Key Insights

The North American Mobile Satellite Services (MSS) market is projected for substantial growth, anticipated to reach approximately 6 billion by 2024. Driven by a Compound Annual Growth Rate (CAGR) of 9%, this expansion is attributed to the escalating need for dependable, high-speed connectivity in remote and underserved areas, especially within the enterprise and government sectors. The proliferation of Low Earth Orbit (LEO) satellite constellations is a significant catalyst, enhancing data speeds and reducing latency to make mobile satellite services more competitive with terrestrial networks. Advancements in satellite technology, including miniaturization and increased payload capacity, are enabling a broader range of service offerings and lowering operational costs, thereby increasing MSS accessibility for diverse applications. The maritime and aviation industries, requiring consistent global coverage, will remain key adopters, while the enterprise sector will utilize MSS for critical communications, IoT deployments, and backup connectivity.

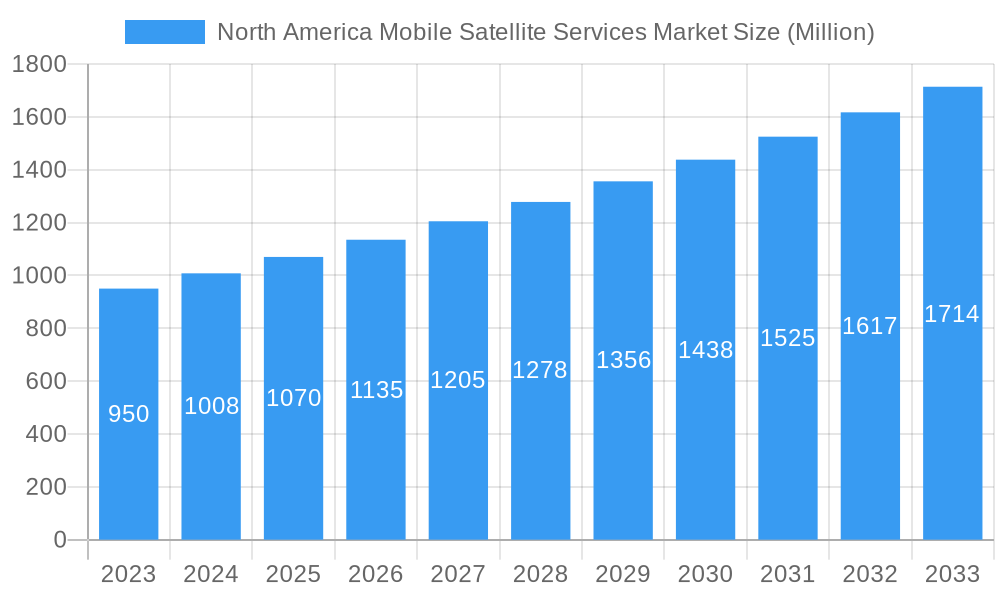

North America Mobile Satellite Services Market Market Size (In Billion)

The market's expansion is further bolstered by increased investments in satellite infrastructure and a growing recognition of the strategic importance of resilient communication networks, particularly following global disruptions. While the initial high cost of satellite terminals and services has been a historical restraint, technological innovation and heightened competition are progressively mitigating these concerns. The expansion of services to encompass more sophisticated data and voice solutions, beyond basic communication, is also broadening the appeal of MSS. Key market participants, including Iridium Communications Inc., Intelsat S.A., and Viasat Inc., are actively investing in next-generation satellite systems and expanding their service portfolios to secure a greater market share in this dynamic landscape. North America, with its vast geography and high connectivity demand, is expected to maintain its dominant position in the global MSS market, fueled by innovation and the continuous pursuit of seamless communication.

North America Mobile Satellite Services Market Company Market Share

This comprehensive report offers a detailed analysis of the North America Mobile Satellite Services (MSS) market, providing critical insights into its current status, future trajectory, and competitive environment. Spanning from 2019 to 2033, with a base year of 2024, this analysis utilizes high-traffic keywords and parent-child market segmentation for maximum visibility and value. We examine market dynamics, growth trends, dominant regions, product innovations, key drivers and barriers, emerging opportunities, growth accelerators, and leading players, presented in clear, concise language. All quantitative values are presented in billion units.

North America Mobile Satellite Services Market Market Dynamics & Structure

The North America Mobile Satellite Services market is characterized by a dynamic interplay of technological advancements, evolving end-user demands, and a robust regulatory environment. Market concentration is influenced by a handful of established global players, alongside emerging innovators, creating a competitive yet collaborative ecosystem. Technological innovation, particularly in LEO satellite constellations, is a primary driver, promising enhanced bandwidth, lower latency, and broader coverage. Regulatory frameworks, while generally supportive of infrastructure development, can present hurdles related to spectrum allocation and data privacy. Competitive product substitutes, including terrestrial mobile networks, are being increasingly integrated with satellite services, fostering a hybrid connectivity model. End-user demographics are expanding beyond traditional government and enterprise sectors to include a growing demand from the consumer and IoT segments. Mergers and acquisitions (M&A) trends are notable, with companies seeking to consolidate market share, expand service portfolios, and gain access to new technologies. For instance, the past few years have seen several strategic partnerships and acquisitions aimed at strengthening network capabilities and expanding geographic reach.

- Technological Innovation Drivers: Advancements in LEO satellite technology, miniaturization of satellite components, and improved ground terminal designs are significantly reducing deployment costs and increasing service efficiency.

- Regulatory Frameworks: Spectrum licensing, orbital slot management, and international telecommunication regulations are crucial factors influencing market entry and service deployment.

- Competitive Product Substitutes: The increasing ubiquity of 4G and 5G terrestrial networks necessitates the integration of satellite services to provide seamless connectivity in remote or underserved areas.

- End-User Demographics: A widening user base includes remote workers, outdoor enthusiasts, autonomous vehicle manufacturers, and various IoT applications requiring reliable, global connectivity.

- M&A Trends: Strategic acquisitions are focused on acquiring complementary technologies, expanding customer bases, and securing market leadership in specific service niches.

North America Mobile Satellite Services Market Growth Trends & Insights

The North America Mobile Satellite Services market is poised for substantial growth, driven by increasing demand for ubiquitous connectivity, the expansion of the Internet of Things (IoT), and ongoing technological advancements. The market size evolution reflects a consistent upward trend, with adoption rates for satellite-based communication solutions steadily increasing across various industries. Technological disruptions, such as the proliferation of Low Earth Orbit (LEO) satellite constellations, are fundamentally reshaping the market by offering higher bandwidth, lower latency, and more cost-effective services than ever before. This shift is attracting new users and applications that were previously unfeasible with traditional geostationary (GEO) satellite technology. Consumer behavior is also shifting, with a growing appreciation for reliable connectivity regardless of location, spurred by remote work trends and the increasing reliance on digital services.

The market penetration of mobile satellite services is expanding beyond niche applications into mainstream use cases. For instance, the ability of satellites to provide direct-to-device connectivity is a significant disruptor, promising to bridge the digital divide in remote and rural areas. The Compound Annual Growth Rate (CAGR) for the North America MSS market is projected to be robust over the forecast period, reflecting the increasing investment in satellite infrastructure and the expanding range of applications. From voice services for remote workers and emergency responders to high-speed data for maritime and aviation sectors, the versatility of MSS is a key growth driver. The rise of satellite-enabled IoT solutions for asset tracking, environmental monitoring, and smart agriculture further amplifies market demand. Furthermore, government initiatives aimed at expanding broadband access and enhancing national security are providing significant impetus to market growth. The convergence of satellite and terrestrial networks is also a major trend, enabling seamless connectivity and enhanced user experience.

- Market Size Evolution: The market is projected to grow from an estimated $xx Million units in 2025 to $xx Million units by 2033, demonstrating a significant expansion in value.

- Adoption Rates: Increasing adoption in sectors like agriculture, logistics, and disaster management, driven by the need for real-time data and communication.

- Technological Disruptions: The deployment of LEO constellations is a game-changer, offering competitive alternatives to traditional GEO services and opening new market segments.

- Consumer Behavior Shifts: Growing demand for 'always-on' connectivity, even in remote or off-grid locations, fuels the adoption of satellite-based solutions.

- Market Penetration: Expanding beyond enterprise to consumer markets with direct-to-device capabilities and satellite-enabled entertainment solutions.

- CAGR Projection: The North America Mobile Satellite Services market is expected to witness a CAGR of xx% during the forecast period.

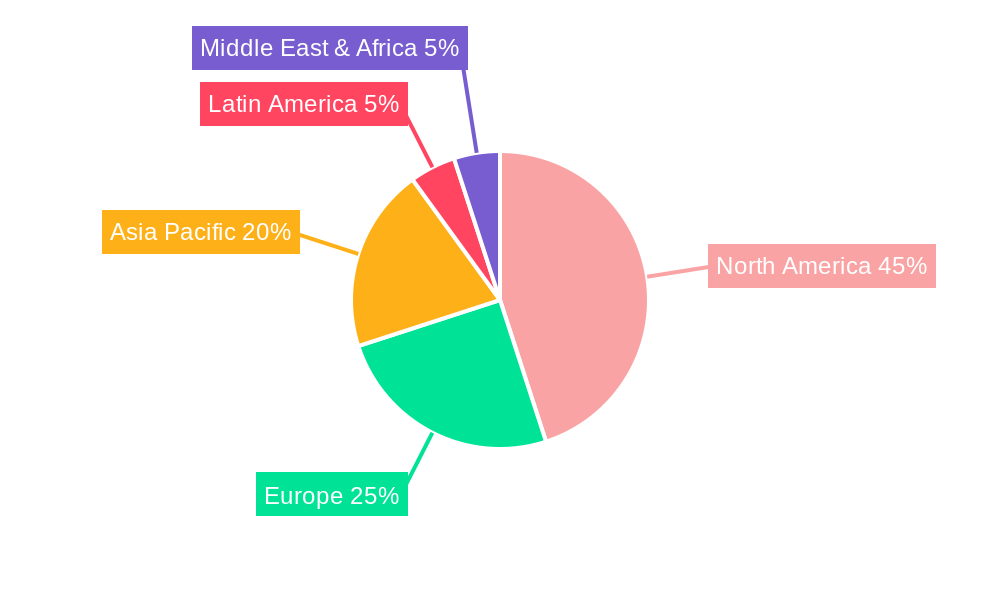

Dominant Regions, Countries, or Segments in North America Mobile Satellite Services Market

The North America Mobile Satellite Services market exhibits distinct regional dominance, driven by specific end-user demands, robust infrastructure development, and favorable economic policies. The United States consistently emerges as the leading region, owing to its vast geographical expanse, significant technological innovation capabilities, and a substantial concentration of industries reliant on reliable, wide-area connectivity. The Government sector in the United States is a major consumer of MSS, utilizing these services for defense, emergency response, and critical infrastructure communication, often representing a significant portion of market share.

Within the End-user Industry segment, the Government sector's unwavering demand for secure and resilient communication solutions, especially in areas lacking terrestrial infrastructure, solidifies its dominance. This includes military operations, disaster relief efforts, and public safety communications, which are non-negotiable and often budget-protected. Following closely are Enterprise and Maritime sectors, driven by the needs of industries such as oil and gas, mining, remote sensing, shipping, and fishing, where continuous connectivity is paramount for operations, safety, and efficiency. The Aviation sector also represents a significant segment, with increasing demand for in-flight connectivity and real-time flight data.

Analyzing Satellite Type, Low Earth Orbit (LEO) satellites are rapidly gaining traction and are projected to witness the highest growth. Their ability to offer lower latency and higher bandwidth at potentially lower costs is disrupting the market, especially for data-intensive applications and direct-to-device services. However, Geostationary Earth Orbit (GEO) satellites continue to hold a substantial market share, particularly for broadcasting and fixed data services where continuous coverage is critical. Medium Earth Orbit (MEO) satellites offer a balance between LEO and GEO, finding applications in specific enterprise and government solutions.

In terms of Service, Data services are experiencing the most significant growth, fueled by the proliferation of IoT devices, the need for real-time data transmission from remote assets, and the increasing demand for high-speed internet access. While Voice services remain crucial, especially in remote and emergency scenarios, their growth rate is surpassed by data-centric applications.

- Leading Region/Country: United States, driven by government spending and a large enterprise base.

- Dominant End-user Industry: Government, due to critical communication needs for defense, public safety, and disaster management.

- Key Segment Drivers (End-user):

- Government: National security, emergency response, remote operations.

- Enterprise: Resource exploration, logistics, remote asset management.

- Maritime: Vessel tracking, safety communications, crew welfare.

- Aviation: In-flight connectivity, air traffic management.

- Dominant Satellite Type Trend: Increasing adoption of LEO satellites for low latency and high bandwidth applications, while GEO remains significant for continuous coverage.

- Dominant Service Trend: Rapid growth in data services driven by IoT and broadband demand.

North America Mobile Satellite Services Market Product Landscape

The product landscape of the North America Mobile Satellite Services market is characterized by continuous innovation and diversification, aimed at meeting the evolving needs of a broad spectrum of users. Key product developments focus on enhancing terminal portability, increasing data transmission speeds, and enabling seamless integration with existing terrestrial networks. Innovations in satellite modems, portable satellite phones, and ruggedized data terminals are making MSS more accessible and user-friendly for field operations, remote work, and emergency situations. Furthermore, advancements in satellite antenna technology, including phased-array antennas and user-terminals for direct-to-device communication, are enabling higher throughput and more reliable connections. Applications range from basic voice and messaging to sophisticated IoT solutions for asset tracking, environmental monitoring, and remote sensor data collection. The performance metrics of these products are continually improving, with faster data speeds, lower latency, and greater power efficiency becoming standard.

Key Drivers, Barriers & Challenges in North America Mobile Satellite Services Market

Key Drivers: The North America Mobile Satellite Services market is propelled by several significant drivers. The ever-increasing demand for reliable connectivity in remote and underserved areas, especially for critical applications like emergency response and public safety, is a primary catalyst. Technological advancements, particularly the development of LEO satellite constellations offering higher bandwidth and lower latency, are opening up new possibilities and making satellite services more competitive. The burgeoning Internet of Things (IoT) market, with its need for ubiquitous data collection and transmission, is a substantial growth engine. Government initiatives aimed at expanding broadband access and enhancing national security also play a crucial role in market expansion.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several barriers and challenges. High initial infrastructure costs for satellite deployment and ground segment development can be a deterrent. Regulatory hurdles related to spectrum allocation, licensing, and orbital slot management can create delays and complexities. Competition from expanding terrestrial mobile networks, particularly in urban and suburban areas, necessitates a clear value proposition for MSS. Supply chain issues for critical components and manufacturing can impact production timelines and costs. Furthermore, the perceived complexity of satellite systems and the need for specialized training for some end-users can present adoption challenges. Geopolitical factors and the increasing threat of space debris also pose long-term concerns.

Emerging Opportunities in North America Mobile Satellite Services Market

Emerging opportunities within the North America Mobile Satellite Services market are abundant, driven by technological convergence and evolving societal needs. The direct-to-device satellite connectivity for smartphones presents a transformative opportunity, promising to eliminate mobile 'dead zones' and expand the reach of communication for billions. The expansion of satellite-enabled IoT solutions for smart agriculture, autonomous vehicles, and industrial applications in remote locations offers significant growth potential. The increasing demand for resilient and secure communication networks for critical infrastructure, including energy grids and transportation systems, creates a stable demand for MSS. Furthermore, the growing trend of remote work and the desire for connectivity in recreational and off-grid settings are opening up new consumer market segments.

Growth Accelerators in the North America Mobile Satellite Services Market Industry

Several catalysts are accelerating the long-term growth of the North America Mobile Satellite Services market. Technological breakthroughs, such as advancements in small satellite technology, more efficient propulsion systems, and sophisticated ground station networks, are driving down costs and improving service quality. Strategic partnerships between satellite operators, mobile network operators (MNOs), and device manufacturers are crucial for seamless integration and broader market penetration. Market expansion strategies, including the development of new service offerings tailored to specific industry needs and the entry into previously untapped geographic regions, are also key growth accelerators. The increasing investment in LEO constellations by multiple players is fostering innovation and competition, ultimately benefiting end-users with more advanced and affordable solutions.

Key Players Shaping the North America Mobile Satellite Services Market Market

- Iridium Communications Inc

- Intelsat S A

- ORBCOMM Europe Holding BV

- Swarm Technologies Inc

- Inmarsat PLC

- Viasat Inc

- Thales Group

- Globalstar Inc

- Telesat

- TerreStar Solutions Inc

Notable Milestones in North America Mobile Satellite Services Market Sector

- February 2022: Lynk Global, Inc., a satellite-direct-to-phone telecoms company, announced the signing of multiple commercial contracts with Mobile Network Operators (MNOs) covering seven island nations in the Pacific and Caribbean, including Telikom PNG in Papua New Guinea (PNG) and bmobile in the Solomon Islands. This signifies a major step towards direct satellite-to-smartphone connectivity, expanding the reach of mobile communication.

- January 2022: Telesat, a satellite operator, announced a strategic partnership with Canada's ENCQOR 5G. This partnership aims to transform and accelerate the delivery of 5G networks across Canada. Further, the partnership will conduct demonstrations, trials, and pilots to advance 5G connectivity in rural and urban areas, highlighting the integration of satellite technology with terrestrial 5G infrastructure.

In-Depth North America Mobile Satellite Services Market Market Outlook

The outlook for the North America Mobile Satellite Services market is exceptionally positive, characterized by sustained growth and transformative innovation. The ongoing deployment of advanced LEO constellations, coupled with the increasing demand for ubiquitous connectivity, especially for IoT and direct-to-device applications, will continue to be major growth drivers. Strategic partnerships between satellite providers and terrestrial network operators will further blur the lines between traditional and satellite communication, offering seamless, integrated solutions. The market is poised to witness an influx of new applications across various sectors, from autonomous systems and advanced logistics to enhanced public safety and remote sensing. Continuous investment in research and development, coupled with favorable regulatory environments, will fuel further technological advancements, ensuring the North America MSS market remains at the forefront of global connectivity solutions.

North America Mobile Satellite Services Market Segmentation

-

1. Satellite Type

- 1.1. Low Earth Orbit (LEO)

- 1.2. Medium Earth Orbit (MEO)

- 1.3. Geostationary Earth Orbit (GEO)

-

2. Service

- 2.1. Voice

- 2.2. Data

-

3. End-user Industry

- 3.1. Maritime

- 3.2. Enterprise

- 3.3. Aviation

- 3.4. Government

North America Mobile Satellite Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Mobile Satellite Services Market Regional Market Share

Geographic Coverage of North America Mobile Satellite Services Market

North America Mobile Satellite Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Integration Demands for Satellite and Terrestrial Mobile Technology5.1.2 5G mobile networks with next-generation satellite capabilities is likely to propel the market growth

- 3.3. Market Restrains

- 3.3.1. Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology

- 3.4. Market Trends

- 3.4.1. Increasing Government Investments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mobile Satellite Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Type

- 5.1.1. Low Earth Orbit (LEO)

- 5.1.2. Medium Earth Orbit (MEO)

- 5.1.3. Geostationary Earth Orbit (GEO)

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Voice

- 5.2.2. Data

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Maritime

- 5.3.2. Enterprise

- 5.3.3. Aviation

- 5.3.4. Government

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Satellite Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iridium Communications Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intelsat S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ORBCOMM Europe Holding BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Swarm Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inmarsat PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Viasat Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Globalstar Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Telesat

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TerreStar Solutions Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Iridium Communications Inc

List of Figures

- Figure 1: North America Mobile Satellite Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Mobile Satellite Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Mobile Satellite Services Market Revenue billion Forecast, by Satellite Type 2020 & 2033

- Table 2: North America Mobile Satellite Services Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: North America Mobile Satellite Services Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Mobile Satellite Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Mobile Satellite Services Market Revenue billion Forecast, by Satellite Type 2020 & 2033

- Table 6: North America Mobile Satellite Services Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: North America Mobile Satellite Services Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Mobile Satellite Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Mobile Satellite Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Mobile Satellite Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Mobile Satellite Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mobile Satellite Services Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the North America Mobile Satellite Services Market?

Key companies in the market include Iridium Communications Inc, Intelsat S A, ORBCOMM Europe Holding BV, Swarm Technologies Inc, Inmarsat PLC, Viasat Inc, Thales Group, Globalstar Inc, Telesat, TerreStar Solutions Inc.

3. What are the main segments of the North America Mobile Satellite Services Market?

The market segments include Satellite Type, Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Integration Demands for Satellite and Terrestrial Mobile Technology5.1.2 5G mobile networks with next-generation satellite capabilities is likely to propel the market growth.

6. What are the notable trends driving market growth?

Increasing Government Investments.

7. Are there any restraints impacting market growth?

Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology.

8. Can you provide examples of recent developments in the market?

In February 2022, Lynk Global, Inc. satellite-direct-to-phone telecoms company announced that it had signed multiple commercial contracts with Mobile Network Operators (MNOs) covering seven island nations in the Pacific and Caribbean, including Telikom PNG in Papua New Guinea (PNG) and bmobile in the Solomon Islands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mobile Satellite Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mobile Satellite Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mobile Satellite Services Market?

To stay informed about further developments, trends, and reports in the North America Mobile Satellite Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence