Key Insights

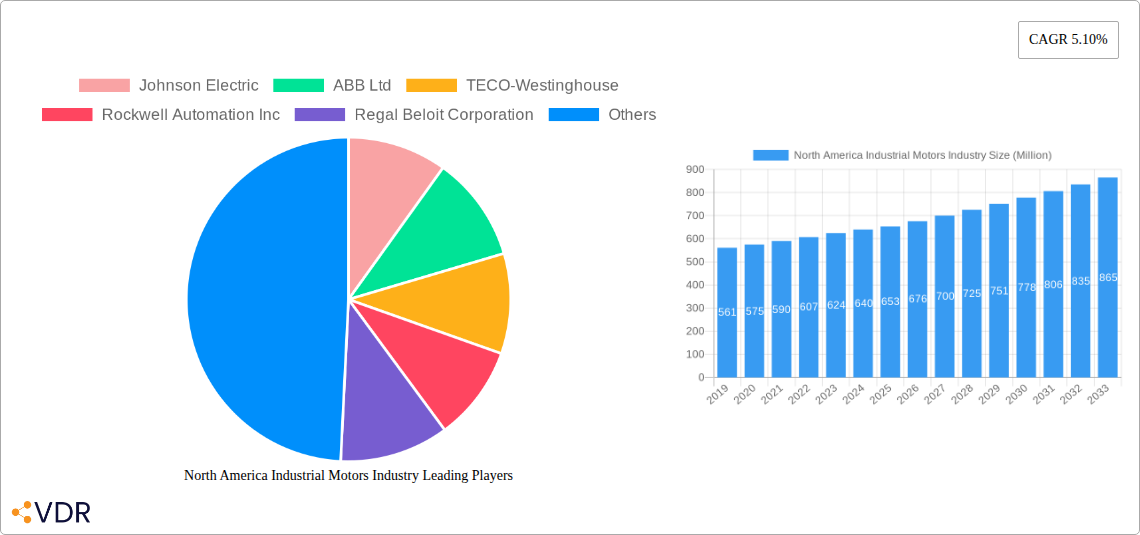

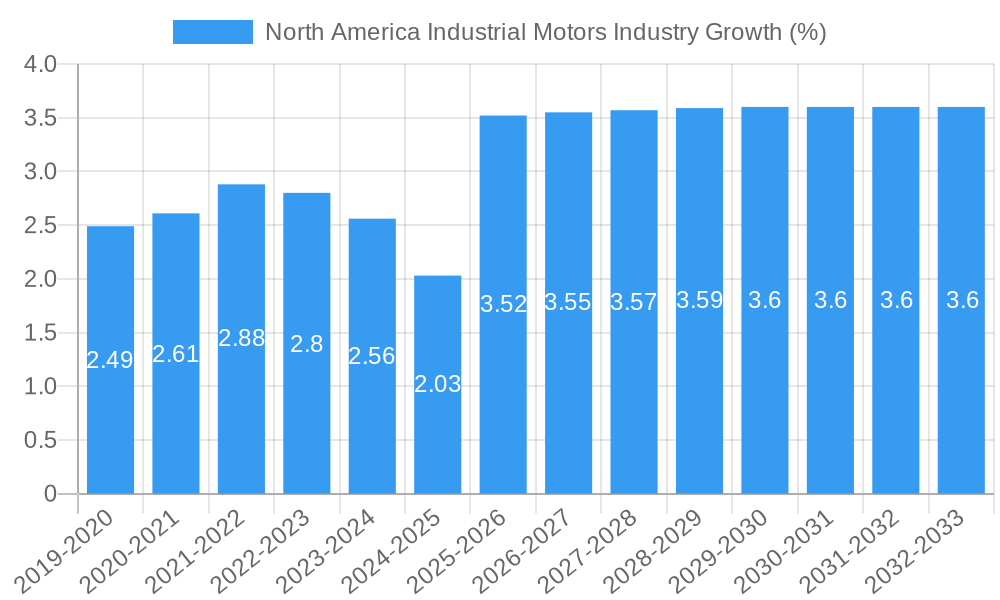

The North America Industrial Motors market is poised for significant expansion, projected to reach approximately USD 653 million by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.10% through 2033. This growth is primarily fueled by escalating demand across critical sectors such as oil and gas, power generation, and mining and metals, where advanced and reliable motor solutions are indispensable for operational efficiency and output. The increasing adoption of automation and sophisticated machinery in these industries, coupled with a strong emphasis on energy efficiency and sustainable practices, are key drivers propelling the market forward. Furthermore, significant investments in infrastructure development and the modernization of manufacturing facilities across North America are creating a fertile ground for the deployment of high-performance industrial motors. The market's segmentation, with AC motors holding a dominant share due to their widespread application and DC motors showing steady growth in specialized areas, reflects the diverse needs of the industrial landscape. High voltage and medium voltage motors are particularly sought after in heavy industries, while low voltage motors cater to a broader range of manufacturing and processing applications.

The North American industrial motors landscape is characterized by a dynamic interplay of technological advancements and evolving industry demands. Key trends include the integration of smart technologies, such as IoT and predictive maintenance capabilities, into industrial motors, enhancing their operational intelligence and reducing downtime. The growing focus on reducing carbon footprints and complying with stringent environmental regulations is also driving the demand for energy-efficient motor designs and variable speed drives, which optimize energy consumption. However, the market also faces certain restraints, including the high initial investment costs associated with advanced motor technologies and the potential for supply chain disruptions, which can impact production and delivery timelines. Nevertheless, with leading companies like Siemens AG, ABB Ltd, and Rockwell Automation Inc. continuously innovating and expanding their product portfolios, the North America Industrial Motors market is well-positioned to navigate these challenges and capitalize on the burgeoning opportunities presented by its dynamic industrial ecosystem. The United States, Canada, and Mexico collectively form a substantial market, with ongoing industrial modernization and a strong manufacturing base underpinning sustained demand.

North America Industrial Motors Industry Market Dynamics & Structure

The North America Industrial Motors industry is characterized by a moderate market concentration, with key players like Siemens AG, ABB Ltd, Johnson Electric, and Yaskawa Electric Corporation holding significant shares. Technological innovation remains a primary driver, fueled by the increasing demand for energy-efficient motors and the integration of smart technologies like IoT and AI for predictive maintenance and enhanced operational control. Regulatory frameworks, particularly those focused on energy efficiency standards and environmental compliance, are shaping product development and market access. Competitive product substitutes, while present, are largely differentiated by performance, efficiency, and specialized application suitability. End-user demographics are increasingly leaning towards industries with high automation needs and significant power consumption, such as manufacturing, oil & gas, and power generation. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Moderate, with established global players dominating.

- Technological Innovation: Focus on energy efficiency, smart motor technology (IoT, AI), and variable speed drives.

- Regulatory Frameworks: Driving adoption of stricter energy efficiency standards and emissions regulations.

- Competitive Landscape: Differentiated by performance, reliability, and specialized application solutions.

- End-User Demographics: Growth driven by automation-intensive industries and critical infrastructure.

- M&A Trends: Companies consolidating to gain market share, acquire new technologies, and enhance service offerings.

North America Industrial Motors Industry Growth Trends & Insights

The North America Industrial Motors market is poised for robust growth throughout the study period of 2019–2033, driven by an accelerating adoption of advanced automation across diverse end-user industries. The base year, 2025, marks a significant point where the momentum of industrial modernization and the ongoing push for operational efficiency are clearly discernible. Market size evolution is projected to be substantial, with a compound annual growth rate (CAGR) estimated to be in the high single digits. This growth is underpinned by technological disruptions such as the widespread implementation of smart motors integrated with IoT capabilities, enabling real-time monitoring, predictive maintenance, and optimized performance. Consumer behavior shifts are evident, with end-users prioritizing motors that offer lower total cost of ownership through energy savings and reduced downtime. The adoption rates of high-efficiency motors, particularly those meeting IE3 and IE4 standards, are rapidly increasing as companies strive to meet sustainability goals and reduce operational expenditures. The ongoing digital transformation across industries, from discrete manufacturing to continuous process industries like chemicals and petrochemicals, is a primary catalyst. Furthermore, the resurgence of domestic manufacturing and reshoring initiatives are injecting fresh demand for reliable and advanced industrial motor solutions. The forecast period of 2025–2033 is expected to witness continued expansion, driven by innovation in motor design, the development of specialized motors for niche applications, and the increasing electrification of various industrial processes. The historical period (2019–2024) has laid the groundwork for this upward trajectory, marked by steady growth and the initial embrace of energy-efficient technologies. The estimated year, 2025, will solidify the market's transition towards smart and sustainable motor solutions, reflecting a significant leap in market penetration for these advanced technologies. This continuous evolution is indicative of an industry adapting to global economic trends, technological advancements, and the imperative for sustainable industrial operations.

Dominant Regions, Countries, or Segments in North America Industrial Motors Industry

Within the North America Industrial Motors industry, Alternating Current (AC) Motors are the dominant segment, consistently driving market growth. This dominance is attributed to their widespread application across nearly all industrial sectors, their reliability, and the continuous advancements in AC motor technology, including the integration of variable frequency drives (VFDs) for precise speed control and enhanced energy efficiency. The United States stands as the leading country in this market, owing to its massive industrial base, significant investment in automation, and a strong emphasis on energy efficiency regulations. Key drivers for this dominance include robust economic policies encouraging industrial modernization, substantial infrastructure development across sectors like power generation and water treatment, and a high adoption rate of advanced manufacturing technologies.

Dominant Motor Type: Alternating Current (AC) Motors, accounting for over 70% of the market share.

- Drivers: High reliability, versatility, energy efficiency improvements, integration with VFDs.

- Growth Potential: Continued demand from discrete manufacturing, process industries, and infrastructure projects.

Dominant Voltage Segment: Low Voltage motors represent the largest share due to their extensive use in a broad spectrum of applications, from small machinery to large industrial equipment. High Voltage motors, while a smaller segment, are critical for heavy-duty applications in power generation, mining, and oil & gas. Medium Voltage motors bridge the gap for intermediate industrial needs.

Dominant End-User Industries:

- Discrete Manufacturing: A major consumer due to high levels of automation in automotive, electronics, and machinery production.

- Key Drivers: Reshoring initiatives, Industry 4.0 adoption, demand for precision and speed.

- Process Industries (Chemicals & Petrochemicals, Oil & Gas, Water & Wastewater Management): These sectors require robust and reliable motor solutions for continuous operations, pumping, and material handling.

- Key Drivers: Infrastructure upgrades, demand for energy-efficient pumping and compression, environmental regulations.

- Power Generation: Driven by the need for efficient motors in turbines, generators, and auxiliary equipment.

- Key Drivers: Renewable energy expansion, grid modernization, demand for reliable power supply.

- Mining and Metals: Relies on powerful motors for heavy-duty machinery like crushers, conveyors, and mills.

- Key Drivers: Demand for raw materials, modernization of mining operations, focus on operational efficiency.

- Discrete Manufacturing: A major consumer due to high levels of automation in automotive, electronics, and machinery production.

The growth in these segments is further amplified by government initiatives promoting industrial competitiveness and sustainability, alongside significant private sector investments in upgrading and expanding manufacturing capacities.

North America Industrial Motors Industry Product Landscape

The North America Industrial Motors industry is characterized by a dynamic product landscape focused on enhanced performance, energy efficiency, and smart capabilities. Manufacturers are continuously innovating, offering a wide array of AC and DC motors designed for diverse applications. Alternating Current (AC) motors, particularly induction motors and synchronous motors, remain prevalent due to their robustness and cost-effectiveness. Direct Current (DC) motors are favored for applications requiring precise speed control and high starting torque. Innovations include the development of IE5-rated motors for unparalleled energy efficiency, specialized explosion-proof motors for hazardous environments, and integrated motor-drive solutions that simplify installation and optimize performance. The trend towards smart motors, equipped with sensors and connectivity for IoT integration, allows for real-time data acquisition, remote monitoring, and predictive maintenance, significantly enhancing operational uptime and reducing maintenance costs. These advanced products offer unique selling propositions through improved reliability, reduced carbon footprint, and lower total cost of ownership for end-users.

Key Drivers, Barriers & Challenges in North America Industrial Motors Industry

Key Drivers:

- Technological Advancements: The relentless pursuit of energy efficiency, driven by sustainability goals and rising energy costs, is a primary catalyst. Innovations in motor design, materials, and control systems are leading to more efficient and intelligent motor solutions.

- Industrial Automation & Digitalization: The widespread adoption of Industry 4.0 principles and the Internet of Things (IoT) is fueling demand for smart, connected motors that enable predictive maintenance, remote monitoring, and optimized operational performance.

- Infrastructure Development & Modernization: Significant investments in critical infrastructure, including power generation, water and wastewater management, and transportation, necessitate the use of reliable and high-performance industrial motors.

- Government Regulations & Incentives: Stringent energy efficiency standards and government incentives for adopting eco-friendly technologies are pushing manufacturers and end-users towards more efficient motor solutions.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain volatility, including shortages of critical components and raw materials, can impact production timelines and cost of goods for motor manufacturers.

- High Initial Investment Costs: While energy-efficient motors offer long-term cost savings, their higher upfront purchase price can be a barrier for some small and medium-sized enterprises (SMEs) or in price-sensitive markets.

- Skilled Workforce Shortage: The increasing complexity of smart motor technologies and automation systems requires a skilled workforce for installation, maintenance, and operation, posing a challenge in finding qualified personnel.

- Intense Competition: The market is characterized by intense competition from both established global players and emerging regional manufacturers, leading to price pressures and the need for continuous innovation to maintain market share.

- Cybersecurity Concerns: With the increasing connectivity of industrial motors, cybersecurity threats pose a significant challenge, requiring robust security measures to protect sensitive operational data and prevent potential disruptions.

Emerging Opportunities in North America Industrial Motors Industry

Emerging opportunities in the North America Industrial Motors industry are primarily driven by the accelerating transition towards sustainable energy and the growing demand for smart manufacturing solutions. The electrification of transportation, particularly in commercial fleets and industrial machinery, presents a significant untapped market for specialized electric motors. The expansion of renewable energy projects, such as wind and solar farms, requires a continuous supply of highly reliable and efficient motors for auxiliary systems and power conversion. Furthermore, the increasing focus on circular economy principles and industrial symbiosis is creating opportunities for motors designed for adaptable and modular industrial processes, facilitating easier upgrades and repurposing. The development of advanced predictive maintenance solutions powered by AI and machine learning for industrial motors also represents a burgeoning area, offering service providers and motor manufacturers new revenue streams and enhanced customer engagement.

Growth Accelerators in the North America Industrial Motors Industry Industry

Several key catalysts are accelerating long-term growth within the North America Industrial Motors industry. The ongoing digital transformation across all industrial sectors, particularly the adoption of Industry 4.0 technologies, is a major growth accelerator, driving demand for smart motors with integrated sensors and connectivity. Technological breakthroughs in materials science and motor design, leading to lighter, more powerful, and exceptionally energy-efficient motors, are also crucial. Strategic partnerships between motor manufacturers, automation solution providers, and end-users are fostering innovation and accelerating the development and deployment of tailored solutions. Market expansion strategies, including the penetration into emerging industrial applications and the focus on lifecycle services, are further propelling growth. The increasing global emphasis on decarbonization and sustainability is also a significant accelerator, pushing industries to invest in electric and highly efficient motor technologies.

Key Players Shaping the North America Industrial Motors Industry Market

- Johnson Electric

- ABB Ltd

- TECO-Westinghouse

- Rockwell Automation Inc

- Regal Beloit Corporation

- Altra Industrial Motion Corp

- Fuji Electric Co Ltd

- Toshiba International Corporation

- Siemens AG

- Yaskawa Electric Corporation

- Nidec Motor Corporation

Notable Milestones in North America Industrial Motors Industry Sector

- 2019: Siemens AG launches its next-generation IE5 synchronous reluctance motor portfolio, setting new benchmarks for energy efficiency.

- 2020: Rockwell Automation Inc. acquires a majority stake in Kal Automation, expanding its capabilities in advanced automation and smart manufacturing solutions.

- 2021: ABB Ltd. introduces its new generation of energy-efficient NEMA premium efficiency motors designed for various industrial applications.

- 2022: Regal Beloit Corporation completes the acquisition of Littelfuse, Inc.'s automotive fuse business, further strengthening its diversified industrial offerings.

- 2023: Yaskawa Electric Corporation announces significant investments in expanding its smart factory automation solutions in North America.

- 2024: Nidec Motor Corporation enhances its AC motor offerings with advanced digital connectivity features for predictive maintenance.

In-Depth North America Industrial Motors Industry Market Outlook

The North America Industrial Motors industry is characterized by a highly optimistic market outlook, driven by persistent technological advancements and a strong global push towards sustainable industrial practices. Growth accelerators, including the pervasive adoption of Industry 4.0 and the electrification of industrial processes, are expected to sustain a robust CAGR. Strategic partnerships and market expansion into niche applications, coupled with continuous innovation in energy-efficient and smart motor technologies, will further solidify market growth. The industry is set to witness increased demand for customized solutions tailored to specific end-user requirements, particularly in sectors like renewable energy, advanced manufacturing, and infrastructure development. The future of this market is intrinsically linked to its ability to deliver not just power, but intelligent, efficient, and sustainable motion solutions.

North America Industrial Motors Industry Segmentation

-

1. Type of Motor

- 1.1. Alternating Current (AC) Motors

- 1.2. Direct Current (DC) Motors

- 1.3. Other Ty

-

2. Voltage

- 2.1. High Voltage

- 2.2. Medium Voltage

- 2.3. Low Voltage

-

3. End-user Industry

- 3.1. Oil & Gas

- 3.2. Power Generation

- 3.3. Mining and Metals

- 3.4. Water and Wastewater Management

- 3.5. Chemicals and Petrochemicals

- 3.6. Discrete

- 3.7. Process

North America Industrial Motors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Industrial Motors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Energy Efficiency Owing To Government Regulations; Growing Shift Towards Smart Motors

- 3.3. Market Restrains

- 3.3.1. High Initial Investment For Procuring New Equipment And Upgrading Existing Equipment

- 3.4. Market Trends

- 3.4.1. Oil & Gas Industry Expected to Exhibit Maximum Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Motors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Motor

- 5.1.1. Alternating Current (AC) Motors

- 5.1.2. Direct Current (DC) Motors

- 5.1.3. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Voltage

- 5.2.1. High Voltage

- 5.2.2. Medium Voltage

- 5.2.3. Low Voltage

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil & Gas

- 5.3.2. Power Generation

- 5.3.3. Mining and Metals

- 5.3.4. Water and Wastewater Management

- 5.3.5. Chemicals and Petrochemicals

- 5.3.6. Discrete

- 5.3.7. Process

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Motor

- 6. United States North America Industrial Motors Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Industrial Motors Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Industrial Motors Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Industrial Motors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Johnson Electric

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TECO-Westinghouse

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Rockwell Automation Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Regal Beloit Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Altra Industrial Motion Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fuji Electric Co Ltd *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toshiba International Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Siemens AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yaskawa Electric Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Nidec Motor Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Johnson Electric

List of Figures

- Figure 1: North America Industrial Motors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Industrial Motors Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Industrial Motors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Industrial Motors Industry Volume Piece Forecast, by Region 2019 & 2032

- Table 3: North America Industrial Motors Industry Revenue Million Forecast, by Type of Motor 2019 & 2032

- Table 4: North America Industrial Motors Industry Volume Piece Forecast, by Type of Motor 2019 & 2032

- Table 5: North America Industrial Motors Industry Revenue Million Forecast, by Voltage 2019 & 2032

- Table 6: North America Industrial Motors Industry Volume Piece Forecast, by Voltage 2019 & 2032

- Table 7: North America Industrial Motors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: North America Industrial Motors Industry Volume Piece Forecast, by End-user Industry 2019 & 2032

- Table 9: North America Industrial Motors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Industrial Motors Industry Volume Piece Forecast, by Region 2019 & 2032

- Table 11: North America Industrial Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Industrial Motors Industry Volume Piece Forecast, by Country 2019 & 2032

- Table 13: United States North America Industrial Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Industrial Motors Industry Volume (Piece) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Industrial Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Industrial Motors Industry Volume (Piece) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Industrial Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Industrial Motors Industry Volume (Piece) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Industrial Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Industrial Motors Industry Volume (Piece) Forecast, by Application 2019 & 2032

- Table 21: North America Industrial Motors Industry Revenue Million Forecast, by Type of Motor 2019 & 2032

- Table 22: North America Industrial Motors Industry Volume Piece Forecast, by Type of Motor 2019 & 2032

- Table 23: North America Industrial Motors Industry Revenue Million Forecast, by Voltage 2019 & 2032

- Table 24: North America Industrial Motors Industry Volume Piece Forecast, by Voltage 2019 & 2032

- Table 25: North America Industrial Motors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: North America Industrial Motors Industry Volume Piece Forecast, by End-user Industry 2019 & 2032

- Table 27: North America Industrial Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Industrial Motors Industry Volume Piece Forecast, by Country 2019 & 2032

- Table 29: United States North America Industrial Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States North America Industrial Motors Industry Volume (Piece) Forecast, by Application 2019 & 2032

- Table 31: Canada North America Industrial Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada North America Industrial Motors Industry Volume (Piece) Forecast, by Application 2019 & 2032

- Table 33: Mexico North America Industrial Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico North America Industrial Motors Industry Volume (Piece) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Motors Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the North America Industrial Motors Industry?

Key companies in the market include Johnson Electric, ABB Ltd, TECO-Westinghouse, Rockwell Automation Inc, Regal Beloit Corporation, Altra Industrial Motion Corp, Fuji Electric Co Ltd *List Not Exhaustive, Toshiba International Corporation, Siemens AG, Yaskawa Electric Corporation, Nidec Motor Corporation.

3. What are the main segments of the North America Industrial Motors Industry?

The market segments include Type of Motor, Voltage, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 653 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Energy Efficiency Owing To Government Regulations; Growing Shift Towards Smart Motors.

6. What are the notable trends driving market growth?

Oil & Gas Industry Expected to Exhibit Maximum Adoption.

7. Are there any restraints impacting market growth?

High Initial Investment For Procuring New Equipment And Upgrading Existing Equipment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Piece.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Motors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Motors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Motors Industry?

To stay informed about further developments, trends, and reports in the North America Industrial Motors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence