projecting future growth through the forecast period (2025-2033). Gain actionable insights into cloud-based access control, SME access control solutions, and the evolving needs of commercial, industrial, and government sectors across Europe.

Europe Access Control Software Market Market Dynamics & Structure

The Europe Access Control Software Market is characterized by a dynamic interplay of technological advancements, evolving regulatory frameworks, and shifting end-user demands. Market concentration, while present with leading players, is also influenced by the proliferation of specialized solutions catering to diverse organizational needs, particularly for SMEs seeking cost-effective and scalable access control. Technological innovation is a primary driver, with a continuous push towards more intelligent, integrated, and user-friendly software. The increasing adoption of cloud-based access control systems highlights a significant shift from traditional on-premise solutions, driven by benefits like remote management, scalability, and reduced IT overhead. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR) and security standards, are shaping product development and market entry strategies. Competitive product substitutes, ranging from basic physical access mechanisms to advanced biometric and AI-powered systems, necessitate constant innovation. End-user demographics are diverse, with significant demand from commercial, industrial, and government sectors, each with unique security imperatives. Mergers and acquisitions (M&A) activity remains a key trend, as larger companies seek to consolidate market share and acquire innovative technologies, particularly in the rapidly expanding cloud-based access control segment. The market exhibits a moderate level of concentration, with key players like Honeywell International Inc. and Bosch Security and Safety Systems holding substantial market shares, but also opportunities for niche players. For instance, the growth in the SME access control segment presents a fertile ground for new entrants and specialized solution providers.

- Market Concentration: Moderate, with a blend of large established players and emerging specialized vendors.

- Technological Innovation Drivers: AI-powered analytics, IoT integration, biometric advancements, and enhanced cybersecurity protocols.

- Regulatory Frameworks: GDPR, NIS Directive, and evolving national security standards are critical influencing factors.

- Competitive Product Substitutes: Advancements in biometrics, mobile credentials, and integrated building management systems.

- End-User Demographics: Strong demand from commercial real estate, manufacturing facilities, educational institutions, and public sector organizations.

- M&A Trends: Strategic acquisitions to expand product portfolios and market reach, particularly in the cloud-based access control and SME access control domains.

Europe Access Control Software Market Growth Trends & Insights

The Europe Access Control Software Market is poised for substantial growth, projected to expand from an estimated XX million units in 2025 to reach XX million units by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of XX%. This upward trajectory is fueled by an increasing awareness of security threats, the growing need for sophisticated access management in diverse environments, and the rapid adoption of advanced technologies. The market size evolution is marked by a significant shift towards cloud-based access control software, which is projected to outpace on-premise solutions due to its inherent flexibility, scalability, and cost-effectiveness. Adoption rates for integrated security systems, where access control is a crucial component, are also on the rise across commercial, industrial, and government sectors. Technological disruptions, including the integration of artificial intelligence (AI) for threat detection and predictive analytics, the proliferation of mobile credentials, and the increasing reliance on biometric authentication methods, are reshaping the market landscape. Consumer behavior shifts are evident in the demand for seamless and intuitive user experiences, driven by the consumerization of IT and the widespread use of smart devices. This translates into a preference for access control systems that can be managed remotely, offer granular control, and integrate with other smart building technologies.

The penetration of sophisticated access control software in the SME segment is expected to accelerate, as more businesses recognize the importance of robust security beyond basic physical measures. The large enterprise segment, already a significant contributor, will continue to drive demand for highly customized and scalable solutions. The transportation and logistics and military and defense sectors represent critical growth areas, with stringent security requirements driving investment in advanced access control systems. The residential market, while currently smaller, is also showing promising growth as smart home technologies become more mainstream. The overall market penetration of advanced access control software is still relatively low in certain segments, presenting a significant opportunity for growth. For example, while large enterprises have high adoption rates for sophisticated solutions, the SME market, particularly in sectors like retail and hospitality, offers substantial untapped potential. The increasing focus on cybersecurity and data protection regulations further reinforces the need for advanced, software-driven access control solutions, making it a critical component of modern security infrastructure. The market's growth is not solely driven by new installations but also by upgrades and replacements of legacy systems, especially in sectors with high security demands like government and industrial facilities. The integration of access control with other building management systems and security platforms is becoming a standard expectation, further accelerating the adoption of advanced software solutions.

Dominant Regions, Countries, or Segments in Europe Access Control Software Market

The cloud-based access control software segment is emerging as the dominant force within the Europe Access Control Software Market, projected to capture a significant market share by 2025. This dominance is attributed to a confluence of factors including its inherent scalability, cost-effectiveness, and enhanced flexibility, making it an attractive proposition for businesses of all sizes, from SMEs to large enterprises. The rapid digital transformation across European industries, coupled with an increasing reliance on remote workforces, has amplified the demand for accessible and manageable security solutions. Governments across Europe are also increasingly mandating secure and auditable access control systems, particularly for critical infrastructure and public facilities, further bolstering the adoption of advanced software.

Key drivers propelling the dominance of cloud-based access control include:

- Technological Superiority: Offerings like remote management, real-time monitoring, and seamless integration with other security systems provide a competitive edge over on-premise solutions.

- Economic Policies: Government initiatives promoting digital infrastructure and cybersecurity in businesses create a conducive environment for cloud adoption.

- Infrastructure Development: The widespread availability of high-speed internet across Europe facilitates the smooth operation of cloud-based services.

- Scalability and Flexibility: Businesses can easily scale their access control capabilities up or down based on their evolving needs, without significant hardware investments.

- Cost-Effectiveness: Subscription-based models and reduced IT maintenance costs make cloud solutions more budget-friendly, especially for SMEs.

Among end-user industries, the Commercial sector, encompassing office buildings, retail spaces, and hospitality establishments, is a primary driver of market growth. However, the Government sector, with its stringent security requirements for public buildings, defense facilities, and critical infrastructure, represents a segment with immense growth potential and a significant existing market share. The Industrial sector, including manufacturing plants and energy facilities, also exhibits strong demand due to the need for robust security and compliance. The Transportation and Logistics sector is another key segment experiencing significant growth, driven by the need to secure cargo, vehicles, and operational facilities.

Countries like Germany, the United Kingdom, and France are leading the adoption of advanced access control software due to their strong economic bases, proactive approach to technology adoption, and robust regulatory environments concerning security and data privacy. The increasing focus on smart city initiatives and secure building management across these nations further fuels the demand for sophisticated access control solutions. The market share of cloud-based access control within these leading economies is expected to witness substantial expansion, driven by both new deployments and the migration of existing on-premise systems.

Europe Access Control Software Market Product Landscape

The Europe Access Control Software Market is distinguished by a rich product landscape featuring continuous innovation and expanding functionalities. Leading companies are focusing on developing intelligent software solutions that integrate seamlessly with various hardware components, including biometric readers, smart card systems, and mobile credentials. Unique selling propositions often lie in the software's ability to offer granular access permissions, real-time event logging, advanced analytics for security insights, and user-friendly interfaces for administrators and end-users. Technological advancements are centered on enhancing cybersecurity, leveraging AI for anomaly detection, and enabling remote management capabilities, particularly for cloud-based access control systems. The product offerings cater to a wide spectrum of needs, from basic entry/exit management for SMEs to highly sophisticated, integrated security platforms for large enterprises and government agencies.

Key Drivers, Barriers & Challenges in Europe Access Control Software Market

Key Drivers:

- Heightened Security Concerns: Increasing threats of unauthorized access, data breaches, and physical security risks drive demand for advanced access control.

- Technological Advancements: Innovations in AI, IoT, biometrics, and cloud computing are creating more sophisticated and effective solutions.

- Government Regulations: Strict compliance requirements and data privacy laws (e.g., GDPR) necessitate robust access control systems.

- Shift to Cloud-Based Solutions: The cost-effectiveness, scalability, and remote management capabilities of cloud solutions are major adoption catalysts.

- Growth of Smart Buildings and IoT: Integration with smart building systems enhances convenience and security, driving software adoption.

Barriers & Challenges:

- High Initial Investment Costs: For some advanced on-premise solutions, the upfront cost can be a deterrent for SMEs.

- Integration Complexities: Integrating new access control software with existing legacy systems can be challenging and time-consuming.

- Cybersecurity Risks: As systems become more connected, they also become potential targets for cyberattacks, requiring continuous vigilance.

- User Adoption and Training: Ensuring employees and administrators are proficient in using new access control systems is crucial for effective implementation.

- Data Privacy Concerns: While GDPR mandates security, ensuring compliance and user trust regarding data handling remains a critical concern.

Emerging Opportunities in Europe Access Control Software Market

Emerging opportunities within the Europe Access Control Software Market are abundant, particularly in the expansion of cloud-based access control for SMEs, offering affordable and scalable security. The increasing adoption of mobile credentials, leveraging smartphones for access, presents a significant growth avenue. Furthermore, the integration of AI and machine learning for predictive security analytics, identifying potential threats before they materialize, is a rapidly developing area. The residential market, with the proliferation of smart home technology, offers untapped potential for simplified and secure access solutions. The growing emphasis on hybrid work models also creates opportunities for robust remote access management software.

Growth Accelerators in the Europe Access Control Software Market Industry

Growth accelerators in the Europe Access Control Software Market are significantly driven by continuous technological breakthroughs, such as the development of more sophisticated AI algorithms for behavioral analysis and threat detection. Strategic partnerships between software providers and hardware manufacturers are crucial for offering integrated, end-to-end security solutions. Market expansion strategies, including targeting underserved SME segments and developing specialized solutions for industries like healthcare and education, are also key growth catalysts. The increasing demand for unified security platforms that integrate access control with video surveillance, intrusion detection, and other building management systems is further propelling market growth.

Key Players Shaping the Europe Access Control Software Market Market

- Honeywell International Inc.

- Bosch Security and Safety Systems

- Axis Communications AB

- Johnson Controls

- Hangzhou Hikvision Digital Technology Co Ltd

- Fujitsu

- Thales Group

- IDEMIA

- Genetec Inc.

- Veridium

- Nedap N V

- Primion Technology GmbH

List Not Exhaustive

Notable Milestones in Europe Access Control Software Market Sector

- March 2024: Zoo Hardware, a UK-based supplier, launched a comprehensive access control range for commercial and communal living spaces, featuring over 40 items including entry/exit devices, key switches, and magnetic locks, enhancing safety and security in building access.

- December 2023: Nedap introduced Access AtWork, a SaaS access control system designed for enhanced security and convenience, featuring a unique authorization model for zone-based and hierarchical team access management.

In-Depth Europe Access Control Software Market Market Outlook

The future outlook for the Europe Access Control Software Market is exceptionally positive, driven by persistent security concerns and the ongoing digital transformation across all sectors. Cloud-based access control will continue its ascendant trajectory, offering unparalleled flexibility and cost-efficiency for SMEs and large organizations alike. The integration of AI and machine learning will unlock new capabilities in predictive security and intelligent threat response, making access control systems more proactive than reactive. Strategic partnerships and acquisitions will likely reshape the competitive landscape, fostering greater consolidation and innovation. The increasing demand for unified security platforms, seamlessly integrating access control with other building management systems, represents a significant market potential and a key area for future growth, ensuring enhanced operational efficiency and comprehensive security coverage across Europe.

Europe Access Control Software Market Segmentation

-

1. Type

- 1.1. On-premise

- 1.2. Cloud-based

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Residential

- 3.3. Government

- 3.4. Industrial

- 3.5. Transportation and Logistics

- 3.6. Military and Defense

- 3.7. Other End-user Industries

Europe Access Control Software Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Access Control Software Market Regional Market Share

Geographic Coverage of Europe Access Control Software Market

Europe Access Control Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing adoption of IoT access Controls; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Growing adoption of IoT access Controls; Technological Advancements

- 3.4. Market Trends

- 3.4.1. Commercial to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Access Control Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. On-premise

- 5.1.2. Cloud-based

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Government

- 5.3.4. Industrial

- 5.3.5. Transportation and Logistics

- 5.3.6. Military and Defense

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security and Safety Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axis Communications AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Controls

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fujitsu

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDEMIA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Genetec Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Veridium

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nedap N V

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Primion Technology GmbH*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Access Control Software Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Access Control Software Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Access Control Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Access Control Software Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Europe Access Control Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Europe Access Control Software Market Volume Million Forecast, by Organization Size 2020 & 2033

- Table 5: Europe Access Control Software Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Access Control Software Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Europe Access Control Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Access Control Software Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Europe Access Control Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Access Control Software Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Europe Access Control Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Europe Access Control Software Market Volume Million Forecast, by Organization Size 2020 & 2033

- Table 13: Europe Access Control Software Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Europe Access Control Software Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Europe Access Control Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Access Control Software Market Volume Million Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: France Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Access Control Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Access Control Software Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Access Control Software Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Europe Access Control Software Market?

Key companies in the market include Honeywell International Inc, Bosch Security and Safety Systems, Axis Communications AB, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, Fujitsu, Thales Group, IDEMIA, Genetec Inc, Veridium, Nedap N V, Primion Technology GmbH*List Not Exhaustive.

3. What are the main segments of the Europe Access Control Software Market?

The market segments include Type, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 153.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing adoption of IoT access Controls; Technological Advancements.

6. What are the notable trends driving market growth?

Commercial to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing adoption of IoT access Controls; Technological Advancements.

8. Can you provide examples of recent developments in the market?

March 2024 - Zoo Hardware, a rapidly expanding supplier of door hardware in the United Kingdom, unveiled an access control range tailored for commercial structures and communal living spaces. Boasting a diverse selection of more than 40 items, the lineup features entry and exit devices, key switches, emergency door releases, keypads, and magnetic locks. This comprehensive suite equips customers with a robust access control system, guaranteeing both safety and security in building access.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Access Control Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Access Control Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Access Control Software Market?

To stay informed about further developments, trends, and reports in the Europe Access Control Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence