Key Insights

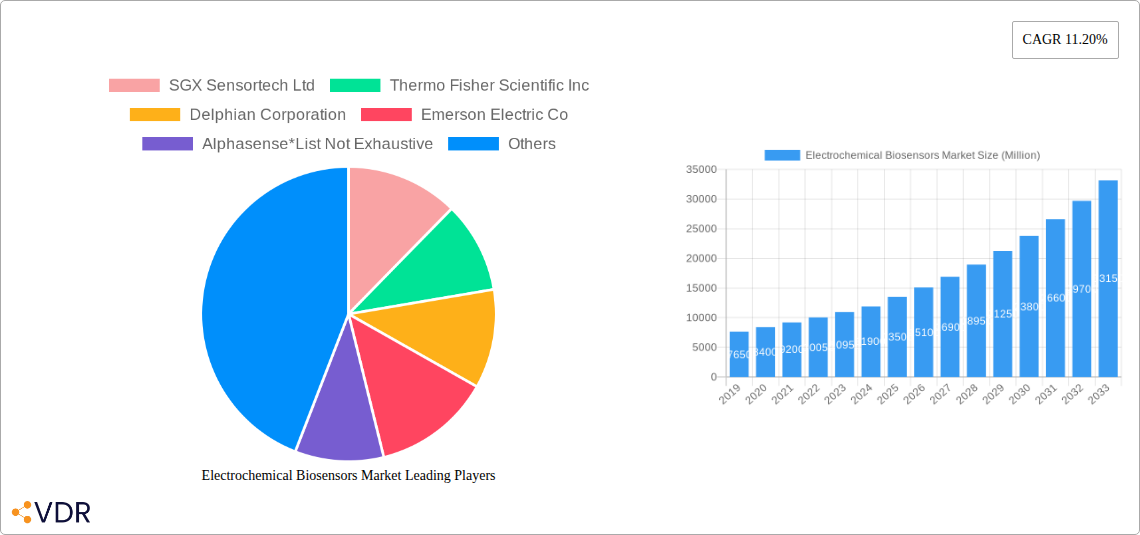

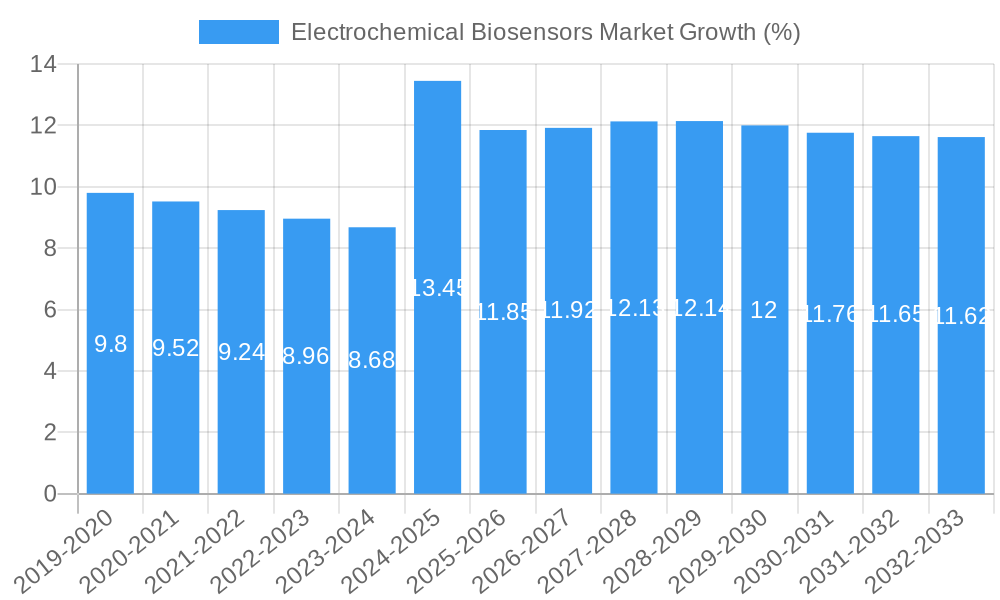

The global Electrochemical Biosensors Market is poised for substantial growth, projected to reach a market size of approximately $13,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 11.20% through 2033. This expansion is fueled by a confluence of powerful market drivers, including the escalating demand for rapid and accurate diagnostic tools in the healthcare sector, the increasing need for sophisticated monitoring solutions in the oil and gas and chemical industries, and the growing adoption of advanced sensors in automotive applications for emissions control and safety. Technological advancements in sensor materials and miniaturization are further propelling innovation, enabling the development of more sensitive, selective, and cost-effective electrochemical biosensors. The market is segmented into key types such as Potentiometric Sensors, Amperometric Sensors, and Conductometric Sensors, with Amperometric sensors leading due to their versatility and widespread application in various analytical techniques.

The market's trajectory is also significantly influenced by emerging trends like the integration of electrochemical biosensors with wearable devices for continuous health monitoring, their application in point-of-care diagnostics, and the development of novel biosensing platforms for environmental monitoring and food safety. Key end-user industries like Medical, Oil and Gas, Chemical and Petrochemicals, and Food & Beverage are expected to dominate revenue generation, owing to stringent regulatory requirements and the inherent need for precise analyte detection. While the market exhibits strong growth potential, certain restraints such as the high initial cost of development and manufacturing for specialized biosensors and the need for standardized calibration and validation protocols may present challenges. However, ongoing research and development efforts are actively addressing these limitations, paving the way for broader market penetration across diverse applications. Prominent companies like Thermo Fisher Scientific Inc., Emerson Electric Co., and SGX Sensortech Ltd. are actively innovating and expanding their product portfolios, driving competitive dynamics and market evolution.

This in-depth report provides a detailed analysis of the global Electrochemical Biosensors Market, offering crucial insights into its dynamics, growth trends, dominant segments, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving landscape of electrochemical biosensing technologies. We delve into market segmentation by type (Potentiometric Sensors, Amperometric Sensors, Conductometric Sensors) and end-user industry (Oil and Gas, Chemical and Petrochemicals, Medical, Automotive, Food & Beverage, Other End-user Industry), providing granular data and actionable intelligence. The report includes an exhaustive examination of key players, notable industry milestones, and emerging opportunities, all presented with a focus on SEO optimization using high-traffic keywords relevant to the electrochemical biosensors industry.

Electrochemical Biosensors Market Dynamics & Structure

The electrochemical biosensors market is characterized by a moderately concentrated landscape, driven by continuous technological innovation and stringent regulatory frameworks aimed at ensuring safety and efficacy across various end-user industries. Key drivers include advancements in nanotechnology, microfluidics, and biomaterial development, which enable the creation of more sensitive, selective, and portable biosensing devices. Competitive product substitutes, while present, often lack the specificity and real-time detection capabilities offered by electrochemical biosensors, particularly in medical diagnostics and environmental monitoring. End-user demographics are increasingly demanding user-friendly and cost-effective solutions, influencing product development and market strategies. Mergers and acquisitions (M&A) trends reveal strategic consolidation by leading players seeking to expand their product portfolios and market reach. Barriers to innovation include the high cost of research and development, complex regulatory approval processes, and the need for highly skilled personnel.

- Market Concentration: Moderately concentrated with a few key players holding significant market share.

- Technological Innovation Drivers: Nanotechnology, microfluidics, point-of-care diagnostics, IoT integration.

- Regulatory Frameworks: FDA, CE marking, EPA regulations influencing product development and market access.

- Competitive Product Substitutes: Optical biosensors, mechanical sensors, traditional laboratory diagnostic methods.

- End-user Demographics: Growing demand for rapid diagnostics, personalized medicine, and real-time environmental monitoring.

- M&A Trends: Strategic acquisitions to broaden product offerings and gain technological expertise.

- Innovation Barriers: High R&D costs, lengthy approval cycles, need for specialized expertise.

Electrochemical Biosensors Market Growth Trends & Insights

The global electrochemical biosensors market is poised for robust growth, driven by an escalating demand for rapid and accurate diagnostic solutions in healthcare, alongside critical applications in environmental monitoring and industrial safety. The market size evolution is a testament to the increasing adoption rates of electrochemical biosensing technologies across diverse sectors. Technological disruptions, such as the miniaturization of devices and the integration of artificial intelligence for data analysis, are further accelerating market penetration. Shifts in consumer behavior, particularly a heightened awareness of health and environmental safety, are fueling the demand for point-of-care devices and real-time monitoring systems. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated to be in the range of 8.5% to 10.5%, indicating a significant expansion in market value. This growth is underpinned by substantial investments in research and development and supportive government initiatives promoting advanced sensing technologies. The ability of electrochemical biosensors to offer real-time, sensitive, and specific detection of analytes makes them indispensable tools for disease diagnosis, food safety, and industrial process control.

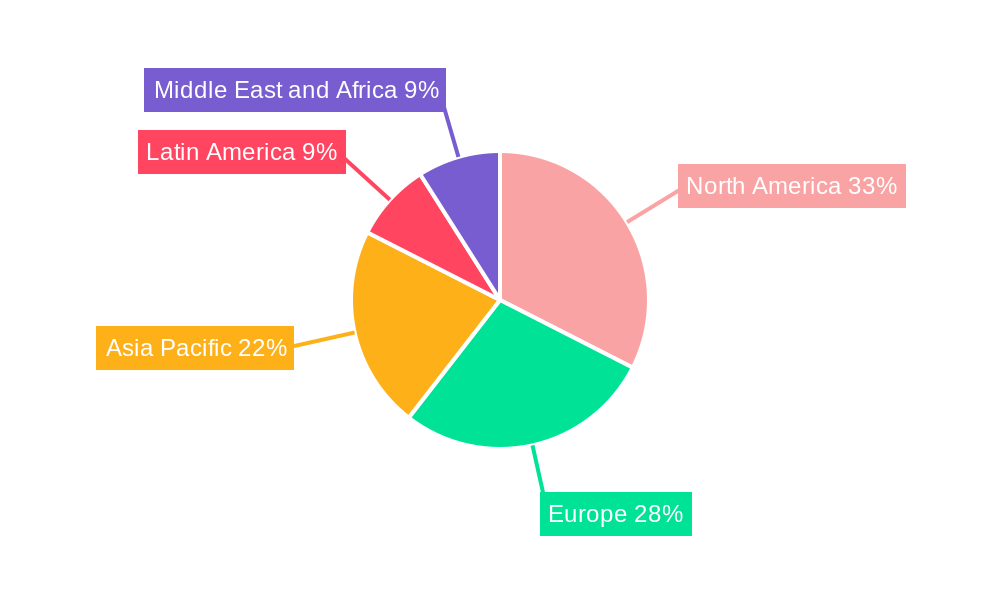

Dominant Regions, Countries, or Segments in Electrochemical Biosensors Market

North America currently leads the electrochemical biosensors market, primarily driven by substantial investments in healthcare infrastructure, a strong emphasis on personalized medicine, and advanced research institutions. The United States, in particular, is a major hub for innovation and adoption of biosensing technologies. Economic policies promoting technological advancement and a well-established regulatory framework for medical devices further bolster its dominance. In terms of segments, Amperometric Sensors represent the largest share within the electrochemical biosensors market due to their versatility and widespread use in glucose monitoring, environmental analysis, and food safety applications. The Medical end-user industry is another significant growth driver, propelled by the rising prevalence of chronic diseases, an aging global population, and the increasing demand for point-of-care diagnostic tools.

Dominant Region: North America, specifically the United States.

- Key Drivers: Advanced healthcare infrastructure, high R&D spending, supportive government policies, strong presence of leading biosensor companies.

- Market Share: Estimated at 30-35% of the global market.

- Growth Potential: Continued innovation in diagnostic and therapeutic applications, increasing adoption in remote patient monitoring.

Dominant Segment (Type): Amperometric Sensors.

- Key Drivers: High sensitivity and selectivity, wide range of applications (glucose, urea, lactate, etc.), cost-effectiveness compared to some other biosensing modalities.

- Market Share: Estimated at 40-45% of the biosensor type segment.

- Growth Potential: Integration into portable devices, development of multi-analyte amperometric sensors.

Dominant Segment (End-user Industry): Medical.

- Key Drivers: Rising prevalence of chronic diseases (diabetes, cardiovascular diseases), increasing demand for rapid diagnostics, aging population.

- Market Share: Estimated at 35-40% of the end-user industry segment.

- Growth Potential: Expansion of point-of-care testing, development of biosensors for early disease detection and prognosis.

Electrochemical Biosensors Market Product Landscape

The electrochemical biosensors market is witnessing a surge in product innovations focused on enhanced sensitivity, selectivity, and miniaturization. Manufacturers are developing advanced Amperometric Sensors for continuous glucose monitoring, offering improved accuracy and patient comfort. Innovations in Potentiometric Sensors are targeting the detection of various ions and gases in environmental and industrial applications. The development of novel electrode materials, such as graphene and nanomaterials, is leading to biosensors with superior performance metrics, including lower detection limits and faster response times. Applications span across medical diagnostics for early disease detection, food and beverage industries for quality control and pathogen detection, and the oil and gas sector for monitoring hazardous substances.

Key Drivers, Barriers & Challenges in Electrochemical Biosensors Market

Key Drivers:

- Technological Advancements: Continuous innovation in materials science, nanotechnology, and microfluidics is creating more sensitive, selective, and portable biosensors.

- Growing Healthcare Needs: Increasing prevalence of chronic diseases and the demand for rapid point-of-care diagnostics are significant market propelers.

- Environmental and Safety Concerns: Stringent regulations and public awareness are driving the adoption of electrochemical biosensors for environmental monitoring and industrial safety.

- Cost-Effectiveness: Electrochemical biosensors offer a more economical alternative to traditional laboratory-based analytical methods for many applications.

Barriers & Challenges:

- Regulatory Hurdles: Obtaining regulatory approval for new biosensing devices, especially for medical applications, can be a complex and time-consuming process.

- Interference and Stability: Ensuring the stability and accuracy of biosensors in diverse and complex sample matrices, and mitigating interference from other substances, remains a challenge.

- Manufacturing Scalability and Cost: Scaling up the production of highly sensitive and complex biosensors while maintaining cost-effectiveness can be challenging for manufacturers.

- Limited Consumer Awareness: In certain segments, a lack of widespread consumer awareness about the benefits of electrochemical biosensors can hinder adoption.

Emerging Opportunities in Electrochemical Biosensors Market

Emerging opportunities in the electrochemical biosensors market lie in the expansion of point-of-care diagnostics for infectious diseases and personalized medicine, particularly in developing economies with limited access to advanced laboratory facilities. The integration of electrochemical biosensors with IoT platforms for remote patient monitoring and smart healthcare solutions presents significant growth potential. Furthermore, the development of low-cost, disposable electrochemical biosensors for widespread environmental monitoring of pollutants and agricultural applications for crop health assessment are untapped markets ripe for innovation. The increasing demand for wearable health trackers also opens avenues for highly integrated and miniaturized electrochemical biosensing components.

Growth Accelerators in the Electrochemical Biosensors Market Industry

The long-term growth of the electrochemical biosensors market is being accelerated by several key catalysts. Technological breakthroughs in the development of novel biorecognition elements and electrode materials are continuously enhancing sensor performance. Strategic partnerships between biosensor manufacturers, research institutions, and end-users are fostering innovation and facilitating market penetration. Furthermore, market expansion strategies, including geographical diversification and the development of application-specific biosensing solutions, are driving sustained growth. The increasing trend towards miniaturization and multiplexing capabilities in biosensor design will also play a crucial role in accelerating market adoption across a wider array of applications.

Key Players Shaping the Electrochemical Biosensors Market Market

- SGX Sensortech Ltd

- Thermo Fisher Scientific Inc

- Delphian Corporation

- Emerson Electric Co

- Alphasense

- Ametek Inc

- Figaro USA Inc

- Conductive Technologies Inc

- Dragerwerk AG

- MSA Safety

- Membrapor AG

Notable Milestones in Electrochemical Biosensors Market Sector

- July 2022: Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots, marking a significant advancement in cancer diagnostics.

- September 2021: Alphasense launched two new electrochemical sensors, the VOC-A4 and VOC-B4, specifically designed for Volatile Organic Compounds (VOCs). These sensors, compatible with amperometric 4-electrode air quality sensors, offer adjustable voltage settings (V, 0.1V, 0.2V, or 0.3V) to detect a range of gases, enhancing air quality monitoring capabilities.

In-Depth Electrochemical Biosensors Market Market Outlook

- July 2022: Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots, marking a significant advancement in cancer diagnostics.

- September 2021: Alphasense launched two new electrochemical sensors, the VOC-A4 and VOC-B4, specifically designed for Volatile Organic Compounds (VOCs). These sensors, compatible with amperometric 4-electrode air quality sensors, offer adjustable voltage settings (V, 0.1V, 0.2V, or 0.3V) to detect a range of gases, enhancing air quality monitoring capabilities.

In-Depth Electrochemical Biosensors Market Market Outlook

The electrochemical biosensors market is projected for continued strong performance, fueled by sustained innovation and increasing adoption across critical sectors. The integration of advanced materials and miniaturization technologies will drive the development of more sophisticated and user-friendly devices. Strategic initiatives focusing on expanding applications in personalized medicine, environmental monitoring, and the Internet of Things (IoT) will act as significant growth accelerators. The market's future outlook is characterized by exciting prospects in disease prediction, real-time health management, and enhanced industrial safety, promising substantial returns for stakeholders invested in this dynamic field.

Electrochemical Biosensors Market Segmentation

-

1. Type

- 1.1. Potentiometric Sensors

- 1.2. Amperometric Sensors

- 1.3. Conductometric Sensors

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemicals

- 2.3. Medical

- 2.4. Automotive

- 2.5. Food & Beverage

- 2.6. Other End-user Industry

Electrochemical Biosensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Electrochemical Biosensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Nanotechnology-based Sensors; Government Rules and Regulations for Safety in Hazardous Places

- 3.3. Market Restrains

- 3.3.1. Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements

- 3.4. Market Trends

- 3.4.1. Medical Sector to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Potentiometric Sensors

- 5.1.2. Amperometric Sensors

- 5.1.3. Conductometric Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemicals

- 5.2.3. Medical

- 5.2.4. Automotive

- 5.2.5. Food & Beverage

- 5.2.6. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Potentiometric Sensors

- 6.1.2. Amperometric Sensors

- 6.1.3. Conductometric Sensors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Chemical and Petrochemicals

- 6.2.3. Medical

- 6.2.4. Automotive

- 6.2.5. Food & Beverage

- 6.2.6. Other End-user Industry

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Potentiometric Sensors

- 7.1.2. Amperometric Sensors

- 7.1.3. Conductometric Sensors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Chemical and Petrochemicals

- 7.2.3. Medical

- 7.2.4. Automotive

- 7.2.5. Food & Beverage

- 7.2.6. Other End-user Industry

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Potentiometric Sensors

- 8.1.2. Amperometric Sensors

- 8.1.3. Conductometric Sensors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Chemical and Petrochemicals

- 8.2.3. Medical

- 8.2.4. Automotive

- 8.2.5. Food & Beverage

- 8.2.6. Other End-user Industry

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Potentiometric Sensors

- 9.1.2. Amperometric Sensors

- 9.1.3. Conductometric Sensors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Chemical and Petrochemicals

- 9.2.3. Medical

- 9.2.4. Automotive

- 9.2.5. Food & Beverage

- 9.2.6. Other End-user Industry

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Potentiometric Sensors

- 10.1.2. Amperometric Sensors

- 10.1.3. Conductometric Sensors

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Chemical and Petrochemicals

- 10.2.3. Medical

- 10.2.4. Automotive

- 10.2.5. Food & Beverage

- 10.2.6. Other End-user Industry

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Electrochemical Biosensors Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SGX Sensortech Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Thermo Fisher Scientific Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Delphian Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Emerson Electric Co

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Alphasense*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ametek Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Figaro USA Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Conductive Technologies Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Dragerwerk AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 MSA Safety

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Membrapor AG

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 SGX Sensortech Ltd

List of Figures

- Figure 1: Global Electrochemical Biosensors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Electrochemical Biosensors Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Electrochemical Biosensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Electrochemical Biosensors Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Electrochemical Biosensors Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Electrochemical Biosensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Electrochemical Biosensors Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Electrochemical Biosensors Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Electrochemical Biosensors Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Electrochemical Biosensors Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Electrochemical Biosensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Electrochemical Biosensors Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Electrochemical Biosensors Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Electrochemical Biosensors Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Electrochemical Biosensors Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electrochemical Biosensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electrochemical Biosensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Electrochemical Biosensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Electrochemical Biosensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Electrochemical Biosensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Electrochemical Biosensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Electrochemical Biosensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Electrochemical Biosensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Electrochemical Biosensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Electrochemical Biosensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Electrochemical Biosensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Electrochemical Biosensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Electrochemical Biosensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Electrochemical Biosensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Electrochemical Biosensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Electrochemical Biosensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Electrochemical Biosensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Electrochemical Biosensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Electrochemical Biosensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Electrochemical Biosensors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrochemical Biosensors Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the Electrochemical Biosensors Market?

Key companies in the market include SGX Sensortech Ltd, Thermo Fisher Scientific Inc, Delphian Corporation, Emerson Electric Co, Alphasense*List Not Exhaustive, Ametek Inc, Figaro USA Inc, Conductive Technologies Inc, Dragerwerk AG, MSA Safety, Membrapor AG.

3. What are the main segments of the Electrochemical Biosensors Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Nanotechnology-based Sensors; Government Rules and Regulations for Safety in Hazardous Places.

6. What are the notable trends driving market growth?

Medical Sector to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements.

8. Can you provide examples of recent developments in the market?

July 2022 - Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrochemical Biosensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrochemical Biosensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrochemical Biosensors Market?

To stay informed about further developments, trends, and reports in the Electrochemical Biosensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence