Key Insights

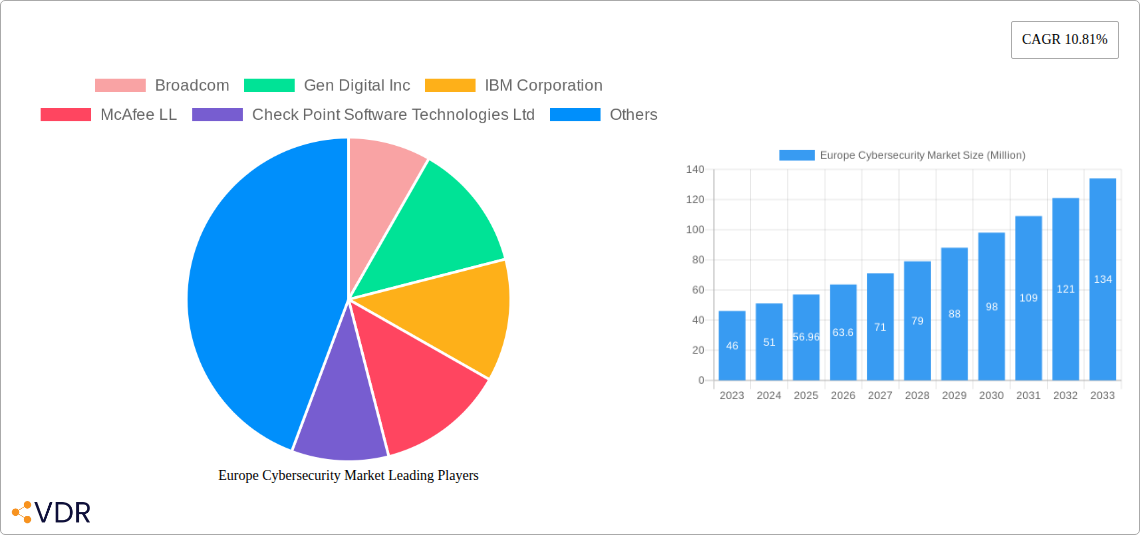

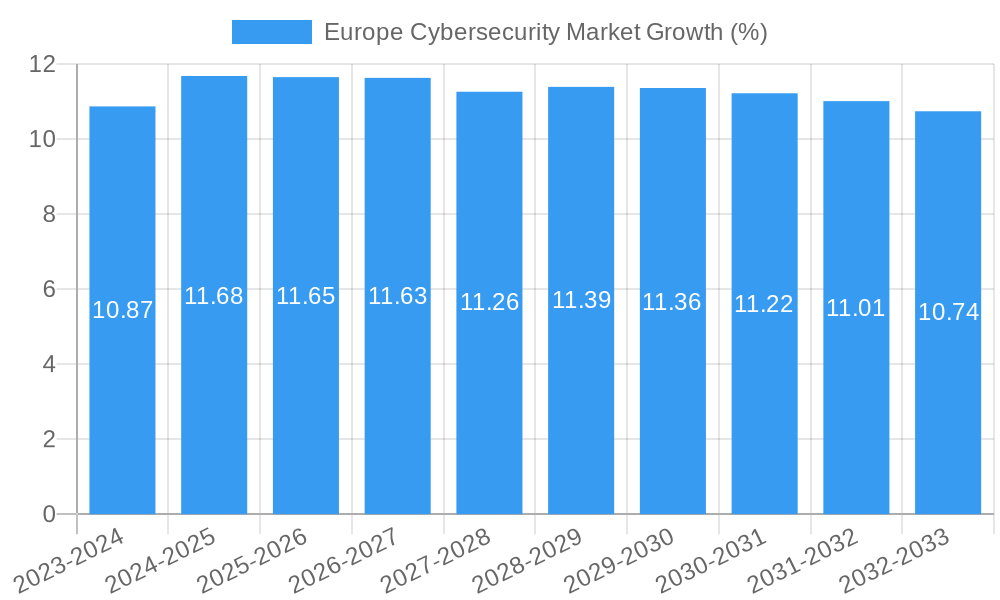

The European cybersecurity market is poised for significant expansion, projected to reach approximately USD 56.96 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 10.81% anticipated through 2033. This robust growth is fueled by a confluence of escalating cyber threats, increasing digitalization across industries, and stringent regulatory frameworks like GDPR that mandate robust data protection measures. Key drivers include the rise of sophisticated cyberattacks, the expanding attack surface due to IoT adoption, and the growing need for cloud security solutions as businesses migrate their operations online. The market is segmented across various offerings, with Cloud Security, Data Security, and Identity and Access Management (IAM) emerging as dominant segments. Services, encompassing consulting, managed security, and incident response, are also experiencing substantial demand as organizations seek expert guidance to navigate complex security landscapes.

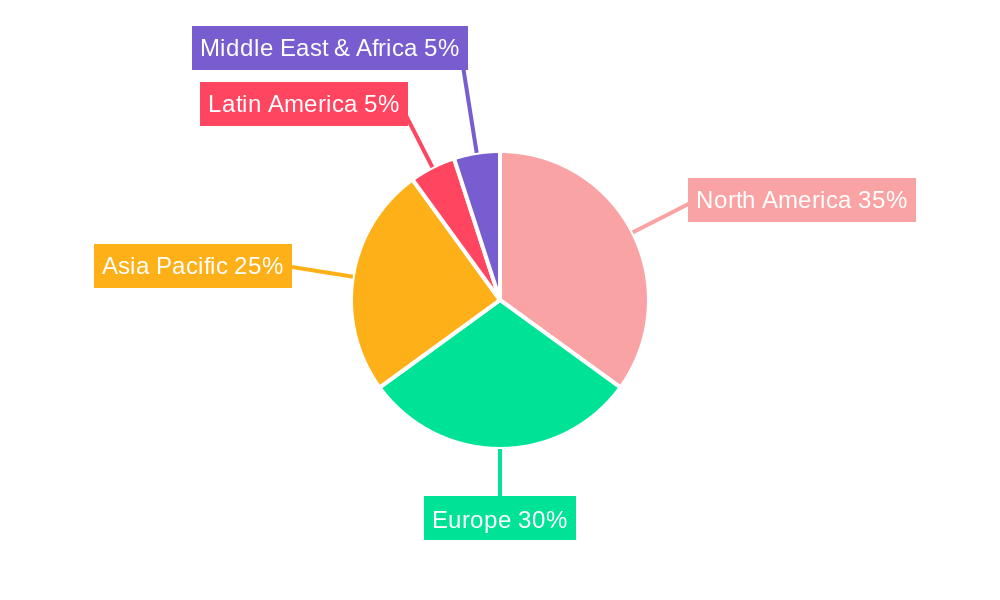

Geographically, Europe presents a fertile ground for cybersecurity investments. While specific regional market shares are not provided, it is evident that nations like the United Kingdom, Germany, France, and the Netherlands are leading the charge in adopting advanced security solutions, driven by their highly digitized economies and proactive stance on cybersecurity. The on-premise deployment model remains relevant, particularly for sectors with critical infrastructure and sensitive data, such as BFSI and Government & Defense. However, the cloud deployment model is rapidly gaining traction due to its scalability, cost-effectiveness, and agility, especially within the IT & Telecommunication and Healthcare industries. Emerging trends include the increasing adoption of AI and Machine Learning for threat detection and response, the growing importance of zero-trust security architectures, and the focus on supply chain security. The market faces restraints such as the shortage of skilled cybersecurity professionals and the complexity of integrating disparate security solutions, but the overall outlook remains highly optimistic due to the persistent and evolving nature of cyber risks.

Europe Cybersecurity Market: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report offers a strategic analysis of the Europe Cybersecurity Market, a critical and rapidly evolving sector projected to witness significant growth. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, growth trends, key players, and emerging opportunities. We analyze both parent and child markets, providing a holistic view for industry professionals seeking to understand and capitalize on this expansive landscape. Leverage insights into cloud security, data security, identity and access management (IAM), network security, consumer security, and infrastructure protection. Understand the impact of cybersecurity services and deployment models like cloud and on-premise solutions across vital end-user industries including BFSI, Healthcare, Manufacturing, Government and Defense, and IT and Telecommunication.

Europe Cybersecurity Market Market Dynamics & Structure

The Europe Cybersecurity Market is characterized by a dynamic and evolving structure, driven by escalating cyber threats and increasingly stringent regulatory frameworks. Market concentration varies across segments, with established players and innovative startups vying for market share. Technological innovation remains a paramount driver, with advancements in AI-powered threat detection, zero-trust architecture, and sophisticated encryption techniques constantly reshaping the competitive landscape. Regulatory frameworks, such as GDPR and NIS2 Directive, are significantly influencing market strategies, compelling organizations to invest heavily in robust cybersecurity solutions. The competitive product substitute landscape is dense, with numerous offerings catering to specific needs, from comprehensive endpoint protection to specialized cloud security platforms. End-user demographics reveal a growing demand for advanced security across all sectors, particularly within the BFSI and IT and Telecommunication industries. Merger and acquisition (M&A) trends indicate a consolidation phase, with larger entities acquiring smaller, niche players to expand their portfolios and technological capabilities.

- Technological Innovation Drivers: AI/ML for threat intelligence, cloud-native security, Extended Detection and Response (XDR), secure access service edge (SASE).

- Regulatory Frameworks: GDPR, NIS2 Directive, Schrems II, and country-specific data protection laws mandating higher security standards.

- Competitive Product Substitutes: Integrated security platforms vs. best-of-breed solutions, managed security services vs. in-house security.

- End-User Demographics: Increasing digital transformation across SMBs and enterprises, rise of remote work, and the growing attack surface.

- M&A Trends: Strategic acquisitions to gain market share, acquire specialized technologies, and enhance service offerings. Estimated M&A deal volume in the past two years is approximately 85 deals with a combined value of over $15,000 Million.

Europe Cybersecurity Market Growth Trends & Insights

The Europe Cybersecurity Market is poised for robust expansion, driven by a confluence of escalating cyber threats, increased regulatory compliance, and the pervasive digital transformation across industries. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reaching an estimated market value of $120,000 Million by the end of the forecast period. Adoption rates for advanced cybersecurity solutions are accelerating, fueled by a heightened awareness of the financial and reputational damage associated with cyber breaches. Technological disruptions, such as the rise of quantum computing and the increasing sophistication of AI-driven attacks, are creating a continuous demand for cutting-edge defense mechanisms. Consumer behavior shifts, including a greater emphasis on data privacy and digital trust, are also influencing enterprise security strategies.

- Market Size Evolution: The market is projected to grow from an estimated $45,000 Million in 2025 to over $120,000 Million by 2033.

- Adoption Rates: High adoption rates for cloud security, identity and access management, and advanced threat detection solutions.

- Technological Disruptions: AI/ML in cybersecurity, blockchain for secure data management, and the evolving threat landscape from nation-state actors and organized crime.

- Consumer Behavior Shifts: Increased demand for privacy-preserving technologies and transparent data handling practices.

- Market Penetration: Significant growth in managed security services and subscription-based security models.

Dominant Regions, Countries, or Segments in Europe Cybersecurity Market

The Europe Cybersecurity Market is experiencing robust growth driven by several dominant regions, countries, and segments. Western Europe, particularly Germany, the UK, and France, holds a significant market share due to the presence of a mature IT infrastructure, stringent regulatory compliance, and a high concentration of enterprises across various sectors. Among the segments, Cloud Security and Network Security are leading the growth trajectory, driven by the accelerated adoption of cloud-based services and the increasing complexity of network infrastructures. The IT and Telecommunication sector, along with the BFSI industry, consistently represent the largest end-user segments, investing heavily in comprehensive security solutions to protect sensitive data and critical operations.

- Dominant Region: Western Europe, with countries like Germany, the UK, and France exhibiting the highest market penetration and investment in cybersecurity.

- Dominant Segments (Offering):

- Cloud Security: Essential for protecting data and applications hosted on public, private, and hybrid cloud environments. Market share estimated at 25% of the total market in 2025.

- Network Security: Crucial for defending against network-borne threats, including firewalls, intrusion detection systems, and VPNs. Market share estimated at 20% of the total market in 2025.

- Dominant Segments (Deployment):

- Cloud Deployment: Increasingly favored for its scalability, flexibility, and cost-effectiveness.

- Dominant End-User Industries:

- IT and Telecommunication: High spending due to the inherent digital nature and the critical need to protect vast amounts of data and infrastructure. Market share estimated at 28% of the total market in 2025.

- BFSI: Continuous investment driven by the high value of financial data and the constant threat of financial fraud and cyberattacks. Market share estimated at 22% of the total market in 2025.

- Key Drivers of Dominance: Strong economic policies supporting digital innovation, robust regulatory frameworks, and a high level of digital literacy.

Europe Cybersecurity Market Product Landscape

The Europe Cybersecurity Market product landscape is defined by continuous innovation and a focus on delivering comprehensive and adaptive security solutions. Companies are increasingly offering integrated platforms that combine various security functionalities, such as endpoint detection and response (EDR), cloud access security brokers (CASB), and security information and event management (SIEM). Product applications span across threat detection and prevention, data protection, identity and access management, and compliance management. Performance metrics emphasize real-time threat intelligence, rapid incident response, and minimal false positives. Unique selling propositions often lie in the application of advanced AI and machine learning for predictive analytics, zero-trust architectures, and user-friendly interfaces for streamlined security operations.

Key Drivers, Barriers & Challenges in Europe Cybersecurity Market

The Europe Cybersecurity Market is propelled by several key drivers, including the escalating sophistication of cyber threats, the increasing adoption of cloud computing and IoT devices, and the growing emphasis on data privacy regulations like GDPR. Governments are also actively promoting cybersecurity initiatives, further bolstering market growth. However, the market faces significant barriers and challenges, including a persistent cybersecurity skills gap, the high cost of implementing and maintaining advanced security solutions, and the complex and fragmented regulatory landscape across different European nations. Supply chain vulnerabilities, particularly in the context of globalized IT infrastructure, also pose a considerable threat.

- Key Drivers:

- Rising cyber-attacks and data breaches.

- Digital transformation and cloud migration.

- Strict regulatory compliance (GDPR, NIS2).

- Government initiatives for cybersecurity.

- Key Barriers & Challenges:

- Shortage of skilled cybersecurity professionals.

- High implementation and maintenance costs.

- Fragmented regulatory environment.

- Supply chain vulnerabilities and geopolitical risks.

- Rapidly evolving threat landscape.

Emerging Opportunities in Europe Cybersecurity Market

Emerging opportunities in the Europe Cybersecurity Market lie in the growing demand for proactive and intelligent security solutions. The expansion of the Internet of Things (IoT) presents a significant untapped market for specialized IoT security platforms. Furthermore, the increasing adoption of remote work models is driving demand for secure access service edge (SASE) solutions and robust endpoint security. Evolving consumer preferences for privacy are also creating opportunities for privacy-enhancing technologies and data anonymization services. The development of AI-powered threat hunting and automated incident response systems also represents a promising frontier.

- IoT Security: Specialized solutions for securing connected devices across industries.

- Remote Work Security: Demand for SASE, VPNs, and advanced endpoint protection.

- Privacy-Enhancing Technologies: Data anonymization, differential privacy, and secure multi-party computation.

- AI-Powered Security Automation: Threat hunting, incident response, and predictive analytics.

Growth Accelerators in the Europe Cybersecurity Market Industry

Several catalysts are accelerating the growth of the Europe Cybersecurity Market. Technological breakthroughs in artificial intelligence and machine learning are enabling more sophisticated threat detection and response capabilities. Strategic partnerships between cybersecurity vendors, cloud providers, and managed security service providers (MSSPs) are expanding market reach and service offerings. Furthermore, government investments in national cybersecurity infrastructure and initiatives to foster innovation are creating a favorable ecosystem for growth. The increasing focus on resilience and business continuity in the face of cyber threats also encourages sustained investment in advanced security measures.

- Technological Breakthroughs: AI/ML for predictive threat intelligence and automated defense.

- Strategic Partnerships: Collaborations for integrated solutions and expanded service delivery.

- Market Expansion: Focus on emerging economies within Europe and specific industry verticals.

- Increased Investment: Government funding and private sector R&D.

Key Players Shaping the Europe Cybersecurity Market Market

- Broadcom

- Gen Digital Inc

- IBM Corporation

- McAfee LL

- Check Point Software Technologies Ltd

- Fujitsu Limited (Fujitsu Group)

- Cisco Systems Inc

- F5 Inc

- Palo Alto Networks

- Dell Technologies Inc

- Intel Corporation

Notable Milestones in Europe Cybersecurity Market Sector

- December 2023: The European Union Agency for Cybersecurity (ENISA) signed a Working Arrangement with the US Cybersecurity and Infrastructure Security Agency (CISA) in capacity-building, exchanging best practices, and boosting situational awareness. This comprehensive arrangement includes temporary cooperation structured activities and the development of long-term cooperation in cybersecurity policy implementation approaches to build on them, significantly enhancing transatlantic collaboration and information sharing.

- October 2023: BT and Google Cloud announced a new partnership to enhance their commitment to cybersecurity innovation. Several common innovative opportunities are set out in this new Strategic Security Partnership with Google Cloud. As part of this partnership, BT will become the managed services provider for Google's Autonomic Security Operations Service, available on Google Chronicle, marking a significant advancement in managed security services and cloud-based security operations.

In-Depth Europe Cybersecurity Market Market Outlook

The Europe Cybersecurity Market is set for sustained and robust growth, driven by an unwavering demand for advanced security solutions against an evolving threat landscape. Key growth accelerators include the continuous innovation in AI and machine learning for predictive threat intelligence, fostering a more proactive defense posture. Strategic partnerships between leading technology providers and cybersecurity firms will continue to expand market reach and offer integrated solutions, addressing complex security challenges. Government initiatives aimed at bolstering national cybersecurity infrastructure and promoting digital sovereignty will further stimulate investment. The increasing emphasis on business resilience and data protection mandates a continuous upgrade and adoption of cutting-edge cybersecurity technologies, ensuring the market's upward trajectory and presenting substantial strategic opportunities for stakeholders.

Europe Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Security Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government and Defense

- 3.5. IT and Telecommunication

- 3.6. Other End-user Industries

Europe Cybersecurity Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Demand for Digitalization and Scalable IT Infrastructure; Need to Tackle Risks from Various Trends Such as Third-party Vendor Risks

- 3.2.2 the Evolution of MSSPS

- 3.2.3 and the Adoption of a Cloud-first Strategy

- 3.3. Market Restrains

- 3.3.1 Challenges Related to Data Quality

- 3.3.2 Consistency

- 3.3.3 and Accessibility

- 3.4. Market Trends

- 3.4.1. Cloud Security to Witness Rapid Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Security Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government and Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Germany Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Broadcom

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Gen Digital Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 McAfee LL

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Check Point Software Technologies Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Fujitsu Limited (Fujitsu Group)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Cisco Systems Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 F5 Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Palo Alto Networks

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Dell Technologies Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Intel Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Broadcom

List of Figures

- Figure 1: Europe Cybersecurity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Cybersecurity Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Europe Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Europe Cybersecurity Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 15: Europe Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Europe Cybersecurity Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Cybersecurity Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cybersecurity Market?

The projected CAGR is approximately 10.81%.

2. Which companies are prominent players in the Europe Cybersecurity Market?

Key companies in the market include Broadcom, Gen Digital Inc, IBM Corporation, McAfee LL, Check Point Software Technologies Ltd, Fujitsu Limited (Fujitsu Group), Cisco Systems Inc, F5 Inc, Palo Alto Networks, Dell Technologies Inc, Intel Corporation.

3. What are the main segments of the Europe Cybersecurity Market?

The market segments include Offering, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Digitalization and Scalable IT Infrastructure; Need to Tackle Risks from Various Trends Such as Third-party Vendor Risks. the Evolution of MSSPS. and the Adoption of a Cloud-first Strategy.

6. What are the notable trends driving market growth?

Cloud Security to Witness Rapid Growth.

7. Are there any restraints impacting market growth?

Challenges Related to Data Quality. Consistency. and Accessibility.

8. Can you provide examples of recent developments in the market?

December 2023 - The European Union Agency for Cybersecurity (ENISA) signed a Working Arrangement with the US Cybersecurity and Infrastructure Security Agency (CISA) in capacity-building, exchanging best practices, and boosting situational awareness. It is a comprehensive arrangement that includes temporary cooperation structured activities and the development of long-term cooperation in cybersecurity policy implementation approaches to build on them.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Europe Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence